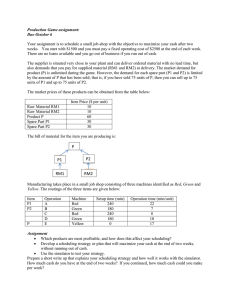

PART 1: QUESTION 2 Global oil price dynamics are subject to many factors, the principal of which are the balance of supply and demand, macroeconomic and geopolitical situation, dynamics of the US dollar exchange rate and conditions on the global financial markets. Technological breakthroughs make it possible to develop huge resources. The increase in unconventional oil and gas production in the US serves as a good example. Taking into account the US oil production progress many analytical agencies lower their long-term oil price forecasts. At the same time a number of trends will support oil prices in the medium term. In this articles we would like to specify these trends and critically analyze a number of challenges that affect oil industry specifically Malaysia nowadays. Figure 1: Factors that affect oil prices. Our planet’s population will continue to grow rapidly. Between 2015 and 2025 global population will grow by more than 1.1 billion people. Greatest population growth will be registered in the developing countries, while in the developed countries population will remain relatively stable. High rates of population growth are expected, first of all, in India, which will become the world’s most populous country by 2020. Explosive population growth is also forecasted for the African countries where it will be the result of improvement in socio- economic conditions and quality of medical services. Along with population growth, developing countries will experience the movement of rural population to the cities, known as urbanization. According to the estimates of Mckinsey Global Institute, by 2025 440 cities in the developing countries will contribute up to half of the global GDP growth. At the same time the levels of consumption will grow. It is expected that by 2025 the size of the urban consumer class will grow by 1 billion people and overall middle class will amount to more than 50% of the total global population. The main growth will come from the developing Asian countries Urbanization and growth of the consumer class in developing countries will, in turn, promote growth in demand for real estate, infrastructure, cars, hi-tech goods and, as a result, energy resources. OIL DEMAND Demand for liquid hydrocarbons will continue to grow. Global demand for liquid hydrocarbons will continue to grow annually by 1.2% on average and will, in our estimates, reach 105 mb/d by 2025. The greatest surge in oil demand will come from the transportation sector, for which oil is the principal energy source (over 90%). Consumption of liquid hydrocarbons will increase in the developing countries where the transportation industry is undergoing rapid growth. Analysts expect to see significant growth in the number of cars as well as the development of sea, air and railway transportation. In addition to this, growth in demand for oil in the developing countries will be further encouraged by the industrial sector, in particular, the petrochemical industry. At the same time, consumption of liquid hydrocarbons in the developed countries will remain relatively stable due to the low rates of economic growth and further improvements of fuel economy Despite stable growth rates oil’s share in the global consumption of energy resources will gradually decrease, because of substitution for other energy sources in such sectors as power generation and housing. OIL PRICES IN MALAYSIA In 2013 and 2014, the local industry was optimistic, although this was a sentiment of cautious optimism, choosing to invest strategically in projects that would yield higher returns. Petronas had refocused investment on big oil and gas projects in Malaysia, from marginal fields to deepwater exploration, and oil and gas was a key industry in the government’s Economic Transformation Programme. Throughout the first part of 2014, oil and gas players continued to be listed on Bursa Malaysia (the local bourse), and Petronas announced the investment decision on its multi-billion-dollar Refinery and Petrochemical Integrated Development Project in the southern state of Johor. As oil prices began to slide, the tone has shifted from talking about how much the industry has grown to discussing how companies are delaying projects, cutting nonessential budgets and managing to stay afloat while oil prices remain low. The question on everyone’s mind is: How long will this last? Petrol price in Malaysia are fixed according to a managed float system, which is based on the monthly average world price of crude oil. The move was followed by a 4 sen decline in the price of RON95 from RM2.30 to RM2.26 per litre for the month of December. In January 2015, retail prices of RON95 and RON97 fell further to RM1.91 per litre and RM2.11 per litre, respectively. Historically, the retail prices of petrol and diesel in Malaysia had been determined through the automatic price mechanism (APM), which ensured that the difference between retail and actual prices were borne by subsidies and sales tax exemptions. Through the system, set in place in 1983, the Government also standardized fuel prices at pump stations, and fixed the margins of oil companies and dealers at a level that will not be affected by fluctuations in world oil prices. RON95 petrol entered the Malaysian market in 2009 at RM1.75 per litre. It replaced the loweroctane RON92, which cost RM1.70 per litre in 2008. The price of RON95 has increased steadily from year-to-year, due to the gradual reduction in fuel subsidy as part of the Government’s long-term plan to boost national coffers. The fuel’s price was raised from RM1.90 to RM2.10 per litre in September 2013, and again in October 2014, from RM2.10 to RM2.30 per litre. Though there have been much hesitation on removing fuel subsidies in the past, due primarily to fears about its political repercussions, the Government has finally set a firm footing on its subsidy reform plan. Subsidy for sugar prices was also abolished in 2014, which saw the increase of sugar prices from RM2.50 to RM2.84 per kilo. One advantage that comes with the removal of fuel subsidies is that consumers now get to enjoy the benefits from any decline in global crude oil prices, something Malaysians have not been getting for the past 31 years when the retail prices of fuel products in Malaysia had remained mostly static or gone up. The new managed float system has put the price of RON95 in Malaysia as one of the lowest in the world, at only US$0.54 (RM1.91) per litre, compared to neighboring countries like Singapore and Thailand, where RON95 costs US$1.38 (RM4.94) per litre and US$1.00 (RM3.58) per litre respectively. Meanwhile, RON95 costs US$1.07 (RM3.83) in China, US$0.99 (RM3.54) in Australia, and US$1.72 (RM6.16) in the United Kingdom. In the long term, although subsidy removals are often unpopular with consumers, the cut-back on subsidy expenditures is necessary in ensuring the long-term sustainability of the national budget and in elevating the country to high-income status by 2020. Savings on fuel subsidies will instead be channeled on infrastructure and development that would directly benefit the welfare of the people. The priority now should be to raise productivity and increase median income levels so that Malaysians can enjoy better standards of living and achieve our target of becoming a highincome nation.