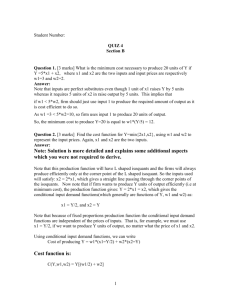

ECON2101 Intermediate Microeconomics

Technology

Aleksandra Balyanova

1/21

The supply side of the market

Having studied consumer choice (under certainty and uncertainty) and derived

demand, we now turn to the firm side of the market. We will

1.

2.

3.

4.

Model firm technology (now)

Derive from the firm’s technology its cost function, i.e. the cheapest way for it

to produce any given output level (next)

Derive from its cost function its supply function, i.e. how much it will supply to

the market for any given price of its output (later)

Aggregate individual supply to study market supply and long run equilibrium in

a perfectly competitive market (even later)

2/21

Firms

Firms are complex and heterogenous organisations.

•

•

They employ different types of resources to produce a variety of goods and

services sold to consumers in different markets.

They employ a wide variety of incentive schemes and compensation structures

(to varying effect!) to induce lower-level employees to perform in a way desired

by higher level management

In modelling the firm, we abstract from all of these details. Our bare-bones model of

the firm depicts it only as a “black box” that transforms inputs (like labour and

capital) into output. The firm’s technology is the process by which inputs are turned

into outputs.

3/21

Technology

Example 1:

•

You are a firm that transforms the input “hours spent studying” into the output

“Micro 2 mark”. The technology by which you do so can be modeled by the

production function

√

f (h) = h

i.e. your mark increases rapidly at the beginning, but as you spend more and

more time studying, your mark increases more slowly (the marginal product of h

is decreasing - more on this later). Notice that if you study for 9 hours, you can

get a maximum mark of 3, but you can also “waste” some of your effort and get

a mark of 2, or even a mark of 0.

4/21

Technology

When the technology is

modeled by f (z), for any

input quantity z, f (z)

describes the maximum

possible output.

5/21

From 1 input to N inputs

A single, price-taking firm operating in a market economy uses N inputs (capital,

labour, raw materials, etc.) and transforms them into output q.

Denote inputs by zn ≥ 0. An input vector is z = (z1 , . . . , zN )

The N + 1-dimensional input-output vector (z, q) is a feasible plan for the firm if q

can be produced given z, given the firm’s available technology.

Given an input vector (z1 , . . . , zN ), the maximum output that can be produced is

f (z1 , . . . , zN ). The function f : RN

+ → R+ is the firm’s production function.

A plan is feasible if

q ≤ f (z1 , . . . , zN )

The collection of all feasible plans is the production set.

6/21

From N to 2 inputs

Much like with the consumer optimisation problem, we will focus on the two-input

case.

•

Similar reasoning as for consumer problem: two inputs is the minimum needed

to capture the fact that there may be choices to be made about how to produce

a given output

7/21

From N to 2 inputs

Example 2:

•

•

•

•

1

1

Suppose the production function of the firm is q = f (z1 , z2 ) = 2z13 z23

The firm can produce q = 8 using (z1 , z2 ) = (8, 8)

But there are other ways - e.g.

z10 , z20 = (64, 1) and z100 , z200 = (1, 64)

In fact, any (z1 , z2 ) such that z1 × z2 = 64 can be used.

Isoquants

The q-output isoquant is the collection of all input vectors that yield output level q

using the firm’s available technology.

The map of isoquants is an equivalent way to describe the production function.

8/21

Isoquants

Isoquants are to the

production function what

indifference curves are to

the utility function:

mappings of combinations

of inputs (of the function)

that yield the same

output (of the function).

9/21

Marginal production

Marginal production

The production function f : RN

+ → R+ represents the maximum amount of output

that can be produced using an input vector z = (z1 , . . . , zN ). Isoquants are

representations of different combinations of inputs that yield the same output level.

•

•

This does not mean that all input combinations are economically equivalent.

A profit maximising firm asks what is the most cost effective way to produce q.

Marginal Products

Given a differentiable production function f : RN

+ → R+ , the marginal product of

input n = 1, . . . , N at b

z is the rate of change of output as the quantity used of input n

changes slightly

∂f bz

for n = 1, . . . , N

MPn b

z =

∂zn

10/21

Technical rate of substitution

To be able to eventually determine what is the most cost effective way to produce an

output q, we explore the trade-offs

involved in input use. Fix an input vector b

z at

which the output level is f b

z = q. Totally differentiating this expression gives

∂f b

z

∂z1

∂f

dz1 + · · · +

b

b

z

∂zN

dzN = 0

When focusing on changes in two inputs only, say input l and input k, we have

dzj = 0 for all j 6= k, l. Rearranging, we see that

∂f b

z /∂zl

MPl b

z

dzk

=−

=−

dzl

∂f b

z /∂zk

MPk b

z

This expression captures the rate at which the firm has to decrease input k to

marginally increase its use of input l while keeping output constant.

11/21

Technical rate of substitution

Given a differentiable

production function

f : RN

+ → R+ „ the

technical rate of

substitution between

input l and input k at b

z is

TRSl,k

MPl b

z

bz =

MPk b

z

For inputs 1 and 2, the

TRS1,2 at zb1 , zb2 is the

absolute value of the

slope of the isoquant at

that input vector.

12/21

Commonly used production

functions

Perfect substitutes

Let f : R2+ → R+ be given by

f (z1 , z2 ) = az1 + bz2

This production function

represents perfect substitution

between inputs 1 and 2.

13/21

Perfect substitutes

To employ one extra unit of input

1 without changing the production

level, the firm gives up ba units of

input 2.

14/21

Perfect complements/fixed proportions

Let u : R2+ → R be given by

f (z1 , z2 ) = min {az1 , bz2 }

This production function

represents perfect

complementarity between inputs

1 and 2.

15/21

Perfect complements/fixed proportions

The firm uses at least ba units of

input 2 for each unit of input 1.

When inputs are in the “ideal”

ratio, additional units of either do

not affect output (if the other

input is fixed).

16/21

Cobb Douglas

Any production function of the

form

f (z1 , z2 ) = Cz1a z2b

with C , a, b > 0 is called a Cobb

Douglas production function.

17/21

Cobb Douglas

e.g. Example 2,

1

1

f (z1 , z2 ) = 2z13 z23

Isoquants are hyperbolic,

approaching but never touching

either axis

CD technology captures smooth

substitutability between inputs

18/21

Technology: exercise 1

Firm 1 has technology given by

f1 (z1 , z2 ) = 2z1 + z2

Firm 2 has technology given by

f2 (z1 , z2 ) = z1 + 2z2

The two firms merge. As a result, the new firm has access to the production methods

that were available to both firms. The joint firm’s production function is then

fj (z1 , z2 ) = max {2z1 + z2 , z1 + 2z2 }

Depict the joint firm’s isoquant for q = 8. Label the TRS along the isoquant.

19/21

Technology: exercise 1

The joint firm’s production function is then

fj (z1 , z2 ) = max {2z1 + z2 , z1 + 2z2 }

Depict the joint firm’s isoquant for q = 8. Label the TRS along the isoquant.

•

•

When 2z1 + z2 > z1 + 2z2 , i.e. when z1 > z2 , Firm 1’s method is more

productive: q = 2z1 + z2 . Substituting in q = 8 and rearranging, we have that

below the 45◦ line, the isoquant is given by z2 = 8 − 2z1

When z1 < z2 , Firm 2’s method is more productive: q = z1 + 2z2 . Substituting

in q = 8 and rearranging, we have that above the 45◦ line, the isoquant is given

by z2 = 4 − 21 z1

20/21

Technology: exercise 1

•

•

Below the kink when z1 > z2 - the

joint firm is using

Firm 1’s method

and the isoquant is

given by

z2 = 8 − 2z1

Above the kink when z2 < z2 - the

joint firm is using

Firm 2’s method

z2 = 4 − 12 z1

21/21