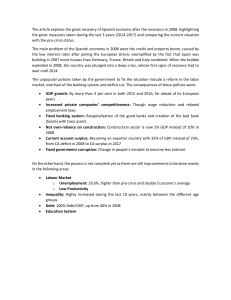

GDP, BANKING, TRADING AND MORE ... ****This was an article written for the ECON-101 magazine of IIM Rohtak. **** “For the only way in which a durable peace can be created is by worldwide restoration of economic activity and international trade.” -James Forrestal Secretary, US Navy Many factors like Gross Domestic Product(GDP), Literacy Rate, Employment Rate, Currency Exchange Rate, Population Growth Rate, Banking Systems, and Corruption Rate influence the trade and thus economy of a country directly or indirectly. However, the primary key set by International Organisations to rank different economies is GDP. Annual GDP reports the final values of goods and services produced during that particular year. But GDP doesn't take into account the sustainable goals, unpaid work, or products that have been resold. So other reliable indicators like Gross National Product (GNP) set by International Monetary Funds(IMF) or Sustainable Trade Index (STI) set up by Heinrich Foundation are also considered when comparing the countries’ economic statuses. The difference between GNP and GDP can be easily understood with an example where an Indian company's annual sales growth set up in Germany will be counted under Germany's if GDP and under India's GNP. The import and export of goods (finished or unfinished) and services in return for another service or monetary profit form the basis of any trade at any level-domestic, national or international. The current COVID 19 situation could not have been controlled without International Trade and Global Cooperation where different companies from around the world came up with raw materials, equipment and machinery, research-based skill set, and knowledge. IMF and the World Bank come forward to provide low-interest loans to keep the countries afloat during the times of any national or international crisis. However, low-interest loans come with unforeseeable vulnerabilities (fiscal deficits), risks (exploitation of the currency value), and weaker growth prospects (unpayable debts) in the longer run. According to the 'Global Waves of Debt: Cause and Consequences' (published: March 2020, World Bank Group) the world entered its 4th biggest and broadest financial debt crisis in 2010. GDP, BANKING, TRADING AND MORE ... Total debt has already reached a record high of almost 170 percent of GDP ($55 trillion) in 2018, an increase of 54% of GDP since 2010. The estimated impact will be greater than the previous three economic recessions collectively (1970-89 ; 1990-2001; 2002-2009) especially on emerging markets and1 developing economies-including India.[1] THE INDIAN ECONOMY - RISE AND FALL Indian economy, struggling from the blows of previous recessions of the 1970s, boomed after the introduction of 1991 economic policies welcoming globalisation, liberalisation and privatisation. According to the Economic Survey of India 2013-14, the ratio of total goods and service trade to GDP rose from 17.2% in 1992 to 30.6% in 2002. 2 The 1991 reforms revolutionised the banking sector with the introduction of new private banks and in the telecommunication sector where the National Telecom Policy opened its doors to private players from foreign in 1994. The cycle of demand and supply was set in other industrial sectors like Automation and Aviation Industry, Research and Development and Information Technology but not in agriculture and rural informal sector; till date they lack behind other sectors. Unfortunately, the seeds of rural unemployment and financial inequality were sown when this sector was neglected in the very beginning of economic reforms. The evolution of the Sensitive Index (Sensex) occurred when Bombay Stock Exchange (BSE) crashed in April 1992 (Harshad Mehta’s scam)and National Stock Exchange (NSE) - India’s first electronic exchange system-was born in November 1992;thus bringing in transparent and simpler trading opportunities for individual investors. The growth of Indian market in the 2000s accelerated till it busted in 2008 following the Great Depression of 2008 due to the housing price bubble of the US (major negative impact of 1 https://pubdocs.worldbank.org/en/377151575650737178/Debt-Chapter-1.pdf 2 http://indiabefore91.in/impact-reforms#:~:text=Reforms%20led%20to%20increased%20competition,private%20players%20in%20these%20sectors.&text=Competition%20also %20helped%20to%20keep%20inflation%20in%20check. GDP, BANKING, TRADING AND MORE ... globalisation). The recession was followed by the exposure of the multi-million dollar Kingfisher Scam where the business tycoon, Mr. Vijay Mallaya defaulted on his debts and then owed the Indian Government approximately Rs 6000 crores (valuing to Rs 12000 crores in Jan 2020). 3 The concept of Shadow Banking- continuing since more than 3 decades in - must be highlighted here. Non-Banking Financial Companies (NBFCs) generate liquidity in the market by providing flexible loan opportunities acting as the intermediaries between the investors(banks and mutual funds) and borrowers(citizens). They work at high risk (& high return) since they raise short term funds for themselves but lend out long term loans to the borrowers. In India, NBFCs fall under the Company’s Act 1956, do not need to have banking licenses but have to be registered with RBI, SEBI, IRDAI or other regulating body depending upon the type of company. The interdependence of NBFCs poses a huge risk to the financial stability of the market since defaulting at any stage in this cycle can lead to a liquidity crunch. The latest example being that of IL&FS group in 2018 where it’s maximum subsidiary companies couldn’t repay their loans worth a total $60 million to banks.4 In reciprocation and fear, other NBFCs, couldn’t receive more bank loans and if they did, did so at very high percentage rate interests. The US housing loan bubble indirectly highlights the failure of NBFCs. Realising the blunders made, RBI in compliance with Financial Action Task Force, has promised to monitor the banking systems, the top 100 country’s NBFCs and housing finance companies (HFCs) by introducing risk-based internal audits and a transparent, accountable and ethical driven internal governance. ‘Utkarsh 2022’ aims at monitoring the implementations of rules so that any more IL&FS can be avoided. India managed to make a quick V-shape recovery from 2008 recession through loser fiscal policies, forgiveness of loans for farmers and renewing capital inflows from the advanced economies. But the GDP again took a hit in 2011 falling down to 5.2% from 8.5% since the 3 https://m.economictimes.com/industry/transportation/airlines-/-aviation/kingfisher-airlines-got-vijay-mallyas-guarantee-for-rs-6176-cr-in-2010-11/articleshow/10170291.cms 4 https://internationalbanker.com/banking/is-indias-shadow-banking-on-the-road-to-recovery/#:~:text=Shadow%20banking%20in%20India%20has,(NBF Cs)%20across%20the%20country GDP, BANKING, TRADING AND MORE ... consequences of techniques applied to combat the 2008 financial crisis started unfolding.5 The biggest mistake Indian economic policy makers have made time and again is to raise consumer demand to roll back the economy, whereas private investments should have been a major focus. Consequently,the value of rupees plummeted by over 20%, India had to repay a foreign loan of $140billion.6 Foreign Direct Investments were the necessary key to balance out and keep the country afloat in 2012. And just when India needed a stable administrative governance at the top level to correct the policy mistakes of the past, came the Modi Government with its own set of rules and regulations in 2014. The end of 2016 came as a huge shock to the Indian market with demonetisation devastating the informal sector contributing towards half of the domestic output and 90% of the workforce. The poor implementation of GST in 2017, in scope of capturing “black-money” from the market, further added to the already existing economic and unemployment stress. The country witnessed understandable job losses between 6.2 million(2011) to 15.5 million(2017).The Ministry of Finance’s Report on Income Tax Reforms for Building New India stated a fall of 2.8%(2016) from 7.5%(2015) in the fixed investment to GDP ratio.But the corresponding ratio according to the CSO’s National Accounts rose to 12% from 11.7% of GDP in 2016-17. Surprisingly, the Central Statistical Office (CSO) stated the GDP growth rate of 2016-17 at 8.2%.7 The divergence of data is easily visible! What actually happened here ? In 2015, GDP series was changed to the base year 2011-12 from the previous year of 2004-05. Changing the base year reference in 7 to 10 years is important for better statistical methods and improved databases. The absolute gdp size for 2011-12 was 2.3% smaller than that of the previous old series. But the annual growth rate in the following years was higher as compared with the previous series.8 The GDP growth rate of 2016-17 was simply over exploited by changing the basis of comparison. Else India’s GDP would not have fallen in the next two consecutive fiscal years (7.2% in 2017-18 followed 6.1% ).9 10 Comparing the position globally, India stands at the 11th position on the Sustainable Trade Index 2018 which evaluates the 20 Indo-Pacific countries on the basis of environmental, social and economic goals.11 5 https://www.google.com/search?rlz=1C1CHBF_enIN924IN924&sxsrf=ALeKk01kxvGpwPNUT7hZLUsDLDrYCv3oGQ:1620753818054&q=india+gdp+gr owth+rate&stick=H4sIAAAAAAAAAOPgUeLQz9U3MC7KNtAyS0m20s9JTU9MrrTKyU9OLMnMz4svLgHSxSWZyYk58UWp6SCh9JSC-PSi_PKSjPiixJL ULkYnLrghQpQaYmhmlES-Ic5cnCBDLJPNy8l2yiJW0cy8lMxEBaC4AkRcASQOAE1XM78sAQAA&sa=X&ved=2ahUKEwjTqd-8ksLwAhVU4jgGHaUDB XIQth8wAXoECAwQAw&biw=1536&bih=666 6 https://www.eastasiaforum.org/2012/01/27/india-s-economic-slowdown-a-stain-on-2011/ 7 https://www.theindiaforum.in/article/understanding-india-s-economic-slowdown 8 https://www.theindiaforum.in/article/understanding-india-s-economic-slowdown 9 https://economictimes.indiatimes.com/news/economy/indicators/gdp-growth-rate-for-2017-18-revised-upwards-to-7-2-/articleshow/67775487.cms?from=mdr 10 https://economictimes.indiatimes.com/news/economy/policy/gdp-growth-rate-for-2018-19-revised-downwards-to-6-1-pc/articleshow/73808214.cms?from=mdr 11 https://www.hinrichfoundation.com/research/wp/sustainable/sustainable-trade-index-2018/ GDP, BANKING, TRADING AND MORE ... The COVID-19 pandemic has added to the already existing financial bubble. India is currently in its second wave pandemic with no surety of full recovery.Weak Demand, ballooning unemployment, lack of fiscal stimulus and rising inflation are the key challenges our country faces today.The 21 lakh crore fiscal stimulus relief package announced was mainly focused on banking credit for businesses and did not directly favor the urgent needs of people at the ground level. However, talking about the present day, there is a crippling fear among people since the current government policies cannot be trusted upon.This pandemic has significantly highlighted the need to analyse and apply the power of Information Technology into various other sectors. India ranks at the 36th position on the 2018 Global Green Economy Index - which measures 130 countries on the basis of leadership and climate change, efficiency sectors, markets and investment, and the environment.12 Definitely, a lot more can and needs to be achieved as a nation. And James Forrestal’s saying seems like the only possible solution in the present times of distress and uncertainty. 12 https://knoema.com/infographics/enedcw/global-green-economy-index-2018 GDP, BANKING, TRADING AND MORE ... Regards Chehak Joneja