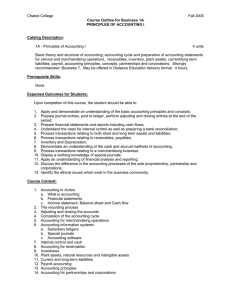

Financial Accounting & Reporting Fundamentals Textbook

advertisement

FINANCIAL ACCOUNTING & REPORTING (Fundamentals) ZEUS VERNON B. MILLAN Chapter 1: Introduction to Accounting (FAR by: Millan) Chapter 1 Introduction to Accounting Learning Objectives 1. Define accounting. 2. Describe the nature and purpose of accounting. 3. Give examples of branches of accounting. 4. State the function of accounting in a business. 5. Differentiate between external and internal users of accounting information. 6. Narrate the history/origin of accounting. 7. State the forms of business organization. 8. State the types of business according to their activities. Chapter 1: Introduction to Accounting (FAR by: Millan) Definition of accounting • Accounting is a process of identifying, recording and communicating economic information that is useful in making economic decisions. Chapter 1: Introduction to Accounting (FAR by: Millan) Essential elements of the definition of accounting 1. 2. 3. Identifying – The accountant analyzes each business transaction and identifies whether the transaction is an “accountable event” or “non-accountable event.” This is because only “accountable events” are recorded in the books of accounts. “Non-accountable events” are not recorded in the books of accounts. Recording – The accountant recognizes (i.e., records) the “accountable events” he has identified. This process is called “journalizing.” After journalizing, the accountant then classifies the effects of the event on the “accounts.” This process is called “posting.” Communicating – At the end of each accounting period, the accountant summarizes the information processed in the accounting system in order to produce meaningful reports. Accounting information is communicated to interested users through accounting reports, the most common form of which is the financial statements. Chapter 1: Introduction to Accounting (FAR by: Millan) Nature of accounting • Accounting is a process with the basic purpose of providing information about economic activities intended to be useful in making economic decisions. Chapter 1: Introduction to Accounting (FAR by: Millan) Types of information provided by accounting 1. Quantitative information 2. Qualitative information 3. Financial information Chapter 1: Introduction to Accounting (FAR by: Millan) Functions of Accounting in Business 1. To provide external users with information that is useful in making investment and credit decisions; and 2. To provide internal users with information that is useful in managing the business. Chapter 1: Introduction to Accounting (FAR by: Millan) Brief history of accounting • Accounting can be traced as far back as the prehistoric times, perhaps more than 10,000 years ago. • Archaeologists have found clay tokens as old as 8500 B.C. in Mesopotamia which were usually cones, disks, spheres and pellets. These tokens correspond to commodities like sheep, clothing or bread. They were used in the Middle West in keeping records. After some time, the tokens were replaced by wet clay tablets. During such time, experts concluded this to be the start of the art of writing. (Source: http://EzineArticles.com/456988) • Double entry records first came out during 1340 A.D. in Genoa. • In 1494, the first systematic record keeping dealing with the “double entry recording system” was formulated by Fra Luca Pacioli, a Franciscan monk and mathematician. The “double entry recording system” was included in Pacioli’s book titled “Summa di Arithmetica Geometria Proportioni and Proportionista,” published on November 10, 1494 in Venice. • The concept of “double entry recording” is being used to this day. Thus, Fra Luca Pacioli is considered as the father of modern accounting. Chapter 1: Introduction to Accounting (FAR by: Millan) Common Branches of Accounting Chapter 1: Introduction to Accounting (FAR by: Millan) Common Branches of Accounting Chapter 1: Introduction to Accounting (FAR by: Millan) Common Branches of Accounting Chapter 1: Introduction to Accounting (FAR by: Millan) Common Branches of Accounting Chapter 1: Introduction to Accounting (FAR by: Millan) Users of Accounting Information 1. Internal users – those who are directly involved in managing the business. Examples: • Business owners who are directly involved in managing the business • Board of directors • Managerial personnel 2. External users – those who are not directly involved in managing the business. Examples: • Existing and potential investors (e.g., stockholders who are not directly involved in managing the business) • Lenders (e.g., banks) and Creditors (e.g., suppliers) • Non-managerial employees • Public Chapter 1: Introduction to Accounting (FAR by: Millan) Forms of Business Organizations Chapter 1: Introduction to Accounting (FAR by: Millan) Advantages and Disadvantages Chapter 1: Introduction to Accounting (FAR by: Millan) Advantages and Disadvantages Chapter 1: Introduction to Accounting (FAR by: Millan) Advantages and Disadvantages Chapter 1: Introduction to Accounting (FAR by: Millan) Advantages and Disadvantages Chapter 1: Introduction to Accounting (FAR by: Millan) Advantages and Disadvantages Chapter 1: Introduction to Accounting (FAR by: Millan) Advantages and Disadvantages Chapter 1: Introduction to Accounting (FAR by: Millan) Advantages and Disadvantages Chapter 1: Introduction to Accounting (FAR by: Millan) Types of Business According to Activities 1. Service business 2. Merchandising (Trading) 3. Manufacturing Chapter 1: Introduction to Accounting (FAR by: Millan) Advantages and Disadvantages Chapter 1: Introduction to Accounting (FAR by: Millan) Advantages and Disadvantages Chapter 1: Introduction to Accounting (FAR by: Millan) Advantages and Disadvantages Chapter 1: Introduction to Accounting (FAR by: Millan) Chapter 2 Accounting Concepts and Principles Learning Objectives 1. Give examples of accounting concepts and principles. 2. Apply the concepts in solving accounting problems. Chapter 2: Accounting Concepts and Principles (FAR by: Millan) Basic Accounting Concepts 1. Separate entity concept 2. Historical cost concept 3. Going concern assumption 4. Matching 5. Accrual Basis 6. Prudence (or Conservatism) 7. Time Period 8. Stable monetary unit 9. Materiality concept 10. Cost-benefit 11. Full disclosure principle 12. Consistency concept Chapter 2: Accounting Concepts and Principles (FAR by: Millan) Basic Accounting Concepts – (cont’n) • Separate entity concept – The business is viewed as a separate entity, distinct from its owner(s). Only the transactions of the business are recorded in the books of accounts. The personal transactions of the business owner(s) are not recorded. • Historical cost concept (Cost principle) – assets are initially recorded at their acquisition cost. • Going concern assumption – The business is assumed to continue to exist for an indefinite period of time. • Matching – Some costs are initially recognized as assets and charged as expenses only when the related revenue is recognized. Chapter 2: Accounting Concepts and Principles (FAR by: Millan) Basic Accounting Concepts – (cont’n) • Accrual Basis of accounting – income is recorded in the period when it is earned rather than when it is collected, while expense is recorded in the period when it is incurred rather than when it is paid. • Prudence – The observance of some degree of caution when exercising judgments under conditions of uncertainty. Such that, if there is a choice between a potentially unfavorable outcome and a potentially favorable outcome, the unfavorable one is chosen. This is necessary so that assets or income are not overstated and liabilities or expenses are not understated. Chapter 2: Accounting Concepts and Principles (FAR by: Millan) Basic Accounting Concepts – (cont’n) • Reporting Period – The life of the business is divided into series of reporting periods. • Stable monetary unit – Assets, liabilities, equity, income and expenses are stated in terms of a common unit of measure, which is the peso in the Philippines. Moreover, the purchasing power of the peso is regarded as stable. Therefore, changes in the purchasing power of the peso due to inflation are ignored. Chapter 2: Accounting Concepts and Principles (FAR by: Millan) Basic Accounting Concepts – (cont’n) • Materiality concept – An item is considered material if its omission or misstatement could influence economic decisions. Materiality is a matter of professional judgment and is based on the size and nature of an item being judged. • Cost-benefit – The costs of processing and communicating information should not exceed the benefits to be derived from the information’s use. Chapter 2: Accounting Concepts and Principles (FAR by: Millan) Basic Accounting Concepts – (cont’n) • Full disclosure principle – Information communicated to users reflect a balance between detail and conciseness, keeping in mind the cost-benefit principle. • Consistency concept – Like transactions are accounted for in like manner from period to period. Chapter 2: Accounting Concepts and Principles (FAR by: Millan) Philippine Financial Reporting Standards (PFRSs) The PFRSs are Standards and Interpretations adopted by the FRSC. They consist of the following: 1. Philippine Financial Reporting Standards (PFRSs); 2. Philippine Accounting Standards (PASs); and 3. Interpretations Chapter 2: Accounting Concepts and Principles (FAR by: Millan) Qualitative Characteristics I. Fundamental Qualitative Characteristics i. Relevance (Predictive Value, Confirmatory Value, Materiality) ii. Faithful Representation (Completeness, Neutrality, Free from error) II. Enhancing Qualitative Characteristics i. Comparability ii. Verifiability iii. Timeliness iv. Understandability Chapter 2: Accounting Concepts and Principles (FAR by: Millan) Fundamental vs. Enhancing • The fundamental qualitative characteristics are the characteristics that make information useful to users. • The enhancing qualitative characteristics are the characteristics that enhance the usefulness of information Chapter 2: Accounting Concepts and Principles (FAR by: Millan) Relevance • Information is relevant if it can affect the decisions of users. • Relevant information has the following: a. Predictive value – the information can be used in making predictions b. Confirmatory value – the information can be used in confirming past predictions Materiality – is an ‘entity-specific’ aspect of relevance. Chapter 2: Accounting Concepts and Principles (FAR by: Millan) Faithful representation • Faithful representation means the information provides a true, correct and complete depiction of what it purports to represent. • Faithfully represented information has the following: a. Completeness – all information necessary for users to understand the phenomenon being depicted is provided. b. Neutrality – information is selected or presented without bias. c. Free from error – there are no errors in the description and in the process by which the information is selected and applied. Chapter 2: Accounting Concepts and Principles (FAR by: Millan) Enhancing Qualitative Characteristics 1. Comparability – the information helps users in identifying similarities and differences between different sets of information. 2. Verifiability – different users could reach consensus as to what the information purports to represent. 3. Timeliness – the information is available to users in time to be able to influence their decisions. 4. Understandability – users are expected to have: a. reasonable knowledge of business activities; and b. willingness to analyze the information diligently. Chapter 2: Accounting Concepts and Principles (FAR by: Millan) Chapter 3 The Accounting Equation Learning Objectives 1. Illustrate the accounting equation. 2. Perform operations involving simple cases with the use of accounting equation. Chapter 3: The Accounting Equation (FAR by: Millan) The Accounting Equation Assets = Liabilities + Chapter 3: The Accounting Equation (FAR by: Millan) Equity Definitions • ASSETS – are the economic resources you control that have resulted from past events and can provide you with economic benefits. • LIABILITIES – are your present obligations that have resulted from past events and can require you to give up economic resources when settling them. • EQUITY – is assets minus liabilities. Chapter 3: The Accounting Equation (FAR by: Millan) The Expanded Accounting Equation Assets = Liabilities + Equity + Income - Expenses Chapter 3: The Accounting Equation (FAR by: Millan) Definitions • INCOME – is increases in economic benefits during the period in the form of increases in assets, or decreases in liabilities, that result in increases in equity, excluding those relating to investments by the business owner. • EXPENSES – are decreases in economic benefits during the period in the form of decreases in assets, or increases in liabilities, that result in decreases in equity, excluding those relating to distributions to the business owner. • The difference between income and expenses represents profit or loss. Chapter 3: The Accounting Equation (FAR by: Millan) Applications of the accounting equation 1. If total assets is ₱10,000 and total liabilities is ₱6,000, how much is the total equity? 2. If total liabilities is ₱5,000 and total equity is ₱4,000, how much is the total assets? 3. If total assets is ₱10,000 and total equity is ₱3,000, how much is the total liabilities? 4. If total income is ₱10,000 and total expenses are ₱3,000, how much is the profit or loss? 5. If total income is ₱10,000, total expenses are ₱8,000, total liabilities is ₱7,000, and total equity (before profit or loss) is ₱6,000, how much is the total assets? Chapter 3: The Accounting Equation (FAR by: Millan) Chapter 4 Types of Major Accounts Learning Competencies 1. Discuss the five major accounts. 2. Cite examples of each type of account. 3. Prepare a Chart of Accounts. Chapter 4: Types of Major Accounts (FAR by: Millan) The Account • An account is the basic storage of information in accounting. It is a record of the increases and decreases in a specific item of asset, liability, equity, income or expense. Chapter 4: Types of Major Accounts (FAR by: Millan) The T-Account Chapter 4: Types of Major Accounts (FAR by: Millan) The Five Major Accounts 1. 2. 3. 4. 5. ASSETS – are the resources you control that have resulted from past events and can provide you with economic benefits. LIABILITIES – are your present obligations that have resulted from past events and can require you to give up economic resources when settling them. EQUITY – is assets minus liabilities. INCOME – are increases in economic benefits during the period in the form of inflows or enhancements of assets or decreases of liabilities that result in increases in equity, other than those relating to investments by the business owners. EXPENSES – are decreases in economic benefits during the period in the form of outflows or depletions of assets or increases of liabilities that result in decreases in equity, other than those relating to distributions to the business owners. Chapter 4: Types of Major Accounts (FAR by: Millan) Classification of the Five Major Accounts Chapter 4: Types of Major Accounts (FAR by: Millan) Chart of Accounts A chart of accounts is a list of all the accounts used by a business. Chapter 4: Types of Major Accounts (FAR by: Millan) Common Account Titles • BALANCE SHEET ACCOUNTS ASSETS a. b. c. d. e. f. g. h. i. j. k. l. Cash Accounts receivable Allowance for bad debts Notes receivable Prepaid supplies Prepaid rent Prepaid insurance Land Building Accumulated depreciation - Building Equipment Accumulated depreciation - equipment Chapter 4: Types of Major Accounts (FAR by: Millan) Common Account Titles - Continuation • BALANCE SHEET ACCOUNTS LIABILITIES a. b. c. d. e. f. Accounts payable Notes payable Interest payable Salaries payable Utilities payable Unearned Chapter 4: Types of Major Accounts (FAR by: Millan) Common Account Titles - Continuation • BALANCE SHEET ACCOUNTS EQUITY a. Owner’s capital (or Owner’s equity) b. Owner’s drawings Chapter 4: Types of Major Accounts (FAR by: Millan) Common Account Titles - Continuation • INCOME STATEMENT ACCOUNTS INCOME a. b. c. d. Service fees Sales Interest income Gains Chapter 4: Types of Major Accounts (FAR by: Millan) Common Account Titles - Continuation • INCOME STATEMENT ACCOUNTS EXPENSES a. Cost of sales (or Cost of goods sold) b. Freight-out c. Salaries expense d. Rent expense e. Utilities expense f. Supplies expense g. Bad debt expense h. Depreciation expense i. Advertising expense j. Insurance expense k. Taxes and licenses l. Transportation and travel expense m. Interest expense n. Miscellaneous expense o. Losses Chapter 4: Types of Major Accounts (FAR by: Millan) Chapter 5 Books of Accounts and Double-entry System Learning Ojectives 1. Identify the uses of the two books of accounts. 2. Illustrate the format of general and special journals. 3. Illustrate the format of general and subsidiary ledgers. Chapter 5: Books of Accounts & Doubleentry System (FAR by: Millan) The Books of Accounts 1. Journal (General and Special) 2. Ledger (General and Subsidiary) Chapter 5: Books of Accounts & Double-entry System (FAR by: Millan) Journal The journal, also called the “book of original entries,” is the accounting record where business transactions are first recorded. 1. Special Journal – is used to record transactions with similar nature (e.g., Sales journal, Purchases journal, Cash receipts journal, and Cash disbursements journal) 2. General Journal – All other transactions that cannot be recorded in the special journals are recorded in the general journal. Chapter 5: Books of Accounts & Double-entry System (FAR by: Millan) Ledger • The ledger is used to classify the effects of business transactions on the accounts. It is also called the “book of final entries.” 1. General ledger – contains all the accounts appearing in the trial balance. 2. Subsidiary ledger – provides a breakdown of the balances of controlling accounts. Chapter 5: Books of Accounts & Double-entry System (FAR by: Millan) Chapter 5: Books of Accounts & Double-entry System (FAR by: Millan) Format of the General Journal Chapter 5: Books of Accounts & Double-entry System (FAR by: Millan) Formats of the Ledgers Chapter 5: Books of Accounts & Double-entry System (FAR by: Millan) Double-entry System • Concept of duality – each transaction is recorded in two parts – debit and credit • Concept of equilibrium – each transaction is recorded in terms of equal debits and credits. Chapter 5: Books of Accounts & Double-entry System (FAR by: Millan) Normal balances of accounts Chapter 5: Books of Accounts & Double-entry System (FAR by: Millan) Rules of Debits and Credits Chapter 5: Books of Accounts & Double-entry System (FAR by: Millan) Chapter 5: Books of Accounts & Double-entry System (FAR by: Millan) Contra and Adjunct accounts • Contra accounts are presented in the financial statements as deduction to their related accounts. • Adjunct accounts are presented in the financial statements as addition to their related accounts. Chapter 5: Books of Accounts & Double-entry System (FAR by: Millan) Chapter 6 Business Transactions & Their Analysis Learning Objectives 1. Describe the nature and give examples of business transactions. 2. Identify the different types of business documents. 3. Analyze common business transactions using the rules of debit and credit. Chapter 6: Business Transcations & Their Analysis (FAR by: Millan) Steps in the Accounting cycle 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. Identifying and analyzing Journalizing Posting Unadjusted trial balance Adjusting entries Adjusted trial balance (and/or Worksheet) Financial statements Closing entries Post-closing trial balance Reversing entries Chapter 6: Business Transcations & Their Analysis (FAR by: Millan) Identifying and analyzing transactions and events • Only accountable events are recorded. Accountable events are those that affect the assets, liabilities, equity, income or expenses of the business. • Accountable events are normally identified from source documents, such as sales invoice, official receipts, delivery receipts, and the like. Chapter 6: Business Transcations & Their Analysis (FAR by: Millan) Types of Events 1. External events – are transactions that involve the business and another external party. 2. Internal events – are events that do not involve an external party. Chapter 6: Business Transcations & Their Analysis (FAR by: Millan) Journalizing Journalizing refers to recording an identified accountable event in the journal by means of a journal entry. Chapter 6: Business Transcations & Their Analysis (FAR by: Millan) Simple and Compound journal entries • Simple journal entry – contains a single debit and a single credit element. • Compound journal entry – contains two or more debits or credits. Chapter 6: Business Transcations & Their Analysis (FAR by: Millan) Chapter 7 Posting to the Ledger Learning Objectives 1. Post transactions in the ledger. 2. Prepare the unadjusted trial balance. Chapter 7: Posting to the Ledger (FAR by: Millan) Posting Posting, the third step in the accounting cycle, is the process of transferring data from the journal to the appropriate accounts in the ledger. Chapter 7: Posting to the Ledger (FAR by: Millan) Example of posting: Transaction: Jan. 8 - Services worth ₱30,000 were rendered for cash. Journalizing: Chapter 7: Posting to the Ledger (FAR by: Millan) Example of posting (continuation) Posting Chapter 7: Posting to the Ledger (FAR by: Millan) Trial balance • A trial balance is a list of general ledger accounts and their balances. It is prepared to check the equality of total debits and total credits in the ledger. Chapter 7: Posting to the Ledger (FAR by: Millan) Types of Trial balance a. Unadjusted trial balance – this is prepared before adjusting entries are made. b. Adjusted trial balance – this is prepared after adjusting entries but before the financial statements are prepared. c. Post-closing trial balance – this is prepared after the closing process. Chapter 7: Posting to the Ledger (FAR by: Millan) Errors revealed by a trial balance 1. Journalizing or posting one-half of an entry, i.e., a debit without a credit, or vice versa. 2. Recording one part of an entry for a different amount than the other part. 3. Errors of Transplacement (Slide error) on one side of an entry. 4. Error of Transposition on one side of an entry. Chapter 7: Posting to the Ledger (FAR by: Millan) Errors not revealed by a trial balance 1. Omitting entirely the entry for a transaction 2. Journalizing or posting an entry twice 3. Using wrong account with the same normal balance as the correct account 4. Wrong computation with the same erroneous amounts posted to debit and credit sides Chapter 7: Posting to the Ledger (FAR by: Millan) Chapter 8 Adjusting Entries Learning Objectives 1. Enumerate the common end-of-period adjustments. 2. Prepare adjusting entries. Chapter 8: Adjusting Entries (FAR by: Millan) Adjusting entries • Adjusting entries are entries made prior to the preparation of financial statements to update certain accounts so that they reflect correct balances as of the designated time. Chapter 8: Adjusting Entries (FAR by: Millan) Purpose of adjusting entries a. To take up unrecorded income and expense of the period. b. To split mixed accounts into their real and nominal elements. Chapter 8: Adjusting Entries (FAR by: Millan) Real, Nominal and Mixed Accounts a. Real Accounts (Permanent accounts) – accounts that are not closed at the end of the accounting period. These accounts include all balance sheet accounts, except the “Owner’s drawings” account. b. Nominal Accounts (Temporary accounts) – accounts that are closed at the end of the accounting period. These accounts include all income statement accounts, drawings account, clearing accounts and suspense accounts. c. Mixed accounts – accounts that have both real and nominal account components. These accounts are subject to adjustment. Chapter 8: Adjusting Entries (FAR by: Millan) Chapter 8: Adjusting Entries (FAR by: Millan) Methods of Initial Recording of Income 1. Liability method – under this method, cash receipts from items of income are initially credited to a liability account. At the end of the period, the earned portion is recognized as income while the unearned portion remains as liability. 2. Income method – under this method cash receipts from items of income are initially credited to an income account. At the end of the period, the unearned portion is recognized as liability while the earned portion remains as income. Chapter 8: Adjusting Entries (FAR by: Millan) Methods of Initial Recording of Expenses 1. Asset method – under this method cash disbursements for items of expenses are initially debited to an asset account. At the end of the period, the incurred portion (‘used up’ or ‘expired’) is recognized as expense while the unused portion remains as asset. 2. Expense method – under this method, cash disbursements for items of expenses are initially debited to an expense account. At the end of the period, the unused portion (‘not yet incurred’ or ‘unexpired’) is recognized as asset while the incurred portion remains as expense. Chapter 8: Adjusting Entries (FAR by: Millan) Chapter 9 Accounting Cycle of a Service Business Learning Objectives 1. Prepare a worksheet. 2. Prepare closing entries. 3. Prepare a balance sheet and income statement of a service business. 4. Prepare reversing entries. Chapter 9: Accounting Cycle of a Service Business (FAR by: Millan) Worksheet A worksheet is an analytical device used to facilitate the gathering of data for adjustments, the preparation of financial statements, and closing entries. Chapter 9: Accounting Cycle of a Service Business (FAR by: Millan) Chapter 9: Accounting Cycle of a Service Business (FAR by: Millan) Financial statements • The financial statements are the end product of the accounting process. Information from the journal and the ledger are meaningless to most users unless they are summarized and communicated through the financial statements. Chapter 9: Accounting Cycle of a Service Business (FAR by: Millan) The major processes in accounting are summarized below: Chapter 9: Accounting Cycle of a Service Business (FAR by: Millan) Financial Statements • Statement of financial position (or Balance sheet) – shows information on assets, liabilities and equity. • Statement of profit or loss (or Income statement) – shows information on income and expenses, and consequently, the profit or loss for the period. Chapter 9: Accounting Cycle of a Service Business (FAR by: Millan) Closing entries • Closing entries are entries prepared at the end of the accounting period to “zero out” all nominal accounts in the ledger. This is done so that the transactions during the period will not commingle with the transactions in the next period. Chapter 9: Accounting Cycle of a Service Business (FAR by: Millan) Closing entries • Closing entries are prepared as follows: a. All income accounts are debited and all expense accounts are credited. The resulting balance is recorded in a clearing account called the “Income summary.” b. The balance of “Income summary” is closed to the “Owner’s capital” account. c. Any balance in the “Owner’s drawings” account is closed to the “Owner’s capital” account. Chapter 9: Accounting Cycle of a Service Business (FAR by: Millan) Chapter 9: Accounting Cycle of a Service Business (FAR by: Millan) Reversing Entries • Reversing entries are entries usually made on the first day of the next accounting period to reverse certain adjusting entries made in the immediately preceding period. Chapter 9: Accounting Cycle of a Service Business (FAR by: Millan) Adjusting entries that may be reversed 1. Accruals for income or expense 2. Prepayments initially recorded using the expense method 3. Advanced collections initially recorded using the income method Chapter 9: Accounting Cycle of a Service Business (FAR by: Millan) Chapter 10 Accounting Cycle of a Merchandising Business Learning Objectives 1. Prepare the Statement of Cost of Goods Sold and Gross Profit. 2. Complete the accounting cycle of a merchandising business Chapter 10: Accounting Cycle of a Merchandising Business (FAR by: Millan) Merchandising Business • A merchandising business is one that buys and sells goods in their original form and without any further processing. Those goods are referred to as merchandise inventory (or simply, inventory). Chapter 10: Accounting Cycle of a Merchandising Business (FAR by: Millan) Inventory Systems a. Perpetual inventory system – under this system, the “Inventory” account is updated each time a purchase or sale is made. Thus, the “Inventory” account shows a continuing or running balance of the goods on hand. b. Periodic inventory system – under this system, the “Inventory” account is updated only when a physical count is performed. Thus, the amounts of inventory and cost of goods sold are determined only periodically. Chapter 10: Accounting Cycle of a Merchandising Business (FAR by: Millan) Chapter 10: Accounting Cycle of a Merchandising Business (FAR by: Millan) Accounts used under Periodic System • Purchases – the account used to record purchases of inventory under the periodic system. • Freight-in (Transportation-in) – the account used to record the shipping costs incurred on purchases of inventory under the periodic system. • Purchase returns – the account used to record returns of purchased goods to the supplier. • Purchase discounts – the account used to record cash discounts availed of on the purchased goods. Chapter 10: Accounting Cycle of a Merchandising Business (FAR by: Millan) Chapter 10: Accounting Cycle of a Merchandising Business (FAR by: Millan) Chapter 10: Accounting Cycle of a Merchandising Business (FAR by: Millan) Gross Profit Chapter 10: Accounting Cycle of a Merchandising Business (FAR by: Millan) Chapter 10: Accounting Cycle of a Merchandising Business (FAR by: Millan) Chapter 10: Accounting Cycle of a Merchandising Business (FAR by: Millan) • Sales – include both cash sales and credit sales. • Sales returns – the account used to goods sold but were returned by customers. • Sales discounts – the account used to record cash discounts given to and taken by customers. Chapter 10: Accounting Cycle of a Merchandising Business (FAR by: Millan) Statement of Cost of Goods Sold and Gross Profit Chapter 10: Accounting Cycle of a Merchandising Business (FAR by: Millan) END Chapter 10: Accounting Cycle of a Merchandising Business (FAR by: Millan)