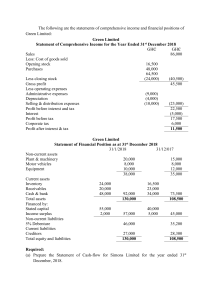

Faculty Faculty of Business and Accounting Assessment Name Internal Test 5 Paper Code AFR2/C22/I-05 Module Name Financial Reporting 2 Module Code A7-FR2–17 Semester Mar – Aug 22 Submission Mode Blackboard 30 Duration Submission Exam/Submission Date (Eg: End/Sup) ( E.g Jul-Dec-2021) Total Marks Assessment Type Eff Date: 18-03-2021 (Eg: Written/Practical/Submission) (E.g Turnitin, blackboard, hardcopy) 22 June 22 @ 8.00 am Instructions 1. Answer all questions. 2. Type USING Times Roman or Arial 12. Spacing should be 1.5 3. Answers should be uploaded in Word document 4. Please write your Student ID and Campus clearly on the front page of the answer sheet. Failure to do so may result in your work not being marked. QP-ASM-001|Rev 006 5. Answers should be clear and readable. 6. Save the file using student ID, module abbreviation, Month, Year (e.g. SGB123456_FR1_END NOV 2021). 7. Late submissions will not be allowed or graded. 8. At the end of the exam, submit the answer through Blackboard on or before 22 June 22, 08:00 HRS No alternative routes of submission are allowed. 9. You are advised to start trying to upload your answers earlier to ensure that you have time to respond to any challenges. 10. All cases of suspected plagiarism will be treated seriously. Your attention is drawn to the sections on to the plagiarism in the student regulations. Page 1 of 3 Answer all the questions (25 marks) Question 1 Silver plc acquired 75% of the issued share capital of Gold Ltd on 1 January 2019. Summarised statements of profit or loss for the year ended 31 December 2019 are shown below: Silver plc £000 Gold Ltd £000 Continuing operations Revenue Cost of sales (56,400) (8,754) 32,600 11,146 Eff Date: 18-03-2021 19,900 Other income – dividend from Brown Ltd QP-ASM-001|Rev 006 Gross profit 89,000 (a) Draft the consolidated statement of profit or loss for Silver plc and its subsidiary up to and including the profit from operations line for the year ended 31 December 2019. (15 marks) 4,950 – Operating expenses (14,342) (6,735) Profit from operations 23,208 4,411 Additional information During the year Silver sold goods which had a cost of £350, 000 to Gold Ltd for £795, 000. None of these goods remain in inventory at the end of the year. Goodwill of £350, 000 arose at the acquisition. The directors of Silver plc concluded that the goodwill had been impaired by 20% during the year. Question 2 Bull plc acquired 80% of the issued share capital of bear Ltd on 1 January 2018 for £4,600, 000. At that date Bear Ltd had issued share capital of £3,000, 000 and retained earnings of £840, 000. The summarised statements of financial position of the two companies one year later at 31 st December 2018 are as follows: Statements of financial position as at 31st December 2018 Bull plc Bear Ltd £000 £000 Page 2 of 3 Assets Investment in Bear Ltd 4,600 Non-current assets 7,500 4,590 Current assets 3,800 1,570 Total assets 15,900 6,160 Share capital 5,000 3,000 Retained earnings 7,800 1,510 12,800 4,510 Non-current liabilities 1,000 750 Current liabilities 2,100 900 Total liabilities 3,100 1,650 15,900 6,160 Total equity and liabilities Equity QP-ASM-001|Rev 006 Eff Date: 18-03-2021 Total equity Total equity and liabilities Additional data The fair value of non-current assets of Bear Ltd at 1 January 2018 was £4,200, 000. The book value of the non-current assets was £3,900, 000. The revaluation has not been recorded in the books of Bear Ltd. (ignore any effects of depreciation for the year) The directors of Bull plc have decided that non-controlling interest be valued at their proportionate share of Bear’s net assets. (a) Draft a consolidated statement of financial position for Bull plc and its subsidiary as at 31st December 2018. (15 marks) *****THE END ***** Page 3 of 3