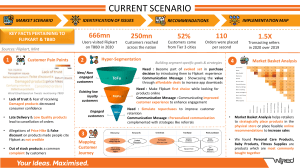

Flipkart: Transitioning to a Marketplace Model Building An eCommerce Business in India There are many challenges that Flipkart has had to face and overcome in establishing an eCommerce business in India. Flipkart needed to tackle some significant hurdles with logistics and payment systems that are unique to this area. They did this by investing heavily in a logistics and payment system. They came up with new ways to address the problems with delivering packages in India in areas where package theft is high, and people won’t pay until they receive the product. This was no easy feat for Flipkart in its early days. They also address another issue with doing business over the internet in India by setting up an ad campaign to build trust with their customers. These early decisions have enabled them to take advantage of growth opportunities in the future. With the eCommerce market expected to expand in India as the population grows from 1.3 billion to 1.5 billion by 2030, Flipkart is uniquely positioned to market these services and online products to the growing population. The ability to stay on top of the market is becoming more challenging, but they have an advantage over their competition. They were able to address logistic issues that their competition is now facing in the company’s early days. The challenge in the future is retaining market dominance over the competition as they catch up to Flipkart’s innovations. To build a marketplace model business in India, a company must look at many areas to decide if the switch is worth it. One of the most significant areas of consideration for me is if the parent company can control the quality of the experience. Flipkart has been cautious in selecting its selling partners, but with 30,000 partners in 2015 and 420,000 in 2021, it can be tough to track the quality of every seller. This is very apparent with the sandal incident. In 2015 Flipkart had 20 million products on its website. As of now, they have four times that amount. With so many products listed on the site, it is impossible to vet every seller properly. A rating system would need to be in place that tracks the problems customers report on each seller and eliminate bad players. To compete with companies such as Amazon on customer experience, Flipkart would have to do the same as them and side with the customer on nearly every complaint filed against the seller. This can be good for the customer, giving them a better experience but bad for the selling partners. The strategy is that the marketplace platform is so big that sellers would stay on even when they know that Flipkart will side against them with nearly all complaints. Moving to a Marketplace The challenge of moving to a marketplace from an inventory-based model is that Flipkart would need to sell off its current inventory without getting replacement inventory. They would then need to have hope that a selling partner would start selling the same merchandise to keep the product on the website. One option they could have would be to partner with a company and sell them all their current inventory, and then as a partner, they could keep it listed under a different seller’s name. The challenge with this method is they would need to sell it at a discounted rate to the seller, and all the potential profits of those products would now go to the selling partner instead of Flipkart. Until the move to a marketplace model, these products were Flipkart’s bread and butter. The upside of this move would be a significant reduction in the warehousing of all the products until they are sold, plus a reduction in managing these products. Those costs would be shifted to a third party, and the costs associated with warehouse employees are no longer needed. Another option Flipkart could have implemented would be to slowly move to a market-based model by having a mixed model, such as Amazon until the inventory is all sold. They could sell all the current inventory, thereby keeping the legacy cash revenue stream going until all the stock is gone. This would help them fund the transition by making greater profits from their products and making minuscule profits off the transactions of third-party sellers. The upside of this move would allow Flipkart to transition slowly, keeping the employees they have that they can later move into other positions as the need shifts. The downside to this move is the products they currently sell that customers are coming to their website for may not be available after all the inventory is gone. It will be up to third-party sellers to either start selling the product or offer a comparable product. It can be assumed that thirdparty sellers would replace most, if not all, products because of the profits from these products. The problem lies with the quality of the products being once controlled by Flipkart now being controlled by another company. This could tarnish Flipchart’s good reputation during the shift if the new seller doesn’t perform at the same standards as Flipkart. This is where careful planning will need to occur so as not to dilute the customer care promises they made to their customers. Flipkart’s Path to Profitability To have a path to profitability, they first need to determine why they are not currently profitable and what can be done about it? In the case study, they expected to be profitable within eighteen months back in June of 2015, but as of this moment, in 2022, they still have not been profitable. The customers from the second-tier and third-tier cities are a big part of Flipkart’s boost in growth and sales, but there is a gap in the model to generate revenue. The problem may be with the highly competitive environment Flipkart is working in. The profit margins in each product are too slim to correct for mistakes and still have funding for anything else. The path to being profitable will have to change how they discount products from their selling partners by passing those expenses onto them. The marketing model is straightforward, a product is sold on the site by a third party, and they profit from the sale of that product. They use the profits to build the platform people use to buy the products. This model depends on the volume of sales more than the cost of the product. So why the losses? In 2014 they had about one and a half times more money than Snapdeal, and their GMV was only that of Snapdeal. To stay ahead of the competition, they have poured money into three main areas, product discounts, free shipping, and advertising. At some point, these expenses need to be built into the cost of the products or passed along to the partnering sellers. Flipkart can entice the sellers to stay on the platform, even with the higher costs, by leveraging the network they have built over the years. Investing in Flipkart Even though Flipkart appears to be a good investment, it worries me that it’s not as good of an investment as it seems. Since they have switched to a marketing model, they have failed to turn a profit. This could be because of the complexity of doing business in India, or it could be part of a larger long-term strategy. Either way, with a company that is continually losing money year of year, when is the return on the investment? Their customer base grew five times in three years and has the potential to triple in the next ten years to over 150 million customers. If they can keep their fixed cost constant and their variable cost low, then the potential is there to triple their profits. My hesitation about this possible outcome is it should have already happened when they grew from 7 million customers in 2012 to 20 million in 2015. If they didn’t become profitable at that point when what is the magic number of customers that will make them profitable? This brings me back to is Flipkart a good investment? Looking at the potential for future growth, it seems to be, but the past performance would indicate that it is not. I believe the deep discount model is not sustainable over a long period, and the company strategies would need to change before I would want to invest or recommend investment for others.