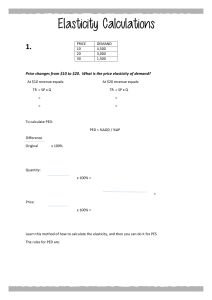

@ Price elasticity By the end of this chapter, you should be able to: • define price elasticity of demand and supply and perform simple calculations • demonstrate the usefulness of price elasticity in particular situations such as revenue changes and consumer expenditure. Taken from Cambridge International ExamiJlabom ~la bus (IGCSE 0455/0 Level 228 1) O Camb<odgelntematiooalExaminatioo, Price elasticity of demand The law of demand (see Chapter 3) states that as the price ofa product increases, the quantity demanded of that product will rend to full. H owever, the responsiveness of change in the quamiry demanded may vary depending on the customer's degree of ability and willingness to pay. For example, a rise in the price of a product with plemy of substitutes (such as bananas, greetings cards or chocolate bars) will have a larger impact on its lewl of demand than a rise in the price ofa product that has fewer substitutes (such as petrol, roothpaste or haircuts). Price elasticity of dema nd (PED) measures the degree of responsiveness of quantity demanded for a product following a change in its price. !fa price change causes a relatively small change in the quantity demanded, then demand is said to be price inelaHic: that is, buyers are not highly responsive to changes in price. For example, if the price of rice increases slightly, it is unlikely seriously to affect the demand for rice in countries like China, Vietnam and Thailand. By contrast, demand is said to be price elastic if there is a relath·ely large change in the quantity demanded of a product following a change in its price: that is, buyers are very responsive to changes in price. For example, a small rise in the price of Pepsi Cola is likely to reduce its demand quite drastically as customers switch to buying rival brands such as Coca-Cola. Demandforsoftdrinksispriceelasticbecausethereare many substitute products Asastaplefoodforbillionsofpeople, ricei shighlyprice inelasticinAsiaandtheWestlndies Price elasticity Exam p ractice Explain whether the price elasticity of demand for the following products is likely to be price elastic or price inelastic. Justify your answers. 1 Pineapples 2 To~ (4) 3 Overseas holidays 4 Textbooks (4) (4) ~ The uses of price elasticity of demand Knowledge of PED can give firms valuable information about how demand for their products is likely to change if prices are adjusted. This information can be used in se\·eralways: • Helping firms to decide on their pricing strategy - for example, a business with price inelastic demand for its products is likely to increase its prices, knowing that quantity demanded will be hardly affected. Therefore, the firm will benefit from higher revenue from selling its products at a higher price. • Predicting the impact on firms following changes in the exchange rate - for instance, firms that rely on exports will Theme parks charge different prices for essentially the same service. The difference is explained by PED generally benefit from lower exchange rates (as the price of exports become cheaper) and thus will become more price competitive. l11is assumes that the PED for exports is elastic, of course. • Price discrimination - this occurs when firms charge different customers different prices for essentially the same product because of differences in their PED. For example, theme parks charge adults different prices from children and they also offer discounts for families and annual pass holders. • Deciding how much ofa sales tax can be passed on to customers - for example, products sud1 as alcohol, tobacco and petrol are price inelastic in demand, so government taxes on these products can quite easily be passed on to customers without much impact on the quantity demanded. • Helping governments to determine taxation policies - for example, the government can impose heavy taxes on demerit goods (see Chapter 5) such as petrol and cigarettes, knowing that the demand for these products is price inelastic. While demerit goods are harmful to society as a whole, the high level ofraxes on such products does not significantly affect the level of demand (with minimal impact on sales revenues and jobs), but the go\·ernment can collect large sumsoftax revenues. The a/location of resources: how the market works; market failure Activity Discuss in pairs some examples of the ways in which multinational companies such as McDonald's, Microsoft, IKEA and Audi use PED in their businesses. Calculating price elasticity of demand Price elasticity of demand is calculated using the formula: PED percentage change in quantity demanded percentage change in price which can be abbreviated as: PED =%b.QD "p For example, ifa cinema increases its ticket price from $10 to $11 and this leads to demand fulling from 3500 to 3325 customers per week, then the PED for cinema tickets is calculated as: 332 500 • percentage change in quantity demanded= x 100 = - 5% : - ~ 50 11 10 • percentage change in price = ; x 100 = + 10% 0 • PED = ~ 10 =-0.5 Worked example: Calculating PED Assumethedemandforfootball matchticketsatSSOisSOOOO perweek. lfthefootballclub raisesitspricetoS60perticket and demand subsequently fallsto45000perweek,what isthevalueofpriceelasticity of demand? • First,calculatethe percentage change in thequantitydemanded demandfellby10percent from50000to45000match tickets per week. • Next,calculatethe percentage change in the priceofmatchtickets pricesincreasedby20per centfromSSOtoS60per match ticket. • Then, substitutethesefiguresintothePEDformula: ~ 20 m- 0.5 As the PED for match tickets is less than 1 (ignoring the minus sign), the demand for match tickets is price inelastic: in other words, football fans are not very responsive to the increase inmatchticketprices. Consequently,thereisarelativelysmallfallinthequantitydemanded comparedwiththepricerise. Price elasticity Interpreting PED calculations So what does a PED value of -0.5 actually mean? The cinema ticker example suggests that the demand for cinema tickers is price inelastic (i.e. relatively unresponsive to changes in price). This is because a 10 per cent increase in the price (from $10 to $11) only caused quantity demanded to drop by 5 per cent (from 3500 tickers per week to3325 ). The value of PED is negative due to the law of demand - an increase in the price of a product will rend to reduce its quantity demanded (see Chapter 3). The inverse relationship between price and quantity demanded also applies in the case of a price reduction - rhar is, a price fall rends to lead to an increase in the quantity demanded. The calculation of PED generally has rwo possible outcomes: • If the PED for a product is less than l (ignoring the minus sign), then demand is price inelastic (i.e. demand is relatively unresponsive to changes in price). This is because the percentage change in quantity demanded is smaller than the percentage change in the price (see Figure 4.1). • If the PED for a product is greater than 1 (ignoring the minus sign), then demand is price elastic (i.e. demand is relatively responsive to changes in price). This is because the percentage change in quantity demanded is larger than the percentage change in the price of the product (see Figure 4.2). §; p~lLti~~t~ i i P1 0 ;:i~~ : n,!~"'ceeci ~~~~;i:1~:~ G)., QI Gm nti!ydernooded Figure4.1 Thepriceinelasticdemandcurve . j''E f:cr~~:;::;a: =:~Jm~ta•"'ci ] p~ chocda1ebcn, .drdmls. mu and ai rline travel 0 QI Gi Gm nti!y demaoded Figure4.2 Thepriceelasticdemandcurve The a/location of resources: how the market works; market failure However, there are three special cases which are theoretical possibilities: • If the PED for a product is equal to 0, then demand is perfectly price inelastic: that is, a change in price has no impact on the quamity demanded. This suggests that there is absolutely no substitute for such a product, so suppliers can charge whatever price they like (see Figure 4.3). • If the PED for a product is equal to infinity ("") then demand is perfectly price elastic: that is, a change in price leads to zero quantity demanded. This suggests that customers switch to buying other substitute products if suppliers raise their price (see Figure 4.4). • If the PED for a product is equal to l (ignoring the minus sign), then demand has unitar}' price elasticity: that is, the percentage change in the quamity demanded is proportional to the change in the price (see Figure 4.5 ). ~(~ r r__~~i~:f" 1 ~~1t~1ceevel. P, ~~~"'t~ '"'""" a. 0 Qoor111ydemanded Figure4.3 Theperfectlypriceinelasticdemandcurve C i[j~~ §op 0 ] 0 ~~,:~nex~a~~ kocislo oo lnfini1echan'1hln ~i:"~1:=i1t+:re ~:1::'~'"ti= ~ify Gloo ntifydemaoded Figure4.4 Theperfectlypriceelasticdemandcurve o Qi E~~'i"~ a, ~nded Figure4.5 Theunitarypriceelasticdemandcurve Price elasticity Ac t ivity Many governments around the world raise taxes on tobacco, alcohol and petrol, on a regular basis. 1 Asaclass,discu5Stheeconomicreasonsfordoingso. 2 Usetheconceptofpriceelasticityofdemandinyourarguments. Exam practice 1 Assume the price of a sack of rice falls from $25 to $24, resulting in an increase in quantity demanded from 850 sacks to 875 sacks per month. Calculate the value of price elasticity of demand for the product and comment on your fi nding. (4) 2 Explain two reasons why the demand for rice is price inelastic in countries like India, Vietnam and China. (4) Determinants o f price elasticity of dema nd There are many interlinked determinants of the PED for a product: Demand for fresh flowers on special days like Valentine's Day and Mother's Day is relatively price inelastic compared with other days • Su bstitutio n - This is the key determinant of the PED for a good or service. In general, the greater the number and availability of close substitutes there are for a good or service, the higher the value of its PED will tend to be. This is because such products are easily replaced if the price increases, due to the large number of close substitutes that are readily available. By contrast, products with few substitutes, such as toathpicks, private education and prescribed medicines, have relatively price inelastic demand. • Income - The proportion of a consumer's income that is spent on a product also affects the value of its PED. lf the price of a box ofroothpicks or a packet of salt were to double, the percentage change in price is so insignificam to the consumer's overall income that quantity demanded would be hardly affected, if at all. By contrast, if the price of an overseas cruise holiday were to rise by 25 per cent from $10000 to $12 500 per person, this would discourage many more customers because the extra $2500 per ticket has a larger impact on a person's disposable income (even though the percentage increase in the price ofa cruise holiday is much lower than that of the box of toothpicks or packet of salt). Therefore, the larger the proportion ofincome that the price of a product represents, the greater the value of its PED tends to be. Of course, those on extremely high levels of income (such as Carlos Slim, Bill Gates and Warren Buffet - the three richest men on the planet) are probably not responsive to any change in the market price of goods and services! • Necessity - The degree of necessity of a good or service will affect the value of its PED. Products that are regarded as essential (such as food, fuel, medicines, housing and transportation) tend to be relath'ely price inelastic because households need these goods and services, and so will continue to purchase them even if their prices rise. By contrast, the demand for luxury products (such as Gucci suits, Chanel handbags and Omega watches) is price elastic, as these are not necessities for most households. The degree of necessity also depends on the timeframe in question. For example, demand for fresh flowers on Valentine's Day and on Mother's Day is relatively price inelastic compared with other days. It also applies to peak and off-peak times. For example , many countries operate public transport systems that charge more for The a/location of resources: how the market works; market failure • • • • • Study tips Although there are many determinants ofP ED,thekey factors can be remembered by THIS acronym: • Time • Habits, addictions and • Income • Substitutes (ava ila bi lity and price of). • tra\'Clling during peak time. This is partly due to overcrowding problems during such times, but also because the transport operators know that peak·time travel is more of a necessity than off-peak travel. H abits, add ictio n s, fashio n and t astes - !fa product is habit forming (such as tobacco) or highly fashionable (such as smartphones in many coumries), its PED tends to be relatively price inelastic. Similarly, people who are extremely devoted to a particular hobby, such as sports or music, are more willing to pay, e\·en at higher prices. Hence, the demand from these people is less sensitive to changes in price. Ad vertising an d brand loyalty - Marketing can have a huge impact on the buying habits of customers. Effectiw advertising campaigns for certain products nor only help to shift the demand curve outwards to the right, but can also reduce the price elasticity of demand for the product. Customers who are loyal to particular brands are less sensitive to a change in their prices, partly because these brands are demanded our of habit and personal preference - rhar is, they are the default choice over rival brands. Examples of brands with a loyal customer following include Coca-Cola, Apple, Samsung, Chanel, Toyota and Mercedes-Benz. Time - The period of time under consideration can affect the value of PED because people need time to change their habits and behavioural norms. Over time, they can adjust their demand in response to more permanent price changes by seeking out alternath·e products. For example, parems with children in private fee -paying schools are unlikely to withdraw their children from school if these establishments raise school fees because this would be very disruptive to their children's learning. Similarly, owners ofprivare motor \·chicles are nor likely to get rid ofrheir vehicles simply because of higher fuel prices. H owever, if there is a continual hike in prices o\·er time, both parents and vehicle owners may seek alternarh·es. H ence, demand rends to be more price elastic in the long run. D u rab ility - Some products, such as fresh milk, are perishable (do nor last \'cry Jong) and need to be replaced, so will continue to be bought even if prices rise. By contrast, if the price of consumer durable products (such as household furniture, LCD televisions or motor vehicles) increases, then households may decide to posq:one replacing these items due to the high prices involved in such purchases. Therefore, the more durable a product is, the more price elastic its demand tends to be. T he costs o f switching - There may be costs inrnh'ed for customers who wish to switch benveen brands or products. In the case of high switching costs, the demand for the product is Jess sensitive to changes in price - rhar is, it tends to be price inelastic. For example, manufacturers ofsmartphones, laptops and digital cameras make it more difficult for their customers to switch between rival brands by supplying different power chargers, memory cards and software. Similarly, mobile phone users and satellite television subsc.ribers are bound by length}' contracts, which makes switching between rival brands or services less easy. Such barriers to switching therefore make customers less responsi\·e to higher product prices. T h e br ead th of definition o f th e prod uct - !fa good or service is very broadly defined (such as 'food' rather than fruit, meat, apples or salmon), then demand will be more price inelastic. For example, there is clearly no real substitute for food or housing, so demand for these products will be very price inelastic. H owever, it is perhaps more useful to measure the price elasticity of demand for specific brands or products, such as carbonated soft drinks, Australian beef and !GCSE textbooks. Price elasticity Case Study: Toyota Motor Corporatio n Japanesecar-makerToyotahasseen its fairshareoftroublesinrecenttimes. It hashadtodealwithseveralcasesof global productrecallsforitscarsdueto safety concerns. The global financial crisis of2008alsoharmedglobalsalesfor severalyears. Ontopofthat,muchofthe world's largest car-maker's stocks of new carsweredestroyedinthetsunamiof March 2011 . Nevertheless,customerloyaltyremains strong in the USA, China and many other parts of the world. Toyota's closest rival, General Moto rs (GM), estimated the value of customer loyalty at S700 million for every percentage point of improvement in customer retention rates. Market research from Experian Automotive revealed that 47.3 per cent of Toyota's current customers from the USA would purchase a Toyota, Scion or Lex us model as their nextcar. Globally,thisfigurestandsat58percentforToyotaand52percentforGM. Toyota'suseofmarketingsloganssuchas'Thebestbuiltcarsintheworld'cancertainly go a long way to reassure Toyota's loyal customers about their cars. SourcPS:adaptl'dfromW.JI/Sm>etJouma/andT/Mf8u5ines, Discusshowtheconceptofpriceelasticityofdemandanditsdeterminantscanhelpto explain why Toyota Motor Corporation is the world's largest car-maker. PED, consumer expenditure and revenue changes Knowledge of the price elasticity of demand for a product can be used to assess the impact on consumer expenditure and therefore sales revenue following changes in price. Sales revenue is the amoum of money received by a supplier from the sale ofa good or service. It is calculated by multiplying the price charged for each product by the quamitysold, i.e. Rc~·enue = price x quantity demanded Note that this is not the same as profit, which is the numerical difference between a firm's sales revenues and its total costs of production. For example, if Leno.•o sells 5000 laptops at $700 each in the first quarter of the month, its sales revenue is $3.5 million. Suppose that the computer maker reduces its price to $650 and quantity demanded rises to 5200 units in the following quarter. Was this a gcxxi business decision? The a/location of resources: how the market works; market failure A quick calculation of PED reveals that the demand fur Lenom laptops is price elastic: 550 ~~000 x l 00 = +10% • percenrage change in quantity demanded= • percenrage change in price= $ 65 7 ~; ~ 00 x 100 = - 7. 14% 0 • thus, PED= 1.4 This means the PED fur Lenovo laptops is price elastic. Hence a fall in price causes a relatively larger increase in the quantity demanded, so sales revenues should increase. This can be checked as follows: original sales revenue = $700 x 5000: $3 500000 new sales revenue = $650 x 5500 = $3 575 OOO difference in sales revenue= $3.575m - $3.5m = +75000 Given that demand fur LenO\'O laptops in the above example is price elastic, a reduction in price was a sensible business decision. Therefore , it can be seen that knowledge of PED fur a product can infurm firms about their pricing strategy in order to maximise sales revenues. These relationships are summarised in Table 4. 1 and and Figures 4.6 and 4.7. Ta ble4.1 TherelationshipbetweenPEDandsalesrevenue Price chan ge Inel a sti c Increase price Reduce price Figure4.6 Revenues fall Unita ry Elas ti c No change in revenues Revenues fall No change in revenues Price inelasticdemandandsalesrevenue =~~tj.!.,vfu p resporu;M!1ochange, ln ~el . A 1 :~r.:~:~,*:=C:.&f ~ j p~ 1oa contra.ll. lfp<tewera1olocreose de :=.-;:~~::: ne! b. ln><Jle:sreveo.ie Q QI G:i Qw~ Figure4.7 Priceelasticdemandandsales revenue Price elasticity Activity In small groups, discuss why firms use peak and off-peak pricing strategies, such as airline ticketsbeingfarmoreexpensiveduringschoolholidays. 1 How many examples of price discrimination based on time (peak and off-peak) can your group come up with? 2 Does your group believe that price discrimination is beneficial? Justify your argument. Exam practice Suppose Sharma Fabrics sells 1350 units of wool per month at $4.00 each. Following an increase in price to $4.60 per unit, the firm discovers that the quantity demanded falls to 1215unitspermonth. 1 2 Calculate the price elasticity of demand for wool sold at Sharma Fabrics. Calculate the change in the total revenue following the increase in price of wool. l Explain how knowledge of price elasticity of demand can be of use to Sharma Fabrics. (3) (3) [4) Price elasticity of supply Price elasticity of supply (PES) measures the responsh'Cness of the quantity supplied ofa product following a change in its price. Supply is said to be price elastic if producers can quite easily increase supply without a time delay if there is an increase in the price of the product. This can help to gi\'c such finns a compctiti\'c advantage, as they arc able to respond to changes in price. By contrast, supply is price inelastic if firms find it difficult to change production in a gi\'cn time period when the market price d1angcs. Calculating price elasticity of supply Price elasticity of supply is calculated using the formula: percentage change in quantity supplied PES percentage change in price whid1 can be abbreviated as: %t.QS PES = %K]> For example, if the market price of beans increased from $2 per kilo to $2.20 per kilo, causing quantity supplied to rise from 10000 units to 10 500 units, then the PES is calculated as: • percentage change in quantity supplied= 105 ~~~000 x lOO = +5% 2 2 • percentage change in price= $ .2~ ~ $ .0 x 100 = +1 0% 20 • PES=~=0.5 +10% CD