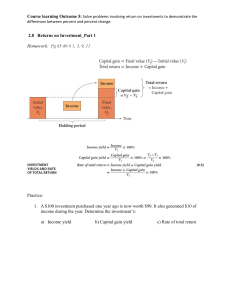

BFC 5935 – Portfolio management and theory Lecture 1 – Assets and Investment Investor Policy Statement [IPS] Return: Capital preservation, Capital appreciation(增值) Current income, Total return Objectives: (目标) Risk: Ability(net wealth,年龄的影响), Willingness Financial Planning: (财务规划) Constraints: (限制因素) Time horizon, Liquidity, Legal, Unique circumstance Accumulation phase Investor life cycle: Consolidation phase Spending and gifting phase Asset allocation: (资产配置) Growth Assets: Equity and Property Asset Classes: Defensive Assets: Fixed Income and cash 如何为投资者指定适合他的投资组合 1. 判断投资者属于哪个 phase 2. 阐述投资者的短期,长期目标 3. 投资者的资产分配建议 Holding Period Return [HPR] 持有期间的回报 = Ending Value / Beginning Value Holding Period Yield [HPY] 持有期间的回报率 = HPR – 1 Example 1: Assume that you invest $200 at the beginning of the year and get back $220 at the end of the year. What are the HPR and the HPY for your investment? HPR = 220/200 = 1.1 HPY = HPR1 = 1.11 = 0.1=10% Lecture 2 – Portfolio Theory Portfolio Return: E[Rp] = w1E[R1] + w2E[R2] + … + wnE[Rn] Portfolio Risk: Correlation coefficient [rAB]: Standardized measure of association between two variables. R: [-1,1] ·r = 1, perfect positive correlation ·r = 0, no correlation ·r = -1, perfect negative correlation 负相关就不要后面那串公式了 S.D.=(0.8)^2 * 0.02 + (0.2)^2 * 0.03 = 0.014 For a portfolio comprising 2 securities, let X be the proportion invested in the first security and (1-X) be the proportion invested in the second security. 对于一个由 2 种证券组成的投资组合,设 x 为投资于第一种证券的比例, (1-x)为投资 于第二种证券的比例。 The Minimum Variance Portfolio (MVP) 最小方差组合 Lecture 3 – Asset Pricing Models The Capital Market Line (CML) 资本市场线 Optimal risky portfolio with access to a risk-free asset. 获得无风险资产的最佳风险组合 This portfolio returns according to the CML: Any portfolios on the RfT are inefficient(低效率) Investors can achieve a portfolio with the best possible return for any level of risk by holding Portfolio M The line RfMN tangents with the efficient frontier The line RfMN represent different combinations of risk-free asset and the Portfolio M Investor 2 (with U2) prefers to invest 100% of the wealth in Portfolio M Investor 1 (with U1) prefers to invest<100% of the wealth in Portfolio M and lend at the risk-free rate Investor 3 (with U3) prefers to invest>100% of the wealth in Portfolio M and borrow at the risk-free rate Capital Asset Pricing Model (CAPM) 资本资产定价模型 CAPM: Developed by Sharpe, Lintner and Mossin The covariance term is the only explanatory factor in the equation that is specific to asset i. In equilibrium, all assets should plot on the SML. 在平衡状况下,所有的资产都应该绘制在 SML 上 Any security with an estimated return that plots above the SML is underpriced. 任何估计回报率高于 SML 的证券都是被低估的 Any security with an estimated return that plots below the SML is overpriced. 任何估计回报率低于 SML 的证券都是被高估的 Lecture 4 – Market Efficiency The Efficient Market Hypothesis (EMH) 有效市场假说 ·The price fully reflect all available information ·The reaction is instantaneous (即时) and unbiased (无偏见) Characteristics of an efficient market ·A large number of competing participants ·Investors respond quickly to new information ·Random Walk Hypothesis Categories of Market Efficiency 1. Weak-form efficiency: all past information is fully reflected in a security’s current market price 2. Semi-strong form efficiency: all publicly available information is fully reflected in a security’s current market price. 3. Strong-form efficiency: all information, whether public or private, is fully reflected in a security’s current market price. Fundamental Analysis (基本面分析) · The market either ignores some publicly available information, or systematically misinterprets that information. 市场要么忽略一些公开的信息,要么曲解了这些信息 ·Careful analysis may reveal mispriced securities. 仔细的分析可能会揭示出错误的证券定价 Technical Analysis (技术分析) ·Plotting a share’s historical price record on a chart and then using this as the basis for predictions as to the likely future short-term course of prices. ·However, the alleged benefits of this type of analysis are dubious (可疑的). Lecture 5 – Behavioral Finance House-Money Effect - After people have experienced a gain/profit, they are willing to take more risk Snakebite Effect - After have experienced a loss, they are less willing to take risk Trying to Break Even Effect - People tend to take the chance to make up their losses Endowment Effect - People generally demand more to sell than to buy an object Status Quo Bias Effect - People tend to keep things that have been given rather than exchanging them. Lecture 6 – Bond Financial Markets Capital Market – where long-term securities are raised and traded Money Market – where short-term, liquid, low-risk debt securities are traded. Bond Risks Interest Rate Risk 1. There is a negative relationship between the bond price and the change in interest rate. 2. If interest rate increases, bond price will fall; If interest rate decrease, bond price will rise. 3. Interest rate risk is the major risk faced by investors in the bond market. Coupon Rate = Market Yield (Price = Par Value) Coupon Rate > Market Yield (Price > Par Value) Coupon Rate < Market Yield (Price < Par Value) Reinvestment Risk 1. This is the risk that the proceeds received have to be reinvested at a lower interest rate than the bond that provided the proceeds. 这是指收到的收益必须以低于提供收益的债 券的利率进行再投资的风险 2. Reinvestment risk occurs when an investor purchases a bond and relies on the bond’s yield as a measure of return. 再投资风险发生在投资者购买债券并依靠债券的收益率 作为衡量回报的标准。 3. Zero-Coupon bonds do not have reinvestment risk. Credit Risk 1. Default Risk: Risk that the bond issuer will fail to make payment. 2. Credit Spread Risk: Yield on a similar default-free bond issue and a premium above the yield on a default-free bond. 3. Downgrade Risk: A credit rating indicates the potential default risk of a particular bond or issuer. Liquidity Risk 1. This is the risk that an investor have to sell a bond below its indicated value. 2. The primary measure of liquidity is the spread size. Exchange Rate or Currency Risk 1. A bond whose payments are in foreign currency means that the receipts in domestic currency are uncertain. 2. If the foreign currency depreciates then fewer of domestic dollars can be exchanged. 3. If the foreign currency appreciates then more of domestic dollars can be exchanged. Event Risk 1. This is the risk related to the change in the issuer’s ability to make interest and principle payments due to dramatically and unexpectedly change of event. (Natural Disaster, Takeover / Corporate Restructuring, Regulatory Change) Bond Yield Nominal Yield (名义收益率) - It is simply the coupon rate of a particular issue - For example, a bond with an 8% coupon has an 8% nominal yield Current Yield (目前的收益率) - Similar to dividend yield for stocks - CY = Ci / Pm - CY = The current yield on a bond - Ci = The annual coupon payment of Bond i - Pm = The current market price of the Bond Yield to Maturity (YTM) Yield to Call Realized (horizon) yield Bond Valuation Bond Duration (债券期限) Lecture 7 & 8 – Security Analysis Valuation Approach - Top-down, three-step approach - Bottom-up, stock valuation, stock picking approach The different between the two approaches is the perceived importance of economic and industry influence on individual firms and stocks. Present Value Analysis Ct = Cash flow in period t n = The nth cash flow i = The discount rate Dividend Discount Model PV = value of all cash flows from a given stock n = the last period the stock is held Pn = the price of the stock in period n ke = the investor’s required rate of return for this stock, which is determined by the uncertainty (risk) of the stock’s cash flows Infinite period model assumes a constant growth rate for estimating future dividends 无限期模型假设一个恒定的增长率来估计未来的红利 Vj = present value of stock j Do = dividend payment in the current period g = the constant growth rate of dividends ke = required rate of return on stock j n = the number of periods, which we assume to be infinite (无限) This may be reduced to What is the significance of errors in the growth rate? Assume Div = $0.20, ke = 8% If g = 5%: PV = $0.20(1+0.05)/0.08 – 0.05 = $7 If g = 6%: PV = $0.20(1+0.06)/0.08 – 0.06 = $10.60 Plowback ratio (回流率) 1. Payout ratio = Dividends / Profits 2. Plowback ratio = 1 – Payout Ratio 3. ROE = Profits / Equity 4. Growth rate = Plowback * ROE Lecture 9 & 10 – Portfolio Management Managed Fund Products Capital Stable - Large investments in defensive asset classes - Long term stability with low risk Balanced - Balanced investments in different asset classes - Medium risk with medium returns Growth - Attain capital growth and reinvest earnings - High risk position - Active management and longer term horizon