Merger Assignment: Stock Swaps, Exchange Ratios, Gains

advertisement

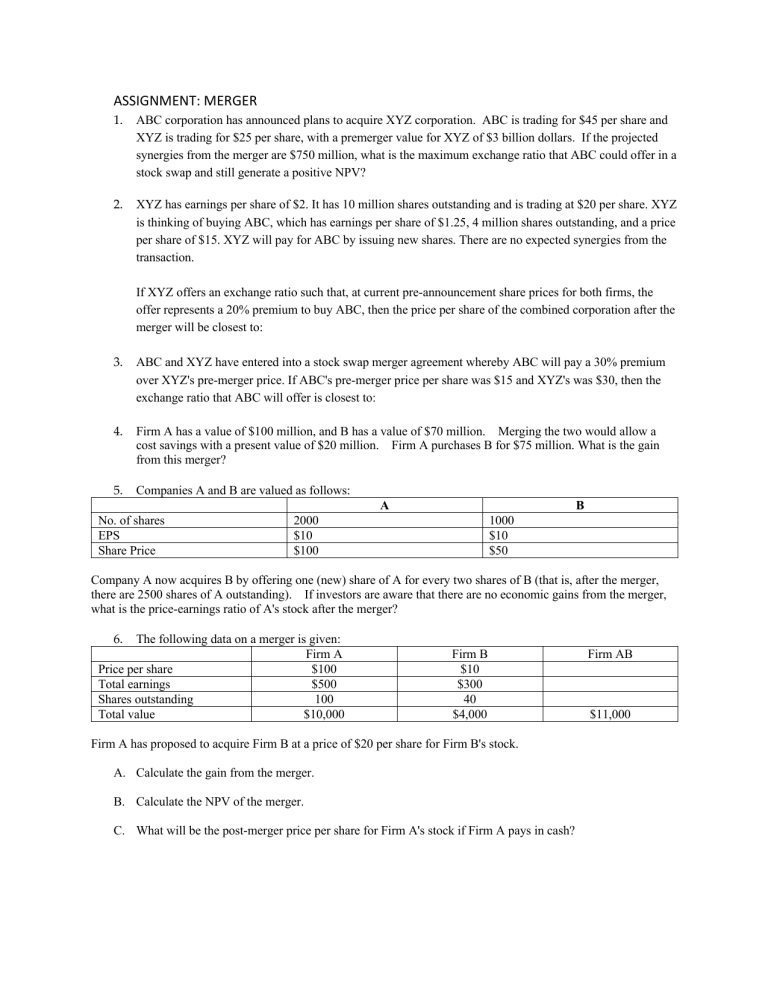

ASSIGNMENT: MERGER 1. ABC corporation has announced plans to acquire XYZ corporation. ABC is trading for $45 per share and XYZ is trading for $25 per share, with a premerger value for XYZ of $3 billion dollars. If the projected synergies from the merger are $750 million, what is the maximum exchange ratio that ABC could offer in a stock swap and still generate a positive NPV? 2. XYZ has earnings per share of $2. It has 10 million shares outstanding and is trading at $20 per share. XYZ is thinking of buying ABC, which has earnings per share of $1.25, 4 million shares outstanding, and a price per share of $15. XYZ will pay for ABC by issuing new shares. There are no expected synergies from the transaction. If XYZ offers an exchange ratio such that, at current pre-announcement share prices for both firms, the offer represents a 20% premium to buy ABC, then the price per share of the combined corporation after the merger will be closest to: 3. ABC and XYZ have entered into a stock swap merger agreement whereby ABC will pay a 30% premium over XYZ's pre-merger price. If ABC's pre-merger price per share was $15 and XYZ's was $30, then the exchange ratio that ABC will offer is closest to: 4. Firm A has a value of $100 million, and B has a value of $70 million. Merging the two would allow a cost savings with a present value of $20 million. Firm A purchases B for $75 million. What is the gain from this merger? 5. Companies A and B are valued as follows: A No. of shares EPS Share Price B 2000 $10 $100 1000 $10 $50 Company A now acquires B by offering one (new) share of A for every two shares of B (that is, after the merger, there are 2500 shares of A outstanding). If investors are aware that there are no economic gains from the merger, what is the price-earnings ratio of A's stock after the merger? 6. The following data on a merger is given: Firm A Price per share $100 Total earnings $500 Shares outstanding 100 Total value $10,000 Firm B $10 $300 40 $4,000 Firm A has proposed to acquire Firm B at a price of $20 per share for Firm B's stock. A. Calculate the gain from the merger. B. Calculate the NPV of the merger. C. What will be the post-merger price per share for Firm A's stock if Firm A pays in cash? Firm AB $11,000 7. From the following calculate the free cash flow: EBITDA Depreciation Expense Interest expense Tax rate Purchases of fixed asset Change in WC Net borrowing Common dividends $1000 400 150 30% 500 50 80 200