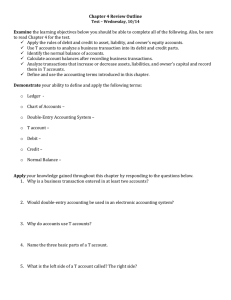

Maria Juarez General journal For the quarter ended April 30, 2010 P2-2B Maria Juarez is a licensed dentist. During the first month of the operation of her business, the following events and transactions occurred. April 1 Invested $40,000 cash. 1 Hired a secretary-receptionist at a salary of $600 per week payable monthly. 2 Paid office rent for the month $1,000. 3 Purchased dental supplies on account from Smile Company $4,000. 10 Provided dental services and billed insurance companies $5,100. 11 Received $1,000 cash advance from Trudy Borke for an implant. 20 Received $2,100 cash for services completed and delivered to John Stanley. 30 Paid secretary-receptionist for the month $2,400. 30 Paid $1,600 to Smile Company for accounts payable due. Maria uses the following chart of accounts: No. 101 Cash, No. 112 Accounts Receivable, No. 126 Supplies, No. 201 Accounts Payable, No. 205 Unearned Revenue, No. 301 Maria Juarez, Capital. No. 400 Service Revenue, No. 726 Salaries Expense, and No. 729 Rent Expense. Requirement (a) Date 2010 April 1 April 1 April 2 April 3 April 10 April 11 April 20 April 30 April 30 Account Title and Explanation Cash Maria Juarez capital (Invested cash to start business) No entry- Not a transaction Rent expenses Cash (To record rent paid) Supplies Accounts payable (Purchased supplies from smile company) Accounts Receivable Service Revenue (Billed clients for services provided) Cash Unearned Service Revenue (Received advance for the services to be provided) Cash Service Revenue (To record cash for service provided) Salary Expense Cash (To be record salary paid) Accounts payable Cash (To record payment made to Smile Co.) Ref Debit 101 301 $ 40,000 729 101 $ 1,000 126 201 $ 4,000 112 400 $ 5,100 101 205 101 400 $ 1,000 $ 2,100 726 101 $ 2,400 201 101 $ 1,600 Credit $ 40,000 $ 1,000 $ 4,000 $ 5,100 $ 1,000 $ 2,100 $ 2,400 $ 1,600 1. 2. 3. 4. 5. Identify whether an economic event or not? If an economic event or transaction, identify the accounts related to that transaction. Set/Apply the golden rule. Cash: Asset: Debit Capital: credit Requirement (b) GENERAL LEDGER Cash No:101 Date 2010 April 1 April 2 April 11 April 20 April 30 April 30 Explanation Ref Debit J1 $ 40,000 J1 J1 J1 J1 J1 - $1,000 $2,100 Credit - $ 40,000 $1,000 $2,400 $1,600 Account Receivable Date 2010 April 10 2010 April 3 April 30 Explanation Ref Debit J1 $5,100 Credit - 2010 April 3 Balance $5,100 No:206 Explanation Ref J1 J1 Debit $1,600 Supplies Date $39,000 $40,000 $42,100 $39,700 $38,100 No:112 Accounts Payable Date Balance Credit Balance $4,000 $4,000 - $2,400 No:126 Explanation Ref Debit J1 $4,000 Credit Balance $4,000 Unearned Revenue Date 2010 April 11 No:205 Explanation Ref J1 Debit - Credit $1,000 Salaries Expenses Date 2010 April 30 2010 April 10 April 20 Explanation Ref Debit J1 $2,400 Credit - 2010 April 2 No:400 Explanation Ref Debit J1 - J1 - Credit $5,100 $2,100 2010 April 1 Balance $5,100 $7,200 No:729 Explanation Ref Debit J1 $1,000 Credit - Balance $1,000 Maria Juarez, Capital Date Balance $2,400 Rent Expenses Date $1,000 No:726 Service Revenue Date Balance No:301 Explanation Ref J1 Debit - Credit Balance $ 40,000 $ 40,000 Requirement (c) Maria Juarez Trial Balance April 30, 2010 Name of the Accounts Cash Accounts Receivable Supplies Accounts Payable Unearned Revenue Maria Juarez Capital Service Revenue Salaries Expenses Rent Expenses Total Arithmetically Accurate Debit $38,100 $5,100 $4,000 $2,400 $1,000 $50,600 Credit $2,400 $1,000 $40,000 $7,200 $50,600