Bank of England Interest Rate Decision: An Economic Analysis

advertisement

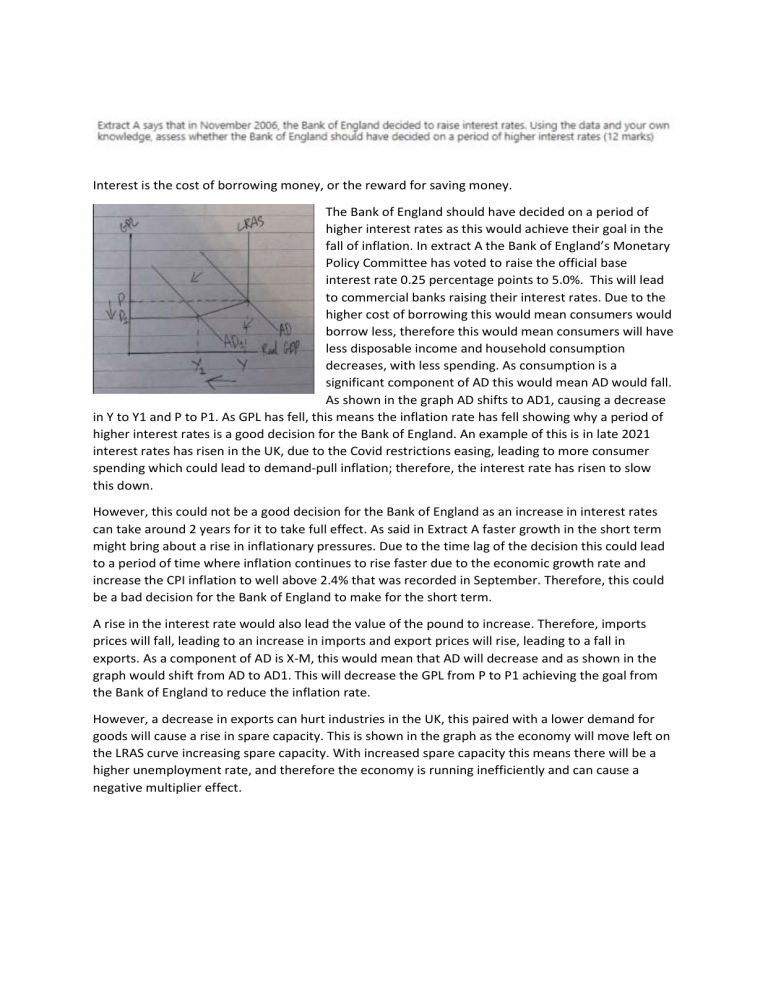

Interest is the cost of borrowing money, or the reward for saving money. The Bank of England should have decided on a period of higher interest rates as this would achieve their goal in the fall of inflation. In extract A the Bank of England’s Monetary Policy Committee has voted to raise the official base interest rate 0.25 percentage points to 5.0%. This will lead to commercial banks raising their interest rates. Due to the higher cost of borrowing this would mean consumers would borrow less, therefore this would mean consumers will have less disposable income and household consumption decreases, with less spending. As consumption is a significant component of AD this would mean AD would fall. As shown in the graph AD shifts to AD1, causing a decrease in Y to Y1 and P to P1. As GPL has fell, this means the inflation rate has fell showing why a period of higher interest rates is a good decision for the Bank of England. An example of this is in late 2021 interest rates has risen in the UK, due to the Covid restrictions easing, leading to more consumer spending which could lead to demand-pull inflation; therefore, the interest rate has risen to slow this down. However, this could not be a good decision for the Bank of England as an increase in interest rates can take around 2 years for it to take full effect. As said in Extract A faster growth in the short term might bring about a rise in inflationary pressures. Due to the time lag of the decision this could lead to a period of time where inflation continues to rise faster due to the economic growth rate and increase the CPI inflation to well above 2.4% that was recorded in September. Therefore, this could be a bad decision for the Bank of England to make for the short term. A rise in the interest rate would also lead the value of the pound to increase. Therefore, imports prices will fall, leading to an increase in imports and export prices will rise, leading to a fall in exports. As a component of AD is X-M, this would mean that AD will decrease and as shown in the graph would shift from AD to AD1. This will decrease the GPL from P to P1 achieving the goal from the Bank of England to reduce the inflation rate. However, a decrease in exports can hurt industries in the UK, this paired with a lower demand for goods will cause a rise in spare capacity. This is shown in the graph as the economy will move left on the LRAS curve increasing spare capacity. With increased spare capacity this means there will be a higher unemployment rate, and therefore the economy is running inefficiently and can cause a negative multiplier effect.