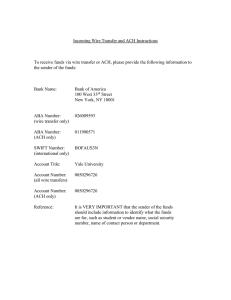

ACH Transaction Fees: What is it & How much does it cost? ACH transaction fees are the fees charged by your financial institution for processing an ACH payment. These fees can vary depending on the bank or credit union, but they typically range from $0.25 to $1.00 per transaction. While these fees may seem small, they can add up quickly if you're making multiple payments. To save money on ACH fees, consider using a low-cost online checking account or credit union rather than your bank. Low-cost accounts typically charge $0 to $2 per month as opposed to the $10 to $20 average cost of a traditional stand. ACH transaction fees are charged by financial institutions to process payments made by ACH, or Automated Clearing House. Fees can vary depending on the bank or credit union, but typically range from $0.25 to $1.00 per transaction. In order to save money on these fees, it's important to use a low-cost checking account or credit union rather than your traditional bank account. Low-cost accounts typically charge $0 to $2 per month, as opposed to the $10 to $20 average cost of a traditional bank account. When making multiple ACH payments, be sure to take advantage of any fee discounts that may be offered by your financial institution. For example, some banks offer free or discounted ACH transfers if you set up direct deposit with them. ACH payment fees can add up quickly, but there are ways to save money on these charges. By using a low-cost checking account or credit union, you can avoid paying high fees for ACH transfers. Also, be sure to take advantage of any fee discounts that may be offered by your bank or credit union. This could include free or discounted ACH transfers for customers who set up direct deposit with them. With a little research and planning, you can easily save money on ACH fees!