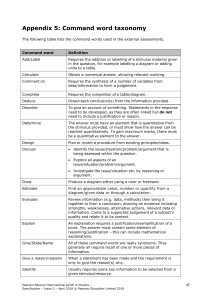

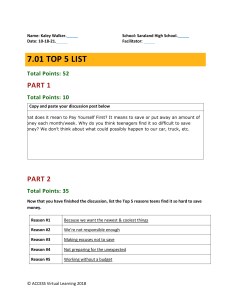

Financial Management: Principles & Applications Thirteenth Edition Chapter 20 Corporate Risk Management Copyright Education, © 2018, 2014, 2011 Pearson Inc. All Reserved Rights Reserved Copyright © 2018, 2014, 2011 Pearson Inc. Education, All Rights Learning Objectives 1. Define risk management in the context of the five-step risk management process. 2. Understand how insurance contracts can be used to manage risk. 3. Use forward contracts to hedge commodity price risk. 4. Understand the advantages and disadvantages of using exchange-traded futures and option contracts to hedge price risk. 5. Understand how to value option and how swaps work. Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved Principles Applied in This Chapter • Principle 1: Money Has a Time Value • Principle 2: There is a Risk-Return Tradeoff Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved 20.1 FIVE—STEP CORPORATE RISK MANAGEMENT PROCESS Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved Five—Step Corporate Risk Management Process 1. Identify and understand the firm’s major risks. 2. Decide which types of risks to keep and which to transfer. 3. Decide how much risk to assume. 4. Incorporate risk into all the firm’s decisions and processes. 5. Monitor and manage the risk that the firm assumes. Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved Step 1: Identify and Understand the Firm’s Major Risks • The first step is to develop a full understanding of the types of risks the firm faces. These risks relate to the factors that drive the firm’s cash flow and volatility. The most common sources include the following: Demand risk, Commodity risk, Country or Political risk, Operational risk, and Foreign Exchange risk. • Only operational risk is largely under the direct control of the firm’s management. Risk management generally focuses on the external factors that influence the firm’s cash flow volatility. Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved Step 2: Decide Which Type of Risk to Keep and Which to Transfer This is perhaps the most critical step. For example, oil and gas exploration and production firms (E&P) have historically chosen to assume the risk of fluctuations in the price of oil and gas. However, many firms have chosen to actively manage the risk. These firms believe that they can operate more efficiently if they mitigate future price fluctuations. Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved Step 3: Decide How Much Risk to Assume • Figure 20-1 illustrates the concept of a firm’s “appetite” for assuming risk, or its risk profile. The figure provides three distributions of cash flow that correspond to three different approaches to risk management. • The specific strategy chosen will depend upon the firm’s attitude to risk and the cost/benefit analysis of risk management strategies. Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved Figure 20.1 Cash Flow Distributions for Alternative Risk Management Strategies Legend: Risk Scenario Expected Cash Flow Low risk $58.34 million Standard Deviation in Cash Flow $3.14 million Probability of Not Being Able to Meet Capital Expenditure, Dividend, and Principal and Interest Requirements 0.00% Medium risk $61 million $12.33 million 11.46% High risk $66.81 million $21.44 million 16.53% Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved Step 4: Incorporate Risk into All the Firm’s Decisions and Processes • The firm must implement a system for controlling the firm’s risk exposure. • For example, for those risks that will be transferred, the firm must determine an appropriate means of transferring risk such as buying an insurance policy. Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved Step 5: Monitor and Manage the Firm’s Risk Exposure An effective monitoring system ensures that the firm’s day-to-day decisions are consistent with its chosen risk profile. Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved 20.2 MANAGING RISK WITH INSURANCE CONTRACTS Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved Managing Risk with Insurance Contracts Insurance is defined as the equitable transfer of the risk of a loss from one entity to another in exchange for the payment of premium. Essentially, the insured exchanges the risk of a large, uncertain, and possibly devastating loss to an insurance company in exchange for a guaranteed, small loss (premium). Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved Types of Insurance Contracts Type of Risk Type of Insurance Contract Used to Hedge Property damage to company facilities due to fire, storm, or vandalism Property insurance Loss of business resulting from a temporary shutdown because of fire or other insured peril Business interruption insurance Loss of income resulting from the disability or death of an employee in a key position Key person life insurance Losses resulting from claims against the officers and directors for alleged errors in judgment, breaches of duty, and wrongful acts related to their organizational activities Director and officer insurance Losses due to on-the-job injuries suffered by employees Workers’ compensation insurance Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved Why Purchase Insurance? • When a firm decides to purchase insurance, it is typically the result of a cost-benefit type of analysis involving a comparison of the costs of purchasing the insurance contract and the expected cost of retaining the risk that would be covered by the insurance. • Self-insurance entails setting aside a calculated amount of money to compensate for the potential future loss. Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved 20.3 MANAGING RISK BY HEDGING WITH FORWARD CONTRACTS Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved Managing Risk by Hedging with Forward Contracts (1 of 4) Hedging refers to a strategy designed to offset the exposure to price risk. For example, If you are planning to buy 1 million Euros in 6 months, it will cost you more if Euro strengthens. Such risk can be mitigated with forward contracts. Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved Managing Risk by Hedging with Forward Contracts (2 of 4) A Forward contract is a contract in which a price is set today for an asset to be sold in the future. These contracts are privately negotiated between the buyer and seller. Since the price is locked-in today, risk from future adverse price fluctuation is eliminated. Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved Managing Risk by Hedging with Forward Contracts (3 of 4) • If you are planning to buy 1 million Euros in 6 months, you could negotiate a rate today for Euros (say 1 Euro = $1.35) using a forward contract. • In 6-months, regardless of whether Euro has appreciated or depreciated, your obligation for 1 million Euros will be at $1.35 each or $1.35 million. Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved Managing Risk by Hedging with Forward Contracts (4 of 4) The following table shows potential future scenarios and the cash flows. It is seen that Forward contract helps to reduce risk if Euro appreciates. However, if Euro depreciates, Forward contract obligates the firm to pay a higher amount. Future Exchange Rate of Euro Cost with a Forward Contract Cost without a Forward contract Effect of Forward Contract $1.20 $1.35 million $1.20 million Unfavorable $1.30 $1.35 million $1.30 million Unfavorable $1.40 $1.35 million $1.40 million Favorable $1.50 $1.35 million $1.50 million Favorable Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved Hedging Commodity Price Risk Using Forward Contracts (1 of 2) • Assume jet fuel is currently selling for $100 per barrel. If an airline company does not want to suffer the risk associated with future price fluctuations in the cost of fuel, it can enter into a forward contract today with a delivery price equal to the current price of fuel of $100. Such a contract will have a payoff found in Panel A of Figure 20.2. • The firm that owns this position is said to have taken a long position. If the actual price of jet fuel rises to $130 in six months, then the forward contract is worth $30 per barrel because the cost to airline company remains $100 per barrel. Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved Hedging Commodity Price Risk Using Forward Contracts (2 of 2) Assume a refining company anticipates that it will have jet fuel refined and ready for sale in six months. To eliminate the risk of drop in market price in six months, the company can sell a forward contract (i.e. take a short position) for the delivery of fuel in six months at a price of $100. The payoff for this contract is found in panel B. If the price of jet fuel rises to $130 on the delivery date, the refining company suffers a loss of $30 on the forward contract, as the price received per barrel is $100. Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved Figure 20.2 Delivery Date Profits or Losses (Payoffs) from a Forward Contract (Panel A) Long Position in Forward Contract Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved Figure 20.2 Delivery Date Profits or Losses (Payoffs) from a Forward Contract (Panel B) Short Position in Forward Contract Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved CHECKPOINT 20.1: CHECK YOURSELF Hedging Crude Oil Price Risk using Forward Contract Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved The Problem Consider the profits that Progressive might earn if it chooses to hedge only 80% of its anticipated 1 million barrels of crude oil under the conditions just described. Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved Step 1: Picture the Problem • The figure shows that the future price of crude oil could have a dramatic impact on the total cost of 1 million barrels of crude oil. • If the price is not managed, it will significantly affect the future profits of the firm. Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved Step 2: Decide on a Solution Strategy The firm can hedge its risk by purchasing a forward contract. This will lock-in the future price of oil at the forward rate of $130 per barrel. Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved Step 3: Solve (1 of 2) The table on the next slide contains the calculation of firm profits for the case where the price of crude oil is not hedged (column E), the payoff on the forward contract (column F) and firm profits where the price of crude is 80% hedged (column G). Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved Step 3: Solve (2 of 2) Price of Oil/bbl A Total Cost of Oil B=A×1m Total Revenues C Total Refining Costs D=$30×1m Unhedged Annual Profits Profit/Loss on Forward Contract =(A$130)×1mx%He dge E=C+B+D 80% Hedged Annual Profits G=E+F $110 $(110,000,000) $165,000,000 $(30,000,000) $25,000,000 $(16,000,000) $9,000,000 115 (115,000,000) $165,000,000 (30,000,000) $20,000,000 $(12,000,000) $8,000,000 120 (120,000,000) $165,000,000 (30,000,000) $15,000,000 $(8,000,000) $7,000,000 125 (125,000,000) $165,000,000 (30,000,000) $10,000,000 $(4,000,000) $6,000,000 130 (130,000,000) $165,000,000 (30,000,000) $5,000,000 $— $5,000,000 135 (135,000,000) $165,000,000 (30,000,000) $0 $4,000,000 $4,000,000 140 (140,000,000) $165,000,000 (30,000,000) $(5,000,000) $8,000,000 $3,000,000 Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved Step 4: Analyze • The total cost of crude oil increases as the price of crude oil increases. The unhedged annual profits range from a loss of $5 million to a gain of $25 million. • With 80% hedging, losses are avoided and the firm ends with profits ranging from $3 million to $5million. The forward contract obviously benefits the firm when the price of oil is higher than $130. Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved Hedging Currency Risk Using Forward Contracts (1 of 2) • Currency risk can be hedged using forward contracts. • For example, If Disney expects to receive ¥500 million from its Tokyo operations in 3 months. Disney can lock-in the exchange rate and thereby eliminate any risk of an unfavorable move in exchange rates. Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved Hedging Currency Risk Using Forward Contracts (2 of 2) Disney will follow a 2-step procedure to hedge its currency risk: 1. (Today): Enter into a forward contract which requires Disney to sell ¥500 million three months from now at the forward rate of say $0.009123/ ¥. 2. (In three months): Disney will convert its ¥500 million cash flow at the contracted forward rate, yielding $4,561,500 (¥500 m × $0.009123). Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved Limitations of Forward Contract 1. Credit risk exposure: Both parties are exposed to the credit risk or default risk that the other party may default on his or her obligation. 2. Sharing of strategic information: The parties know what specific risk is being hedged. In case of exchange-traded contracts, the parties to the agreement are anonymous so no such sharing of information would occur. 3. It is hard to determine the market values of negotiated contracts as these contracts are not traded. Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved 20.4 MANAGING RISK WITH EXCHANGE—TRADED FINANCIAL DERIVATIVES Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved Managing Risk with Exchange—Traded Financial Derivatives • A derivative contract is a security whose value is derived from the value of the another asset or security (which is referred to as the underlying asset). • Exchange traded financial derivatives cannot be customized (like forward contracts) and are available only for specific assets and for limited set of maturities. Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved Futures Contract • A futures contract is a contract to buy or sell a stated commodity (such as soybean or corn) or a financial claim (such as U.S. Treasury bonds) at a specified price at some specified future time. These contracts, like forward contracts, can be used by the financial manager to lock in future prices of raw materials, interest rates, or exchange rates. • Two categories: Commodity futures and financial futures. Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved Managing Default Risk in Futures Market Futures exchanges use two mechanisms to control credit or default risk. 1. Futures Margin – Futures exchanges require participants to post collateral called futures margin or just margins. Collateral is used to guarantee that he or she will fulfill the obligations in that contract. 2. Marking to Market – This means that daily gains or losses from a firm’s futures contract are transferred to or from its margin account. Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved Figure 20.4 Marking to Market on Futures Contracts Margin Account Balance on 10 Futures Contracts Value of 1 Futures Contract Change in Value of 1 Futures Contract Change in Value of 10 Futures Contracts 1-Oct-17 $4,000 $2,578 Blank Blank 2-Oct-17 $3,180 $2,496 ($82) ($820) 3-Oct-17 $3,250 $2,503 $7 $70 4-Oct-17 $3,880 $2,566 $63 $630 Date Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved Hedging with Futures Contract (1 of 4) Futures contract can be used to build financial hedges like forward contracts. – If the firm is planning to buy, it can enter into a long hedge by purchasing the appropriate futures contract. – If the firm is planning to sell, it can enter into a short hedge by selling (or going short) a futures contract. Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved Hedging with Futures Contract (2 of 4) Futures contracts are only available for a subset of all assets and for a limited set of maturities. As a result, it is often not possible to form a perfect hedge. Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved Hedging with Futures Contract (3 of 4) • Restrictions on available futures contracts and maturities give rise to the following practical problems: 1. Inability to find a futures contract on the exact asset that is the source of risk 2. The hedging firm may not know the exact date when the hedged asset will be bought or sold 3. The maturity of the futures contract may not match the period for which the underlying asset is to be held or until it must be acquired Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved Hedging with Futures Contract (4 of 4) • The three reasons listed (on previous slide) lead to basis risk. Basis risk arises any time the asset underlying the futures contract is not identical to the asset underlying the firm’s risk exposure. As a consequence, if the basis risk is nonzero, the firm does not have a perfect hedge. • If a specific asset is not available, the best alternative is to use an asset whose price changes are highly correlated with the asset. In general, whenever the correlation is higher, the hedge will be better. Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved Option Contracts (1 of 2) • There are many situations in which firms would like to guarantee a minimum revenue but do not need to absolutely fix their revenues. The firm can accomplish this if it hedges with options rather than with futures contracts. • Options are rights (not an obligation) to buy or sell a given number of shares or an asset at a specific price over a given period. • The option owner’s right to buy is known as a call option while the right to sell is known as a put option. Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved Option Contracts (2 of 2) For example, if you buy a call option on 100 shares of XYZ stock at a premium of $4.50 and exercise price of $40 maturing in 90 days means: – You can buy the XYZ stock at $40, even though the market price of the stock maybe above $40. – If the stock price is below $40, you will choose not to use your option contract and will lose the premium paid • A key difference between an options contract and a futures contract is that the option owner does not have to exercise the option. Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved A Graphical Look at Option Pricing Relationships Figures 20.5 to Figures 20.8 graphically illustrate the expiration date profit or loss from the following option positions: – Buying a call option (figure 20.5) – Selling (Writing) a call option (figure 20.6) – Buying a put option (figure 20.7) – Selling (Writing) a put option (figure 20.8) Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved Figure 20.5 Expiration Date Profit or Loss from Purchasing a Call Option Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved Figure 20.6 Expiration Date Profit or Loss from Selling (Writing) a Call Option Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved Figure 20.7 Expiration Date Profit or Loss on Holding a Put Option Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved Figure 20.8 Expiration Date Profit or Loss from Selling (Writing) a Put Option Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved Option Pricing Relationship Summary Blank Buy Call Write Call Buy Put Write Put Maximum Profit Unlimited Premium Exercise Price − Premium Premium Maximum Loss Premium Unlimited Premium Exercise Price − Premium Future Market Expectation Bullish Bearish Bearish Bullish Exercise Price + Premium Exercise Price + Premium Exercise Price − Premium Exercise Price − Premium Break-even Point Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved Figure 20.9 Option Price Quotes for Apple Computers on February 24, 2016 AAPL (APPLE INC) Price as of 2/24/2016: $93.99 Last Sale Vol Open Int 16 Apr 90 Call $7.15 30 4,050 16 Apr 95 Call $4.26 361 10,394 16 Apr 100 Call $2.18 508 117,700 16 Jul 90 Call $9.40 0 16 Jul 95 Call $7.15 16 Jul 100 Call $4.86 Calls Last Sale Vol Open Int 16 Apr 90 Put $3.04 220 11,897 16 Apr 95 Put $5.15 272 15,221 16 Apr 100 Put $8.35 22 125,674 1,147 16 Jul 90 Put $5.35 0 4,546 116 2,966 16 Jul 95 Put $8.30 234 4,487 7 9,639 16 Jul 100 Put $11.20 216 15,109 Puts Sources: www.cboe.com, www.quote.com, wsj.com, www.fidelity.com, and www.optionshouse.com. Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved CHECKPOINT 20.2: CHECK YOURSELF Determining the Break-Even Point and Profit or Loss on a Call Option Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved The Problem If you paid $5 for a call option with an exercise price of $25, and the stock is selling for $35 at expiration, what are your profits and losses? What is the breakeven point on this call option? Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved Step 1: Picture the Problem (1 of 2) Stock Price A Call Premium B Exercise Price C Exercised or Not D Profit or Loss E Blank Blank Blank Blank = Max(O, A−C)−B $20 ($5) $25 No ($5) $25 ($5) $25 No ($5) $30 ($5) $25 Yes $0 $35 ($5) $25 Yes $5 $40 ($5) $25 Yes $10 Maximum Loss= Premium Break Even Point Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved Step 1: Picture the Problem (2 of 2) Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved Step 2: Decide on a Solution Strategy • Break-even Point = Exercise price + Premium • Profit = (Stock price − Exercise price) − Premium – If (stock price – exercise price) is negative, the profit or losses is equal to $0 – Premium. Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved Step 3: Solve • Break-even Point = Exercise price + Premium = $25 + $5 = $30 • Profit (at stock price of $35) = (Stock Price – Exercise Price) – Premium = ($35 − $25) − $5 = $5 Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved Step 4: Analyze • The graph in Step 1 shows that the option buyer will start exercising the option once it crosses $25. • The option buyer will earn $1 (before considering option premium) for every $1 that the stock price rises above $25. Since the option premium is $5, at a stock price of $30, the option position earns $5 that covers the premium and leads to a no profit/no loss situation. Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved 20.5 VALUING OPTIONS AND SWAPS Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved Valuing Options and Swaps • The value of option is determined by the present value of the expected payout when the option expires. • The most popular option pricing model is the Black-Scholes Option Pricing Model (BS-OPM). Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved Black—Scholes Option Pricing Model (1 of 3) There are six variables that influence an option’s price: 1. The price of the underlying stock 2. The option’s exercise or strike price 3. The length of time left until expiration 4. The expected stock price volatility over life of the option 5. The risk-free rate of interest 6. The underlying stock’s dividend yield Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved Black—Scholes Option Pricing Model (2 of 3) What IF Value of Call option Value of Put Option Price of underlying stock increases Increases Decreases Exercise price is higher Decreases Increases Time to expiration is longer Increases Increases Stock price volatility is higher over the life of the option Increases Increases Risk-free rate of interest is higher Increases Decreases The stock pays dividend Decreases Increases Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved Black—Scholes Option Pricing Model (3 of 3) Black-Scholes option pricing model for call options is stated as follows: Stock Price Strike Risk-free Time to N ( d ) e N (d 2 ) 1 Value (Call ) Today (P0 ) Price ( X ) rate expiration Call Option d1 Variance in Stock Price Risk-free Time to Today Stock Returns ln 2 Stock Rate Expiration Price Variance in Stock Returns d 2 d1 Variance in Stock Returns Time to Expiration Time to Expiration Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved CHECKPOINT 20.3: CHECK YOURSELF Valuing a Call Option Using the Black-Scholes Model Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved The Problem What will happen if the firm decides to issue a large dividend? Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved Step 1: Picture the Problem (1 of 2) Given: – Current price of stock = $32 – Exercise price = $30 – Maturity = 0.25 years – Annualized variance in stock returns = .16 – Risk-free rate =4% Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved Step 1: Picture the Problem (2 of 2) Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved Step 2: Decide on a Solution Strategy If the firm declares a dividend, the stock price is expected to fall. Assume the firm declares a dividend of $1 and the price drops from $32 to $31. Equation 20-1 can be used to determine the value of call option using Black-Scholes option pricing model to examine the impact of dividend payment and consequent decline in stock price. Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved Step 3: Solve (1 of 3) d1 Variance in Stock Price Risk-free Time to Today Stock Returns ln Stock 2 Rate Expiration Price Variance in Stock Returns Line 1 d−1 (steps) In(S/E) Time to Expiration Computation Blank Blank 0.03278 2 R=.5(Variance) .5*.16 0.08 3 (Rf+.5Var)*time (.04+line2)*.25 0.03 4 Numerator line 1+line3 0.06278 5 tXvariance .16*.25 0.04 6 Sqrt(T*Variance) sqrt(line5) 0.2 7 d−1 line 4/line 6 0.31395 Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved Step 3: Solve (2 of 3) d 2 d1 Line Variance in Stock Returns d−2 (steps) Time to Expiration Blank Computation 8 tXvariance .16*.25 0.04 9 sqrt(T*Variance) sqrt (line 8) 0.2 10 d−2 line (7−9) .1139 11 N(d1) Normsdist (line7) 0.6232 12 N(d2) Normsdist (line10) 0.545 Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved Step 3: Solve (3 of 3) Stock Price Strike Risk-free Time to N (d1 ) e N (d 2 ) Value (Call ) Today (P0 ) Price ( X ) rate expiration Call Option Call value (steps) Computation Blank 13 S*N(d−1) $31*line 11 19.3198 14 −R*t −0.12*0.25 −0.0100 15 exp^(−R*T) exp (line 14) 0.99 E*e^RT*N(d−2) $25*line 15*line 12 16.198 Call Value Line 13−Line 16 3.122 Line 16 Blank Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved Step 4: Analyze • The value of this option is $3.12 using BS-OPM. • The current stock price of $31 represents a $1 decline due to distribution of $1 dividend. As expected, a decline in the stock price leads to fall in the value of call option from $3.77 to $3.12. Therefore, the larger the stock’s dividend yield, the lower the value of call option on that stock. Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved Swap Contract • A swap contract involves the swapping or trading of one set of payments for another. • An interest rate swap may involve trading fixed interest payments for floating-rate interest payments. • A currency swap involves an exchange of debt obligations in different currencies. Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved Figure 20.10 Fixed—Interest—Rate for Floating—Interest— Rate Swap 9.75% $250 million 2 Fixed-Rate Coupon C 8.5% $250 million 2 Year A Six-Month LIBOR Rate B 0.00 8.5% 0.50 7.2% $12,187,500 $10,625,000 ($1,562,500) 1.00 10.0% $12,187,500 $ 9,000,000 ($3,187,500) 1.50 9.3% $12,187,500 $12,500,000 $312,500 2.00 9.8% $12,187,500 $11,625,000 ($562,500) 2.50 10.8% $12,187,500 $12,250,000 $62,500 3.00 11.3% $12,187,500 $13,500,000 $1,312,500 3.50 11.5% $12,187,500 $14,125,000 $1,937,500 4.00 10.5% $12,187,500 $14,375,000 $2,187,500 4.50 9.5% $12,187,500 $13,125,000 $937,500 5.00 Blank $12,187,500 $11,875,000 ($312,500) Blank Floating-Rate Coupon D Net Swap Cash Flow E Blank Blank Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved Credit Default Swaps Credit default swaps are like insurance policies. If an investor is worried that the bond he holds may default, he can buy a credit default swap that will pay if the bond defaults. Credit default swaps were abused and played a central role in the financial market meltdown that lead to our recent recession. While the recession began with the collapse of the housing market, it was amplified by problems with credit default swaps. Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved Key Terms (1 of 4) • American option • Basis risk • Call options • Commodity futures • Credit risk or default risk • Currency swap • Derivative contract Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved Key Terms (2 of 4) • European option • Exercise price • Financial futures • Forward contract • Futures contract • Futures margin • Hedging • Insurance Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved Key Terms (3 of 4) • Interest rate swap • Long position • Marking to market • Notional principal • Option contract • Option expiration date • Option premium • Option writing Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved Key Terms (4 of 4) • Put option • Risk profile • Self-insurance • Short position • Spot contract • Strike price • Swap contract Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved Copyright Copyright © 2018, 2014, 2011 Pearson Education, Inc. All Rights Reserved