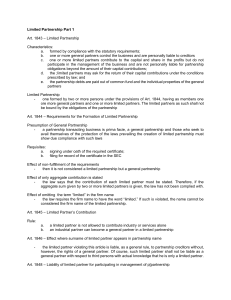

lOMoARcPSD|5677371 Reviewer - Partnership PARTNERSHIP & CORPORATION (De La Salle University) StuDocu is not sponsored or endorsed by any college or university Downloaded by nikki santin (nikkisantin13@gmail.com) lOMoARcPSD|5677371 Chapter 1: General Provisions - Article 1767 By a contract of partnership, two or more persons bind themselves to contribute money, property, or industry to a common fund with the intention of diving the profits among themselves. - Two or more persons may also form a partnership for the exercise of a profession. Concept of partnership: 1. an association of two or more persons 2. a legal relation upon the expressed or implied agreement of 2 or more competent persons whereby they unite their property, labor 3. a joint undertaking to share in profit/loss 4. the status arising out of a contract entered into by 2 or more persons whereby agree to share as common owners the profit 5. an organization for production of income to which each partner contributes 6. an entity, distinct and apart from the members composing it EXERCISE OF A PROFESSION Profession - calling in the preparation for or practice of which academic learning is required - prime purpose: rendering public service is not a business or an enterprise for profit law does not allow individuals to practice a profession as a corporate entity -> personal qualifications for such practice cannot be possessed by corporation CHARACTERISTICS 1. Consensual – perfected by mere consent -> upon the express or implied agreement (not have to be in writing) 2. Nominate – has a special name (ex: contract of sale) 3. Bilateral – entered into by 2 or more persons; rights and obligations are always reciprocal 4. Onerous – benefit through the giving of something (must contribute) 5. Commutative – undertaking of each partner is considered as the equivalent of others (all equal) 6. Principal – does not depend for its existence upon some other contract 7. Preparatory – entered into as a means to an end (ex: realization of profits) FIDUCIARY IN NATURE Partnership is a form of voluntary association entered into by the associates Downloaded by nikki santin (nikkisantin13@gmail.com) lOMoARcPSD|5677371 It is a personal relation in which the element of delectus personae exists (trust and confidence) 1. Right to choose co-partners – No one can become a member of the partnership without the consent of all 2. Power to dissolve partnership – Mutual agency arises and the doctrine of delectus personae allows them to have the power to dissolve; must act in good faith ESSENTIAL FEATURES OF PARTNERSHIP 1. Valid contract 2. Parties must have legal capacity 3. Mutual contribution 4. Object must be lawful 5. Purpose: obtain profit and divide 1. Valid Contract A form of voluntary and personal association: delectus personae Creation and proof of existence – may be informally created, existence proved by the conduct or acts or parties a. articles of partnership – embody the terms of association in a written document b. elements of contract: consent, object, cause Other forms of association excluded – excludes from its concept all other associations which do not have their origin in a contact General rule: Parties have the necessary legal capacity to enter into a contract Cannot give their consent: 1. Unemancipated minors 2. Insane/demented persons 3. Deaf mutes who do not know how to write 4. Persons who are suffering from civil interdiction 5. Incompetents who are under guardianship Exception: Persons who are prohibited from giving each other any donation cannot enter into a universal partnership No prohibition against a partnership being a partner in another partnership. A corporation is without capacity to enter into a contract of partnership 3. Mutual Contribution Proprietary or financial interest: partners must have a proprietary or financial interest in the business. No mutual contribution, no partnership Form of contribution: 1. Money: currency which is legal tender in the PH. No contribution of money until they have been cashed Legal tender – medium of payment recognized by the law that can be used to extinguish private or public debt 2. Legal Capacity Downloaded by nikki santin (nikkisantin13@gmail.com) lOMoARcPSD|5677371 2. Property: capable of being appropriated 2 types of property: 1. Real (immovable) - land 2. Personal (movable) Tangible – touchable Intangible – ex: intellectual property (patent, trademark, copyright, goodwill) 3. Industry: work/services 4. Legality of object Effect of illegality – the object is unlawful when it is contrary to law, morals, good customs, public order or public policy Business partnership not permitted to engage in: may not engage in an enterprise for which the law requires a specific form of business 5. Intention to realize and divide profits Very reason for existence of partnership: obtain profits Sufficient if obtaining profit principal purpose: Profit need not be the exclusive aim, sufficient that is it the principal purpose Sharing of profits Not necessarily in equal shares: Necessary that there be an intention of dividing profits among the members, not necessarily in equal shares; there must be a join interest in the profits Not conclusive evidence of partnership: merely presumptive and not conclusive Sharing of losses: Necessary corollary of sharing in profits: The right to share in the profits carries with it the obligation to share also in the losses Agreement not necessary: Not necessary for the parties to agree upon a system of sharing Art 1768 Partnership has a juridical personality separate and distinct from partners Separate juridical personality (SJD) - Recognized as a legal person - May acquire and possess property of all kinds, incur obligations Art 1769 Determining whether a partnership exists, these rules shall apply: 1. Persons who are not partners as to each other are not partners as to third persons (estoppel) 2. Co-ownership or co-possession does not of itself establish a partnership 3. Sharing of gross returns does not of itself establish a partnership 4. Receipt by a person of a share of the profits is prima facie evidence but no such inference shall be drawn if profits were received as payment a. Debt by installment b. Wages of an employee Downloaded by nikki santin (nikkisantin13@gmail.com) lOMoARcPSD|5677371 c. Annuity to a widow d. Interest on a loan e. Sales of goodwill Prima facie: first impression is what you seem to be truth 1. Persons not partners as to each other Estoppel - Admission and misrepresentation rendered conclusive - Misled third persons or parties into believing that the former are partners in a non-existing partnership - Cannot take it back 2. Co-ownership Co-ownership - Ownership of an undivided thing or right belongs to different persons - Profits must be derived from the operations of the business by the members not merely from ownership Sharing of profits is not a prima facie evidence that he is a partner in the business under sub-paragraphs a b c d e Co-ownership The ownership of an undivided thing or right belongs to different persons Partnership Co-ownership Creation Always with contract May exist without contract Juridical personality Yes None Purpose Profit Common enjoyment Duration No limitation Not more than 10 years Disposal of interest May not dispose Can dispose Power to act with third person May bind the partnership Cannot represent coowner Effect of death Dissolve Not necessarily dissolve Conjugal Partnership of Gains Partnership formed by the marriage of husband and wife by virtue of which they place in a common fund the fruits and income from their separate properties and those acquired through their efforts or chance Co-possession - Can be surrendered 3. Sharing of gross returns - does not indicate a partnership, it should be the profits Net returns – creates an inference that there is a partnership (sharing of profits and loss) 4. Receipts of share in the profits Partnership Conjugal Partnership Parties Any gender Man and woman Laws which govern Stipulation of the parties Governed by law Juridical personality Yes None Commencement Execution of contract Marriage Purpose Profit Regulate property Distribution of profits According to agreement Divided equally Downloaded by nikki santin (nikkisantin13@gmail.com) lOMoARcPSD|5677371 Management Equally Husband decision prevails Disposition of shares May be disposed Cannot be disposed Voluntary Association Organized for social purposes (social clubs, committee, fraternal societies) Partnership Voluntary Association Juridical personality Yes None Purpose Pecuniary profit Objective is lacking Contribution of members Capital Fees Liability of members Liable for debts Depends Art 1770 A partnership must have a lawful object and must be established for the common benefit of the partners Effects of an unlawful partnership 1. The contract is void 2. The profits shall be confiscated in favor of the government 3. The instruments or tools and proceeds of the crime shall be forfeited 4. The contributions of the partners shall not be confiscated unless part of the crime Art 1771 A partnership may be constituted in any form expect where immovable property or real rights are contributed which a public instrument shall be necessary Art 1772 Capital of 3000 or more must be registered in sec Not an absolute rule Only a general rule Exception: - immovable property contributed - 3000php or more capital Art 1773 Partnership is void if not inventory must be signed and attached to the public instrument (ISAP) Public instrument - written contract - authorized by the public office (notary) Inventory - list of items of immovable property contributed - signed by the partners attached to the public instrument - registered in SEC Exceed 3k, no registration - not prevent the formation of partnership - no effect on third person - why is it there: to enable others to register Art 1774 Acquired in partnership name, conveyed only in partnership name Art 1775 Associations and societies, whose articles are kept secret among the members, and Downloaded by nikki santin (nikkisantin13@gmail.com) lOMoARcPSD|5677371 wherein anyone of the members may contract in his own name with third persons, shall have no sjp Articles of partnership kept secret is not considered as a partnership At 1776 Classification of partnership Extend of its subject matter Of all present property - contribute all of their property - profits they accrued For profit - subject of contribution: profit - transfer: right of the property, use it Particular partnership - determinate things, profession Liability of partners General partner - at least one - liab extends to personal property Limited partner - partner in a limited partnership - liab extends to capital contribution Duration Partnership at will – no time specified, can terminated anything Partnership with a fixed term – particular undertaking As to the legality of its existence De jure – complied with all legal documents De facto – failed to comply Representation Ordinary/real – existing among partners Ostensible – estoppel Publicity Secret – not known to public, active Open – made known to public Purpose Commercial (trading) – business Professional (non-trading) – profession Kinds of Partners Capitalist partner – contributes money Industrial partner – contributes industry General partner – liability extends to capital contribution Limited partner – liability limited to capital contribution Managing partner – manages the affairs of the partnership Silent - not active, known as a partner Secret - active, not known Dormant - not active, not known Art 1777 Universal partnership – to all present property or to all the profits Art 1778 All present property Contribute property Divide profits Art 1779 All present property becomes the common property of all the partners as well as profits Future properties cannot be contributed Inheritance, legacy, donation No guarantee that property will go to you Art 1780 Universal property of profits – comprises all that the partners may acquire their industry Downloaded by nikki santin (nikkisantin13@gmail.com) lOMoARcPSD|5677371 or work during the existence of the partnership Ownership of present and future property: partners retain their ownership Pass: profits Profits acquired by chance: lotter is not included; must be from work Art 1781 Not specified which universal - Profit - Why: less obligations Art 1782 Persons who are prohibited from giving each other any donation cannot enter into a universal partnership Ex: Partnership Husband lawyer Wife engineer - not allowed: they have different undertakings/ethical considerations involved that could make some trouble Husband and wife – particular partnership Donation shall be void: - Guilty of adultery - Guilty of the same crime - Public officer (virtue: position in office) Art 1783 Particular partnership – determinate thing, profession Downloaded by nikki santin (nikkisantin13@gmail.com) lOMoARcPSD|5677371 Chapter 2: Obligations of the Partners Art 1784 Partnership begins from the moment of the execution of the contract, unless otherwise stipulated Commencement of partnership Consensual contract Necessary – essential requites Executory agreement of partnership 1. Future partnership – may stipulate some other date 2. Agreement to create partnership – Agreement remains executory, no partnership exists 3. Failure to agree on material terms – may prevent any rights/obligations Art 1785 Fix term/particular undertaking – continued after the termination without express agreement Rights and duties of partners stay the same promise to contribute 1m today contributed 2 years from today no demand is necessary partner who fails to give contribution: becomes a debtor demand triggers delay (dito hindi) the moment demand is not needed, delay begins liable for damages Effect of failure to contribute property promised 1. Liability as debtor to partnership – mutual contribution to a common fund is the essence of the contract of partnership Art 1787 Bound to contribute goods Appraisal must be made in the manner prescribed in the contract of partnership In absence of stipulation, it shall be made by experts Continuation of the business by the partners without settlement/liquidation is prima evidence of continuation Appraisal of the value of the good contributed is necessary to determine how much has been contributed by the partners Expiration of the term – automatic dissolution Immovable property – appraisal is made in the inventory Fixed term/particular undertaking is automatically dissolved and turns into a partnership at will Art 1788 Partner who has undertaken to contribute a sum of money and fails to do so becomes a debtor for the interest and damages from the time he should have complied with his obligation Art 1786 Every partner is a debtor of the partnership for whatever he may have promised to contribute Same rule applies when he may have taken from the partnership He shall be bound for warrant in case of eviction of specific things Downloaded by nikki santin (nikkisantin13@gmail.com) lOMoARcPSD|5677371 2 distinct cases: Money promised but not given Personal use If no agreement, in case on imminent loss, any partner who refuses shall be obliged to sell his interest to the other partners Guilty partner is liable for both interest and damages from the time he should have complied with this obligation Indemnity for damages shall only be the payment Without stipulation, legal interest of 6% Because it reflects the lack of interest to continue the partnership Art 1789 Industrial partner (Contributes industry/service) cannot engage in business for himself Unless the partnership expressly permits to Capitalist partners may exclude him from the firm or avail benefits Industrial partner - Cannot engage in the same business in which the partnership is engaged or in any kind of business Capitalist partner - Cannot engage to any operation which of the same kind of business If industrial partner engages - Capitalist partner have the right to exclude him from the business - Avail themselves of the benefits - Capitalist have a right to damages Art 1790 Unless there is a stipulation, partners shall contribute equal shares Art 1792 Partner authorized to manage collects a demandable sum Owed to him in his name From a person who owed the partnership another sum The sum collected shall be applied to the two credits in proportion of the amounts If given to the partnership, amount shall be fully applied to the latter Art 1793 A partner who has received his share in partnership credit when others have not yet collected, is obliged to bring to the partnership capital when the debtor becomes insolvent receive from debtor of partnership, 90k 3 partners including you instead bring money to partnership you took 30k allowed to do: no general provision: everything that you receive on behalf of the partnership, you must return to the partnership (art 1807) because it belongs to the partnership gave 90k, get 30k debtor is declared insolvent insolvent - assets are less than liabilities Partners can stipulate of unequal shares Art 1791 if you already receive: bring back to the partnership share to the partners Downloaded by nikki santin (nikkisantin13@gmail.com) lOMoARcPSD|5677371 gave 90k, get 30, leave our share on table nasunog building require to surrender 30k: no once you have split the profits, it is there responsibility in case liable for taxes Art 1794 Every partner is responsible to the partnership for damages He cannot compensate them with the profits and benefits which he may have earned for the partnership Courts may lessen responsibility through the extraordinary efforts in OTHER activities, unusual profits have been realized Art 1795 Risk of specific and determinate things which are not fungible, contributed only the use shall be borne by the partner Fungible – risk shall be borne by the partnership Risk of things brought and appraised in the inventory – shall be borne by partnership fungible - cannot be used w/out consuming it - every unit of measure of that thing it the equivalent of that other thing - ex: rice, oil, sugar perishable - interchangeable - deteriorate contributed 1 sack of rice to the partnership demand return of that sack of rice: no ask: what is the purpose of the rice: to be consumed 2 types surrender partnership of the thing the use - expected to be retuned (see if perishable/fungible exception single sack to rice - sasambahin you can demand it again: special (irreplaceable) in the absence of any specific agreement you can demand the return of the co equivalent Art 1796 The partnership shall be responsible to every partner for the amounts he may have disbursed on behalf of the partnership 1. To refund amounts disbursed by him in behalf of the partnership 2. To answer for the obligation 3. To answer for risks Art 1797 Losses and profits shall be distributed in conformity with the agreement Profits only agreement, losses shall be in same proportion No stipulation, in proportion to contribution Industrial partner - not liable for losses - receive such just and equitable share 1st: agreement (stipulation how to profits will be divided) 2nd: capital contribution divided the losses at the same with the profits Downloaded by nikki santin (nikkisantin13@gmail.com) lOMoARcPSD|5677371 possible to agree any % in share of profit: can stipulate A party did not intend to share in lossesmay be a factor in determining that no partnership exists industrial partner shall receive such share, must be satisfied first before capitalist partners Industrial partner is not liable for losses because he cannot withdraw the work already done by him Art 1798 Agree to in trust to a third person the designation of profits, such designation may be impugned only when it is manifestly inequitable – can complain Art 1800 Partner appointed as managing in the articles of partnership may execute all acts of administration, unless he should act in bad faith partners determine the hatiian, can be 3rd person His power is irrevocable without just and lawful case. Partner began to execute the decision of the 3rd person Can complain within 3 months Vote – controlling interest for such revocation No agreement = all has equal voice e can complain manifestly inequitable e got the 1000, wants to sue - not possible you can’t attack a contract and benefit from it ill use you 1 year - no - must be 3 months from the date mismo can delegate the profit/loss to one of the partners: no protestative: only one will of the partner Art 1799 Stipulation to exclude one or more partners in the profits/loss - void i will not share in the profits - no any stipulation excluding the partners for profit is void stipulation: void 2 distinct cases: Appointment as manager in the articles: Execute all acts unless bad faith Revocation – change in terms of contract Need consent of all partners Appoint as manager after the constitution: Simple contract of agency – may be revoked anytime Vote – controlling interest agency - a person appoints another person to do something or to render service for behalf with the effect that this person who made the appointment empowers this other person and as a result like the person who appointed did it appointed him as my agent sign deed of sale (special power of attorney) as if i was the one who signed Downloaded by nikki santin (nikkisantin13@gmail.com) lOMoARcPSD|5677371 agency 1. a person bind themselves to the other in order to perform 2. removable at will (if no longer has confidence) Art 1802 Stipulated: none of the managing partners shall act without the consent of others (unanimous consent) Exception: unless there is imminent danger Scope of Power of a Managing Partner 1. Issue receipts 2. Buying and selling without the approval of other partners 3. Authority to dismiss an employee (with justifiable cause for dismissal) Compensation for Services Rendered 1. No partner is entitled to compensation without the consent of all the partners 2. Each member of the partnership assumes the duty to give his time, attention, and skill → a share in the profits is his only compensation Art 1801 2 or more partners in trusted with the management of the partnership without specification One of them shall not act without the consent of all the others Oppose acts = decision of majority will prevail Tie = decided by partners owning the controlling interest Decision: 3. managing partner stated: majority managing partner 4. controlling interest (majority %) 5. no managing partner: majority (assumed that all are managing partner) Art 1803 Manner of management has not been agreed upon 1. All partners shall be considered agents 2. None of the partners make any alteration in the immovable property without the consent of others a. refuse to give consent and prejudicial - intervention of the court may be sought b. necessary for preservation, consent of the other partners is not required why immovable property: hindi na pwede mabalik, cant revert from its previous status Art 1804 Every partner may associate another person Associate shall not be admitted into partnership without the consent of all other partners (Sub partner) Sub partner - not a partner, entitled to receive the interest Art 1805 The partnership books shall be kept, subject to any agreement between the partners, at the principal place of the business of the partnership, and every partner shall at reasonable hour have access to and may at any inspect and copy any of them partnership books Downloaded by nikki santin (nikkisantin13@gmail.com) lOMoARcPSD|5677371 1. contains: agreement between the partners 2. where: principal place of business 3. when can view: reasonable hours (business hours) 4. rule: they cannot take the books outs 5. why: para di mawala/alteration Art 1806 Partners shall render on demand true and full information of all things affecting the partnership to any partner or the legal representative of any partner Art 1807 Every partner must account to the partnership for any benefit duty of account: general provision: everything that you receive on behalf of the partnership, you must return to the partnership Art 1808 Capitalist partners cannot engage for their own cannot in any operation which is of the kind of business Violate: must bring common fund and shall personally bear the losses Art 1809 Any partner shall have the right to a formal account as to the partner affairs: 1. wrongfully excluded 2. right exists under the terms of any agreement 3. 1807 4. Other circumstances Downloaded by nikki santin (nikkisantin13@gmail.com) lOMoARcPSD|5677371 Section 2: Property Rights of a Partner Art 1810 Property Rights of a Partner 1. Rights in specific partnership property 2. Interest in the partnership 3. Right to participate in management attachment - abscond (attach the property para di na ma ibenta execution - court order - issue a notice of garnishment from widrawing from the account Art 1811 property a partner is a co owner along with the other partners of partnership property - false Art 1812 A partner’s interest: profits and surplus co ownership - right to use for the partnership purposes surplus – assets of the partnership after the partnership debts and liabilities are paid assignment - assignee steps into the shoes of the assignor, all rights go to can a partner assign partnership property: no it is the property of the partnership (sjp) 2 rights of the partners exemption who makes the assignment: all the partners 3 attachment utang ng partnership: partnership may ari partnership utang na personal: partnership kaninong properties yung properties: partner 4 support that is indespensible to dwelling sustenance and eduation of a dependent use partnership property to satisify their needs: no profit - excess of returns over expenditure Art 1813 Conveyance by a partner of his whole interest does not dissolve partnership Rights withheld from assignee 1. Interfere in the management 2. Require any information 3. Inspect partnership books Rights of assignee of partner’s interest 1. Receive in accordance with his contract 2. Avail himself of the usual remedies 3. Receive the assignor’s interest in case of dissolution 4. Require an account of partnership affairs in case of dissolution Art 1814 Any judgement creditor of a partner, may charge interest of the debtor partner with payment of the unsatisfied amount of such judgement debt with interest thereon The interest charged may be redeemed at any time before foreclosure, may be Downloaded by nikki santin (nikkisantin13@gmail.com) lOMoARcPSD|5677371 purchased without thereby causing a dissolution Every partnership shall operate under a firm name Remedies of separate judgement creditor of a partner: Not members but included their names in the firm shall be subjected to the liability of a partner 1. Application for a charging order: A separate creditor cannot attach upon specific partnership property for the satisfaction of his credit Right of partners to choose firm name 1. Use of misleading name 2. Use of names of deceased persons Charging order - Collection remedy that a creditor uses to execute against judgement debtor’s interest in a partnership Art 1816 All partners are liable pro rata with all their property and after all the assets have been exhausted Preferred rights of partnership creditors: The claims of partnership creditors must be satisfied first before the separate creditors of the partners can be paid out Any partner may enter into a separate obligation to perform a partnership contract Redemptioner: The interest of the debtor partner so charged may be redeemed with the separate property of any one or more of the partners, or with the partnership property but with the consent of all the partners whose interest are not so charged or sold Redemption price: Inadequacy of the price obtained Right of redeeming non-debtor partner: Redeeming non debtor partnership does not acquire absolute ownership, but holds it in trust for him (fiduciary) Right of partner under exemption laws: A partner cannot claim any right under the exemption laws when specific partnership property is attached for partnership debt Partnership liability - partners are principals to the other partners and agents for them and the partnership - liable to third persons who have dealt with one of them in t Individual liability - a partner may assume a separate undertaking - partner is personally bound even if only the partnership is shown to have derived benefits from it Nature of individual liability of partners 1. Pro rata (jointly) – based on the number of partners 2. Subsidiary – partners become personally liable only after all the partnership assets have been exhausted 3. Industrial partner – not liable for losses but liable for liability Art 1815 Art 1817 Downloaded by nikki santin (nikkisantin13@gmail.com) lOMoARcPSD|5677371 Any stipulation against the liability laid down shall be void, except as among the partners Art 1818 Every partner is an agent of the partnership Ordinary course of the business Unless partner acting has no authority Act of a partner Not ordinary course of the business Does not bind the partnership Unless authorized by other partners No act of a partner in contravention of a restriction on authority shall bind the partnership to persons having knowledge of the restriction Power of partner as agent of partnership 1. As among themselves a. Acts within the scope of his actual authority = agent to the partnership b. Agreement is silent as to the authority = implied authority → based on the doctrine of estoppel c. principal as to himself, and to the partnership, and copartners has unlimited authority → partnership is not liable for the acts of an unauthorized partner unless they ratify a. Founded on the doctrine of mutual agency b. Limitations upon the authority of any one of the partners are not binding upon innocent third persons → have the right to assume that every general partner has power to bind the partnership c. Third persons Liability of partnership for acts of partners 1. Every partner may execute acts with binding effect on the partnership even if he has no authority unless the third person has knowledge of such lack of authority 2. Partnership is not bound for acts which are not apparently for carrying on in the usual way 3. Partnership is not liable to third persons having actual or presumptive knowledge of the restrictions 2. As to third persons No duty to make inquiries as to acting partner’s authority Presumption that acting partner has authority to bind partnership → presumption is sufficient to hold the firm liable on transactions No right to assume that acting partner Liability of Partner Acting Without Authority A partner to undertakes to bind his copartners by a contract without authority is himself personally liable Art 1819 Title to real property is in the partnership name, any partner may convey title to such property by a conveyance executed in the partnership name; but partnership may recover such property unless the partner’s Downloaded by nikki santin (nikkisantin13@gmail.com) lOMoARcPSD|5677371 act binds the 1st paragraph of 1818 or unless such property has been conveyed by the grantee or a person claiming through such guarantee to a holder for value without knowledge that the partner exceeded his authority Title to real property – partnership A conveyance executed by a partner in his own name passes the equitable interest Title to real property – name of one or more partners but not all Partnership may recover the property if the partners’ act does not bind the partnership Title to real property – name of one or more or all partners A conveyance executed by a partner in the partnership name Passes equitable interest Where the title to real property is in the names of all the partners, a conveyance executed by all the partners passes all their rights in such property A purchaser without notice may acquire a valid title, right to presume possession 2. Legal title of property in partnership name, conveyed in partnership name A conveyance by a partner of partnership property in the partnership name even though without authority, cannot be removed by the partnership 3. Ratification of conveyance partnership name yung real property, pero partner lang nag benta under his own name transfer: equitable interest, legal title legal title: siya may ari against the whole world equitable ownership: right mo lang only with respect who sold it to you Conveyance or real property belonging to partnership 1. Prima facie ownership of real property Indicate in the certificate of title Art 1820 An admission or representation made by any partner concerning partnership affairs within the scope of his authority in accordance with this title is evidence against the partnership Presumption that property purchased with partnership funds belongs to the partnership Art 1821 Protection of innocent purchaser’s for value 1. Legal title to partnership property in partner making the conveyance Legal title: partner making Equitable interest: partnership Notice to or knowledge of any partner of any matter relating to partnership affairs operates as a notice to or knowledge of the partnership (except in case of fraud) mutual agency - the partners are considered as agent of the partnership and one another* - agent: yung ginawa ng isa is as good as the other Downloaded by nikki santin (nikkisantin13@gmail.com) lOMoARcPSD|5677371 - notice to the partner is notice to the partnership may right kang mag demanda: bc of damages 7 -> 15 days u can refuse to pay: made representation for the partnership ang sinabi ng isang tao cannot prejudice another dapat nanghingi ng letter of authorization unless the person is authorized rule exception one person can be prejudice of the act of the partner because mutual agency - notice to the partner is notice to the partnership, an act of the partner is act to the partnership Art 1822 Any wrongful act/omission Ordinary course of business Loss/injury to any person not a partner Partnership is liable, same extend to the acting partner Art 1823 The partnership is bound to make good the loss: 1. When one partner acting within the scoop of his apparent authority receives money/property of a third person and misapplies it 2. Where the partnership in the course of its business receives money/property of a third person and the money/property so received is misapplied by any partner while it is in custody of the partnership Art 1824 all partners are liable because solidary liable you can directly use (the liability is direct) industrial partner nabungo old lady (accident) but using airpods, but using for delivery situation: quasi delict requisites of quasi delict: - wrong act or omission (omission - wala kang ginawa, u didnt do it) negligence: lack of foresight (speed), lack of skill/imprudence (lasing) ex: reckless imprudence resulting to homicide murder - qualifying circumstances (pinagplanuhan) - damage - through fault/negligence - no agreement who can sue: the partnership, acting partner, all the partners because: obligations of the partnership = obligation of all partners requisite: 1. guilty of wrongful act/omission 2. acting in the ordinary course of business Art 1825 Estoppel – when a person represents himself as a partner in an existing partnership, he is liable to any such persons Downloaded by nikki santin (nikkisantin13@gmail.com) lOMoARcPSD|5677371 to whom such representation has been made 1. Partnership liability – liable as though he were an actual member 2. No partnership liability – liable pro rata When all members of the existing partnership consent to the representation, a partnership act/obligation results Estoppel - Precludes a person from denying to that which has been established as the truth by his own deed - Misrepresentation - Cannot be denied Art 1826 Person admitted as a partner into an existing partnership is liable for all the obligations arising before his admission Liability shall be satisfied only out of partnership property Art 1827 The creditors shall be preferred to those of each partner as regards the partnership property Private creditors of each partner may ask for the attachment and public sale Downloaded by nikki santin (nikkisantin13@gmail.com) lOMoARcPSD|5677371 Chapter 3: Dissolution and Winding Up Art 1828 The dissolution of a partner is the change of relations of the partners caused by any partners ceasing to be associated in the carrying on as distinguished from the winding up of the business Winding up – settling of the business affairs after dissolution Termination – end of partnership life Art 1829 On dissolution, Partnership is not terminated Continues until the winding up is completed Art 1830 Dissolution is caused: Without violation of agreement 1. Termination of term 2. Express will of any partner, must act in good faith 3. Express will of all partner 4. Expulsion In contravention of agreement Any event – unlawful Promise to contribute perishes Death Insolvency Civil interdiction Decree of court Without violation 1. Termination of term 2. Express will of any partner – partnership at will 3. Express will of all partner – particular partnership 4. Expulsion Loss of specific thing Loss before delivery – dissolved Loss after delivery – not dissolved Loss where use contributed – partners bears loss Art 1831 Court shall decree 1. Insane 2. Incapable 3. Guilty of such conduct 4. Willfully commits a breach 5. Carried at a loss 6. Other circumstances Art 1832 Authority of partner ceases when not AID Exception: purpose of winding up Art 1833 AID + 3RD person to whom a partner contracts with has no knowledge of AID = contract entered into is binding to the partnership As if the partnership has not been dissolved Unless a. Acting partner has knowledge b. Acting partner has knowledge or notice Knowledge – knowledge of other facts Notice – delivers through mail, a written statement of the fact Art 1834* After dissolution, a partner can bind the partnership except 1. Act appropriate for winding up partnership affairs 2. Any transaction which would bind the partnership Downloaded by nikki santin (nikkisantin13@gmail.com) lOMoARcPSD|5677371 Notice of dissolution to creditors As to persons who extended credit to partnership prior to dissolution – customers must have knowledge or notice to relieve the partnership from liability As to persons who had known of partnership’s existence – published in the newspaper is sufficient Dormant partner need not give notice Art 1835 Dissolution of the partnership does not discharge the existing liability of any partner Discharge by an agreement between partnership creditor and partners Individual property of a deceased partner shall be liable for all obligations incurred while he was a partner Art 1836 Partners who have not wrongfully dissolved the partnership, legal representative of last surviving partner Has the right to wind up the partnership affairs Manner of winding up 1. Judicially – court 2. Extrajudicially – partners Persons authorized to wind up 1. Designated in agreement 2. All partners who have not wrongfully dissolved the partnership 3. Legal representative of the last surviving partner Art 1837 Dissolution is cause in any way expect in contravention May have the partnership property applied to discharge its liabilities and surplus applied to pay in cash the net amount owing the partner Dissolution – expulsion Expelled partner is discharged from all partnership liabilities Shall receive in cash only the net amount due him from the partnership Dissolution – in contravention Partner who has not cause dissolution: All rights in 1st paragraph Damages Desire to continue business may do so Provided secure the payment by bond approved by court Pay to any partner who has caused the dissolution wrongfully, value of interest less any damages Partner who has caused the dissolution wrongfully shall have a. Business not continued: All rights 1st paragraph, subject to liability for damages b. Business continued: interest less damages, released from all existing liabilities Art 1838 Partnership contract -> fraud Party entitled to rescind Lien – interest over a property to secure the payment of debt Partners are subsidiary liable Downloaded by nikki santin (nikkisantin13@gmail.com) lOMoARcPSD|5677371 1. To a lien on, right of retention of surplus after satisfying the partnership liabilities 2. To stand in the place of the creditors of the partnership after all liabilities to third persons has been satisfied 3. To be indemnified by the person guilty Art 1842 Liquidation is not necessary when there is already a settlement or an agreement as to what he shall receive 4. Art 1839 Settling accounts between the partners after dissolution Assets: 1. Partnership property 2. Contributions Liabilities: 1. Partnership creditor 2. Partners other than capital and profits 3. Partners – capital 4. Partners – profit Distribution of property of insolvent partner: 1. Separate creditors 2. Partnership creditors 3. Partners by way of contribution Art 1841 Legal representative may have the value of his interest at the date of dissolution Administrator: person appointed by the court to be in charge of the estate when someone dies without a Last Will and Testament. Executor: person appointed by the court to be in charge of the estate when someone dies with a Last Will and Testament. Downloaded by nikki santin (nikkisantin13@gmail.com) lOMoARcPSD|5677371 Chapter 4: Limited Partnership The limited partnership is one formed by two or more persons under the provisions of the following article, having as members one or more general partners and one or more limited partners. The limited partners as such shall not be bound by the obligations of the partnership Characteristics of a limited 1. Compliance with the requirements 2. One or more general partners: personally liable 3. One or more limited partners: contribute to capital, share in profit, do not participate in management, not personally liable 4. Limited partners may ask for the return of capital contribution 5. Partnership debts: paid out of the common fund of the individual properties of general partners 2 classes of partners: General partner Limited partner – liability is limited to the amount of money contributed (expectation to the general rule – pro rata) Business reason and purpose of statutes authorizing formation of limited partnership 1. Secure capital from others for one’s business and still remain control Men in business often desire to secure capital from others 3 classes of contracts 1. The ordinary loan on interest 2. The lender takes a share in the profits of the business 3. Person advancing the capital secures General Partnership Limited Partnership Can be constituted in any form of contract/conduct of the parties Created by members after compliance with the requirements Composed only of general partners Governed by law Must be followed by the word “Limited” Dissolution and winding up are governed by different rules Art 1844 Two or more persons desiring to form a limited partnership shall: 1. Sign and swear to a certificate 2. File for record the certificate in SEC Limited partnership is not a mere voluntary agreement Requirements of the statute must be followed So that public notice may be given to all who desire the essential features of the partnership Limited partnership formed: compliance in good faith with the requirements set forth Otherwise, the partnership becomes a general partnership Downloaded by nikki santin (nikkisantin13@gmail.com) lOMoARcPSD|5677371 Requirements for formation of a limited partnership 1. Certificate or articles of the limited partnership, must be signed and sworn to 2. Certificate must be filed in SEC Purpose of certificate: to give actual notice to potential creditors of limited liab Presumption of general partnership: Partnership transacting business – prima facie a general partnership Those who seek to avail themselves of the protection accorded by law must conform to the requirements Failure to extend its term or register: divesting privilege of limited liability Art 1845 Contributions of limited partner: cash or other property Not services A partner may be a general partner and a limited partner at the same time (should be stated in the certificate) but a limited partner may not be an industrial partner without being a general partner Art 1846 Surname of limited partner shall not appear in the partnership name unless: 1. Also the surname of the general partner 2. Business had been carried on under a name in which his surname appeared A limited partner whose surname appears contrary is liable as a general partner Liable to partnership creditors Art 1847 Certificate contains false statement One who suffers loss by reliance on such statement may hold liable any party to the certificate who knew the statement to be false 1. At time he signed the certificate 2. Sufficient time before the statement was relied upon to enable him to cancel Art 1848 Limited partner shall not become liable as a general partner unless he takes part in the control of the business Art 1849 Additional limited partners may be admitted upon filling an amendment to the original certificate Art 1850 A general partner shall have all rights and powers and be subject to all restrictions and liabilities. Without written consent or ratification, a general partner has no authority to Art 1851 Downloaded by nikki santin (nikkisantin13@gmail.com) lOMoARcPSD|5677371 Shall have the same rights as a general partner 1. Have partnership books kept at the principal place of business 2. Demand true and full information 3. Dissolution and winding up by decree of court Art 1852 A person who has contributed to the capital of a business, believing that he has become a limited is not reason by exercise of the rights of the limited partner Art 1853 A person may be a general partner and a limited partner in the same partnership Rights and powers: general partner (liable with his separate property) Contribution: limited partner Art 1856 A limited partner may receive from the partnership the share of profits or the compensation stipulate in the certificate The partnership assets are in excess of all liabilities of the partnership except liabilities to limited partners on account of their contribution and to general partners Third party creditors have priority over the limited partner’s rights Art 1857 A limited partner shall not receive from a general partner/partnership property any part of his contribution until 1. All liabilities have been paid 2. Consent of all members is had 3. Certificate is cancelled Art 1854 A limited partner may loan money and transact other business with the partnership, unless he is a general partner Limited partner may rightfully demand the return of his contribution 1. On the dissolution 2. Date specified in the certificate 3. After he has given 6 months’ notice in writing to all other members No limited partner shall claim: 1. Collateral security 2. Receive payment from a general partner/partnership Absence of any agreement: right to demand cash in return for his contribution Art 1855 One or more of the limited partners shall have priority to return of contributions, compensation (must be stated in the agreement) Absence of agreement: equal footing Limited partner may have the partnership dissolved 1. He rightfully but unsuccessfully demands the return of his contribution Downloaded by nikki santin (nikkisantin13@gmail.com) lOMoARcPSD|5677371 2. Other liabilities have not been paid or partnership property is insufficient Art 1858 A limited partner is liable to the partnership 1. Difference between his contribution and stated in the certificate 2. For any unpaid contribution A limited partner holds as trustee for the partnership 1. Specific property stated in the contribution was not contributed 2. Money or property wrongfully paid The liabilities can be waived only by the consent of all members Contributor rightfully received the return of contribution, he is still liable Art 1859 A limited partner’s interest is assignable A substituted limited partner is a person admitted to all the rights of a limited partner who has died or assigned his interest in a partnership Assignee - does not become a substituted limited partner - no right to require any information - only entitled to receive the share of the profits - have the right to become a substitute limited partner if all the members consent (when the certificate is appropriately amended) Art 1860 The retirement, death, insolvency, insanity, civil interdiction of a general partner dissolves the partnership, unless the business is continued by remaining general partners 1. stated in the certificate 2. consent of all members Art 1861 On the death of a limited partner his executor and administrator shall have the right of a limited partner Administrator: person appointed by the court to be in charge of the estate when someone dies without a Last Will and Testament. Executor: person appointed by the court to be in charge of the estate when someone dies with a Last Will and Testament. Art 1862 Court may charge the interest of the indebted limited partner Interest may be redeemed with the separate property of any general partner But not be redeemed with the partnership property Art 1814* two ways to - separate property of any of the partners Downloaded by nikki santin (nikkisantin13@gmail.com) lOMoARcPSD|5677371 partnership property (consent of all partners) except the partner whose interest is charged or sold 2nd option does not exist in the limited partnership setting* - Art 1863 Who has priority over distribution of assets in a limited partnership? 1. Creditors, including limited partners who have a claim against the partnership, except those on account 2. Limited partners share in profits 3. Limited partners return of capital contribution 4. General partners other than for capital and profit 5. General partners share in profits 6. General partners return of capital contribution The difference of this with general partnerships is that in a general partnership: capital contributions are returned BEFORE profits from surplus are shared. 3. Recorded in Sec Art 1866 A contributor, unless a general partner Not a proper party to proceedings Except where the object is to enforce a limited partner A limited partner - Mere contributor - Liability is limited to his interest in the firm - Without any right and power to participate in the management - Liability is to the partnership Art 1867 A limited partnership may become a limited partnership provided that the certificate sets forth: 1. Amount of original contribution and time when contribution was made 2. Excess assets over liability Art 1864 Certificate shall be cancelled when the partnership is dissolved A certificate shall be amended (many stuff) Art 1865 1. Conform to the requirements of Articles of 1844 (registered in sec) 2. Signed and sworn by all partners Requirements to amend/cancel certificate 1. In writing 2. Signed and sworn Downloaded by nikki santin (nikkisantin13@gmail.com) lOMoARcPSD|5677371 How do you distinguish Limited Partner from a General Partner? 1. Limited to the amount of money he has put into the partnership 2. No prohibition in engaging in business for himself 3. No share in the management 4. May only contribute cash or property 5. Not a proper party to proceedings by or against a partnership 6. Interest is freely assignable → assignee acquires all the rights of a limited partner 7. Name cannot appear in the firm name 8. Retirement, etc. does not have the same effect (dissolution) 6. Must have “Limited” in the firm name Can an Industrial partner be a limited partner? What about a limited Partnership v. General Partnership? Art 1853 A person may be a general partner and a limited partner in the same partnership General Partnership Limited Partnership Can be constituted in any form of contract/conduct of the parties Created by members after compliance with the requirements Composed only of general partners Governed by law Must be followed by the word “Limited” Dissolution and winding up are governed by different rules 1. Formed by compliance with the requirements 2. One or more general partners → control the business and are personally liable to creditors 3. One or more limited partners → contribute to the capital, have a share in profits, do not participate in the management, are not personally liable for partnership obligations beyond their capital contribution 4. The limited partners may ask for the return of their capital contributions 5. The partnership debts are paid out of the common fund and the individual properties of the general partner A partner may be a general partner and a limited partner at the same time (should be stated in the certificate) but a limited partner may not be an industrial partner without being a general partner Art 1845 Contributions of limited partner: cash or other property, not services (because he will be considered as an industrial and general partner, he shall not be exempted from personal liability) Rights and powers: general partner (liable with his separate property) Contribution: limited partner Art 1861 On the death of a limited partner his executor and administrator shall have the right of a limited partner Administrator: person appointed by the court to be in charge of the estate when someone dies without a Last Will and Testament. Executor: person appointed by the court to be in charge of the estate when someone dies with a Last Will and Testament. Downloaded by nikki santin (nikkisantin13@gmail.com) lOMoARcPSD|5677371 General: Dissolution In settling accounts, The liabilities of the partnership shall rank in order of payment 1. Owing to the partnership creditor 2. Owing to the partners other than capital and profits 3. Owing to the partners with respect to capital 4. Owing to the partners with respect to the profit Art 1814 indebted partner court may charge the interest separate property of any general partner and partnership property Limited: Art 1862 indebted limited partner court may charge the interest separate property of any general partner not with partnership property Art 1863 Limited: Who has priority over distribution of assets in a limited partnership? 1. Creditors, including limited partners who have a claim against the partnership, except those on account 2. Limited partners share in profits 3. Limited partners return of capital contribution 4. General partners other than for capital and profit 5. General partners share in profits 6. General partners return of capital contribution The difference of this with general partnerships is that in a general partnership: capital contributions are returned before profits from surplus are shared. General: Downloaded by nikki santin (nikkisantin13@gmail.com)