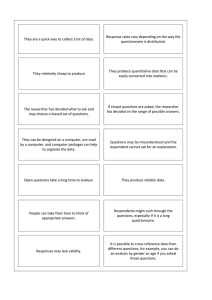

USING PARTICIPATORY METHOD OF TEACHING AND LEARNING TO ASSIT FORM TWO BUSINESS ACCOUNTING STUDENTS TO PREPARE A FINAL ACCOUNT OF A BUSINESS CONCERN AT ENCHI BRENTU SENIOR HIGH TECHNICAL SCHOOL. BY BREW EMMANUEL EKO (4111010007) AN ACTION RESEARCH SUBMITTED TO THE DEPARTMENT OF ACCOUNTING STUDIES OF THE UNIVERSITY OF EDUCATION WINNEBAKUMASI CAMPUS IN PARTIAL FULFILMENT OF THE REQUIREMENTS FOR THE AWARD OF BACHELOR OF SCIENCE EDUCATION DEGREE IN ACCOUNTING EDUCATION. JUNE, 2014 i ACKNOWLEGMENT The product of a graduate degree is never the result of one person labour but rather the sacrifices and support of others. I therefore owe a debt of gratitude to few individuals for their immense contribution to the success of this study. A million thanks to my parents George Brew and Rebecca Koffie for their immense contribution and support. Although, my education was a big blow to them; yet they never ever opted to give up. Dad and Mum, I really appreciate all that you have done for me. It is my fervent prayer that the Almighty God Richly blesses you and gives you long life as well. Special thanks also to my supervisor Mr. Ahmed Musah, for your time, dedication and contributions towards the completion of this piece. Infect, I really enjoyed working under your supervision. God bless you abundantly. I am grateful to uncle Eric Nzoley, Emmanuel Assemiah Duncan, my Grand Mum Obapayin NketaAdjoa , Mr. Augustine Ano Assemah, Madam Comfort Cudjoe, Mavis Brew,Veronica Brew ,Miss Gladys Abiew, Emmanuel Ayertey, Rose Okra, and all my study partners especial John Akwete, Bipuah, Elder Amankwa, my mentor Madam Genevieve Mensah, Mr. John Awutey ,Mr.Tutu Lawrence, Robert Koomson and all staff teachers of Brentu Senior High Technical School. Lastly, to the typist and all and sundry, who contributed immensely towards my educational career. I truly adore you all. Thanks so much. ii STUDENT’S DECLARATION I hereby declare that this Action Research is the result of my own original research, except Literature Review cited as a source of additional information. I wish to emphasis that any short coming in this work is entirely mine. Signature ……………………………… DATE …………………………………… (BREW EMMANUEL EKO) iii SUPERVISOR’S DECLARATION I hereby declare that the preparation and presentation of this Action Research which is in partial fulfilment for the award of a 4-Year Bsc Accounting Education was supervised in accordance with the guidance for the supervision of an Action Research in U.E.W. Signature ……………………………… DATE …………………………………… (MR. MUSA AHMED) iv ABSTRACT This study was conducted in Enchi Brentu Senior High Technical School from September, 2013 to May, 2014. The aim of the study was to assist form two Accounting students to improve upon their performance in final account preparation. This study became necessary because most form two students perform poorly in accounting. Therefore the results of the study will benefit most students, teachers, educational policy formulators and other researchers. Specifically, the objectives of the study was to assist form two students to prepare final account of a business concern through the use of participatory methods such as cooperative learning group, group project work and demonstration lesson. The research questions used were what are the causes of students’ inability to prepare final account of a business concern?, to what extent can participatory method of teaching and learning assist students prepare a final account of a business concern?, what role does teaching and learning material play in helping students prepare a final account of a business concern? The study was restricted to form two Accounting students a population of forty-eight students. The data collection techniques used in the study was: Observation, unstructured interview, class exercises (test) and questionnaire. Data collection was done during the diagnostic stage of the intervention to help identify the problem and also after the intervention to assess the strength and effectiveness of the intervention. The data collected were analysed by means of frequency tables and percentages. iv The findings of the study revealed that teaching methods and techniques used by instructors/teachers were not effective enough to make accounting topics interesting to learners. This led to negative misconception of learners about the course and finally led to their poor performance. However, after the implementation of the intervention, the performance of the students has improved drastically. The conclusion drawn from the study was that students’ poor attitude and perception was due to the teacher-centred method of teaching used mostly by the teacher. Therefore, cooperative learning group, group project work, demonstration method, alongside discussion method made students active learners. Student’s participation which is an essential element of lesson objective achievement was obtained when these methods were used. v DEDICATION Dedicated to my parents who were there for me through thick and thin? Dad and Mum, if you are not the best, then, you are among the best. I love you, Thanks so much for your unlimited love and support. I really appreciate it. vi TABLE OF CONTENT Content Page Tittle Page I acknowlegment II Student’s Declaration III Supervisor’s Declaration IV Abstract IV Dedication VI Table Of Content VII List Of Tables Chapter One 1.1 1.2 1.3 1.4 1.5 1.6 1.8 1.9 IX Introduction 1 BACKGROUND TO THE STUDY STATEMENT OF THE PROBLEM PURPOSE OF THE STUDY RESEARCH QUESTIONS SIGNIFICANCE OF THE STUDY LIMITATION OF THE STUDY DELIMITATION OF THE STUDY ORGANIZATION OF THE STUDY 1 3 4 4 5 5 6 6 Chapter Two Literature Review 7 2.1 THE CONCEPT OF FINAL ACCOUNT OF A BUSINESS 2.1.1 Trading Account 2.1.2 Profit And Loss Account 2.1.3 Appropriation Account 2.1.4 Balance Sheet 2.2.1. Insufficient Textbooks 2.2.2. Financial Problem 2.2.3 Lack Of Students Interest In Accounting 2.2.4. Inappropriate Teaching Methods By Some Accounting Teachers 2.3 THE EXTENT TO WHICH PARTICIPATORY METHODS OF TEACHING AND LEARNING CAN ASSIST FORM TWO (2) BUSINESS STUDENTS IN PREPARING FINAL ACCOUNT OF A BUSINESS CONCERN 2.3.1 Co-Operative Learning Group 2.3.2 Group Project Work 2.3.3 Demonstration Lesson vii 7 8 9 9 10 12 13 13 13 14 14 15 16 2.4 THE ROLE OFTEACHING AND LEARNING MATERIAL IN ASSISTING FORM TWO (2) BUSINESS STUDENTS IN PREPARING FINAL ACCOUNT OF A BUSINESS CONCERN 17 Chapter Three Methodology 18 3.1 RESEARCH DESIGN 3.2 POPULATION AND SAMPLING 3.3 DATA COLLECTION INSTRUMENTS 3.3.1 Observation 3.3.2 Unstructured Interview 3.3.3 Class Exercise 3.3.4 Questionnaire 3.4 INTERVENTION DESIGN AND IMPLEMENTATION 3.4.1pre-Intervention 3.4.2 Intervention Design 3.5POST-INTERVENTION 3.6 DATA COLLECTION PROCEDURE 3.6.1observation 3.6.2 Unstructured Interview 3.6.3 Class Exercises 3.6.4 Questionnaires 3.7 DATA ANALYSIS 3.8 DATA RELIABILITY AND DATA VALIDITY Chapter Four 19 19 20 20 20 20 20 21 21 22 25 26 26 26 27 Ошибка! Закладка не определена. 28 28 Results Of The Study 29 4.1 PRE-INTERVENTION RESULTS 4.2 POST-INTERVENTION RESULTS Chapter Five 30 33 Summary, Conclusion And Recommendation 5.1 SUMMARY 5.2 CONCLUSION 5.3 RECOMMENDATION 5.4 SUGGESTING FOR FURTHER STUDIES 43 43 44 45 46 References 47 Appendix I Pre-Intervention Questionnaire for Students 49 Appendix Ii Pre-Intervention Questionnaire for Teachers 51 Appendix Iii Post-Intervention Questionnaire for Students and Teachers 52 viii LIST OF TABLES Table 1 .............................................................................................................................. 30 4.1.1 Choice of Business Programme ............................................................................... 30 Table 2 .............................................................................................................................. 31 4.1.2 Programme Students Would Have Chosen .............................................................. 31 Table 3 .............................................................................................................................. 32 4.1.3 Possible Causes of Students Poor Performance ....................................................... 32 Table 4 .............................................................................................................................. 34 4.2.1 Students’ Participation In Lesson Increases Students Interests. .............................. 34 Table 5 .............................................................................................................................. 36 4.2.2 Respondents Rating of The Effectiveness of The Use of Co-operatives Learning . 36 Table 6 .............................................................................................................................. 37 4.2.3 Responses Of Students On Group Project As An Opportunity To Practice ............ 37 Table 7 .............................................................................................................................. 38 4.2.4 Respondents’ Rating On The Use Of Demonstration Method For Teaching Of Final Accounts ........................................................................................................................... 38 Table 8 .............................................................................................................................. 39 4.2.5 Students Performance In Examination Before And After Intervention Implementation ................................................................................................................. 39 ix x CHAPTER ONE INTRODUCTION The purpose of the study is to investigate how students can develop the skills in preparing final accounts of a business concern through participatory methods of teaching and learning such as co-operative learning group, group project work and demonstration of lessons. This chapter covers background to the study, statement of the problem, purpose of the study, research questions, significance of the study, limitation of the study, delimitation of the study and organisation of the study. 1.1 Background to the Study Accounting as a subject and accounting as a profession has been identified as one of the exciting and lucrative profession in the world of today. No wonder students pursue business programmes than any other programmes these days. In Ghana for example Nkrumah University of Science and Technology which was established mainly for science and technology Education now offers Business programmes of which Accounting is one of their areas of specialization. Also University of Education, Winneba which was established mainly for educational programmes now offer other programmes such as Banking and Finance and Bachelor of Business Administration. Enchi Brentu Senior High Technical School (B.S.T.S) where the research is conducted which was established in 1989 by Nana Brentu IV to run technical programmes now offers Business Accounting. One cannot under estimate the importance of accounting in both human and national developments. The profitability of every business including the service industries such as 1 banks, local and central government, Hospitals, co-operative societies, public Co- operatives and others depends on good accounting practices. This means that students who pursue accounting must be well vest in the subject. Among the general aims of accounting education is to enable students acquire the knowledge of accounting principles and their applications in modern Business manuals,mechanicals and computerized systems of financial reporting (teaching syllabus for financial Accounting). Financial report is a statement prepared by Accountants to summarize the financial affairs of a Business for managers and others users of accounting information. This enables users of financial report to compare the performance of one business to the other and decide which one to invest in. Again, it helps owners of business to know the financial growth, progress and prospects of their business. This makes it important that upcoming accountants are to possess the necessary skills in preparing financial report (final accounts). However, attempts to assist Enchi Brentu Senior High Technical School (B.S.T.S) prepare final accounts of business concern poses major challenge to them. This was revealed through series of assignment, class, exercises, class test conducted. More than twenty (20) students had below the pass mark (50%), students participation in lesson was low. Observation and interview conducted also revealed that, one of the causes of the problem was due to inadequate teaching and learning material such as self- explanatory textbooks, students were not ready to work practical questions after the day’s lesson. The problem of the second year accounting students inability to prepare final accounts poses a challenge to their future performance. 2 It is therefore imperative to adopt strategies that will enhance student performance or chance the situation. This has led the researcher to research into how to assist second year accounting student of Enchi Brentu Senior High Technical School prepare a final account of a sole proprietorship through participatory methods of teaching and learning. Sarfo (2007), explains participatory method of teaching and learning as “the teacher acts as a guide or advisor to the students, suggesting activities that are appropriate. The teacher is therefore supposed to explain points when they have misunderstood or do not understand and to answer their questions by directing them to sources where they can find the answers for themselves, the teacher helping only when necessary. The participatory methods to be considered under this study include co-operative learning group, group project work and demonstration lessons. The importance of Participatory method of teaching and learning are׃Emphasis on learning instead of teaching, Participation by every student, Development of democratic way of thinking, Training in reflective thinking and Spirit of tolerance is inculcated. Based on the above importance of participatory method of teaching and learning, that’s why the researcher recommends it to teachers. 1.2 Statement of the problem One of the main purposes of studying financial accounting is to equip student with the basic accounting principles and their application in preparing accounts and also to enable student to keep proper books of accounts and to prepare final account of a business concern. However, through various observations, interviews, assignments.(individuals, group), exercises and class test, it was revealed that general performance by form two (2) Accounting students were not encouraging in Enchi Brentu Senior High Technical School (B.S.T.S) due to; insufficient textbooks, financial problem, lack of interest in accounting as a subject, 3 inappropriate teaching method by some teachers. The situation has led these students inability to identify income statement (trading, profit or loss account) items and statement of financial position items (balance sheet) when preparing final account of a business concern. Hence the study is conducted to assist B.S.T.S students to prepare a final account of a business concern through participatory method of teaching and learning. 1.3 Purpose of the study The purpose of this research work is to use participatory methods of teaching such as cooperative learning groups, demonstrative lessons and group project work to improve the second year accounting students’ performance in preparing final account of a business concern at Enchi Brentu Senior High Technical School. Specifically the following objectives are outlined to achieve the above purpose 1. To find out the causes of student inability to prepare final account of a business concern 2. To use participatory method of teaching and learning to assist form two students understand and prepare final account of a business concern. 3. To find out the role of teaching and learning materials in preparing final account of a business concern. 1.4 Research questions 1. What are the causes of student’s inability to prepare final account of a business concern? 2. To what extent can participatory method of teaching and learning can assist students prepare final account of a business concern? 3. What role does teaching and learning materials play in helping students prepare final account of a business concern? 4 1.5 Significance of the study Even though some studies have already been done by other researchers on the topic, further research on it becomes expedient especially when desired level of academic standard of financial accounts seem not to have been achieved. The researcher hopes that the research will expose other areas for further research. The outcome of the study will serve as a guide to accounting teachers both professional and non-professional to have a look at their teaching methods and techniques to respond to the need of students so far as their cognitive and psychomotor capabilities are concerned. The study will also educate parents, teachers and other stakeholders on the need to consider their wards interest, capabilities, and potentialities when choosing courses at the SHS level. It will again educate teachers and students of the need to adopt appropriate teaching methods like co-operative learning group, demonstration lesson and group work in preparing final account of a business concern. It will encourage stakeholders in education to provide the needed support material for learning. Lastly but not the least, the study will add to the existing literature on similar topic and serve as a basis for further educational research. 1.6 Limitation of the Study This project report was limited by certain factors and conditions despite the relentless efforts put in place by the researcher. Among these were: The researcher found it difficult to have access to past achievement record of the student. Also, administering the questionnaire to the respondents was difficult task as most of them were not willing to disclose vital information to the researcher for fear of being reprimanded and intimidated by the teachers and administrators. 5 Last but not the least, time did not permit the researcher to schedule interview with some respondents due to the fact that the researcher had to undertake other academic duties in the school. 1.8 Delimitation of the Study The study was restricted to form two accounting students of Enchi Brentu Senior High Technical School. 1.9 Organization of the study This research work has been organized into five chapters. Chapter one deals with the background to the study, statement of the problem , the purpose of the study, research questions, significance of the study, limitation of the study, delimitation of the study and organization of the study. Chapter two involves the review of related literature which covers concepts of preparing final accounts, participatory methods of teaching and learning, causes of students inability to prepare final account of a business concern, the role of teaching and learning play in assisting students to prepare a final account of a business concern. The third chapter covers the research design, population, sample and sampling techniques, research instruments, administration of the instruments, data collection procedure, data analysis and intervention design and implementation, data reliability and validity. The fourth chapter deals with data presentation and discussion of the study. The fifth chapter deals with the reflection, conclusion and recommendations for further studies. 6 CHAPTER TWO LITERATURE REVIEW The purpose of the study is to investigate how students can develop the skills in preparing final accounts of a sole trader through demonstration methods of teaching and learning. The chapter is concerned with the review of related literature to the study. It is designed to review the available literature on cultivating appropriate method of preparing final account of a business concern. The related literature to the study is reviewed under these main headings; The concept of final account of a business, Causes of students inability to prepare final account of a business concern The extent to which participatory methods of teaching and learning can assist form two (2) business students in preparing final account of a business concern and the role of teaching and learning materials play in assisting students to prepare a final account of a business concern, 2.1 The Concept of Final Account of a Business According to McQuaig and Bille (2005), Accounting is a process of analysis, classifying, recording, summarizing and interpreting business transactions in a financial term. Summarizing as one of the five basic tasks of the accounting process involves preparation of final accounts. Final accounts are accounts prepared at the end of the business financial year. They are summary of all the financial transactions during the period and also give financial state of affairs as at the end of the period (Kojo, 2000). Baldwin and Ingram (1998) considers final account as a financial statement which are the primary format organizations use to report general purpose accounting information to external users. According to wood (2002), the main objective of the accounting function is the calculation of the profit earned by a business or the losses incurred by it. The main reason why the business 7 is set up in the first place is to make profit and owners of the business will want to know for various reasons how much profit has been made. Therefore, by preparing the final account of a business, one will know the profit earned during the period. According to Woods (2002),a business may derive the following benefits by preparing final accounts; to forecast and plan ahead, to obtain loan from banks or from private individuals, to show a prospective partner or person to whom he hopes to sell the business to, and to know his tax obligation to the state. It should however be noted that final account differs according to the type of business unit. But all other final account prepared by companies, partnership, sole proprietorship, non-profit making organization, departmental accounts may include at least one final account below; Trading Profit and loss account Appropriation account Balance sheet 2.1.1 Trading Account Trading is the basic process of business. Manufacturing companies, for example, buy in raw materials and used them to make products for sale, whereas retail companies buy in finished goods for sale at a higher price; this is the basis of their trade. The trading account for either of these types of business shows how much profit the firm makes by this basic business process, ignoring other expenses the company may incur. It simply looks at how profitably the firm makes from goods or processes them for the sale to customers. This account is prepared to ascertain the cost of goods sold and match it against net sales (sales less sales returns and allowances), so that the difference being either gross profit or loss can be 8 determined (Kojo, 2000). Gross profit is the excess of net sales over the cost of sales. On the other hand gross loss is the excess of cost of sale over net sales. 2.1.2 Profit And Loss Account Profit and loss account is sometimes called earning statement or an income statement (Baldwin and Ingram, 1998). This account is prepared after the trading account has been prepared by a merchandising firm. With the service business the income statement is prepared right away without the trading account. Although the trading account shows us what the firm has made from its basic line of business, it does not reveal the true profit of the firm as it does not take into account any of the general expenses of the business. The profit and loss account takes the gross profit of the firm and deducts all the expenses to find the final profit or loss for the year, known as the net profit or net loss. The result net profit (total revenue in excess of total expenses) or net loss where the revenue is less than total expense after all owing and prepayments have properly adjusted. This account repots the performance of a business over a period of time such as a month, quarter or fiscal year. It is prepared to ascertain net profit or loss of a business. The income statement shows total revenue minus total expenses. 2.1.3 Appropriation Account Final accounts for a sole trade do not require an appropriation account. When we are compiling final accounts for a sole trader there is nothing further to do for the profit and loss account, since the net profit is simply available for the owner to use as he or she sees fit. 9 However, in the case of a partnership or a limited company decisions have to be made about how to distribute the net profit. The appropriation account is the statement of how net profit is distributed to the partners or shareholders. (www. F:\books.html). Partnership appropriation accounts deals with details of how net profit is distributed to each partner as recorded in the original partnership agreement, draw up when the partnership commenced, It may contain details about the following methods of distributing salaries, interest on capital, sharing of remaining profit or loss. For a limited company the appropriation account is constructed differently and may include the following entries like corporation tax, interim dividend, proposed dividend, reserves, retained earnings (Kojo, 2000). It can therefore be confirm that the appropriation of one business unit is different from one another depending on the entries made. 2.1.4 Balance Sheet The true value of worth of a firm is tied up in many things, such as the things that it has bought, the things it has made, the regular customers it has and even the reputation of the company or its brand. The balance sheet is not account unlike the other final accounts but a financial statement. But in practice it is grouped with the others and called the final accounts (www.ebooktovou.net/fina1-accountsofsoletraderconcern.pdfpp). While the trading and profit and loss account shows the profit that a firm has earned in a particular year, the balance sheet shows what the firm is truly worth and what makes up its value. The balance sheet reports the balances of the assets, liabilities and owners equity 10 accounts at a particular date. The balance sheet shows the financial position or the condition of the business assets offset by claims against them at a particular date. It starts with a comparison of the items of value within the firm (its assets) and the money that it owes (its liabilities). The balance sheet is the last document in a set of final accounts and can be defined as an overview of a company’s financial position on a particular date, showing the total assets and liabilities of the firm. The first section on a balance sheet details the fixed assets (non-current assets) of the firm. These comprise the capital items of value that the firm has bought and will use for an extended period of time, such as buildings, machinery, equipment and vehicles. These are often referred to as tangible fixed assets (tangible means you can touch them). The fixed assets section of the balance sheet will show the original price paid for these assets, the amounts by which their value has depreciated, and the net current value of each of them (original price minus depreciation). Occasionally an item entitled ‘goodwill’ will be seen in this section. This is an example of an intangible fixed asset (intangible means that it is something you cannot touch). Goodwill does not represent an item of value but arises when a new owner pays above the book value of the firm to compensate the previous owners for the good reputation of the business. The second section in the balance sheet contains amounts that are readily available in the company for paying debts, called current assets. This generally includes stocks, debtors, prepayment, money in the bank and cash held on the premises of the business. The third section in the balance sheet contains amounts that are owed to suppliers or lenders that are due to be repaid fairly shortly (normally within one year). These are known as current 11 liabilities. This section will typically contain creditors, bank overdraft, accruals, VAT and loans that are due to be repaid in less than one year. For limited companies, this section may also include corporation tax and dividends proposed. The final section of the balance sheet shows us where the money came from to run the business. In the final accounts, this will typically be capital introduced by the owner(s) and retained profits from previous years of trading. This section will also show the amount that the owner has taken from the business for his or her own use, known as drawings. This section may contain long term liabilities; those debts that have to be paid for in more than one year’s time, such as a mortgage on company property, debentures or a long-term bank loan. This is what is called “Financed by”. After final adjustment is made to income and expenses accounts where necessary. The final account normally prepared first is the trading account then profit and loss account and the last is the balance sheet. For partnership businesses and limited liability companies an appropriation account is required for sharing of profit. And for business units involved in manufacturing, manufacturing account is prepared before other final accounts are prepared depending on that business concern. Cause of Students Inability to Prepare Final Account 2.2.1. Insufficient Textbooks Roner (1993), investigated on students problems in the studying of financial accounting. He found out that there were few accounting textbooks in most of our libraries. With this, it becomes difficult for the students to make reference after a lesson was taught. Educationally, it is important for each student to get a textbook for himself or herself. This is not the case in 12 Enchi Brentu Senior High School. Students find it difficult to have access to textbooks thereby finding the subject very boring. 2.2.2. Financial Problem The research revealed that students who perform poorly are due to financial problem. These students take care of themselves in the school and for that matter have to stay away from school on Wednesday which is a market day in Enchi so that they go to the market to work in order to get little money to feed themselves. The responses from the students showed that they personally pay for their fees, buy books and others out of the little money they earn each Wednesday while some students said they have to go and assist their parent in the market. Other among these students serves as by – day (laborers) who go to work in people farms for their survival, therefore after the days hard work they find it difficult to learn and these has contributed to their poor performance. 2.2.3 Lack of students interest in accounting Most students complain that the business course was imposed on them by parents and for that matter have no interest in the subject. They fail to pay attention in class, write notesand refuse to do class exercises and assignments. 2.2.4. Inappropriate teaching methods by some accounting teachers According to Arkhurst (1994), the most unique problem faced by most accounting students were poor teaching methods used by their accounting teachers in most of the second cycle institution. Instead of teachers using participatory method of teaching and learning, they rather use lecture method which many a time do not allow the student to take active part in the teaching and learning process so there is no need for them to hunt for information before and 13 after a lesson has been taught. Teachers do not solve practical questions with them on the chalkboard but rather read the questions and solutions for them to copy. 2.3 The Extent to Which Participatory Methods of Teaching and Learning Can Assist Form Two (2) Business Students in Preparing Final Account of a Business Concern Sarfo (2007), explains teaching methods as the procedures or set of techniques selected by the teacher to help learners experience the message the teacher wants to put across. With participatory method of teaching, the teacher acts as a guide or advisor to the student, suggesting activities that are appropriate. He may give them introductory information without which they would not be able to work on their own. The teacher is therefore supposed to explain points when they have misunderstood or do not understand and to answer their questions by directing them to sources where they can find the answers for themselves, the teacher helping only when necessary. There are numerous examples of participatory methods of teaching and learning which include co-operative learning group, group project work and demonstration lessons. 2.3.1 Co-operative Learning Group Johnson and Johnson (1985), explains co-operative learning group as an instrumental method whereby a group of learners work together to maximize their own and each other’s learning. In this type of learning the students interacts with each other and build upon their school relationship which is different from the traditional way of teaching. Co-operative is a team process where members support and rely on each other to achieve an agreed-upon goal. The classroom is an excellent place to develop team-building skills you will need later in life. 14 The main idea behind co-operative learning is to teach the students to be a functional part of a group so that they have grouped responsibilities as well as individual responsibilities. This type of learning does not only increase the study skills of the students only but also develop their communication skills. This type of learning strategy when used with other methods will motivate individuals to work in groups for each other’s benefit. It has proven to be a successful teaching strategy in which small teams, each with students of different levels of ability, use a variety of learning activities to improve the understanding of a subject. As they work on a task or goal such as solving a problem. Sarfo (2007), encourages teachers to reinforce the use of co-operative learning because learners need to develop skills in learning and working together because eventually they will work in teams in their work places. He however stated that at times competitions in the classroom interfere with slow learning from each other. However to make this strategy very successful it should be interactive. To make it very interactive, it was suggested on the web site www.studvgs.net/cooplear.htm that each member must accept, develop and share a common goal, contribute their understanding of the problem. Again each member must work to the understanding of the other members’ question, insight and solutions. Each member should empower the other to speak and contribute, and to consider that they are accountable to one another. 2.3.2 Group Project Work In the course of teaching, the teacher will explain in detail how to carry out a particular activity. There is no way of knowing whether or not the students have acquired the behavior he intends to explain unless they carry out the activities. By only explaining to them what to do is only a mental exercise and does not mean the 15 students will be able to do it. The project may be worked out either on an individual or group basis but either way, students must be free to ask the teacher or other colleagues about things they do not know and also learn in a natural way. It is very imperative that a project needs careful planning and supervision, so that the student gets the most out of it and so that time is not wasted. It is also necessary to make sure that those with special difficulties are attended to so that the project may be successful. Farrant (1999), maintains that the teacher tasks in the project work are simply to guide the learners as they find need for his or her help. This does not mean that he leaves them to themselves. He should encourage his or her students by showing interest in their work and assessing the value of the project work by the quality of learning shown in what they produce. He concludes that project work method make learning real by presenting a real task for the learners to tackle. It makes learning clear as they supply concrete objectives so that the learners know at the end if they have achieve such objectives. It makes learning social when they involves several students working together, each student contributing his/her energy and skills to the work of the group so that the final objectives of the group may be achieved. 2.3.3 Demonstration Lesson In demonstrating method of teaching, the learner views a real or a lifelike example of skills; it can be executed by the teacher or by the learner (Sarfo, 2007). Later then the student or leader attempt to exhibit such skills. Accounting like all other practical subjects requires special method of teaching. Listed among such method is demonstration (Sackek, 1994) and (Amofa. 1998). As recommended by both authors, demonstration method is the best method for teaching practical oriented subjects like accounting. 16 Balongun et al (1981), explains that in demonstration lessons, students are allowed to witness and practice the skill on their own. He stressed that each student should have a clear view of the demonstration which must be followed by explanation and supervision of student’s work. Again, Annor (1997), argues that demonstration method of teaching consists of showing the learner how to perform a new skill. The witness of the skills should be accompanied by explanation of how the skills are performed. 2.4 The Role of Teaching and Learning Material in Assisting Form Two (2) Business Students in Preparing Final Account of a Business Concern Teaching and learning materials are any materials that, both the teacher and students use to facilitate teaching and learning, comprehension, acquisition of knowledge, concepts, principles and skills. Amofa (1998), says that “teaching and learning materials include materials and devices that teachers and students use to enhance teaching and learning or improve the quality of teaching and enrich the learning process”. Teaching and learning materials play an important role in the teaching and learning process. Visual teaching and learning materials like charts enhance the potential for learning when the teacher presents facts and concepts. Tamakloe (1996), opines that ‘instructional materials are effective mechanisms of helping students to build clear and accurate concepts”. Another role of teaching and learning materials is to attract the attention and focus of students in the classroom. Olaitan (1991), says “instructional aids promote intellectual curiosity, contribute to longer retention of learning and clarify principles outside the range of ordinary experience”. Teachers find it very easy when teaching and learning materials are used effectively. Teachers are able to dictate and the pace of lessons in the classroom when teaching and learning materials 17 are used. Teaching and learning materials are used to motivate and sustain the interest of students in the classroom. According to Hall and Paolussi (1970), “selecting and using instructional materials properly could motivate and sustain the interest of learners to clarify information and summarize what has been taught and provide experiences which encourage transfer of learning skills”. In the case where handling of real objects is needed, the real object itself is used as a learning material to teach students. Dosoo (1996), states that effective use of teaching and learning materials can improve learning in providing a means for learners to manipulate or handle an object for a better understanding of things and promoting active participation in class”. CHAPTER THREE METHODOLOGY The purpose of the study is to investigate how students can develop the skills in preparing final accounts of a business concern through participatory methods of teaching and learning such as co-operative learning group, group project work and demonstration of lessons. 18 This chapter entails the procedure for collecting information for the research work. It includes Research Design, Population and Sampling, Data Collection Instruments, Intervention Design and implementation, Data Collection Procedures, Data Analysis, Data Reliability and Validity. 3.1 Research Design This research is a classroom base which focuses on how to cultivate skills of students preparing final accounts of a business concern hence it is not extended to student outside the selected classroom. It is therefore an action research which according to Mckenzie (2001) action research studies changes before, during and after they happen and actually involves the researcher in participating in the process of change. Action research involves trying out an idea in practice with the view to improving or changing something by trying to have a real effect on the situation. It focuses on immediate application, not on developing theory on general application. This research, therefore seek to provide immediate solution on how to improve their skills in preparing final account of a business concern. 3.2 Population and Sampling The research was carried out in Enchi Brentu Senior High Technical School in Western Region of Ghana. The research work was precisely carried out in the business department. However, for the purpose of convenience, all second year students studying accounting were chosen. The population therefore comprises of forty-eight students and two teachers of 2013 academic year. As a result of the conditionality of an action research, stratified random sampling was used. This is a sample procedure where population is divided into two or more groups which are known to pose specific features relating to the phenomena being investigated. 19 The class selected for this research was form two accounting students. This class was selected for the study because they were the class from which the problem was identified and the researcher handles them most during the internship period. Two instructors were also involved in the study because they deal directly with the students. 3.3 Data Collection Instruments For the purpose of this study, the following research instruments were used to collect needed data, assess the progress of the students when intervention is implemented and also assess the outcome of the research. Observation Unstructured interviews Class exercise Questionnaires 3.3.1 Observation Observation is using ones sense to see, smell, tough, occasionally taste and listen to what is going on in a given social settings. 3.3.2 Unstructured Interview Unstructured interview is a non-directive type of interview were most of the speaking is done by the respondent. 3.3.3 Class Exercise Class exercise is educational piece of work intended to test somebody knowledge or skill. 3.3.4 Questionnaire Questionnaire is a written instrument that contains a series of questions or statements called items that attempt to collect information on a particular topic. 20 3.4 Intervention Design and Implementation A major feature that makes action research distinctly different from the traditional research is the introduction of intervention and its implementation with the research process. This means that, the research was concerned not only with identifying the problem but in solving it in a particular context. This section deals with strategies and measures which were used to arrest the situation. These measures helped Form Two Accounting Students of B.S.T.S to be able to prepare the final accounts. 3.4.1Pre-Intervention From the information gathered through observations, interviews, exercise books and questionnaires, it was established that a problem really existed. The researcher therefore prepared the students in order to make the intervention process very effective and efficient. The students selected for the study were place under Group I and Group II. Each group was asked to prepared 15 questions on the topic final accounts that they had difficulties with. This enabled them to find out for themselves some of the problems they are having. By so doing, it raised questions on how to attempt these difficulties. In a week’s time, each group presents their questions to the other group for possible answers in the form of a quiz just that this time questions comes from one contestant to the other. The quiz master being the researcher only confirming whether the answers given where acceptable or not. 21 The researcher made a follow up to the class and re-echoed solutions to questions asked during the quiz activity. As part of the pre-intervention design students were advice to buy one text book recommended by the head of department. 3.4.2 Intervention Design At this stage the researcher sorts to put plans in place to solve the problem at stake. Therefore the instructional strategies listed below were employed to support students prepare final account of a business concern. Co-operative learning group Group project work Demonstrative lessons Implementation of Design 3.4.2.1 Co-operative Learning Group In designing this intervention, the group project work is conceded as an exercise that allows for co-operative learning. Co-operative is a team process which is more concern with members supporting and relying on each other to achieve an agreed upon goal unlike group project an individual may just solve the project for the entire group without the help of other members. The team activities begin with training in and understanding group processes. The researcher explained co-operative learning group to the class. The researcher then gave the student opportunity to ask any question. It was suggested that any individual who is non-cooperative and non-participative to the goal of the group should be fired and asked to find another group. This was suggested to encourage members to participate in contribution. On the other hand, any individual who felt he or she was doing all the goal of the group may decide to resign. For that individual, he/she will find another group easier. 22 The researcher only served as facilitator of discussion and suggesting alternatives but does not impose solutions on the team, especially those having difficulty working together. Teams with problems were invited to meet with the instructor to discuss possible solutions. After students have completed the project work through each individual effort, marks were awarded. This was done based on confidential peer rating to help determine who is contributing and who is not. Immediate feedback to students’ performance in class exercises, assignments and class tests, aroused, sustained and improved their performance in the subject tremendously. That is students works were marked immediately it was submitted and given back to them to make necessary correction, and also for them to see their performance, whether they were improving or not. It deals with the evaluation of intervention procedure; the academic difficulties of students are of diverse complexity. Therefore the researcher adopted the curriculum based assessment which is characterized by taking of frequent measurement of student’s observable performance as he or she proceeds through the curriculum. During the intervention the researcher discovered that, there were some students who were slow in learning. The researcher decided to take enough time aside to meet with those special students. The researcher made good use of this time by teaching the whole book-keeping system from subsidiary books through the ledgers to final accounts at the pace that will suite them. This helped them to better appreciate the book-keeping system and easily prepare the final accounts. 3.4.2.2 Group Project Work One of the best ways of helping students to understand and learn an idea is to give them the opportunity to practice as much as possible. For this reason, group project work was used to 23 assist students prepare final accounts of a business comprising trading, profit or loss account and the balance sheet. In designing this intervention students were put into groups after the demonstration lesson, and question based on what has been demonstration is given to the student for further practice and discussion. To ensure that each member of the group has enough time to make his or her contribution, the class was put into small groups of seven to seven members in each group. The researcher acted as an expert and a facilitator whom the students consulted for direction throughout the period. Each group came out with their solution after the researcher’s supervision and guidance. After supervision and collection of the group work, the researcher led the class to solve the question and many others. 3.4.2.3 Demonstration of Lessons Researches indicated that, demonstration of lesson is one of the methods used mainly when the teacher wants the students to learn new skills. The goal of demonstration lesson is that the student will be able to perform the skills on their own. The final accounts however require some skills which need to be mastered by the students for further preparation of other final accounts. In designing this intervention, the whole topic was divided into three sub topics; trading account, profit or loss account and the balance sheet. All the sub topics were treated at least within four periods each of forty minutes each. The first two periods dealt with the theoretical aspect of the sub topic and the other two periods, students put into practice what they have been taught. During the beginning of each day’s lesson, the day’s objective was communicated to the students to help them monitor their own progress as the lesson proceeds. Black board 24 illustrations accompanied by explanations and questions from both the teacher and the students were adopted. Where a format was needed, it was presented in the form of a chart to the students and each item on the chart was then identified and explained by a student with help from the researcher. With the use of chart it helped to attract the attention of students and further arouse their interest in the lesson. Since talking about the skills on its own does not help students to understand it, provisions were made within the lesson to enable students to practice the skill they have observed and acquired to ensure that the skills are mastered. At the end of each lesson, the day’s lesson was summarized. Ten minutes were made available for student to ask questions for further explanation. Assignments and group projects were given for further practice. 3.5 Post-Intervention It deals with the evaluation of intervention procedure. The academic difficulties of students are of diverse complexity. Therefore the researcher adopted the curriculum based assessment which is characterized by taking of frequent measurement of student’s observable performance as he or she proceeds through the curriculum. During the intervention the researcher discovered that, there were some students who were slow in learning. The researcher decided to take enough time aside to meet with those special students. The researcher made good use of this time by teaching the whole book-keeping 25 system from subsidiary books through the ledgers to final accounts at the pace that will suite them. This helped them to better appreciate the book-keeping system and easily prepare the final accounts. The whole remedial classes motivated students because their problems were taken care of; they were able to be at par with the rest of the students in the class and this made them have sense of belongingness since they can also participate in discussions and answer questions correctly when posted to them. 3.6 Data Collection Procedure 3.6.1Observation Observation as a data collection techniques was used at the diagnosis, implementation and after implementation stages of the study. The observation involved watching students’ expressions on their faces in class during accounting lessons, the way they answer questions in class, the participation level of students in class and their performance when answering text questions given them. 3.6.2 Unstructured Interview Interviews were used as a direct verbal interaction between the researcher and the student. It was used to create a cordial relationship between the researcher and the students and to ensure effective problem analysis. Though not structured, it took a general structure that is in the mind of the interviewer. A non-directive type of interview was used and this is where the students did most of the talking. 26 The interview was used at the diagnosis stage of the study to know the background of students in accounting and their problem in final accounts preparation. After the implementation stage, students were interviewed to determine the effectiveness of the intervention. 3.6.3 Class Exercises The researcher used set of questions to find out the level of understanding and skills in the preparation of final account. Class exercises were used at the diagnosis stage, implementation stage and after the implementation stage. Class exercises given to student at the diagnosis stage to find the problem or errors students make when preparing the final accounts of a business concern. At the implementation stage class exercises were used to find out the progress students were making during the intervention. After implementation stage, class exercises were given to know the level of improvement in performance. The tests items were set in a way that will reveal or depict the level of skills student have at every stage of the study. The class exercises were given to every student in the classroom. 3.6.4 Questionnaires This is a set of written down question and given to students to answer as questionnaires. The questionnaires were used to find out whether students were consulted before accounting was chosen for them. Questionnaires used was closed ended question items. The research was to find out how best to improve the skills of students, will want to be taught and the problem they face in preparing final account. Again, a set of questions were also given to two instructors who teach accounting during the diagnosis stage to find out the methods they used in teaching accounting. 27 After the implementation of the intervention, questionnaires found in appendix III were given to both teachers and students to find out how successful the interventions were. In all fifty questionnaires were distributed. Forty eight were given to students and two to teachers. All the respondents were given questionnaires to answer. This was done under the full supervision of the researcher. Questionnaires were collected the same day after they were administered. As soon as the responses were collected, it was recorded promptly and the data collected from the studies brought together for final analysis. 3.7 Data Analysis The results of the findings were statistically analyzed by the use of frequency tables and percentages. This is to be done in the next chapter, under presentation analysis and discussion. 3.8 Data Reliability and Data Validity Data reliability refers to the consistency of a measurement, or the degree to which a test measures the same way each time it is taken by the same category of people, under the same condition Archer (2009). The purpose of the reliability is to assess the instrument ability to measure the same way. The researcher used test-retest reliability to validate the data collected. The same test item was administered to same people on different occasion. In this instance, the same exercises and questionnaires were given to the same group of people for responds a week after the first. In order to obtain accurate, reliable and valid results, visits were made by the researcher to the class chosen. Questionnaires were explained to students and all the other parties to the research for them to understand better and how to fill the form. Respondents were advised to answer all 28 questions. Questionnaires were collected immediately. By using this approach, misplacement of questionnaire and its’ incompetence’s were avoided Data validity on the other hand refers to the extent to which an instrument measure that which it purport to measure. That is data validity is concerned with the accuracy of measurement. The purpose of data validity is to ascertain the degree to which the measure is accurate for specific purpose. CHAPTER FOUR RESULTS OF THE STUDY The purpose of the study is to investigate how students can develop the skills in preparing final accounts of a business concern through participatory methods such as co-operative learning groups, group project work and demonstration lesson. Chapter four seeks to discuss and interpret students responses based on the research instruments. The results of the study were therefore based upon the data gathered through observation, interviews and questionnaires administered to the respondents in the school. 29 4.1 Pre-intervention Results To confirm whether a problem really existed, a set of questionnaire was given to the forty eight students to respond to. That gave the researcher a fair idea of the existence of a problem in order to adopt the appropriate intervention measures to improve the situation. The data was organized into tables and the main techniques used in analysis the result was percentages Students’ Choice of Business Programme This data collected was on how the students chose the business programme have been measured in the table below. Table 1 4.1.1 Choice of Business Programme Response Frequency Percentage (%) Myself 12 25 Parents 8 16.7 School Authorities 28 30 58.3 Total 48 100 Source: Researcher’s field of study (2013) In the table above it indicate that out of 48 students only 12 students chose the business Programme by themselves. This represented 25% of the total students to whom the questionnaire was administered. 8 students representing 16.7% said course was chosen by their parents while 28 students representing 58.3% said the course was imposed on them by the school authorities. In effect, the research revealed that 75% of students who offered the business programme were imposed on them. It is therefore obvious why most of the students may not have interest in the business programme. The Programme Students would have chosen In the questionnaire, students were asked to indicate the programme they would have chosen if they were given the option. The responses of students’ choice of program are shown below in the table Table 2 4.1.2 Programme students would have chosen Programme Frequency Percentage (%) Business 27 56.3 General Arts 9 18.7 31 Science 7 14.6 Home Economics 5 10.4 Total 48 100 Source: Researcher’s field of study (2013) Giving the data covered in table 4.2, 27 of the respondents confirm they would have chosen Business programme representing 56.3%. This left us with 43.7% of the respondents who would have chosen other programmes. 9 students representing 18.7% would have chosen General Art, 7 students representing 14.6% for Sciences and 5 students representing 10.4% for Home Economics. This result shows that not all Students liked the business programme for that matter the reading of accounting. This resulted in the poor performance of students in the entire accounting subject. There was therefore the need to adopt appropriate measures that will arouse the interest of the students. Possible Causes of Students’ Poor Performance in the Preparing of Final Accounts. Through interviewing of students on the causes of their poor performance in preparing a final accounts of a business concern the following information were gathered. The result is what has been presented in table Table 3 4.1.3 Possible Causes of Students Poor Performance Causes Frequency 32 Percentage (%) Insufficient textbooks 12 25 Inappropriate teaching methods 19 39.6 Lack of interest 8 16.6 Subject new to students 9 18.8 Total 48 100 Source: Researcher’s field of study (2013 From the table 4.3 above, 12 of the respondents representing 25% indicated that insufficient textbooks are responsible for students’ poor performance.19 students which is the majority representing 39.6% of the respondent are of the view that inappropriate method of teaching the subject was the main cause of students’ performance. Whiles 8 and 9 respondent representing 16.6% and 18.8% indicated that lack of interest and the subject is new respectively were the cause of student’s poor performance. In further analysis, the above shows clearly there are the existence of the problem under investigation. The researcher therefore employed all possible intervention to arrest the situation. 4.2 Post-Intervention Results This involves data collection and analyses based on the questionnaires after implementation of the interventions. In other words, it indicates the feedback of the intervention strategy. 33 Students’ participation in lesson increases student’s interests Data collection and respondents’ view on how participation in lesson increases students’ interest have been summarized in the table 4.4 below. Table 4 4.2.1 Students’ Participation in Lesson increases Students interests. Students Teachers 34 Responses Frequency Percentage Frequency (%) Percentages (%) Strongly agree 28 58.3 2 100 Agree 15 31.3 - - Disagree 5 10.4 - - Total 48 100 2 100 Source: Researcher’s field of study (2013) It can be seen from table 4.4 that 28 students and 2 teachers’ respondents strongly agree that students’ participation in lesson further increase students’ interest. This represent 58.3% and 100% respectively.15 respondents representing 31.3% agree Whiles 5 respondents representing 10.4% of students disagree that their participation in lesson further increase student’s interest. Even though about 5 out of 48 disagree on the subject but the majority making about 89.6% of the respondent at least agreed that a student participation in the lesson increase his or her interest. Therefore, it can be concluded that whenever lessons are designed in such a way that it affords student participation it generates their interest. Respondents’ Rating the Effectiveness of the use of Co-operatives Learning Group Table 4.5 indicates how respondents rate the effectiveness of Co-operatives learning group in arousing students’ interest in the study of accounting. 35 Table 5 4.2.2 Respondents rating of the effectiveness of the use of Co-operatives learning Students Responses Teachers Frequency Percentage Frequency Percentages (%) (%) Average 3 6.3 - - Good 5 10.4 - - Very good 13 27.0 - - Excellent 27 56.3 2 100 100 2 100 Total 48 Source: Researcher’s field of study (2013) From table 4.5 above 27 respondents representing 56.3% rated the effectiveness of co-operative learning group as excellent, 13 respondents representing 27% also rated the method as very good, whiles 5 respondents representing 10.4% and rated the method as good and 3 respondents representing 6.3% rated the method as average. However, both teachers representing 100% believed that co-operative learning group is an effective method of helping students to develop interest in a particular subject. They therefore rated the method as excellent. Looking at the result from the table the popular opinion confirms the effectiveness of the method as excellent. It can therefore be concluded that student have now developed interest in the entire accounting subject after the implementation. Group Project Work an Opportunity to Practice with Group Members. The table shows how group project work gave them the opportunity to practice with group members. 36 Table 6 4.2.3 Responses of students on group project as an opportunity to practice Responses Frequency Percentage (%) Strongly disagree - - Disagree 4 8.3 Agree 44 91.7 Total 48 100 Source: Researcher’s field of study (2013) According to the responses, 44 students were of the view that group project work forced them to practice with group members representing 91.7% while 4 students representing 8.3% disagree. Unlike when they were not giving group project work, they may decide to practice what has been taught in class. This can be seen in large number agreeing to the fact that the method gave them the opportunity to practice with group members. This represented 91.7% of the students. Respondents’ rating of the use of demonstration method for teaching of final account 37 The result from this questionnaire was to find out from both teachers and students view on the effectiveness of demonstration teaching and learning of accounting. It was to find out how this method helped reduce errors students make when preparing final accounts. Table 7 4.2.4Respondents’ Rating on the Use of Demonstration Method for Teaching of Final Accounts Students Responses Teachers Frequency Percentage Frequency (%) Percentages (%) Average 2 4.2 - - Good 6 12.5 - - Very good 15 31.3 - - Excellent 25 52.0 2 100 Total 48 100 2 100 Source: Researcher’s field of study (2013) Result from table 4.8 indicates that 25 of the respondents representing 52% are of the view that demonstrative lesson is an effective method of teaching the students how to prepare final accounts. They therefore rated it excellent. For the 48% of respondents left,15 students representing 31.3% rate the method very good, 6 students representing 12.5% rated it as good and 2 students representing 4.2 % rated it as average. On the hand, both teachers who responded to the questionnaire were in favour of the useof demonstration to teach a final account and further helped them reduce the errors they made. It can therefore be concluded that adoption of demonstration of lesson to assist student learn how to prepare final accounts is the best. 38 Students Performance in Examination before and after Intervention Implementation Table 8 4.2.5 Students Performance in Examination before and after Intervention Implementation Marks Grade Before intervention Frequency Percentage After intervention Frequency (%) Percentages (%) 80 – 100 A1 3 6.3 9 18.7 60 – 79 B2 – B3 9 18.8 14 29.2 45 – 59 C4 – C6 10 20.8 19 39.5 35 – 44 D7 – E8 18 37.5 2 4.2 F9 8 16.6 1 2.1 - - - 3 6.3 48 100 48 100 Below 35 Absent Total Source: Researcher’s field of study (2013) This information was obtained before and after implementation of the interventions. The results obtained before the intervention indicated that only 3 students representing 6.3% had A1, 9 students representing 18.8% had B2 and B3, 10 students representing 20.8% had between C4 and C 5, 18 students representing 37.5% had D7−E8 whiles 8 students representing 16.6% had F9.In other words 25.1% score 60% and above, 20.8% score 50% and above while 37.5% of the students scored below 50% and 16.6% failed the examination. After the intervention there was improvement in the situation 9 students representing 18.7 % had A1 ,14 students representing29.2% had B2−B3, 19 students representing 39.5% had C4−C6 ,2 students representing 4.2% had D7−E8, a student representing 2.1% had F9 whiles 39 3 students representing 6.3% were absent during the examination. In other words 47.9% scored above 60% with only 1 student failing. Even though 3 students representing 6.3% were absent during the examination after the intervention, leaving 93.7% of the students for the study .More than 90% of the students passed the examination. So it can be concluded that, the strategies employed during this study to bring about an improvement in the situation were successful. 40 Discussion of Post Intervention Results The results of this study are based on the data described in this chapter and are discussed objectively to answer the research questions for the study. The first research question sought to find out ways the use of co-operative learning group generated interest in students and encouraged them to come to class. Co-operative learning group as explained in chapter two is an instructional method whereby a group of learners learn to maximize their own and each other’s learning. In this case every student is each group is working to help himself/herself and the other member. The need to help ones’ self through helping other group members generated interest in the study of final accounts. Since it gave them a sense of belonging and recognition. Table 4.5 confirmed as a large number of respondents rating co-operative learning group as excellent in arousing students’ interest in the study of final accounts. This eventually manifested in students reporting for accounting class regularly. The results obtained from table 4.6 proved that group project work gave students the opportunity to practice with other group members. One of the concern raised during this study that student did not practice after class lessons. This resulted in their inability to prepare final accounts. By the use of group project work students were encouraged to practice even after class. Since it is a group project work so each member must be present and since marks were awarded based on confident peer rating one is force to participate during the group project work. To demonstrate is to show clearly. Demonstration lesson as a way of reducing errors students make when preparing final accounts helped to correct these errors. Because after observing students were given opportunity to practice during the lessons and even by a way of group 41 project work. Table 4.7 justified that demonstration lesson is an excellent method for Leaching financial accounting as agreed by Sackey (1994), and Amofa (1998). The role teaching and learning materials play in preparing final accounts of a business concern was addressed by this study. Teaching and learning will not be effective without the use of any support materials. Students will have to revise before and after class and teachers will have to be prepared before coming to class. How is all these made possible? By using teaching and learning materials. It is by so doing that during the pre-intervention parents were advised to obtain text book recommended by the head of department for their wards. 42 CHAPTER FIVE SUMMARY, CONCLUSION, RECOMMENDATION AND SUGGESTIONS FOR FURTHER RESEARCH The purpose of the study is to investigate how students can develop the skills in preparing a final account of a business concern through participatory methods such as co-operative learning groups, group project work and demonstration lesson. The chapter concludes the entire action research work. It includes summary, conclusion, recommendation and suggestion for further studies. 5.1 Summary In the analysis of the data obtained during this research, the following were arrived. This study has basically been concern with helping students of B.S.T.S prepare final accounts through intervention like co-operative learning group, group project work, demonstration lesson. It was revealed that both school authorities and parents influence the choice of programme for a larger number of students which affects their interest in the study of accounting. Again it came to light that students perceived the study of financial accounting as a difficult subject, simple because it has been newly introduced to them at the second cycle level anything involving arithmetic is difficult. The study also revealed that most of the second year business students of the school do not have the required Accounting text book and also did not belong to any study group. They only have to rely on note given during lesson. This does not allow them to extend their studies after class. 43 The study further indicated that lack of interest among the students; as well as student absenteeism was found to be among the causes of students’ poor performance in the preparation of final accounts. Nonetheless, after the implementation of the various interventions, the researcher made the following headway; Students have developed much interest in the study of financial accounting due to the interventions implemented through co-operative learning group. Again, students now have regular study group whom he or she depends on and can be depended upon. Most students also took the opportunity to ask their parents to acquire for them the recommended text book by the head of department. Those who could not afford learning materials now share with group members when they go for group meeting. Shy student who normally keep to themselves, now comes out to share their ideas with their colleagues. 5.2 Conclusion As much as it is important to encourage individualism as it has been, it is important to facilitate the need of working together in groups as was done during this research. By using co-operative learning groups, group project work and demonstration lessons to assist students prepare the final accounts of a business concern; the individual student had the opportunity to interact with other group members. This further gave them the opportunity to seek help from them. By using participatory methods students learn better. First observed through demonstration lessons and later they are given the opportunity to practice what they have observed through group project work where they have the opportunity to share and learn during co-operation. It can be added that, teaching and learning materials draws students’ attention, makes them concentrated on whatever lesson is being studies if properly used. 44 5.3 Recommendation Based on the findings and conclusions of this research work, conscious efforts should be made to involve the students in the selection of programmes at the JHS level. Also guidance services should be provided for all students before they select any programme for their SHS level. To arouse student interest in learning of accounting, make him or her feels part of a group whom he or she is accountable to for his or her actions. With the knowledge that there is someone watching out for me, this will encourage the student to study hard and eventually enjoy being in class. Again, when teaching a practical subject like accounting it is necessary to give students group project work so that they will practice after the lesson has been demonstrated. During the project work, the teacher should serve as a consultant from whom students may come for advice. Demonstration lesson is also recommended for the teaching of accounting and for that matter final account. It helped to show students how to prepare the final accounts. This help them minimized errors they made during the group project work. With the problem of inadequate teaching and learning materials, parents, teachers and the ministry of education should employ all available resources to acquire such materials like textbooks and pamphlets for students. This will provide students the opportunity to practice even after class. With the use of these material students will be able to experience what is being learnt. 45 5.4 Suggesting For Further Studies This study was conducted to assist Form Two Accounting students prepare final accounts of a business concern through participatory methods such as co-operative learning group, group Project work and demonstration learning. However, due to limited time constrains only a section of these students were chosen for the study. The researcher therefore suggests that the study should be extended to cover other students to help improve their performance in accounting and final accounts for that matter. The researcher also suggests that, other data collection instruments should be used to find out the other causes of the problem considered under this study. Again, the researcher suggest that a detailed study is conducted into the effect of each participatory methods used in this study on each of the final accounts. For instance, a topic like “improving performance of students in preparing trading account through co-operative learning group” should be studied. This will give specific effect of co-operative learning group on students in preparing trading account. 46 REFERENCES Archer, F. K. (2009). Measurement and Evaluation. Kumasi: Osra Printing Works. Amofa, A. K. (1998). Sociological Foundation for African Students. Accra: Black Mask Limited, Annor, R. (1997). Education Studies. Kumasi: Freema Press Limited. Baldwin, B. A. & Ingram, B. W. (1998). Financial Accounting, USA: South Western College publications, Balogun, D. G et al. (1981). Principles and Practices of Education, Macmillan Basic Books in Education. Dosoo, M. K. (1996). Comprehensive Notes on Education for Training Colleges (Vol.2). Farrant, J. S. (1999). Principles and Practices of Education in Africa, Singapore: Longman Publisher Limited. Johnson, D. W. & Johnson, R. T. (1991). Co-operative Learning, Increasing College Faculty Instructional Productivity. USA: Geor Washington University. Kojo, J. M. (2000). Comprehensive Manual to Financial Accounting. McQuaig, J. D. & Bille, A. P. (2005). College Accounting (8th ed.). Ghana: Hougton Miffin Ministry of Education Teaching Syllabus on Financial Accounting. Oduro, E. (2001). Financial Accounting, Bivo Ventures. Olaitan, S. O. &Agubiobo, N. (1981). Principles of Practice Teaching. London: John Wiley and sons Ltd. Sackey, J. N. K. (1994). General Principles and Practices of Teaching for Teachers. Sarfo, F .K. (2007). Educational Technology. Kumasi: Ospra Publishing Company Limited, Tamakloe, et el. (1996). Principles and Methods of Teaching. Accra: Black Mask Ltd. 47 Woods, F. (2002). Frank Woods Business Accounting (9th ed.). Halow FT/Prentice Hall. www.ebooktoyou.net/final-accountsofsole-traderconcern.pdf.php www.f:\books.html www.studygs.net/cooplearn.html 48 APPENDIX I UNIVERSITY OF EDUCATION, WINNEBA COLLEGE OF TECHNOLOGY – KUMASI CAMPUS DEPARTMENT OF ACCOUNTIN STUDIES PRE-INTERVENTION QUESTIONNAIRE FOR STUDENTS This questionnaire is purely for academic purpose and intended to be used for action research on assisting form two Accounting students in preparing final account of a business concern. Any information given will be treated with a high sense of confidentiality. Please tick where applicable and fill where necessary. 1. Who chose the business programme for you? Myself [ ] Parents [ ] School Authority [ ] 2. If you were given the chance, which programme would you have chosen? Business [ ] Science [ ] General Arts [ ] Home Economics [ 3. How do you find the study of accounting? Interesting [ ] Boring [ ] Difficult [ ] 4. Do you have accounting text book on your own? Yes [ ] No [ ] 5. How often do you solve Accounting questions on your own? Many times [ ] Few Times [ ] Not at all [ ] 6. Do you belong to any co-operative learning group in your class? 49 ] Yes [ ] No [ ] 7. How has your group helped you to develop your skills in preparing the final account of a business concern? Not well [ ] Quite well [ ] Very well [ ] 8. Do you participate fully in the discussion? Yes [ ] No [ ] Sometimes [ ] 9. Does your teacher use teaching and learning materials (e.g. Chart showing format)in his /her teaching? Yes [ ] No [ ] 10. Does he / she involves you in his / her teaching? Yes [ ] No [ ] Sometimes [ 50 ] Sometimes [ ] APPENDIX II UNIVERSITY OF EDUCATION, WINNEBA COLLEGE OF TECHNOLOGY – KUMASI CAMPUS DEPARTMENT OF ACCOUNTIN STUDIES PRE-INTERVENTION QUESTIONNAIRE FOR TEACHERS This questionnaire is purely for academic purpose and intended to be used for action research on assisting form two Accounting students in preparing final account of a business concern. Any information given will be treated with a high sense of confidentiality. Please tick where applicable and fill where necessary. 1. Does student’s participation in lesson arouse their interest? Yes [ ] No [ ] Sometimes [ ] 2. Do all teaching methods serve the same purpose? Yes [ ] No [ ] Sometimes [ ] 3. What are the possible causes of student’s poor performance? Insufficient Textbooks [ Lack of Interest [ ] Inappropriate Teaching Methods [ ] Subject new to Students [ ] ] 4. Do you have adequate Financial Accounting textbook for all students? Yes [ ] No [ ] 5. Imposing subjects causes them to perform poorly? Strongly Agree [ ] Agree [ ] 51 Disagree [ ] APPENDIX III UNIVERSITY OF EDUCATION, WINNEBA COLLEGE OF TECHNOLOGY – KUMASI CAMPUS DEPARTMENT OF ACCOUNTIN STUDIES POST-INTERVENTION QUESTIONNAIRE FOR STUDENTS AND TEACHERS This questionnaire is purely for academic purpose and intended to be used for action research on assisting form two Accounting students in preparing final account of a business concern. Any information given will be treated with a high sense of confidentiality. Kindly answer these questions as you can. Tick where applicable. 1. Do you solve exercises from textbooks or pamphlet after topic has been treated? Yes [ ] No [ ] 2. How do you rate the effectiveness of the use of co-operative group discussion? Good [ ] Average [ ] Very Good [ ] Excellent [ ] 3. Co-operative learning group is an effective method for developing skills in preparing final accounts of a business? Strongly Disagree [ ] Disagree [ ] Agree [ ] 4. The use of group project work method has given me the opportunity to practice with group members. Strongly Disagree [ ] Disagree [ ] Agree [ ] 5. How do you rate the use of demonstration method in the teaching of Final Accounts of a business? Excellent [ ] Very Good [ ] Good [ ] 6. How do you find the preparation of the final account? 52 Average [ ] Interesting [ ] Difficult [ ] Boring [ ] 7. Did student’s involvement in the co-operative group learning helped to bring a better understanding? Yes [ ] No [ ] 8. Did the use of teaching and learning material arouse interest in the topic? Yes [ ] No [ ] 9. Did a student’s participation in lessons further increase their interest? Strongly Agree [ ] Agree [ ] Disagree [ 53 ]