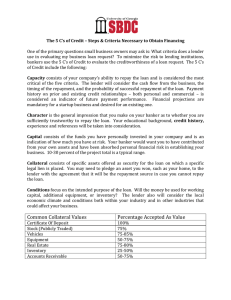

5Cs Of Credit/5Ps Of Credit (Extracted from What Can I Sell? 101 Business Ideas for Youth in Africa, By Ojijo) Am I trying to get a loan or line of credit for my small business? Then I need to know what bankers are thinking when they consider my application. One key to success in obtaining the financing I need is to understand the “six C’s of credit.” Lenders customarily analyze the credit worthiness of the borrower by using the Five C’s: capacity, capital, collateral, conditions, and character. Each of these criteria helps the lender to determine the overall risk of the loan. While each of the C’s is evaluated, none of them on their own will prevent or ensure access to financing. The five Cs/Ps of credit are: 1. Character/Person 2. Capacity/Payment 3. Capital/Principal 4. Collateral/Protection 5. Conditions/Purpose Commercial loan lenders are in business to make money. Consequently, when a commercial loan lender lends money it wants to ensure that it will be paid back. The commercial loan lender must consider the 6 “C’s” of Credit each time it makes a loan. Credit investigation could get intricate and dense. The information that is being gathered could be getting strewn and scattered all over the place. The fundamental question that remains to be answered by the lender is: ‘Will I get paid on time?’ ق 1st C-Character/Person JP Morgan, a successful businessman once said that ‘I will do business with anyone as long as he is honest!’ Bankers will consider my personal character, which includes both my personal and business credit history. Character depends a great deal on other people’s impressions of me, including my trustworthiness and integrity. The banker will consider my references (are they, themselves, of good character?) as well as my experience in the business and/or industry. Last, but not least, what kind of impression do I make on the banker? Does the borrower have a history of being honest, reputable and timely in honoring his or her financial obligations? If not, go no further. This is the area where I may make my greatest contribution. I may know something about the borrower that no one else knows that could be critical to the lending decision. Character is the personal impression I make on the potential lender or investor. The lender decides subjectively whether or not I am sufficiently trustworthy to repay the loan or generate a return on funds invested in my company. My educational background and experience in business and in my industry will be reviewed. The quality of my references and the background and experience of my employees will also be considered. The first thing that loan officers look for when reviewing a proposal is evidence of my trustworthiness. My loan application can be rejected without even reviewing my proposed business idea if loan officers find any evidence in my background indicating lack of integrity. They would ask questions like: “Who are I? How long have I lived where I live? How long have I been in business? Do I live up to my obligations? What is my standing in the community? The answers to these questions will normally come from my business plan and references. In analyzing Consumer Credit one would consider the following: Has the person declared bankruptcy in the past Does the person have a good credit record Does he/she have a stable job What is the level of education/experience What is the person earning and what is the earning potential Stability at the place of residence, whether rented or owned. In analyzing Commercial Credit one would consider the following: The size of the operations The number of years in business The form of the business. By this one means ‘Retail’, ‘Wholesale’, ‘Service’ or ‘Manufacturing’. Typically the incidence of business failures is high in the Retail and Service segments. Is the business a Parent, Subsidiary or a division? Does the business have a Holding company? The structure of the business. Is the business a Sole Proprietor, Partnership or Corporation? For Sole proprietor or Partnership type one would further seek personal information on individual(s) running the business. The number of employee. There are Industry specific Norms for ‘Employees to Sales’ ratio. The management record of the company The location of the company Any previous evidence of fraud Any previous Insolvency record? Any Labor disputes or issues? Are the products/service sold by the prospect complimenting products/service to the ones that I may sell? Is the business practice ethical? Is the business seasonal/ non-seasonal Is the business Local/ National or International. The economy of a business accordingly could depend upon local/ national or international economy. Is there a growing or a going market for this business or the business redefining itself and what would be the impact of the internet on this business. How willing is the prospect to share information? How diligently does the prospect fill my Credit Agreement/Application? What are the references saying? Are there too many lay-offs especially of key personnel? Are there any Law suits pending against the company? What does the website of the company say and look like? Is there any recent media coverage about the company? Is it positive or negative. Or are there any rumors floating? If the company’s stock is publicly traded then see how its stock is performing? One can also check the indices for a particular type of Industry to see how in general the Industry is doing. The collapse of the NASDAQ is a warning of the debacle of the tech companies. ق 2ND C-Conditions/Purpose Conditions focus on the intended purpose of the loan. Will the money be used for working capital, additional equipment, or inventory? The lender will also consider the local economic climate and conditions both within my industry and in other industries that could affect my business. There should be a specific explanation of how the borrower is going to use the funds. I will not settle for a simple description such as “working capital.” For example, a farm operator may borrow funds for working capital purposes that include fuel, seed and fertilizer for a new crop. Or, it could be used to cover living expenses until the next harvest. These are two very different purposes with significantly different implications for loan repayment. No business exists in a vacuum, and loan officers would look at a number of factors that may potentially impact on my kind of business. They would pay particular attention to potential economic, legal, employee, supplier, or environmental problems. Expect questions like,” What is the state of the economy? Are there environmental issues to be concerned about? How could these affect the financial condition of my business?” Loan officers tend to consider loan applications more favorably if: (a) I am introducing a new product or service with an obvious demand; (b) there is little competition; (c) my market is composed of small independent businesses; and (d) lower rate of failure in my type of business. There might be likelihood that a company that I am evaluating deals in international trade and a shift in the currency rates might have a detrimental or beneficial effect on it. Again, one might look at how the internet is redefining business. Recently I was at a very small camera shop and soon realized that the business was generating big revenues on the internet and especially on Amazon & eBay. So the size of the shop really did not influence its revenues but the global reach of the World Wide Web does. All of this can again influence the ability or intention of a customer to pay his/her bills. The greatest challenge to businesses is to attract and retain reliable employees. ق 3RD C-Capital/Principal Capital is the money I personally have invested in the business and is an indication of how much I will lose should the business fail. Prospective lenders and investors will expect me to contribute my own assets and to undertake personal financial risk to establish the business before asking them to commit any funding. If I have a significant personal investment in the business I am more likely to do everything in my power to make the business successful. Leveraged borrowing depends on the equity/ net worth that a company has and it is a good idea to see if the company is committed to improve its borrowing-power by contributing to its Equity/Capital/Net Worth. One way of doing this is by retaining all or portions of its earnings. But all said, done and then undone Cash and ONLY Cash pays bills. Thus, keep an eye of the company’s cash-flow and cash-position. In order to make sure that I will be able to pay what I owe a creditor, I need to have a good net worth. This is computed by searching for the difference of all of my assets and my liabilities. My assets are the things that I own. These might also be considered sizeable properties as they can be able to serve as payment for my debts. In addition, my debts or the amount that I owe another party will constitute my liabilities. When I will subtract my liabilities from my assets, the remaining value will represent the other C in credit, the capital. How much capital do I and my business already have? The saying “it takes money to make money” applies here. Bankers will want to see that I have personally invested in my business and are willing to invest more. If I am not willing to put money into the business, why should they be? They also want to see that my equity in the business is growing. The single most common reason that new businesses fail is undercapitalization. There is no fixed amount or percentage that the owner must be vested in his/her own company before he is eligible for a business loan. However, most lenders want to see at least 25% of a company’s funding coming from the owner. Contrary to what is advertised in the media, a bank will not fund 100% of the business venture. In almost every case, any principal that will own more than 10% of the company is required to sign a personal guarantee for the business debt. ق 4TH C-Collateral/Protection Collateral or guarantees are additional forms of security I can provide the lender. If the business cannot repay its loan, the bank wants to know there is a second source of repayment. Assets such as equipment, buildings, accounts receivable, and in some cases, inventory, are considered possible sources of repayment if they are sold by the bank for cash. Both business and personal assets can be sources of collateral for a loan. A guarantee, on the other hand, is just that – someone else signs a guarantee document promising to repay the loan if I cannot. Some lenders may require such a guarantee in addition to collateral as security for a loan. My collateral is important, but banks put more premium on the potential profitability of my business proposal. My collateral represents an “escape hatch” for my bank, and banks normally want it to be large enough to be able to cover their losses (if at all) and easily convertible to cash. From my projected cash flow and list of assets, bankers will ask “How can I be sure of my ability to repay the loan? What can I offer the bank as an alternative source of repayment? In most instances, the bank will require the personal guarantees of all principals. Besides providing another source of repayment, it also shows my commitment to the business. This is a property that will serve as security against a loan or an amount that I owe a lender. The collateral will be repossessed by the lender if the person is unable to pay off the debt as agreed. The lender will be able to take back the money that they lent I by selling the property to an interested buyer. Machinery, accounts receivable, inventory, and other business assets that can be sold if a borrower fails to repay the loan are considered collateral. Since small items such as computers and office equipment are not typically considered collateral, in the case of most small business loans, the owner’s personal assets (such as his/her home or automobile) are required in order for the loan to be approved. When an owner of a small business uses his/her personal assets as a guarantee on a business loan, that means the lender can sell those personal items to satisfy any outstanding amount that is not repaid. Collateral is considered a “secondary” source of repayments-banks want cash to repay the loan, not sale of business assets. Financial institutions will generally advance up to 80% of valid accounts receivable. 5TH C-Capacity/Payment This is an evaluation of the company’s ability to repay the loan. The bank needs to know how I will repay the funds before it will approve my loan. Capacity is evaluated by several components, including the following: Cash Flow refers to the income a business generates versus the expenses it takes to run the business analyzed over a specific time period-usually two or three years. If the business is a start up, prepare a monthly cash flow statement for Year 1. Payment History refers to the timeliness of the payments that have been made on previous loans. Today there are companies that evaluate commercial credit ratings (such as Dun & Bradstreet) that are able to provide this kind of history to lenders. Contingent Sources for Repayment are additional sources of income that can be used to repay a loan. These could include personal assets, savings or checking accounts, and other resources that might be used. For small businesses, the income of a spouse employed outside the business is commonly considered. Does my business have the ability to repay the money I am borrowing? Bankers don’t want to lend me money if it won’t have a positive result on my company; nor do they want to throw good money after bad with a loan that will just maintain the status quo. They want to see growth as a result of their investment so that they can get their loan back with interest. How soon will my business show a profit as a result of the changes I plan to make with the loan proceeds? Will the profit be sustainable and how big will it be? These are among the biggest questions bankers want answered. Capacity to repay is the most critical of the five factors. The prospective lender will want to know exactly how I intend to repay the loan. The lender will consider the cash flow from the business, the timing of the repayment, and the probability of successful repayment of the loan. Payment history on existing credit relationships – personal and commercial – is considered an indicator of future payment performance. Prospective lenders also will want to know about my contingent sources of repayment. The capacity of my product to influence payment is also important. If my product being sold is fiercely competitive then it may not have the capacity to influence timely payment. If my product does not directly contribute to the COGS of the buyer then again it might not have the capacity of influencing timely payment. Competition definitely influences Capacity. Cost of Capital (Offer to Investors) When raising capital from investors, I need to indicate what I am going to give back in exchange of the capital, and what happens if I am not able to meet my commitment. This part indicates what the investors will get for putting their money in my company. Ideally, it should be clear as to the figures and exact timelines. Ideally, I should give shares, but where the capital requirement is large, for instance, in cases of venture funding, the venture capitalists always want to also in the board, on top of attending meeting and making everyday management decisions. This gives them peace on their investments. In certain instances, even friends and family also want to take part of management. The plan is to indicate what I will give the owners of capital for using their capital, in essence, the cost of capital. Interest For instance, banks will require interest and principal repayments, while private equity investors will require equity. Security (Guarantee) Further, debtors will require guarantee, in the form of security; the most common being land titles, but they can also accept financial instruments like bonds or share certificates as security for the loan. Equity I will indicate the investor equity, if I wish to give equity for the funds, or if I am giving interest on financing, then I should indicate the percentage, and in what period of time it will be paid back. The equity usually comes along with board position for the investor or his representative. Claw Back Option The fourth part of the financial plan is to indicate the remedies available to the owners of capital in case the above offer is not met. For instance, the banks would want security in terms of attachment of property as guarantee, while private equity investors would go for more shares in the enterprise. If the Management team fails to achieve a given percentage of key performance criteria contained in the strategic plan, for instance, sales volume (subject to negotiation including a mechanism for measuring the investor’s, directors performance and operational support) over a given period of time, then the plan should indicate that the owners of capital will have the right claw back from the Management team and also on equity. This will lead to the equity investors obtaining an additional board position, as well as additional percentage shares, usually leading to controlling stake.