Topic 1: Intestacy

Intestacy

• Rules of intestacy will apply where:

• There is no will;

• The will is invalid;

• The will is partially invalid.

• An intestate is a person who dies without a will or without a valid will that effectively

disposes of his/her estate: Succession Act 2006 (NSW), Section 102.

Survivorship Requirement

• A person may not participate in distributing an intestate estate unless the person survives the intestate:

SA, Section 108. A person will not be regarded as having survived an intestate unless he/she survives the

intestate for at least 30 days: SA, Section 107.

Spouses

• A spouse of an intestate is a person married to the intestate immediately

before the intestate’s death, or who was in a domestic partnership with the intestate

immediately before death: SA, Section 104.

• A domestic partnership refers to a registered relationship or de facto relationship that

has either existed 2 years, or has resulted in thebirth of a child: SA, Section 105.

• If an intestate leaves a spouse but no issue, the spouse is entitled to the whole of the

estate: SA, Section 111.

• If an intestate leaves a spouse and issue, and the issue are all issue of the spouse, the

spouse is entitled to the whole of the estate: SA, Section 112.

• If an intestate leaves a spouse and any issue who are not issue of the spouse, the

spouse is entitled to:

o the intestate’s personal effects, and

o a statutory legacy, and

o one-half of the remainder (if any) of the intestate estate: SA, Section 113.

• If an intestate leaves more than one spouse, but no issue, the spouses are entitled to

the whole of the intestate estate in shares: SA, Section 122.

• If an intestate leaves more than one spouse and issue all issue of one or more

of the surviving spouses, the spouses are entitled to the whole of the estate in shares: SA, Section 123.

• If an intestate leaves more than one spouse and any issue who are not issue of the

surviving spouse:

o the spouses may share the intestate’s personal effects; and each spouse may share the statutory

legacy that would be payable if the intestate had left only one spouse; and the spouses may

share one-half of the remainder (if any) of the intestate estate: SA, Section 124.

• Spouses are to share the estate under a written agreement (SA, Section

125(1)(a)), or under a distribution order (SA, Section 125(1)(b)), or if the conditions in SA, Section 125(2)

are satisfied, the spouses are to share the estate in equal shares.

Children

• If an intestate leaves no spouse, but leaves issue, the intestate’s children are entitled to

the whole of the estate: SA, Section 127(1).

• If the intestate leaves a spouse or spouses and issue not also issue of a surviving spouse, and part of the

estate remains after satisfying the spouse’s entitlement(s), the intestate’s children may have the

remaining part of the intestate’s estate: SA, Section 127(2).

• If no child predeceased the intestate leaving issue who survived the intestate, then:

o If there is only one surviving child – the entitlement vests in the child; or

o If there are two or more surviving children – the entitlement vests in them in equal shares: SA,

Section 127(3).

Parents

• The parents of the intestate are entitled to the whole of the intestate estate if the

intestate leaves no spouse and no issue: SA, Section 128(1).

• If both parents survive the intestate, the entitlement vests in them in equal shares: SA, Section 128(2).

Brothers and Sisters

• The brothers and sisters of the intestate are entitled to the whole of the intestate estate

if the intestate leaves no spouse, issue, or parents: SA, Section 129(1).

• If more than one brother and/or sister survives the intestate, the entitlement will vest

in them in equal shares: SA, Section 128(2).

Grandparents

• The grandparents of the intestate are entitled to the whole of the intestate estate if the

intestate leaves no spouse, issue, parents, brothers or sisters, or issue of a deceased

brother or sister: SA, Section 130(1).

• If both grandparents survive the intestate, the entitlement will vest in them in equal shares

Partial Intestacy

• Where the deceased wrote a valid will but failed to dispose of all their assets

• The typical approach in partial intestacy cases is to distribute any assets covered by the will as instructed,

and the remaining assets will fall into residue and are subject to the normal intestacy laws – especially

where the will is silent on residue

• E.g. John dies leaving valid will. Has a Suzuki that isn’t on the will but has a clause in the will "I leave

residue to my daughter" – if he didn't have the clause, the Suzuki would be distributed under the laws of

intestacy

• Can also occur where a disposition by will fails (i.e. failed gift)

2

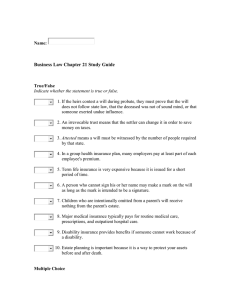

Topic 3: Formal requirements of a Will

General

6 How should a will be executed?

(1) A will is not valid unless:

(a) it is in writing and signed by the testator or by some other person in the presence of and at the direction of the

testator, and

(b) the signature is made or acknowledged by the testator in the presence of 2 or more witnesses present at the

same time, and

(c) at least 2 of those witnesses attest and sign the will in the presence of the testator (but not necessarily in the

presence of each other).

s7 A will is valid even if one or more of the witnesses to the will did not know the document they were attesting

and signing was a will

Who cannot witness?

o

o

o

s9 A person who is blind cannot attest that a testator has signed a will

s10 Beneficial disposition to interested witness is void: s10(2). Not void if at least 2 other people who

attested will were not interested witnesses: s10(3)(a), all the persons who benefit from the beneficial

disposition being avoided, consent in writing for the beneficial disposition to the interested witness:

s10(3)(b), the Court is satisfied that the testator knew and approved of the disposition and made the

disposition freely and voluntarily

Only the persons who can benefit from avoidance can object – and unaffected beneficiary cannot

In the Goods of Adams

A will can be in ink or pencil – however if both are used there a risk that pencil may be interpreted as not intending

to form part of will. The pencil writing was written over and in some places rubbed out – concluded tat the

intention of the deceased was the ink writing was to supersede pencil

An initial or part of signature may be sufficient if done with the intention of giving attention to the will: Re Male

1934

The dispensing power – s8 (informal wills)

s8 Court's Dispensing Power

A S8 - When may the Court dispense with the requirements for execution, alteration or

revocation of wills?

(1) This section applies to a document, or part of a document, that:

(a) purports to state the testamentary intentions of a deceased person, and

(b) has not been executed in accordance with this Part.

(2) The document, or part of the document, forms:

(a) the deceased person’s will-if the Court is satisfied that the person intended it to form

his or her will, or

(b) an alteration to the deceased person’s will-if the Court is satisfied that the person

intended it to form an alteration to his or her will, or

(c) a full or partial revocation of the deceased person’s will-if the Court is satisfied that

the person intended it to be a full or partial revocation of his or her will.

(3) In making a decision under subsection (2), the Court may, in addition to the document or

part, have regard to:

(a) any evidence relating to the manner in which the document or part was executed, and

(b) any evidence of the testamentary intentions of the deceased person, including

evidence of statements made by the deceased person.

In the Estate of Masters:

The requirements of s8 are –

(a) there must be a document

(b) which purports to state the testamentary intentions of the deceased

3

(c) which the deceased intended to form his will

Re Application of Brown: Estate of Springfield: In this case the subject document was not seen, read, written or in

some way adopted or authenticated by the deceased – not able to satisfy that the document was intended by the

deceased to bill his will. Notes of deceased intentions cannot be admitted to probate. The document was annexed

to an affidavit and contained a list of beneficiaries and amounts they would be awarded however did not have a

signature and was not in the deceased's handwriting. The deceased also did not make a will.

Estate of Wai Fun Chan

DVD can be a document – need transcript of contents translated to English

DVD is a document for the purposes of s21C interpretation act – it is a "record of information"

Video added as codicil to will

Estate of Laura Angius; Angius Angius[2013]NSWSC 1895,

three pages of handwritten notes in a notebook constituted an informal will. The notes were written in Italian.

Letters of Administration included a copy of the notes and an English translation. When called upon to construe

the will, the court observed that the translation was an aid in understanding the will but it was open to the court

to ‘go behind the translation’ and receive expert evidence as to the meaning of the Italian words.

Mutual Wills

Where two persons make wills pursuant to an agreement as to the disposal of their property

The wills can be combined to be one joint mutual will, or two separate wills

The agreement must be proved – the mere fact that two persons make wills simultaneously with similar provisions

is not enough: Re Oldham

Neither party can revoke without the consent of the other – they can be revoked by both testators acting jointly

Mirror Wills

Two separate, identical wills

They are made in identical terms

4

Topic 4: Testamentary capacity

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

A will made by a minor is generally not valid:s5(1)

The trifecta – undue influence, lack of knowledge and approval and lack of testamentary capacity can

result in a will being set aside

Note for each you need to go through and establish "Standing", "Onus", "Legal Test"

Standing – who can challenge

Onus – who bears the legal onus (sometimes they can shift)

Legal Test – what is the legal test

Worked example

Will A – 2017 – Beneficiaries: Salvation Army

Will B – 1967 – Beneficiaries: Homeless Kids

Intestacy – (would go to wife)

Testamentary Capacity

Standing

Using above example – who has standing to challenge the validity of Will A – the beneficiaries of Will B do

The wife has standing on intestacy to challenge the validity of Will A and Will B (can't just challenge one)

Onus

You have a prima facie valid will. There is a presumption of TC.

The person seeking to challenge the validity of the will has the onus to raise doubt about TC

So if the beneficiaries of Will B raise a doubt – the onus SHIFTS to the salvation army – those seeking to

propound the valid will

Legal test – Banks v Goodfellow – 4 1/2 limbs

Banks v Goodfellow

o There is a presumption of sound mind

o The testator must be able to:

1. understand the nature of a will and its effect

2. understand the extent of their assets of which he is disposing;

3. comprehend and appreciate the claims to his bounty;

4. be able to weigh up

4.5 thus: (no delusion will affect the above 4)

i. no disorder of the mind shall poison his affectations or prevent his sense of right

ii. no insane delusion shall influence his will in disposing of his property.

o The testator must possess testamentary capacity at the time they execute a will.

o Partial unsoundness not operating on the mind of a testator in regard to testamentary

disposition is not sufficient to render a person incapable to disposing of their property by will

(The testator did suffer from an insane delusion but that delusion did not influence his capacity

to make a disposition of his property – he had a delusion a butcher (that was dead) was trying to

kill him and went to mental hospitals in the past)

o The butcher is not someone you should consider should receive your bounty – the delusion did

not affect the above 4 limbs – i.e. if I believe my wife was going to kill me that would affect the

above 4

Onus is on person trying to get probate to prove testator did have TC: Timbury v Coffey

Medical evidence is not conclusive, nor does it necessarily have primacy over nonmedical evidence –

Zorbas v Sidiropoulous

Bull v Fulton

o Unsoundness of mind can be evidenced through delusions.

o Testator had delusion that nephews had forged her signature for a number of business

transactions

o The will was invalid as the delusion had a direct bearing on the provisions in the will.

o The propounder failed to discharge the onus – that is to show that the delusion did not affect the

provisions

o Williams J defined delusion as "…a fixed and incorrigible false belief which the victim could not

be reasoned out of"

o However, the fact the testator has delusions is not fatal to the will if the delusion did not affect

the dispositions

In the absence of sound mind, memory and understanding the whole will is void even if the delusion

relates only to a particular gift or restriction on a gift: Woodhead v Perpetual Trustee Co Ltd

5

•

Kerr v Badran: In determining whether a testator is able to understand the extent of their property they

have a right to dispose of, it is not necessary for a person to have a precise and detailed knowledge of

their assets in all circumstances

•

•

•

•

•

•

•

Knowledge and approval

Standing

Using above example – who has standing to challenge the validity of Will A – the beneficiaries of Will B do

The wife has standing on intestacy to challenge the validity of Will A and Will B (can't just challenge one)

Onus

There is a presumption of knowledge and approval

The person seeking to challenge the validity of the will has the onus to raise doubt about knowledge and

approval (usually the challenger will raise suspicious circumstances)

So if the beneficiaries of Will B raise a doubt + SC – the onus SHIFTS to the salvation army – those seeking

to propound the valid will

Legal Test – that the testator did in fact know and approve of the will

Mekhail v Hana

A grandson called a solicitor to make will for grandmother. The will should say everything to go to my

mother (grandmothers daughter), and in the event that she dies, everything is to go to me. We can only

come once to sign the will. Solicitor asked for email to be sent with details.

All 3 went into the office (clearly SC as person giving instructions was a beneficiary and beneficiary was

present when will was done)

It turned out the 'grandson' and the 'mother' were not actually the grandson and daughter of the testator

Held yes there was SC. The fact that it was done by solicitor is taking into account – solicitor caught

making up file notes. Held will not valid

Astridge v Pepper: the testator must have full knowledge and approval of the will in order for it to be

valid.

o The person drafting the will (e.g. solicitor) should read over the will to the testator before they

sign it. The testator needs to confirm they know of the contents of the will and they approve of

its connects.

o Rebuttable presumption that knowledge and approval is established by evidence that the will

was read to the testator – in this case the testator was not capable of reading and understanding

he will but signified approval to the solicitor orally after the will was read to her

Suspicious circumstances – where there may have been coercion – where a beneficiary gives instructions

to a solicitor – where a beneficiary is involved in the procurement of a will – onus is on person seeking to

challenge validity of will to establish there were suspicious circumstances The presumption can be

displaced by an circumstances which raise suspicion or doubt as to whether the will expresses the mind

of the testator: Tobin v Ezekiel

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

Fraud and undue influence

Standing

Is the same as the above but it's also about onus

Fraud and undue influence are very serious allegations

Briginshaw standard – When the gravity of the matters alleged is very serious. The court must be satisfied

that the matter actually did take place. the onus is on the party alleging the fraud, they have to prove

positively that the fraud or undue influence did occur. The court needs to have evidence before it to be

satisfied the matter did actually occur.

Onus

The onus is on the party alleging the fraud

The onus shifts to person seeking to propound the will, to demonstrate the righteousness of the

transaction: Fulton v Andrew

Undue influence in probate – no presumptions

The onus is on the party alleging the undue influence – actual coercion needs to be established (which

will be very hard to do unless the party is a direct witness to the coercion – if they are not they will never

be able to satisfy the Briginshaw standard)

Undue influence is force amounting to coercion that destroys the free agency of the testator

Undue influence goes beyond mere persuasion: Hall v Hall – conduct that overcomes the testator's free

will as opposed to convincing the testator of something

Wingrove v Wingrove

o The essence of undue influence is coercion of the will

6

o

o

•

•

•

•

•

The testator is forced to do something they do not want to do

The coercion must be proved to actually have happened. The fact that a person was in a position

to coerce the testator is not enough.

Hall v Hall

o Plaintiff was wife of testator and sought to propound validity of late husbands will

o Defendant adduced evidence of violence and threats from the plaintiff and that the testator did

not express his true testamentary intentions out of fear and for peace and quiet

o Held that pressure if exerted to an extent where it overpowers the volition of the testator is

undue influence and a valid will cannot be made out of such circumstances

o Do not need to have violence or force for there to be undue influence

o Held undue influence and Court pronounced against the will

o "A testator may be led but not driven"

Petrovski v Nasev

o Testator's son applied consistent and repetitive pressure upon the deceased to an extent that

was more than trying to appeal to her sentiment and affection

o The pressure resulted in the deceased preparing a will in order for the pressure to cease and for

a quiet life – her free judgement and wishes were overborne

o There were no threats but consistent pressure

o Also suspicious circumstances re knowledge and approval – the son provided instructions re part

of will and provided those instructions to a solicitor who was not the usual solicitor of the

testator

Hindson v Weatherill: Solicitor drafted will where he was trustee of next of kin and heir – benefited from

the will

Dickman v Holley: Mrs Simpson age 96, made a will leaving the whole of her estate to Salvation Army. The

lawyer who drafted it was the solicitor for Salvos and she also appointed someone from Salvos as her

executor. Set aside for trifecta.

Lack of Testamentary Intention – absence of "This is my last will and testament" can have an effect on

whether a document actually has testamentary intention

7

Topic 5 Rectification

s8 Court's Dispensing Power

A S8 - When may the Court dispense with the requirements for execution, alteration or

revocation of wills?

(1) This section applies to a document, or part of a document, that:

(a) purports to state the testamentary intentions of a deceased person, and

(b) has not been executed in accordance with this Part.

(2) The document, or part of the document, forms:

(a) the deceased person’s will-if the Court is satisfied that the person intended it to form

his or her will, or

(b) an alteration to the deceased person’s will-if the Court is satisfied that the person

intended it to form an alteration to his or her will, or

(c) a full or partial revocation of the deceased person’s will-if the Court is satisfied that

the person intended it to be a full or partial revocation of his or her will.

(3) In making a decision under subsection (2), the Court may, in addition to the document or

part, have regard to:

(a) any evidence relating to the manner in which the document or part was executed, and

(b) any evidence of the testamentary intentions of the deceased person, including

evidence of statements made by the deceased person.

• Can dispense with the fact that there are no witnesses

• that it was not signed

• Unsent text messages admitted to probate, emails

• The court is satisfied that it intended to from part of the will

• Suicide notes – more complex is planning documents – what you are planning to do

s27 Succession Act – Court may rectify a will

(1) The Court may make an order to rectify a will to carry out the intentions of the testator, if the Court is satisfied

the will does not carry out the testator's intentions because:

(a) a clerical error was made, or

(b) the will does not give effect to the testator's instructions.

(2) A person who wishes to make an application for an order under this section must apply to the Court within 12

months after the date of the death of the testator.

(3) However, the Court may, at any time, extend the period of time for making an application specified in

subsection (2) if:

(a) the Court considers it necessary, and

(b) the final distribution of the estate has not been made.

(If there is a spelling or clerical mistake in a clause of the will, the Court is likely to grant an order for rectification,

brought by an application under s27)

•

•

•

•

•

•

s27 requires a causal connection between the clerical error and the failure of the will to give effect to the

testator's intention due to the word 'because'

First type of rectification – clerical mistake

Mortensen v State of NSW:

o Rectification cannot be used to correct unforeseen circumstances that occur since the will was

made.

o Rectification is available for mistakes, not for lack of vision or perception or knowledge. It is

intended to be for mistakes in expressing the testator's intentions.

o In this case although the intentions of the testatrix were that no monies should go to the

government, she did not indicated an alternative option she would wish to pursue if her gift

failed – accordingly the will could not be rectified (a failure of one of her gifts resulted in partial

intestacy)

Re Gillespie: Rectification is not confined to mistakes only as to the wording of the will. In this case there

were mirror wills of a husband and wife, and each of them signed the wrong will. Grant for rectification

was made

Second type of rectification – Will does not give effect to the testator's instructions

Vescio v Bannister:

o Testatrix had 2 children Mrs Vescio and Mr Tate

o First will executed in 2007 left a unit to Mrs Vescio

o In 2009 she sold the property and acquired a retirement unit

8

o

o

o

o

o

o

o

o

o

•

In May 2009 Mr Hamer (solicitor) created a new will providing for the new transfer

The testatrix fell ill and died before the new will could be executed, Mrs Vescio made an

application under s27

‘my entire interest and estate in my home known as 11 Grevillea Street, Collaroy Plateau

together with all the furniture and contents therein’. Sandra sought to have this rectified to ‘my

entire interest and estate in my home at the time of my death including any accommodation

bond refund from a retirement unit’.

Court determined that in determining whether an order pursuant to a s27 application will be

made, the Court will consider whether there is a discrepancy between the testator's

instructions and the effect of an executed will.

A permissible order must result in a will that is representative of the testator's intentions, so the

Court must determine these intentions

Clear evidence that the testatrix gave instructions is required

In this case not a typographical error – but was it not giving effect to the testator's instructions.

Barret J – the reference to 'instructions' means that s27(1)(b) cannot apply to a will 'composed

of and written by the testator personally'

In this case there was evidence about the testatrix's conversations with the solicitor from

solicitor's file – there were some conflicting pieces of info in there however – case reiterated the

importance of keeping clear notes of instructions as they may be called upon to assist the Court

in explaining aspects of a will and are admissible in a rectification matter

Estate of Terrence Osborne

o s27 provides the court 'may' rectify a will – it is not mandatory

o There are two condition precedents to the court's exercise of the power in s27 – clerical

error or will does not give effect to will-makers instructions

o In order to determine these factors, court must make findings about the 'intentions' of

the testator

o The intention must be examined as at the date of the will not as at the date of death:

Vescio v Bannister, and Mortenson v NSW

o The standard of proof is on the balance of probabilities but clear and convincing

evidence is required: Re Estate of Max Frederick Dippert

9

Topic 6 Revocation

s8 Court's Dispensing Power

A S8 - When may the Court dispense with the requirements for execution, alteration or

revocation of wills?

(1) This section applies to a document, or part of a document, that:

(a) purports to state the testamentary intentions of a deceased person, and

(b) has not been executed in accordance with this Part.

(2) The document, or part of the document, forms:

(a) the deceased person’s will-if the Court is satisfied that the person intended it to form

his or her will, or

(b) an alteration to the deceased person’s will-if the Court is satisfied that the person

intended it to form an alteration to his or her will, or

(c) a full or partial revocation of the deceased person’s will-if the Court is satisfied that

the person intended it to be a full or partial revocation of his or her will.

(3) In making a decision under subsection (2), the Court may, in addition to the document or

part, have regard to:

(a) any evidence relating to the manner in which the document or part was executed, and

(b) any evidence of the testamentary intentions of the deceased person, including

evidence of statements made by the deceased person.

In most cases a will is revoked by inclusion of a revocation clause "I hereby revoke all prior wills made by me"

SA s11 When and how can a will be revoked? (s17 Former Wills Act)

(1) The whole or any part of a will may be revoked but only:

a) if the revocation (whether by a will or other means) is authorised by an order under

section 16 (will of minor) or 18 (will of person who has lost TC), or

b) by the operation of section 12 or 13, or

c) by a later will, or

d) by some writing declaring an intention to revoke it, executed in the manner in which a

will is required to be executed by this Act, or

e) by the testator, or by some person in his or her presence and by his or her direction,

burning, tearing or otherwise destroying the will with the intention of revoking it, or

f) by the testator, or by some person in his or her presence and at his or her direction,

writing on the will or dealing with the will in such a manner that the Court is satisfied

from the state of the will that the testator intended to revoke it.

(2) No will or part of a will may be revoked by any presumption of an intention on the ground

of an alteration in circumstances.

Marriage and Divorce – Involuntary Revocation

s12 Effect of Marriage on Will

(1)A will is revoked by the marriage of a testator

(2)(a) a disposition (legacy, gift) to a person to whom the testator is married at the time of his her death is not

revoked

(4) A will made in contemplation of marriage is not revoked by the solemnisation of marriage

Re Estate Grant, deceased [2018] NSWSC 1031

o A marriage which is in contemplation refers to a marriage, which at the time the will is made, is a

future prospect

o White J – Hoobin v Hoobin: There must be a more definite estate of mind than a mere

consciousness of the possibility of a particular marriage

If I make a will saying, I leave to Sarah my car and later I marry Sarah. Sarah gets my car but any other component

of my will is revoked.

Except if made in contemplation of marriage

If I say I leave to my wife my phone. Then it turns out I was not yet married – in those circumstances, the will was

probably made in contemplation

Harder if, I leave to my fiancé – because yes contemplating marriage but also contemplating the fact that you are

not yet married

10

The best way to avoid this is to say, this will is made in contemplation of my marriage to X.

However, If I say "Subject to me marrying X, she gets my house" If I don't get married, X gets nothing as its

conditional gift upon me getting married.

If I say "This will is made in contemplation of my marriage to X" But then I die and I did not marry X – the will is still

valid

s13 What is the effect of divorce or an annulment on a will?

(1) The divorce of a testator or annulment of his or her marriage revokes:

(a) a beneficial disposition to the testator's former spouse made by a will in existence at the time of

the divorce or annulment, and

(b) an appointment of the testator's former spouse as an executor, trustee, advisory trustee or guardian made by

the will, and

(c) a grant made by the will of a power of appointment exercisable by, or in favour of, the testator's

former spouse.

(2) Subsection (1) does not apply if a contrary intention appears in the will.

By another will s11(1)(c) -Where no revocation clause, revocation can be implied by a later will

o Revocation will occur when a later will contains a revocation clause, this is express revocation. For extra

protection a revocation clause should be inserted in all wills so as to remove any doubts.

o However revocation can sometimes also be implied by terms in later wills that can indicated a will is

either revoked wholly or partially.

o In the Goods of Oswald: A revocation clause must be accompanied by an intention to revoke – therefore,

A revocation clause inserted without the knowledge and approval of the testator will not be admitted –

testator gave directions that a testamentary paper should be prepared. The paper contained a revocation

of all previous wills however it was not read over by the testator and she was unaware it contained a

revocation clause, which was inserted by mistake

o In re Tait: testator gave solicitor instructions about alterations, new will was typed up and it left out two

clauses which the testator was unaware of – the revocation did not revoke the two earlier clauses,

despite new will being made

By writing or declaring an intention to revoke – s11(1)(d)

By destruction – s11(1)(e)

o

o

o

o

Cheese v Lovejoy – insufficient act of revocation

o Any act of destruction must be accompanied with an intention to revoke – therefore a symbolic

destruction or abandonment of a document is not enough

o FACTS:

A testator drew his pen through the lines of various parts of his will, wrote on the back of

it “this is revoked,” and threw it among a heap of waste papers in his sitting-room.

A servant/housekeeper took it up and put it on a table in the kitchen.

It remained lying about in the kitchen till the testator’s death seven or eight years afterwards, and

was then found uninjured.

o HELD:

The will was not revoked, the words “or otherwise destroyed” not being satisfied, as

whatever the testator intended, the will hand not actually been injured.

Thus there was no evidence of revocation.

• There must be the act as well as the intention to which there was no evidence of intention

in this case

“all the destroying in the world without intention will not revoke a will, nor all the

o intention in the world without destroying: there must be both”

• Appeal dismissed

Doe v Perkes (1820) – The Act of destruction must be complete. In this case the testator began to tear up

his will as he was angry at a beneficiary – he was stopped by the time it had been torn into 4 pieces. The

testator fitted the pieces back together. Court held not revoked as the testator had not done all he

intended by way of destruction

In the will of Boyd: A missing will is presumed revoked, but this is a rebuttable presumption

Re Everest: Will had a portion cut away – the testator destroyed that part of the will

By writing/dealing – s11(1)(f)

11

Dependent Relative Revocation

• Allows a court to revive a revoked will

• Where a testator revokes his will with the intention of making a new one but for some reasons fails, the

original one will remain valid OR

• Where a testator revokes the will under a mistaken assumption i.e. destroys previous will on the

assumption that the subsequent will is valid, the Court will then apply the doctrine to reinstate the prior

will by treating the revocation as CONDITIONAL upon the validity of the 2nd will

• Lippe v Hedderwick: A mistaken belief that a later will has already revoked an earlier will, will not be

sufficient to revoke the earlier one

• Re Lindrea: The testator made a will and a year later made another, revoking the first. He then destroyed

the second will, thinking it would have the effect of reviving the first will. The court found the revocation

of the second will was invalid as it was conditional upon the first will being revived (and it was not)

• Estate of Southerden: A testator revoked his will under the mistaken belief that the intestacy rules would

apply and his wife would therefore inherit his whole estate. That was not the effect of the rules and it was

held that his revocation was conditional upon that being effect of the rules (his wife getting everything)

and the revocation was therefore invalid.

• Re Jones: In order for the Court to determine whether the doctrine of DRR will apply the court will

consider:

• Whether the testator destroyed the will with the intention to revoke it? If yes – was the

revocation conditional or absolute. If it was conditional – what was the condition and has the

condition been satisfied?

12

Topic 7: Alterations

s8 Court's Dispensing Power

A S8 - When may the Court dispense with the requirements for execution, alteration or

revocation of wills?

(1) This section applies to a document, or part of a document, that:

(a) purports to state the testamentary intentions of a deceased person, and

(b) has not been executed in accordance with this Part.

(2) The document, or part of the document, forms:

(a) the deceased person’s will-if the Court is satisfied that the person intended it to form

his or her will, or

(b) an alteration to the deceased person’s will-if the Court is satisfied that the person

intended it to form an alteration to his or her will, or

(c) a full or partial revocation of the deceased person’s will-if the Court is satisfied that

the person intended it to be a full or partial revocation of his or her will.

(3) In making a decision under subsection (2), the Court may, in addition to the document or

part, have regard to:

(a) any evidence relating to the manner in which the document or part was executed, and

(b) any evidence of the testamentary intentions of the deceased person, including

evidence of statements made by the deceased person.

•

•

•

•

•

s14 How a will may be altered – only applies where the alteration was made after the execution of the

will

Goods of Sykes: The time of alteration is presumed to be made after execution of a will, but this is

rebuttable

Williams v Ashton: The onus lies on those trying to assert the alteration was made before execution to

prove that fact

In the Goods of Hall – deliberative alterations to a will (i.e. with pencil) will not be admitted to probate

because they do not carry the necessary testamentary intention – they are simply thoughts, discussions

and considerations

Ffinch v Coombe: For their to be sufficient alteration the words must no longer be apparent. Even if they

require use of a magnifying glass – may be still be apparent.

Topic 8 and 9: Republication and Revival

Codicil – an additional or supplementary document that explains, modifies or revokes a will wholly or partially

Republication

Republication is:

1. the re-execution of an unrevoked will, or

2. the execution of a codicil to an unrevoked will which either expressly or impliedly

states that the will is confirmed from the date of execution of the codicil – Re Smith;

The words ‘this is a codicil to my will dated …’ are sufficient.

There must be an intention to republish so that at the time of republication the will or codicil

must evince an intention that the will should operate from the republished date: Re Smith;

Revival

• Revival is the reactivation of a revoked testamentary instrument.

• Succession Act 2006 (NSW) s 15(1) — a will is only arrived by: re-execution, or a codicil duly executed and

showing an intention to revive.

• A destroyed will cannot be revived as it is no longer in writing – Rodgers v Goodenough

• Goods of Steele;— an intention to revive can be shown by:

o Express words referring to the revoked will,

o A disposition of property inconsistent with any other intention, or

o Some other expression that is sufficiently certain.

o Mere statement in a codicil that ‘I confirm my last will’ is not enough, as it

o refers only to an existing will rather than a revoked will.

13

•

o “A codicil may, by referring in adequate terms to a revoked will, revive that will if it

o can be in existence, but the codicil must “show and intention to revive the same.” In

o order to satisfy these words the intention must appear on the face of codicil, either

o by express words referring to a will as revoked and importing an intention to revive

o the same, or by a disposition of the testator’s property inconsistent with any other

o intention, or by some other expression conveying to the mind of the Court with

o reasonable certainty the existence of the intention.”

Extrinsic evidence is admissible to determine which will a codicil purports to revive, but not

to show whether the codicil evinces a sufficient intention to revive – Estate of Brian

14

Topic 9: Gifts by Will

•

•

•

•

•

•

•

Entitlement of the estate is so much of the estate that remains after funeral and administration expenses,

debts and liabilities are properly paid out of the estate: s103 SA

Funeral expenses and hospital bills can be paid out from undisposed of assets under will

The general rule is that the object of the gift (recipient) must survive the testator. A gift will lapse if the

beneficiary does not survive the testator by 30 days.

If a lapsed gift is not residuary, then it falls into residue and the residuary beneficiary/ies takes the lapsed

gift.

If the lapsed gift is residuary then, subject to the provisions of s42 of the Succession Act, it will be

distributed in accordance with the intestacy rules.

Gifts are legacies, or devices (gifts of land) or bequests (gifts of personal property)

Gift of jewellery – in exam sometimes there is a q re characterization – includes watches

Types of Gifts

1. Specific gifts – subject to ademption

This is a gift of a specific chattel or thing, or a group of thing forming part of the testator's estate, can be

money

A specific legacy is a gift of a particular part of the testator’s property: Walford v Walford

The description needs to be sufficient: McBride v Hudson

E.g. "Holder Car, registration XYZ"

It is necessary to be specific as to exact model, licence, colour location etc

Entitled to income earned – e.g. income earned on a rental property of a specifically gifted house

2. General gifts – subject to Abatement

This is something provided for out of the testator's general estate, e.g. a gift of $1000 to Mary, 100 shares

in BHP to Joe

A gift expressed entirely without reference to property actually owned by the testator at the time of

making the will is usually construed as a general legacy: Re Plowright [1971]

3. Demonstrative gifts

Both specific and general

E.g. $10 from CBA Account to Bob

Specific – If CBA account has $10

General – If CBA account has $5

Demonstrative – If Court can take $5 from the estate to create the $10

But if "$10 from CBA account only" – Specific and Non-demonstrative – i.e. Bob will only get $5 – Where

the legacy is demonstrative, if the fund is insufficient to pay the legacy, the balance is payable from

general estate

4. Residuary gift

Gift of residue – Residue is what is left when all the funeral, testamentary and administration expenses,

the deceased's debts have been paid and all other legacies have been paid – what is left after all gifts and

liabilities have been satisfied

If a residuary gift fails it will pass on intestacy

Includes income but not interest

5. Legacy – cash gift

A gift of money, which can be general, specific or demonstrative

General legacy (payable from general estate, not from any particular fund or place)– I give a legacy of

$1000 to Joe. s84A Interest is payable – general legacies accrue interest to the extent that they are not

paid within 1 year

General legacies do not carry income – If I leave 100 dollars in an account to Joe and then the account

grows to 150 – Joe is not entitled to the 50 (income), only to interest

Specific legacies (payable from particular place or fund) – I give Joe all the money contained in my shoe

box in my study or I give joe all my money in my account 123

• Main 3 are:

General legacies

specific gifts

residuary dispositions

15

Failure of gifts

Ademption and Satisfaction

• Gift will fail if deemed to be satisfied or if gift has adeem

• Satisfaction – I give 102 dollars to Joe but I already gave Joe 102 before I died

• The doctrine of ademption applies where there is a specific gift fails if the subject matter of the gift no

longer forms part of the testator's property at death: Re Clifford - thereby causing the gift to be

inoperative – the gift adeems

• You can't give something away that you do not own

• There are some exceptions – If I say I give my blue car to Joe but I do not have a blue car, I can give a

direction to my executor to buy a blue car

• Reynolds v Bonnici 2017

• In NSW there are at least four situations where a valid legacy might adeem

• (a) A gift of specific property fails if that property no longer exists

• (b) a portion – parent has gift in the will but during lifetime makes particular gift

• (c) where a will makes a gift for a particular purposes and the will maker subsequently makes an

intervivos gift for the same purpose – the testamentary gift is a deemed (I give 100 for establishing a joe

blog trust but then testator gives 100 during lifetime for purpose of establishing joe bloggs trust)

• (d) an express ademption where will maker makes will containing gift but subsequently makes as

intervivos gift with the intention that once accepted it adeems the testamentary gift

• If a testator bequeaths a specific article or devises realty by will and the subsequently sells, transfers,

loses or destroys it, the bequest or devise fails

• Re Clifford: where a will included a legacy of "23 shares" in Company that belonged to the testator. At the

time each of the shares were worth 80 pounds. However, the Company changed its name and subdivided

the shares into four 20 pound shares. The Court held shares changed in form and not in substance, and

where property changes in form and not in substances, no ademption occurs. The legatee took the

equivalent number of shares representing the original 23.

• So where a gift changes in substance – ademption occurs

• When determining whether ademption has occurred, the court asks two questions:

o Is the gift specific (rather than general)?

o If it is a specific gift, is the gifted property in the estate?

o If the gift is specific and the gifted property is not in the estate, the gift fails. The beneficiary

receives nothing and cannot receive the cash equivalent of the gifted property.

Example

I leave my Sidney Nolan painting to my grandson David (in my 2008 will)

In 2015 I sell the painting for 30k

I deposit it into a bank account that is part of my estate

The gift has adeemed, the sale proceeds fall into residue (rather than passing to David)

Example

I leave 200 shares in Tyre Co to Emily

In my assets I have 100 shares in Aus Tyres (in 2010 Tyre Co was subject to a takeover by Aus Tyres and

shareholders were given an option to be issued 1 share for every 2 shares previously owned in Tyre Co – I

exercised that option)

Re Clifford: The shares changed in substance and not form so no ademption occurs

Emily will be entitled to the 200 shares

Lapse

•

•

•

•

•

•

Beneficiary dies

A beneficiary must survive the testator by 30 days otherwise the gift lapses: s35(1) Succession Act 2006,

unless there is a contrary intention in the will: 35(2)

The lapsed gift will fall into the residue of the estate, however if there is a clause which directs it to go to

next of kin for example (i.e. a contrary intention) that will take effect.

If the testator leaves a gift to their child and that child dies before 30 days, then their share goes to the

children of their child (grandchildren) in equal shares: s41 unless a contrary intention appears: s41(3) and

the children of the child must survive the testator by 30 days

Exceptions to the Lapse Rule

when the gift in question is to a charity

16

•

•

•

•

s35(2) A gift will not lapse and fall into the residue of the estate if there is a contrary intention

S41 If testator leaves gift to their own child who does not survive them, their share goes to their

children's children in equal shares

joint tenancy (both personal and real property)– a gift to persons as joint tenants where one predeceases

the testator means the survivor takes the whole of the gift unless both joint tenant predecease the

testator. However, not the case for tenancy in common – as the death of one means their whole share

lapses.

There is a presumption that whenever you have gifts to groups of people they are presumed to take gifts

as tenants in common

Abatement (general legacy)

This occurs when all the funeral, testamentary and administration expenses and debts have been paid, and the

assets that are left over are insufficient to pay all the legacies in full

Where this occurs, the legacies abate and a person named as a legatee may lose all or part of his legacy as a result

Lets say estate consists of 200k – will says I give 100k to J, 100k to S, and 50k to E

These legacies will abate rateably

There are two parts for J – 50 and 50

2 parts to S – 50 and 50

1 part to E

200/5 = 40

J gets 80k, S gets 80k, E gets 40k

Subject to contrary intention

Class gifts

• Gift to a class of persons is normally taken to refer to those persons who belong to the class or after the

date of death of the testator, i.e. my grandchildren

• If there is no specific wording, the right of survivorship operates and if one dies the other/s will take the

whole lot.

• The specific identification of persons can prevent the gift operating as a class gift in favour of all the

grandsons/nephews/children

Void for uncertainty – Hickin v Ors

• The testator was estranged from children and adult children

• children had converted to Jehovah's witness

• I leave my children x y z gifts provided they converted to roman Catholicism

• should it be voided for uncertainty – because it was not clear what should be done to become a roman

catholic – court said not void for uncertainty – particular steps that people can take to become roman

catholic – not void for that purpose

Rejecting a gift – a gift may fail as a result of a voluntary act of beneficiary – passes to residuary beneficiary or on

intestacy

Public Policy – the individual's freedom is overridden in the interest of some higher good, in light of public interest

Hickins v Ors

I give Joe a gift provide he murder 10 people – void for public policy reasons – gifts that encourage an illegal

purpose

Expenses

• Expenses are the costs associated with the maintenance and preservation of the property that forms the gift.

• In the case of a specific gift, the expenses fall to the beneficiary and not the general estate, subject to contrary

intention shown in the will: Re Rooke;

In the case of a general gift, the beneficiary is only liable for expenses from the date the property passed to them:

Re Collins’ Will Trusts [1971] 1 WLR 37

Gift of shares

Re Plowright: a gift of shares (held to be general gift) which have ceased to exist at the testator's death in which

case it is impossible to obtain the shares or to ascertain their value.

Order to pay liabilities with assets

1. Assets undisposed of by will, subject to retention of a fund sufficient to pay pecuniary

legacies;

17

2.

Assets not specifically disposed of by will but included (either by specific or general

description) in a residuary gift, subject to retention of a fund sufficient to pay pecuniary

legacies;

3. Assets specifically appropriated or disposed of by will (either by specific or general

description) for the payment of debts;

4. Assets charged with or disposed of by will (either by specific or general description)

subject to a charge for the payment of debts.

5. The fund, if any, retained to meet pecuniary legacies;

6. Assets specifically disposed of by will, rateably according to value.

IE Specific gifts are last – executors will do everything to try and ensure specific gift get to their intended new

owners.

Creditors get first pick – from what part of the estate do they get paid

Creditors are paid first from residue, then from general legacies and then to the extent necessary from

specific gifts

18

Topic 14: Administration of Solvent Estates

Administration of assets of solvent estates

• The order in which creditors are paid – who of the beneficiaries is required to meet these liabilities first

• If the estate is solvent, there is a statutory hierarchy of assets that are to be used to pay debts: s46C PAA

Administration of Assets

• The assets in a solvent estate are to be applied, subject to the provisions of Locke King's Act and any

directions contained in the will.

• 46C Administration of assets

• (2) Where the estate of a deceased person is solvent the deceased person's real and personal estate shall,

subject to the provisions of any Act as to charges on property of the deceased and to the provisions, if

any, contained in the deceased person's will, be applicable towards the discharge of the funeral,

testamentary, and administrative expenses, debts, and liabilities, payable thereout in the order

mentioned in Part 2 of the Third Schedule.

SCHEDULE 3

(Section 46C)

Part 2 - Order of application of assets where the estate is solvent

The order in which assets of the estate are utilised to pay debts

A Assets not disposed of by will (intestacy – comes off the top)

B Residue

C Assets specifically appropriated for payment of debts

D Assets charged with payment of debts

(Note – "c" or "d" – as a matter of practical reality – these assets go first before "a" "b")

Unless the will specifically provides otherwise, the assets (if any) that are undisposed of are to be applied first, if

exhausted, then assets covered by a residue clause and continuing in the above order.

E pecuniary legacies

F specific legacies

The above order can be varied by specific language: s46(2)

Example - Intestacy

2 children – beneficiaries

Estate:

House worth 1 mil

Cash of 500k

Creditor – liability is 500k

Does not matter what assets – 500k comes off – assets are not set aside for any particular purpose

Note if spouse – spouses legacy will be preserved and protected last – in that situation it's the residue that bears

debts

Example - Intestate

2 children previous marriage

spouse who is not mother of children

1.5 million cash

Creditor – liability is 500k

Liability comes off the top, residue of 1mil – spouses gets roughly 470k + statutory legacy + 1/2 residue

The statutory legacy is not liable to pay creditors, unless the statutory legacy is more than the estate (i.e. only 400k

available, liability is 200k, creditor gets paid first, 200k left in estate and that would go wholly to the spouse as that

is as much of the estate that can be awarded under statute and no residue so kids get nothing)

Example – Will

Must pay in accordance with order above

1 Assets not disposed of by will (intestacy – comes off the top)

From anything that forms part of the estate that falls under partial intestacy

2 Residue

Not assets that are specifically gifted – the leftovers

You do not know what residue is until you have distributed and all creditors paid

3 Assets specifically appropriated for payment of debts

In practice, If a will says I set up fund to pay debts of the estate – the testator has displaced the order in Part 2

Sched 3 by saying this

19

4 Assets charged with payment of debts

Goes against Locke kings act and s145 conveyancing act

(Note – "3" or "4" – as a matter of practical reality – these assets go first before "1" "2")

Unless the will specifically provides otherwise, the assets (if any) that are undisposed of are to be applied first, if

exhausted, then assets covered by a residue clause and continuing in the above order.

5 pecuniary legacies (monetary legacies)

6 specific legacies

Example

1 mil in estate

Partial Intestacy 500k

Creditor 400k

1 – assets undisposed of the will

400k from partial intestacy goes to creditor

100k would be distributed according to rules of partial intestacy

1 million is untouched and the will will act an operate according to its terms

Example

Estate of Louis

• 2 mil in cash

• House at 123 Fake st (subject to mortage of 500k) Property is worth 1 mil

• Ferrari worth 250k

Creditors

• Mortgagee of 123 Fake St

• Other creditors of valid debts – 1 mil

Will

1. I give my property at 123 Fake St to Sam

2. I give 100k to each of Snap Crackle and Pop (general legacies)

3. I give my Ferrari to Jose (specific gift)

4. I give residue of my estate to Linda

According to Locke King's Act, that mortgage will travel with the property – there is no clause that says general

estate or fund to pay mortgage. Samuel has to pay mortgage

General legacies to S C P – not affected

Specific gift to Jose not affected as it is a specific gift

Residue (2 in the order) to Linda is affected to pay creditors – residue will be used to pay creditors – so 700k will be

left for Linda

Residue is used first because there is nothing on partial intestacy in this case

Example

Will of Sultana

• I give my property at 77 smith lane to Michael

• I give 500k to Miguel

• I give 100k to each of my 5 children, apple, banana, pear, orange and grapefruit

• I give residue to my wife Mrs Prune

Assets

• Property at 77 smith lane

• Cash 1.5mil

Debts

• Creditor/s – 1mil – all valid

First, distribute property to Michael as that is a specific gift

Nothing here has fallen on partial intestacy, so the first thing that is used is assets the form part of residue

That means, because there is a creditor of 1 mil and cash of 1.5 – Mrs Prune will get nothing

Then we have 2 general legacies – 500k to M and 100k to each of 5 children (500k to children in total)

These assets are going to abate rateably – they are going to bear equally the burden of what was that 1 million

dollar liability – they have to bear the same proportional share of the debt

M will receive 250k and each of the kids will receive 50k (there is only 500k left in the property – 500/10 parts =

50k each – Miguel had 5 parts so 5 x 50 and kids had 1 part each so 50k each)

20

Example

Will of Sultana

• I give my property at 77 smith lane to Michael

• I give 1 mil to Miguel

• I give 500k to potato

• I give residue to my wife Mrs Prune

Assets

• Property at 77 smith lane

• Cash 1.5mil

Debts

• Creditor/s – 1mil – all valid

We have 500k available

500/3 = to get the value of each part = 166k

2 x 166 to M = 333k

1 x 166 to potato = 166k

Mrs Prune gets nothing

Mrs Prune to get more - ? Some people argue that actually there is no more difference between property and

money – so the property should also rateably abate – So Michael should pay 2/5ths – the issue is unresolved

There is an argument that Michael's property will have to abate rateably too

Example

Will of Sultana

• I give my property at 77 smith lane to Michael

• I give 1 mil to Miguel

• I give 500k to potato

• I give residue to my wife Mrs Prune

• I direct my executor to pay any liabilities and creditors from the proceeds of sale of 77 smith lane, if sale is

necessary, before any liabilities are paid from my general estate

Assets

• Property at 77 smith lane

• Cash 1.5mil

Debts

• Creditor/s – 1mil – all valid

That would displace the order in Sched 2 and Michael would receive proceeds of sale

Locke King's Act

• Special rule referred to as the rule in Locke King's Act, now contained in s145 Conveyancing Act 1919

(NSW) which states that property subject to a charge is primarily liable for the payment of the charge,

unless there is a contrary intention by the deceased (signified by will, deed or other document): s145(1)

• The rule in Locke King's Act is subject to their being a contrary intention (does not need to be in will, can

be in another doc): s145(1)

• The rule will be excluded if there is a direction to pay debts out of a fund which is not residuary: Re Fegan

• A general direction to pay debts from a residuary fund will be insufficient to exclude the rule and the

operation of s145: Re Neeld – UNLESS the direction is specifically mentioned for certain charges, the

exclusion of the rule will then apply to those specifically mentioned: Re Bernstein

• The rule applies to real and personal property and to all types of charges including mortgages, whether

legal or equitable, liens for unpaid purchase money and statutory charges such as unpaid council rates.

• The effect of the rule is that a beneficiary takes property subject to any charge and cannot have the

charge paid from the other assets of the deceased – the charge flows with the property

• The rule can be excluded by the creation of a special fund for the payment of charge and if the fund is

exhausted, the left over part falls back onto the charged property and not on the general estate: Re Fegan

Example: Where mortage passes with property:

• To my son, Ethan (E), I leave my property at 18/205 Eldridge Esplanade, Edgecliff NSW.

• But - 18/205 Eldridge Esplanade, Edgecliff NSW $480,000 (mortgage to ANZ

• $60,000)

• Ethan died in a car accident. Ethan had issue.

21

•

Due to rule Locke King's Act, the Edgecliff property will pass to E's issue with the mortgage, as Edgecliff is

a property with a charge, as there was no contrary intention and no creation of a special fund for the

payment of the charge

Example: Where mortgage does not pass with property

• To my daughter, Felicity I leave my property at 4/6 Fallows Street, Frenchs Forest NSW. I direct that

Felicity is not to bear any mortgage on 4/6 Fallows Street, Frenchs Forest NSW in existence at the date of

my death. Any mortgage is to be paid from ANZ account 262-000 626-000.

• 4/6 Fallows Street, Frenchs Forest NSW $600,000 (mortgage to ANZ $45,000)

• But – the Bank account only has $25,000

• Felicity is married and has issue and a spouse

• The French's forest property will pass free of the mortgage to Felicity as there is a contrary intention

(s145(1) and there is a creation of a special fund (Re Fegan) for the payment of the charge. However, the

special fund (the bank account) will only be able to meet a part of the mortgage ($45,000 - $25,000), and

$20,000 will be left over.

• The $20,000 outstanding mortgage will fall back onto the property or would be paid out of residue (if this

is reasonable to conclude) (Re Fegan). Prima facie "I direct that Felicity is not to bear any mortgage" does

indicate that it paid from residue.

Superannuation Funds – generally excluded and left to the Trustee's discretion

Re Tong: property undisposed of by will is property undisposed of by will regardless of whether it happened on

purpose or by accident

Null and void gift due to interested witness provisions

Perpetual v Walker: Lapsed share of residue (4th) normally failed part of residue goes to Order 1

order of priority displaced by terms of the will so as to remove residue from being calculate at the start

Permanent Trustee v Temple – whole of provisions need to be read to determine whether order is displaced

22

Topic 10, 11 and 12: Jurisdiction of the Probate Court, Estates Pending Grants of

Representation and Grants of Representation

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

Who is responsible for giving effect to what the will says and who has the power to administer estate

A will can name and Executor, but the Executor will not have power to administer the estate until they

have a grant of probate

A similar concept applies with respect of intestate estates, the Court will issue Letters of Grants of

Representation

The grant acts as proof that will is the last will and it conveys authority that the executor has the power

to perform their duties, and administer estate in respect of what the will says

The jurisdiction for the Court to determine probate matters is the SCNSW. "Probate" falls into – in

chambers grants, probate suits, probate undue influence and capacity, will to be admitted as informal

document, whether executor is liable

Matters about will construction and family provision fall under Court's equitable jurisdiction

Probate disputes are heard as part of the Equity division of the SCNSW

Courts functions – issue grants of representation – letters of administration and probate and decide

probate disputes

Conditions precedent for a grant to be made (overlaps with Grants of Representation topic) – whether

the court is in a position to make a grant of representation to any person, will depend on:

1. Deceased must leave property in NSW

2. Death or presumed death

Property in NSW

Property can be a range of things – It can be real property if in NSW, movable property (money in bank

accounts, shares, personal affects)

The will must deal with that property. Eg I have a property in NSW and in my will I say I leave my property

in QLD to Joe. The SCNSW will not have any jurisdiction to make any order or to make any grant of

representation in respect of that will as there is no property in the WILL to be dealt with in NSW.

However – Intestacy – someone could get a grant on the basis that there is property in NSW and that

property is governed by NSW intestacy rules. Usually the person with the biggest entitlement in intestacy

will be entitled to take a grant of representation

o Moveables

o Probate is not a federal jurisdiction – it is a state based jurisdiction

o Property is governed by the estate in which it was located or the state in which the deceased was

domiciled

o The rule is the law that applies to immovable property (real property) is the lex situs (where the

property is located). i.e If the deceased dies in Bermuda, and there is real property in NSW and

he makes a will in Bermuda, it may be possible for NSW to grant probate of the Bermudan will if

it deals with NSW property. The law of NSW is the law that will govern succession of the NSW

asset.

o The law that applies to moveable property (cash etc) is governed by the law of domicile (domicile

as at the date of death). If i have $100k in QLD bank account, but I was domiciled in NSW as at

the date of my death, QLD law will not apply to that money. This applies to moveables

irrespective of where they are located i.e can be overseas

o Eg say no will – intestacy – I have cash in QLD and real property in NSW – domiciled in QLD. The

intestacy rules in QLD will apply to the cash and the intestacy rules in NSW will apply to the

property.

Death or presumed death

Probate and Administration Act

s40A Evidence or presumption of death: (1) Where the Court is satisfied, whether by direct evidence or

on presumption of death, that any person is dead, the Court shall have jurisdiction to grant probate of

the person's will or administration of the person's estate, notwithstanding that it may subsequently

appear that the person was living at the date of the grant.

Statutory source of power is s40A

Direct evidence of death can be proved by providing a death certificate

Estate of Lyn Burtonwood: An application for a grant for presumption of death occurs in all cases where

the body is not found.. even though a certificate of death may have issued

Presumption of death at common law – If a person has not been heard of 7 years that they are

presumed dead

23

•

•

•

•

•

•

•

•

•

•

However Estate of Lyn Burtonwood: even if 7 years has not passed, there will many cases where the Court

can draw an inference of death from surrounding circumstances

s40B Presumption of death

o (1) If a grant of probate or administration is made on presumption of death only, the provisions

of this section shall have effect.

o (2) The grant shall be expressed to be made on presumption of death only.

o (3) The estate shall not be distributed without the leave of the Court.

o Leave may be given subject to conditions

In the event that the deceased turns up alive, the Court may revoke grant on any terms it sees fit

Where deceased owns real property in multiple states

you get a grant of probate in one jurisdiction and then apply in other jurisdictions for a reseal – Reseal will

say Queensland will allow this grant of probate to deal with the property in queensland

In the Goods of Morton – whilst in Carlton appointment of executor was necessary to show nexus with

property, in this case where the will did nothing more than appoint a testamentary guardian, the will can

not be appropriated for want of connection to property, simply by appointing a testamentary guardian.

The difference between this case and Carlton is than an executor is a trustee over property whereas there

is no real property connection with a testamentary guardian

In re Carlton – court found that a will can have operation in respect of property even if it does not dispose

of it. there was will appointing an executor in a particular jurisdiction was enough to find the will dealt

with property

In the Goods of Tamplin – if the will does not deal with property in the jurisdiction, even if there is

property in the jurisdiction, the court is not able to grant probate over it

New York Breweries – a foreign grant is no good in a different jurisdiction than the foreign grant was

made in, unless there is some authority like a reseal

Boyd v Leslie – grant of probate in NSW does not enable executor to file appearance in VIC

Estates Pending a Grant of Administration

• Fred dies, he leaves a will appointing Joe as his executor. The will is valid.

• What happens between the period a person dying and the court making a grant of probate ("lacuna")

• And what rights to beneficiaries and executors have during this period

• s61 Probate and Administration Act (kind of legal fiction)

• When a person dies, until probate or administration is grant, real and other property will vest in the

NSW Trustee

• s61 provides prevention of a lacuna in the chain of title – ensures chain of title continues

• If someone decides to deal with property (disposing of assets, physically taking possession, dealing

with deceased's business) before a grant of probate is made they are referred to as an intermeddler

(didn't have authority or any basis to deal with the estate, they act as though they are executor or

administration)

• Court can find this person to be an Executor de son tort – someone who messes around with estate,

without authority to do so, they can still be bound by what they have done and more importantly

they can be sued

• Not intermeddling – taking steps in times of emergency, advertising probate

• The reality is people do many things before a grant of probate is granted

• Defence – "Plane Administravit" – I am not liable because I dealt with the estate in the way it ought

to have been dealt with

• Carolyn Deigan:

• The Appeal: An executor named in a will rescinding a contract in her capacity as an executor before

she got a grant of probate

o Because she purported to a rescind a contract without a grant of probate, the rescission was

not effective

o White J found she did have authority, not withstanding she did not have a grant of probate

o White J effectively found an executor of a will does have authority to take steps before

probate is granted (contrary to decisions of superior courts)

o Many estates are administered without a grant of probate – i.e using monies to pay for

funeral expenses, transferring monies to executors accounts

o In my view, considering s44 and s61, the executor does have such powers

o S61 is a bare legal title – no active duties and no powers of management or organisation

o By definition the estate is unadministered and the executor will be the beneficial owner of

real and personal estate. A such the executor is entitled to possession of the assets

24

o

•

•

•

•

An executor has authority from the will to collect assets, pay debts and manage the estate.

That authority is only removed to the extent that removal is necessarily implied by s44 and

s61 of pAA

o Ms Deigan's giving notice of rescission was exercise of rights arising under the contract of

sale, not a divestment of the NSW Trustee's titled to the contractual chose in action.

o Ms Deigan did get a grant of probate, so the effect of s44 would have allowed to her to

rescind the contract, even if she did not have authority to rescind the contract at that time

o s44 came back retrospectively to grant her with authority

What White J argued is obiter only. You cannot say that the Court determined an executor can take

steps prior to grant of probate.

The normal position is that no one has authority to deal with an estate after death until they have a

grant of administration, other than if their particular urgent steps. That has been the position under

common law interpretation of s61 and s44 up until the Deigan case. If the obiter of justice white is

correct, being an executor provides far more authority.

If you had a problem question on this you should say – On one view the executor has no authority to

take any step prior to a grant of probate or letters of administration being given, however, the obiter

of White J in matter of Deigan could be argued that the authority to take steps arises from the will

and therefore the executor wont be found not to have had authority to take the particular step, if the

reason of White J is accepted

s44 Upon the grant of probate or administration, all real and personal estate shall be from the date of

death vested in the Executor (retrospective vesting provision)

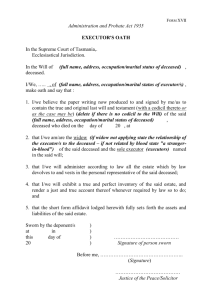

Grants of Representation

• 3 different types of grant

o A grant of probate to named executors (I appoint A and B as my executors and trustees

or I appoint A as my executor but if he is unavailable, I appoint B)

o

A grant of letters of administration on intestacy (the only way anyone has authority to

deal with an intestate estate is through a grant of letters of administration – no

exceptions). Letters usually say person X (person most entitled) has authority to deal

with estate according to rules of intestacy

o

•

•

•

•

•

•

•

•

•

•

•

•

Inbetween – a will that appoints an executor and an alternative executor – but both are

unavailable – court grants letters of administration with the will annexed

Appointments of executor can be subject to conditions – i.e. executors for particular property,

limited to that

Executors can renounce probate – must be before they have taken a grant. It will go to

substitute.

o An executor renounces executorship or dies

o An executor appointed by will can renounce their executorship as long as they have not

done any acts regarding the will

o If this happens, under s63 of the Probate and Administration Act 1898, it is possible for

a grant of representation to be made to someone other than a person named as

executor in the will. This is done with a will being annexed rather than a grant of

probate.

Anyone can act as executor – testator can appoint whoever they want

Court has jurisdiction to refuse grants to particular people – mental incapacity or legal disability

i.e. minor

Jurisdiction to 'pass-over' executors: where executor not appropriate – in jail or inappropriate or

guilty of fraud, conflict of interest

However if testator was aware of conflict of interest and still appointed that is an exception to