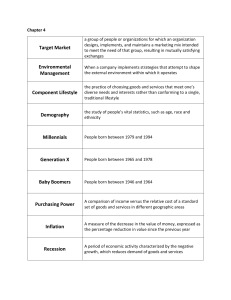

INBU Chapter 1 Notes Learning objectives 1. Define the terms globalization, globalization of markets, and globalization of production. Globalization refers to the shift toward a more integrated and interdependent world economy. Globalization has several different facets, including: • Globalization of Markets • Globalization of Production • Globalization of Consumers Globalization of Markets and Consumers • Refers to the merging of historically distinct and separate national markets into one huge global marketplace. • Falling barriers to cross-border trade have made it easier to sell internationally. • Tastes and preferences of consumers in different nations converge on some global norm, thereby helping to create a global market • Consumer products such as Citicorp credit cards, Apple iPhones, offer a standardized product worldwide, helping create a global market. Globalization of Production • Refers to the sourcing of goods and services from locations around the world to take advantage of national differences in costs and quality of factors of production (labor, energy, land and capital). • Companies lower overall cost structure and/or improve quality or functionality of product offering, thereby allowing them to compete more effectively. 2. Examine the rise and functions of global institutions. • Global institutions help manage, regulate, and police the global marketplace. • Promote the establishment of multinational treaties to govern the global business system. • • • • Including the following organizations: • United Nations (1945) • World Trade Organization (WTO) preceded by the GATT • International Monetary Fund (IMF) • World Bank World Trade Organization (WTO) www.wto.org Responsible for policing the world trading system and making sure nation-states adhere to the rules laid down in trade treaties signed by WTO member states. IMF was to maintain order in the international monetary system Lender of last resort to nation-states whose economies are in turmoil and whose currencies are losing value World Bank was to promote economic development 1 • • • • Provides low interest rate loans to cash-strapped governments that wish to undertake infrastructure investments (building dams or road systems,..). International Monetary Fund The IMF loans come with strings attached: • Countries are required to adopt specific policies aimed at returning their troubled economies to stability and growth. • Some critics charge that the IMF’s policy recommendations are often inappropriate. The World Bank Most often it is the IBRD that is involved in international business opportunities for Canadian companies Canada's Dept. of Foreign Affairs has a section on their website providing an overview of the steps a company must take to be involved with World Bank projects 3. Examine Drivers of Globalization. Two macro factors seem to underlie the trend toward greater globalization: • • • • • • • • • Decline in barriers to the free flow of goods, services, and capital, since the end of World War II Technological change in communication, information processing, and transportation Declining Trade and Investment Barriers Lowering barriers to international trade enables firms to view the world, rather than a single country, as their market. Reducing and eliminating trade and investment barriers allows firms to base production at the optimal location, serving the world market from that location. A firm might design a product in one country, produce component parts in two other countries, assemble the product in yet another country, and then export the finished product around the world. Technological Change Technological change has made globalization of markets and production a tangible reality. Since the end of World War II, the world has seen major advances in: • Communication, • Information processing, • Transportation technology and • Explosive emergence of the Internet and World Wide Web. Technological Change Microprocessors and Telecommunications Development of the microprocessor enabled the explosive growth of high-power, lowcost computing, vastly increasing the amount of information that can be processed. Satellite, Optical fiber, wireless and Internet technologies rely on microprocessor to encode, transmit, and decode the vast amount of information that flows along these electronic highways. Technological Change 2 • • • Internet In 1990, fewer than 1 million users were connected to the Internet. By 2019, approximately 4 billion Internet users. The Web makes it much easier for buyers and sellers to find each other, wherever they may be located and whatever their size. It enables enterprises to coordinate and control a globally dispersed production system in a way that was not possible 25 years ago Transportation Change Super freighters and jets and trains. 4. Illustrate the changing demographics of the global economy. Country USA Share World Output, 1960 (%) Share World Output 2018 (%) Share World Exports, 2018 (%) 38.3% 24.4% 8.6% Germany 8.7 4.6 8 France 4.6 3.3 3 Italy 3.0 2.4 2.8 United Kingdom 5.3 3.3 2.5 Canada 3.0 2.1 2.3 Japan 3.3 6.1 3.8 China NA 15.4 12.8 3 Country—Exports Year US$ (millions) United States 2018 319,067 China 2018 18,187 United Kingdom 2018 13,636 Japan 2018 9,118 Mexico 2018 6,052 South Korea 2018 4,089 United States 2018 221,967 China 2018 54,661 Mexico 2018 27,352 Germany 2018 13,826 Japan 2018 13,503 United Kingdom 2018 6,852 Country—Imports Changes in Foreign Direct Investment (FDI) Among developing nations, the largest recipient of FDI has been China (received between 2004 and 2012 between $60B to $100B a year, followed by Brazil, Mexico, and India. Sustained flow of FDI into developing nations is an important stimulus for economic growth in these countries The Changing Nature of the Multinational Enterprise • A multinational enterprise (MNE) is any business that has productive activities in two or more countries. • Since the 1960s, there have been two notable trends in the demographics of the multinational enterprise: • The rise of non-U.S. multinationals, particularly Japanese multinationals, and • The growth of mini multinationals. Non-U.S. multinationals • The large number of U.S. multinationals reflected U.S. economic dominance in the three decades after World War II while, • The large number of British multinationals reflected that country’s industrial dominance in the early decades of the twentieth century Non-U.S. multinationals 4 • Globalization of the world economy and Japan’s rise to the top rank of economic powers has resulted in a relative decline in the dominance of U.S. and British firms in the global marketplace • If we look at smaller firms, we see significant growth in the number of multinationals from developing economies. The Rise of Mini-Multinationals • Most Int’l trade and investment still conducted by large firms but, • Many medium-sized and small businesses are becoming increasingly involved in international trade and investment. Example: • International Road Dynamics (IRD) of Saskatchewan has subsidiaries in the United States, Chile, China, Belgium. • Iceculture Inc., based in Ontario with a staff of 15 export to Britain, Europe, South Africa, Iceland, etc. The Changing World Order • • • • • • • • The Changing World Order The economies of most of the former communist states are in very poor condition, and their continued commitment to democracy and free market economics cannot be taken for granted. More quiet revolutions have been occurring in India, China, and Latin America. • Their implications for international businesses may be just as profound as the collapse of communism in Eastern Europe. China continues to move progressively toward greater free market reforms. If what is occurring in China continues for two more decades, China may move from developing economy to industrial superpower status even more rapidly than Japan did. Throughout most of Latin America debt and inflation are down. Governments are selling state-owned enterprises to private investors. FDI is welcomed and the region’s economies are growing; These changes have increased the attractiveness of Latin America, both as a market for exports and as a site for FDI. 5 5. Globalization debate: Impact of globalization on job security, income levels, labor and environmental policies, and national sovereignty. Is the shift toward a more integrated and interdependent global economy a good thing? Anti-globalization arguments: • Harmful effects on jobs and income • Labor policies • Environmental impact • National sovereignty • Worlds poor Globalization, Jobs, and Income • Outsourcing of Canadian jobs to developing countries: fears of a long-term harmful effects on Canadas’s well-being. (Example Gildan Activewear Inc. Montreal). • Technological change has had a bigger impact than globalization on the declining share of national income enjoyed by labor. • The solution is not in limiting free trade and globalization, but in increasing society’s investment in education to reduce the supply of unskilled workers Globalization, Labour Policies • A second source of concern is less developed countries lack adequate regulations to protect labour and the environment from abuse by the unscrupulous. • Globalization critics often argue that adhering to labour and environmental regulations significantly increases the costs of manufacturing enterprises and puts them at a competitive disadvantage in the global marketplace Globalization and National Sovereignty • Another concern is increasingly interdependent global economy shifts economic power away from national governments toward organizations such as WTO, EU and UN. • The WTO is a favourite target of those who attack the headlong rush toward a global economy Globalization and the World’s Poor • Critics of globalization argue that despite the supposed benefits associated with free trade and investment, the gap between the rich and poor is widening. • While some of the worlds poorer nations are capable of rapid periods of economic, there is stagnation among the world’s poorest nations economies. 6. Understand opportunities and challenges that business managers must confront in Canada and beyond. The task of managing an international business • Differences between countries require that an international business vary its practices country by country. 6 • Cross-border transactions also require that money be converted from the firm’s home currency into a foreign currency and vice versa. 7. Understand how establishing and committing to a global supply chain code of conduct can result in sustainable international operations. ADIDAS GROUP: APPROACH to SUSTAINABILITY and SUPPLY-CHAIN MANAGEMENT APPROACH to LABOUR STANDARDS What has been the result and benefit to Adidas Group? • • • • • Chapter 2 Notes Learning Objectives 1. Examples of how the political systems of countries differ. Collectivism • Political system that stresses the primacy of collective goals over individuals’ goals. Plato (427-347 BC) - Individual rights should be sacrificed for the good of society. Socialism 1. Communism – revolution and totalitarian dictatorships 2. Social Democrats – socialism by democratic means Individualism Political system that focuses on the interests of the individual over the interests of the state. Aristotle (384 – 322 BC) – Private property is more highly productive than communal property and will thus stimulate progress Individualism has two central tenets: 1. Individual Freedom and self-expression – John Stuart Mill 2. Let people pursue their own economic self-interest – Adam Smith Democracy Political system in which the people elect representatives to form the government. Democracy demands: 1. Freedom of expression 2. Free media 3. Regular elections 4. Limited terms for representatives 5. Fair court system 6. Nonpolitical – police and army Totalitarianism All the constitutional guarantees on which representative democracies are built—such as an individual’s right to freedom of expression and organization, a free media, and regular elections—are denied to the citizens. 7 • • • • • • In most totalitarian states, political repression is widespread and those who question the right of the rulers to rule find themselves imprisoned or worse. Totalitarianism There are four major forms of totalitarianism: • Communist totalitarianism • Theocratic totalitarianism • Tribal totalitarianism • Right-wing totalitarianism 2. Distinguish how the economic systems of countries differ. Market Economy All productive activities are privately owned. Supply and demand determine price and production Command Economy The government determines the allocation of resources including the determination of production and prices Mixed Economy Some sectors are left to private ownership and free market mechanism. Others have significant government ownership and government planning. 3. Explain how the legal systems of countries differ and how corruption affects economic development. Legal systems refer to a system of rules that regulates behavior and the processes by which the laws of a country are enforced and through which redress of grievances is obtained. Different Legal Systems Common Law System of law based on tradition, precedent, and custom. When law courts interpret common law, they do so with regard to these characteristics. Civil Law Law based on a very detailed set of written laws and codes. Theocratic Law System of law based on religious teachings. Different in Contract Law Definition of Contract • Contract is a document that specifies the conditions under which an exchange is to occur and details the rights and obligations of the parties involved. Contract Law • Contract law is the body of law that governs contract creation and enforcement • Parties to an agreement invoke contract law when there is belief there was violation of the agreement International Trade and Contract Disputes • United Nations Convention of Contacts for the International Sale of Goods (CISG); 8 • • • • • • • • • By adopting the CISG, a nation accepts to treat the convention rules as part of its law. CISG applies automatically to all contracts for the sale of goods between different firms based in countries that have ratified the convention, unless the parties to the contract explicitly opt out Property Refers to a resource over which an individual or business holds a legal title, meaning it owns the resource. Resources include: • Land & real estate; Equipment; Capital • Mineral rights; Businesses; Intellectual property (patents, copyrights and trademarks) Property rights Bundle of legal rights over the use to which a resource is put and over the use made of any income that may be derived from that resource. • Essentially, “people own stuff and can use it” Private Action Private Action is an action by private individuals or groups against property holders including actions such as: • Theft • Piracy • Blackmail • Any criminal activity against property rights Public Action and Corruption Public Action violates property rights when public officials extort income from property holders, including actions such as: Bribes Levying excessive taxation Requiring expensive licenses or permits from property holders or taking assets into state ownership without compensating the owners 9 • • • • • • • Public Action and Corruption Canada’s Bill S-21 Otherwise known as the Corruption of Foreign Public Officials Act that entered into force in1999 It has long been illegal to bribe officials in Canada Now it is illegal for Canadian officials to bribe officials in another country • Does have “loophole” provisions to cover for those instances in which a bribe might be solely a perception, due to cultural considerations of gift giving, in other countries • Sets out a lawful exception that an accused could use as a defence. Namely, that the payment was lawful in the foreign state or public international organization for which the foreign public official performs duties or functions The Protection of Intellectual Property Intellectual Property refers to property that is the product of intellectual activity such as computer software, music, formulas etc. Ownership rights are established through: 1. Patents 2. Copyrights 3. Trademarks • Paris Convention for the Protection of Industrial Property: International agreement signed by 96 nations to protect intellectual property Trade Related Aspects of Intellectual Property Rights (TRIPS) Agreement (1995) Agreement amongst member states of the World Trade Organization (WTO) to oversee the enforcement of stricter intellectual property regulations. Product Safety and Product Liability Product Safety Laws set safety standards to which products must adhere, where it is going to be commercialized. 10 • • • • • • • • • Product Liability involves holding a firm and its officers responsible when a product causes injury, death, or damage 4. Determinants the level of economic development of a nation. The political, economic, and legal systems can have a profound impact on a country’s economic development. a. Gross National Income (GNI) i. Total income of all citizens of a country. b. Purchasing Power Parity (PPP) i. Adjustment in gross domestic product per capita for a comparison of living standards in different countries. Slide 27, 28 tables Human Development Index (HDI) Human Development Index (HDI) measures the quality of human life in different countries The Nobel prize-winning economist Amartya Sen has argued that development should be assessed less by material output measures, such as GNP per capita, and more by the capabilities and opportunities that people enjoy. Measures quality of human life in different countries in terms of: 1. Life expectancy at birth (which is a function of health care) 2. Education attainment (which is measured by a combination of the adult literacy rate and enrolment in primary, secondary, and tertiary education), 3. Average incomes, based on PPP estimates, are sufficient to meet the basic needs of life in a country (adequate food, shelter, and health care). Innovation and Entrepreneurship: The engines of growth Innovation and entrepreneurial activity are the engines of long-run economic growth. Innovation definition broadly to include not just new products, but also new processes, new organizations, new management practices, and new strategies. Innovation and Entrepreneurship require a Market Economy Economic freedom associated with a market economy creates greater incentives for innovation and entrepreneurship than either a planned or a mixed economy. In a planned economy, the state owns all means of production: Entrepreneurial individuals have little economic incentive to develop valuable new innovations, since it is the state, rather than the individual, that captures most of the gains Innovation and Entrepreneurship require strong property rights: Both individuals and businesses must be given the opportunity to profit from innovative ideas Without strong property rights protection, businesses and individuals run the risk that the profits from their innovative efforts will be expropriated, either by criminal elements or by the state The Required Political System There is a great deal of debate as to the kind of political system that best achieves a functioning market economy with strong protection for property rights. 11 • Four of the fastest-growing economies of the past 30 years—South Korea, Taiwan, Singapore, and Hong Kong—had one thing in common at the start of their economic growth: undemocratic governments. Economic Progress Begets Democracy • While it is possible to argue that democracy is not a necessary precondition for a free market economy in which property rights are protected, subsequent economic growth often leads to establishment of a democratic regime. • Several of the fastest-growing Asian economies adopted more democratic governments during the past two decades, including South Korea and Taiwan. • Geography, Education, and Economic Development • While a country’s political and economic system is probably the big locomotive driving its rate of economic development, other factors are also important: • Geography Harvard’s Jeff Sachs: by virtue of favorable geography, certain societies were more likely to engage in trade than others and were thus more likely to be open to and to develop marketbased economic systems The general assertion is that nations that invest more in education will have higher growth rates because an educated population is a more productive population. 5. Summarize the main changes that are currently reshaping political, economic, and legal systems worldwide. The political economy of many of the world’s nation-states has changed radically since the late 1980s. Two trends have been evident. 1. During the late 1980s and early 1990s, a wave of democratic revolutions swept the world. Totalitarian governments collapsed and were replaced by democratically elected governments 2. There has been a strong move away from centrally planned and mixed economies and toward a freer market economic model. The New Order? The end of the Cold War and the “new world order” that followed the collapse of communism in Eastern Europe and the former Soviet Union, taken together with the collapse of many authoritarian regimes in Latin America, have given rise to intense speculation about the future shape of global geopolitics: • Author Francis Fukuyama has argued that “we may be witnessing . . . the end of history as such: that is, the end point of mankind’s ideological evolution and the universalization of Western liberal democracy as the final form of human government • Huntington theorizes that modernization in non-Western societies can result in a retreat toward the traditional, such as the resurgence of Islam in many traditionally Muslim societies: 12 • • • The Islamic resurgence is both a product of and an effort to come to grips with modernization In contrast to Fukuyama, Huntington sees a world that is split into different civilizations, each of which has its own value systems and ideology The Spread of Market-Based Systems In general, command and mixed economies failed to deliver the kind of sustained economic performance achieved by countries adopting market-based systems, such as the United States, Switzerland, Hong Kong, and Taiwan. 6. Describe how transition economies are moving toward market-based systems. Deregulation Deregulation involves removing legal restrictions to the free play of markets, to the establishment of private enterprises, and to the manner in which private enterprises operate Privatization Transfers the ownership of state property into the hands of private individuals, frequently by the sale of state assets through an auction. Legal Systems Without a legal system that protects property rights, and without the machinery to enforce that system, the incentive to engage in economic activity can be reduced substantially by private and public entities, including organized crime, that expropriate the profits generated by the efforts of private-sector entrepreneurs • • • • 7. Explain the implications of changes in political economies. In practice, the road that must be travelled to reach a market-based economic system has often been rocky. This has been particularly true for the states of Eastern Europe in the post-communist era. In this region, the move toward greater political and economic freedom has sometimes been accompanied by economic and political chaos Implications for business The implications for business are enormous. For the best part of 50 years, half of the world was off-limits to Western businesses. Now all that is changing. Many of the national markets of Eastern Europe, Latin America, Africa, and Asia may still be undeveloped and impoverished, but they are potentially enormous. Attractiveness Benefits In the most general sense, the long-run monetary benefits of doing business in a country are a function of: • the size of the market, • the present wealth (purchasing power) of consumers in that market, • and the likely future wealth of consumers 13 • • • • • • First-mover advantages are the advantages that accrue to early entrants into a market. Late-mover disadvantages are the handicap that late entrants might suffer Costs • A number of political, economic, and legal factors determine the costs of doing business in a country. • With regard to political factors, the costs of doing business in a country can be increased by a need to pay off the politically powerful to be allowed by the government to do business. • One of the most important variables is the sophistication of a country’s economy. • It may be more costly to do business in relatively primitive or undeveloped economies because of the lack of infrastructure and supporting businesses. Risks Risks of doing business in a country are determined by a number of: • political, • economic, • and legal factors. • Political risk has been defined as the likelihood that political forces will cause drastic changes in a country’s business environment that adversely affect the profit and other goals of a particular business enterprise. • Economic risk can be defined as the likelihood that economic mismanagement will cause drastic changes in a country’s business environment that adversely affect the profit and other goals of a particular business enterprise • Legal risk might be defined as the likelihood that a trading partner will opportunistically break a contract or expropriate property rights • The overall attractiveness of a country as a potential market and/or investment site for an international business depends on balancing the benefits, costs, and risks associated with doing business in that country. Overall attractiveness The overall attractiveness of a country as a potential market and/or investment site for an international business depends on balancing the benefits, costs, and risks associated with doing business in that country Implications for business Ethics and Regulations Ethics and Human rights One major ethical dilemma facing firms from democratic nations is whether they should do business in totalitarian countries, such as China, that routinely violate the human rights of their citizens. Some argue that investing in totalitarian countries provides comfort to dictators and can help prop up repressive regimes that abuse basic human rights Ethics and Regulations 14 • A second important ethical issue is whether an international firm should adhere to the same standards of product safety, work safety, and environmental protection that are required in its home country This is of particular concern to many firms based in Western nations, where product safety, worker safety, and environmental protection laws are among the toughest in the world Ethics and Corruption A final ethical issue concerns bribes and corruption Should an international business pay bribes to corrupt government officials to gain market access to a foreign country? To most Westerners, bribery seems to be a corrupt and morally repugnant way of doing business, so the answer might initially be no. Chapter 3 Notes Learning Objectives 1. Explain what is meant by the culture of a society. Follow both Hofstede, and Namenwirth and Weber a culture is seen as a system of values and norms that are shared among a group of people, and that when taken together constitute a design for living Values and Norms Values form the bedrock of a culture. • They provide the context within which a society’s norms are established and justified. Norms are the social rules that govern people’s actions toward one another. • Norms can be subdivided further into two major categories: folkways and mores. Culture, Society, and the Nation-State • There is not a strict one-to-one correspondence between a society and a nation-state • Nation-states are political creations. They may contain a single culture or several cultures: • France is embodiment of French culture • Canada has at least 3 cultures—an Anglo culture, a French-speaking “Quebecois ” culture, and Indigenous culture (encompasses hundreds of different cultures) 2. Identify the forces that lead to differences in social culture and explain the business and economic implications of differences in culture. 15 Social Culture Individual and Groups Group • Definition: Group is the association of two or more individuals who have a shared sense of identity and who interact with each other in structured ways on the basis of a common set of expectations about each other’s behavior. • Example: One central value of some Asian cultures is the importance attached to group membership. Individual • Definition: In Western societies, the individual is the basic building block of social organization. • Example: In the United States and Canada the emphasis on individual performance finds expression in an admiration of “rugged individualism” and entrepreneurship. Social Stratification Social Strata: Hierarchical social categories often based on family background, occupation, and income. • Defined on the basis of characteristics such as family background, occupation, and income. Individuals are born into a particular stratum. Social Mobility Social mobility refers to the extent to which individuals can move out of the strata which they are born Caste System is a closed system of stratification in which social position is determined by the family into which a person is born, and change in that position is usually not possible. 16 Religious and Ethical Systems Religion is defined as a system of shared beliefs and rituals that are concerned with the realm of the sacred Ethical Systems refer toa. Set of moral principles, or values, that are used to guide and shape behaviour. 17 Language Spoken Language • Language does far more than just enable people to communicate with each other. • The nature of language also structures the way we perceive the world. it also helps define culture. • In countries with more than one language, one also often finds more than one culture. Language Unspoken Language • Unspoken language refers to nonverbal communication. • Many nonverbal cues, however, are culturally bound. • A failure to understand the nonverbal cues of another culture can lead to a failure of communication Education • From an international business perspective, one important aspect of education is its role as a determinant of national competitive advantage • The availability of skilled and educated workers seems to be a major determinant of the likely economic success of a country 3. Recognize how differences in social culture influence values in the workplace. How a society’s culture affects the values found in the workplace is of considerable importance to an international business with operations in different countries. Hofstede isolated five dimensions that he claimed summarized different cultures: Power distance Individualism versus Collectivism Uncertainty avoidance Masculinity versus femininity 18 Long-term versus short-term orientation Power distance Focused on how a society deals with the fact that people are unequal in physical and intellectual capabilities Individualism versus Collectivism Focused on the relationship between the individual and his or her fellows. Uncertainty avoidance measured the extent to which different cultures socialized their members into accepting ambiguous situations and tolerating uncertainty Masculinity versus femininity In masculine cultures, sex roles were sharply differentiated and traditional “masculine value” such as achievement and the effective exercise of power, determined cultural ideals. Long-term versus short-term orientation Deals with virtue regardless of truth. Values associated with long-term orientation are thrift and perseverance; values associated with short-term orientation are respect for tradition, fulfilling social obligations, and protecting one’s “face Slide 23 Table 4. Demonstrate an appreciation for the economic and business implications of cultural change. Culture is not a constant; it evolves over time. Several studies have suggested that economics may be an important factor in societal change. The cultures of societies may also change as they become richer because economic progress affects several other factors, which in turn influence culture. Cross-Cultural Literacy • Doing business in different cultures requires adaptation to conform with the value systems and norms of that culture. • Adaptation embraces all aspects of an international firm’s operations in a foreign country, including: • The way deals are negotiated • The appropriate incentive and pay systems for salespeople • Adaptation embraces all aspects of an international firm’s operations in a foreign country, including: • The structure of the organization • The name of a product • The tenor of relations between management and the workforce • The way the product is promoted Cultural and Competitive Advantage • The value systems and norms of a country influence the costs of doing business • Attitudes toward cooperation between management and labor, toward work, and toward the payment of interest are influenced by social structure and religion. 19 • The connection between culture and competitive advantage has important implications for the choice of countries in which to locate production facilities and do business Cultural and Business Ethics • Although many ethical principles are universal, some are culturally bound • When faced with conflicting ethical principles, international businesses may be confronted with difficult dilemmas. Cultural and Business Ethics • For example, guanxi networks are often supported by the idea of reciprocal gift giving. • One response to such a dilemma is to argue that because customs vary from country to country, businesses should adopt the customs (and by extension, ethical practices) of the country in which they are currently doing business. Chapter 4 Notes Learning Objectives 1. Explain the source and nature of ethical issues and dilemmas in international business. The circumstances that affect ethical considerations • Political environment (regional, national, and international), and the consequent laws and regulations • Social-cultural environment, which has been influenced by immigration worldwide, and a continued movement of populations from rural to urban areas. • Technological environment, which has affected communications regionally and globally and has also affected the work environment and productivity. • Economic environment, which sees currency fluctuations and international organizations like the IMF and World Bank playing a more significant role in national and regional economies. • The need for corporations to remain economically competitive influences corporate objectives and has consequences for consumer priorities. • The competitive environment which is causing companies to make decisions in a global context, resulting in actions that affect their employees or customers 2. Show how important it is for managers to consider ethical issues when making strategic and operating decisions. Ethics in the Changing Political Environment Corruption • International businesses can still gain economic advantages by making payments to corrupt officials. • Convention on Combating Bribery of Foreign Public Officials in International Business Transactions • The convention obliges member states to make the bribery of foreign public officials a criminal offence. Perceptions of corrupt politicians in Canada • Corruption in government and businesses in Quebec and federal government money from taxpayers • Toronto Mayor Rob Ford scandal 20 • • • • • • • • • • • • • • • Political scandals based on unethical dealings that are played out daily in the international news raise concerns of international businesspeople dealing with Canada. Ethics in the Changing Political Environment Human Rights In 2011 and 2012, Canada was caught up in human rights issues through its participation in a coalition of countries operating in Afghanistan Ethics in the Changing Sociocultural Environment What is considered normal practice in one culture may be considered unethical in others. Examples of these “ranges” of ethical/unethical behavior may include things such as: • how gift giving might be considered bribery. • how you interact with law enforcement officers. • whether companies only concern themselves with obeying precise regulations Ethics in the Changing Technological Environment Developments and applications of sophisticated technology can create ethical nightmares reaching far across the globe and touching many governments and organizations. Fake news” is information sourced from opinion sites. Stories lack research and, therefore, journalistic integrity The growing popularity of social media has affected how employees connect with one another and the world. Ethics in the Changing Economic Environment The economic environment sees currency fluctuations and international NGOs playing a more significant role in national and regional economies Panama Papers scandal and wealthy Canadians Ethics in the Changing Competitive Environment Employment practices Competitive environment increases in intensity, and continued advances in the technological environment conspire to challenge companies to increase employee productivity. how whistle-blowers are treated. Canadian Amazon Web Services VP case. Outsourcing When outsourced firms provide products and services at a lower cost, one of the most obvious considerations is discovering how the provider of the outsourced activity is “doing it cheaper.” • Are they using cheaper materials than what you would have used? • Do they get away with bypassing pollution and environmental considerations? Environmental Pollution Ethical issues arise when environmental regulations in host nations are far inferior to those in the home nation. Should a multinational feel free to pollute in a developing nation? (To do so hardly seems ethical.) Is there a danger that amoral management might move production to a developing nation precisely because costly pollution controls are not required? 21 • • • • • A Corporate Right to Pollute? some parts of the environment are a public good that no one owns, but anyone can despoil. No one owns the atmosphere or the oceans, but polluting both, no matter where the pollution originates, harms all The tragedy of the commons occurs when a resource held in common by all, but owned by no one, is overused by individuals, resulting in its degradation. Managers must confront very real ethical dilemmas There are situations in which none of the available alternatives seems ethically acceptable Ethical dilemmas exist because many real-world decisions are complex, difficult to frame, and involve first-, second-, and third-order consequences that are hard to quantify 3. Identify the causes of poor ethical decision making in international business organizations. Determinants of Ethical Behaviour Business ethics are not divorced from personal ethics, which are the generally accepted principles of right and wrong governing the conduct of individuals An individual with a strong sense of personal ethics is less likely to behave in an unethical manner in a business setting 4. Explain why the Internet and social media are having such a large influence on ethics. Why Does the Internet Have Such a Big Influence on Ethics? • The answer is magnitude. A large amount of content can be created on a large scale in a short period of time. • Web content is being created in larger volumes because there are more devices being used by more people. 22 • • • • • The global population continues to increase, and most of the increase is in urban areas with high-speed Internet connectivity. Quantity Variety Speed Impact 5. Discuss the steps that managers can take to promote an awareness of ethical issues throughout the organization and to make sure that ethical considerations enter into strategic and operational decisions. For many of the most vexing ethical problems arise because there are very real dilemmas inherent in them and no obvious correct action. Managers can and should do many things to make sure that basic ethical principles are adhered to and that ethical issues are routinely inserted into international business decisions. Five things international business and its managers can do to make sure ethical issues are considered in business decisions: 1. Favor hiring and promoting people with a well-grounded sense of personal ethics. 2. Build an organizational culture that places a high value on ethical behavior. 3. Make sure that leaders within the business not only articulate the rhetoric of ethical behavior, but also act in a manner that is consistent with that rhetoric. 4. Put decision-making processes in place that require people to consider the ethical dimension of business decisions. 5. Develop moral courage. Ethical Decisions and Approaches to Corporate Social Responsibility Corporate social responsibility refers to the idea that businesspeople should consider the social consequences of economic actions when making business decisions, and that there should be a presumption in favor of decisions that have both good economic and social consequences. CSR Moral Obligations • Multinational corporations have power that comes from their control over resources and their ability to move production from country to country. • Some moral philosophers argue that with power comes the social responsibility for multinationals to give something back to the societies that enable them to prosper and grow • Businesses, particularly large successful businesses, need to recognize their noblesse oblige and give something back to the societies that have made their success possible • Noblesse oblige is a French term that refers to honorable and benevolent behavior considered the responsibility of people of high (noble) birth Four common terms used to describe corporates CSR behavior: 1. Obstructionist stance: Companies taking this stance create barriers that make it difficult for customers to address their concerns. 2. Defensive stance: Companies taking this stance deny responsibility for the cause of concern. 23 3. Accommodative stance: In taking this stance, a company exceeds its customers’ expectations. 4. Proactive stance: In taking this stance, companies respond to issues as soon as they arise and inform their customers of how they will be proceeding. Chapter 5 Notes Learning Objectives 1. Explain why nations trade with each other. Mercantilism advocated that should simultaneously encourage exports and discourage imports Adam Smith’s theory of absolute advantage. • Proposed in 1776, Smith’s theory was the first to explain why unrestricted free trade is beneficial to a country. • Free trade refers to a situation where a government does not attempt to influence what its citizens can buy and sell Building on Smith’s work are additional theories • One is the theory of comparative advantage, by David Ricardo • Ricardo’s work was refined by Eli Heckscher and Bertil Ohlin, whose theory is known as the Heckscher–Ohlin theory • The great strength of the theories of Smith, Ricardo, and Heckscher– Ohlin is that they identify with precision the specific benefits of international trade • Benefits of Trade • The gains of trade arise because international trade allows a country to specialize in the manufacture and export of products that can be produced most efficiently in that country, while importing products that can be produced more efficiently in other countries. • The theories of Smith, Ricardo, and Heckscher–Ohlin show why it is beneficial for a country to engage in international trade even for products it can produce for itself. • Many Canadians believe that to help save Canadian jobs from foreign competition, Canadian consumers should buy products produced in Canada, by Canadian companies, whenever possible. The Pattern of International Trade The theories of Smith, Ricardo, and Heckscher–Ohlin also help to explain the pattern of international trade that we observe in the world economy. • Some aspects of the pattern are easy to understand. • Climate and natural-resource endowments explain why • Ghana exports cocoa, • Brazil exports coffee, • Saudi Arabia exports oil, • and China exports ginseng. • Some aspects of the pattern are difficult to understand, leading to the New Trade Theory: 24 • • • • New Trade Theory stresses that, in some cases, countries specialize in the production and export of particular products not because of underlying differences in factor endowments, but because in certain industries the world market can support only a limited number of firms. National competitive advantage Theory put forward by Michael Porter that attempts to explain why particular nations achieve international success in particular industries. In addition to factor endowments, Porter points out the importance of country factors such as domestic demand and domestic rivalry in explaining a nation’s dominance in the production and export of particular products. Trade Theory and Government Policy All these theories agree that international trade is beneficial to a country, but they lack agreement in their recommendations for government policy. • Mercantilism: Government involvement in promoting exports and limiting imports. • The theories of Smith, Ricardo, and Heckscher–Ohlin form part of the case for unrestricted free trade. • New trade theory and Porter’s theory of national competitive advantage: Some limited government intervention to support the development of certain exportoriented industries. 2. Distinguish theories that explain trade flows between nations Mercantilism • Mercantilism is an economic philosophy advocating that countries should simultaneously encourage exports and discourage imports. • The flaw with mercantilism was that it viewed trade as a zero-sum game. • Absolute Advantage • A country has an Absolute Advantage in the production of a product when it is more efficient than any other country in producing it. Slide 15 and 16 Comparative Advantage Theory that countries should specialize in the production of goods and services they can produce most efficiently. Absolute advantage refers to the ability to produce more or better goods and services than somebody else. Comparative advantage refers to the ability to produce goods and services at a lower opportunity cost, not necessarily at a greater volume or quality. 3. Unrestricted (free) trade between nations will raise the economic welfare of all participant countries Heckscher-Ohlin Theory • Predicts that countries will export those goods that make intensive use of factors that are locally abundant, while importing goods that make intensive use of factors that are locally scarce. 25 • • • • • • • Like Ricardo’s theory, the Heckscher– Ohlin theory argues that free trade is beneficial. The Product Life-Cycle Theory Raymond Vernon’s theory went on to argue that early in the life cycle of a typical new product, while demand is starting to grow rapidly in the United States, demand in other advanced countries is limited to high-income groups. Vernon’s argument that most new products are developed and introduced in the United States seems ethnocentric New Trade Theory Began to emerge in the 1970s when several economists were arguing that increasing returns to specialization might exist in some industries. Economies of scale: • Represent one particularly important source of increasing returns. • Economies of scale are unit cost reductions associated with a large scale of output. Increasing Product Variety and Reducing Costs Consequences of a small national market. What happens when national markets are combined into a larger world market 4. Government can play a proactive role in promoting national competitive advantage in certain industries. Michael Porter’s Theory (The Competitive Advantage of Nations, 1990) determines that four broad attributes of a nation shape the environment in which local firms compete, and these attributes promote or impede the creation of competitive advantage. 1. Demand conditions 2. Relating and supporting industries 3. Factor endowments 4. Firm strategy, structure, and rivalry 26 5. Demonstrate the important implications that international trade theory holds for business practice. 1. Location Implications 2. First-mover Implications 3. Policy Implications Location Implications. • different countries have particular advantages in different productive activities it makes sense for a firm to disperse its productive activities to those countries where, according to the theory of international trade, they can be performed most efficiently First-mover Implications • Firms that establish a first-mover advantage with regard to the production of a particular new product may subsequently dominate global trade in that product • It pays to invest substantial financial resources in trying to build a first-mover, or earlymover, advantage, even if that means several years of substantial losses before a new venture becomes profitable Policy Implications • The theories of international trade also matter to international businesses because firms are major players on the international trade scene. • Because of their pivotal role in international trade, businesses can influence government trade policy, lobbying to promote free trade or trade restrictions 27 Chapter 6 Notes Learning Objectives 1. Identify the policy instruments used by governments to influence international trade flows. Trade policy uses seven main instruments: • tariffs, • subsidies, • import quotas, • voluntary export restraints, • local content requirements, • administrative policies and • anti-dumping duties Tariffs • Ad valorem tariffs • Are levied as a proportion of the value of the imported good. • Specific tariffs • Are levied as a fixed charge for each unit of a good imported (for example, $3 per barrel of oil) Subsidies • A government payment to a domestic producer. • Can take many forms including • cash grants, • low-interest loans, • tax breaks, and government equity participation. • By lowering production costs, subsidies help domestic producers in two ways: • they help them compete against foreign imports, • and they help them gain export markets. Import quotas and voluntary export restraints • A direct restriction on the quantity of some good that may be imported into a country. • The restriction is usually enforced by issuing import licences to a group of individuals or firms. • For example, the United States has a quota on cheese imports. • The only firms allowed to import cheese are certain trading companies 28 • • • • • • Export Tariffs and Bans An export tariff is a tax placed on the export of a good. The goal behind an export tariff is to discriminate against exporting to ensure there is sufficient supply of a good within a country An export ban is a policy that partially or entirely restricts the export of a good. One well-known example was the ban on exports of U.S. crude oil production that was enacted by the U.S. Congress in 1975. Local content requirements Demands that some specific fraction of a good be produced domestically. The requirement can be expressed either in physical terms, • (e.g., 75 percent of component parts for this product must be produced locally) • or in value terms • (e.g., 75 percent of the value of this product must be produced locally). Buy America Act, specifies that government agencies must give preference to American products when putting contracts for equipment Administrative policies Bureaucratic rules designed to make it difficult for imports to enter a country. Japanese are the masters of this trade barrier. In recent decades, Japan’s formal tariff and nontariff barriers have been among the lowest in the world However, critics charge that the country’s informal administrative barriers to imports more than compensate for this. For example, Japan’s car market has been hard for foreigners to crack. Antidumping policies 29 • • • Dumping is selling goods in a foreign market at below their costs of production, or as selling goods in a foreign market at below their “fair” market value. Antidumping duties (often called countervailing duties) If a domestic producer believes that a foreign firm is dumping production in the local market, it can file a petition In Canada, companies can complain to the Canada Border Services Agency (CBSA) 2. Understand why governments sometimes intervene in international trade. Political Arguments for Intervention 1. Protecting jobs and industries 2. National security 3. Retaliation 4. Protecting consumers 5. Furthering foreign policy objectives 6. Protecting human rights Protecting jobs and industries • The most common political argument for government intervention is that it is necessary for protecting jobs and industries from unfair foreign competition. • Competition is viewed as unfair when producers in exporting country are subsidized in some way by their government • in Canada particularly, protect cultural industries from foreign competition Protecting national security • Countries argue that it is necessary to protect certain industries because they are important for national security. • Defense-related industries get this kind of attention (e.g., aerospace, advanced electronics, and semiconductors) • Trump Adm. announced tariffs on imports of foreign steel and aluminum in March 2018 citing national security issues Retaliation • The U.S. government has used the threat of punitive trade sanctions to try to get the Chinese government to enforce its intellectual property laws • If it works, such a politically motivated rationale for government intervention may liberalize trade and bring with it resulting economic gains Protecting consumers • Many governments have long had regulations to protect consumers from unsafe products. • The indirect effect of such regulations often is to limit or ban the importation of such products. 30 • In 2003 several countries, including Japan and South Korea, banned imports of U.S. beef after a single case of mad cow disease was found in Washington State Further foreign policy objectives • A government may grant preferential trade terms to a country with which it wants to build strong relations. • Trade policy has also been used several times to pressure or punish “rogue states” that do not abide by international law or norms. Protecting Human Rights • Governments sometimes use trade policy to try to improve the human rights policies of trading partners. • In the 1980s and 1990s, Western governments like Canada used trade sanctions against South Africa as a way of pressuring that nation to drop its apartheid policies, which were seen as a violation of basic human rights. Economic Arguments for Intervention 1. The infant industry argument 2. Strategic trade policy The infant industry argument • New manufacturing industries cannot initially compete with wellestablished industries in developed countries. • To allow manufacturing to get a toehold, the argument is that governments should temporarily support new industries with tariffs, import quotas, and subsidies until they have grown strong enough to meet international competition. Strategic trade policy: • Government can help raise national income • Government might intervene in an industry if it helps domestic firms to overcome the barriers to entry created by foreign firms. • Bombardier in Quebec has benefited greatly from support from the federal government and the Quebec provincial government 3. Arguments against strategic trade policy. Revised case for Free Trade • Strategic trade policy looks appealing in theory but in practice it may be unworkable. • This response to the strategic trade policy argument constitutes the revised case for free trade • A strategic trade policy aimed at establishing domestic firms in a dominant position in a global industry is a beggar-thy-neighbor policy (Krugman) that boosts national income at the expense of other countries. • Domestic Politics • Governments do not always act in the national interest when they intervene in the economy; politically important interest groups often influence them. 31 • The European Union’s support for the Common Agricultural Policy (CAP), which arose because of the political power of French and German farmers, is an example 4. Describe the development of the world trading system and the current trade issue. • 1980 – 1993: GATT under pressure During the 80s and 90s GATT came under pressure due to: • Economic success of Japan • Persistent trade deficit in the world’s largest economies Countries found ways to get around GATT regulations, such as VERs (Voluntary Exports Restraints) • The Uruguay Round and the World Trade Organization • 1995 the agreement was formally signed • The World Trade Organization (WTO) was created to implement the GATT agreement. World Trade Organization • The WTO acts as an umbrella organization that encompasses the following bodies: 1. GATT 2. GATs (General Agreement on Trade in Services) 3. TRIPs (Trade Related Aspects of Intellectual Property Rights) • WTO has taken the responsibility for arbitrating trade disputes and monitoring the trade policies of member countries The Future of the WTO: Unresolved Issues and Doha Round Unresolved Issues Three issues at the forefront of the WTO agenda: 1. The rise of antidumping policies 2. The high level of protectionism in agriculture 3. The lack of strong protection for intellectual property rights 4. Market Access for Nonagricultural Goods and Services The Future of the WTO: Unresolved Issues and Doha Round A new round of talks: Doha • Launched in 2001, The talks were originally scheduled to last three years, although they have already gone on for 15 years and are currently stalled. • The Doha agenda includes cutting tariffs on industrial goods and services, phasing out subsidies to agricultural producers, reducing barriers to cross-border investment, and limiting the use of anti-dumping laws. • The talks are currently ongoing. Chapter 7 Notes 1. Recognize current trends regarding foreign direct investment (FDI) in the world economy. Flow of FDI refers to the amount of FDI undertaken over a given time period (normally a year). 32 Stock of FDI refers to the total accumulated value of foreign-owned assets at a given time. Outflows of FDI refers to the flow of FDI OUT of a country. Inflows of FDI refers to the flow of FDI INTO a country. 33 The Form of FDI: Acquisitions versus Greenfield Investments FDI takes two main forms. The first is a greenfield investment, which involves the establishment of a new operation in a foreign country. The second involves acquiring or merging with an existing firm in the foreign country. Canada’s Case Positive and Negative Factors Affecting FDI Flows, 2013–2015 34 2. Explain the different theories of FDI. Eclectic Paradigm Argument that combining location-specific assets or resource endowments and the firm’s own unique assets often requires FDI. It requires the firm to establish production facilities where those foreign assets or resource endowments are located. Why Foreign Direct Investment • Exporting involves sale of products produced in one country to residents of another country. • Licensing involves granting a foreign entity (the licensee) the right to produce and sell the firm’s product in return for a royalty fee on every unit sold. 35 • • • • • • • • • • • • Limitations of Exporting When transportation costs are added to production costs, it becomes unprofitable to ship products over a large distance. Products of low value-to-weight ratio can be produced in almost any location: Examples: cement, soft drinks Products with a high value-to weight ratio: transport costs are normally a very minor component of total landed cost. Examples: electronic components, medical equipment Limitations of Licensing Internalization theory explains why firms often prefer FDI over licensing as a strategy for entering foreign markets. Licensing may result in a firm giving away valuable technological know-how to a potential foreign competitor. Licensing does not give a firm the tight control over manufacturing, marketing, and strategy in a foreign country. The Pattern of Foreign Direct Investment Strategic Behavior Oligopoly (industry composed of a limited number of large firms.) Multipoint competition (arises when two or more enterprises encounter each other in different regional markets, national markets, or industries.) The Eclectic Paradigm Location-specific advantages: Advantages that arise from using resource endowments or assets that are tied to a particular foreign location and that a firm finds valuable to combine with its own unique assets (such as the firm’s technological, marketing, or management know-how). 3. Understand how political ideology shapes a government's attitude toward FDI. The Radical View • The radical view - Marxist political and economic theory • Argues that the multinational enterprise (MNE) is an instrument of imperialist domination • See the MNE as a tool for exploiting host countries to the exclusive benefit of their capitalist-imperialist home countries • They argue that MNEs extract profits from the host country and take them to their home country The Free Market View • argues that international production should be distributed among countries according to the theory of comparative advantage. • That is, countries should specialize in the production of those goods and services that they can produce most efficiently Pragmatic Nationalism 36 • • • • • • In practice, many countries have adopted neither a radical policy nor a free market policy toward FDI, but instead a policy that can best be described as pragmatic nationalism. The pragmatic nationalist view is that FDI has both benefits and costs. FDI can benefit a host country by bringing capital, skills, technology, and jobs, but those benefits often come at a cost. Shifting Ideology Recent years have seen a marked decline in the number of countries that adhere to a radical ideology. Although few countries have adopted a pure free market policy stance, an increasing number of countries are gravitating toward the free market end of the spectrum and have liberalized their foreign investment regime As a counterpoint, there is some evidence of a shift to a more hostile approach to foreign direct investment in some nations. 4. Describe the benefits and costs of FDI to home and host countries. Host Country Benefits • Resource-transfer effects • Employment effects - FDI brings jobs to a host country • Balance of payment effects. • FDI is a substitute for imports of goods and services • MNE uses the subsidiary in the host country to export goods and services to other countries • Balance of payments from inward flow of foreign earnings. • Positive employment effects when a subsidiary demands home country exports of capital equipment. • Home country MNE learns skills transferable in technologies for use in the home country. Effect on Competition and Growth Host Country Costs • Adverse effects on competition • Foreign subsidiaries have strong economic power to put local competitors out of market • Adverse effects on the balance of payments. • Against the initial capital inflow that comes with FDI must be the outflow of earnings to be repatriated • National sovereignty and autonomy Home Country Costs • Balance of payments from outward FDI • Employment effect from outward FDI 5. Explain the range of policy instruments that governments use to influence FDI. 37 Home Country Policy Encouraging outward FDI Restricting outward FDI Host country policies Encouraging inward FDI Restricting inward FDI International Institutions and the Liberalization of FDI • Until the 1990s, there was no consistent involvement by multinational institutions in the governing of FDI. • This changed with the formation of the World Trade Organization in 1995 6. Identify the implications for managers of the theory and government policies associated with FDI. A Decision Framework 38 Chapter 8 1. Describe different levels of regional economic integration(REI). The renegotiation of NAFTA was complicated by the fact that multilayered supply chains now span both sides of the U.S.–Mexican border. Nowhere is this more the case than in the automobile industry. Auto parts manufactured in the US shipped to plants in Mexico, for assemblage and then shipped back to the US On 30 September 2018, Canada, Mexico, and the United States reached agreement on a revised version of NAFTA • The past two decades have witnessed a proliferation of regional trade blocs that promote regional economic integration • In 2018, there were 284 regional trade agreements in force • Groups of countries aim to reduce trade barriers more rapidly than can be achieved under the auspices of the WTO • This has become an increasingly important policy approach, given the failure of the WTO to make any progress with its the Doha Round. 39 1. Free Trade Area: all barriers to the trade of goods and services among member countries are removed) 2. A Customs Union : group of countries committed to: • removing all barriers to the free flow of goods and services between each other and • the pursuit of a common external trade policy.) 3. A Common Market :A group of countries committed to: • removing all barriers to the free flow of goods, services, and factors of production between each other; • pursuing a common external trade policy; and • allowing factors of production to move freely among members.) 4. Economic Union: A group of countries committed to: • The removal of all barriers to the free flow of goods, services, and factors of production between each other; • the adoption of a common currency; • the harmonization of tax rates; and • the pursuit of a common external trade policy. 5. Political Union : A central political apparatus that coordinates economic, social, and foreign policy. 2. Understand the economic and political arguments for REI. Economic Case for Integration • Regional economic integration can be seen as an attempt to achieve additional gains from the free flow of trade and investment between countries beyond those attainable under global agreements such as the WTO Political Case for Integration • Linking neighboring economies and making them increasingly dependent on each other creates incentives for political cooperation between neighboring states and reduces the potential for violent conflict. Impediments to Integration • Strong economic, political arguments for integration, but never been easy to achieve or sustain: 1. Economic integration benefits the majority but has its costs. • While a nation as a whole may benefit significantly from a regional free trade agreement, certain groups may lose. • Moving to a free trade regime involves some painful adjustments. 2. Concerns over national sovereignty. • Mexico’s concerns about maintaining control of its oil interests resulted in an agreement with Canada and USA under CUSMA (formally NAFTA). 3. Understand economic and political arguments against REI. Concerns that the benefits of regional integration have been oversold, while the costs have often been ignored 40 • The benefits of regional integration are determined by the extent of trade creation, as opposed to trade diversion • Trade creation occurs when high-cost domestic producers are replaced by lowcost producers within the free trade area. • Trade diversion occurs when lower-cost external suppliers are replaced by higher cost suppliers within the free trade area. 4. Explain the history, current scope, and future prospects of the worlds most important REI. Political Structure of the European Union The five main institutions in this structure are: 1. The European Council 2. The Council of Ministers 3. The European Commission 4. The European Parliament 5. The Court of Justice 41 Benefits •Individuals and businesses realize significant savings from having only one currency •A common currency makes it easy to compare prices across Europe •European producers will be forced to look for ways to reduce their production costs to maintain profits •Supports the development of the pan-European capital market Costs •National authorities have lost control over monetary policy •The Maastricht Treaty called for establishment of an independent European Central Bank •ECB has the responsibility to set interest rates and determine monetary policies for the euro zone The United Kingdom's exit from the European Union in 2020 brings the total number of member states to 27. 5. Understand how foreign investment can support sustainable community development. NAFTA The Case FOR NAFTA Proponents argue that NAFTA should be viewed as an opportunity to create an enlarged and more efficient productive base for the entire region. Advocate acknowledge that one effect of NAFTA would be that many U.S. and Canadian firms will move some production to Mexico to take advantage of lower labour costs (In 2015, the average hourly labour cost in Mexican automobile factories was $8–$10 an hour including benefits, compared to $42–$58 an hour in the USA) The Case AGAINST NAFTA Those who opposed NAFTA claimed that ratification would be followed by a mass exodus of jobs from the USA and Canada into Mexico as employers sought to profit from Mexico’s lower wages and less strict environmental and labour laws. The period since NAFTA took effect has had little impact on trends already in place. The new NAFTA: CUSMA Canada-United States-Mexico Agreement, or CUSMA for short, the "New NAFTA," made some changes to the 25-year-old NAFTA treaty, as discussed earlier in this chapter NAFTA required automakers to produce 62.5 percent of a vehicle’s content in North America to qualify for zero tariffs. CUSMA raises that threshold to 75 percent. The new NAFTA: CUSMA The idea is to compel automakers to source fewer parts for a car assembled in North America from Germany, Japan, South Korea, or China Critics see CUSMA as likely to result in trade diversion rather than trade creation and argue that the consequences may include higher costs to North American automobile producers and higher prices for consumers 6. Understand the implications for business that are inherent in regional economic integration agreements. 42 Chapter 9 1. Describe the functions of the foreign exchange market. Foreign Exchange Market • is a market for converting the currency of one country into that of another country. Exchange Rate • is the rate at which one currency is converted into another. Foreign Exchange Risk • is the adverse consequence of unpredictable changes in the exchange rate. Currency Conversion • International businesses use foreign exchange markets when: • the payments a company receives for its exports, the income it receives from foreign investments, or the income it receives from licensing agreements with foreign firms may be in foreign currencies • when they must pay a foreign company for its products or services in its country ’s currency Currency Conversion • International businesses use foreign exchange markets when: • when they have spare cash that they wish to invest for short terms in money markets • Currency speculation typically involves the short-term movement of funds from one currency to another in the hopes of profiting from shifts in exchange rates The World and the Canadian Dollar • The Canadian dollar is a currency linked to the raw materials, including oil and natural gas, that Canada exports (petrocurrency). • The movements of the Canadian dollar have become increasingly correlated with price of oil • Small Canadian businesses can be highly susceptible to exchange rate fluctuations when exporting to the United States and fear that a rise in the Canadian dollar will increase the cost to the U.S. consumer and damage export related profits. • Small Canadian businesses can be highly susceptible to exchange rate fluctuations when exporting to the USA and fear that a rise in the Canadian dollar will increase the cost to the U.S. consumer and damage export related profits. Insuring Against Foreign Exchange Risk • A second function of the foreign exchange market is to provide insurance to protect against the possible adverse consequences of unpredictable changes in exchange rates • Spot exchange rates • Forward exchange rates • Currency swaps Spot Exchange Rates • The spot exchange rate is the rate at which a foreign exchange dealer converts one currency into another currency on a particular day. • When a Canadian tourist goes to a bank to convert her Canadian dollars into pounds, the exchange rate is the spot rate for that day. 43 • • • Forward Exchange Rates A forward exchange occurs when two parties agree to exchange currency and execute the deal at some specific date in the future. Exchange rates governing such future transactions are referred to as forward exchange rates. Currency Swaps A currency swap is the simultaneous purchase and sale of a given amount of foreign exchange for two different value dates. 2. Understand the nature of the foreign exchange market. Even though the British pound has declined in importance as a vehicle currency, London remains the key location for global foreign exchange. The most important trading centres: • London (37 percent of activity); • New York (18 percent of activity); • and Zurich, Tokyo,and Singapore Major secondary trading centres include: • • • • • • Zurich, Frankfurt, Paris, Hong Kong, San Francisco, and Sydney. 3. Understand the different theories explaining how currency exchange rates are determined and their relative merits. Prices and Exchange Rates • The Law of One Price • Purchasing Power Parity (PPP) • Money supply and price inflation Summary of Exchange Rate Theories Relative monetary growth, relative inflation rates, and nominal interest rate differentials are: • Moderately good predictors of long-run changes in exchange rates. • Poor predictors of short-run changes in exchange rates, however, perhaps because of the impact of psychological factors, investor expectations, and bandwagon effects on short-term currency movements 4. Understand the issues surrounding currency convertibility. The Efficient Market School • Prices reflect all available public information 44 The Inefficient Market School • A market in which prices do not reflect all available information. • Forward exchange rates will not be the best possible predictors of future spot exchange rates 5. Compare and contrast the differences among translation, transaction, and economic exposure. Free Convertible Currency • A country’s currency is freely convertible when the government of that country allows both residents and nonresidents to purchase unlimited amounts of foreign currency with the domestic currency. Nonconvertible Currency • A currency is not convertible when both residents and nonresidents are prohibited from converting their holdings of that currency into another currency. Externally Convertible Currency • Nonresidents can convert their holdings of domestic currency into foreign currency, but the ability of residents to convert the currency is limited in some way. • Convertibility and Government Policy • Free convertibility is not universal. • Many countries place some restrictions on their residents’ ability to convert the domestic currency into a foreign currency (a policy of external convertibility). • Governments limit convertibility to preserve their foreign exchange reserves. • A country needs an adequate supply of these reserves to service its international debt commitments and to purchase imports Countertrade Countertrade refers to a range of barter-like agreements through which goods and services can be traded for other goods and services. • Venezuela traded iron ore for Caterpillar construction equipment. Countertrade Countertrade refers to a range of barter-like agreements through which goods and services can be traded for other goods and services. • Caterpillar in turn sold the iron ore to Romania for farm products, which it then sold on international markets for dollars. Chapter 10 1. Describe the historical development of the modern global monetary system. • The international monetary system refers to the institutional arrangements that countries adopt to govern exchange rates. • The demand and supply of currencies is influenced by their respective countries’ relative inflation rates and interest rates • When the foreign exchange market determines the relative value of a currency, we say that the country is adhering to a floating exchange rate regime. • The world’s four major trading currencies: 45 • • • • • • • • • • • • the U.S. dollar, • the European Union’s euro, • the Japanese yen, • and the British pound, The are all free to float against each other. Their exchange rates are determined by market forces and fluctuate against each other. Pegged Exchange Rate The rate at which currency value is fixed relative to a reference currency. Dirty Float System A system in which a countrys currency is nominally allowed to float freely against other currencies, but the government will intervene, buying and selling currency, if it believes that the currency has deviated too far from its fair value. Mechanics of the Gold Standard Gold standard is the practice of pegging currencies to gold and guaranteeing convertibility. Gold Value is the amount of currency needed to purchase one ounce of gold Strength of the Gold Standard Balance-of-trade equilibrium is reached when the income a nation’s residents earn from exports equals money paid for imports. 2. Explain the role played by the World Bank and the IMF in the international monetary system. In 1944, at the height of World War II, representatives from 44 countries met at Bretton Woods, New Hampshire, to design a new international monetary system With the collapse of the gold standard and the Great Depression of the 1930s fresh in their minds, these statesmen were determined to build an enduring economic order that would facilitate postwar economic growth The agreement reached at Bretton Woods established two multinational institutions—the International Monetary Fund (IMF) and the World Bank. Role of IMF Discipline A fixed exchange rate regime imposes discipline in two ways. • The need to maintain a fixed exchange rate puts a brake on competitive devaluations and brings stability to the world trade environment. • A fixed exchange rate regime imposes monetary discipline on countries, thereby curtailing price inflation. • Flexibility • The architects of the Bretton Woods agreement wanted to avoid high unemployment, so they built limited flexibility into the system. • Two major features of the IMF Articles of Agreement fostered this flexibility: IMF lending facilities and adjustable parities. Role of the World Bank • The official name for the World Bank is the International Bank for Reconstruction and Development (IBRD) 46 • When the Bretton Woods participants established the World Bank, the need to reconstruct the war-torn economies of Europe was foremost in their minds The bank lends money under two schemes: • Under the IBRD scheme, the bank offers low-interest loans to risky customers whose credit rating is often poor. • A second scheme is overseen by the International Development Agency (IDA), an arm of the bank created in 1960. IDA loans go only to the poorest countries. Borrowers have 50 years to repay at an interest rate of 1 percent a year. 3. Compare and contrast the differences between a fixed and a floating exchange rate system. The system collapsed in 1973, and since then we have had a managed-float system. To understand why the system collapsed, one must appreciate the special role of the U.S. dollar in the system. As the only currency that could be converted into gold, and as the currency that served as the reference point for all others, the dollar occupied a central place in the system. • The Bretton Woods system had an Achilles’ heel: the system could not work if its key currency, the U.S. dollar, was under speculative attack. • The Bretton Woods system could work only as long as the U.S. inflation rate remained low and the United States did not run a balance-of-payments deficit. • Once these things occurred, the system soon became strained to the breaking point. The Jamaica Agreement The main elements of the Jamaica agreement include the following: • Floating rates were declared acceptable. • Gold was abandoned as a reserve asset. The IMF returned its gold reserves to members at the current market price, placing the proceeds in a trust fund to help poor nations. • Total annual IMF quotas—the amount member countries contribute to the IMF—were increased to US$41 billion. 47 The Case for Floating Exchange Rates Monetary Policy Autonomy • To maintain exchange rate parity under a fixed system, countries were limited in their ability to use monetary policy to expand or contract their economies. • Advocates of a floating exchange rate regime argue that removing the obligation to maintain exchange rate parity would restore monetary control to a government The Case for Floating Exchange Rates Trade Balance Adjustments • If a country is running a trade deficit, the imbalance between the supply and demand of that country’s currency in the foreign exchange markets will lead to depreciation in its exchange rate. • By making its exports cheaper and its imports more expensive, an exchange rate depreciation should correct the trade deficit. The Case for Fixed Exchange Rates Monetary Discipline • The need to maintain a fixed exchange rate parity ensures that governments do not expand their money supplies at inflationary rates. Speculation • Speculation can cause fluctuations in exchange rates. • The Case for Fixed Exchange Rates • Uncertainty 48 • The unpredictability of exchange rate movements in the post-Bretton Woods era has made business planning difficult, and it makes exporting, importing, and foreign investment risky activities 4. Identify exchange rate regimes used in the world today and why countries adopt different exchange rate regions. Governments around the world pursue a number of different exchange rate policies 21 % of the IMF’s members allow their currency to float freely. Another 23 % intervene in only a limited way (the so-called managed float) 43 % use more inflexible systems, including a fixed peg arrangement Pegged Exchange Rates • Under a pegged exchange rate regime, a country will peg the value of its currency to that of a major currency so that, for example, as the U.S. dollar rises in value, its own currency rises too. • Pegged exchange rates are popular among many of the world’s smaller nations. Financial Crises in the Post–Bretton Woods Era • Currency Crisis occurs when a speculative attack on the exchange value of a currency results in a sharp depreciation. • Banking Crisis refers to a loss of confidence in the banking system. • Foreign Debt Crisis is a situation in which a country cannot service its foreign debt obligations, whether private or government debt. Evaluating the IMF Policy Prescriptions • All IMF loan packages come with conditions attached. • Until very recently, the IMF has insisted on a combination of tight macroeconomic policies, including: • cuts in public spending, • higher interest rates, and • tight monetary policy. Evaluating the IMF Policy Prescriptions Inappropriate policies • A “one size-fits-all” approach to macroeconomic policy that is inappropriate for many countries. Moral Hazard IMF rescue efforts are exacerbating a problem known to economists as moral hazard (arises when people behave recklessly because they know they will be saved if things go wrong). 5. Understand the debate surrounding the role of the IMF in the management of financial crises. 6. Explain the implications of the global monetary system for currency management and business strategy. Chapter 11 49 Strategies are actions that managers take to attain the goals of the firm. Profitability rate of return that the firm makes on its invested capital Profit growth The percentage increase in net profits over time. Determinants of Enterprise Value Value Creation • Two basic conditions determine a firm’s profits • the amount of value customers place on the firm’s goods or services (sometimes referred to as perceived value) and • the firm’s costs of production. • The more value customers place on a firm’s products, the higher the price the firm can charge for those products. • Value creation is a group of activities that increase the value of goods or services to consumers. 50 Strategic Positioning • Porter notes that it is important for a firm to be explicit about its choice of strategic emphasis with regard to value creation (differentiation) and low cost and to configure its internal operations to support that strategic emphasis. Operations: The Firm as a Value Chain 51 The operations of a firm can be thought of as a value chain composed of a series of distinct value creation activities, including production, marketing and sales, materials management, research and development, human resources, information systems, and the firm infrastructure Primary Activities Primary activities have to do with the design, creation, and delivery of the product; its marketing; and its support and after-sale service. Primary activities are broken into four functions: research and development, production, marketing and sales, and service Support Activities Provide inputs that allow the primary activities to take place The materials management (or logistics) function HR Human Resource function Information systems Company infrastructure, or the context within which all the other value creation activities occur. Organization: The Implementation of Strategy The strategy of a firm is implemented through its organization. For a firm to have superior return on invested capital (ROIC), its organization must support its strategy and operations 52 Strategic Fit market conditions, strategy, operations, and organization must all be consistent with each other, or fit each other, for superior performance to be attained. Firms that operate internationally are able to: 1. Expand the market for their domestic product offerings by selling those products in international markets. 53 2. Realize location economies by dispersing individual value creation activities to those locations around the globe where they can be performed most efficiently and effectively. 3. Realize greater cost economies from experience effects by serving an expanded global market from a central location, thereby reducing the costs of value creation. 4. Earn a greater return by leveraging any valuable skills developed in foreign operations and transferring them to other entities within the firm’s global network of operations. Firms that compete in the global marketplace typically face two types of competitive pressure. They face pressures for cost reductions and to be locally responsive Pressure for cost reductions Responding to pressures for cost reduction requires a firm to try to lower the costs of value creation The liberalization of the world trade and investment environment in recent decades, by facilitating greater international competition, has generally increased cost pressures Pressure for local responsiveness • Differences in consumer tastes and preferences • Differences in infrastructure and traditional practices • Differences in distribution channels • Host-government demands • The Rise of Regionalism Choosing a Strategy 54 Global Standardization Strategy Firms that pursue a global standardization strategy focus on increasing profitability and profit growth by reaping the cost reductions that come from economies of scale, learning effects, and location economies. Localization Strategy A localization strategy focuses on increasing profitability by customizing the firm’s goods or services so that they provide a good match to tastes and preferences in different national or regional markets Transnational Strategy Firms that pursue a transnational strategy are trying to: • simultaneously achieve low costs through location economies, economies of scale, and learning effects; • differentiate their product offering across geographic markets to account for local differences; and • foster a multidirectional flow of skills between different subsidiaries in the firm’s global network of operations International Strategy 55 • • • International strategy, is taking products first produced for their domestic market and selling them internationally with only minimal local customization. Firms are selling a product that serves universal needs, but they do not face significant competitors; Firms are not confronted with pressures to reduce their cost structure 56 57 Strategic Alliances • Refer to cooperative agreements between potential or actual competitors. In this section, we are concerned specifically with strategic alliances between firms from different countries. The Advantages of Strategic Alliances • Strategic alliances may facilitate entry into a foreign market. • Strategic alliances also allow firms to share the fixed costs (and associated risks) of developing new products or processes. • An alliance is a way to bring together complementary skills and assets that neither company could easily develop on its own • Technological sharing reasons The Disadvantages of Strategic Alliances • They give competitors a low-cost route to new technology and markets • Alliances have risks. • Unless a firm is careful, it can give away more than it receives Making Alliances Work • Partner selection • Alliance structure • Managing the alliance • Building trust 58 • Learning from partners Structuring Alliances to Reduce Opportunism Chapter 12 Which Foreign Markets? • 195 countries, 61 territories and 6 disputed areas as of 2018 • Uneven opportunities and profit potential • Base Decision on an assessment of a nation’s long-run revenue potential • Balance the benefits, costs and risks associated with doing business in that country Timing of Entry • Go early, or late • First or Early Mover • Advantages – Establish Brand, Sales Volume, Experience Curve • Disadvantages - Pioneering Costs (Promotion, Regulation) • Late Movers or Entrants • Advantages: Experience, Avoid Pioneering Costs • Disadvantages: Switching Costs, Cost Disadvantage Scale of Entry and Strategic Commitments • Large scale of entry requires the commitment of significant resources and rapid entry. • A large strategic commitment has a long term impact and it cannot be easily reversed, yet it can capture first-mover advantages. 59 • Large commitment to one country often means less resources to support expansion in other markets. • Small-scale entry limits the firm’s exposure to just one market, while allowing it to both learn about the market and diversify by entering and building presence in other foreign markets. Market Entry Summary • No “right” decision, difference in risk and reward levels • Entering a large developing nations such as China or India before other international businesses in the firm’s industry, and entering on a large scale, will be associated with • high levels of risks and • high rewards • Businesses from developing countries looking to become late entrants in global markets success factors depend on their ability to serve market niches and benchmark their operations and performance. • Exporting Advantages Exporting has two distinct advantages. • First, it avoids the often-substantial costs of establishing manufacturing operations in the host country. • Second, exporting may help a firm achieve experience curve and location economies Disadvantages Exporting has a number of drawbacks. • Exporting from the firm’s home base may not be appropriate if there are lower-cost locations for manufacturing the product abroad. • High transport costs can make exporting uneconomical, particularly for bulk products • Tariff barriers can make exporting uneconomical • Foreign agents often carry the products of competing firms and so have divided loyalties • • • • Turnkey Projects Turnkey projects occur when a contractor handles all details of a project for a foreign client, including the training of operating personnel. At completion of the contract, the foreign client is handed the “key” to a plant that is ready for full operation. Advantages: Way to earn great economic benefits from a technologically complex project where FDI is limited Disadvantages: No long term interest in the foreign market and creating a competitor Licensing 60 • A licensing agreement is an arrangement where a licensor grants the rights to intangible property to another entity (the licensee) for a specified period, and in return, the licensor receives a royalty fee from the licensee. Intangible Property: inventions, formulas, designs, copyrights, trademarks and processes Advantages: Firm does not have to bear developmental costs and risks, appropriate for markets where it would be prohibited by barriers to investment. Disadvantages: Loss of control over manufacturing, marketing and strategy => firm does no realize experience curve and location economies. • Franchising Franchising is a specialized form of licensing in which a franchiser not only sells intangible property (normally a trademark) to a franchisee, but also insists that the franchisee agrees to bide by strict rules as to how the business is conducted. Advantages: Similar to licensing, the franchisee assumes all the costs and risks. Disadvantages: The firm does no realize experience curve and location economies and quality control. • • Joint Ventures A joint venture entails establishing a firm that is jointly owned by two or more otherwise independent firms. Advantages: A firm benefits from local partner’s knowledge of the host country’s competitive environment and shares with the local firm the developmental costs and risks. In some countries, joint ventures are the only feasible entry mode. Disadvantages: A firms risks giving control of its technology to its partner, lack of control over subsidiary needed to realize experience curve or location economies and shared ownership arrangements can lead to conflicts over control. • • • Wholly Owned Subsidiary Wholly-owned subsidiaries occur when a firm owns 100 percent of its stock. By establishing a wholly-owned subsidiary in a foreign market: 1. The firm can either set up a new operation in the host country (Greenfield venture); or 2. the firm acquires an established firm in the host nation and uses that firm to promote its products. 2. Advantages: A wholly owned subsidiary reduces the risk of loosing control over technological competence necessary for engaging in global strategic coordination and allows the firm to realize location and experience curve economies 3. Disadvantages: It is the most costly method of serving a foreign market, firms bear all the costs and risks and have to learn about new cultures or acquire enterprises in the host country. 61 1. Core Competencies and Entry Mode Technological Know-How Management Know-How 2. Pressures for Cost Reductions and Entry Mode 1. Core Competencies and Entry Mode Technological Know-How • If a firm’s competitive advantage (its core competence) is based on control over proprietary technological know-how, licensing and joint venture, arrangements should be avoided if possible to minimize the risk of losing control over that technology Management Know-How • The competitive advantage of many service firms is based on management know how (e.g., McDonald’s). • For such firms, the risk of losing control over the management skills to franchisees or joint-venture partners is not that great. • These firms’ valuable asset is their brand name, and brand names are generally well protected by international laws pertaining to trademarks. 2. Pressures for Cost Reduction and Entry Mode 62 • • The greater the pressure for cost reduction the more likely the firm will pursue a combination or exporting and wholly owned subsidiaries The firms strategy (i.e. global standardization or transnational) play an important part when choosing an entry mode. Global Business Today 6th Edition ©2021 McGraw Hill Ryerson All rights reserved PowerPoints by Associate Professor Frank Cotae, Mount Royal University Chapter 12 Slide 24 Acquisitions fail for several reasons. • First, the acquiring firms often overpay for the assets of the purchased firm. • The price of the target firm can get bid up if more than one firm is interested in its purchase, as is often the case. • Second, many acquisitions fail because there is a clash between the cultures of the acquiring and acquired firm. • After an acquisition, many acquired companies experience high management turnover, possibly because their employees do not like the acquiring company’s way of doing things • These problems can be overcome if the firm is careful about its acquisition strategy. 63 Chapter 13 (Opportunities and Difficulties) Promises • The great promise of exporting is that large revenue and profit opportunities are to be found in foreign markets for most firms in most industries. • The international market is normally so much larger than the firm’s domestic market that exporting is nearly always a way to increase the revenue and profit base of a company. • Exporting can enable a firm to achieve economies of scale, thereby lowering its unit costs • Firms that do not export often lose out on significant opportunities for growth and cost reduction Pitfalls and Difficulties: • Exporters often face voluminous paperwork, complex formalities, and many potential delays and errors. A typical export transaction may involve 30 parties, 60 original documents, and 360 document copies. • The time involved in preparing documentation often amounts to 10 percent of the final value of goods exported. 64 • Poor market analysis, identification of opportunities, expertise, failure to customize the product, lack of an effective distribution and promotion program. • Problems securing financing. Improving Export Performance • International Comparisons • Information Sources • Service Providers • Export Strategy International Comparisons • Collect Information: trade associations, government agencies, banks • Example of Japan and Germany • Role of MITI and sogo shosha • Canada has not yet developed an institutional structure as it exists in Germany and Japan. Information Sources Canadian Companies are increasingly becoming aware of international business opportunities. Source for Information include: Federal Level: • Global Affairs Canada, ISEDC, Stats Canada, EDC • International Trade Centers (ITC), Canada Trade Missions • Forum for International Trade Training (FITT) Provincial • Local chambers of commerce, trade representation offices • Commercial banks Service Providers Freight forwarders, export management companies (EMC), export trading or packaging companies, customs brokers, confirming houses, export agents and merchants, economic processing zones. EMC • are export specialists who act as the export marketing department or international department for their clients • start exporting operations for a firm with the understanding that the firm will take over operations after they are well established. • performed start-up services with the understanding that the EMC will have continuing responsibility for selling the firm’s products. 65 66 Letter of Credit Issued by a bank at the request of an importer, the letter of credit states the bank will pay a specified sum of money to a beneficiary, the exporter, on presentation of particular documents Draft An order written by an exporter instructing an importer, or an importer’s agent, to pay a specified amount of money at a specified time; also called a bill of exchange. • Sight vs. Time Draft • Negotiable Instrument after Acceptance stamp Bill of Lading A document issued to an exporter by a common carrier transporting merchandise. It serves as a receipt, a contract, and a document of title. 67 Countertrade Countertrade is an alternative means of structuring an international sale when conventional means of payment are difficult, costly, or nonexistent • The Royal Bank of Canada became the first Canadian bank to create a division to facilitate cashless transactions. Example: Philip Morris shipped cigarettes to Russia, for which it received chemicals that can be used to make fertilizer. Philip Morris shipped the chemicals to China, and in return, China shipped glassware to North America for retail sale by Philip Morris. Types of Countertrade • Barter – the direct exchange of goods and /or services between parties without a cash transaction. Simplest, yet not common arrangement. • Counterpurchase - it occurs when a firm agrees to purchase a certain amount of materials back from a country to which a sale is made. • Offset – similar to counterpurchase, the difference is that this party can fulfill the obligation with any firm in the country to which the sale is being made. • Switch Trading – refers to the use of a specialized third-party trading house in a countertrade arrangement and it involves the receipt and trade of credits. 68 • Compensation of Buybacks - Occurs when a firm builds a plant in a country—or supplies technology, equipment, training, or other services to the country—and agrees to take a certain percentage of the plant’s output as partial payment for the contract Chapter 14 Beginning Case: Mass advertising is quickly becoming an ancient way of doing business. There is way more sophisticated there is big businesse analytics and more sophisticated marketing research. Now, the least companines can do is that we expect these companies to understand our wants and need and target advertisements to us appropriately. This is targeted global messaging, which has higher probability that customer action will take place. Alternative facts: Something open to interpretation. Companies can leverage big data, business analytics, and int marketing research today in sophisticated ways that potentially should be good for society and useful to the consumer. • Mass Advertising – ancient way of doing business • Big data, analytics, customization of advertising becoming a must for multinational companies • Facebook impact and targeted global messaging • Rollout of fake news and alternative facts 69 Globalization of Market and Brands: Theodore Levitt writes: • A powerful force drives the world toward a converging commonality, and that force is technology. • The global corporation operates with resolute consistency—at low relative cost—as if the entire world were a single entity; it sells the same thing in the same way everywhere. • Ancient differences in national tastes or modes of doing business disappear. • The commonalty of preference leads inescapably to the standardization of products, manufacturing, and the institutions of trade and commerce. Is Levitt right? • May have a point when looking at basic industrial products and with regards to the effect of modern transportation and communication technologies on tastes and preferences • Most academic feel that he “overstates his case” • McDonald’s customizes its products from market to market • The continuing persistence of some unique cultural and economic differences between nations acts as a brake on many trends toward the standardization of consumer tastes and preferences across nations. Product Attributes: A product can be viewed as a bundle of attributes. Ex: The attributes that make up a car include power, desging, qualitu, performance, fuel consumption and comfort. Cultural Differences impacting product attributes: Ex: A hamburger wont sell well in Islamic countries. The most important aspect of cultural differences is probably the impact of tradition. Ex: Scent differences as well Taking advantages of trends Economic Development and product attributes: Firms based in very developed countries add extra attributes. Consumers in the most advanced countries are willing to pay more for products that have additional features. Product and Technial standards: Differing government mandated product standards can result in companies ruling out mass production. Communication Strategy: Communication Channels social media, direct selling, sales promotion and advertising. Barriers to International Communication • Cultural Barriers – difficult to communicate across cultures • Source Effects – occur when the receiver of the message (the potential consumer in this case) evaluates the message on the basis of status or image of the sender. • Noise Levels – refers to the number of other messages competing for a potential consumer’s attention, and this too varies across countries. • Push vs. Pull Strategies 70 • • • • Push A marketing strategy emphasizing personal selling rather than mass media advertising. Pull Strategy A marketing strategy emphasizing mass-media advertising as opposed to personal selling. Global Business Today 6th Edition ©2021 McGraw Hill Ryerson All rights reserved PowerPoints by Associate Professor Frank Cotae, Mount Royal University Chapter 14 Slide 16 Pricing Strategies: International pricing strategy is an important component of the overall international marketing mix Three aspects of International Pricing Strategy Price Discrimination Strategic Pricing Regulatory Influences on Prices 71 Strategic Pricing • Predatory Pricing - the use of price as a competitive weapon to drive weaker competitors out of a national market. • Multipoint Pricing Strategy - refers to the fact that a firm’s pricing strategy in one market may have an impact on its rivals’ pricing strategy in another market. • Experience Curve Pricing – introduce low prices worldwide in attempting to build global sales volume as rapidly as possible, even if this means taking large losses initially. Regulatory Influences on Prices: Anti-Dumping Regulations: Anti-dumping rules set a floor under export prices and limit firms ability to pursue strategic pricing. Competition Policy: Limiting and restricting monopoly practices. Configuring the Market Mix 72 73 Implication for Business: The need to integrate R&D and marketing to adequately commercialize new concepts and designs cases special problems for international businesses, since commercializaction may require different versions of a new product to be produced for different companies. For some companies, the integration of R&D, marketing, and production in an international company may require R&D centres in North America, Asia, and Europe that need to be linked by formal and informal mechanisms that integrate marketing operations in each country in their region and with the various manufacturing facilities. In addition, companies may have to establish cross-functional teams with members dispersed around the globe. This complex endeavour requires a company to use a range of integrating mechanisms to knit its far-flung operations together so they can produce new products in an effective and timely manner. Many companies establish a network of R&D centres as one solution. With this model, fundamental research is undertaken at basic research centres, typically where there is a pool of skilled talent, like in Waterloo, Ontario, or Silicon Valley in the United States. These centres are the innovation engines of the company, developing the basic technologies that become new products. These technologies are then picked up by R&D units attached to global product divisions and are used to generate new products to serve the global marketplace. The emphasis here is on commercialization of the technology and design for manufacturing. If further customization is needed, an R&D group based in a subsidiary in another country or region will adapt it to local consumer tastes and preferences. Both Hewlett-Packard and Microsoft use this model. Chapter 15 • • Where in the world should production activities be located? What should be the long-term role of foreign production sites? 74 • Should the firm own foreign production facilities, or it is better to outsource those activities to independent vendors? Cost issues, as they related to global logistics and global purchasing – need to be strategically and tactically addressed Strategy, Production, and Supply Chain Management Supply Chain -is the part of the supply chain that plans, implements, and controls the effective flows and inventory of raw material, component parts, and products used in manufacturing. Logistics is the part of the supply chain that plans, implements, and controls the effective flows and inventory of raw material, component parts, and products used in manufacturing. Total Quality Management (TQM) to Six Sigma – evolution of a management philosophy that advance into a statistically based philosophy that aims to reduce defects, boost productivity, eliminate waste, and cut costs throughout a company. ISO 9000 – is a certification process that requires certain quality standards that must be met. Where to Produce? 75 76 77 The Hidden Costs of Foreign Location High Employee Turnover Shoddy Workmanship Poor Quality Low Productivity Connect these hidden cost to the overall purpose of a globally competitive supply chain management. Make or Buy Decisions Make-or-Buy decision is often based largely on two critical factors: cost and production capacity. Changing, other elements play key roles in the decision! Make elements: quality control, proprietary technology, operational control, excess capacity, limited suppliers, assurance of continual supply and industry drivers Buy elements: firms lacks expertise, supplier competencies, volume, brand preference, nonessential items and inventory planning. The implications for business: Fall into 4 areas: Coordination through materials management, just in time systems, the importance of info technology, and the coordination of global supply chains. A GLOBAL PRODUCTION SYSTEM 78 Materials management, which encompasses logistics, embraces the activities needed to get materials from suppliers to a manufacturing facility, through the manufacturing process, and out through a distribution system to the end user. It must be done at the lowest possible cost and in a way that best serves customer needs, thereby lowering the costs of value creation and helping the firm establish a competitive advantage through superior customer service. The potential for reducing costs through more efficient materials management is enormous. Typically, material costs account for 50 to 70 percent of revenues, depending on the industry, and even a small reduction in costs can have a substantial impact on profitability. In a saturated market, it is much easier for a company to reduce materials costs than significantly increase sales revenues. THE POWER OF JUST-IN-TIME Just-in-time inventory systems were pioneered by Japanese firms in the 1950s and 1960s and now play a major role in most manufacturing firms. The philosophy is to economize on inventory holding costs by having materials arrive at a manufacturing plant just in time to enter the production process, and not before. The major cost savings come from speeding up inventory turnover. This reduces holding costs, such as warehousing and storage, It also means the company is less likely to have excess unsold inventory that it has to write off against earnings or price low to sell. The system can also improve product quality because it allows for defective parts or inputs to be spotted right away, since they are not warehoused. The drawback of this approach is that it leaves a firm without a buffer stock of inventory to tide over shortages caused by supplier disruptions, like a labour dispute, or to respond quickly to increases in demand. This drawback has become apparent for many companies trying to respond to increased consumer demand for certain products--from trampolines to propane heaters--during the COVID-19 pandemic. THE ROLE OF INFORMATION TECHNOLOGY AND THE INTERNET Web-based information systems play a crucial role in modern materials management. By tracking component parts as they make their way across the globe to an assembly plant, information systems enable a firm to optimize its production scheduling according to when components are expected to arrive. By being able to locate parts in the supply chain more precisely, the firm can accelerate production when needed. Electronic data interchange (EDI) is also used by firms to coordinate the flow of materials into the manufacturer and out to customers. The system allows for better communication between a firm and its suppliers and shippers. Today, Internet software Coordination of Global Supply Chains Global supply chain integration refers to shared decision-making opportunities and operational collaboration to coordinate global supply chain activities. Shared decision making creates a more integrated, coherent, efficient, and effective global supply 79 chain. It can include consideration of issues related to inventory replenishment and holding costs, collaborative planning, costs of different processes, frequency of orders, batch size, and product development. Six operational considerations need to be considered to achieve integration of a global supply chain: responsiveness, variance reduction, inventory reduction, shipment consolidation, quality, and life-cycle support. Chapter 16 Opening Case: Global Mobility at Shell • Royal Dutch Shell is a British–Dutch multinational oil and gas company that is headquartered in the Netherlands and incorporated in the United Kingdom. • 90,000 employees in more than 70 countries • 6 -7,000 at any one time on expat assignments • Crucial Task: Managing expatriate workforce • Short-term goals: Develop local and foreign talent Challenges with Moving Employees to other Countries • Separation from children • Harm done to a spouse’s career and employment • Failure to recognize and involve the spouse in the decision • Failure to provide information and assistance on relocation • Health issues • Solutions at Shell • Build elementary schools and offer educational grants • Set up spouse employment centre • Set the “Outpost” for family support • Financial incentives Reality – Expats an expensive resource Intro: Pg 574 • HRM - refers to the activities an organization carries out to use its human resource effectively. • HRM function can help the firm achieve its primary strategic goals of reducing the costs of value creation and adding value by better serving customers. • Role of HRM is more complex in an international business context. We identify 4 major tasks for the HRM function: • Staffing Policy • Management Training and Development • Performance Appraisal • Compensation Policy LO1 80 LO2: Staffing policy is concerned with the selection of employees for particular jobs. At one level, this involves selecting individuals who have the skills required to do particular jobs Corporate culture, the organization’s norms and value systems. Types of Staffing Policies - The Ethnocentric Approach: Where all key mgmt. positions are filled by parent country nationals. - The Polycentric Approach: Requires host country nationals to be recruited to manage subsidiaries, while parent company nationals occupy key positions at corporate headquarters. - The Geocentric Approach: Seeks the best people for key jobs throughout the organization, regardless of nationality. Comparison of Staffing Approaches 81 LO3: Expatriates Failure Rates: The premature return of an expatriate manager to their home country. Expatriate falure represents a failure of the firms selection policies to indentify individuals who will not thrive abroad. The consequences include premature return from a foregin posting and high resignation rates, with expatriates leaving their company at about twice the rate of domestic managers. 82 Expatriate Selection: Mendenhall and Oddou identified four dimensions that Page 563 --> seem to predict success in a foreign posting: • Self-Orientation: Such individuals are able to adapt their interests in food, sport, and music. Technically competent. Strengthen the expatriates self-esteem. • Others-Orientation: The attributes of this dimension enhance the expatriates ability to interact effectively with host country nationals. • Perceptual Ability: This is the ability to understand why people of other countries behave the way they do, the ability to empathize. • Cultural Toughness: This dimension refers to the relationship between the country of assignment and how well an expatriate adjusts to a particular posting. LO4: • Training for Expatriate Managers • Cultural Training: Seeks to foster an appreciation for the host countrys culture. Will help the manager empathize with the country • Language Training: Willingness to communicate in the host countrys language. 83 • Practical Training: Ease themselves into day to day life in the host country. Establish a routine, and do it sooner. • Repatriation of Expatriates: Prepare them for reentry into their home country organization. Seen as the final link in an integrated, circular process. Building a Diverse Global Workforce – source of competitive advantage: A significant mix of both genders of which cultural and ethnic minorites are well represented. Workforce diversity has been linked to superior financial performance. Companines in top quartile of gender and ethnic diversity were 35% more likely to have financial returns above their national industry median. Diverse talents bring insights into the needs of a diverse customer base. LO5: • Performance Appraisal Problems • Cultural differences in expectations • Hard data use in evaluations of performance • Foreign postings seen as detrimental to careers • Guidelines for Performance Appraisals • Onsite manager importance • Same nationality • Former expatriates should be involved in the appraisal • Home-office managers should be consulted LO6: • National Differences in Compensation • Expatriate Pay • Base Salary: Should normally be in the same range as the base salary for a similar position in the home country. Frequently developed countries offer higher base salaires than cpmparable jobs and positision in the company in other less developed countries. • Foreign Service Premium: Extra pay the expatriate receives for working outside their country fo origin. Inducement for foreign postings • Taxation: The expatriate may have to pay income tax to both the home and host country governments unless a host country has a reciprocal tax treaty with the expatriates home country. • Benefits: Receive the same level of medical and pension benefits abroad that they received at home. This can be costly for the firm. 84 LO7: • The Concerns of Organized Labour • Better pay, job security and better working conditions • Bargaining power – strikes and work protests • The Strategy of Organized Labour • Establish International labour organizations • Lobbying for national legislation • Trying to achieve international regulations • Approached to Labor Relations • Historically decentralized activities • Changing towards centralized 85 86