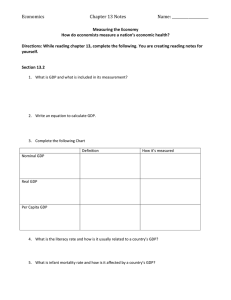

AP Macro Economics Review Peggy Pride, Presenter Production Possibility Curve B2 Capital goods Capital goods B D2 D A B C F W Consumer goods D E Consumer goods Market Equilibrium P r i c e Supply Pe Demand Qe Quantity A change in Demand versus a change in the Quantity Demanded Change in Demand Change in Quantity Demanded √ Moves the curve •Income •Future Expectations •# of Buyers √ Moves Along the SAME curve • Caused only by Price change. •Consumer Information •Taste and Preference •Substitues and Complements Price Change Price of Corn P CORN P $5 4 3 2 1 QD 10 20 35 55 80 $5 4 3 2 1 o D 10 20 30 40 50 60 70 80 Quantity of Corn Q GRAPHING DEMAND Price of Corn Increase in Quantity Demanded P CORN P $5 4 3 2 1 QD 10 30 20 40 35 60 55 80 80 + $5 4 3 2 1 o Increase in Demand 10 20 30 40 50 60 70 80 Quantity of Corn D’ D Q A change in Supply versus a change in the Quantity Supplied Change in Supply Change in Quantity Supplied √ Moves the curve •Costs of Production •Future Expectations •# of Sellers √ Moves Along the SAME curve • Caused only by Price change. •Taxes and Subsidies •Prices of goods using same resources •Time period of production Price Change Price of Corn P CORN P $5 4 3 2 1 QD 10 20 35 55 80 S $5 4 3 2 1 o 10 20 30 40 50 60 70 80 Quantity of Corn Q GRAPHING SUPPLY Price of Corn P $5 4 3 2 1 Increase in Supply S S’ CORN P QS $5 4 3 Increase 2 in Quantity 1 Supplied o 10 20 30 40 50 60 70 80 Quantity of Corn Q 60 80 50 70 35 60 20 45 5 30 Verbal Clues • • • • • • • • • • • Use a correctly labeled graph and show… Analyze the effect… Explain the mechanism… Identify the area of… Show the impact… Calculate (number and process)… Show price and output… Compare before and after… Two separate graphs correctly labeled graph Side-by-side What is the relationship… Distinguish between: • Price and price level • AD and D ASlr Price Level • AS and S ASsr PL 1 AD1 o Qf Real domestic output GROSS DOMESTIC PRODUCT Defining… Market Value of the total goods and services produced within the boundaries of the US whether by Americans or foreigners in one year. GROSS DOMESTIC PRODUCT Expenditures Approach Consumption by Households Income Approach Wages + Expenditures + Rents + Interest + Profits + Statistical by Foreigners Adjustments + Investment G by Businesses = = D + Government P Purchases NOMINAL GDP vs. REAL GDP Nominal GDP … reflects the current price level of goods and services and ignores the effect of inflation on the growth of GDP. … this measure is called Current Dollar GDP. Real GDP … measures the value of goods and services adjusted for change in the price level. It will reflect the real change in output. … This measure is called the Constant Dollar GDP. … indicates what the GDP would be if the purchasing power of the dollar has not changed from what it was in a base year. The government currently uses 2000 as its base year for Real GDP measurement. GDP Price Index Price Index in a given = year Real GDP = Price of market basket in specific year Price of same market basket in base year Nominal GDP Price Index (in hundredths) x 100 Disposable Income By subtracting from Personal Income, the dollars lost to taxes, we have the Disposable Income. This is the “bottom” line of national income accounting. Disposable Income = C + S Unemployment Rate = Unemployed Labor Force Frictional – “temporary”, “transitional”, “short-term” (“between jobs” or “search” unemployment) (seasonal work) Structural – “technological” or “long term”. basic changes in the “structure” of the labor force which make certain “skills obsolete”. Cyclical – “economic downturns” in the business cycle. The Full employment rate of unemployment or the Natural Rate of Unemployment (NRU) is present when the economy is producing its potential output. The Natural Rate of Unemployment exists when the cyclical unemployment is zero. GDP Gap and Okun’s Law √ The basic loss of unemployment is forgone output. √ Potential GDP is the capacity of the economy assuming the Natural Rate of Unemployment. The growth of the Potential GDP assumes the normal growth rate of the real GDP. √ GDP GAP is the amount by which actual GDP falls short of potential GDP For every 1% the unemployment rate exceeds the natural rate…Approximately a 2% GDP Gap occurs. Inflation A rising of the general level of prices Price of the market basket CPI = in the particular year x 100 Price of the same market basket in 2000 Producer Price Index (PPI) Prices at the wholesale or production level which are early indicators of inflation. Real and Nominal Income Nominal income … is the number of dollars earned as rent, wages, interest or profit Real income… measures the amount of goods and services nominal income can buy. √ If nominal income rises faster than price level, real income will rise. √ If the price level increases faster than nominal income, then real income will fall. √ Your real income falls only when nominal income fails to keep up with inflation. Long Run Equilibrium Price Level ASlr PL1 o In the extended ASsr AD-AS model, equilibrium occurs at the intersection of AD and the ASlr and the ASsr. Qf is the amount of Real GDP at full employment. AD1 Qf Real domestic output Price Level DEMAND-PULL INFLATION and Self-Correction PL3[7%] ASlr AS2sr ASsr c b PL2[5%] PL1[2%] Short Run— Increase in AD shows point b a AD2 o AD1 Qf Long Run Nominal Wages rise and AS2sr moves left. RGDP returns to previous level on Aslr But…PL rises even more to PL3! Y2 Real domestic output Price Level COST-PUSH INFLATION with government action ASlr AS2sr ASsr c PL3[5%] b PL2[3%] a PL1[2%] o Y Q 2 f AD1 If government stimulates AD to dotted line, an inflationary spiral will occur…PL3 at Qf. We have Full Employment but at a higher price level. AD2 Real domestic output Price Level COST-PUSH INFLATION with NO government action ASlr AS2sr c PL3[5%] a PL1[2%] o If government lets ASsr the recession take its course, nominal wages will fall in the long run and return to point a…PL1 at Qf. AD1 Qf Real domestic output Price Level Recession ASlr AS1sr AS2sr a PL1[5%] PL2[3%] b This decline in the price level will eventually shift the AS1sr to AS2sr. Price level declines to PL3 at Qf . Shown at point c. c PL3[2%] AD1 o AD2 Y2 Qf Real domestic output The Phillips Curve Concept Annual rate of inflation 7 As inflation declines... 6 5 4 Unemployment increases 3 2 1 0 PC 1 2 3 4 5 6 7 Unemployment rate (percent) The Phillips Curve Summary The short run Phillips Curve is downward sloping. Aggregate Demand changes move along the same short run Phillips curve. Aggregate Supply changes create new short run Phillips curves. √ In the long run, there is not a stable relationship between unemployment and inflation. √ The long-run Phillips curve is the vertical line at the natural rate of unemployment. Expansionary Fiscal Policy Goal: To Reduce Unemployment and Effects of Recession… √ Increase Government Spending √ Decrease Tax Rates …Or Combination of the Two Contractionary Fiscal Policy Goal: To Reduce Demand—Pull Inflation… √ Decrease Government Spending √ Increase Tax Rates …Or Combination of the Two EXPANSIONARY FISCAL POLICY the multiplier at work... $20 billion decrease in tax rates; $15 billion in new consumption spending Price level AS MPS = .25 $60 billion increase in Aggregate Demand P2 P1 AD1 $490 $550 AD2 Real GDP (billions) CONTRACTIONARY FISCAL POLICY the multiplier at work... $20 billion increase in tax rates; $15 billion lost in consumption spending Price level AS MPS = .25 $60 billion decrease in Aggregate Demand P2 P1 AD4 $490 $550 AD3 Real GDP (billions) Built-in Stability Some changes in relative levels of government expenditures and taxes occur automatically. This is not like discretionary changes in spending and tax rates since these net tax revenues vary directly with RGDP. …tends to increase the government deficit (or reduce the surplus) during recession or to increase the surplus ( or reduce the deficit) during inflation without requiring specific action by policy makers. Real Interest Rate, (percent) Crowding —Out Effect Increased demand for loanable funds by government raises the interest rate. S i% i% D2 D LF0 LF1 Quantity of Loanable Funds Fiscal policy weakened by NET EXPORT EFFECT Expansionary fiscal policy Problem: Recession More government spending and/or lower taxes Contractionary fiscal policy Problem: Inflation Lower government spending and/or higher taxes Higher domestic interest rates (crowding-out effect) Lower domestic interest rates (government role in loanable funds market is less) Increased foreign demand for dollars (foreigners want to earn higher interest) Dollar appreciates Net Exports decline (AD decreases, partially offsetting expansionary policy) Decreased foreign demand for dollars (foreigners find higher rates elsewhere) Dollar depreciates Net Exports increase (AD increases, partially offsetting contractionary policy) Supply-Side Economics Supply-Side Economics aims to manipulate aggregate supply by enacting policies designed to stimulate incentives to work, to save and invest (including measures to encourage entrepreneurship). These policies may include tax cuts which will increase disposable incomes, thus increasing household saving and increase the profitability of investments by businesses. •Tax cut stimulates more consumption, saving and investment to increase AD. •The new investment moves the AS curve to the right. Work incentives push more workers into employment and they spend and save increasing AD further. •Low taxes act to push risk takers to move toward new production methods and new products. Laffer Curve …shows the relationship between tax rates and tax revenues √ Up to a point, higher tax rates will result in larger tax revenues. √ But still higher tax rates will adversely affect incentives to work and produce, reducing the size of the tax base and reducing tax revenues. √ Lower tax rates will lessen tax evasion and avoidance, and reduce government transfer payments. THE LAFFER CURVE Tax rate (percent) 100 l 0 Tax revenue (dollars) THE LAFFER CURVE Tax rate (percent) 100 m l 0 Tax revenue (dollars) THE LAFFER CURVE 100 Tax rate (percent) n m l 0 Tax revenue (dollars) THE LAFFER CURVE Tax rate (percent) 100 n m m Maximum Tax Revenue l 0 Tax revenue (dollars) M M O N E Y E A S U R E S • Large time deposits + • Money market accounts • Savings deposits • Small time deposits M3 M2 + • Checkable deposits • Travelers checks • Currency MI The Money Market i% i%1 Sm Supply of money is a vertical line since monetary authorities (FED) and financial institutions have provided Dm the economy with a certain stock of money. $$ demanded Creation of Money in the Banking System Money supply can be increased when: 1. Banks issue loans to customers and receive a demand deposit. 2. Banks buy securities from the public and credit a demand deposit for the cost. Money supply will be decreased when: 1. Customers repay loans and take money from their demand deposit. 2. Banks sell securities to the public and a demand deposit is reduced to pay for the bond. √ One bank can loan only its excess reserves and is limited by those reserves in creating money. √ The banking system creates a “multiplied” amount. The Money Multiplier 1 = Money Multiplier Required reserve ratio Maximum DemandDeposit creation = Excess reserves x Money Multiplier Currency drain and no creditable customers will decrease the amount multiplied. EASY MONEY Goal: Cheap, available credit; increase the money supply MS i% In C AD PL RGDP Actions • FED will buy government bonds from banks and the public • FED will lower the legal reserve ratio • FED will lower the discount rate charged to member banks Results ¦ Increase the bank excess reserves, and banks can make more loans. An increase in the money supply will lower the interest rate, causing Investment to increase and equilibrium GDP to rise. The amount of the change will be dependent on the size of the Income Multiplier (1/MPS) Easy money is reinforced by the Net Export Effect Easy Monetary Policy And Equilibrium GDP Real rate of interest, i Sm1 Sm2 Sm3 10 10 8 8 6 6 Dm 0 Quantity of money demanded and supplied PL3 PL2 PL1 0 Amount of investment, i If the Money Supply Increases to Stimulate the Economy… Interest Rate Decreases Investment Increases AD & GDP Increases AD3(I=$25) with slight inflation AD2(I=$20) Increasing money supply AD1(I=$15) continues the growth – Real domestic output, GDP but, watch Price Level. AS Price level Investment Demand Tight Money Goal: Restrict credit; decrease the money supply MS i% Actions Results In • FED will sell government bonds to banks and the public ¦ Decrease the bank excess reserves, and banks will issue fewer loans C AD PL RGDP • FED will raise the legal reserve ratio • FED will raise the discount rate charged to member banks An decrease in the money supply will raise the interest rate, causing Investment to increase and equilibrium GDP to fall. The amount of the change will be dependent on the size of the Income Multiplier (1/MPS) Tight money is reinforced by the Net Export Effect Tight Monetary Policy And Equilibrium GDP Real rate of interest, i Sm3 Sm2 Sm1 10 10 8 8 6 6 Dm 0 Quantity of money demanded and supplied PL1 PL2 PL3 0 Amount of investment, i If the Money Supply Decreases to “cool” the Economy… Interest Rate Increases Investment Decreases AD & GDP Decreases with lower PL AD1(I=$25) AD2(I=$20) Decreasing money supply AD3(I=$15) continues the “cooling” – Real domestic output, GDP as Price Level falls. AS Price level Investment Demand Nominal Rate = Real Interest rate + expected rate of inflation Real Interest Rate = Nominal rate—expected rate of inflation ANTICIPATED INFLATION 11% = + 5% Nominal Interest Rate Real Interest Rate 6% Inflation Premium Money Market Graph—Nominal Interest Rate i % Sm The supply of money is vertical no matter what the interest rate is on the vertical axis. The FED controls the supply of money. i%e Qe Q of $$ demanded The demand for money is composed of the Dmtransaction demand and asset demand. Loanable Funds Market—Real Demand is: Interest Rate r SLF • Business for investment • Consumer for spending re • Government for Deficit spending DLF Qe Q of LF Supply is mostly from private savings Changes in the real interest rate caused by movements of demand (from borrowers) and supply (from savers). Classical View: determines the output at Qf √ AD is stable and determines the price level as long as money supply is stable. √ If AD is unstable, prices and wages adjust. Price Level √ AS is vertical and AS P1 P2 AD1 AD2 Qf Real Domestic Output A shift to AD2 shows that the price level declines. Keynesian View: AS Price Level √ Product prices and wages are downward inflexible √ AS is horizontal up to P1 Qf then becomes AD1 vertical AD2 √ If AD is unstable, Q2 Qf changes in AD have no Real Domestic Output effect on PL but affect Movement from AD1 to AD2 RGDP. reduces the Real GDP but the PL remains constant. NEW CLASSICAL VIEW OF SELF-CORRECTION Price Level Self-Correction P3 P2 P1 AD increases ASLR AS1 moves economy from a to b. Price level rises (P2) and then c self-correction b to c by shifting a AD2 left to AS2 as Nominal Wages AD1 rise. AS2 Q1 Real Domestic Output Monetary rule : supported by Monetarists and other Neo-Classical Economists like Rational Expectationists. …directs the Fed to expand the money supply each year at the same annual rate as the typical growth of the economy’s productive capacity. Discretionary Fiscal and Monetary Policy (especially monetary): supported by Mainstream Economists. Summary of Alternative Views New Classical Economics Issue Monetarism Rationa l expectations Stable in long run at natural ra te of unemployment Inappropriate monetary policy Stable in long run at natural ra te of unemployment Unanticipated AD and AS shocks in the short r un Monetary rule Monetary rule By directly changing AD which changes GDP No effect on o utput because price-level changes are anticipated View of velocity of money How fiscal policy affects the econo my Active fiscal and monetary By changing interest rat es, changing investment and real GDP Unstable Stable No consensus Changes AD and GDP via the multipl ier No effect unless money suppl y changes View of Cost push infl ation Possibl e (wagepush, AS shock) Imp ossible in long run in absence of excessive money suppl y gro wth No effect on o utput because price-level changes are anticipated Imp ossible in long run in absence of excessive money suppl y gro wth View of the private economy Cause of observed stabili ty of private economy Appropriate macro policy How chang es in money suppl y affect the econo my Mainstream Macroeconomics Keynesian Based Potenti ally unstable Investment does not equal saving causing chang es in AD; AS shocks Deficits, Surpluses and Debt A budget deficit is the amount by which the government expenditure exceeds the government revenue in a particular year. A budget surplus is the amount by which the government revenue exceeds the government expenditure in a particular year. The National or Public Debt is the accumulated deficits and surpluses of the government over time. Types of Budgets Annually Balanced—procyclical Cyclically Balanced—to hard to predict cycles Functional Finance-work for goals √ Comparative Advantage …is the ability to produce an item at a lower opportunity cost. Resources are scarce, so that one can only produce more of one product by taking the resources away from another. It means that total world output will be greatest when each good is produced by the nation which has the lowest domestic opportunity cost. √ As a result of trade, countries that trade products based on their own specialization will have more of BOTH products (produced and traded for). √ Terms of Trade…the exchange ratio between goods traded. This ratio explains how the gains from international specialization and trade are divided among the trading nations; it depends on the world supply and demand for the two products. Flexible exchange rates S $ Price of Foreign Currency The intersection will be the exchange rate. $fc D Qfc Quantity of Foreign Currency A nation’s Balance of Payments records all the transactions that take place between its residents and the residents of a foreign nation. Current Account Capital Account Mdse. Trade Real Investment Services Trade Financial Investments Net Investment Income Net Transfers = Official Reserves Account + to balance a deficit —to balance a surplus The Market For Currency S FC Depreciates; $ Appreciates FC price of dollars Dollar price of foreign currency S Dollar Depreciates; FC Appreciates FCP/$ Dollar Appreciates; FC Depreciates $P/fc D FC Appreciates; $ Depreciates Q D Q Quantity of foreign currency Quantity of $ Determinants of exchange rates: Changes in tastes Changes in relative incomes Changes in relative prices Changes in relative interest rates Speculation in currencies