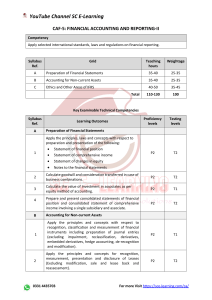

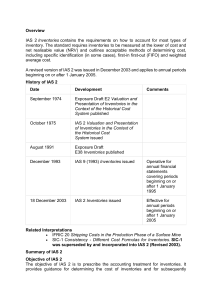

1. Accounting for Intangible Assets 2. Accounting for capital, funds and financial results 3. Accounting for cash and settlements 4. Accounting for Financial Assets 5. Accounting for fixed assets and intangible assets 6. Accounting for Inventories 7. Accounting for labor and wages 8. Accounting for materials 9. Accounting for products, goods (works, services) and their sale 10.Accounting for Shareholders’ Equity ( Owners' Equity ) 11.Accounting for taxes and other obligatory payments 12.Accruals and prepayments 13.Acquisition of intangibles 14.Amortization 15.Balance Sheet 16.Business Transactions and the Accounting Equation 17.Capital and Revenue Expenditure 18.Cost Accounting 19.Depreciable Assets 20.Depreciation Methods 21.Disposal Account 22.Double entry bookkeeping 23.Financial statements 24.Goodwill 25.IAS 16 Property, plant and equipment 26.IAS 21 The Effects of Changes in Foreign Exchange Rates 27.IAS38 Treatment of Research and Development costs 28.Impact of Business Transactions on the Accounting Equation 29.Income Statement 30.Initial Recognition and Measurement of Intangible Assets 31.Intangible Assets 32.Inventories 33.Inventory Accounting – IAS 2 34.Inventory valuation methods 35.Investment Accounting 36.Main disclosure requirements of IAS38 37.Main disclosure requirements of IFRS3 38.Marginal Costing vs Absorption Costing 39.Material Accounting 40.Nature of Business and Accounting 41.Non-Depreciable Asset 42. Overheads 43.Retained Earnings 44.Revaluation 45.Revaluation of non-current assets 46.Role of Accounting in Business 47.State the accounting equation and define each element of the equation. 48.Statement of Cash Flows 49.The Accounting Equation Elements or Classifications 50.The statement of financial position and statement of profit or loss