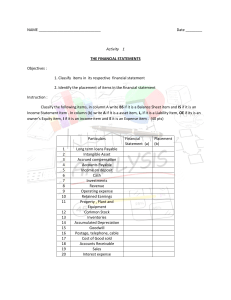

Journal Entry ALFRESCO MARKETING Journal Entry June 30, 2018 June 1, Furniture and Equipment 2018 201 Mabuhay, Capital ₱ 30,000.00 ₱ 30,000.00 501 To record purchase of laptop recorded as additional investment June 2, Rent Payable 2018 Utilities Payable 408 ₱ 10,000.00 409 ₱ 1,000.00 Creditable Income Tax Withheld 410 ₱ 500.00 Cash in Bank 102 ₱ 10,500.00 To record rent and utilities payable less 5% creditable Income Tax Withheld for the month of May June 2, VAT Payable 2018 411 Cash in Bank ₱ 2,058.15 ₱ 2,058.15 102 To record payment to BIR for the VAT June 2, Withholding Taxes Payable 2018 406 Cash in Bank ₱ 729.88 ₱ 729.88 102 To record payment to BIR for withholding tax June 2, Cash on Hand 2018 101 ₱ 3,158.75 Sales Discount 602 ₱ 166.25 Output Tax 411.2 ₱ 356.25 Sales 601 ₱ 2,968.75 To record sales to Dr. Eva Perez with a 5% sales discount June 3, Cash on Hand 2018 Accounts Receivable 101 ₱ 1,235.00 104 ₱ 3,705.00 Output Tax 411.2 ₱ 529.29 Sales 601 ₱ 4,410.71 To record sales to Philippine Christian House in terms of 25% dp with check number PNB 1008848 June 4, Cash in Bank 2018 102 ₱ 6,547.50 Sales Discount 602 ₱ 180.80 Output Tax 411.2 ₱ 21.70 Accounts Receivable ₱ 6,750.00 104 To record collection of pending payment of International Supermarket for May in terms of 3/7, n/15 with check number 789321 June 4, Repairs & Maintenance Expense 2018 814 Petty Cash Fund ₱ 1,000.00 ₱ 1,000.00 103 To record repair and maintenance expense on petty cash fund June 6, Cash in Bank 2018 102 Accounts Receivable 104 ₱ 9,825.00 ₱ 9,825.00 To record collection of pending payment of Zen's Spa with check number 542310 June 6, Cash in Bank 2018 102 Cash on Hand ₱ 24,393.75 ₱ 24,393.75 101 To record collections deposits from June 1 to 6 including the deposit in transit June 7, Mabuhay, Personal 2018 502 Petty Cash Fund ₱ 200.00 ₱ 200.00 103 To record petty cash withdrawal of Mr. Mabuhay for personal use June 7, Cash on Hand 2018 Accounts Receivable 101 ₱ 4,050.00 104 ₱ 12,150.00 Output Tax 411.2 ₱ 1,735.71 Sales 601 ₱ 14,464.29 To record sales from Shop Here Supermarket in terms of 25% dp with BPI Check 980314 June 8, Pag-ibig Premiums Expense 2018 806 ₱ 1,000.00 SS and EC Premiums Expense 809 ₱ 8,950.00 Medicare Premiums Expense 807 ₱ 5,940.00 Cash on Hand To record payment of pag-ibig, SS and Ec, and Medicare premiums expense 101 ₱ 15,890.00 June 8, Accounts Payable 2018 401 ₱ 2,700.00 Purchase Discount 703 ₱ 54.00 Cash in Bank 102 ₱ 2,646.00 To record settlement of accounts payable to Ever Bright Candles June 8, Gas and Oil 2018 VAT Payable Petty Cash Fund 805 ₱ 446.43 411 ₱ 53.57 ₱ 500.00 103 To record petty cash fund paid on gas and oil June 9, Cash on Hand 2018 101 ₱ 3,800.00 Output Tax 411.2 ₱ 407.14 Sales 601 ₱ 3,392.86 To record sold gooods to Joni Bulatao on cash June 9, Creditable Income Tax Withheld 2018 410 Cash on Hand ₱ 500.00 ₱ 500.00 101 To record payment of creditable income tax withheld to BIR June 9, Accounts Payable 2018 401 Cash on Hand To record settlement of accounts of the month of May to Nature's Best 101 ₱ 5,850.00 ₱ 5,850.00 June 10, Cash on Hand 2018 101 Accounts Receivable ₱ 3,705.00 ₱ 3,705.00 104 To record the payment of Philippine Christian House with PNB Chk. 108873 June 10, Furniture and Equipment 2018 201 ₱ 13,500.00 411.1 ₱ 1,620.00 Input Tax Accounts Payable ₱ 15,120.00 401 To record the purchase of furniture to Hall of Fame June 11, Petty Cash Fund 2018 103 Cash on Hand ₱ 1,700.00 ₱ 1,700.00 101 To record the replenishment of Petty Cash Fund June 11, Cash on Hand 2018 Accounts Receivable 101 ₱ 3,700.00 104 ₱ 11,100.00 Output Tax 411.2 ₱ 1,585.71 Sales 601 ₱ 13,214.29 To record sales from Vasquez Grocery with PCIB Chk 542347 for the down payment June 11, Purchases 2018 VAT Payable Accounts Payable 701 ₱ 20,892.86 411 ₱ 2,507.14 401 ₱ 23,400.00 To record the purchase of goods from Nature Best Co.'s June 13, Supplies Expense 2018 811 ₱ 275.00 411.1 ₱ 33.00 Input Tax Petty Cash Fund ₱ 308.00 103 To record the purchase of supplies on petty cash June 13, Cash in Bank 2018 102 Cash on Hand ₱ 15,225.00 ₱ 15,225.00 101 To record the collections deposited June 14, Cash on Hand 2018 101 Accounts Receivable ₱ 12,150.00 ₱ 12,150.00 104 To record the collections of accounts receivable from Shop Here Supermarket with BPI Chk 980346 June 14, Accounts Payable 2018 401 Cash on Hand ₱ 11,700.00 ₱ 11,700.00 101 To record the 50% account due payment to Nature's Best Co on account June 15, Cash on Hand 2018 Accounts Receivable Output Tax 101 ₱ 1,005.00 104 ₱ 3,015.00 411.2 ₱ 430.71 Sales ₱ 3,589.29 601 To record the sold goods to Paula's Mini Mart on cash June 15, Salaries Expense 2018 810 ₱ 54,000.00 Withholding Taxes Payable 406 ₱ 364.94 Pag-ibig Premiums Payable 405 ₱ 250.00 SS and EC Premiums Payable 403 ₱ 1,453.25 MCR Premiums Payable 404 ₱ 1,485.00 Cash in Bank 102 ₱ 50,446.81 To record salaries expense on cash in bank June 15, Purchases 2018 701 ₱ 38,571.43 411.1 ₱ 4,628.57 Input Tax Accounts Payable ₱ 43,200.00 401 To record the purchases to Wonder Cash on account June 17, Repairs & Maintenance Expense 2018 814 ₱ 403.62 411.1 ₱ 48.43 Input Tax Petty Cash fund ₱ 452.05 103 To record repair service expense to Extelcom on petty cash fund June 17, Cash on Hand 2018 101 ₱ 2,850.00 Output Tax 411.2 ₱ 305.36 Sales 601 ₱ 2,544.64 To record sales from Marietta Milan June 18, Cash in Bank 2018 102 Cash on Hand ₱ 16,005.00 ₱ 16,005.00 101 To record the collections deposited June 20, Accounts Receivable 2018 104 ₱ 3,600.00 Input Tax 411.1 ₱ 385.71 Purchase Return & Allowances 704 ₱ 3,214.29 To record the return good to Wonder Care on account June 22, Repairs & Maintenance Expense 2018 814 ₱ 710.10 411.1 ₱ 85.20 Input Tax Petty Cash Fund ₱ 795.30 103 To record petty cash paid for repairs. June 22, Cash on Hand 2018 Accounts Receivable 101 ₱ 4,200.00 104 ₱ 12,600.00 Output Tax 411.2 ₱ 1,800.00 Sales 601 ₱ 15,000.00 To record sales from Fairview Grand Hotel with BPI Chk 412859 June 23, Cash on Hand 2018 101 ₱ 2,850.00 Accounts Receivable 104 ₱ 8,550.00 Output Tax 411.2 ₱ 1,221.43 Sales 601 ₱ 10,178.57 To record sales from International Supermarket with Citibank Chk 789340 June 23, Accounts Payable 2018 401 Cash in Bank ₱ 19,800.00 ₱ 19,800.00 102 To record the payment on half of the account to Wonder Care June 25, Purchases 2018 701 ₱ 4,821.43 411.1 ₱ 578.57 Input Tax Cash on Hand ₱ 5,400.00 101 To record purchases from Ever Bright June 27, Cash on Hand 2018 101 Accounts Receivable ₱ 6,300.00 ₱ 6,300.00 104 To record the collections of accounts receivable from Shop Here Supermarket with BPI Chk 980346 June 27, Cash in Bank 2018 102 Cash on Hand To record collections deposited 101 ₱ 13,350.00 ₱ 13,350.00 June 28, Gas and Oil 2018 805 ₱ 312.50 411.1 ₱ 37.50 Input Tax Petty Cash Fund ₱ 350.00 103 To record petty cash fund paid on gas and oil June 29, Cash on Hand 2018 101 ₱ 3,847.50 Output Tax 411.2 ₱ 412.23 Sales 601 ₱ 3,435.27 To record the sold goods on cash June 30, Salaries Expense 2018 810 ₱ 54,000.00 SS and EC Premiums Payable 403 ₱ 364.94 Pag-ibig Premiums Payable 405 ₱ 250.00 MCR Premiums Payable 404 ₱ 1,453.25 Withholding Taxes Payable 406 ₱ 1,485.00 Cash on Hand 101 ₱ 50,446.81 To record cash paid on employee's salary General Ledger ALFRESCO MARKETING Journal Entry June 30, 2018 Account: Cash on Hand Balance Date Particulars F Debit Credit Debit Credit 2 To record sales to Dr. Eva Perez with a 5% sales discount 101 3,158.75 3,158.75 3 To record sales to Philippine Christian House in terms of 25% dp with check number PNB 1008848 101 1,235.00 4,393.75 6 To record collections deposits from June 1 to 6 including the deposit in transit 101 7 To record sales from Shop Here Supermarket in terms of 25% dp with BPI Check 980314 101 4,050.00 8 To record payment of pag-ibig, SS and Ec, and Medicare premiums expense 101 9 To record sold gooods to Joni Bulatao on cash 101 3,800.00 9 To record payment of creditable income tax withheld to BIT 101 500.00 (24,146.25) 9 To record settlement of accounts of the month of May to Nature's Best 101 5,850.00 (29,996.25) 10 To record the payment of Philippine Christian House with PNB Chk. 108873 101 3,705.00 11 To record the replenishment of Petty Cash Fund 101 11 To record sales from Vasquez Grocery with PCIB 101 3,700.00 Chk 542347 for the down payment 13 To record the collections deposited 101 14 To record the collections of accounts receivable from Shop Here Supermarket with BPI Chk 980346 101 12,150.00 20,000.00 (15,606.25) (11,556.25) 15,890.00 (27,446.25) (23,646.25) (26,291.25) 1,700.00 (27,991.25) (24,291.25) 15,225.00 (39,516.25) (27,366.25) 14 To record the 50% account due payment to Nature's Best Co on account 15 To record the sold goods to Paula's Mini Mart on 101 1,005.00 cash (38,061.25) 17 To record sales from Marietta Milan 101 2,850.00 (35,211.25) 18 To record the collections deposited 101 22 To record sales from Fairview Grand Hotel with BPI Chk 412859 101 4,200.00 (47,016.25) 23 To record sales from International Supermarket with Citibank Chk 789340 101 2,850.00 (44,166.25) 25 To record purchases from Ever Bright 101 27 To record the collections of accounts receivable from Shop Here Supermarket with BPI Chk 980346 101 6,300.00 27 To record collections deposited 101 29 To record the sold goods on cash 101 3,847.50 30 To record cash paid on employee's salary 101 Account: Cash In Bank Date Particulars 101 11,700.00 (39,066.25) 16,005.00 (51,216.25) 5,400.00 (49,566.25) (43,266.25) 13,350.00 (56,616.25) (52,768.75) 50,446.81 (103,215.56) Balance F Debit Credit Debit 2 To record rent and utilities payable less 5% creditable Income Tax Withheld for the month of 102 May Credit 10,500.00 10,500.00 2 To record payment to BIR for the VAT 102 2,058.15 12,558.15 2 To record payment to BIR for withholding tax 102 729.88 13,288.03 4 To record collection of pending payment of International Supermarket for May in terms of 3/7, 102 6,547.50 n/15 with check number 789321 6 To record collection of pending payment of Zen's 102 9,825.00 Spa with check number 542310 6 To record collections deposits from June 1 to 6 including the deposit in transit 102 20,000.00 6,740.53 3,084.47 23,084.47 8 To record settlement of accounts payable to Ever Bright Candles 13 To record the collections deposited 15 To record salaries expense on cash in bank 18 To record the collections deposited 23 To record the payment on half of the account to Wonder Care 27 To record collections deposited 102 2,646.00 20,438.47 102 15,225.00 102 35,663.47 50,446.81 102 16,005.00 102 14,783.34 1,221.66 19,800.00 18,578.34 102 13,350.00 5,228.34 Account: Petty Cash Fund Balance Date Particulars F Debit Credit Debit Credit 4 To record repair and maintenance expense on petty cash fund 1,000.00 1000.00 7 To record petty cash withdrawal of Mr. Mabuhay for personal use 200.00 1200.00 8 to record petty cash fund paid on gas and oil 500.00 1700.00 11 To record the replenishment of Petty Cash Fund 13 To record the purchase of supplies on petty cash 308.00 308.00 17 To record repair service expense to Extelcom on petty cash fund. 452.05 760.05 22 To record petty cash paid for repairs. 795.30 1555.35 28 To record petty cash fund paid on gas and oil 350.00 1905.35 1,700.00 0.00 0.00 Account: Accounts Receivable Balance Date Particulars F Debit Credit Debit 3 To record sales to Philippine Christian House in terms of 25% dp with check number PNB 1008848 4 To record collection of pending payment of International Supermarket for May in terms of 3/7, n/15 with check number 789321 3,705.00 Credit 3,705.00 6,750.00 3045.00 6 To record collection of pending payment of Zen's Spa with check number 542310 7 To record sales from Shop Here Supermarket in terms of 25% dp with BPI Check 980314 10 To record the payment of Philippine Christian House with PNB Chk. 108873 11 To record sales from Vasquez Grocery with PCIB Chk 542347 for the down payment 14 To record the collections of accounts receivable from Shop Here Supermarket with BPI Chk 980346 15 To record the sold goods to Paula's Mini Mart on cash 3,015.00 20 To record the return good to Wonder Care on account 3,600.00 1,140.00 22 To record sales from Fairview Grand Hotel with BPI Chk 412859 12,600.00 13,740.00 23 To record sales from International Supermarket with Citibank Chk 789340 8,550.00 22,290.00 27 To record the collections of accounts receivable from Shop Here Supermarket with BPI Chk 980346 9,825.00 12870.00 12,150.00 720.00 3,705.00 11,100.00 4425.00 6,675.00 12,150.00 5475.00 2460.00 6,300.00 15,990.00 Account: Furniture & Equipment Balance Date Particulars F Debit Credit Debit 1 To record purchase of laptop recorded as additional investment 201 30,000.00 30,000.00 10 To record the purchase of furniture to Hall of Fame 201 13,500.00 43,500.00 Account: Accounts Payable Date Particulars F Debit Credit Balance Credit Debit Credit 8 To record settlement of accounts payable to Ever Bright Candles 401 2,700.00 2,700.00 9 To record settlement of accounts of the month of May 401 5,850.00 to Nature's Best 8,550.00 10 To record the purchase of furniture to Hall of Fame 401 15,120.00 6570.00 11 To record the purchase of goods from Nature Best Co.'s 401 23,400.00 29970.00 14 To record the 50% account due payment to Nature's Best Co on account 401 11,700.00 15 To record the purchases to Wonder Cash on account 401 23 To record the payment on half of the account to Wonder Care 401 19,800.00 Account: 18270.00 43,200.00 61470.00 41670.00 SS and EC Premiums Payable Balance Date Particulars F Debit Credit Debit Credit 15 To record salaries expense on cash in bank 403 1,453.25 1453.25 30 To record cash paid on employee's salary 403 364.94 1818.19 Account: MCR Premiums Payable Date Particulars Balance F Debit Credit Debit Credit 15 To record salaries expense on cash in bank 404 1,485.00 1485.00 30 To record cash paid on employee's salary 404 1,453.25 2938.25 Account: Pag-ibig Premiums Payable Balance Date Particulars F Debit Credit Debit Credit 15 To record salaries expense on cash in bank 405 250.00 250.00 30 To record cash paid on employee's salary 405 250.00 500.00 Account: Withholding Taxes Payable Balance Date Particulars F Debit Credit Debit 2 To record payment to BIR for withholding tax 406 729.88 15 To record salaries expense on cash in bank 406 364.94 30 To record cash paid on employee's salary 406 1,485.00 Credit 729.88 364.94 1120.06 Account: Creditable Income Tax Withheld Balance Date Particulars F Debit Credit Debit Credit 2 To record rent and utilities payable less 5% creditable Income Tax Withheld for the month of May 410 9 To record payment of creditable income tax withheld to BIT 410 500.00 500.00 500.00 0.00 0.00 Account: VAT Payable Date Particulars F Debit Credit Balance Debit 2 To record payment to BIR for the VAT 411 2,058.15 2,058.15 8 To record petty cash fund paid on gas and oil 411 53.57 2,111.72 11 To record the purchase of goods from Nature Best Co.'s 411 2,507.14 4,618.86 Credit Account: Input Tax Balance Date Particulars F Debit Credit Debit Credit 10 To record the purchase of furniture to Hall of Fame 411.1 1,620.00 1,620.00 13 To record the purchase of supplies on petty cash 411.1 33.00 1,653.00 15 To record the purchases to Wonder Cash on account 411.1 4,628.57 6,281.57 17 To record repair service expense to Extelcom on petty cash fund. 411.1 48.43 6,330.00 20 To record the return good to Wonder Care on account 411.1 22 To record petty cash paid for repairs. 25 To record purchases from Ever Bright 411.1 578.57 6,608.06 28 To record petty cash fund paid on gas and oil 411.1 37.50 6,645.56 385.71 5,944.29 85.20 6,029.49 Account: Output Tax Balance Date Particulars F Debit Credit Debit Credit 2 To record sales to Dr. Eva Perez with a 5% sales discount 411.2 356.25 356.25 3 To record sales to Philippine Christian House in terms of 25% dp with check number PNB 1008848 411.2 4 To record collection of pending payment of International Supermarket for May in terms of 3/7, n/15 with check number 789321 411.2 21.70 7 To record sales from Shop Here Supermarket in terms of 25% dp with BPI Check 980314 411.2 1,735.71 2599.55 9 To record sold gooods to Joni Bulatao on cash 411.2 407.14 3006.69 11 To record sales from Vasquez Grocery with PCIB Chk 542347 for the down payment 411.2 1,585.71 4592.40 15 To record the sold goods to Paula's Mini Mart on cash 411.2 430.71 5023.11 17 To record sales from Marietta Milan 411.2 305.36 5328.47 22 To record sales from Fairview Grand Hotel with BPI Chk 412859 411.2 1,800.00 7128.47 23 To record sales from International Supermarket with Citibank 411.2 Chk 789340 1,221.43 8349.90 29 To record the sold goods on cash 412.23 8762.13 529.29 411.2 885.54 863.84 Account: Rent Payable Balance Date Particulars F Debit Credit Debit 2 To record rent and utilities payable less 5% creditable Income Tax Withheld for the month of May 808 10,000.00 Credit 10,000.00 Account: Utilities Payable Balance Date Particulars F Debit Credit Debit 2 To record rent and utilities payable less 5% creditable Income Tax Withheld for the month of May 813 1,000.00 1,000.00 F Balance Account: Mabuhay, Capital Date Particulars Debit Credit Credit Debit Credit 1 To record purchase of laptop recorded as additional investment 501 30,000.00 30000.00 Account: Mabuhay, Personal Balance Date Particulars F Debit Credit Debit Credit 7 To record petty cash withdrawal of Mr. Mabuhay for personal use 502 200.00 200.00 Account: Sales Balance Date Particulars F Debit Credit Debit Credit 2 To record sales to Dr. Eva Perez with a 5% sales discount 601 2,968.75 2968.75 3 To record sales to Philippine Christian House in terms of 25% dp with check number PNB 1008848 601 4,410.71 7379.46 7 To record sales from Shop Here Supermarket in terms of 25% dp with BPI Check 980314 601 14,464.29 21843.75 9 To record sold gooods to Joni Bulatao on cash 601 3,392.86 25236.61 11 To record sales from Vasquez Grocery with PCIB Chk 542347 for the down payment 601 13,214.29 38450.90 15 To record the sold goods to Paula's Mini Mart on cash 601 3,589.29 42040.19 17 To record sales from Marietta Milan 601 2,544.64 44584.83 22 To record sales from Fairview Grand Hotel with BPI Chk 412859 601 15,000.00 59584.83 23 To record sales from International Supermarket with Citibank Chk 789340 601 10,178.57 69763.40 29 To record the sold goods on cash 601 3,435.27 73198.67 Account: Sales Discount Balance Date Particulars F Debit Credit Debit Credit 2 To record sales to Dr. Eva Perez with a 5% sales discount 602 166.25 166.25 4 To record collection of pending payment of International Supermarket for May in terms of 3/7, n/15 with check number 789321 602 180.80 347.05 Account: Purchases Balance Date Particulars F Debit Credit Debit Credit 11 To record the purchase of goods from Nature Best Co.'s 701 20,892.86 20,892.86 15 To record salaries expense on cash in bank 701 38,571.43 59,464.29 25 To record purchases from Ever Bright 701 4,821.43 64,285.72 Account: Purchase Discount Balance Date Particulars F Debit Credit Debit Credit 8 To record settlement of accounts payable to Ever Bright Candles 703 54.00 54.00 Account: Purchase Returns & Allowances Balance Date Particulars F Debit Credit Debit Credit 20 To record the return good to Wonder Care on account 704 3,214.29 3214.29 Account: Gas and Oil Date Particulars Balance F Debit Credit Debit 8 To record petty cash fund paid on gas and oil 805 446.43 446.43 28 To record petty cash fund paid on gas and oil 805 312.50 758.93 Credit Account: Pag-ibig Premiums Expense Balance Date Particulars F Debit Credit Debit To record payment of pag-ibig, SS and Ec, and Medicare premiums expense 8 Account: Medicare Premiums Expense Date Particulars 806 1,000.00 Credit 1,000.00 Balance F Debit Credit Debit Credit 8 To record payment of pag-ibig, SS and Ec, and Medicare premiums expense Account: SS and EC Premiums Expense 807 5,940.00 5,940.00 Balance Date Particulars F Debit Credit Debit 8 To record payment of SS and EC premiums expense Account: Salaries Expense Date Particulars F Debit 8,950.00 8,950.00 Credit Balance Credit Debit Credit 15 To record salaries expense on cash in bank 54,000.00 54,000.00 30 To record cash paid on employee's salary 54,000.00 108,000.00 Account: Supplies Expense Balance Date Particulars F Debit Credit Debit 13 To record the purchase of supplies on petty cash 811 275.00 Credit 275.00 Account: Repair & Maintenance Expense Balance Date Particulars F Debit Credit Debit 4 To record repair and maintenance expense on petty cash fund 17 To record repair service expense to Extelcom on petty cash fund. 814 403.62 1,403.62 22 To record petty cash paid for repairs. 814 710.10 2,113.72 1,000.00 1,000.00 Credit Trial Balance ALFRESCO Marketing Trial Balance June 30,2018 Account Title Account No. Debit Credit Cash on Hand 101 103,215.56 Cash in Bank 102 5,228.34 Petty Cash Fund 103 1,905.35 Accounts Receivable 104 15,990.00 Furniture and Equipment 201 43,500.00 Accounts Payable 401 41,670.00 SS and EC Premiums Payable 403 1,818.19 MCR Premiums Payable 404 2,938.25 Pag-ibig Premiums Payable 405 500.00 Withholding Taxes Payable 406 1,120.06 Rent Payable 408 10,000.00 Utilities Payable 409 1,000.00 Creditable Income Tax Withheld 410 - Vat Payable 411 4,618.86 Input Tax 411.1 6,645.56 Output Tax 411.2 8,762.13 Mabuhay, Capital 501 30,000.00 Mabuhay, Personal 502 Sales 601 Sales Discount 602 347.05 Purchases 701 64,285.72 Purchase Discount 703 54.00 Purchase Returns and Allowances 704 3,214.29 Gas and Oil 805 - 200.00 73,198.67 758.93 Pag-ibig Premiums Expense 806 1,000.00 Medicare Premiums Expense 807 5,940.00 SS and EC Premiums Expense 809 8,950.00 Salaries Expense 810 108,000.00 Supplies Expense 811 275.00 Repairs & Maintenance Expense 814 2,113.72 TOTAL 273,624.84 273,624.84 ADJUSTING ENTRY Alfresco Marketing Adjusting Entry June 30, 2018 a. SS and EC Premium Expense 6,043.50 SS and EC Premium Payable Medicare Premium Expense 6,043.50 2,970.00 Medicare Premium Payable Pag-ibig Premium Expense 500 10,000.00 Rent Payable 250 250 1905.8 Petty Cash Fund g. Output tax 10,000.00 700 Supplies Expense f Cash in Bank 500 700 Cash in Bank e. Prepaid Supplies 2,970.00 Pag-ibig Premium Payable b. Rent Expense d. Bank Charges VAT Payable 1905.8 8762.13 444.14 Input Tax Utilities Expense 9206.27 1,000.00 Utilities Payable 1,000.00 h. Interest Expense 1587.6 Interest Payable c. Depreciation- Delivert Equipment 1587.6 7,466.60 Accumulated Depreciation- Delivery Equi[ment 7,466.60 Mechandising i. Inventory 71800 Income summary Depreciation- Furniture and Equipment Accumulated Depreciation- Furniture and Equipment 71800 1,886.13 1,886.13 j. Cash on Hand Cash in Bank 3847.5 3847.5 BANK RECONCILIATION STATEMENT ALFRESCO MARKETING Bank Reconciliation Statement June 30, 2018 6,729.41 Cash balance as per bank statement, June 30, 2018 Add: Deposit in transit 3847.50 Lack Deposit 111.15 1005.00 Bank Charges 700.00 ₱ 13033.57 Adjusted cash balance Less: Uncleared Check Overpayment by Dr. Eva Perez Adjusted cash balance 19800.00 166.25 (₱ 6932.71) STATEMENT OF FINANCIAL POSITION ALFRESCO MARKETING Statement of Financial Position June 30, 2018 ASSETS Current Assets Cash on Hand Cash in Bank Petty Cash Fund Accounts Receivable Merchandise Inventory Prepaid Supplies Total Current Assets Noncurrent Assets Furniture and Equipment Depreciation - Furniture & Equipment Accumulated Depreciation - Furniture & Equipment Delivery Equipment Depreciation - Delivery Accumulated Depreciation - Delivery Expense Total Noncurrent Assets Other Assets Deposit for Rent Deposit for Utilities TOTAL ASSETS: LIABILITIES Current Liabilities Accounts Payable SS and EC Premiums Payable MCR Premiums Payable Pag-ibig Premiums Payable Withholding Taxes Payable Rent Payable Utilities Payable Interest Payable Creditable Income Tax Withheld VAT Payable Input Tax Output Tax Total Current Liabilities Mabuhay, Capital TOTAL LIABILITIES AND CAPITAL (30,495.00) 23,987.10 (1,811.15) 28,965.00 129,590.00 563.35 150,799.30 70,000.00 1,883.13 (2,495.63) 90,000.00 7,466.60 (10,133.60) 156,720.50 10,000.00 2,000.00 12,000.00 ₱ 319,519.80 52,020.00 8,950.00 5,940.00 1,000.00 729.88 10,000.00 1,500.00 1,587.60 0.00 (444.14) 0.00 0.00 81,283.34 238,236.46 ₱ 319,519.80 INCOME STATEMENT ALFRESCO MARKETING Income Statement For the month ended June 30, 2018 Revenue Sales Less: Sales Discount Net Sales: Purchases Less: Purchase Returns & Allowances Purchase Discount Net Purchases: 73,198.67 347.05 72,851.62 64,285.72 3,214.29 54.00 Gross Profit: Expenses Salaries Expense Supplies Expense Repairs and Maintenance Gas and Oil SS and EC Premiums Expense Medicare Premiums Expense Pag-ibig Premiums Expense Rent Expense Utilities Expense Interest Expense Bank Charge Total Expenses Income & Expense Summary Net Loss: 3,268.29 61,017.43 11,834.19 108,000.00 25.00 2,113.72 758.93 6,043.50 2,970.00 500.00 10,000.00 1,000.00 1,587.60 700.00 133,698.75 71,800.00 (₱ 50,064.56)