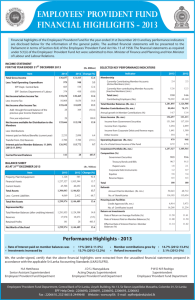

Profit Sharing Compensation Generally, The Agrani Bank shares the profit with each employee of the bank on the basis of its respectable profit. If a reasonable profit is achieved as per as the target, the bank authorities pay 3 times or 3.25 times or 3.50 times or 4 times of their basic salary as “Incentive Bonus” to all the permanent officers and employees employed there. In some cases, if the bank is not able to make a respectable profit, then according to the decision of the bank authorities, all the permanent officers and employees employed there get 1 times or 1.25 times or 1.5 times of their basic salary as "Gracious Allowance". Point to be noted that if a departmental case is pending against an officer or employee for breach of discipline, he will be deprived of the above benefits. According to the judgment of the departmental case, as per the decision of the authority, the said employee can get all the benefits deprived during the trial period in one time full or partial refund or not at all. Festival Bonus Normally, all the officers and employees of the Agrani bank get two festival bonuses in a year. Each festival bonus is equal to the basic salary of each employee. N.B. If an officer or employee is temporarily suspended for any reason as directed by the authorities, he / she will receive two festival bonuses at ½ times of his / her basic salary. Welfare Fund Each officer and employee creates a fund called Welfare Fund by deducting Rs.100, Rs.150, Rs.185, Rs.200 or Rs.250 from their salary according to the grade of the job. In the case of an employee who is seriously ill, he receives assistance from the Welfare Fund as per the decision of the authority based on his / her application. All retiring officers and employees will receive a benefit of Rs. 2 lakhs for welfare fund. Funeral Allowance If an officer or employee dies while in service or in PRL, the officer or employee is immediately paid a funeral allowance of Rs. 50,000 / -. Note that, once the PRL expires, no officer or employee will receive this benefit. General Provident Fund (GPF) vs Central Provident Fund (CPF) First of all, it should be noted that as per the instructions of the AGRANI BANK authorities 2 years ago, the newly joined employees and officers no longer get the benefit of General Provident Fund and instead, they get the benefit of Central Provident Fund. However, the officers and employees staying under the General Provident Fund facility before the directive are still availing this facility. Prior to the directive, officers and employees could avail of either the General Provident Fund or the Central Provident Fund benefit. According to the one-time financial benefit calculation, the General Provident Fund facility is more profitable than the Central Provident Fund facility. Due to this, before the implementation of the new directive on General Provident Fund facility of the bank, all the officers and employees under the then Central Provident Fund facility availed the General Provident Fund facility instead of their Central Provident Fund facility. General Provident Fund (GPF) Officers and employees covered under the General Provident Fund facility will form an personal fund by deducting minimum 5% and maximum 25% of their monthly basic salary. The bank authorities will pay a compounding interest rate of 11% to 13% on the amount deposited in the said fund. At the end of the service, all officers and employees will receive a one-time refund with interest on all money deposited in the General Provident Fund. According to the new guidelines, in the 2021-22 financial year, the initial rate of GPF will be up to Tk 15 lakh and the profit rate will be 13 percent. The profit rate from Tk 15 lakh to Tk 30 lakh has fixed at 12 percent. If the initial GPF is more than Tk 30 lakh, the profit rate will be 11 percent. Central Provident Fund (CPF) All the officers and employees under the Central Provident Fund form a personal fund by deducting minimum 3% and maximum 8% of their monthly basic salary and the bank authorities pay compound interest of 11% to 13% on the deposits of that fund. In addition, the bank authority deposits 10% of their basic salary to all the officers and employees under the Central Provident Fund. However, no profit is paid above 10% of the basic salary paid by the bank authority. At the end of the service, all officers and employees will receive a one-time refund on all money deposited in the Central Provident Fund as like as General provident Fund. Superannuation Fund (SAF) Superannuation is an organizational pension program created by an organization for the benefit of its employees. It is also referred to as an organizational pension plan. Funds deposited in a superannuation account will grow, typically without any tax implications, until retirement or withdrawal. In AGRANI BANK, The bank authorities set up a fund for each officer or employee called a supernatural fund where 75% of the basic salary of the officer or employee is deposited every month on which no interest is paid. The money deposited in the Superannuation Fund is used to pay the monthly pension after retirement of the said officer or employee.