ACCA

O OpenTuition

to Se

Ju pte

ne m

20 be

22 r 2

ex 021

am

s

Advanced Audit

and Assurance

(AAA) (INT/UK)

Spread the word about OpenTuition, so

that all ACCA students can benefit.

How to use OpenTuition:

1) Register & download the latest notes

2) Watch ALL OpenTuition free lectures

3) Attempt free tests online

4) Question practice is vital - you must obtain

also Exam Kit from BPP or Kaplan

OpenTuition Lecture Notes can be downloaded FREE from https://opentuition.com

Copyright belongs to OpenTuition - please do not support piracy by downloading from other websites.

The best things

in life are free

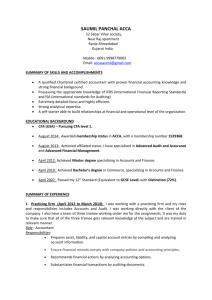

IMPORTANT!!! PLEASE READ CAREFULLY

To benefit from these notes you must watch our free lectures on the

OpenTuition website in which we explain and expand on the topics covered.

In addition question practice is vital!!

You must obtain a current edition of a Revision / Exam Kit. It contains a great

number of exam standard questions (and answers) to practice on.

If you order on line, you can buy study materials from BPP with our 20%

discount code: bppacca20optu

You should also use the free “Online Multiple Choice Tests” which you can find

on the OpenTuition website:

https://opentuition.com/acca/

September 2021 to June 2022 exams

Watch free ACCA AAA lectures

1

Advanced Audit and Assurance (AAA) (INT/UK)

INTRODUCTION TO ADVANCED AUDIT AND ASSURANCE (AAA) (INT/UK)

REGULATION, LEGAL MATTERS AND QUALITY CONTROL

1.

2.

3.

4.

5.

6.

7.

8.

9.

What is Assurance?

Corporate Governance and Auditor Regulation

Appointment as an Auditor

Professional Ethics

Money Laundering

Responding to Non-Compliance with Laws and Regulations (NOCLAR)

Auditors’ Liability

Fraud, Error, the Evaluation of Misstatements and Reporting Control Weaknesses

Quality Control

7

11

17

23

31

35

39

43

47

AUDIT PLANNING AND RISK ASSESSMENT

10.

11.

12.

Audit planning

Risk

Question Practice on Risk

51

57

63

AUDIT EVIDENCE

13.

14.

15.

16.

17.

18.

19.

20.

Audit Evidence

Relevant Accounting Standards

Automated Tools and Techniques

Experts

Internal Audit

Outsourced Accounting Functions

Written Representations

Related Parties

71

75

79

83

85

87

91

93

THE AUDIT OF GROUP FINANCIAL STATEMENTS

21.

Group Audits

97

THE FINAL STAGES OF AN AUDIT

22.

23.

24.

25.

Subsequent Events

The Auditor’s Report 1: Overall Structure

The Auditor’s Report 2: Going concern

The Auditor’s Report 3: Types of Audit Opinion

105

107

115

119

OTHER ASSIGNMENTS

26.

27.

28.

29.

30.

31.

32.

Types of Assignment

Prospective Financial Information

Forensic Audits

Due Diligence

Social, Environmental and Integrated Reporting

The Audit of Performance Information in the Public Sector (International Syllabus only)

Auditing aspects of insolvency (UK Syllabus only)

123

125

131

135

137

141

149

EMPLOYABILITY AND TECHNOLOGY SKILLS

33.

Employability and Technology Skills

153

Only on OpenTuition you can find: Free ACCA notes • Free ACCA lectures • Free ACCA tests • Free ACCA tutor support • The largest ACCA community

September 2021 to June 2022 exams

Watch free ACCA AAA lectures

2

Access FREE ACCA AAA

online resources on OpenTuition:

AAA LECTURES (complete course)

To fully benefit from these notes you should watch our free AAA lectures

AAA Flashcards

Practice key terms and concepts using our AAA flashcards!

AAA Revision lectures

How to tackle the AAA exam, how exam answers are marked and AAA questions debriefs

Ask the AAA Tutor

Post questions to our ACCA tutor

visit https://opentuition.com/acca/aaa/

Only on OpenTuition you can find: Free ACCA notes • Free ACCA lectures • Free ACCA tests • Free ACCA tutor support • The largest ACCA community

September 2021 to June 2022 exams

Watch free ACCA AAA lectures

3

INTRODUCTION TO ADVANCED AUDIT AND

ASSURANCE (AAA) (INT/UK)

1. Warning!

Do not even think of studying this paper if you haven’t already studied paper Strategic Business

Reporting (SBR)/Corporate Reporting (P2).

In every AAA paper, there is at least one question dealing with audit risk and/or audit evidence. Audit

risk is the risk that there might be a material misstatement in the financial statements. Whenever

there is such a risk, the auditor must decide how to respond and that usually means carrying out more

audit work to gather more audit evidence.

What you need to realise is that material misstatements can be caused by two types of error:

๏

The amount is wrong.

๏

The item has not been treated in line with the relevant accounting standards or financial

reporting standards.

For example, if the company incurs research and development expenditure, not only does the auditor

have to obtain evidence about the amount of expenditure, but must also collect evidence that the

expenditure has been written off or capitalised in line with IAS 38 Intangible Assets. Therefore, if the

expenditure has been capitalised, the auditor must collect evidence that the project is technically

viable, that the company can fund its completion….and so on. If you do not know the standard, you

cannot plan to collect the right evidence.

Every accounting standard studied in SBR/P2 sets out rules that govern how amounts in financial

statement are to be displayed and therefore each standard has implications for auditors.

2. The ‘maturity’ of answers required

Consider this: During attendance at a physical inventory count at a client who makes jars of preserved

food, a pack of 12 jars falls from its shelf in the warehouse and the jars shatter. The contents smell

awful and it is obvious that pack contained food that had gone bad. What audit issues does this

incident cause and how should the auditors respond?

At the AA level you might simply have said that the pack had to be written off. At AAA, the incident

raises many more issues. See if you can think what they might be. This is discussed in the lecture for

Chapter 12.

Only on OpenTuition you can find: Free ACCA notes • Free ACCA lectures • Free ACCA tests • Free ACCA tutor support • The largest ACCA community

September 2021 to June 2022 exams

Watch free ACCA AAA lectures

4

3. Topics in AAA, not in AA

The main additions are:

๏

Money laundering and professional liability

๏

Business risk (audit risk, but not business risk, was in AA)

๏

The audit of groups

๏

Specific assignments (due diligence, prospective financial information and forensic audits)

๏

Social, environmental and integrated reporting

๏

The audit of performance information in the public sector (INT Syllabus only)

๏

Auditing aspects of insolvency (UK Syllabus only)

๏

Current issues

Most AA topics appear again in AAA but to a more detailed level. Professional ethics remain very

important. You will not be asked to evaluate an accounting system to identify weaknesses in internal

control.

4. Syllabus

4.1. Aim

To analyse, evaluate and conclude on the assurance engagement and other audit and assurance

issues in the context of best practice and current developments.

4.2. Objectives

On successful completion of this paper, candidates should be able to:

A.

Recognise the legal and regulatory environment and its impact on audit and assurance practice.

B.

Demonstrate the ability to work effectively on an assurance or other service engagement within

a professional and ethical framework

C.

Assess and recommend appropriate quality control policies and procedures in practice

management and recognise the auditor’s position in relation to the acceptance and retention of

professional appointments.

D.

Identify and formulate the work required to meet the objectives of audit assignments and apply

the International Standards on Auditing.

E.

Evaluate findings and the results of work performed and draft suitable reports on assignments.

F.

Identify and formulate the work required to meet the objectives of non-audit assignments.

G.

Understand the current issues and developments relating to the provision of audit-related and

assurance services.

H.

Demonstrate employability and technology skills.

Only on OpenTuition you can find: Free ACCA notes • Free ACCA lectures • Free ACCA tests • Free ACCA tutor support • The largest ACCA community

September 2021 to June 2022 exams

Watch free ACCA AAA lectures

5

5. Approach to examining the syllabus

The syllabus is assessed by a 3 hour 15 minute paper-based examination.

The examination is constructed in two sections. Questions in both sections will be largely discursive.

However, calculations will be expected, for example to be able to assess materiality and calculate

relevant ratios where appropriate.

Part A

Case study (50%)

Set at the planning stage of the audit. Candidates will be provided with detailed information and be

required to address a range of requirements from syllabus sections A, B, C and D.

Four professional marks are available in Section A

Part B

Two compulsory 25 mark questions, predominately based around a short scenario.

One question will always predominantly come from syllabus section E (completion, review and

reporting). The other question can be drawn from any other syllabus area including section F.

Syllabus section G, Current Issues, may be examined in Section A or Section B, but is unlikely to to

form the basis of any question on its own.

Full details are shown on syllabus available from the ACCA’s site:

Advanced Audit & Assurance (INT) - syllabus and study guide September 2021 to June 2022

Advanced Audit & Assurance (UK) - syllabus and study guide September 2021 to June 2022

Only on OpenTuition you can find: Free ACCA notes • Free ACCA lectures • Free ACCA tests • Free ACCA tutor support • The largest ACCA community

September 2021 to June 2022 exams

Watch free ACCA AAA lectures

6

Only on OpenTuition you can find: Free ACCA notes • Free ACCA lectures • Free ACCA tests • Free ACCA tutor support • The largest ACCA community

September 2021 to June 2022 exams

Watch free ACCA AAA lectures

7

REGULATION, LEGAL MATTERS AND QUALITY

CONTROL

Chapter 1

WHAT IS ASSURANCE?

1. Audit and assurance

We start with a little bit of revision of AA, and indeed you will be making use of AA skills throughout

AAA (such as suggesting audit evidence to look for).

The paper is called ‘Advanced Audit and Assurance’ and we start by explaining what is meant by the

terms ‘audit’ and ‘assurance’.

It is often not possible to check things for yourself, whether quality, accuracy, performance or

existence: you might not have the skills or the time, or you might be in the wrong location. Therefore

you must rely on someone else to give you assurance. This means you have to decide:

๏

What standards should be applied?

๏

What represents ‘good’, ‘acceptable’ or ‘unacceptable?

๏

How much checking should be done? All checking and assurance has an associated cost.

Audit is one form of assurance. We will see that in AAA other forms of assurance might have to be

described and discussed too, such as providing assurance to a bank that a company’s cash flow

budget is not a work of fantastic fiction or that a take-over target is not hiding horrific liabilities.

An audit is defined as: the independent examination of and expression of opinion on the financial

statements of an entity by a duly appointed auditor in pursuit of that appointment.

The important words here are ‘independent’ and ‘opinion’.

Independence is essential and underlies the value of auditing - and of all other forms of assurance

Opinion really means that one auditor or accountant could look at a set of financial statements (or a

cash budget) and disagree with the opinion of another.

Judgment is essential to all assurance: there are no certainties and there are no certifications of

correctness or accuracy.

Only on OpenTuition you can find: Free ACCA notes • Free ACCA lectures • Free ACCA tests • Free ACCA tutor support • The largest ACCA community

September 2021 to June 2022 exams

Watch free ACCA AAA lectures

8

Auditing is the most regulated form of assurance you will meet in AAA. Legislation, International

Auditing Standards and financial reporting standards all lay down rules about how auditing should be

carried out and how financial statements should be prepared. Other forms of assurance are much less

uniform and this can cause a problem unless the work to be performed is precisely agreed between

auditor and client at the very start. For example, if you are asked to give assurance about a cash flow

forecast you need to find out if it is a one, three or five year budget as the work and difficulties are

very different in each case.

2. Elements of an assurance engagement

2.1. The elements of an assurance engagement

The following are the five elements of an assurance engagement:

(1)

A three party relationship involving a practitioner, a responsible party and intended users.

(2)

Appropriate subject matter (eg the financial statements, a budget, a take-over target).

(3)

Suitable criteria (eg financial reporting standards)

(4)

Sufficient appropriate evidence.

(5)

A written assurance report in the form appropriate to a reasonable assurance engagement or a

limited assurance engagement.

Item 4 on the list is sufficient appropriate evidence and if assurance had to be summed up in one

word ‘EVIDENCE’ would be it. Assurance is not based on the auditor guessing or hoping that

something is the case. All assurance is based on gathering sufficient appropriate evidence and if the

required evidence is not available then assurance cannot be given.

It will be said again, but when it comes to the audit of financial statements evidence is required about

two elements:

๏

Is the amount materially correct?

๏

Do the presentation and disclosures conform to the financial reporting standards?

There is no point in tracing research and development expenditure back to invoices supporting the

accuracy of the amounts if you do not also give assurance that the amounts have been written off or

capitalised in line with the IAS 38. Evidence is needed to support the treatment of the amounts.

Only on OpenTuition you can find: Free ACCA notes • Free ACCA lectures • Free ACCA tests • Free ACCA tutor support • The largest ACCA community

September 2021 to June 2022 exams

Watch free ACCA AAA lectures

9

2.2. Professional scepticism

A practitioner should plan and performs an assurance engagement with an attitude of professional

scepticism to obtain sufficient appropriate evidence about whether the subject matter information is

free of material misstatement. An attitude of professional scepticism means the practitioner questions

the validity of evidence and is alert to evidence that brings into question the reliability of documents

or representations.

Scepticism means that you don’t know. It does not mean that the practitioner assumes everyone is

dishonest or that figures have been deliberately misrepresented. Nor does it mean that you believe all

figures and statements are correct. It means you are aware that we can all be subject to optimism

(perhaps too much), human error, giving quick answers because we are short of time, and

misunderstanding. It also recognises that sometimes people are deliberately misleading or dishonest.

Scepticism means that evidence is required to test statements or assumptions. You could almost

summarise the process of assurance in the phrase ‘collect evidence that supports everything that is

being claimed’.

Sufficiency is the measure of the quantity of evidence. Appropriateness is the measure of the quality

of evidence - its relevance and its reliability.

The reliability of evidence is influenced by its source and by its nature, and is dependent on the

individual circumstances under which it is obtained, eg documentary evidence is better then oral,

directly obtained evidence better then evidence provided by a client.

2.3. Assurance Report

The practitioner provides a written report containing a conclusion. There are two types of assurance

reports:

In a reasonable assurance engagement the practitioner’s conclusion is worded in the positive form,

for example: “In our opinion internal control is effective, in all material respects, based on XYZ criteria.”

It is called ‘reasonable’ because the practitioner will never give guarantees. Only reasonable assurance

is ever given.

In a limited assurance engagement the conclusion is worded in the negative form, for example,

“Based on our work described in this report, nothing has come to our attention that causes us to

believe that internal control is not effective, in all material respects, based on XYZ criteria.”

Only on OpenTuition you can find: Free ACCA notes • Free ACCA lectures • Free ACCA tests • Free ACCA tutor support • The largest ACCA community

September 2021 to June 2022 exams

Watch free ACCA AAA lectures

10

2.4. Examples:

Positive

๏

The financial statements "present fairly, in all material respects..." / "show a true and fair view".

๏

The value of amount of inventory lost is $x.

Negative

๏

We have discovered nothing wrong with the financial statements.

๏

The basis of the forecast is not unreasonable.

๏

There is no evidence of discrimination in the appointment.

All statutory audits attempt to provide positive assurance that the financial statements "present fairly,

in all material respects" / "show a true and fair view of" (these phrases are equivalent) the company's

financial position, financial performance and cash flows. There are some types of assurance

assignment where giving positive assurance is not possible. For example, it would be impossible to

give assurances that a budget is correct because it depends on so many assumptions and factors that

cannot be verified with certainty, such as the state of the economy next year, competitors’ plan and

sales forecasts.

A practitioner would not express an unmodified conclusion for either type of assurance engagement

when:

๏

There is a limitation on the scope of the practitioner’s work (ie sufficient appropriate evidence

cannot be obtained); or

๏

The assertion is not fairly stated (in all material respects) or the subject matter information is

materially misstated (ie the assertion is incorrect).

Only on OpenTuition you can find: Free ACCA notes • Free ACCA lectures • Free ACCA tests • Free ACCA tutor support • The largest ACCA community

September 2021 to June 2022 exams

Watch free ACCA AAA lectures

11

Chapter 2

CORPORATE GOVERNANCE AND

AUDITOR REGULATION

1. Why corporate governance is needed

Corporate governance is the system by which companies are directed and controlled. Auditing

financial statements adds to their credibility and this enables shareholders to better understand how

the directors and company have performed.

2. Principles of corporate governance

The Organisation of Economic Cooperation Development (OECD) promotes six Principles of a

corporate governance framework:

๏

It should promote transparent and fair markets and the efficient allocation of resources and

support effective supervision and enforcement.

๏

It should protect shareholders’ rights, ensuring fair treatment of all shareholders, including

minority and foreign shareholders. For example all shareholders should have access to the same

information.

๏

It should provide for stock markets to function in a way that contributes to good corporate

governance (eg insider trading should be prohibited).

๏

It should recognise the rights of all stakeholders, not just shareholders, and encourage active

cooperation between the entities and stakeholders in creating wealth, jobs and sustainability of

financially sound entities.

๏

It should ensure timely and accurate disclosure on all material matters, including financial

position, performance, ownership and governance.

๏

It should ensure the strategic guidance of the entity, effective monitoring of management by

the board and the board’s accountability to the entity and their shareholders. In particular the

board should set its own objectives, monitor its own performance and have its own

performance assessed.

Only on OpenTuition you can find: Free ACCA notes • Free ACCA lectures • Free ACCA tests • Free ACCA tutor support • The largest ACCA community

September 2021 to June 2022 exams

Watch free ACCA AAA lectures

12

3. The UK Corporate Governance Code

The OECD principles are put into effect in a variety of ways in different countries. The UK Corporate

Governance Code published by the Financial Reporting Council (FRC) can be referred to as an

example of best practice.

The Principles of the Code emphasise the value of good corporate governance to the long-term

success of the company.

Comply or explain

The Code has no force in law and is enforced on listed companies through the Stock Exchange. Listed

companies are expected to ‘‘comply or explain’’ and this approach is the trademark of corporate

governance in the UK.

Listed companies have to state that they have complied with the code or else explain to shareholders

why they haven’t. This allows some flexibility and non-compliance might be acceptable in some

circumstances.

The UK and most of Europe have adopted a principles-based approach rather than a rules-based

approach to Corporate Governance. Broad principles are set out but then companies decide how to

put those into operation. This can provide flexibility and adaptability.

In the US most corporate governance is regulated through statute, the Sarbanes-Oxley Act 2002. This

takes a procedural ('rules-based') approach that is much more prescriptive, requiring both directors

and auditors to sign off documentation stating that the rules have been followed. Criminal charges

can follow if the Act is not followed.

Main principles of the UK Code

๏

Board Leadership and Company Purpose

๏

Division of Responsibilities

๏

Composition, Succession and Evaluation

๏

Audit, Risk and Internal Control

๏

Remuneration

Board Leadership and Company Purpose

๏

Every company should be headed by an effective board which is collectively responsible for the

long-term success of the company.

๏

All directors must act with integrity, lead by example and promote the desired culture.

๏

The board should:

‣ establish the company’s purpose, values and strategy

‣ ensure the company has the necessary resources to meet its objectives

‣ establish effective controls to assess and manage risk

‣ ensure effective engagement with, and encourage participation from, stakeholders

‣ ensure that workforce policies and practices are consistent with the company’s values and

support its long-term success.

Only on OpenTuition you can find: Free ACCA notes • Free ACCA lectures • Free ACCA tests • Free ACCA tutor support • The largest ACCA community

September 2021 to June 2022 exams

Watch free ACCA AAA lectures

13

Division of Responsibilities

๏

There should be a clear division… between the running of the board and the executive

responsibility for the running of the company’s business. No one individual should dominate

decision making. This means that the roles of CEO and chair should not be performed by one

person as that concentrates too much power in that person.

๏

The chair is responsible for leadership of the board and should be independent on

appointment (e.g. not an employee within the last 5 years).

๏

At least half the board should be non-executive directors (NEDs) who are considered

independent (e.g. no close family ties with executive directors, no significant shareholdings, etc).

๏

NEDs should provide constructive challenge and strategic guidance and hold management to

account.

Composition, Succession and Evaluation

๏

Appointments to the board should be subject to a formal, rigorous and transparent procedure

led by a nomination committee. A majority of the committee should be independent NEDs.

๏

The board and its committees should have a combination of skills, experience and knowledge.

The length of service of the board as a whole should be considered and membership regularly

refreshed. The post of chairman should not be held beyond nine years.

๏

The board should undertake a formal and rigorous annual evaluation of its own performance

and that of its committees and individual directors.

๏

All directors should be submitted for re-election annually.

Audit, Risk and Internal Control

๏

The board should establish formal and transparent policies and procedures to ensure the

independence and effectiveness of internal and external audit and the integrity of financial

statements.

๏

The board should present a fair, balanced and understandable assessment of the company’s

position and prospects. The financial statements should state whether the board considered

the appropriateness of the going concern basis of accounting and identify any material

uncertainties for at least 12 months from the date of approval of the financial statements.

๏

The board should establish procedures to manage risk, oversee internal controls and determine

the nature and extent of the principal risks the company is willing to take to achieve its longterm strategic objectives.

To meet the above Principles, the board should establish an audit committee of at least three

independent NEDs (two for smaller companies). At least one committee member must have recent

and relevant financial experience.

Only on OpenTuition you can find: Free ACCA notes • Free ACCA lectures • Free ACCA tests • Free ACCA tutor support • The largest ACCA community

September 2021 to June 2022 exams

Watch free ACCA AAA lectures

14

Remuneration

In essence, remuneration should be sufficient to attract, retain and motivate directors of sufficient

quality… but avoid paying more than is necessary.

๏

Remuneration policies and practices should be designed to support strategy and promote longterm sustainable success. For example, a significant proportion of executive directors’

remuneration may be structured to link rewards to corporate and individual performance. In

other words, profit-related pay is encouraged. Directors should not receive high pay irrespective

of company performance.

๏

There should be a formal and transparent procedure for developing policy on executive

remuneration and for fixing the remuneration packages of individual directors. No director

should be involved in deciding his or her own remuneration. This means that a remuneration

committee (NEDs) should be formed to fix directors’ remuneration.

4. The role of the audit committee

The audit committee is a very important part of corporate governance.

Review of internal audit

Financial Statements

Liaison with external auditors:

Review of internal control

Monitor integrity of

financial statements

• Scope of external audit

• Forum to link directors/auditors

• Deal with auditors’ reservations

• Obtain information for auditors

• Review independence and objectivity

• Approve non-audit services

Only on OpenTuition you can find: Free ACCA notes • Free ACCA lectures • Free ACCA tests • Free ACCA tutor support • The largest ACCA community

September 2021 to June 2022 exams

Watch free ACCA AAA lectures

15

The main roles and responsibilities of the audit committee include the following:

๏

Monitoring and reviewing the effectiveness of internal audit. Companies don’t have to have an

internal audit department, but the need for one must be reviewed annually.

๏

Monitoring the integrity of the financial statements and reviewing significant financial reporting

judgements.

๏

Review the internal financial controls and risk management systems (unless there is a separate

risk committee or the board does this).

๏

Making recommendations to the board about the appointment, reappointment and removal of

the external auditors and agreeing the terms of engagement. (Note that the external auditors

are appointed by members in general meeting, but the board puts forward the nomination.)

๏

Annually assessing the independence, objectivity and effectiveness the external auditors

including confirming that there are no self-interest or familiarity issues and that partners and

staff are rotated properly.

๏

Acting as a forum to link directors and auditors. Auditors will typically write to the audit

committee about any problems they may be having on the audit or obtaining all the

information they require. If the auditors are worried in some way about the financial statements

they will raise those concerns with the audit committee.

๏

Developing and implementing policy on the engagement of the external auditor to supply nonaudit services: skills, approval and non-approval for certain services, ensuring any threats to

independence and objectivity are reduced to acceptable levels and monitoring the fees for

those services and the total fee for all services provided by the external auditor.

Only on OpenTuition you can find: Free ACCA notes • Free ACCA lectures • Free ACCA tests • Free ACCA tutor support • The largest ACCA community

September 2021 to June 2022 exams

Watch free ACCA AAA lectures

16

5. Regulation of auditors

Auditors are regulated by:

๏

Professional bodies (eg ACCA). ACCA is a recognised supervisory body that supervises

qualifications, behaviour and quality.

๏

National bodies. In the UK and Ireland, the Financial Reporting Council. This regulates auditors

and accountants and sets the UK’s Corporate Governance Code.

๏

International bodies (eg IFAC, the International Federation of Accountants). The purpose of IFAC

is to serve the public interest by, establishing and promoting adherence to high-quality

professional standards.

IFAC has a number of boards and committees such as:

‣ IAASB (International Auditing and Assurance Standards Board): Sets International Standards

on Auditing (ISAs) and other assurance standards

‣ IESBA (International Ethics Standards Board for Accountants): Issues the International Code of

Ethics for Professional Accountants.

‣ TAC (Transnational Auditors Committee): Responsible for implementing and advancing the

promotion of high-quality standards of financial reporting and auditing practices worldwide.

๏

The Public Interest Oversight Board (PIOB) oversees the public interest activities of the standard

setters. It brings greater transparency and integrity to the audit profession, thereby contributing

to the enhanced quality of international financial reporting.

IAASB's ISAs are adopted by the FRC in the UK which has local regulatory power. The IESBA's Code has

been adopted by ACCA in its Code of Ethics and Conduct.

Only on OpenTuition you can find: Free ACCA notes • Free ACCA lectures • Free ACCA tests • Free ACCA tutor support • The largest ACCA community

September 2021 to June 2022 exams

Watch free ACCA AAA lectures

17

Chapter 3

APPOINTMENT AS AN AUDITOR

1. Overview of the audit process

Appointment

Plan the audit

Understand entity

Assess risk of material misstatement

Respond to risk

Expect effective controls

Tests of controls

Expect ineffective controls

Unsatisfactory

Report significant deficiencies

to those charged with

governance

Satisfactory

Reduced substantive

procedures

Full substantive

procedures

Overall review of FS

Report to management

Auditor’s report

This is an important and useful diagram and it sets out the stages or approach to an audit.

Only on OpenTuition you can find: Free ACCA notes • Free ACCA lectures • Free ACCA tests • Free ACCA tutor support • The largest ACCA community

September 2021 to June 2022 exams

Watch free ACCA AAA lectures

18

2. Marketing professional services

The ACCA 's Code of Ethics and Conduct states that professional accountants can inform the public

about their services using advertising and other form of promotion, subject to the general

requirement that the medium shall not reflect adversely on the professional accountant, ACCA or

the accountancy profession.

It is recognised that there can be a conflict between some of the ethical principles, for example, a selfinterest threat and complying with the principle of professional behaviour.

The professional accountant in public practice must be honest and truthful and must not:

๏

Make exaggerated claims for services, experience etc or be misleading in other ways.

๏

Make disparaging references or unsubstantiated comparisons to the work of another.

๏

Bring the ACCA, the accountancy profession or other accountants into disrepute.

If fees are mentioned, promotional material must state the basis of charging and great care has to be

taken that readers are not mislead about the services offered and the fees that will be charged. It is

possible to compare fees with those of other firms provided the comparison is not misleading.

If commissions are paid or received (for example, by recommending software package), full disclosure

of the commercial arrangement must be made.

3. Tendering for professional services

Often, to obtain new work, accountants will be asked to submit a tender in competition with other

firms. Before submitting a tender, contact must be made with the existing or previous accountant (see

section 5, below) to see if there are any reasons why the appointment should not be accepted.

The fees quoted can can be whatever the accountant thinks appropriate, but there can be threats to

compliance with the fundamental principles. For example, if the fee were so low that it would be

difficult to carry out the work to the required standard of competence and due care. The IESBA states

that:

๏

Auditors should perform high quality audits irrespective of the audit fee charged.

๏

Adequate time must be planned and spent to enable the audit to be performed in accordance

with the technical and professional standards.

๏

Audit personnel with appropriate expertise and experience should be assigned to the work.

๏

Two-way communication between the auditors and those charged with governance (TCWG) to

mitigate the threats that can arise from fee pressure.

Only on OpenTuition you can find: Free ACCA notes • Free ACCA lectures • Free ACCA tests • Free ACCA tutor support • The largest ACCA community

September 2021 to June 2022 exams

Watch free ACCA AAA lectures

19

There is no set format for a tender document, but a little thought will show that something like the

following would be usual for a tender for audit work:

๏

A brief introduction to the accountancy firm.

๏

Areas of expertise and specialisms.

๏

A reiteration of the requirements of the client (to confirm understanding) and suggestions for

other work that might be needed.

๏

An outline of the proposed audit approach. For example:

‣ Planning.

‣ Assessment of the system of internal controls.

‣ Testing internal control and reporting on control weaknesses (interim audit timing might be

suggested).

‣ Possible use of internal audit for some aspects of the audit.

๏

Timing of the final audit and suggested dates for auditor’s report signature.

๏

Work do be done at the final audit stage (eg attend inventory counts at certain branches etc).

๏

Planned use of computer assisted audit techniques.

๏

Quality control steps and systems that the firm uses to ensure that a ‘good’ audit will be

performed.

๏

Key partner’s and manager’s name. Details of audit team composition.

๏

Fee and the basis of its calculation. Invoicing arrangements and terms of payment.

๏

Any other services (that are not prohibited) that the firm may provide (eg corporate financial

advice).

Only on OpenTuition you can find: Free ACCA notes • Free ACCA lectures • Free ACCA tests • Free ACCA tutor support • The largest ACCA community

September 2021 to June 2022 exams

Watch free ACCA AAA lectures

20

4. Before you say ‘yes’ (and continuance decisions)

It is, of course, flattering to be asked to be the auditor of a company. Now only does it feed one’s ego,

it also promises more income for the firm. However, auditors must exercise great caution: they must

be confident that they can carry out the work profitably, ethically, competently, incurring an

acceptable level of risk and avoiding damage to their reputation.

The following need to be investigated:

๏

Are they professionally qualified to act? Is it legal and ethical for them to do so? For example,

they shouldn’t accept an appointment if the fees exceed the 15% limit for public interest

companies, unless there are adequate safeguards. Are there issues of familiarity or self-review?

๏

Do they have adequate resources in terms of staff, time and expertise? Can the new work be

carried out when the client wants without adversely affecting existing clients? If the potential

audit client acts in a specialist area of business and the auditors have no prior experience of that,

it would be very unwise for them to accept the appointment.

๏

Investigate the client, its management and directors. Many firms of auditors have access to

databases which, for example, will allow them to search on directors’ names to see if any of the

directors have been banned from being directors of companies because of their past behaviour.

They may discover that it is too risky to become the auditor of a company if they have no trust in

the honesty of the directors. The audit fee is often modest, why risk your reputation by

undertaking an audit where the directors may be fraudulent?

๏

Consider the nature of the industry or business. If there is a risk of criminal involvement or

money laundering it might be better to stay clear.

๏

Money laundering regulations (covered in a later chapter) require auditors to ‘know their client’:

ownership, commercial rationale, sources of funds etc.

๏

Communicate with present auditors. There is a professional requirement to do this and it is

essential to find out why the old auditors are retiring or being removed.

๏

Consider politically exposed persons. These are people who have or who have had positions

of political influence. For example, politicians, senior military personnel, senior civil servants.

Unfortunately, there is a history of many of these individuals having profited from corruption

and they might still have influence that permits the misuse of public funds, the improper

awarding of contracts and large-scale money laundering.

๏

The potential client’s credit-rating.

๏

Preconditions for the audit: will the financial reporting framework used be acceptable and do

management understand and accept their responsibilities for preparing the financial

statements and for supplying the auditors with all the information they require?

Only on OpenTuition you can find: Free ACCA notes • Free ACCA lectures • Free ACCA tests • Free ACCA tutor support • The largest ACCA community

September 2021 to June 2022 exams

Watch free ACCA AAA lectures

21

5. Communication with existing auditors

If the auditor is approached by new audit client, if it’s a new business and this is the first audit there

will be no previous auditors to communicate with and new auditors must make their own decision.

If it is not a new business and there is an existing auditor then the new auditor must ask the client for

permission to contact the old auditor. If permission is not given, the appointment should be declined.

Why would permission not given? Is a client trying to conceal something? Why else would they not

allow a new auditor to communicate with the existing auditor?

Assuming permission is given the new auditor will write to the old auditor for information. The old

auditor can’t simply send that information to the new auditor because that is confidential, and the old

auditor has to ask the client for permission in turn. If that permission is not given the new auditor

should decline the appointment because again the client is trying to stop communication between

the old and new auditors.

If the old auditor provides information then the new auditor is more fully equipped to make their

accept or reject decision. If the existing auditor decides not to provide information the new auditor

should try to persuade the old auditor to provide it, but otherwise might have to rely on information

as been found in other ways.

6. The engagement letter

Upon appointment, auditors should send an engagement letter to their new client.

Engagement letters are often regarded as rather dull documents, sent once and then forgotten.

However, they are of crucial importance because they set out the contractual relationship between

the auditor and the client. If the engagement letter is not sent out it’s very difficult for an auditor

subsequently to complaint that the client hasn’t done what was expected, or it might be difficult for

the auditor to defend the firm against a claim that the auditor has not done what was expected.

Engagement letters:

๏

Define the auditor’s responsibilities

๏

Provide written evidence of the auditor’s acceptance of the appointment.

๏

Should be sent to the board of directors or audit committee prior to the first audit.

๏

Identify any reports to be produced in addition to the auditor's report. For example, for banking

or insurance clients who may come under additional scrutiny.

๏

Should be updated for all changes. For example, if the auditor begins to undertake tax work for

the client.

Only on OpenTuition you can find: Free ACCA notes • Free ACCA lectures • Free ACCA tests • Free ACCA tutor support • The largest ACCA community

September 2021 to June 2022 exams

Watch free ACCA AAA lectures

22

7. Typical contents of an engagement letter

๏

Description of the objective of an audit: to obtain reasonable assurance whether the financial

statements are free from material misstatement and issue an auditor's report that include an

audit opinion.

๏

Defining responsibilities: management’s are to prepare the financial statements and to set up a

system of internal control. It is the auditor’s responsibility to audit the financial statements.

๏

Reference to the applicable financial reporting framework. For example, national legislation (eg

companies act) and/or IFRS.

๏

Emphasis that audits depend on sampling that there are no guarantees. The audit looks for only

material misstatements. It will examine records on a test basis that can only give a reasonable

assurance.

๏

The auditors will state that they expect unrestricted access to the company’s records and they

expect full explanations for any queries they might have.

๏

They will state that the auditor’s report is a matter between them and the addressees of the

report (the members of company) and that it should not be relied upon by other parties.

๏

There will be certain matters about planning the audit, such as arranging the interim audit and

final audit, attending inventory counts, organising external confirmation of receivables, and

liaison with the internal audit department.

๏

Almost certainly there will be something about fees. They should be estimated but subject to

the proviso that if more work needs to be done, it will be done and additional fees will be

required.

๏

Description of the expected relationship between the external auditor and internal audit; how

the work of internal audit might be reviewed and then relied on by the external auditors.

Only on OpenTuition you can find: Free ACCA notes • Free ACCA lectures • Free ACCA tests • Free ACCA tutor support • The largest ACCA community

September 2021 to June 2022 exams

Watch free ACCA AAA lectures

23

Chapter 4

PROFESSIONAL ETHICS

1. Introduction

It was mentioned in the previous chapter that before accepting an appointment, the auditor must

ensure that the appointment will be ethical.

Ethics is seen as the unique selling proposition of professional accountants. If they do not adhere

strictly to ethical principles, how could they continue to earn good fees? What is the point in paying

someone for advice or assurance if they cannot be trusted or believed?

The ACCA Code of Ethics and Conduct ('the Code') is based on the IESBA’s Code of Ethics. It sets out

certain fundamental principles about how its members should behave. It also recognises how its

members could be subject to certain threats which would compromise their behaviour, and suggests

ways in which members can safeguard themselves against the operation of those threats.

The conceptual framework approach to professional ethics recognises that there are:

๏

Fundamental principles to be followed

๏

These are subject to threats

๏

Threats must be addressed

The Code applies to all members of ACCA and also to all ACCA students. Note that applies not only to

those in public practice ('auditors') but also those in industry and commerce ('in business').

2. Fundamental principles

The ACCA’s fundamental principles are as follows:

๏

Integrity

๏

Objectivity

๏

Professional competence and due care

๏

Confidentiality

๏

Professional behaviour

See Chapter 4 of our AA notes if you need to revise the fundamental principles.

Note that in AAA you need to be able to explain when the duty of confidentiality must be set aside in

order to disclose non-compliance with laws and regulations (see Chapter 6).

Only on OpenTuition you can find: Free ACCA notes • Free ACCA lectures • Free ACCA tests • Free ACCA tutor support • The largest ACCA community

September 2021 to June 2022 exams

Watch free ACCA AAA lectures

24

3. Threats to the fundamental principles

Threats to compliance with the fundamental principles arise from

๏

Self-interest

๏

Self-review

๏

Advocacy

๏

Familiarity

๏

Intimidation.

Note also there are management threats, where the auditor performs managerial functions for the

client. These are not a separate category, but covered under several of the above, such as self-interest,

familiarity and advocacy.

Where such threats exist, the auditor must:

๏

Eliminate the circumstance that creates the threat(s); or

๏

Apply safeguards, where available, to reduce the threats to an acceptable level (see s.4); or

๏

Decline or end the specific professional activity.

3.1. Self-interest threats

Self-interest threats may arise from the following:

๏

Financial interests – the provisions of the Code consider who holds the interest, whether the

interest is direct or indirect and materiality. Firms, members of audit teams and immediate

family members cannot hold direct or material indirect financial interests in audit clients.

However, safeguards may be applied where a close family has such an interest.

๏

Close business relationships – cannot be entered into unless immaterial and insignificant to

both the firm and the client or is management.

๏

Family and personal relationship – the existence and significance of any threat depends on

the individual’s role in the audit team, the role of the individual within the client and the

closeness of the relationship.

๏

Loans and guarantees – the existence and significance of any threat depends on whether

making loans is the client’s business, the terms and conditions and to whom it is made.

๏

Fees – the Code does not prescribe the basis for calculating fees. However:

‣ Contingent fees – are not permitted for audit engagements

‣ Relative size – the only benchmark in the Code is 15% of total fees, for two consecutive years,

for a PIE client

‣ Low-balling – quoting a lower fee is not in itself unethical, but must not be so low that it

threatens professional competence and due care

‣ Overdue fees – may be seen as equivalent to a loan

๏

Recruiting services – generally, must not assume management responsibility (eg act as

negotiator for management) and hiring decision must be the client’s. For a PIE, cannot seek or

take up references for a director or senior management position.

See Chapter 4 of our AA notes if you need to revise these example of self-interest threats.

Only on OpenTuition you can find: Free ACCA notes • Free ACCA lectures • Free ACCA tests • Free ACCA tutor support • The largest ACCA community

September 2021 to June 2022 exams

Watch free ACCA AAA lectures

25

3.2. Self-review threats

Self review threats arise when an auditor does work for a client and that work may then be subject to

self-checking during the subsequent audit. For example, if the auditor prepares the financial

statements, and then has to audit them, or the auditor performs internal audit services and then has

to check that the system of internal control is operating properly. Auditors could obviously be

reluctant to criticise the work which their own firms have earlier undertaken, and this could interfere

with independence and objectivity.

Generally auditors must be very careful when undertaking such work. Certainly it is common for

auditors to do additional work for their clients, but what is important that the work is done by an

entirely different team from the audit firm.

Whether auditors should be allowed to provide non-assurance ('other') services to an audit client is a

controversial topic, as there are both pros and cons. For example, auditors will know a great deal

about the operations of their clients and this can make the performance of other work much more

efficient. If entirely new companies have to be brought in to supply these services, much of the

information they find out about the client will already be known by the auditor and there is a real

duplication of effort.

The provision of many non-assurance services will create a self-review threat (eg bookkeeping,

internal audit, tax calculations and valuations material to the financial statements).

Another danger, of course, is that the auditors come to rely too heavily on the fees earned from the

other work and are therefore reluctant to risk losing a client if they express a modified audit opinion

(ie self-interest threat). Large audit firms can at least use separate departments, though this may be

difficult with small firms.

In the US listed companies are not allowed to obtain other services from their auditor. This is to ensure

that the auditor is independent and performs only the audit. In most jurisdictions, there are no hard

and fast rules but the overall guidance on ethics relating to objectivity and independence should be

adhered to.

Remember that self-review threats can also arise if a member of the audit team:

๏

Recently served as a director/officer of the client

๏

Is seconded ('lent') to the client for a temporary assignment.

Only on OpenTuition you can find: Free ACCA notes • Free ACCA lectures • Free ACCA tests • Free ACCA tutor support • The largest ACCA community

September 2021 to June 2022 exams

Watch free ACCA AAA lectures

26

3.3. Advocacy threats

Advocacy is where the assurance or audit firm promotes a point of view or opinion to the extent the

subsequent objectivity is compromised. An example would be where the audit firm promotes the

shares in a listed company or supports the company in some sort of dispute (eg with the tax

authorities). Advocacy can interfere with professional scepticism.

As always, the audit firm should weigh up the risks to its objectivity, integrity and independence and

should withdraw from performing further work if those risks are too high.

3.4. Familiarity threats

Familiarity threats arise because of the close relationship between members of the audit team and the

client. The close relationship can arise by friendship, family or through business connections. There is

no general definition of what’s meant by close relationships, but if you were an auditor and your

brother was the Finance Director of a client firm then there probably is a close relationship! If however

the finance director was a remote cousin of yours, there might not be a close relationship. Note that

there does not have to be any family or legal relationship: friendship can threaten independence and

integrity.

Long association of senior personal creates a familiarity (and self-interest) threat. The Code requires

that an engagement partner cannot serve a PIE client for more than seven years (the 'time-on'

period). This is to prevent too close a relationship and friendship growing between the two parties.

The problem is that when a close relationship does grow, objectivity and skepticism are more likely to

be lost. After the time-on period, the 'cooling-off' period for an engagement partner is five

consecutive years. The cooling-off period for an individual responsible for EQCR (see Chapter 9) is

three years.

3.5. Intimidation

The final groups of threats are intimidation threats. These can deter the assurance team from acting

properly.

Examples could be threatened litigation, blackmail, or there might even be physical intimidation,

though it is to be hoped that that is rare. Blackmail could be more subtly applied . For example, if a gift

or hospitality from a client were to be accepted, the possibility of that being made public would

create an intimidation threat to objectivity.

4. Safeguards

Applying safeguards may be a suitable response to address an identified threat. Other responses are

to eliminate the source of the threat or decline/end the activity.

The ACCA Code of Ethics (2019) defines safeguards as "actions, individually or in combination, taken

by the professional accountant that effectively eliminate threats to compliance with the

fundamental principles or reduce them to an acceptable level".

The ‘test’ of what is acceptable is whether a “reasonable and well informed party… would be likely to

conclude that … compliance with the fundamental principles is not compromised”.

Although the Code is ‘principles-based’, that does not mean that ‘anything goes’ (ie nothing is

actually prohibited). Some threats are considered ‘too significant’ that no safeguards could reduce the

threats to an acceptable level.

Only on OpenTuition you can find: Free ACCA notes • Free ACCA lectures • Free ACCA tests • Free ACCA tutor support • The largest ACCA community

September 2021 to June 2022 exams

Watch free ACCA AAA lectures

27

Example 1 – No safeguards

State FIVE threats which NO safeguards could reduce to an acceptable level.

Example 2 – Safeguards to reduce threat to an acceptable level

State FIVE safeguards that may be applied to reduce a threat to an acceptable level.

For each, safeguard, give one example of its application.

Note that the concepts of broader safeguards (“created by the profession”, “in the work environment”,

“implemented by the entity”) are not now regarded as safeguards.

These “no longer safeguards” may, however, affect the evaluation of a threat. For example, “seeking

advice” does not meet the definition of a safeguard but may assist in assessing a complex matter.

A professional accountant’s action is not a safeguard unless it is effective.

5. Conflict of interest

This is not a fundamental principle but a situation that creates a threat to objectivity (and possibly

other fundamental principles). An example is where the auditor has two clients and one of the clients

wants to buy the other. The auditor has been asked to advise the purchaser. The conflict of interest

arises because the auditor will have detailed knowledge about the target company: costs, mark-ups,

budgets etc which would be very useful to the purchaser. Even if no confidential information was

supplied, there can be the suspicion that it might be and you can understand why clients might feel

uncomfortable.

In such a situation, the audit firm should inform both parties. They might say that they are not

bothered, but even then the audit firm must judge whether it would be seen to be independent and if

there is a risk to reputation the work should be turned down.

6. Proposed Revisions to the Code

IESBA Proposed Revisions to the Code to Promote the Role and Mindset Expected of Professional

Accountants is an examinable document. The objective of the "role and mindset" (formerly

"professional skepticism") project is to ensure that the Code promotes the role, mindset and

behavioural characteristics expected of all professional accountants.

Note: Topics of exposure drafts are examinable to the extent that relevant articles about them are

published in student accountant. It is particularly important, therefore, to read articles about exposure

drafts which you will also find in the technical articles section of AAA study resources (see

www.accaglobal.com/gb/en/student/exam-support-resources.html)

Only on OpenTuition you can find: Free ACCA notes • Free ACCA lectures • Free ACCA tests • Free ACCA tutor support • The largest ACCA community

September 2021 to June 2022 exams

Watch free ACCA AAA lectures

28

7. Example solutions

Solution 1 – No safeguards (only five were asked for)

๏

An audit firm having a direct financial interest or material indirect financial interest in an audit

client. (So if a firm had shares in Alfa Co it would have to dispose of them to accept the audit

appointment.)

๏

Close business (commercial) relationships (eg the firm and client package their services or the

client marketing the firm’s services).

๏

Accepting loans and guarantees that are not the client’s business or not on normal terms.

๏

Contingent fees for an audit engagement.

๏

Assuming any management responsibility for an audit client.

๏

Providing valuation services to a PIE that are material to the financial statements. (Also for a nonPIE client if the valuation involves a significant degree of subjectivity.)

๏

Giving tax or corporate finance advice which depends on a particular accounting treatment and

has consequences that are material to the financial statements.

๏

A partner or employee of the firm serving as a director or officer of an audit client.

๏

Acting as an advocate for an audit client before a court (unless amount involved are immaterial).

๏

Promoting, dealing in or underwriting client’s shares.

๏

Gifts and hospitality unless trivial and inconsequential.

Only on OpenTuition you can find: Free ACCA notes • Free ACCA lectures • Free ACCA tests • Free ACCA tutor support • The largest ACCA community

September 2021 to June 2022 exams

Watch free ACCA AAA lectures

29

Solution 2 – Safeguards to reduce threat to an acceptable level (only five were asked for)

Safeguard

Application

Separate engagement teams

Taxation, internal audit and other services

(where allowed) to an audit client. Also for

conflicts of interest.

Not including or removing a member of the

audit team

Financial interest held by a member of the audit

team (or immediate family member).

An immediate family holds a position of

influence in relation to the audit client’s financial

statements (eg director).

Actual or prospective future employment with

the audit client.

Staff loaned to clients.

Review of audit work by a professional who was

not a member of the audit team

Long association

Review of non-audit work by a professional who

was not involved in the work

Other services such as bookkeeping, taxation

and valuation (where not prohibited).

Discussion of ethical issues with TCWG/audit

committee

Fees from a PIE client exceed 15% benchmark

for two consecutive years. Also for conflicts of

interest.

Disclosure of fees to TCWG/audit committee

High proportion of fees. Also low-balling.

Assigning appropriate time and qualified staff

Low-balling

Rotating senior members of the audit team

Long association

Engagement quality control review (or

equivalent)

Fees from a PIE client exceed 15% benchmark

for two consecutive years (and subsequent

years).

Notify the existing auditor of the proposed work

(with permission)

Requests for a ‘second opinion’ by a company

that is not an existing client (typically on the

application of a financial reporting standard).

Note that the examples of the threats to which these safeguards may be applied cannot include

any of the threats in Solution 1.

Only on OpenTuition you can find: Free ACCA notes • Free ACCA lectures • Free ACCA tests • Free ACCA tutor support • The largest ACCA community

September 2021 to June 2022 exams

Watch free ACCA AAA lectures

30

Only on OpenTuition you can find: Free ACCA notes • Free ACCA lectures • Free ACCA tests • Free ACCA tutor support • The largest ACCA community

September 2021 to June 2022 exams

Watch free ACCA AAA lectures

31

Chapter 5

MONEY LAUNDERING

1. Introduction

Money laundering is a process whereby the proceeds of criminal activity are converted into assets

appearing to have a legitimate origin.

Dirty money is made clean-looking. The money typically comes from extortion, drugs, prostitution,

illegal gambling, illegal arms sales and people-trafficking. Criminal property may also arise from tax

evasion.

2. The stages of money laundering

The process of money laundering can be described in the following three steps:

๏

Placement: this is the process of introducing the money into a legitimate business activity so

that its origins appear bona fide. Methods include:

‣ Blending funds: mixing the dirty money with legitimate cash such as boosting the cash

takings of a business. Tax will have to be paid, but that’s a small price if the remainder of the

money is safe-guarded.

‣ Gambling: winnings are artificially increased and this can be used to explain the source of the

funds.

‣ Currency smuggling: move the cash to a lax jurisdiction where few questions will be asked.

You will notice that cash transactions facilitate placement because cash is relatively difficult to

trace compared to bank or credit transactions

๏

Layering: repeated transfer of money through different bank accounts and different countries

in an attempt to conceal or camouflage its origins. That way, even if the placement process

becomes known to the authorities it becomes difficult for them to trace the cash and recover it.

๏

Integration: the movement of previously laundered money into the economy so that the

money can be safely used. Examples include the purchase of assets such as expensive cars and

art works and jewellery.

Only on OpenTuition you can find: Free ACCA notes • Free ACCA lectures • Free ACCA tests • Free ACCA tutor support • The largest ACCA community

September 2021 to June 2022 exams

Watch free ACCA AAA lectures

32

3. Legislation

Many countries now have legislation to combat money laundering and the proceeds of crime and

also to interfere with the supply of money to terrorist organisations. As well as creating criminal

offences for the immediate perpetrators of the crimes, the legislation can also cover the behaviour

and responsibilities of auditors and accountants.

In the UK the Proceeds of Crime Act 2002 sets out three types of offence that can be committed by

any person:

๏

Concealing, disguising, converting or transferring money that is from the proceeds of crime.

๏

Entering into an arrangement to launder the proceeds of crime or having the suspicion that

money laundering is taking place yet not reporting it.

๏

Acquisition, use or possession of criminal property.

Two further offences are relevant to individuals in regulated sectors (financial services, law firms,

estate agents, casinos, etc):

๏

Failure to disclose knowledge or suspicion of money laundering:

‣ internally to a Money Laundering Reporting Officer (MLRO) or

‣ externally to the Serious Organised Crime Agency (SOCA).

๏

Tipping off.

The penalties are severe. For example, taking part in money laundering attracts a maximum prison

sentence of 14 years and/or an unlimited fine.

Note that if the prosecution can show that a defendant had a even suspicion that money had criminal

origins that the defendant can be found guilty of these crimes. So, ‘turning a blind eye’ is no defence.

Obviously an accountant could be directly participating in or abetting money laundering, but here we

will assume you are all ethical and won’t take part in that. However, it is easier to inadvertently

commit some of the other offences.

For example, suspicions would be expected to arise if:

๏

You work in a bank and see a customer dealing in large amounts of cash without any reasonable

explanation of their origin.

๏

You are an auditor and see cash passing through various banks accounts for no apparent

reason.

Tipping off is the disclosure of information that is likely to prejudice an investigation. So, saying to a

client “I think this is money laundering and I am going to report my suspicions to the authorities” is

clearly tipping off. However, what if you repeatedly ask for evidence about a transaction? The client

then knows that you might be suspicious and that your next step is to report the matter. However, if

you make no enquiries at all or inadequate enquiries, you might fail to uncover a perfectly innocent

explanation.

Only on OpenTuition you can find: Free ACCA notes • Free ACCA lectures • Free ACCA tests • Free ACCA tutor support • The largest ACCA community

September 2021 to June 2022 exams

Watch free ACCA AAA lectures

33

Auditors also do not want junior members of the audit team taking this into their own hands and

directly informing the authorities. Junior member of the team are relatively inexperienced and might

simply be jumping to the wrong, but dramatic, conclusions. Instead, all suspicions should be reported

to the auditing firm’s money laundering reporting officer. This is a person who has sufficient

experience and seniority to be able to make reliable decisions about when matters ought to be

reported to the authorities.

4. Auditors’ responsibilities

The Money Laundering Regulations 2007 require businesses in the accountancy sector to establish

anti money laundering ('AML') systems and controls including:

๏

Customer due diligence (‘Know your client’) measures include identification of the people

involved, the ownership of companies, the economic rationale of the business, the sources of

funds.

๏

Appointment of a Money Laundering Reporting Officer (MLRO).

๏

Train staff to identify the types and patterns of transaction that might indicate money

laundering.

๏

Establish a system for the reporting of suspicions to the MLRO.

๏

Include a paragraph in the engagement letter setting out the auditor’s responsibilities in respect

of money laundering.

๏

Maintain records detailing how the regulations have been complied with, for five years.

5. Risk factors

The existence of higher than normal risk factors require increased attention to gathering and

evaluation of KYC information and heightened awareness of the risk of money laundering in

performing professional work. For example:

๏

A cash-based business

๏

Many similar deposits and withdrawals in various bank accounts for no obvious reason

๏

Many jurisdiction involved in the transfer of money

๏

The use of tax havens

๏

Bearer bonds or cheques

๏

Higher profits than could be reasonably expected

๏

Poor documentation for transactions

๏

Secrecy

Only on OpenTuition you can find: Free ACCA notes • Free ACCA lectures • Free ACCA tests • Free ACCA tutor support • The largest ACCA community

September 2021 to June 2022 exams

Watch free ACCA AAA lectures

34

Only on OpenTuition you can find: Free ACCA notes • Free ACCA lectures • Free ACCA tests • Free ACCA tutor support • The largest ACCA community

September 2021 to June 2022 exams

Watch free ACCA AAA lectures

35

Chapter 6

RESPONDING TO NON-COMPLIANCE

WITH LAWS AND REGULATIONS

(NOCLAR)

1. Introduction

This chapter deals with how the auditor should respond to a client’s failure to comply with laws and

regulations. Potentially, non-compliance will lead to fines, penalties and damages and these should

be recognised as liabilities or contingent liabilities. Additionally, non-compliance might cause going

concern issues if the company is then prohibited from trading or the non-compliance damages the

reputation of the company to such an extent that its survival is threatened.

ISA 250 Consideration of Laws and Regulations in the Audit of Financial Statements is relevant. In

addition, IESBA's pronouncement Responding to Non-Compliance with Laws and Regulations

(NOCLAR) provides a framework for how professional accountants should act in the public interest,

when they become aware of or suspect NOCLAR.

NOCLAR is defined as acts of commission or omission, intentional or unintentional, committed by a

client or TCWG... contrary to laws or regulations. The definition excludes personal misconduct (i.e.

unrelated to business activities).

The ethical standard permits accountants to set aside the duty of confidentiality in order to disclose

NOCLAR rather than simply resign.

2. Management’s and auditor’s responsibilities

ISA 250 states that “It is the responsibility of management, with the oversight of those charged with

governance, to ensure that the entity’s operations are conducted in accordance with the provisions of

laws and regulations, including compliance with the provisions of laws and regulations that

determine reported amounts and disclosures in an entity’s financial statements”.

Management’s responsibilities will be easier to meet if there is an effective system of internal controls,

an internal audit department and an audit committee.

ISA 250 also states “the auditor is not responsible for preventing non-compliance and cannot be

expected to detect non-compliance with all laws and regulations”.

However, overall the auditor is responsible for identifying material misstatements whether caused by

fraud or error but the ISA recognises that the risk of the auditor failing to detect material

misstatements arising because of non-compliance can be increased because:

๏

There are many laws and regulations that do not directly affect the financial statements.

๏

Non-compliance might be accompanied by deliberate concealment.

๏

Whether an act amounts to non-compliance is ultimately a matter for the court or regulators.

Only on OpenTuition you can find: Free ACCA notes • Free ACCA lectures • Free ACCA tests • Free ACCA tutor support • The largest ACCA community

September 2021 to June 2022 exams

Watch free ACCA AAA lectures

36

ISA 250 distinguishes the auditor’s responsibilities for compliance between two categories of laws

and regulations:

๏

Those that have a direct effect on the financial statements (eg tax and pension laws). Here, the

auditor must obtain sufficient appropriate audit evidence regarding compliance with these

laws. This is, essentially a positive confirmation.

๏

Those that do not have a direct effect on the financial statements, but may be fundamental to

business operations, going concern or the avoidance of material penalties. Here, the auditor’s

responsibility is limited to undertaking procedures to help the identification of non-compliance

where this could have a material effect on the financial statements. This is, essentially, a negative

confirmation.

3. Audit procedures to assess compliance

๏

Obtain an understanding of the client’s regulatory environment and how the client complies.

๏

Obtain sufficient appropriate audit evidence where the laws and regulations directly affect the

financial statements.

๏

In respect of other laws:

‣ enquire of management whether the entity is in compliance

‣ inspect correspondence with relevant licensing authorities.

๏

Remain alert during the audit that other audit procedures might detect non-compliance.

๏

Ask for written representations from management declaring that all known incidents of noncompliance whose effects should be considered in the preparation of the financial statements

have been disclosed to the auditor.

๏

In the absence of identified or suspected non-compliance the auditor is not required to carry

out audit procedures to confirm compliance other than those listed above.

4. Non-compliance is identified or suspected

The auditor must:

๏

Understand the nature of the non-compliance and evaluate the possible effects on the financial

statements.

๏

Discuss the matter with management and TCWG if appropriate.

๏

If sufficient information about the suspected non-compliance cannot be obtained, consider the

effect of this lack of sufficient appropriate evidence on the audit opinion.

๏

Consider the effects of non-compliance on other aspects of the audit such as risk assessment

and the reliability of written representations. [In other words, the directors may have shown that

they consider compliance to be voluntary. If they act like this in one area how many other