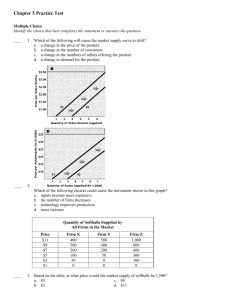

Unit 3 Practice Test AP Macroeconomics Krugman Text Multiple Choice Identify the choice that best completes the statement or answers the question. ____ 1. The marginal propensity to consume is: A. increasing if the marginal propensity to save is increasing. B. the proportion of total disposable income that the average family consumes. C. the change in consumer spending divided by the change in aggregate disposable income. D. the change in consumer spending less the change in aggregate disposable income. E. equal to 1. ____ 2. The MPS plus the MPC must equal: A. zero. B. one. C. total income. D. saving. E. disposable income. ____ 3. An increase in the MPC: A. increases the multiplier. B. shifts the autonomous investment line upward. C. decreases the multiplier. D. shifts the autonomous investment line downward. E. decreases the slope of the consumption function. ____ 4. Suppose the government increases its spending by $100 billion as a stimulus package. If the MPC is 0.6, then equilibrium income will: A. decrease by $250 billion. B. increase by $250 billion. C. increase by $600 billion. D. decrease by $400 billion. E. increase by $400 billion. ____ 5. If the size of MPS is decreasing, it will: A. make the multiplier smaller. B. make the multiplier larger. C. not affect the value of the multiplier. D. increase the interest rate. E. cause the MPC to also decrease. ____ 6. Suppose the marginal propensity to consume changes from 0.75 to 0.90. How will this affect the consumption function? A. The slope will get steeper. B. Autonomous consumption will increase. C. The function will exhibit a parallel shift upward. D. The slope will get steeper and autonomous consumption will increase. E. The function will exhibit a parallel shift downward. ____ 7. According to the table below, the MPC and autonomous consumption are ________ and ________, respectively, for Bob. Individual Consumption Function for Bob Disposable Income Bob’s Consumption $0 $9,000 $10,000 13,000 A. B. C. D. E. 0.6; $10,000 0.4; $13,000 0.6; $9,000 0.4; $9,000 0.4; $22,000 ____ 8. Other things being equal, investment spending ________ as long as ________. A. decreases; technological innovation develops faster than technological obsolescence B. increases; sales exceed the existing production capacity C. increases; the rate of growth of real GDP is lower than the marginal propensity to save D. decreases; the rate of growth of physical capital is positive E. increases; market interest rates continue to rise ____ 9. Positive unplanned inventory investment occurs when: A. actual depreciation is less than expected depreciation. B. actual sales are less than expected sales. C. actual depreciation is more than expected depreciation. D. actual sales are more than expected sales. E. actual sales exceed expected depreciation. Scenario 16-2: Income-Expenditure Equilibrium Autonomous Consumption is $500, and planned investment spending is $200. The marginal propensity to consume is 0.8. ____ 10. Use Scenario 16-2 above. If GDP is $3,000, how much is unplanned inventory investment? A. 0 B. $600 C. $100 D. –$100 E. $200 GDP (in billions) $0 500 1,000 1,500 2,000 2,500 3,000 Disposable income Consumption (in billions) (in billions) $0 $400 500 700 1,000 1,000 1,500 1,300 2,000 1,600 2,500 1,900 3,000 2,200 Table 16-3: The Economy of Albernia Planned Investment (in billions) $600 600 600 600 600 600 600 ____ 11. Use Table 16-3 above. If GDP is $1,500 billion, then the level of unplanned inventories will be equal to: A. $400 billion. B. –$400 billion. C. $600 billion. D. –$600 billion. E. zero. ____ 12. An increase in the expected future disposable income of households: A. shifts the planned aggregate spending line down. B. increases the slope of the aggregate spending line. C. decreases the slope of the aggregate spending line. D. shifts the planned aggregate spending line up. E. causes a movement upward along the aggregate spending line. Scenario 16-3: Aggregate Consumption Function Use the following information to answer the next two questions. Suppose the aggregate consumption function is given by the following equation: C = 1,000 + 0.75YD where C stands for consumption and YD stands for disposable income. ____ 13. Use Scenario 16-3. Suppose disposable income increases by $100, this means aggregate consumption will increase by _________ and autonomous consumption _______________. A. $75; remains at $1000 B. $1000; remains at $75 C. $100; increases by $100 D. $175; increases by $100 E. $400; remains at $1000 ____ 14. If the government lowers taxes in response to a recession, the government is engaging in what economists call: A. monetary policy. B. investment policy. C. consumption policy. D. fiscal policy. E. foreign exchange policy. _____ 15. A cut in taxes ________, therefore shifting the aggregate demand curve to the ________. A. decreases government transfers and consumption; right B. increases disposable income and consumption; right C. decreases the marginal propensity to save and consumption; left D. increases corporate profits and investment; left E. increases disposable income and investment; left ____ 16. The short run in macroeconomic analysis is a period: A. in which many production costs can be assumed to be fixed. B. in which wages become fully flexible. C. of 2 months, and the long run is a period greater than 12 months. D. in which interest rates are fixed. E. in which the unemployment rate is assumed constant. ____ 17. Changes in short-run aggregate supply can be caused by changes in: A. wages. B. wealth. C. government spending. D. consumption spending. E. investment spending. Figure 19-1: Shifts of the AD–AS Curves ____ 18. Use the “Shifts of the AD–AS Curves” Figure 19-1. In the short run, an increase in net exports is illustrated by: A. Panel (A). B. Panel (B). C. Panel (C). D. Panel (D). E. Panels (A) and (C). ____ 19. In the short run, the equilibrium price level and the equilibrium level of total output are determined by the intersection of: A. LRAS and SRAS. B. LRAS and aggregate demand. C. SRAS and aggregate demand. D. potential output and LRAS. E. potential output and aggregate demand. ____ 20. A natural disaster that destroys part of a country's infrastructure is a type of _________ and therefore shifts the _________ to the _________. A. negative demand shock; aggregate demand curve; right B. negative supply shock; aggregate demand curve; left C. negative supply shock; short-run aggregate supply curve; left D. negative demand shock; long-run aggregate supply curve; left E. negative supply shock; short-run aggregate supply curve; right ____ 21. Suppose the equilibrium aggregate price level is rising and the equilibrium level of real GDP is falling. Which of the following most likely caused these changes? A. An increase in short-run aggregate supply. B. An increase in aggregate demand. C. A decrease in short-run aggregate supply. D. A decrease in aggregate demand. E. An increase in short-run aggregate supply and an increase in aggregate demand. ____ 22. Inflationary and recessionary gaps are closed by self-correcting adjustments that shift: A. the SRAS curve. B. the AD curve. C. the LRAS curve. D. both the SRAS curve and the LRAS curve. E. both the AD curve and LRAS curve. ____ 23. A recessionary gap will be eliminated because there is _______ pressure on wages, causing the _______ . A. downward; short-run aggregate supply curve to shift rightward. B. downward; short-run aggregate supply curve to shift leftward. C. downward; aggregate demand curve to shift rightward. D. upward; aggregate demand curve to shift to leftward. E. upward; short-run aggregate supply curve to shift rightward. Figure 19-7: AD–AS Model II ____ 24. Use the “AD–AS Model II” Figure 19-7 above. As the size of the labor force increases over time, which of the following will take place? A. LRAS will shift to the right. B. LRAS will shift to the left. C. AD curve will shift to the left. D. AD curve will shift to the right. E. SRAS curve will shift to the right. ____ 25. Stagflation occurs when: A. the aggregate price level and the aggregate output level both fall. B. the aggregate price level falls and the aggregate output level rises. C. the aggregate price level rises and the aggregate output level falls. D. the aggregate price level and the aggregate output level both rise. E. the aggregate price level rises and the nominal interest rate falls. ____ 26. If there is a sudden increase in commodity prices, this will lead to a shift in the: A. SRAS curve to the right resulting in higher aggregate output. B. AD curve to the right resulting in higher aggregate price levels. C. SRAS curve to the left resulting in lower aggregate output. D. AD curve to the left resulting in lower aggregate price levels. E. LRAS curve to the right resulting in higher aggregate output. ____ 27. The current level of real GDP lies above potential GDP. An appropriate fiscal policy would be to _____, which will shift the _____ curve to the _____. A. decrease government purchases; AD; right. B. increase government purchases; AD; left. C. decrease government purchases; AD; left. D. increase tax rates; AD; right. E. increase the federal funds rate; AD; left Figure 20-2: North-West Government ____ 28. Use the “North-West Government” Figure 20-2. Using the accompanying figure, which of the following would be the appropriate response of the North-West government? A. Expand aggregate demand by increasing taxes to close the inflationary gap. B. Reduce aggregate demand by cutting taxes to close the inflationary gap. C. Expand aggregate demand by decreasing taxes to close the recessionary gap. D. Reduce aggregate demand by increasing taxes to close the recessionary gap. E. Expand aggregate demand by increasing taxes to close the recessionary gap. ____ 29. An expansionary fiscal policy: A. typically decreases a government budget deficit or increases a government budget surplus. B. may include decreases in government spending. C. may include increases in the money supply. D. may include decreases in taxes. E. may include a reduction in transfer payments. Figure 20-6: Fiscal Policy II ____ 30. Use the “Fiscal Policy II” Figure 20-6. Suppose that this economy is in equilibrium at E2. If there is an increase in government transfers, then: A. AD2 will shift to the right, causing an increase in the price level and an increase in real GDP. B. AD2 will shift to the left, causing a decrease in the price level and a decrease in the real GDP. C. AD1 will shift to the right, causing an increase in the price level and an increase in real GDP. D. AD1 will shift to the left, causing a decrease in the price level and a decrease in real GDP. E. AD2 will shift to the right, causing an increase in the price level and a decrease in real GDP. Figure 20-7: Fiscal Policy Choices ____ 31. Use the “Fiscal Policy Choices” Figure 20-7. In Panel (a), the economy is initially at output level Y1 and there is: A. an inflationary gap. B. a recessionary gap. C. equilibrium at full employment. D. A budget gap. E. a foreign exchange gap. Scenario 20-1: Fiscal Policy Consider the economy of Arcadia. The households of Arcadia spend 75% of their income. There are no taxes and no foreign trade. The currency of Arcadia is called “Arcs”. The level of potential output in Arcadia is 600 billion arcs. ____ 32. Use Scenario 20-1. Refer to the information provided. Suppose the actual real GDP in Arcadia is 500 billion arcs. Then, the economy has: A. a recessionary gap. B. production at the full-employment level. C. an inflationary gap. D. a liquidity trap. E. an unemployment rate that is higher than the natural rate of unemployment. ____ 33. Suppose an economy is producing real GDP of $300 billion. The potential output is equal to $400 billion, and the MPC is equal to 0.80. Then the government should follow a policy of: A. raising taxes by $25 billion to take the economy back to potential output. B. cutting taxes by $33.33 billion to take the economy back to potential output. C. raising taxes by $33.33 billion to take the economy back to potential output. D. cutting taxes by $25 billion to take the economy back to potential output. E. cutting taxes by $20 billion to take the economy back to potential output. ____ 34. Assume that the MPC = 0.8 and the government increases spending by $100 billion, financing this spending with a $100 billion tax increase. Which of the following will be the likely effect of this action? A. Real GDP will contract by $200 billion. B. Real GDP will contract by $100 billion. C. Real GDP will expand by $500 billion. D. Real GDP will expand by $400 billion. E. Real GDP will expand by $100 billion. Figure 38-1: Productivity ____ 35. Use the “Productivity” Figure 38-1. Suppose there has been an increase in physical capital per worker with everything else remaining unchanged, then it is shown on the diagram as: A. a movement from B to C. B. a movement from A to C. C. a movement from A to B. D. a movement from B to A. E. a movement from C to B. Unit 3 Retake / Practice Test Answer Section AP Macroeconomics Krugman Text 2012 MULTIPLE CHOICE 1. ANS: SKL: 2. ANS: SKL: 3. ANS: SKL: 4. ANS: SKL: 5. ANS: SKL: 6. ANS: SKL: 7. ANS: SKL: 8. ANS: SKL: 9. ANS: SKL: 10. ANS: SKL: 11. ANS: SKL: 12. ANS: SKL: 13. ANS: SKL: 14. ANS: SKL: 15. ANS: SKL: 16. ANS: SKL: 17. ANS: 18. ANS: SKL: 19. ANS: SKL: 20. ANS: SKL: 21. ANS: SKL: 22. ANS: SKL: C PTS: Definitional B PTS: Concept-Based A PTS: Critical Thinking B PTS: Critical Thinking B PTS: Critical Thinking A PTS: Critical Thinking D PTS: Critical Thinking B PTS: Critical Thinking B PTS: Concept-Based D PTS: Analytical Thinking B PTS: Analytical Thinking D PTS: Critical Thinking A PTS: Critical Thinking D PTS: Concept-Based B PTS: Concept-Based A PTS: Definitional A PTS: A PTS: Analytical Thinking C PTS: Concept-Based C PTS: Critical Thinking C PTS: Critical Thinking A PTS: Concept-Based 1 DIF: E REF: Module 16 1 DIF: E REF: Module 16 1 DIF: M REF: Module 16 1 DIF: M REF: Module 16 1 DIF: M REF: Module 16 1 DIF: M REF: Module 16 1 DIF: M REF: Module 16 1 DIF: M REF: Module 16 1 DIF: M REF: Module 16 1 DIF: D REF: Module 16 1 DIF: M REF: Module 16 1 DIF: M REF: Module 16 1 DIF: M REF: Module 16 1 DIF: E REF: Module 17 1 DIF: M REF: Module 17 1 DIF: E REF: Module 18 1 1 REF: Module 18 DIF: M REF: Module 19 1 DIF: M REF: Module 19 1 DIF: M REF: Module 19 1 DIF: M REF: Module 19 1 DIF: M REF: Module 19 23. ANS: SKL: 24. ANS: SKL: 25. ANS: SKL: 26. ANS: SKL: 27. ANS: SKL: 28. ANS: SKL: 29. ANS: SKL: 30. ANS: SKL: 31. ANS: SKL: 32. ANS: SKL: 33. ANS: SKL: 34. ANS: SKL: 35. ANS: SKL: 36. ANS: SKL: 37. ANS: SKL: 38. ANS: SKL: A PTS: Concept-Based A PTS: Critical Thinking C PTS: Definitional C PTS: Definitional C PTS: Critical Thinking C PTS: Critical Thinking C PTS: Critical Thinking B PTS: Critical Thinking A PTS: Critical Thinking D PTS: Concept-Based B PTS: Concept-Based A PTS: Concept-Based D PTS: Analytical Thinking E PTS: Critical Thinking C PTS: Analytical Thinking D PTS: Analytical Thinking 1 DIF: M REF: Module 19 1 DIF: M REF: Module 19 1 DIF: M REF: Module 19 1 DIF: E REF: Module 19 1 DIF: M REF: Module 19 1 DIF: M REF: Module 20 1 DIF: M REF: Module 20 1 DIF: M REF: Module 20 1 DIF: M REF: Module 20 1 DIF: M REF: Module 20 1 DIF: M REF: Module 20 1 DIF: M REF: Module 20 1 DIF: D REF: Module 21 1 DIF: D REF: Module 21 1 DIF: M REF: Module 38 1 DIF: M REF: Module 39