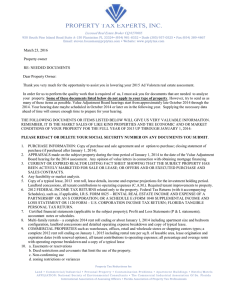

Property Outline: Bundle of Sticks: : The different ownership rights - Possess, exclude, sell, transfer, enjoy, pledge, etc. To determine the rights of the parties, go to: 1. The agreement a. The agreement between the parties represents a private agreement that is enforceable in the courts i. Enforceable in the courts when it is against the law or public policy b. Statute c. Common Law i. Default ii. Changes over time d. Case law e. Law review articles and treatises Determining who has what property rights: Public Policy is the why of the law 1. Determine if there is a property interest a. If there is no property interest, there may be causes of action based upon breach of contract or other theories, but not based upon Property law 2. If there is a property interest, what interest is involved in the dispute a. Possession, right to exclude, right to enjoy, etc. 3. Is there an interest but less than full property that may be protected under property law a. Quasi property b. Pre-possessory interest Identify the Property Interest: - What kind of property? o Real, personal, fixture, tangible, intangible - Who is the owner? o Who is in possession? o Who has the strongest legal claim? - What elements of proof are necessary to determine the rights of claimants to property and who bears the burden of proof or satisfaction or lack of such elements? - What type of property is identified? o What rights are being infringed upon? o What elements of proof are necessary to show a violation of those rights? - Where do the rights and causes of action arise? o Common law? o Case Law? o Statutes? Rights of possession: Nuisances Adams v. Cleveland-Cliffs Iron Co. (MI 1999) pg. 2 Facts: One of the nations largest iron ore mines which in near the P’s home and the mine blasts 3 times a week year-round resulting in the P always having dust from the mine in their house and unable to sell their house. - Need to show both actual and substantial injury to recover Holding: reversed and remanded. The law of trespass does not cover airborne particulate, noise, or vibrations. Nuisances is not a trespass because no one physically brought the dust into the house Nuisance Jacque v. Steenberg Homes Inc. (WI 1997) pg. 6 Facts: D was delivering a mobile home to the P’s neighbor and took it through their property to deliver it despite instruction not to, in order to avoid 7 feet of snow so they could be paid quicker. P had refused to give permission to use their property. - Nominal damages support punitive damages Held: Punitive damages are allowed in intentional trespass; reinstate punitive damages of $100,000 Public policy: - Fundamental right to exclude is part of the right of ownership - Law assumes that there is damages when there is trespass because a right was violated o At a minimum there was nominal damages - Society likes to help those who take care of their property o Possession under a contract is not adverse possession - Right to exclude is not absolute; it is balanced with the right of other rights Real and Personal Property: - Real property: land and improvements like buildings that are permanently attached to the extent that they lose their separate identity o Civil law systems use moveable and immovable terms o Ex: Land Fixture: an item that was originally a chattel but is attached to a piece of real property that becomes part of the property and cannot be removed. - Personal property: things not attached to land and intangible objects o Tangible and intangible Cars, paintings, books, and bank accounts - Intellectual Property - Property comes from o God o The king o The government o Constitution o The federal legislature o Local authorities o Private parties Johnson v. Hicks (OR 1981) pg. 13 Facts: P seeks to require Ds to restore an irrigation line to its original position on her property and refrain from further interference—equity in a mandatory injunction. P’s ex-husband and the D had installed the irrigation system on the property line. D entered her property that she got in the divorce and moved it to his property, depriving her access to water. D and the Ex had made an agreement that if one of them died, the other got the agreement but did not disclose it to P. Holding: removal of the pope interfered with P’s rights, as the irrigation system was a fixture fo the property and D did not have a right to remove it. P did not get damages for her trees that died and did not get right to the water Rules: real property should be considered as a fixture and a part and parcel of the land as between a grantor or mortgagor and mortgagee Factors: - Real or constructive annexation of the article to the reality - Appropriation or adaption to the use or purposes of the reality with which it is connected - The intention to make the annexation permanent Intellectual Property - Property rights in intellectual property are created by creation - Copyright: o an author’s particular expression of an idea but not the idea itself o governed by Federal law o Copyright lasts for life of an author plus 70 years and copyright of an entity lasts 75 years o Registration allowed but not required unless you bring suit for infringement, and you must register it first - Patent Law: o Federal law and the constitution, authorizing a limited monopoly o Must submit an application to the patent and trademark office meeting for exclusive right to make, use, and sell for 20 years o 5 requirements 1. Patentable subject matter 2. Usefulness 3. Novelty 4. non-obviousness 5. Disclosure sufficient to enable other skilled in the art to make and use the invention - Trade Secret Law o protected by state law rather than federal, to protect trade secrets from being stolen by unfair or commercially unreasonable means. - Trademark Law o federal statutes that protect any word, name, symbol, device, or combination thereof o Governed by federal statute like the Lanham Act which gives seller exclusive right to “register” a trademark and prevent competitors from using that trademark o Functionality doctrine Prevents trademark law from inhibiting legitimate competition by allowing a producer to control a useful product feature International News Service v. Associated Press (US 1918) D is a news business and P is one of their competitors. D said that P was stealing their unprinted or early new edition news. Holding: The news is quasi property because it is a good. The equitable theory of consideration in the law of trusts applies—he who has fairly paid the price should have the beneficial use of the property. Dissent: Holmes - Property rights come the ability to exclude so there are not property rights here. The court should not create new property right, merely putting effort does not make it property. A different kind of remedy may be available in the DC. Dissent: Brandeis - The cost to produce does not produce property. The news has never been property, they must rely on contract or unfair competition laws. Parks v. LaFace Records (6th C 2003) Outcast used Rosa Park’s name as the name of a song. She sued, saying that the use of her name was false advertising for the use of her name under the Lanham Act and a right of publicity claim. The only references to Parks was the repeated line “move to the back of the bus.” - Lanham Act is a federal act that allows celebrities to sue for use of their name as they are a known entity. The celebrity must show that it is likely to cause confusion. o If the D’s product is likely to cause confusion, the P can use the 1st amendment as a defense, but it will not succeed unless the underlying work is not relevant or misleading. - The right of publicity act is a state law that protects the right of the celebrity from exploitation. They do not have to prove confusion. Holding: The D’s cry of artist right and symbol does not absolve them from potential liability for using Rosa Park’s name. It is not a 1st amendment issue. Forms of reasoning: - Formal Reasoning: o Legally authoritative reason (a valid legal rule) on which judges and others are empowered or required to base a design or action - Substantive Reasoning o A moral, economic, political, institutional, or other social consideration o Other justifications: Importance of certainty, Preserving peace and order in society, and Bright line rules encourage certainty o Courts can cite rules and/or also cite the public policy behind the rule Acquiring Interest in Things: - Wild animals are acquired by occupancy o Ratione soli o Animus revertendi - Cloud on title: an interest on the title - Rule of Capture: the first possessor of an abandoned item becomes its owner and control is determinative of possession - Law of escape: Loss of a domesticated animal does not terminate the owner’s rights to it Wild Animals Pierson v. Post (NY 1805) pg. 33 Facts: D killed a fox the P was actively pursuing. Fox is a ferae naturae; owned by occupancy only so Rule of capture - More than one person can have interest but the court awards rights to the one with possession Holding: Pursuit does not give legal right to kill the fox because property rights in wild animals are lost when they get free--his intent, pursuit, to possess is not enough Dissent: - Pursuit is enough to own on unoccupied land to establish right to ownership, which trumps the question of possession - Mortal wound: Sometimes the court says that it is close enough to possession Keeble v. Hickeringill (England) 38 P was hunting for ducks, as part of his job, and put out decoys. D purposefully drove away the ducks. Trespass on case - In common law, trespass on case was applicable to indirect injuries or when the P was not in possession or an interest that was not property Holding: Ruled for P; anyone who hinders another’s trade owes damages, but he never had ownership of the ducks; A property holder making lawful use of his land is free to do so without interference from others. Where the landowner uses his property for a profit-making venture, it constitutes a trade, and interfering with a person’s livelihood subjects the interferer to liability for damages. Baseball Popov v. Hayashi (CA) pg. 42 The parties came to watch the homerun record be broken in the section where the baseball player was most likely to catch a homerun. Popov caught it but the crowd knocked him down and he dropped it. Hay did not assault him but picked up the ball and obtained possession. - Absolute dominion is not required where such a rule is unworkable and rule of capture does apply - Gray’s rule for baseball: Custom and practice creates a reasonable expectation that a person will get control before possession –the first person to pick up a loose ball and secure it becomes its possessor but the actor must retain control of the ball after contact - Unlawful activity must be considered Holding: When an actor undertakes significant but incomplete steps to achieve possession and is interrupted by a crime, the actor has a pre-possessory interest in the property constitutes a qualified right to possession. In addition, because Hayashi was not involved in the mob that attacked, he has a right to possession to, because the rule of capture. Therefore, both parties have an equal, undivided interest in the ball. - Court held that the ball needed to be sold and the proceeds split equally Subsequent Possession: Losers and Finders - Undivided interest: an interest in property that cannot be split up physically True owner: who bought the property and owns the interest in it Finder’s rule: A finder is entitled to possession of lost property against everyone except the true owner, and is entitled to keep abandoned property o if property was wrongfully obtained, relative first occupancy is protected Classification of Found Property - Abandoned o When the owner no longer wants to possess it but a finder must show proof that the owner intends to abandon it and voluntarily relinquishes right, title, and interest and then it belongs to the finder - Lost o Owner unintentionally and involuntarily parts with its possession and does not know where it is. Belongs to the finder unless the owner claims the item Stolen property found by someone who is not part of the theft is lost property as to the finder o Finders statutes determine the time a true owner has to claim the item - Mislaid o True owner voluntarily put in a certain place and then overlooks or forgot where the property is belongs not to the finder but to the owner of the premises where found until the true owner shows up - Treasure trove o Element of antiquity, hidden or concealed for such a length of time that the owner is probably dead or undiscoverable –usually coins or currency concealed by the owner o Belongs to the finder against all but the true owner - Embedded Property o Personal property that becomes part of the natural earth, like pottery or a sunken wreck—etc.: partially buried in the ground and belongs to the owner of the land Finder and theft: a finder has the right of ownership but the thief does not. The finder’s right of ownership trumps everyone but the true owner Windfall: A windfall is a large, and many times unexpected, financial gain—often the result of an inheritance, lawsuit settlement, property sale, salary bonus, or even a winning lottery ticket. - History o when the king owned all of the land, the peasants couldn't go on the land to collect sticks, or they were trespassing; but after a storm they had access to the property without trespassing because it blew off of it Bailments: an express or implied agreement that 1 person will entrust personal property to another for a specific purpose and when it is accomplished the bailee will return it - Traditional bailment: one party entrusts property to another - A finder is a type of bailee - Standard of care is determined by the benefit each party receives Gratuitous bailment: bailment for benefit of the bailor; someone agrees to do something without you paying them - Ex: a neighbor watches your good while you are on vacation Bailment for Hire: pay someone to do something for you - Transaction is a constructive bailment with consequences that flow from the - Different standard of care than a gratuitous bailment o Highly expected conduct o The standard of care depends on the benefit to the bailee o Reasonable ordinary care of the expected conduct is ordinary Finder of lost property Armory v. Delamirie (UK 1722) (50) P, a chimney sweep, found a jewel, and took it to a goldsmith (D) for appraisal and to find out what it was. But, D did not give it back complete, just as a socket without the stone. - It does not matter that P worked with the Apprentice, the master is answerable for his employee. Holding: The finder of the jewel does not have absolute ownership of the jewel, the true owner does, but the finder has the right to keep it all from all but the rightful owner -- Relativity of rights analysis Classification of mislaid property Benjamin v. Lindner Aviation Inc. (IW 1995) (53) Benjamin, an employee of the aviation company, Linder Aviation, found $18,000, in the wing of airplane. The plane was owned by State Capital Bank and they were having it serviced at Lindner. The previous owner of the airplane defaulted on a loan and the bank repossessed the plan. All three parties claim ownership and the Money was turned into the authorities in compliance with the finders law TC: decided the money was mislaid property so Iowa Code 644 did not apply as it was not lost and gave the money to the bank. However, they awarded Benjamin a finder’s fee - Statute only applies to lost property - Iowa continues to use common law distinctions between classes of found property despite Code 644 Holding: Money was placed in the plane in a manner that shows it was hidden there; the property where the money was found was the airplane, owned by the bank, and not the hangar so the bank is the rightful owner. TC erred in awarding B a finder’s fee. Dissent: The holding is unfair and fails to come from a logical analysis; the money had been abandoned to B is entitled to the entire amount he found. Embedded Property Corliss v. Wenner (ID 2001) (62) Anderson and Corliss found a glass jar with gold coins in it while excavating on Werner’s ranch. The jar is probably 70 years old. - Embedded property is personal property that becomes part of the natural earth and becomes part of the natural earth and Treasure trove has never been adopted in ID - The average ID citizen would expect to have a possessory interest in any object uncovered on their property Holding: The coins were embedded property and the owner of the land has constructive possession of all personal propertied in, on, or under the land - Ruling for finders would run counter to reasonable expectations of present-day land ownership and there is No reason for a special rule for coins Adverse Possession Doctrine of Adverse Possession: when a possessor acquires ownership against a prior owner - A successful adverse possession action results in a legal titleholder forfeiting ownership to an adverse holder without compensation - Disfavored doctrine Basic Common Law Elements of Adverse Possession 1. Actual a. Physical invasion i. Residence is not required but some use I, in the manner an average owner would for that property and the nature of the land ii. Test: 1. The degree of actual use and enjoyment of the parcel of land involved which the average owner would exercise over similar property under like circumstances 2. Open and Notorious a. Gives notice to the true owner so they have the opportunity to stop the invasion b. A minor encroachment might not be considered open and notorious i. Some states requirements more than a mere encroachment and Courts often do equitable relief in situations where this arises 3. Hostile a. Different in different jurisdictions b. Without consent and inconsistent with the rights of the true owner i. Involved conceptually with trespass ii. Act of trespass is sufficient to meet one element of hostile iii. Cannot be hostile with permission 4. Exclusive a. Cannot be shared with the true owner or a public possession 5. Continuous for the period in the statute a. Color of title statutes are usually less b. Cannot abandon the property for any period of time and must use the property in the way people would customarily use the property i. If abandoned the property, the progress towards the statute of limitations terminates Possession means exclusivity of use - A claimant must prove that he wholly excluded the owner from possession for the required period Adverse possessor cannot gain title to government owned land - Exception: can acquire land owned by the government in a proprietary capacity but not in a governmental capacity the government can acquire title by adverse possession Claim of right - Met all the requirements of adverse possession - Only gets the amount of the property they occupy Public Policy: - Punishment theory: owners should take care of their property - Reward theory: the adverse possessor should be rewarded for putting labor and work into the land - Quiet enjoyment also means stopping other people from using the property - Evidentiary cases, so must be able to prove possession because public records are not always accurate o Effect if running of statute Statute of Limitations: - Starts running when possession begins o When an adverse possessor gets a title after a successful claim , the title is back dated to the day they began possessing the land because of the relation back doctrine - A person who has a cause of action to recover the land must assert it within the specified period or else lose it Legal Disability: - Cannot adversely possess land is the true owner is o A minority, disabled o In the military in some jurisdictions - 3 approaches o Tolling of the statute of limitations paused until the true owner no longer has the disability or the property changes hands If disability happens during the hostile use, the statute of limitations is not tolled so only look at the moment the adverse possession elements all are present o Extension of the time period An owner who suffers from a statutorily specified disability when A goes into possession usually gets the benefit of some form of extension of the statutory period required for A to obtain title o No change in statutory period required Damages: - A cant get restitution from O because A is considered the owner - O cant get restitution from A unless I sued before the statute ran so O could get possession and the value of A’s use and occupation Tacking: - Successive adverse possessions may be tacked together to satisfy the total period required for adverse possession, if the requisite doctrinal requirements are met o Can transfer the interest or the physical possession o Can transfer through a will or the state - Cannot tack on periods where you do not have all the elements of adverse possessions because Stat of lims only runs when the possessor has all the elements - Generally, the parties tacking adverse possession must have privity o A relationship, with various legal consequences depending on the circumstances, between different parties having a legally recognized interest in the same subject matter If you sell/give the property away that is privity Burden of Proof: - burden of production and the responsibility for establishing the case in accordance with the applicable standard of proof o 33 states require clear and convincing standard o 14 states require preponderance of the evidence standard State of Mind Requirements - Maine Doctrine: bad faith required o Only a rule in AK and requires an adverse possessor to deliberately take the property - Connecticut Doctrine: only needs to exercise dominion over the land o A state of mind is irrelevant, objective o Majority rule - Good faith o Some courts require good faith but most do not Replevin: An action seeking return of personal property wrongfully taken or held by the defendant. Claim of RightShultz v. DEW (1997) (72) Concerns a strip of land that includes D's driveway along the western edge of the D's property. P thought the driveway was on their property, mowed the lawn, planted trees in the 1960s. D did not assert the driveway was on their property until they tried to sell the property. Had maintained the strip of property since 1940s or 50s - Burden of proving title by adverse possession is on the one who asserts it and they can prove adverse possession by either a substantial enclosure or cultivation or improvement o Statutory requirement: substantial enclosure, improvement of the land, or cultivation Natural barrier can be a substantial enclosure because it tells the true owner that someone else is claiming it and puts the true owner on notice Reasonableness plays a part in the courts decision Holding: Improved the land by building the driveway and mowing and the tree line constitutes a substantial enclosure as it does not need to be complete and can be natural, as they were intentional and communicated a deliberate enclosure - Enclosure/cultivation or improvement satisfied actual possession Marengo Cave Co v. Ross (1938) (77) Dispute of a cave discovered in 1883 under the party’s land. The opening was on the cave co land, and they claimed title to all of the cave. A survey showed that the cave was also under the neighboring land . - Mere possession is not enough, it must be open and notorious and possession must be exclusive - Policy- cannot assent to allowing adverse possession when the owner does not know it exists Holding: the possession of the land by the company for 20 years was not open, notorious, or exclusive. Possession must be notorious so that is the owner visits the property, he would be put on notice and be able to assert his rights and the D did not have notice so the tolling of that statute of limitations did not begin until the survey - Property ownership is to the sky and to the center of the earth - Only reasonable efforts of search are required Gruebele v. Geringer (2002) (89) Neighbors disputing a piece of land that a garage is on at their property line, they had shared it with the previous owners when Geringer bought the land. Geringer unable to tack the use of the previous owner because they shared the garage. The Gruebele's removed their tools in the garage so Geringer could move the garage - Possession that begins with permission cannot acquire the character of adverse possession until permission is taken away Holding: Geringer did not establish ownership through adverse possession. Tc did not err when it said Gruebeles were the rightful owners because the possession was not exclusive and continuous, the Owner must be wholly excluded from possession by the claimant and there is no evidence of a hostile act (If you count when Gruebeles removed their tools as a hostile act, it does not comply with 20 year requirement) Exceptions: Mistaken possession Mannilo v. Gorski (1969) (95) P seeking injunction against trespass and D counter sued claiming adverse possession D's steps ad concrete walk to her house encroached on P's land by 15 inches. She added it to the house in 1953Owner of the property did not know where the property line was until they got a survey. D did not realize that the 15 inches were their land. TC focused on the D's mistake and their subjective thought process. - Maine Doctrine: bad faith required - Connecticut Doctrine: only needs to exercise dominion over the land Holding: A claim of adverse possession may be based on mistaken possession, but it must also be visible enough to put the owner on notice; no presumption of knowledge arises from a minor encroachment along a common boundary Carpenter v. Ruperto (1982) (101) P appeals action to quiet title to land and D cross-appeal P's relief on equitable grounds. The dispute is over the south 60 feet of the lot. P did not know her exact boundary line when she bought the property but did know she had not purchased the cornfield. Years later, the field was not planted as full as when she first purchased it so she had planted bushes, and put a propane tank and a driveway on the property. Holding: P did not prove the good faith requirement of adverse possession claim and good faith is an essential element of adverse possession, so TC did not err. If the P knows when they enter possession of the disputed land that they have no legal right to do so, it is not in good faith Color of Title - - occupancy under writing that purports to pass title to the occupant but which does not actually do so either because one of the parties fails to have the title or capacity to transfer the title or because of the defective mode of the conveyance used claim o must still satisfy the basic elements of adverse possession o Deed could be wrong, or the person did not have the right to give them the property Do not have to establish that the party has occupied the entire lot, the amount on the deed is the amount the adverse possession gets Some states require the claimant under color of title o o o - - to pay taxes Deed to be recorded Good faith Doctrine of acquiescence: allows land to be acquired by adverse possession without usual adverse intent when the true owner has acquiesced in another possession for 20 years Some courts require a claimant's good faith belief to be reasonable Courts require good faith by manipulating the possession requirements to deny a title to a party to appears to be a knowing trespasser but do not directly state good faith as an affirmative element of adverse possession doctrine in jurisdictions that do not require good faith o Scholarly opinion favors objective view so they cannot acquire by larceny Agreed boundaries o An oral agreement to fix a property boundary is enforceable if there is uncertainty to the true location of the boundary and the uncertainty is resolved by agreement and the agreement is evidence by the parties subsequent actions Estoppel o Analytically separate from agreed boundaries and acquiescence o Representation by one owner to an adjoining owner as to the location of the boundary between them o Title passes when the representation is detrimentally relied upon by the second owner through their construction of encroaching improvements Lott v. Muldoon Road Baptist Church (1970) (107) P's ex husband encroached on the property P was granted in their divorce. She moved out of Alaska, and he split his portion into lots and some of hers and rented it to a Baptist church for a Sunday school with a lease to own option while the P was still not in Alaska. Made part of her property is part of the subdivision platt that he created and lease to a church on a rent to own basis. He borrowed money and put the mortgage on the platt and after he paid off the mortgage, they gave him the title to the entire platt. When he died the church got the title. - Extent of land possessed is decided by the terms of the instrument giving color of title rather than physical use of the claimant - A deed of reconveyance can establish a color of title Holding: The Baptist church through adverse possession through color of title is the true owner Dissent: The adverse possessor must give the title in good faith and cannot know who you are getting the title from got it through theft - A plat of consolidation or plan of consolidation originates when a landowner takes over several adjacent parcels of land and consolidates them into a single parcel. In order to do this, the landowner will usually need to make a survey of the parcels and submit the survey to the governing body that would have to approve the consolidation. - A plat of subdivision or plan of subdivision appears when a landowner or municipality divides land into smaller parcels. If a landowner owns an acre of land, for instance, and wants to divide it into three pieces, a surveyor would have to take precise measurements of the land and submit the survey to the governing body, which would then have to approve it.[6] A plat of subdivision also applies when a landowner/building owner divides a multi-family building into multiple units. This can apply for the intention of selling off the individual units as condominiums to individual owners Can convey property with metes and bounds - An old method to establish boundary lines where a surveyor looks at the whole property and outlines the boundary before it is recorded to establish the property lines Adverse Possession of Personal Property - Discovery rule: a cause of action does not accrue until the injured party discovers or by exercise of reasonable diligence and intelligence should have discovered facts which form the basis of a cause of action o Public policy: shifts the focus from what the P has to prove because If someone is to be penalized, then they should have enough time to discover the injury and is equitable for the innocent parties - Entitled to discovery rule if o due diligence to recover the personal property o effective method to alert the correct people o a way to put a reasonably prudent purchaser on constructive notice that someone other than the possessor was the true owner - UCC 2-403 o A party cannot transfer no greater interest in property than the property owns In cases with stolen property some courts rule that a cause of action accrues when a demand is made upon the possessor and the possessor refused - the last innocent party who could have prevented the lost will not be preferred over an innocent party who did not have the ability to stop the loss o Gets stuck with not having the property o True owner contributes to allowing the transfer o Aligns with UCC o The innocent party who contributed the allowing the transfer (seller of the ring) can still sue the wrongful party (pawn shop) Other remedies available O’Keeffe v. Synder (1980) (114) P claimed that she was the owner of 3 paintings that were stolen from an art gallery and D said that he had a title of adverse possession, statute of limitations, and a purchaser for value of the paintings. The paintings were not reported stolen until 1972, but the theft occurred in 1946. Man who sold the paintings to the D claimed 30 years of continuous possession of the paintings through his father who was friends with O'Keeffe's late husband (a few years before the alleged theft). - Generally, a thief cannot transfer title - True owner is responsible for proving that they were due diligent to get running of the Stat. Of Lim through the discovery rule Holding: The discovery rule applies to the action and tolls the statute of limitations if the property owner acted with due diligence Transferring Interests in Things: Gifts Gifts: immediate transfer of a thing from the donor to the donee. - Requirements for the types of gifts are the same - Some courts construe cause mortis gifts stricter because there is a higher likelihood of fraud - An object capable of manual delivery must be handed over to the donee to satisfy the delivery requirement - Where manual delivery is impractical courts may permit a substitute deliver o Constructive or symbolic - Proponent of the gift has the burden of proving each element by clear and convincing evidence Inter vivos - Gift between living persons it is effective immediately upon satisfaction of requirements and is irrevocable because only one person can be the true owner o Exception for gifts in contemplation of marriage Gifts of land made in contemplation of marriage may also be recovered if the marriage does not occur Failure happens when the parties do not satisfy any of the conditions of the gift o Requirements: Donative intent Delivery What courts allow for a delivery method depends on circumstances that show intent and the jurisdiction Acceptance Assumed when the gift is of value to the done o An inter vivos gift of the interest but not the object is still effective Gifts- Donatio causa mortis: in contemplation of death, it is complete upon delivery/acceptance but can be revoked by donor and will automatically be revoked if donor does not die of the peril that cased the causa mortis gift - Must die for the gift to be effective and must die in the condition expected by the donor because dying of something else is an intervening cause - Did not abandon the property with the gift, it is contingent upon the parties' death as they retain interest - Can be revoked at any time before the donor dies and is automatically revoke if the donor recovers o Intent to transfer the check to the P must be concrete, unequivocal, and undisputed Requirements: 1) Donative intent 2) Delivery 3) Acceptance 4) In contemplation of impending death 5) Donor dies of that cause Delivery methods - Constructive o Donor gives the donee the means of obtaining the possession or control to satisfy the delivery requirement - Symbolic o Donor gives the donee an object or item that symbolizes the subject of the gift - Actual Wills: transfer not effective until death of donor - Statute of wills - If a party wants a gift to be effective at their death, they must bequeath it in the appropriate manner as listed in the statute of wills to avoid fraud - A gift intended to be made by a testamentary disposition effective after death must be made by will - Interest begins when the instrument becomes operation o Interest begins with a will when the trustee dies Can change your will while you are alive, so heirs don’t have a future interest - Interest begins with a deed at transfer - Types o Holographic will: a will that was not witnessed, rather handwritten o Attested will: requires the maker's signature and the signature of two or more credible witnesses. A credible witness is a competent person older than 19 who is not a beneficiary of the will. - UPC will requirements are less formal: o requires that the will must be in writing, o signed or acknowledged by the testator, o signed by at least 2 individuals each whom signed in a reasonable time after they signed the will or testament - 1/3 of states allow a testator to transmit property by an unattested will o Uniform Probate Code 2-101 Intestate Estate 2-103 Share of Heirs other than surviving spouse 2-105 No taker Repugnancy Doctrine: - Note 5 page 244 o A contradiction or inconsistency between clauses of the same instrument or between allegations of the same pleading Courts will resolve contradictions in a document based on the primary intention of the parties or treat earlier statements as effective - If you strike something out of the contract, the contract is considered silent on the matter and the default rule applies Trust: transfers legal title to the trustee who hold it for the benefit of the beneficiaries who hold beneficial title. It divides ownership by vesting title and management powers in the trustee and beneficial interests in the beneficiary of the trust Can be created by: o Trust by making a transfer of property to a trustee o By declaring himself or herself trustee Revocable and irrevocable o Revocable inter vivos trust A way to avoid probate of trust assets Validity of the trust instrument does not depend on compliance with the formalities required for wills Present transfer of property interest to the property - Under contract law there can also be a promise to make a gift enforceable if all conditions satisfied o Must be supported by consideration to be enforceable o Promises are not usually enforceable, must be one of the exceptions Constructive Trust: o Not a trust but a source of duties o An equitable restitutionary remedy based on duties imposed by the substantive law of unjust enrichment o A court can declare the D to be a trustee and order the D to convey the property to the P Clauses: - Granting clause: a clause that is normally found at the beginning of the deed, contains the words of purchase and limitation o O grants to A and his heirs Blackacre - Habendum clause: follows the granting clause with the language “to have and to hold” - Warranty clause: clause that expresses the type of warranty and comes after the habendum - Livery of Seisin: a ceremony to transfer land in feudal times - Most states have a total transfer statute that says all is transferred unless the grant is limited by its words - Residuary clause- rest and remainder—disposes of something to someone just in case they did not include it in the specifications - Precatory language (wishes), are not binding but explanatory and helpful to show grantor’s intent - Scherer v. Hyland (1977) (126) Issue of the estate of Wagner. Wagner lived with P for 15 years and was disabled from an accident. P was took care of her after the accident. She committed suicide after getting a check from her accident settlement and in her suicide note she gave her settlement property from the accident and all her property to P. - An insurance check so she did not have access to move around the money - Donatio causa mortis o Constructive/symbolic delivery can be found to support the gift when evidence of donative intent is concrete and undisputed when there is every indication that the donor intended to make a present transfer of the subject matter of the gift - Suicide does not negate a gift causa mortis - Acceptance will be implied if the gift is unconditional and beneficial to the done Holding: Affirmed gift, the act of endorsing the check and leaving it where only the P had access was adequate delivery ***A Check is a demand to the bank to pay the payee money. A check that is endorsed is only a donative instrument because it can be checked by any person. Like a stack of bills Acceptance Woo v. Smart (1994) (130) Facts: Donee was in an unmarried couple with a relationship over 20 years gave the P 3 checks in the days before his death. He died before the P could cash the checks. P believes that they are entitled to half of decedent's securities. - Check must be deposited because until then, the writer of the check can change the money around and keep the check from being cashed o Loss the ability to cash the checks when he died - A Will does not impose a constructive trust because delivery is an essential element; intent to make the gift cannot overcome the lack of delivery Holding: The drawee is not liable on the instrument until he accepts; mere delivery of the check does not place the gift beyond the donor's power of revocation and the check simply becomes and unenforceable promise to make a gift Constructive Delivery Gruen v. Gruen (1986) (135) P was gifted a painting by his father and had a note that he intended to give him the painting but retained possession - Courts look to see what the intent was of the father Holding: The letters gave the son title to the painting but not right of possession until his death so the painting is rightfully the son’s Romantic Bailment- revocation of inter vivos Lindh v. Surman (1999) 9141) The ex-fiancé refused to return the ring. The P twice proposed to her and he called off the engagement both times. She returned the ring after the first break of the engagement but not the second. - Romantic bailment o Law treats an engagement ring as a conditional gift but is the condition marriage or acceptance of the proposal Holding: A procedure whereby seized goods may be provisionally restored to their owner pending the outcome of an action to determine the rights of the parties concerned. - Fault is not relevant –easier to apply the law o Balance of certainty or equity o Similar principle for divorce Dissent: what if the bride and her family spent a lot of money on a wedding and she was left at the altar, stay with the established precedent because this is not equitable Trust Farkas v. William (1955) (147) Certain declarations of decedent's will (stocks) with the paperwork that their trustee upon Farkas' death were to go to Williams, but not executed with the formalities of the will. Decedent died intestate and Trust was a revocable trust - Manifested an intention to bind himself to having the property transfer to Williams upon death - Decedent did not have control like the owner or settlor would have because of he made Williams trustee Holding: The stock was valid inter vivos trusts and not attempted testamentary dispositions. The beneficiary duties are enough to establish it was an inter vivos trust. Estates in Land - Estates in land o Estate: a generic term that designates any right to possess measured in terms of duration o common law system for organizing and categorizing possessory interests in land is based on the concept an estate in land is a right to possession measured in terms of duration Possession o Right to possess and exclude others from the time in the agreement o Many rights less than the full of right of possession Easements, licenses, gift -> not a estate in land Duration o Life, years, months, etc. Inheritance o o o Table of consanguinity pg. 167 Special laws in the US for surviving spouse Inheritance occurs when the decedent dies without a will or the will does not dispose of a property Laughing heirs are people who are only remotely related and inherit unexpectedly Results in windfall If someone who owns a fee simple absolute dies without a will, their heir If there is more than 1 heir, they own blackacre jointly If there are no heirs, it escheats to the state Heirs must survive the descendent to receive property as a devisee/inherit A person is an heir if o He survives the descendant o Is listed in the statute as an eligible taker and o There are no other takers in any category having preference over the claimant’s category Heirs are determined at death Surviving Spouse’s elective share - At common law a surviving spouse is not an heir but eligible for a dower o A life estate in part or all the inheritable real estate o Support of the spouse is not the equal sharing of assets o Dower and curtsey at common law Rights of a spouse to the other spouse's property is a life estate rather than fee simple Surviving wife’s dower right entitled her to a life estate in an undivided onethird of her husbands lands Conveyance by a husband to a bona fide purchaser does not defeat dower unless the wife joined in the conveyance Husband’s right of curtsey gave his a life estate in all of his wife’s land if issues were born o Public policy: The state did not want to take care of people who could be taken care of by inheritance - With most states they have replaced the concepts with dower and curtsey with a statutory right allowing a surviving spouse is an heir entitled to a specific portion o the surviving spouse has rights under elective share statutes which exist in almost every state ex: choice to take what the will gives them or 1/3 of the total estate o UPC 1990 - - Replaced the surviving spouse's statutory percentage of the decedent's estate with a sliding scale where the spouse's percentage increases with the length of the marriage Applied Elective share to the augmented estate of the decedent spouse Applied the surviving spouse's own assets to the elective share claim leaving the decedent's property liable only when there is a deficiency Under community property o Assets earned during marriage belong to both and each hold an undivided share o Strong presumption towards community property so most of the assets will be community property UMPA- Uniform Marital Property Act adopts community property approach to assets during the marriage o Each spouse enjoys a present vested interest each share is disposable by that spouse o No right to survivorship Present Estates - Created with a deed or a will A notion that a simple owner’s right to possess can be inherited at her death and so down the line of subsequent possessors Types of Present estates: o Fee simple The right of potential eternal ownership Largest, broadest, most exclusive estate A permanent and absolute tenure in land with freedom to dispose of it ay will Main type of land ownership Common law required language or a life estate would be conveyed Words of purchase – “To A” Words of limitation—“and his heirs” Most states do not require it now Corporations don’t have heirs so the appropriate language is “to the A corporation, and its successors and assigns” o The fee tail Obsolete The promise was that the grantor added words and his/her bodily heirs because the grantor was attempting to keep the property in their bloodline Sometimes only a male heir was allowed to inherit Most states have total transfer statutes so these are no longer a issue as to bodily heir conveys a fee simple o The life estate Right to possess measured by the measuring life then possession shifts o Term of years Lease with a term and termination date o Periodic tenancy A lease with recurring renewals until terminated o Tenancy at will A holdover tenant or tenant at sufferance - Escheat: If someone dies without a will or heirs sot here are no taker of their things after they die Purchaser: The designated taker in a conveyance or devise Fee Simple Estates: - Fee Simple absolute: a fee simple without conditions -- Indefeasible o A right to possession that may last forever which means first that the right to possession of the land in which the fee simple exists can pass down through the generations so long as A has heirs available to inherit A or any subsequent holder of the right to possession of the parcel in question is free to transfer the entire fee simple rights in that parcel to whomever they choose Indefeasible No corresponding future interests Formalist opinion Mclaurin v. McLaurin (1975) 160 The deed conforms to the statutory requirement and had words of inheritance in the warranty clause but did not contain words of inheritance in the granting clause and the habendum clause. - Failure to fill in or complete a clause of a printed deed form usually eliminates the provision as part of the act - So the deed was only a deed with an incomplete habendum Holding: The deed did not convey a fee simple estate so the estate will revert back to the conveyor and then disposed of according to statutes Defeasible Fee Dickson v. Alexandria Hospital (1949) 162 The Husband gave the property to his wife as long as she did not get remarried. When the Wife died, she gave the property to the hospital. - Intention of the testator was that his widow should have a fee simple, defeasible only if she got married - Words of inheritance are not necessary to create a fee simple title by deed or will Holding: the will created a defeasible fee simple to residuum in the widow and became a fee simple absolute when she did not remarry - A restraint on remarriage is usually valid but a restraint on ever marrying is not Will Formation Stevens v. Casdorph (1998) 170 D took the decedent to the brank to create his will and he gave it all to the D. The bank employees signed it for him as a witness, but the witnesses and the old man did not witness each other sign the will. The old man’s family challenged the will - The law favors a will over no will - A witness must sign the will in the presence of the testator and each other o Exception: if the witness acknowledges their signature on a will in the physical presence of another witness and the testator then the will is properly witnessed Holding: The will did not meet the narrow exception or follow the correct code How States deal with Fee tail language 1. Majority rule a. The language creates a fee simple absolute b. Texas 2. Some states create a fee simple determinable with the language a. If the person who inherits it does not have bodily heirs, it transfers to another part and their heirs b. Determinable fee because the duration is not absolute and can end if the condition is not satisfied 3. A few states treat the words “heirs of his body” or “bodily heir” as words of purchase rather than limitation so that A will get a life estate and their bodily heirs have the remainder interest in fee simple absolute and O retains a reversion that takes place if A dies without bodily heirs Delaware, Maine, Massachusetts, and Rhode Island all recognize fee tail - Passes through the generations of the family until a disentailing deed cuts off bodily heirs - Disentailed it by conveying o Must be transferred during life, and cannot be transferred at death if the state recognizes fee tail Abandonment Pocono Springs Civic As. V. MacKenzie (1995) 175 The owners could not get rid of the property they inherited because they couldn’t do anything with it so they abandoned it and stopped paying HOA fees. HOA sued. - Someone always owns blackacre - Under Penn law, a perfect title may not be abandoned so if good title exists then abandonment theory does not apply o In order to legally abandon real property, the owner must successfully divest himself of all right, title, claim, or possession of the land. Holding: The property was a fee simple absolute so the D had a duty to the property and cannot abandon it Life Estate - Estate with the duration lasting the measuring life o Typically measured by the grantee’s life o Life estate pur autre vie An estate measured by the life other than the life tenant’s life To grantee for the life of third party - Earliest estate recognized by the common law - Creation by a transfer directly to the life tenant without creation of a trust is generally inadvisable - Life tenant sually has the same rights as the owner of a fee simple, except they cannot commit waste o Present interest for the life estate tenant to use, rent, make money off of for their lifetime time - Possibility of the reversion/remainder o Future interest where a party has a right to the property after the measuring life Remainder If a non-grantor/3rd party holds the future interest Must be explicitly expressed Reversion If the grantor holds the future interest Assumption o Remainderman must leave the life tenant alone Can only enter or change property to protect their own future interest May sue life tenant to protect the value of their future interest - Language o “to grantee for life” or “as long as Grantee lives” Terminations: - Patrician o The division of real or personal property between or among two or more co-owners, such as joint tenants or tenants in common Like a divorce o If the tenant and the remaindermen all agree they can dispose of the property and split the proceeds Can be a way to resolve issues concerning the property o Protects potential owners from buying land from someone with ownership but cannot convey the land to someone else - Ending of the measuring life - Waste o The remainderman can sue for termination - Determinable/condition subsequent met - Termination o Legal life estate: create by transfer directly to tenant o Equitable: Life estate in trust Doctrine of merger - The owner of the future interest comes to own the future estate, the two interests are extinguished and “merger” into a fee simple estate Statutory presumption of fee simple without contrary intention William v. Estate of Williams (1993) 184 A father granted his daughters each 1/3 interest in property and when one dies or gets married the interest transfers to the surviving sister. The father intended to give the sisters a home until their died or got married. - A person who receives a joint lifetime interest in land under a will has a life estate, rather than a fee-simple interest, upon the deaths of the other interest’s holder o After the lifetime interest ends it revert back to the original owner is transferred to their heirs Holding: the estate given to the daughters was less than a fee simple, if the father wanted to give them blackacre, he would have as he was intention with his language and intent - A will must be interpreted consistently with the testator’s intent Partition Long v. Crum (1978) 187 Husband gave his widow (P) 2 parcels of land and decided for it to go to her children and her heirs with the intent for the property to stay in the family. There is not really any likelihood for the couple’s kids to have kids. The kids (D) want to sell the land because its not profitable. - The court may order the sale of property upon the petition of a life tenant with the consent of the reversion holder with the proceeds subject to court order until the right to the proceeds becomes fully vested o Allows a court to exercise its discretion and permit the sale where the property and proceeds would otherwise be entirely lost to the entitled parties Holding: The TC has the discretionary authority to order a sale but the sale must be reasonable and the life tenant and holder of revision must agree Valuation of a life estate: - Can be assigned a present value through actuarial tables and mortality tables - Court of equity can find ways to get money by renting or mortgaging the property - 3 bases for sale of property that is co-owned o Statutory partition of assets held by concurrent present owners o Inherent judicial power of a court of equity to order sale of property held by present and future interest holders o Statutory basis provided by 557.9 as amended in 1947 Ogle v. Ogle (1994) 194 Husband left a will leaving his property for his wife’s death and if there was any left, it would go to his children but his wife executed a deed purporting to convey real property to her son soon after the husband died. The children who have the right to the remainder oppose the transfer - If a will devises property to a person for her lifetime the remainder “if any” at the time of her death to others, without express language of disposition, the will only grants a life estate Holding: The will only granted a life estate so the wife did not have the ability to convey a fee simple estate of the property and cut off the remaindermen ** court could have ruled different if the wife was more sympathetic facts Life tenant sells property: - Right to Dispose: You have a fee simple absolute if you have the right to dispose/sell of it in your lifetime Estate of Campbell (1997) 199 The husband willed his wife the house and required the kids to pay for her expenses and buy out option to receive their inheritances. TC said they had to pay for the house whether she lived there or not. - Wife has a life estate—right to possession and income - Costs of maintain life estate may be properly charged to the remaindermen Holding: Because the children did not reject the bequest of the remainder estate they are liable for the costs of maintaining the property and the will does not terminate the life estate if the widow should move from the property - If you accept a gift, you accept the conditions Waste: - The life tenant is responsible for the condition of the premises and are not allow to commit waste/harm future interest o The grantor may allocate the life tenant’s rights, so an action about waste must be within those rights o Possession comes with the responsibility for the condition of the premises Waste implies neglect or misconduct resulting in material damages to of loss of property but does not include ordinary depreciation of property due to age and normal use over a comparatively short time o a reversioner is entitled to receive the property at the close of the tenancy in the condition in which it was received o The life tenant needs permission for beneficial changes too - Standard is one of prudence and the court assess it by looking at the fact/circumstances of the case o Does not include ordinary depreciation due to age and normal use o Life tenant bears responsibility for ordinary repairs but future interest holder is responsible for extraordinary repairs - A life tenant cannot injure or dispose of the property to the injury of the rights of the remaindermen but can use the property for his exclusive benefit and take the income and profits General rule that the life tenant cannot commit waste Theories of a waste claim: 1. Life-tenant is a trustee 2. Duty of the life tenant to keep the property subject to the life state in repair so to preserve the property and prevent decay or waste 3. Waste implies neglect/misconduct resulting in damages 4. Can be voluntary or permissive 5. Owner of remainder in fee may recover compensatory damages 6. Does not have to wait for the tenant to die to assert a claim Types: o Permissive waste Failure to take care of the property Maintenances, interest, taxes Duty is limited to the income from the property according to the restatement Statute of limitations does not begin to run until the life estate ends o Voluntary/Active waste Destruction of property by the life tenant to the harm of the reversion or remainder Exploitation of natural resources or removal of beneficial structures o Ameliorative waste: An exception to the rule that a change to the property constitutes waste because there is complete and permanent change to the surrounding conditions When changes in the neighbor hood change it’s economic ability, the life tenant can make changes to adjust - Exceptions o Open mine/customary use Unless the deed of the life estate says other wises, the Life tenant is privileged to continue using the land in a manner that is reasonably consistent with the property’s previous use May also make reasonable modifications without permission o o However, the life tenant may not continue that use if the use has been supplanted with a prior use but dormancy alone is not supplanting a use Privilege of Estover Life tenant can use the property’s natural resources to repair or continue operations or for necessary fires Only as reasonably necessary Can exhaust part to preserve the whole o Can only do this after they have tried to do apply any other useable income that is derivable from the land and must pay most immediate crisis first Waste does not limit acceptable changes Remodeling or building a new structure Balancing test Greater the extent the proposed change decreases the value or substantially alters the character, the less likely it will be approved Remedies: - Injunction - Compensatory damages - End life estate o disfavored Moore v. Phillips (1981) 203 P is suing under a theory of waste that the D did not take care of a farmhouse she was supposed to inherit. - Waste the result of a failure to act Holding: D did not carry out her duties as a life tenant and trustee to keep the property in reasonable repair and the law should not require someone to sue their mother Future Interests - - - Enjoyment of possession that is delayed until the ending/termination of the present possessory estate o Has present significance but the right of possession does not vest until the present possession ends Only one person/ group of people with concurrent interests has the right to possess Blackacre at a time Effective on the date of the instrument or the decedent’s death if it is a will Every present estate other than a fee simple absolute will have one or more future interests associated with it o Defeasible fee simple will be accompanied by a future interest Termination o Future estates can end in 2 ways Duration Life or duration specified Termination by grantor If less than a fee simple absolute, the right will at some time terminate or have the potential to terminate o Basic common law rule is that the power of termination is not alienable except as above can be transferred o Inter vivos transfer o By devise o Inheritance Power of termination/right of entry is devisable and decendible but it is alienable only if it supplements a reversionary interest also held in the same land by the owner of such power Landlord's power to terminate is under a landlord's reversion in a lease 4 factors to determine if there is an intent to create a power of termination 1. Language 2. Nature of the specific condition and its importance to the grantor 3. Amount of consideration paid for the transfer in proportion to the full value of the estate in fee 4. Existence of facts showing the grantors intent to benefit the adjacent land by the restriction imposed on the conveyed land a. Used by developers sometimes - 5 future interests o In the grantor and reversionary The reversion The undisposed of interest a transferor retains when she transfers out an estate of lesser quantum—short duration—than she owns o Defeasible estates do not create reversions because there is a possibility the estate will not end early if the event would cause the defeasance does not happen Occurs when O transfers an estate of lesser duration even if it is subject to a premature ending If O owns a fee simple absolute and transfers a defeasible fee, O does not retain a reversion Possibility of reverter O retains a possibility of reverter when O transfers an estate of the same potential duration as O has and subjects the transferee to a special limitation—language of duration Arises when O transfers out an estate of the same potential duration as O has and makes the estate determinable Power of termination (right of reentry) O transfers an estate and imposes a restriction on the transferee’s use in the form of a condition subsequent with a power to reclaim possession in case of violation of the restriction RAP does not apply to reversionary interests o Nonreversionary vest in a 3rd party types Remainder Executory interests RAP applies Classification of no reversionary or revisionary is not changed by subsequent transfers - - Rule 1: o Nonreversionary interests following a defeasible fees, always an executory interest never a remainder Rule 2 o Nonreversionary interests following defeasible particular estates (life estate or term of years) If the estate is subject to a special limitation (LE determinable) the nonreversionary future interest is a remainder If A's particular estate is subject to a condition subsequent Life Estate with condition subsequent, the future interest is an executory interest Rule 3 o Non reversionary interests following nondefeasible particular estates- a remainder if capable of becoming possessory immediately Springing Going from Grantor to Grantee O conveys acre to A if and when A marries X If condition is met it springs from the grantor to the grantee Shifting Going from grantee 1 to grantee 2 O conveys to A, but if A ever marries X, it goes to B Exists in a simple absolute, a defeasible fee simple, fee tail, life estate, leasehold estate, or any defeasible variant of those estates o Fee simple absolute with last forever until alienation, devised, or descended by inheritance o Defeasible fees can expire and become a fee simple determinable or be extinguished Time of creation of a future interest is the effective date of a document that creates the interest o A deed is effective upon execution and delivery of the document o A will is effective at the testator’s death not at the time of execution of the will Defeasibility - Means that the grantor can add a restriction/condition that can cut short the duration of the estate before its natural end - Difference between expiration of a present estate and an elective ending carries consequences for the running of the statute of limitations upon breach of the restriction by the present interest holder - Connected to FSA, life estate, or nonfreehold estate o Nonfreehold—a type of real property that you have a limited right to use or occupy but don’t own - Look for the big if o The grantor is trying to control the property after the grant o Generally, prohibits certain uses or requires certain actions o Make sure it is not a covenant, but a fee - Main restraint is via Rule against perpetuities Defeasible Fee Simple Estates: - Estate revers to grantor upon occurrence of specified future event, but if it does not happen, the grantee keeps a FSA o Grantor conveys ‘lessor’ defeasible estate to grantee o Consideration is a factor in the court’s determination because an FSA is worth more than a fee simple with a condition Indefeasibility: death of a class member before distribution Types: 1. Fee Simple Determinable a. An estate that automatically ends at the event of specified event b. grantor retains “possibility of reverter”, and grantee gets “fee simple determinable” c. Two states have gotten rid of fee simple determinable and replaced it with fee simple subject to a condition instead d. Language i. While during so long as until ii. Language of duration iii. Best if there is language of reverter 2. Fee simple subject to a condition subsequent a. An estate that is subject to the grantor’s ability to end the estate if a condition happens b. Grantor retains a “right of reentry” or the right of termination i. Does not terminate when the specified event happens until/unless the grantor takes formal steps ii. Failure to exercise right of reentry might result in the forfeiture of such right because of equitable concepts or running of a statute of limitations 1. If there is not a specific statute of limitations the court will enforce a reasonable amount of time c. language i. Subject to, and on condition on ii. On condition that but if provide however iii. Language with conditions d. Preferred over FSD because the reverter is not automatic Forsgren v. Sollie (1983) 210 P conveyed 1.4 acres to D that bordered their property “on the condition” that if he surveyed it, built a fence, and a church there but a small section was sold to pay taxes because D1 did not ever pay any and left the state. P rebought the small portion and the rest of it was sold to the other D. Other D paid D to quitclaim his interest to them but P poured concrete on the property and D knocked them down. Holding: The deed creating a fee simple on the condition it was used as a church or a residence and the condition was the motivating cause for the transfer. Because the D did not fulfil the condition in a reasonable time and the grantor exercised her power of termination so P reacquired the property in fee simple. - Ignored that the deed did not use any of the magic words but interpreted the intent of the deed Defeasible fees with 3rd party interests/Executory Interests o Must say that another party has the possibility of reverter or a power of termination Transferor may create a defeasible fee in A and provide that upon violation of the restriction, title passes back to a 3rd party rather than the transferor o If the 3rd party grant follows a Fee simple determinable, it is a present estate with a fee simple determinable with an executory interest Subject to language of duration or language of condition o If a third party grant follows a fee simple condition subsequent, the present estate is a fee simple subject to an executor limitation Or a present estate fee simple with an executory limitation o Can last forever if the conditions are met Adverse possession is a potential if after the conditions are not met and the fee determinable is revoked but the transferee does not vacate the property Unascertained person: the heirs of a person who is still alive (so they cant be determined yet) Strict Construction Red Hill Outing Club v. Hammond (1998) 217 D bought land and cleared it sue use as a ski slope and gave free ski lessons to the town. Sold it to red hill for nominal consideration in a quit claim deed on condition that they gave free ski lessons. If they failed to give free ski lessons, barring lack of snow, they lost the slope. - Strict construction: Literal interpretation of the words in the agreement and nothing else Holding: TC did not err. Substantial compliance is satisfactory and the general rule is to determine intent of parties at time of conveyance. It has not been a full 2 years since they held free ski lessons for the town - May bring another suit in the future for 2 years Racist Hermitage Methodist Homes v. Dominion Trust (1990) 224 Transferor wrote that a school would receive funds as long as it only catered to white people and if they did not cater to that condition the money would go to other schools, subject to the same condition, then eventuality it would go to Methodist homes, but without the racist requirement. Every school was integrated and school argued that the race condition was unconstitutional and void. - Special limitation, created by while, during, as long as, or until o Language of limitation creating an automatic transfer Holding: the court stuck the entire gifts to schools because the offending, unconstitutional language cannot be stuck from the provision without changing the nature and quality of the estate so the only valid remaining interest is the homes Statutory Restrictions Ludington & Northern RR v. Epworth Assembly (1991) 231 A boutique community, D, on Lake Michigan conveyed land to a RR, P, with the condition to retake the property if the RR was not used for more than 1 year. The property was not used for a while because lack of business and P asked D to restore part of the track - a statute that said that to preserve the right of termination, they must record a written notice of their intent not less than 25 years but not more than 30 years after the creation of the interest - A terminable interest is created by a specified contingency and according to the relevant statute the D must record a written notice of their intent in not less than 25 years but not in more than 30 Holding: the 20-year requirement to preserve interest in land is reasonable and does not unconstitutionally impair the obligation of contract or due process. The RR has a fee simple absolute and the grantor, boutique community, does not have any interest anymore Statute of Repose - - Applies to possibility of reverter/power of termination Starts to run when interest is created Day of inter vivos transfer Day of death for testamentary transfer Runs longer than statute of limitations Policy interests in land should not be left uncertain for long periods of time Kills defeasibility Restraints on alienation Alby v. Banc One Financial (2006) 236 Albys sold their farm to their niece, the Brashlers, for way less than value, with the condition that if the property was subdivided, mortgaged, or otherwise encumbered during the Alby’s lifetime, it would automatically revert back to them—Express intention to keep the farm in the family. Brashlers defaulted on a loan that was secured on the property 7 years after they bought the land and the property was sold to the bank - The property is subject to the rule against the restraints on alienation which prohibits undue or unreasonable restraints on alienation but valid if justified by the legitimate interests of the parties o Scope, duration of the restraint, purpose of the restrain, and whether the restraint is supported by consideration Holding: Held in favor of the Alby’s quieting title and that the restraint is reasonable and justified because the Brashlers have a legitimate interest in owning all the interest in their property but their interest is limited because they agreed to the restraint in consideration for the substantially reduced price. The interest conveyed is a FSD and subject to the rule against restraints on alienation Restraints on Alienation: 234-5 - Alienation=right to convey real property - Reasonable restraints on alienation are valid if justified by the legitimate interests of the parties involved - A restraint on alienation must not be undue or unreasonable - In order to determine whether a restraint is reasonable, courts weigh the utility of the purpose of the restraint against the injury likely to result from the enforcement of the restraint - Relevant factors to consider include the scope and duration of the restraint, the purpose of the restraint, and whether the restraint is supported by consideration types - Indirect o A restriction on the use that the grantee may make of the transferred property as in a defeasible fee is an indirect restraint on alienation Zoning laws not included in this o Cannot limit use too much o Always have to look at the language to see what is allowed with a use restriction Pg. 243 - Direct o The provisions in an instrument which by the terms of implication purport to prohibit or penalize the power of alienation A restrain on alienation is a provision in a deed or will that forbids or penalizes the transferee's attempt to transfer property Public policy favors the free alienability of property o Fee simple, life estate, term of years Types Promissory An agreement by the holder of an interest not to alienation with contractual liability if there is a breach Has language such as, O to A who covenants, promises, not to transfer without O’s consent Only valid is a comparable forfeiture restraint would be valid Disabling A provision in the document creating the interest that renders void any attempt to alienate the interest Makes transfer impossible for a period of time Only valid “if and only if under the circumstances of the case and considering the purpose, nature, and duration of the restraint, the legal policy favoring freedom of alienation does not reasonably apply” Forfeiture If someone conveys interest without the grantor’s consent, it is reverted back to the grantor Contains language such as O to A on condition that if A conveys his interest without the O’s consent, it is reverted back to the grantor If the restraint on a life estate or a terms of years makes transfer impossible it is invalid o Valid if a Life estate or terms of years o Cannot be a fee simple absolute A forfeiture restraint on a fee simple that allows a manner of transfer are valid “if and only if” the restraint is reasonable in the following, nonexclusive, ways o Limited in duration o Allows a variety types of transfers o Limited in the number of persons to whom transfer is prohibited o Tends to increase the value of the property o Imposed on an interest that is not otherwise readily marketable or on property that is not readily marketable ** only one person, or people with concurrent interests, has the right to possess Blackacre at a time If a future interest is held by or created in a transferor, it is 1. a reversion i. there is always a chance to revert back to the grantor 2. A possibility of reverter 3. A power of termination If the future interest is created in a transferee 1. Contingent remainder 2. A vested remainder subject to divestment 3. An indefeasibly vested remainder 4. a remainder subject to open 5. An executory interest Executory Interest o o o o Future interest in a transferee that can take effect only by divesting another interest Takes affect and becomes present possessory estate automatically upon present interest holder’s violation of restriction imposed on land; future interest in 3rd party O to A but if condition to B If it follows a FSD the 3rd party interest is an executory interest If it follows a FSCS the 3rd party interest is an executive limitation Operates like a reverter upon satisfaction of the condition the expiration of the present estate is automatic Contingent and Vest Remainders Contingent and Vested Remainder - An interest is vested or contingent depending on whether the interest is subject to a condition and if it is, on how the condition is stated - May correspond to o Life estate o Fee tail o Leasehold o May NOT follow fee simple estates - Remainder o A future interest that corresponds to a present interest More than a mere expectancy Can be sold, devised, or given away Gives some present right and say in the property o Characteristics Arise simultaneously with present interest Not possessory until present interest expires Possessory at the moment the present interest expires There cannot be any lapses/delay of possession o Arise by operation of law o Can never follow a fee simple absolute o 4 Rules (if not met executory interest) Must follow a freehold estate but not a fee simple defeasible As a practical matter, remainders follow life estates Must be created at the same time and by the same instrument as the prior estate Must not have the ability to cut short the prior estate There must not be a built-in time gap that is certain to occur between the prior estate and the remainder o 2 types of remainder Vested remainder Contingent remainder o Rule against perpetuities applies to contingent but not vested remainders - Reversion o whenever a grantor conveys a lesser estate than what he owns, he retains a reversion by operation of law even if the instrument of conveyance does not say so - Vested remainders o o o o P owns it Vested when It is granted to a person who is born and whose identity is presently ascertainable There must be no conditions precedent to the complete vesting of rights in the remainderman Rule of construction: unless the grant states a condition of survival, a grant of a remainder does not presume that survival is required If there are no class takers or successors at the time of the life tenant’s death, the class stays open until it closes by the death of the progenitor of the class Subsets Indefeasibly vested remainder A remainder that is not subject to any condition at all is indefeasibly vested o No condition subsequent o No class that may increase in number o No implied condition of survival (must be explicitly stated in the conveyance) o Remainder passes by will or inheritance o Language is short and to the point Vested remainders subject to complete divestment Still vested to a person and does not require a future event to occur but does specify an event that if it happens will cause the remainder to leave the first party to another o The other party has an executory interest But if o Subject to a condition subsequent Vested remainders subject to open (partial divestment) a remainder created in a class of takers o at least one member has to be ascertained (identifiable) is still a vested remainder because it is vested in a person and no events must happen for it to vest, but the class may grow Ex: single generation class For life, remainder to Jill’s children o Class is open when more members can join o Class closes when it is impossible for members to join When a person can no longer have children or the children can no longer have grandchildren When a member can take possession of the prior estate when it ends Can be evaded by contrary intent o Rule of convenience Children born after A dies do not take o A gift to heirs is not a class gift because there are no heirs until a person dies heirs are determined at point of death o - Indefeasible if there is a death of a class member before distribution No implied condition of survival in remainders So it goes to the class member who died’s heir A transferor can always preclude an indefeasibly vested remainder by imposing a condition of survival on the remainderman Contingent Remainders o P’s ability to own it depends on a future event Held by an unascertained person or subject to a condition precedent To Jill for life then to her heirs o Cannot have heirs until Jill dies o If a transferer’s last state disposition is a contingent remainder, the transferor retains a reversion - Classifications o A remainder that is subject to a condition precedent is a contingent remainder o Remainder that is subject to a condition subsequent is vested, subject to divestment o A remainder that is subject to no condition is indefeasibly vested o A vested remainder subject to open is in some ways unconditional and in some subject to a condition subsequent - Constructional preference for vested interests o Courts will construe a provision as not imposing a condition precedent if they can do so without contradicting the express language of the instrument - Rule of Destructibility of Contingent Remainder o Destroyed if it is not vested before or at the termination of all life estates To A for Life then to C’s children if they are 21 C’s children are not yet 21 when A dies so it reverts back to O Vesting in Interest and Possession - No vested remainder - An indefeasibly vested remainder is certain to vest in possession in the remainderman or her successor in interest Canoy v. Canoy (1999) 259 P instituted this declatory judgement for the court to construe the last will and testament of his mother and declare his interest in certain real property devised to him so he can know what will happen when he dies. P had a life estate and at his death, then 10 equal shares to the 10 children and if the siblings are deceased before P, then to their issue A remainder interest is contingent when it is subject to a condition precedent, owned by unascertainable persons, or both. A condition precedent must be met before an interest will vest. Further, if a vested remainder is subject to a condition subsequent that is not met, the remainder is defeated. Holding: The court held that if the issue does not survive Roger, then the 1/10 remainder goes the issues’ issue - Not a class gift because it refers to 10 individual people The Rule Against Perpetuities - - - - - Requires the nonreversionary future interest to vest or fail within 21 years after some life in being at the creation of the interest (validating life) o contingent remainders, executory interests, and vested remainders subject to open o Classic rule o In Texas Constitution No interest is good unless it must vest, if at all, not later than 21 years after some life in being at the creation of the interest Validating life is the measuring life o Usually named in transfer or if not it is implied by the terms of the transfer If the measuring life name is not related to the grant it must be reasonable o If no measuring life can be found, the interest is void unless it necessarily must vest or fail within 21 years of the effective date of the gift/period in gross o Cannot be a corporation Basically, the law in every state o A restriction making an estate inalienable perpetually or for a period beyond certain limits fixed by law Policy o Means of preventing the dead hand of past generations from controlling the disposition of property too far into the future and keeping property marketable Does not require the interest to actually vest but for the interest if it does vest, to vest no later than the end of the perpetuities period If a future interest violates RAP, the offending language void from the outset and treated as it had not been written Warning signs o A condition in the conveyance is not personal Klamath Falls o Time Period of more than 21 years in the conveyance o A future interest is given to the generation after the next Grandchildren Rule Violation City of Klamath Falls v. Bell (1971) 269 In 1925, a corporation, which has now been dissolved and the shareholders are the heirs, gave the land to the county to use so long as they used the land for a library but in 1969, the county stopped using it as a library. - Grant was a fee simple determinable Holding: The executory interest fails because of RAP but the condition and possibility of reverter survives, remaining in the corporation, but the reverter no longer exists because the corporation has been dissolved - No time period for the county to use as a library Charity on Charity Exemption: - If both the present and future interests are held by charities, the gift is valid - Where there is a gift to the A charity over a gift to the B charity upon a remote contingency, the disposition is valid o Not valid if the 1st or 2nd gift is to a non-charity and the 2nd gift will fail o Exemption does not apply if one of the interests in not a charity Classic Traps: 1. Fertile Octogenarian a. Assume till the last breach that parties are capable of reproducing despite age, disability, physical capabilities, etc. 2. Unborn Widow a. A new widow cannot be the measuring life i. If the couple get divorced and remarried and have another child, there could be a child born outside of the perpetuities period 3. The Administrative Contingency a. O devises to my grandchildren born before or after my death who are living upon final distribution of my estate i. Don’t know how long it will take to distribute the estate so the estate could be longer than 21 years and a grandchild could be born after the gift 1. Grantor is the measuring life 2. Whole class is violated because of the 3 Musketeers rule (all for one and one for all) 3. Savings clause a. A solution to this problem b. A clause that provides that the trust will terminate if it has not been terminated early by its terms no later than 21 years after the death of the last survivor of a specific group who are living at the creation of the trust RAP “Danger Signs” o The condition is not personal to someone. o There is an identified age or time period of more than 21 years. o An interest is given to a generation after the next generation (like grandchildren) o A conveyance requires that a holder survive someone who is merely described rather than named o An event that would normally happen well within 21 years, but might not o The holder won’t be identified until the death of someone merely described rather than named Wait and See Variation: - Interests that satisfy the common law are valid - Interests that violate the rule are only void if as events unfold, they do not vest in time - Does not invalidate an interest that vested within the perpetuities period even though it had the potential to not vest in the perpetuities period - Texas does not have this rule - URSAP/ Uniform statutory Rule against Perpetuities o Statutory variant of the wait and see approach Waiting period is 90 years Dynasty Trusts: To avoid RAP, a bank handles the trust - Banned in some states Ferrero Construction Co v. Dennis Rourke Corp (1988) 277 P and D entered into a contract for the purchase of 2 lots containing a clause to extend the purchaser a first right of refusal on any future sale of any of the 7 remaining lots. Contract was not record. - Majority view is that RAP applies to options and the right of first refusal must comply Minority view: an interest should not be subject to the rule unless the interest constitutes a restraint on alienation because the rule’s sole policy is to eliminate restraints on alienation - A right of first refusal is more than a mere contractual right, it creates a real property interest Types of refusal: i. The right owners to purchase at a fixed price if the property owner should ever desire to sell ii. Purchase at market value iii. Purchase at a price equal to any bona fide offer they may or desire to accept . Holding: The right of first refusal may go forever because it was between 2 businesses so it is unenforceable Classifying Estates in Land-- Process to follow 1. Read language of the question very carefully 2. Read the language of the grant and try to ascertain the grantor's intent 3. Unless otherwise states, assume grantor O owns the FSA 4. Identify the estate owned by the first transferee from O to A. It will be the present estate, right to possession, transferred by O. . Follow the duration, someone has to have a FSA again some day a. Remember for an inter vivos transfer to be effective, the deed, must meet all formal requirements, be delivered and accepted. For a testamentary transfer to be effective, the testator must have a valid will and die, his death being the effective time of the grant. If there is no will or a will does not transfer property, it will go by intestacy at the grantor's death. 5. If the present estate that was transferred is anything other than the FSA . We have to find waldo because we know that the grantor created a future interest Concurrent Interests - - Divided ownership or current possessory interests on 2 or more person o O to A and B o O to X for life, then to A and B Share the right to possession of the whole blackacre The interest can be in present or future interests Grantees are concurrent owners and own an undivided interest with access to everything Types of Concurrent Interests: 1. Tenancy In Common a. Each party is entitled to possess all of the land all the time and neither party can unilaterally keep the other party off any part of the land i. If the two parties mutually agree to separate ownership of the land, it is valid b. Each cotenant’s interest is transferable, not only at inter vivos but also at death i. If a co-tenant dies intestate, their interest will pass to their heirs c. Only requires the unity of possession d. The cotenants do not have to own the same percentage of undivided interest e. Default rule i. Public policy does not like automatic extinguishment f. Divorce does not severe a joint tenancy unless the divorce decree provides it does Creation of Joint Tenancy - The modern presumption favors tenancy in common so the transferor must affirmatively express their intent with clarity to overcome it - Also if the 4 unities are still required, the drafters must also comply with it o In some states without the 4 unities, compliance may be excused by case or statute law but the express intent to create a joint tenancy with the right of survivorship is always crucial - Outcome of what sufficient clarity depends on o The language of the presumption in the statute o The availability of extrinsic evidence of the party's intent o The hostility that some courts seem to have for joint tenancy 2. Joint Tenant with Right of Survivorship a. Interest is not devisable or inheritable at a cotenant’s death b. The right of survivorship entitles A to sole possession if the other cotenant dies first i. Heirs take nothing ii. No transfer because each tenant owns 100%, only an extinguishment of the deceased tenant’s interest c. At common law to create a joint tenant with the right of survivorship the grant had to satisfy the 4 unties i. Four Unities 1. Parties could not hold as joint tenants unless they received their interests a. At the same time b. By the same document c. Giving them equal shares d. And an equal right to possess the entire land d. Severance i. Can transfer interest but cannot transfer survivorship 1. Must emancipate interest and then transfer interest to someone else 2. The severance does not satisfy the 4 unities because the transferee cotenant did not take their interest at the same time in the same document ii. Requires an inter vivos transfer—a will does not sever iii. Common disaster 1. Uniform simultaneous death act a. If deaths are simultaneous act the interest will pass to the heirs 2. UPC says within 120 hours Survivorship - For purposes of survivorship a joint tenant is regarded as an owner of thwewhole but for the purposes of severance, the joint owner owns a fractional share - Pros o Good option for couples to avoid inheritance costs and simplifies the administration process o No probate and not subject to the rights of creditors o Allows the other joint owner to continue to perform the duties without interruption o Fee simple title remains in the surviving joint tenant - Cons o o Can result in a lot of investment that is not passed to the heirs A betting game of who will be a survivor Hazardous for creditors of a cotenant Lien theory Ownership of the borrower was extinguished with their death so there is nothing to collect Abolition - A few states have abolished joint tenancy with the rights of survivorship - But most states still recognize it but also create a presumption that a transfer to multiple grantees creates a tenancy in common unless there is express intent states to have the right of survivorship o Presumption is usually a statutory creation (few courts created the presumption in a few states) Some of the statutes exempt spouses or transfers to trustees where the survivorship right is advantageous Original Uniform simultaneous death act provided that if joint tenants died simultaneously their joint property would be divided half through each of the tenant's heirs 50% Division of the property among the decedent's successors o Did not apply if they was proof they did not die simultaneously One joint tenant survived the other Uniform Probate Code – updated the original simultaneous death act A or B has to survive the other by 120 hours (5 days) o If they all the property passes as one o If none, the property is split 3. Tenancy By the Entirety a. Only between spouses i. Husbands could transfer the interest but they could not get rid of the wife’s right of survivorship b. Texas does not have this type of ownership because it is a community property state c. Divorce usually makes the tenancy as tenants in common instead d. Presumptions i. States that recognize it usually automatically create ti with a transfer to A and B, husband and Wife 1. Some states however specifically include H and W in the statutory presumption in favor of a tenancy thus requiring the would be grantor of tenancy by the entirety to clearly express the requisite intent ii. Unmarried grantees 1. All states required the grantees be married at the creation of the tenancy a. Common law marriage can satisfy it 2. A subsequent marriage of the cotenants does not retroactively validate an attempted tenancy by the entirety iii. Whenever the 4 unities are required a deed from one spouse to another will usually fail to create a tenancy by the entirety even with a clearly expressed intent e. Consequences i. Married women’s property acts 1. In 40 states 2. Decided that the property of a woman owned at the time of her marriage as well as the property acquired by her and after her marriage remains hers or becomes her separate property a. This statute in half that states that passed it have held that tenancy by the entirety as inconsistent with the act and abolished it b. Other 20ish states that have not abolished it but latered it to tenancy by common Indestructible Right of Survivorship - All states recognizing the tenancy by the entirely agree that neither spouse's rights of survivorship can be defeated by the unilateral action of the other spouse - Other Marital Property Issues o Spouses can take advantage of the co-tenancies Concurrent ownership is owned in severalty and controlled by the spouse in whose name is taken However, whether a spouse owns his or her assets in severalty or as a cotenant with the other spouse - Divorce- equitable distribution of Assets o Logic of title allows for unequal distribution of assets accumulated during the marriage Property afterwards of to each part Eliminated or reduced under a system of equitable distribution Hoover v. Smith (1994) 291 A deed gave away an acre of land to a married couple, the H died, and the W made her son a joint owner then died. The son later died, leaving his half of the land to the Smiths. The W’s other children sued, saying after the H died, his interest went to the children of the couple. Rules: - Right of survivorship between joint tenants had been abolished in 1919 except with explicit language Holding: The deed does not say right of survivorship but it does says “not as tenants in common,” the court does not have to follow unclear directions and the intent of survivorship is not manifested enough. The interest does to the children. Camp v. Camp (1979) 295 Mom and son purchased a lot and the grant contained “as tenants in common with the right of survivorship as at common law” defining their relationship. The Son got married, moved his family onto the land, but passed away before the mom. Dispute between widow and mom because mom wanted right of survivorship. Rules: - No parol evidence allowed, must use the plain meaning rule - Tenants in common is repugnant to the words with the right of survivorship o Repugnancy doctrine in this situation Held: The court used the plain meaning of the deed, declaring the deed not ambiguous and deciding that the mom and son were conveyed the property as tenants in common, not joint tenants. Bank Accounts: - - - - 3 different types of joint bank accounts Extrinsic evidence is generally allowed to show that the depositor intended a convenience account rather than the joint tenancy account rather than the joint tenancy account indicated by the bank card o A minority of courts have not allowed it the other way around Payable on Death o The account is listed in A’s name and payable on death to B B does not have present possessory rights or withdrawal powers during A’s lifetime Only entitled to the balance, if there is any, at A’s death A contract between the depositor and the bank Where not authorized by statute, may still be invalid, because at common law court held that the donor did not express her intent in proper testamentary form Joint Tenancy Account o To A and B as joint tenants with the right of survivorship Stated clearly on bank papers o Have present ownership interests in the account as well as the right of survivorship in the remaining balance if one of the cotenant dies In disputes between cotenants, the one who withdraws more that his proportionate share of the funds has to account for the share they took to the other cotenant Convenience Account o The depositor A adds B’s name to the account during A’s benefit or at A’s direction B is an agent without present ownership of fund in the account during A’s life or a right of survivorship at A’s death Death of the other party ceases the authorization No need for the strawman Lipps v. Crowe (1953) 303 P executed a deed conveying to Howard a ½ interest as joint tenant in his premises not as a tenant in common. Howard did without a will and one of her heirs claimed interest in the property as a common tenant, not joint. P disagrees, believing it was right of survivorship. - Essential characteristics of a joint tenancy are interest, title, time, and coexistence - Modern trend- joint tenancy is valid is made directly between rantor and grantees as if it would be made through a 3rd person (via direct conveyance) Held: The court held that the intent of the grantor was clear in the deed that the parties were to hold as joint tenants and not tenants in common. The could found that the requirements for joint tenancy were found when the P changed his interest as right of the owner in the deed to Howard, so the 4 unities were satisfied. Strawman: - How in common law parties would avoid a 4 unities violation - Owner of the property would transfer the property to a 3rd party who then in tern would transfer the property back to the original grantor and grantee (to A and B) - Some statutes and courts have eliminated the need for this if the parties sufficiently express the intent for the tenancy Severance by Conveyance In Re Knickerbrocker (1996) 307 After W filed for divorce, the court prohibited her and her husband from selling, encumbering, or mortgaging their assets, but W was sick and died before the divorce was finalized. W concerned about her children established an inter vivos trust and wrote a new will and executed a quit claim deed as joint tenant of the house, conveying to herself as tenant in common and her interest in the house to go to her will then the trustees. - Intended to severe the joint tenancy of the home Rules: - Common law o a joint tenant could unilaterally terminate a joint tenancy by destroying one of the 4 unities but could not terminate a joint tenancy by executing a unilateral self-conveyance because such a conveyance had no legal effect and could not destroy any of the 4 unities - Modern trend o a severance by be accomplished by a unilateral self-conveyance o use of the strawman to create joint tenancy is unnecessary Holding: Recording the deed eliminated fraud but also established intent and gave the H notice so the conveyance was equal to a record strawman transaction, so wife transferred her interest to the trust. The conveyance did not violate the court’s restraining order because it just changed the form in which they held the title to the residence - if the deed is recorded, notice and knowledge is presumed o public policy to presume actual notice if they could have found out Severance by Mortgage People v. Noggar pg. 311 H and W acquired real property as joint tenants. The couple separate right before H’s death and he executed a promissory note to his parents with money and the mortgage (worth more than ½ of the property). W alleges that the parents did not have title, right or interests so the joint tenancy was not severed Rules: - A mortgage does not operate to pass the legal title to the mortgagee. It is only a charge upon the property hypothecated without the necessity of a change of possession and without any right is possession o The mortgage is an unsecured loan—not secured by the property - Legal title is a title that only one person has and who owns the true title; has the ability to quiet title Holding: The court held that W and H did not become tenants in common rather than joint tenants when the H executed the mortgage and when H’s interest ceased to exist the mortgage expired with it. *** a contract right is a personal property right Mortgage: a mortgage creates a security interest in real property grants the mortgage to repay the debt - Borrower sends a promissory note promising to repay the loan and grants the mortgage to repay the debt - If the borrower defaults, the lender has to settle for a pro-rata recovery against the borrower and the mortgage gives the lender a specific asset available to sell in satisfaction of the debt Deed of Trust- Texas - A form of mortgage where the mortgagor transfers her interest to a trustee for the benefit of the lender. When the mortgage is paid off, the trustee releases the lien, which is filed on record - If there is a foreclosure, the trustee holds a trustee sale - Texas has non-judicial foreclosure—there does not have to be a court hearing Title Theory: The borrowers execution of a mortgage severs the joint tenancy - The mortgage dissolves at least 3 of the 4 unities as a defeasible fee - Protects lenders - Texas’s rule Lien Theory: The title remains in the mortgagor but is encumbered with the lien created in favor fo the mortgage; the granting of a mortgage does not work as a severance, and severance does not occur until the debtor defaults, the lender forecloses, the property is sold, and the debtor’s right of redemption expires - Majority view - Institutional lenders will require the other cotenant to sign the note and mortgage or will require the borrowing cotenant to sever the co-tenancy before getting the loan - Lenders who are not professionals are the most at risk with this theory Unconventional Severance: Homicide and Common Disasters Bradley v. Fox (1955) 316 A married couple bought a property and held it in joint tenancy. H killed his wife and 3 days later conveyed the property to his attorney. He was sentenced and imprisoned for the murder and W’s daughter sued to impose a constructive trust on the property Rules: 1. 3 types of cases where a murderer may acquire or increase his property: 2. Where the beneficiary or heir under a life insurance policy murders the assured to acquire the proceeds of the policy 3. Where the devisee or distribute feloniously kills the testator or intestate ancestor 4. Where one joint tenant murders the other and thus creates survivorship rights a. This case Fundamental common-law maxim that no man shall profit by his own wrong - Prevailing public policy evidenced is not to give to a murder Holding: The murder destroyed all rights of survivorship and lawfully retained only the title to his undivided one-half interest in the property in dispute as a tenant in common with the W’s heir Indestructible Right of Survivorship Albro v. Allen (1990) 321 A commercial property was conveyed to Allen and Albro as joint tenants with full rights of survivorship. Allen a few years later conveyed her interest to Kinzer. Albro instituted an action to enjoin the sale of Allen’s interest Rules: - 2 types of joint tenancy o Joint tenancy with rights of survivorship o Joint Tenancy with Full rights of survivorship - Person sharing a joint life tenant with dual contingent remainders may convey his interest in the joint life estate without destroying the cotenant’s contingent remainder Holding: Allen’s interest is limited by the dual contingent remainders and the joint life estate will terminate upon Allen or Albro’s death Cotenant’s Rights and Duties - Ouster: o Must really prevent the cotenant from using it and be plain o Court can find constructive ouster in a divorce situation o All states require accounting when the occupying cotenant possesses under circumstances that amount to an ouster of the cotenant - Contribution for Expenditures o Carrying charges A cotenant who pays more than his or her proportionate share of taxes or mortgage payments is entitled to contribution from the other cotenants Claim for contribution may be brought as an independent lawsuit or joined o A cotenant who makes improvements to tenancy property without the consent of the other cotenants is entitled to contribution only in the final accounting rendered in a partition action The recovery is limited to the lesser of the cost of the improvement or the value that the improvement adds to the property o Court may also award to improved portion to the improver if that is feasible - Solutions o Partition To legally “partition” property means to bring a proceeding in court to force the physical division or sale of the property and division of the proceeds among the co-owners. In certain cases it can be an absolute right of a co owner while in others it is contingent on various factors Only for current interests, not future interests A cotenant’s divorce o Allows the termination of the co-tenancy relations Each former cotenant either assumes individual ownership in severalty of a potion of the property, or pockets their fractional share o Real property that is improved with buildings does not lend itself to partition in kind as unimproved land does o Can implement the partition agreement by joint deeding a specified portion of the land to each individual’s cotenant or by deeding the land to a 3rd party and sharing the proceeds Voluntary or by court order In kind o Where each cotenant receive ownership of some to the property Can also occur by sale of the property and division of the proceeds Easiest remedy for the court o Court partition Supervised by the court Court of equity has inherent jurisdiction to entertain a partition action Each state has statutes that provide the process of partition and accounting Often resolved in mediation Disputes are common - Accounting and Contribution o What are the rights of the noncollecting or non-occupying cotenants o Accounting A court-ordered process in which the court orders the property be sold and the profits be split. Equitable remedy o Back door accounting The occupying cotenant does not have to pay rent and they can get contribution for the presences Equitable distribution - Generally applies to property acquired during the marriage Cunningham v. Hastings (1990) (325) P and D were cotenants with the right of survivorship and not as cotenants in common. Parties were not married and occupied the property jointly until they broke up. D took sole possession of the property. - Inter vivos gift is not important to decision because it was not a conditional gift - Joint tenancy confers equivalent legal rights on the tenants that are fixed and vested when the joint tenant is created Holding: Regardless of who put the money up for the sale, the creation of joint tenancy relationship after the payment entitles each party to an equal share of the proceeds of the sale upon partition - Money spent before the ownership interest is not subject to accounting, but money spent during the joint tenancy is Concurring opinion: - The inter vivos gift is relevant because you can’t get a gift back and D gave P 50% interest Not ouster Martin v. Martin (1994) (329) D owned 1/8 interest in a tract of land. P owned 7/8 interest. P developed a portion of the property to a mobile home lot and D moved onto it, never paying rent or making improvements. - Majority view o Each cotenant regardless of the size of his fractional share of the property has a right to possess - To legally “partition” property means to bring a proceeding in court to force the physical division or sale of the property and division of the proceeds among the co owners. In certain cases it can be an absolute right of a co owner while in others it is contingent on various factors - A cotenant who has been ousted or excluded from the property held jointly is only entitled to rent if the ouster holds exclusive possession of the entire jointly held property Holding: The appellants occupancy of one of the four lots did not amount to an ouster and to hold otherwise is to repudiate the basic characteristic of a tenancy in common relationship that each cotenant shares a single right to possession of the entire property Tenancy by the Entirety King v. Greene (1959) (335) P had the title to 3 lot but later her husband sued her for interest saying that they were tenants by the entirety. The court ruled for the H and he conveyed the property to D. P instituted the present action for possession that the sheriffs deed only conveyed ½ of the interest and di not convey her right of survivorship. - Coverture o Husband had absolute dominion and could unilaterally alienate his right of survivorship at common law so if the wife died before the husband the interest subject to execution for his debts - Rights of each spouse are alienable, voluntary, or involuntary o A purchaser becomes a tenant in common with the remaining spouse for the joint lives of the husband Holding: If a purchaser buys one tenant’s interest in property held in tenancy by the entirety, the purchaser acquires the tenant’s right of survivorship Dissent: - Estate by the entirety is a remnant of other times o Neither owns a separate distinct interest in the fee and both as an entity own the interest and neither takes anything by survivorship o An execution of the sale will result in the sacrifice of economic interests - The more just approach would be to abolish tenancy by the entirety in favor of joint tenancy. In that situation, the interest offered at an execution sale would be a clearly established one-half interest. Elkus v. Elkus (1991) (345) P a successful opera singer married her husband at the beginning of her career, but her career took off and her H, D, gave up his own career to travel, take care of their children and be her vocal coach. - Marital property is defined broadly in the statute and the statute does not require that property to be transferable to be subject to distribution upon dissolution of marriage o No reason to not extend it to a professional career that does not involve a degree - Domestic relations law- martial property is property acquired during the marriage regardless of the form which title is held Holding: In a divorce action, one’s party celebrity status may be considered marital property subject to equitable distribution so the D can claim her celebrity status to be split **most courts do not consider a professional degree marital property because it is highly personal and holds none of the other property characteristics - Professional goodwill is future earning capacity enhanced by reputation Sullivan v. Burkin (1984) (353) Sullivan died with a will that specifically disinherited his wife, P and left the rest of his estate to the trustee of a revocable trust that he had the general power of appointment. Upon Sulivan’s death the trust was paid to Cronin (D). - P elected to take her spousal share of the estate under the statute and brought an action seeking to include the assets of the Ernest’s revocable trust in the probate estate from which she would take her spousal share Holding: - When a marriage ends with a death of a spouse and the deceased spouse had created an inter vivos trust the assets of that trust shall be included in the probate estate for determining the omitted spouse’s share Unmarried Cohabitants Watts v. Watts (1987) (358) P and D lived together for 12 years in a marriage like relationship and had 2 children. P claims she quit her job and gave up her career plans on D’s promise to provide for her. The couple had the same last name, shared expenses, bank accounts, and tax returns, living as husband and wife. - Unmarried cohabitants may each be entitled to a share of the wealth jointly accumulated during the cohabitation o No under the provisions of the family code dedicated to property decision after marriage to apply to unmarried cohabitating couples so marriage by estoppel will not be applied o Common law marriage could apply Holding: Unmarried cohabitants are free to enter express or implied contracts with one another and the contract with not be unenforceable on the basis of public policy so long as there was some consideration other than sexual activity Ireland v. Flanagan (1981) (371) P and D were in a committed, unmarried relationship and they bought a house together, D continued living in the house after the relationship ended. - If cohabitants intended to share resources for the payment of property obligations they are considered equal co-tenants and are equally responsible to share the enjoyment and obligations of the property - If cohabitants intend to share resources for the payment of property obligations, they are considered equal co-tenants and are equally responsible to share the enjoyment and obligations of the property. o The Supreme Court of Oregon has held that, if property is acquired during a period of cohabitation, division of that property is controlled by the intent of the parties. This is true even if there is no written agreement. If neither party makes an effort to keep separate accounts or total their respective contributions for reimbursement purchases, a court may conclude that the parties intended to pool their resources for their mutual benefit and they are thus co-tenants. Holding: In this case, when the parties purchased the house, they intended joint ownership. Homestead exception: - Applies to any quantity of land not more than 160 acres - The home is exempt from creditors unless there is a lien on the property for home improvement - In Texas it is not limited by the worth of the property Leases: Property and contract - Commercial leasing o UCC does not apply but it is very persuasive authority - On the day the lease starts, the leasing party is given possession - Different from contract law because leases must have a start day - Type of nonfreehold estates: types of landlord-tenant estates o Term of years: a lease for a period of time A lease for a fixed period –what you think of a lease Definiteness of duration Death of the tenant or renter does not end the lease o o No notice is required because it has an ending date o If the tenant stays after the date, they become a tenant at sufferance Must have a certain beginning o Can construe it through a reasonableness o On future construction, courts usually interpret the agreement to require it to be present within a reasonable time RAP applies Periodic tenancy An estate that continues from period to period until either the landlord or the tenant gives the proper notice to terminate the tenancy Any period can be established by agreement of the parties Usually monthly, quarterly, and yearly Evolved from tenancy at will Courts started applying periods of notice o Reasonable notice to terminate o Certain amount of notice and to be given at the end of the rent period Can be created expressly or by implication If parties don’t specify and merely provide a monthly duration for the lease o When the parties fail to specify a duration for the lease Operation of law might create a periodic tenancy in some states when a tenant holds over the end of a term of years lease Notice requirement at common law (default rule) Yearly 6 months Quarterly one quarter Monthly one month 2 part formula in common law to end periodic tenancy A specified amount of notice was required to terminate the tenancy and the tenancy could only be terminated at the end of the rent period o Can only be terminated by notice Fatally defective rule o Computation rule Any notice served on the first day of a month for possession of the first day of the following month is fatally defective Must be at the end of the month to terminate for the following month Don’t count the day the notice was given o 2nd restatement rejects the fatally defective rule but many states still have it Common law is default rules and subject to modification Tenancy at Will Either party can terminate at any time Default tenancy Catch all for agreements that do not fit into the other catagories Continues as long as both parties desire to continue the lease May terminated by notification but not set amount of notice is required Terminates at landlord/renter’s death or landlord’s transfer of the property o Limits Numerus clausus Concept to create estates in land, the grant must create a permitted estate and there are only so many types of estates o Unlike contract law because you can contract almost anything and this is limited Possessory interest in land must fit the transaction into one of the recognized types of estates and customizing is not allowed Stanmeyer v. Davis (1944) (383) P sued to recover the possession of premises he rented for his business from D for 5 years. The full rent amount was never paid for and D terminated the lease and they did not successfully renegotiate new terms. D says that they did figure out an agreement with an oral lease for lower rent for the duration of WWII and until they receive 25 cars in one money. - A lease for years must have a definite and certain time at which it begins and ends o When the end of the term is indefinite and uncreatain the agreement is not valid and the lease is only a tenancy at will o Cant ty the end of the lease to some events that are not certain till they happen Holding: The verbal lease only created a tenancy at will - The alleged verbal lease from which any certain time can be inferred when it will terminate and with the automobile requirement, there is no guarantee that the D is required to receive 25 cars in one month ** a lease can be made defeasible Garner v. Gerrish (1984) (390) Donovan rented a property to D with a fixed rent and duration that ends at D’s wishes, only condition was that the landlord had the right to reentry if rent was not paid after 30 days. Donovan died and the executor of his estate, P, tried to evict D. - a lease for so long as the lessee shall please is said to be a lease at will of both lessor and lessee - Common law- A lease at the will of the lessee it must also be at the will of the lessor o Implied a reciprocal termination in the other party but was modified by the restatement - Restatement- the lease creates a determinable life estate terminable at the lessee's will or at their death - The lease does not provide for renewal and duration cannot be said to be perpetual or indefinite - Typical means of creating a life tenancy terminable at the will of the tenant Holding: The lease will terminate at latest at the death of D because the lease grants to the tenant the right to terminate and does not reserve the same right to the landlord and to hold the landlord had the right of termination would violate the terms of the agreement and the express intent of the parties Occupancy at sufferance: the occupancy at sufferance is not an estate but a status; applies to a former tenant who remains in the possession after the ending of the lease and who is subject to either removal or to the imposition of a new lease at the landlord’s option Statute of Frauds: - All states have a statute of frauds requiring special types of transactions in writing o Some have exceptions to allow some oral contracts Never a good idea because the terms of the agreement depend on the oral testimony o Typically An oral lease must not last for more than a year to comply with the statute of frauds - Majority rule o The more specific lease provisions in the statute of frauds apply to leases - Must be signed by the party which the contract is being enforced against o Modification must be signed by the party not bringing the modification - Compliance: required writing o Restatement Identifies the parties Identifies the premises Specifies the rent to be paid Must be specific enough to enforce Specifies the duration of the lease More than a year Signed by the party to be charged o Many states only require a memo - Noncompliance o May fail because it is oral/not signed o Consequences Restatement No effect unless o Possession Creates a tenancy at will o Possession and rent is paid Periodic tenancy with all the terms of the lease except duration o The parties to the lease undertake substantial performances Full effect of the lease With addition facts of possession and/or paying rent, an enforceable lease is created Majority view is that tenancy is yearly o Part Performance: Certain acts refer unequivocally to the existence of a lease and involve such change of position by one of the parties that allow the defense of nonconformance with the statute would result in irreparable harm Originated in equity Usually limited to an injunction or specific performance - Doctrines o Doctrine of estoppel Allows the enforcement of a noncomplying lease at least to the extent of the recovery of the P’s reliance losses Versions o Promissory estoppel A promise which the promisor should reasonably expect to induce action or forbearance on the part of the promise and does induce the action is enforceable notwithstanding the statute of frauds if injustice can be avoided only by enforcement of the promise o Equitable estoppel Available when the D assures the P that no writing is necessary or that the D has executed or intends to execute a writing or that the D does not intend to involve the statute of frauds to deny enforcement of the contract o Restitution P recovers the benefit conferred on the D under the unenforceable contract Reliance estoppel Crossman v. Fontainebleau Hotel (1959) (398) Oral agreement to lease but there was a dispute concerning the final contract not containing terms, so it was not signed. P occupied it for 4 years and the dispute is over the right to renew. - If a lease is invalid under the statute of frauds, but the lessee partially performs by taking possession of the leased premises and paying the lessor, a court may grant the lessee specific enforcement of the lease. - Under the Florida statute of frauds, leases must be in writing if the lease obligations cannot be performed within one year of the lease’s execution. o However, courts of equity routinely hold the statute of frauds is inapplicable if a contracting party has partially performed under the contract. o In Florida, courts have found performance in part if the lessee has taken possession of the leased premises, in reliance upon the lease, and provided payment of rent. o Although possession and rent payment are sufficient, the lessee’s investment in a property can be additional support for finding part performance Holding: Enforcing the dress shop’s form of the lease because they invested in the property, paid rent, and possessed the space - Equity for part performance and possession in reliance on the instrument Farash v. Sykes Datatronics (1983) (402) P entered into an oral contract and the D would lease a building to complete its renovation and make certain modifications on an expedited basis but D never signed any contract and did not occupy the building. P wants to recover for the value of work he made in reliance Holding: A party acting in reliance or restitution all concur that a promisee who partially performs in a building or at an accelerated pace at a promisor's request should be able to recover the fair and reasonable value of the performance rendered, regardless of the enforceability of the original agreement—quasi contract Dissent: - Statute of frauds bars the reliance claim and second motion - Quasi contract is incorrect - Equity decision—promissory estoppel Licenses: - A lease conveys an estate (possessory interest in land) to the tenant o Only exists if the landlord transfers the right to possession of the leased property License o Gives licensee permission to do something on the owner’s land o Lessor estate than a lease o At will unless specified different o Does not give possessory interest Bona Fide Purchaser - Buys something for value without notice of an interest on their property and has certain protections - Cannot have any of the types of notice o Actual notice Was told o Inquiry notice Should have asked if there was an interest because of something informing them o Constructive notice Something gave them notice and they should have known - Weiman v. Butterman (1970) (409) P installed coin operated laundry equipment and contends he had an agreement to run the laundry room in the apartment building was a lease. The D bought the building the laundry equipment was in, replaced the machines with the competitors, and says it was just a license. Written agreement calls it a lease. - Concession and concessionaire agreement which is usually constructed as a license, but precedent relies on different intentions - Lease is inconsistent with provisions of other licensing agreements and its substance indicates a lease Holding: The agreement is a lease because the D had actual notice of the washing machines because P’s name was displayed on the walls of the laundry room which was sufficient to put the D on inquiry. **First in time, first in right - The first interest has the first right over subsequent interests because you can’t give away uou own Leases and Bilateral Contract: - If one party to the lease breaches, may the other party terminate the agreement University Club of Chicago v. Deakin (1914) (413) Club leased for 2 years at 5k for 1 year on condition that Deakin should only use it as a jewelry and art shop with an exclusivity clause. P sued because another store sold pearls. - Lease a bilateral contract and it was a breach of essential covenant because the exclusivity clause is a vital provision of the lease and breach of it entitles the lessee to rescind o If the provision was vital, operate a discharge is valid - If the tenant's covenant to pay rent dependent on the covenant for exclusivity, it would allow termination of the lease o Common law- Covenant in leases are independent from the covenant to pay rent and do not constitute breach and does not excuse failure to pay rent o Must go to court for damages Holding: The exclusivity provision was vital, and Club needed to prevent the other party from selling pearls. If a lease contains covenants to be performed by both parties, the lease is a bilateral contact for which any breach of a vital provision gives the non-breaching party the right to terminate the lease Overturning common law Implied conditions 1. Early Common Law a. Promises are unconditional unless expressly made dependent by the terms of the agreement 2. Second Restatement a. Promises in bilateral contracts are presumed to be dependent in all cases unless a contrary indication is clearly manifested i. If the implied condition is satisfied if the promisor renders substantial performance ii. If the condition fails and if it is a material breach, the promise elects to terminate the contract 3. Intermediate Approach in Deakin a. The court distinguishes vital dependent promises in a contract from those that are nonessential i. The breach of an essential promise allows termination despite the absence of an express condition Tenant’s Rights - Core aspects to a core set of tenant’s rights and remedies o Access to all leased area o Enjoyment of possession o Habitability - Delivery of possession o Legal right to possession and actual possession is different o Access to premises and right to enjoyment of leased space - Covenant of quiet enjoyment o Express or implied Until the 1970s it was the most important tenant’s right o Landlord beaches the covenant of quiet enjoyment if The landlord prevents the incoming tenant from taking possession A prior tenant or third party is in possession with landlord's consent The incoming tenant is prevented from taking occupancy by the holder of a superior title - Fair Housing Act of 1968— o Cant discriminate against a renter on basis of race, sex, gender, etc. Only applies to commercial and not people renting out a room of their house - Eviction o All states have statutes authorizing speedy removal of a tenant who wrongfully holds over after the lease is over o Elements of damages pg. 425-6 o Actual eviction After the tenant acquires possession if he is turned out it is an eviction o o o o Lockout/denial of access is an actual eviction if the landlord is wrong and the tenant has not breached, the lockout constates actual eviction and breach of the covenant of quiet enjoyment Total eviction The tenant may terminate the lease and recover damages or affirm the lease and recover possession and appropriate damages Even if the tenant is in breach, the lockout by the landlord may violate statutes governing how landlords must act A Partial eviction If there is encroachment on a portion of the premises, the tenant does not habe to pay rent The tenant cannot get equitable remedy of an implied benefit to the tenant because in equity you look at powerpoint Modified by state law in some places Remedies are the same as those available when the landlord fails to deliver possession Terminate and recover damages Enjoyment Constructive Evictions Landlord conduct interferes with the tenant’s possession of the premises Landlord can be guilty of breach of the covenant of quiet enjoyment Interference that fall short of actual or partial eviction but substantially interferes with the tenant’s enjoyment of the premises causing the tenant to vacate is actionable under the doctrine of constructive eviction Can get damages or injunction is not enough for eviction Constructive eviction Similar to a partial actual eviction expect no actual physical deprivation takes place Landlord deprives beneficial use or enjoyment of the property that the action is tantamount to depriving the tenant of physical possession o Conduct not intentions are controlling o Extent of the interference not intent o Pay attention to what the lease grants A tenant must Notify the landlord Give the landlord a reasonable opportunity to cure the situation Vacate within a reasonable time after the landlord is in default They risk Remedies Defense and cause of action is defense to vacating English and American Rule Hannan v. Dusch (1930) (420) P entered into a lease with D to begin 1.1.1928 but the P was unable to enter onto the premises in question due to the presence of a holdover tenant. P sued claiming that the D had the duty to deliver the actual possession of the property even though there was not an express covenant in the lease. - English rule o landlord is under an implied covenant to deliver actual possession of property to a new tenant, whether there is an express covenant in the lease or not. o landlord is in a better position to know whether a previous tenant is likely to holdover and protect against it, and because of this, the landlord is the one who would be required to testify on such matters in legal proceedings. - American rule o suggest the English rule is unduly burdensome on landlords and requires that they either refrain from leasing occupied premises until the tenant has vacated or be subject to legal action for the wrongdoing of another. Cause of action against the holdover Holding: P is not entitled to damages for the D’s failure to deliver actual possession of the leased premises and has a cause of action against the holdover tenant not the landlord and can only sue the landlord if its in the lease o When the landlord breaches the English rule, a tenant is entitled to break the lease and has a cause of action for damages Rent is suspended while the tenant is out of possession Concurring: A lessor having made a lease at the termination of another one is without power to evict a tenant of the prior lease Partial Actual Eviction Smith v. McEnany (1897) (429) P-landlord leased property to the D but the P proceeded to build a wall for the adjacent building that encroached onto the leased property less than 2 feet into the property for 34 feet. D stopped paying rent, treating the intrusion as an eviction. - Partial eviction is a total eviction of a portion of the property - When a landlord leases property, he leases the entire premises and not sections of it separately. o The whole rent is charged on every part of the land. - The extent of the interference is relevant only if the intrusion is not physical. Here, the wall built by landlord physically encroached upon the leased property. Thus, it does not matter that the encroachment did not make the premises uninhabitable nor change the nature of its use. Holding: A landlord’s physical intrusion that interferes with a tenant’s quiet use and enjoyment of a portion of the property amounts to an eviction from the entire property such that rent obligations are suspended. Partial eviction: landlord commits a partial eviction by encroaching on an appreciable part of the tenant’s space Echo Consulting Services v. North Conway Bank (1995) (432) P was a tenant in a building that was later purchased by North Conway Bank and the lease granted a common right of access thereto and common use of the parking lot. D was doing construction, restricting P’s access to one entrance, a parking lot, and made lots of noise. No. It is well settled that there need not be intent on the part of a landlord for a tenant to be constructively evicted. Constructive eviction occurs when a landlord, by omission or affirmative action, deprives a tenant of the use or enjoyment of the leased property, even though there has not been an actual, physical eviction or exclusion. - - For example, a tenant is constructively evicted if the landlord fails to address a nuisance created by neighboring tenants, fails to make the premises safe for habitation, fails to perform a statutory obligation, or fails to perform a lease covenant. The covenant of quiet enjoyment, in an expansion of the traditional rule, protects a tenant not only against denial of actual possession but extends to substantial interferences with the tenant’s use or enjoyment of the premises. o In modern society there are many ways in which a landlord may cause an interference with a tenant’s use and enjoyment of the leased premises, even if they do not rise to the level of a constructive eviction. Such interferences may reduce the value of the lease and call for compensation. o Moreover, particularly in commercial leases, tenants should not be forced to wait for actual dispossession after they have already expended considerable capital in establishing themselves on the premises. Condition of the Premises - Implied warranty of habitability o Accepted by every state in the 1970s - Wide range of noncompliance and establish via fact - Rights flow from the status not the lease o Estate in land and a right to possess - For a tenant to avail on an implied warranty they must first put the landlord on notice of default which implies a reasonable time to cure o A good lease will address this - Tenant remedies o Termination o Damages o Repair and deduct o Specific performance o Punitive damages - Rent abatement o If a tenant does not pay rent and the landlord sues, the tenant will raise breach of implied warranty of habitability as a defense o Must decide if the obligation to pay rent and implied warranty are dependent promises or independent covenants - Texas Exception—commercial leases also have an implied warranty of suitability Javins v. First National Realty Corp (1970) (444) Two individuals rented apartments in the same building from the P. They each withheld rent from the P due to housing code violations that did not arise until after the leases began. - a tenant’s obligation to pay rent extinguished due to housing code violations that arise during the term of the lease - An implied warranty of habitability is read into residential leases and breach of that warranty frees tenants from the obligation to pay rent. Holding: If the landlord does not maintain the premises, the tenant is deprived fo all value for which he contracted so a landlord’s requirement to maintain the premises in livable condition is consistent with contract principles that are increasingly being applied to leased. - An ordinary tenant is no longer able to make repairs himself - Leases are usually for a place to live so they have to be kept in a livable condition so tenants are not required to pay rent until their apartments are habitable Violations of the housing code constitute the landlord’s breach of the implied warranty of habitability in each lease Policy- Tenants sign leases for a certain period of time and they should be able to expect that the premises will be habitable for that entire period. The court rules in favor of the tenants. A warranty of habitability is measured by the standards of the housing regulations for the district of Columbia is implied by law into leases Texas Exception David v. Inwood North Professional Group (1988) (461) D and P entered into a 5 year lease for a space to be used as a Dr. Office. P would provide air conditioning, electricity, hot water, and general maintenance services. The premises had mold issues, a rodent problem, and lights needed replaced so P vacated the premises and stopped paying rent. - Warranty of habitability exists for residential leases. - Duty of the landlord to ensure the property in question is suitable for its intended use Holding: Held that the P did not provide suitable conditions for a doctor’s office and the conditions all violate the implied warranty of suitability because they prevent the normal function of a doctor’s office. - Warranty of suitability is implicit in commercial leases and provides that a leased premises must be suitable for its intended use Richard Barton Enterprises v. Tsern (1996) (466) P leased a commercial building from D. The lease agreement required the D to repair a leaky roof and restore an elevator. Elevator got shut down by the city and D refused to make more repairs. Could not come to an agreement on rent abatement and suit followed. - Under Utah law, when a lessor fails to perform covenants that comprise a significant inducement to the lessee to enter into the lease, the lessee is entitled to abate rent to the extent that the lessor’s failure to perform reduces the value of the premises. - The doctrine of constructive eviction was subsequently modified by the rule that a tenant might remain upon the premises and abate rent in proportion to the tenant’s deprivation of the use of the full leasehold. Holding: Failure to perform covenants that were a significant inducement to the lessee to enter into the lease entitles the lessee to rent abatement in commercial and residential leases. - Constructive eviction o A doctrine that ties the rent obligation to the landlord’s performance of negotiated lease terms appropriately focuses on preserving the expectation interests of the parties to the lease agreement. - Balancing act o A breach that has only a minimal impact on the lessee’s expectations will not support rent abatement. o By contrast, the failure to perform a covenant that served as significant inducement for entry into the lease agreement will support rent abatement in an amount equivalent to the reduction in the value of the premises resulting from the breach. Passive rent abatement: a credit for rent Rent abatement allows - An amount equal to the reduced value fo the premises due to the lessor’s breach o Credit o Termination o Repair Landlord tort liability Ortega v. Flaim (1995) (473) D orally leased a home to the Stroud’s and did not make any agreements regarding repairs, habitability, or retention. A Social guest, P, fell down a staircase that the Stroud’s had previously complained about. - At common law a landlord is only responsible for injuries caused by hidden defects o Only duty to a social guest if the injury was caused by a latent defect or the landlord retains control of the premises o Common law immunity only possibly applicable exception is if the landlord knew about a hidden, latent defect; the tenant did not know about the defect; and the defect caused an injury. In Wyoming, an implied warranty of habitability only applies to a builder’s sale of improved property. Accordingly, it does not apply here. Holding: Because the Stroud’s had complained about the staircase and its condition was known, there is no exception to common law landlord nonliability rule, and the other claims fail, sp the D is not liable for the tort. Exceptions to Landlord nonliability on page 475 Undisclosed conditions known to lessor and unknown to the lessee which were hidden or latently dangerous and caused and injury The premises were leased for public use and a member of the public was injured Part of the premises was retained un the lessor's control but was open to the use of the lessee Lessor had contracted to repair the premises Negligence by lessor in making repairs First National Bank of Omaha v. Omaha National Bank (1974) (493) D a tenant of a 50 year lease stopped paying rent, taxes, and insurance on the rented premises, which the tenant was required to do. Lease did not contain an acceleration clause. TC entered judgement for newly accrued damages and held that he court’s judgment “shall mature and become effective as to each unmatured installment of rent, taxes and insurance on the day after said installment or payments are due and execution may then issue at the instance of the [landlord] to satisfy the same.” - A landlord may sue for a tenant’s future rent only if the lease contains an acceleration clause. Absent an acceleration clause, a tenant is required to pay rent only when it is due under the terms of a lease—not before. - Any judgment for unpaid future rent, taxes, and insurance would be uncertain, and the amount would be indefinite. - Taxes and insurance are inherently variable and cannot be determined in advance. Holding: Because there was no acceleration clause, P could only sue to recover damages and will have to sue again for damages in the future Acceleration Clause - Total amount of rent payable during the term of the lease shall immediately become due and payable o If enforced, the landlord cannot terminate the lease for the tenant’s default that generated the rent acceleration or any other default without reimbursing the tenant for the rent he has paid in advance Cannot collect damages - May be unconscionable to enforce an acceleration clause if it does not have a discount of the amount that must be paid in advance as a result of the enforcement of the clause o Court may enforce it with a discount o Also may be unconscionable if it provides for acceleration on a default by the tenant without first requiring a demand by the landlord that the tenant eliminate the default by the tenant without first requiring a demand by the landlord that the tenant eliminate the default so the tenant has a reasonable amount of time to comply - Calculation: o An interest rate in an acceleration clause must be reasonable and is more likely accepted if attached to a national rate o Reasonableness also is dependent on the interest rate Minority trend Cain Partnership v. Pioneer Investment Services (1996) (495) P leased a tract of property to D which required the D to pay rent and any property taxes. P sued to terminate when they did not pay the taxes. TC found the lease had no provision for termination so the lease could not be adjudicated and dismiss. - Even if a lease does not expressly provide a right of termination, a landlord may terminate the lease and recover damages if: (1) the tenant fails to perform a lease obligation, (2) the landlord is deprived of a material benefit that induced the landlord to the make the lease, and (3) the tenant does not cure the breach within a reasonable period of time. - Under common law a lease conveyed the property to the tenant for the entire lease, even if the tenant failed to pay, the tenants landlord’s only remedy was to sue for the rent - Many states give a landlord right to seek repossession of the property for unpaid rent regardless if its specifically reserved for in the lease o Restatement Holding: Even if a lease does not expressly provide a right of termination, a landlord may terminate the lease and recover if the 3 elements, adopting the common law rule. Majority Trend: In general a tenant's failure to pay rent or to perform any other duty imposed by law or expressed in the agreement is not a basis for the landlord's termination of the lease unless the lease or a statute expressly provides for termination o o Incorporeal Interest Landlord's property interest in rent is not possessory No right to possession Rent is a property interest in the land, reserved and held by the landlord Reserved property tight to share in the benefits of possession exists irrespective of any express contractual promise by the tenant to pay rent Rent in the Form of Promise A tenant who promises to pay rent remains liable after assigning the lease if the assignee does not pay o Reservation In making a lease, the landlord does not have to part with the entirety of the ownership interest Landlord may hold back or "reserve" part of the ownership If the tenant's obligation to the landlord is based on a reservation, the assignment of the lease terminates the tenant's liability o Fair Rental Value Not the same as rent Not the same rights the landlord has with respect to rent If no rent is reserved or promised in the lease, the tenant is not under any obligation to pay rent It is a question of fact in each case whether the landlord intended to make a gift to the tenant of the use of the leased property If not, the tenant is liable for the reasonable worth of his use and occupation and the landlord is entitled to recover in an appropriate action the amount owed by the tenant Cause of action for the recovery of fair rental value is restitutionary The tenant, if not a donee, would be unjustly enriched without the duty to account for the fair rental value of the occupied premises Commonly owed when the tenant holds over after the expiration of the lease term Tenant then becomes an occupant at sufferance and owes fair rental value until the landlord either imposes a new lease or terminates the possession A tenant who occupies under an illegal lease also owes fair rental value for the period of occupancy o Self-help Repossession Can lock out but landlord must give tenant the key or information about how to get the key at any time o Security Deposits Governed by statutes No generalization Express Termination - When the lease does not contain an express termination clause, the clause will be strictly construed - An express condition must be literally rather than substantially performed - Implied in law conditions must be substantially performed, like in contract cases - Acceptance of rent payment with knowledge of a breach is usually considered a waiver even if the lease has an Anti-waiver clause Self Help (locking out the tenant to evict) - Common law o Landlord may rightfully use self-help to retake leased property from a tenant in possession without incurring liability for wrongful eviction provided The landlord is legally entitled to possession The landlord's means of reentry must be peaceable o - - - But many courts have concluded that any attempt at self-help by the landlord would be non peaceable as a matter of law and the parties must go to court In some cases this only applies to residential leases FED - Forcible entry and detainer statutes Provide remedies to the person forcibly dispossessed or forcibly excluded from possession Summary possessory remedy Cause of action for unlawful detainer Usually seek to deter forcible evictions by giving the disposed tenant a cause of action to recover possession as well as a claim for augmented Summary eviction o An eviction accomplished through a simplified legal procedure, without the formalities of a full trial Can acquire a lien on the tenant’s goods to secure payment of the tenant’s rent obligation Security Deposits - Provides protection for the landlord against defaults but is widely government by legislation Neihaus v. Maxwell (2002) (504) P rented his single family home to the D and hired a management company to manage the property who held the security deposit. D refused to vacate at the end of the lease and did not pay rent for September, so P withdrew the last month’s rent from the security deposit. - Failing to keep a security deposit in its own separate account does not violate the rules against commingling tenant and landlord money if the tenant’s money: o (1) is protected from diversion by the landlord, o (2) earns interest, and o (3) is out of reach of the landlord’s creditors. - A landlord may request an initial security deposit from a tenant. A landlord may hold this money during the lease, but the landlord must pay interest on it and return any unused principal plus the interest within 30 days of the tenancy’s end. - A landlord has fiduciary duties that come with holding a tenant’s money though, including a statutory duty to hold a security deposit in its own separate account and otherwise prevent commingling the tenant’s money with the landlord’s money. Holding: Because the security deposit was held separately from the operating account and was not reachable by creditors and not withdrew or available until it was due, the P is not liable. - Not required to return the security deposit until the D had vacated the property. Remedies Against the Abandoning Tenant - When a tenant wrongfully abandons the premises before the end of the term the tradition common law view is that the landlord is entitled to recover from the tenant the full rentals provided in the lease - Landlord does not have a duty to mitigate o Not a true duty o A landlord who fails to mitigate does not commit a breach entitling the tenant to damages and possible termination of the lease but is unable to recover for losses they could have avoided Remedies Against the Holdover Tenant - A tenant who wrongfully stays late becomes an occupant at sufferance o Landlord may evict the tenant or impose a new tenancy (usually periodic) o - Choice cannot be revoked in the agreement All provisions of the previous lease apply How rent is paid, and duration of the periodic lease is decided by the original lease Policy o Deters tenants from holding over Duty to Mitigate or Not - When a person suffers damage as a result of a breach of contract, they have the legal obligation to minimize the effects and losses resulting from the injury - Want the landlords to use the property productively and avoid wasting of resources - Comes from contract law o Not all courts have applied it, especially for commercial leases to find a balance o UCC restatement - Requires a landlord to accept a suitable replacement if one is offered by the tenant and otherwise to seek out a new tenant - Texas has adopted a mitigation rule o Landlord act - Failure to mitigate is usually an affirmative defense Anti-assignment - Lease contains no clause prohibiting transfers by the tenant without the landlord's consent the tenant can avoid the problem by assigning the lease to a substitute o When the lease does contain such a clause the landlord may arbitrarily refuse consent to a proposed transfer by the tenant - Modern treat to read into the clause a duty for the landlord to act reasonably o For breach of this some courts allow the tenant to terminate the lease Landlord’s Remedies - Under the no mitigation view the landlord has many remedies o Sue for back rent as long as the premises must stay vacate o May re-rent the premises and recover from the abandoning tenant any rent deficiencies that result o May accept the surrender and discharge the tenant Sometimes based on conduct the court will find an implied acceptance of surrender via the Doctrine of Surrender Act o If the tenant breaches by anticipatory repudiation, there is an option of an immediate suite to recover damages rather than rent when the tenant abandons Doctrine of surrender by operation of law - Extrapolation from the doctrine of express surrender o If the landlord takes possession or relets, a court will conclude an acceptance of surrender by law which bars recovery from the time of acceptance and completely terminates the tenant’s liability like for rent accruing and damages for future losses Reletting is not acceptance of surrender if the landlord notifies the tenant that he is acting on the tenant’s behalf o The 2R section 12.1's view Modern Trend Sommer v. Kridel (1997) (509) D signed a 2 year lease with P and paid the 1st month’s rent and security deposit but wrote to the P before he moved in he could no longer live there, trying to break the lease. The P did not try to find someone to rent but a 3rd party offered to rent the space and they refused. - A landlord has a duty to mitigate when he seeks to recover rents due from defaulting tenant and is consistent with basic justice and fairness - Increasing trend to treat leases not as conveyances of land but as contracts o Modern trend Holding: The application of contract doctrine of mitigation of damages is appropriate and D does not have to pay the back rent. - If a landlord fails to mitigate damages when he has the opportunity the defaulting tenant may be relieved of his duty to pay rent because of the modern trend of fairness and equity. - P telling the 3rd party that the apartment was not available failing in his duty Maida v. main Building of Houston (1971) (517) P leased building space to D for 10 years for 550 and provided that if the D abandoned the property and the D was responsible to pay the difference in lost rent. D abandoned the property but a second tenant leased the space for 800. - The tenant does not get an offset for any rent the landlord may collect in the future under the new lease - Landlords have 4 options if a tenant abandons the property o First, the landlord can do nothing and sue for unpaid rent as it becomes due. o Second, the landlord can declare the lease forfeited and that the tenant owes no more rent. o Third, the landlord can retake the property and do nothing. In that situation, the tenant’s damages are offset by the fair rental value the landlord could have received if the property was relet. o Fourth, the landlord can retake the property and relet it to a new tenant. In that situation, the tenant’s damages are offset by rent the landlord has actually received from the second tenant. - Can only claim one so they choose the one where they get the most money Holding: P was under no duty to release the property and should not be put in a worse position that if it had done nothing (public policy) but they should not get an extra offset for speculative future rental payments. Richard v. Broussard (1980) (522) P leased a building to the D to operate a seafood restaurant. If the P decided to abandon the property the lease gave the landlord the right to take possession of the property and relet the premises to a third party with acceleration. D abandoned the property but instead of reletting the P opened a seafood restaurant of their own in their own in the space. - If a tenant abandons leased property and the landlord later occupies the abandoned premises for its own business purposes, the landlord may not recover rent from the tenant for the period during which the landlord occupied the property. o In general, when a landlord cancels a lease, the lease is terminated. - However, if the landlord takes possession and occupies the premises itself, the landlord’s occupation does relieve the abandoning tenant of the obligation to pay rent during the landlord’s occupation. - Remedy options- Mutually exclusive o Terminate and sue for accrued rental or o Sue to enforce the lease and recover both accrued and accelerated if the lease has an acceleration clause Holding: In this case the restaurant lease specifically said the landlord could relet the premises if the tenants abandoned with the tenants getting an offset for any rent the landlord received from a new tenant. The P is not entitled to rent due for the period after the landlord reoccupied the property Anticipatory repudiation and discount Hawkinson v. Johnston (1941) (526) P owned 2/3 interest in a 99 year lease involving a vacant lot in KC. D owned the remaining 1/3 and paid the rent and taxes until they decided to abandon their interest. P rejected the repudiation and brought suit for the breach. TC affixed damages for 10 years rather than the remaining 67 years. - In Missouri, when one party to a contract or lease agreement provides notice to the other party that is unwilling to fulfill the terms of the agreement, it is an anticipatory repudiation which is a total breach of the contract or lease agreement. - The Restatement of Contracts, § 318, provides that if one party to a contract provides notice to the other party of his unwillingness, inability, or refusal to perform under the terms of the agreement, this constitutes an anticipatory repudiation which is a total breach of the contract. o The same holds true for lease agreements. Holding: The value and taxes were accurately assessed for the 10 years so the TC’s holding is affirmed. Holdover Clause Gym N-I Playgrounds v. Snider (2007) (533) P leased a commercial warehouse to D that expressly waived any warranty’s on behalf of the D and contained a holdover provision extending the lease on a month to month basis with the same provisions of the old lease on the periodic tenancy. A fire then burnt down the building In Texas, if the lease does not discuss the issue, landlords impliedly warrant that premises are suitable for the intended purpose. - An original lease’s terms apply to a new holdover lease if the original lease’s holdover clause provides that the new lease is subject to the original lease terms. Holding: The original lease’s holdover clause specifically applies the terms to the periodic tenancy so the plain and ordinary meaning of the phrase governs, so the warranties were waived when the fire occurred. Subrogation: The substitution of one person to another in a suit, usually respect to usually an insurance claim - The person owned money can step in and gather the insurance payments - Insurance can sue the tenant if the landlord has a claim against the tenant Holdover Clause: - Common law o The landlord can elect to treat the cotenant as a trespasser or as a tenant holding under the terms of the original lease - - If the landlord decides to hold the holdover as a tenant, the lease is under the same terms as the previous lease Some courts hold that o that the tenancy created under the holdover is a continuation of the old one not a new tenancy thus binding the out of possession co tenant to rent during the holdover Lots of statutes governing this situation o Quite varied o Most modifications are a rejection of the landlord's unilateral option to create a new tenancy and limitation to the new tenancy to a monthly tenancy Condition and Use of the Premises Mercury Investment Co v. FW Woolworth (1985)(538) P leased to the D shopping center planning for them to be the anchor tenant. Leased for 15 years at a minimum rent and an additional rent calculated on the gross receipts in excess of a certain amount, but P never made over the amount. P sued arguing that D breached an implied covenant to diligently operate its business to generate the percentage rent and attrach customers. - Generally, implied covenants in a lease agreement are disfavored. Courts will presume that parties to a lease agreement have included all provisions they intend to be governed by. o However, if (1) the language of the agreement or the contract as a whole strongly indicates that an implied obligation exists, and o (2) the obligation was so clearly contemplated by the parties that they believed it was unnecessary to expressly include it, the obligation will be implied. Specifically, where a lease agreement includes both a percentage rent provision and a guaranteed substantial minimum rent, a covenant to diligently operate business will not be implied. - In contrast, if the minimum rent is merely nominal or nonexistent, a covenant may be implied. o Balancing act Holding: The express terms preclude the implication of an implied covenant and the P cannot define what conduct would satisfy the implied covenant, so the court cannot imply the covenant from the lease agreement. - Court will not rewrite an agreement Illegal Use - If the lease imposes no restrictions on use, the tenant is entitled to use the premises for any purpose that is not illegal against public policy or in contravention of applicable zoning restrictions o Obligation to not use the leased property for an illegal pursue is an implied obligation of the tenant as stated in the restatement o For breach the landlord is entitled to terminate the lease or afform it and get the legal and equitable relief - Restrictions are disfavored and strictly construed o Implied restrictions also are disfavored - Congress required public housing to include a one strike policy for drug use or criminal activity in its leases o An express termination clause - Illegal activity on the leased premises is different than a lease for an illegal purpose o Actor matters Waste Brizendine v. Conrad (2002) (549) P leased a low-income apartment building to D for 12 months with intention to purchase the building at the end. The required a deposit to be credited toward the purchase and required D to assume some maintenance duties. D decided to not purchase and P said that she would not get the money back because of damages and instead of investing the money decided to sell to another buyer. - If a tenant does commit waste, the tenant is liable for treble the waste amount. - A liquidated-damages clause in a lease does not constitute a special license to commit waste. Under the waste statute, a tenant is prohibited from committing waste unless the tenant is given special license in writing to do so. Holding: D did not have a special license to commit waste through the liquidated damages clause because a license to commit waste must be explicit so the D is liable for the waste. Implied obligation under law of waste - Duty to avoid waste (acts of destruction and permissive waste) - Duty imposed a limited obligation to make minor repairs but excludes a duty to reverse wear and tear except when failure to do so would result in progressive and rapid decay of the premises Frustration of Purpose and Impossibility of performance in Leases 1. Destruction of the leased premises a. At common law, the premises is destroyed the lessee still remained liable for the rent unless exempted from such liability 2. Supervening illegality a. If the tenant's intended use of the premises are originally legal but become illegal cases are split on whether the tenant may terminate the lease i. Prevailing view denies termination 3. Supervening government regulation a. If a government activity restricts the tenant's use the tenant is not excused from the lease i. Even with the doctrine of purpose is applied to leases, the standard of frustration remains high 1. Total or nearly total frustration of use is required and the supervening event must not have been reasonably foreseeable a. Unpredictable of results 4. Supervening events and the landlord a. Impossibility of performance Subleases and Assignments: - Lease Transfers: o Law favors free transferability of property but landlords usually impose restrictions on the tenant’s power to transfer the leasehold interest Freedom to transfer Absent any restriction in the agreement, the tenant is free to transfer but when there is a restriction, it is strictly construed Restriction on a transfer in a lease is a running covenant Privity of the parties o Creates a privity of estate between landlord and tenant and continues until the obligation ends (any express promises must be made) Sublease Sub-lease ---> tenant ---> landlord Assignment Assignor--> tenant Assignor --> landlord o Tenant holds the present possessory estate and the landlord holds a reversion in fee simple o An assignment does not create a new lease but substitutes out a party in privity of estate In restatement an assignment only occurs if the tenant transfers the entire balance of the lease terms and retains no reversionary interest o A sublease creates a second lease Tenant still have the duty to pay rent unless they negotiate the sublease to take it on - Running Promises in Leases o Promises running the land or promises made between 2 landowners bind and benefit owners of land Can affect lease transfers EX; only for residential purposes - Violation o Landlord is entitled to equitable relief and damages when the tenant violates a lease clause - Dumpor’s Case o Common law oddity A landlord's unqualified consent to one assignment waives the no transfer clause in effect freeing the lease estate from the restriction thereafter Does not apply to the landowner's consent to a subleasing or to a waiver made by landlord's acceptance of rent after an unauthorized assignment Reasonableness requirement Kendal v. Ernest Pestana (1985) (557) Bixler was subleasing a hangar from D but then agreed to sell his business and lease to P. D refused to consent to the assignment so P brought suit seeking a declaration that the refusal to consent was unreasonable and an invalid restraint on alienation - This is in line with the policy against restraining free alienation of land as well as an increased recognition of the contractual nature of leases and the resulting contractual duties of good faith and reasonableness. - Majority o maintain the rule that if a lease contains an approval clause, the lessor may arbitrarily refuse to approve a proposed assignee unless the lease also provides that consent may not be unreasonably withheld, this view produces harsh consequences to lessees and would-be assignees. - Minority o Restatement Second of Property now maintains that a lessor may withhold consent to an assignment only if he has a commercially reasonable objection to it Holding: Deciding to go with the minority viewing, finding consent may only be withheld if reasonable to align with the duty of good faith in contracts. - Even if a lessor has discretionary power to approve or disapprove an assignee, it must exercise that right according to commercially reasonable standards. - In determining the reasonableness of a landlord’s refusal to consent, courts may look to factors such as the financial stability of the proposed assignee whether the proposed use of the - property is suitable, whether the use will require alterations to the property, and the legality of the enterprise. Cannot refuse an assignment solely on personal taste, convenience, or due to a desire to increase the rent First American National Bank v. Chicken System of America (1980) (556) P leased property to D with a prohibition of assigning the property without the P’s consent. Other D purchased the store and agreed to be responsible for the lease. D eventually defaulted on the rent and vacated the property. - lease assignee can be liable for rent under either of two theories. o First, under a privity of estate theory, the assignee is liable for rent while in possession of the property, also known as being in contact with the estate. Even if the assignee abandons the property, if the assignee still has a right to come back and possess the property, the lessor and assignee are still in privity of estate. However, if the assignee’s right to possess the estate is terminated, like by reletting the property to a new tenant, it terminates the assignee’s relationship with or privity of estate. o Second, an assignee can be liable for rent under a privity of contract theory. Privity of contract between a lessor and an assignee exists only where the assignee affirmatively assumes the lease, thus is liable for all lease terms, including the full rent for the full lease term. Nothing short of an assignee’s express promise to perform the lease requirements constitutes an assumption though. Holding: Held that the second D was not liable for the original lease’s terms because they never affirmatively assumed the lease. Real Estate - Cast of characters o Consumer v. commercial Different protections because most states have a lot of protections for consumers Residential contracts for a single family are highly regulated, usually by the real estate commission and property code Consumer protection statutes sometimes apply too o Seller and buyer/purchaser o Purchase and sale agreement- PSA o Brokers Because of how their commission works they usually represent the buyers but sometimes can represent the seller Usually a multiple listing service Not extensively regulated by the government but do need to get a licensed and are subject to anti-trust laws o Attorneys Negotiations to protect their client Contract formation Closing requirements o Title company Issues title insurance, a contract of indemnity, so the parties can recover if they loose something on the mortgage Can only recover on what they insured - Statute of Frauds o All real estate contracts must comply with the statute of frauds Exceptions take contracts “out from under” the SF Part performance can take a contract out of SF o Full or partial payment Usually not enough by itself o Possession of the buyer o Substantial improvements Exceptions are estoppel driven o Electronic signatures are valid under Uniform Electric Transactions Ac Most states have adopted acts that provide that electronic signatures and contracts are valid Congress has also enacted similar legislation - Gap period o From contract to closing - Closing o At closing the buyer gets the deed Title transfer occurs upon the delivery and acceptance of a deed Acceptance can be presumed because people usually want property but also rebutted Recording a deed is a presumed delivery Requirements o Effective only once signed, delivered, and accepted o Some states require a seal too Recording is not a requirement of an effective transfer but failing to record can cause loss of title if the grantor transfers the property under the recording acts Under the doctrine of merger, the closing marks the start of a new set of legal relations under the deed rather than the sales agreement Merger Doctrine - The deed represents the final understanding of the parties and supersedes prior agreements and previous contract of sale is not the ruling document after the deed is accepted o Exceptions Mutual mistake Scriveners errors - Parol evidence o A partially written contract can be supplemented by proof of a prior or contemporaneous negotiation or agreement by the parties but cannot be contracted by such proof o A fully integrated contract can be neither contradicted nor supplemented by prior or contemporaneous negations nor agreements o Parties sometimes add an entire agreement clause to this effect - Collateral agreements o If there are other agreements that should survive the closing, they may be enforced and Parties can specify in the contract that they survive the closing or by the nature they don’t go to title (example is a performance after closing) SF Shattuck v. Klotzbach (2001) (580) P negotiated the purchase of property from D through email but the D did not satisfy the terms agreement so they renegotiated and accepted. D then refused to go forward with the contract. All emails were signed. - Multiple emails may constitute an agreement in writing sufficient to satisfy the statute of frauds if the emails contain the material terms of the agreement and are authenticated by the electronic signature of each party. o Contracts for the sale of land must be in writing and signed by the parties, a typewritten signature is enough to fulfill this requirement. o Multiple writings may be read together to satisfy the statute of frauds if taken as a single instrument, the writings contain all the material terms of the contract. I Holding: Because all of the correspondence was signed and the emails contained all the material terms of the contract, the claims are not barred by the SF? Conditions- Financing Luttinger v. Rosen (1972) (585) P contracted to buy from D for 85k and 10% down. Under a condition precedent in the contract the parties were obligated to perform the contract only if the P could get a mortgage for 8.5 but they could not get it but D offered to fund the difference in interest rate and refused to give back the down payment. - If a condition precedent in a contract has not been met, the parties have no right to performance and the contract will not be enforced Holding: P was not obligated to accept the offer to account for difference in interest rate because they did their due diligence and do not have to buy the house Marketable Title Lohmeyer v. Bower (1951) (587) P contracted to buy from the D. Deed said the property was free and clear of all encumbrances but subject to easements on the property. After inspection P found 2 violations existed and decided to rescind the purchase. marketable title in real estate was one that was free from reasonable doubt, and a title which carried with it the potential for litigation was doubtful and therefore unmarketable. o In general, zoning ordinances and other private covenants governing land use do not render a title unmarketable. Holding: The property included a house which included 2 land use restrictions and exposed the P to the risk of litigation so the title is unmarketable and would have had to materially change the property to reasonably cure the defects. Source of Obligation - A seller’s title must be marketable unless the contract specifies another way o A restrictive covenant renders the title unmarketable unless the contract accepts the restrictions o Encumbrances On a title to land is an interest or right to the land subsisting in a third person to the diminution of the value of the land through consistent with the passing of fee by conveyance Classified as o Pecuniary charge against the premises Mortgage, lien o Estates or interests in the property less than the fee Lease, life estate o Easements or servitudes on the land Restrictive covenants If the easement is visible, open, and notorious the buyer is presumed to have notice o An encroachment or protrusion usually renders the property unmarketable Can be waived Building codes are not an encroachment o If there is undiscovered defects in title because of the doctrine of merger the buyers claim must be based on the covenants of title in the deed rather than promises in the contract of sale o Courts also often hold an implied warranty of habitability exists - Marketable title legislation o States have passed acts that claim titled should be marketable and purchasers should be able to rely on the chain of title Assert by a right by filling the right or it will be lost (usually 30 years) and they will be barred from claiming interest o Exception for a forged deed If you don’t raise your claim, the issue is barred from being raise and the title becomes marketable over 30 years Equitable Conversion - a purchaser of real property becomes the equitable owner of title to the property at the time he/she signs a contract binding him/her to purchase the land at a later date. - Buyer is treated as the owner event though the contract is not closed o Default Common law doctrine and can be modified o Seller now has a personal property right because of the proceeds - Default rule - Different from risk of loss o States also have statutes deciding which party and usually is dependent on possession Equitable conversion Holscher v. James (1993)(595) D agreed to purchase a cabin from the P with a closing date as 5.1 but the D could get possession 4.5 and a fire destroyed the cabin 4.11. D voided the purchase after the fire. D also insured the cabin with P as other interests. TC held that the D owed insurance proceeds for the value of the cabin under equitable rescission. - If a property sale contract explicitly places the burden of pre-closing losses on the seller, the doctrine of equitable conversion cannot be used to shift the burden of pre-closing losses to the buyer. - Once parties enter a property sale contract, an equitable conversion occurs. The purchaser is treated as having a right to the realty or property and assumes the risk of loss. o the doctrine of equitable conversion applies only if nothing in the sale contract states otherwise. o Rescission is an equitable doctrine stating that if a sale contract is rescinded, both parties must be placed back in their pre-contract positions. Holding: The agreement gave the D the right to void the sale if the cabin was damaged before the sale and the P are entitled to the insurance proceeds because the D could void the sale. Remedies for Breach of Contract - A contract of sale offers the same remedies that are available for breaches of other contracts - Damages might protect o Promise’s interest and protect it by putting the promise back on the position they were before the contract or if the contract would have been performed - Specific performance is readily available but subordinate to damages - English Rule/Flureau o You get your deposit back if there are not damages o No mutuality of obligations - Normal rule o Difference between fair market value and date of breach o mutuality Damages Wolofsjy v. Behrman (1984) (603) P sold a condo to the D but the D could not sell their family home so they sold the condo back to P but before the sale closed P had found another purchaser and allowed them to stay before closing. D ended the contract - Florida follows the English rule which requires bad faith to get full damages from a real estate seller o If there is bad faith seller is liable for full compensatory damages o Loss of bargain is measured as the difference between the value of the property and contract price o Bad faith is when the seller does not act in good faith to fulfill their contractual obligations Holding: D acted in bad faith because there were not factors outside of their control preventing them from closing the sale and are liable for full compensatory damages - English rule is usually only applied to cases were the seller is unable to convey satisfactory title - American rule allows buyers to recover expectation damages and is preferable Kutzin v. Pirnie (1991) 9606) P contract to sell their home to D but they eventually refused to buy and the contract did not have language concerning damages or the deposit. P sold their home 6 months later. - The common law rule, which had previously been recognized in New Jersey, was that a breaching buyer of property who had paid a deposit may not recover the payment, even if the seller received a profit as a result. o Must prove that the seller acted in good faith to limit the damages - Modern trend o However, the trend is moving away from the harsh rule toward a rule that the buyer is entitled to restitution of sums paid which are over and above the loss actually suffered by the seller. o This new rule is superior because it compensates the seller properly while avoiding a forfeiture, which is disfavored in the law. o applies only to those sales contracts that do not contain a liquidated damages or forfeiture clause Holding: D are entitled to the restitution in the amount of difference between their payment and the damages suffered to avoid unjust enrichment Centex Homes Corp v. Boag (1974) (615) P constructed 6 high rises and contracted with the D to purchase one. Contract had a liquidated damages clause. D paid a deposit and extra payment but was relocated and stopped paying. - Specific performance of a contract for the sale of real property is an appropriate remedy when the property in question is unique in that monetary damages are an insufficient remedy for the non-breaching party. Holding: P is not entitled to specific performance, only liquidated damages, because the condo was not unique and was sold using a model unit. - Real property is unique Specific Performance - Buyer’s right to specific performance follows from the property view that each parcel of land is unique o Another property would not be a replacement and damages are inadequate to protect expectancy interest - Seller’s expectation o Expects a certain price and damages can be obtain - Remedies and obligation must be mutual o Not identical or comparable but each party must give consideration for the contract to be binding Types of Title - Legal title o Who owns blackacre - Record title o Who is shown in the public records as owning black acre Not always the same as legal title because the legal title owner can transfer the title to a bona fide purchaser for value The transferee would then have legal title If the first person who purchasers does not record and the seller conveys the title again and the second purchaser is a bona fide purchaser and records Depends on the jurisdiction who gets priority - Equitable title o A purchaser under a purchase and sale agreement who can enforce specific performance Third Party Rights Salter v. Hamiter (2004) (619) D deeded 3 parcels of property to P but asked the P to wait until she died to record the deeds and P added a provision in his will to protect the property but D remained the owner. D (estate) sued to declare the deeds void for insufficient delivery after D died - To be effective, a deed must be delivered to the grantee. To determine if legal delivery occurred, courts look at whether the grantor: (1) intended to divest herself of the property’s title, and (2) relinquished control and dominion over the property. Of these considerations, the grantor’s intention is the most important factor for sufficient delivery. - Moreover, if a grantee has possession of the deed, there is a presumption that the deed was legally delivered. o For an effective deed delivery, the deed must also be accepted on behalf of the grantee. o if a deed is for the benefit of grantee and does not impose any obligations on the grantee, a court presumes sufficient acceptance. - Finally, the timing of the intended transfer controls whether a document is a deed or a will. o A present transfer is a deed. o A transfer that does not vest until after the grantor’s death is a will. Holding: Grantor clearly intended to divest herself of the property’s title so legal delivery of the deed occurred because D physically delivered the deeds to P and expressed her intent to deliver them. Acceptance is presumed and failure to record does not overcome the presumption of acceptance. - Used present tense to convey property so they are not considered wills Delivery - Physical delivery is not always required is the deed is to be operative as a present conveyance but intent to transfer is always necessary - An undelivered deed voids the deed and is ineffective to convey title to the grantee - If an oral condition is expressed at the deed is often ineffective but the deed and delivery is still effective o Some courts with enforce when a grantor’s death is a condition - A grantor cannot make a conditional delivery to the grantee but can deliver a deed on condition to an escrow agent o To solve a condition an escrow agent with refuse to disperse funds or act until an agreement is met because they aren’t paid enough to get sued and will make their attorney fees paid first at court - Escrow: The seller delivers the deed to an escrow agent on the condition that the purchaser pays the purchase price or other conditions Ferguson v. Caspar (1976) (625) D contracted to sell her home to the P with a provision guaranteeing the residence was not in violation of codes on the closing date, but P received notice that it was and decided to figure out how much the repairs would be and tried to get the escrow agent to hold the amount of the repairs in limbo until they received the amount necessary to cover it. Escrow agent refused to deliver. - A deed that is deposited to an escrow agent will not pass to the buyer until all conditions of sale are fulfilled Holding: P are not entitled to specific performance because they showed an intent to take the property subject to the violations. Careless or dishonest escrow agent - Courts do not enforce a deed and its not an effective transfer title when the grantee and escrow agent conspire - But If the deed was transferred to a bona fide purchaser for value courts are split - Some courts treat the deed as undelivered Others hold for bona fide purchaser because the grantor chose the escrow agent If the escrow agent steals the money and before the conditions for closing are met, the buyer bears the loss Merger Doctrine Secor v. Knight (UT 1986) (633) D met with a subdivision sale agent who told them that the developer wanted single family homes but a separate basement apartment wouldn’t be a problem and other people had built them without any problems. When they signed there was not restricted covenants or zoning issues but a restrictive covenant was recorded 2 months later. Warranty deed that referred to restrictions of record - The doctrine of merger ensures that the deed can be trusted to reflect the parties’ full agreement. o Exceptions- fraud, mistake, and the existence of collateral rights in the contract of sale. The collateral rights exception applies to terms that involve a different subject matter from the deed or are otherwise collateral to the sale and he merger doctrine does not extinguish these collateral rights because they do not relate to the same subject matter as the deed. Holding: The deed referred to the recorded restrictions so the acceptance of the deed extinguished the provisions of the underlying money agreement and is binding because a fraud exception does not apply. Disputes after Closing - Sale is completed when the grantor gets paid and the buyer receives the deed and possession - Implied covenant of marketable title protects the buyer against unreasonable risk of litigation - To prevail against the grantor there must be more than a risk of a 3rd party claim o Usually resolved based on the operation of the recording act o If passage of time reveals the condition of the home is less than expected the grantee may have a claim if the expectations are based on representations the grantor made Fraud Implied warranty by builder-seller homes that the property is free of defects in workmanship Recording System - Every state maintains a recording system o Index is how you search the recording system - Record title - Serve to protect innocent purchasers and creditors - Failure to record o Common law First transferee of interest in land had priority over subsequent transferee o every state has an act that reverses the priorities established by the common law if the requirements of the act are met and allows a subsequent purchaser to take title free of an earlier adverse conveyance that is not record exception for a bona fide purchaser o Bona fide purchaser The purchaser must give value and mist lack knowledge or notice of the prior adverse claim o A donee is bound regardless of notice Types of recording acts o Race First to record of A or B wins Knowledge does not matter, just first to record o Notice If B does not have notice of O’s conveyance then B has priority If B has notice, then they do not have priority o Race Notice If B does not know and is the first to record, then B has priority o Common law First in time, first in right because once you transfer you cannot give B anything Types of Notice - Actual notice o The purchaser has subjective knowledge of the existence of the prior claim - Constructive o Should have known of the existence of the prior claim - Inquiry Notice o A reasonable person would investigate and the real existence of an adverse claim - Burris v. McDougald (1992) (640) Stone deeded property to D who did not record the deed until 1985 and Stone continued to live on the property. Stone also left her entire estate to her son and his son, the P, sued claiming ownership. - An unrecorded conveyance is binding on parties to the deed, the parties’ heirs, and all who have knowledge of the conveyance Holding: The property belongs to D because P did not acquire the property through adverse possession and is bonded to the unrecorded conveyance. Index Howard Savings Bank v. Brunson (1990) (644) D purchased a parcel of property and recorded and indexed it but mortgaged the property later from P and the mortgage was not properly indexed until 1998. Before it was properly indexed the other D both the house and mortgaged the property and it was properly recorded. P then brought a foreclosure action against the D. - A mortgage must be properly recorded and indexed to receive priority o In NJ they mortgages must be recorded then indexed in alphabetical order - Prior to the enactment of this statute, New Jersey courts had held that the misindexing of a mortgage had no effect on a subsequent purchaser’s constructive notice of its existence. Recording a mortgage was enough by itself to put a subsequent purchaser on notice of the existing property interest. Because it is sufficient Record notice o But this is against the policy of the recording act- a purchaser would have to examine thousands of pages in thousands of record books and that is an unreasonable burden o indexes are considered part of the official record. Holding: The D made a reasonable search of the chain of title so they did not have any notice of the interest in the property and the D;s fully recorded mortgage ahs priority over the unindexed mortgage - Burden is on the person who misfiled the deed, not the person looking because they could have fixed it o Other states put the burden in statutes Texas makes misfiling a misdemeanor on the county clerk Chain of Title Problems Witter v. Taggart (1991) (650) Lawrance owned a tract of land that he portioned and sold the northern portion. In the deed he included a covenant stating any one holding the land was not permitted to build a dock on the canal or interfere with his view. It was sold to P and after Lawrance died it was eventually purchased by D. P’s deed and no deed in his chain of title after Lawrance contained the covenant-only in the dominate land - A landowner is only bound by restrictions on his land if said restrictions or included in his deed or the deed of a landowner in the same chain of title unless actual notice exists Holding: P’s land is not bound by a restrictive covenant preventing said construction because he should not be expected to search the records of all the plots of land owned at one time of the dominate owner to determine whether a covenant existed. - Some states do not follow this rule and charge owners with knowledge of the cotnents of deeds of other parcels executed by owners in the chain of title Wild deed: a deed outside the chain of title Forged deed conveys noting and is void Marketable Title H&F v. Panama City Bay County Airport (1999) (656) D owned land that resulted in a small parcel inaccessible without crossing over another property. P acquired the small parcel and claimed to have a right of necessity across the land. - One of the purposes of the Marketable Record Title Act is to provide certainty in title to real property. The act prohibits bringing a title claim against any owner of real property holding record title for a period of 30 years. - A way of necessity is an easement arising under the common law presumption that the grantor of land intends to convey all the appurtenant rights necessary to the grantee’s use and enjoyment of the land. - To exclude an unrecordable common law claim would subvert the purpose of the act. The act provides exceptions to applicability for defects inherent in the instrument establishing root title. o Root title refers to the most recent instrument establishing title that was recorded at least thirty years prior to a pending claim against title. o A defect in root title must be apparent on the face of the title instrument. o A defect that does not arise from the instrument of title itself is not a disclosed defect subject to exemption from the act. A common law claim is a legal interest in land, but not a defect inherent in the instrument of title. Holding: The act applies to a common law way of necessity and allowing the P to have a right of necessity across the land would be in violation of this so they do not. Seller’s Deeds and Covenants Seymour v. Evans (1992) (663) D owned land that she sol to the M who later conveyed it to the P. D also conveyed 2 more plots to the other P. All 3 lots were intended for residential purposes. There was zoning ordinances on the property restricting their use from being used as a subdivision. - Common law covenants: seisin, power to sell, freedom from encumbrance, quiet enjoyment, and warranty of title. - A deed that violates property ordinances is valid as long as the violation is not inherently evil act Holding: D did not violate any of the common law covenants and her actions were not inherently evil. Encumbrances are granted – page 670 Types of Deeds - General warranty deed o Most protective because the seller warrants to the buyer that the seller’s title is free of defects arising either during the seller’s period of ownership of the property or before - Special Warranty deed o Only protects the buyer against defect arising during the seller’s ownership of the property, inclusive of any act impairing the title - Quitclaim deed o The seller transfers whatever title the seller ahs without purporting to say that the seller has anything and has not protections for the grantee 5 Common Law Deed Covenants - Present o Seisen Seller represents that the seller owns the title that the deed purports to transfer and conveys a fee simple absolute breaches the covenant of seisin if the seller owns only a defeasible fee or life estate o Right to Convey Seller has the right to convey the right that the deed purports to convey and is basically identical to seisen o Against Encumbrances Warrant the subject property is free of encumbrances that diminish the value of the estate - Breached when the seller executes and delivers the deed and the seller is only liabel to the buyer o Statute of limitation begins to run at the delivery of the deed - Future o Quiet enjoyment Promises that the grantee will not be evicted or substantially disturbed in possession by the grantor or anyone with a paramount title o Warranty Promises to defend against lawful title claims against the buyer and to indemnify the buyer for any loss resulting from an eviction or disturbance of possession Basically Identical to quiet enjoyment o Further assurances Promises to execute any necessary additional documents to perfect the title that the seller purports to convey to the buyer States can imply covenants in deeds or have short form deeds that the seller can use which contain implied covenants - - Statutory deeds Provides the appropriate language or indicates the significance that the language has o Breached only when the grantee is convicted and can be asserted by remote grantees Doctrine of after acquired title o If a grantor purports to convey ownership of real property to which he does not have legal title at the time of the conveyance, but later acquires that title, it automatically vests in the grantee Damages o Usually limited to the purchase price Not liable for increases in property value but capped at the price the seller received for the land Remote Buyer Bridges v. Heimburger (1978) (672) D sold a lot to Moore but he failed to make payments and the D repurchased the lot. However the legal title inadvertently remained in Moore’s hand. D sold the deed to the other D who built a home and sold it to the P. Right before the P sold the home they discovered the title was held by Moore. Moore cured the defect after P sued but the P stopped paying and the home was foreclosed on. - Warranty deed embraces the 5 common law covenants - Seisen and power to sell are personal covenants and do not rune with the land - the covenants of quiet enjoyment and warranty of title do run with the land, and a remote grantor may be held liable for their breach. o However, these two covenants are broken only by actual or constructive eviction of the grantee. Holding: A remote grantor of a warranty deed is liable for breach of the covenants of quiet enjoyment and warranty of title only if the grantee has been actually or constructively evicted and because there is not actual or constructive eviction, the D is not liable for breach. Easements - - a right to cross or otherwise use someone else's land for a specified purpose. o Must indicate a benefited and burdened party Underlying property that is subject to the easement is the servient estate/property Parcel that enjoys the benefit of an appurtenant easement is called the dominant estate There is no dominant estate for a benefit in gross Relevant parties are usually The original benefitted party Successor to the original beneficiary A prior purchaser from the servient landowners who later creates the servitude in favor of the prior purchaser o Use right not a possession right o Only conferred rights, not the right to exclude generally Maybe the right to exclude other people but not the exclude everyone But if you can exclude the owner, the court will likely call the grant a fee Subject to the statute of frauds - - - - - - - Balancing act of possession right and use right with contract rights Generally can use the easement as a general or expected use but cannot in an unreasonable manner against the burdened estate o And the burdened estate can use the property where the easement is but not in a manner that affects the easement o Runs with the property o Reasonableness requirement In gross and appurtenant o In gross A benefit that is not tied to ownership or occupancy of a particular unit or a parcel of land Users of the easements aren’t estates but people and companies The servient estate cannot actively transfer rights to the easement o Appurtenant When the benefit is tired to the ownership or occupancy of a particular parcel Transferred with the deed 2 adjacent parcels Cannot be used for the benefit of property other than the dominant estate Injunction preferred Exclusive and nonexclusive o Parties to an easement in gross usually intend the easement to be exclusive o An exclusive easement usually does not sufficiently express intent to bar servient owners from using the roadway Reserved or granted o Reserved The landlord sold the parcel of land that connects his piece that he kept to the road o Granted Formal easements o Profit a prendra Is a nonpossessory interest in land similar to the better-known easement which gives the holder the right to take natural resources such as petroleum, minerals, timber, and wild game from the land of another EX Hunting license Express easement is created by a written agreement between the parties to the easement between the parties o Preferred–may also be created informally o Can be through consideration or via gift Blanket easement o Covers the entire land of property and is not specific but is often specified later o If land is broken up and sold, the blanket easement applies Damages o Interference with the easement is a tort and the P is entitled to damages for harm Injunction is also available o In some cases, they can be entitled to restitution of any benefits obtained by the defendant who interferes with the easement 3 categories in common law to devise private parties’ rights and obligations that run with the land - Easements o Usually on the right to use as subject to statute and common law o 4 types of easements In writing Prior use Necessity prescription - Real covenants - Equitable servitudes Common law - Servitudes were very complicated and could only be used for certain things - Many distinctions still exist but the 3rd restatement is trying to simplify it - The burdening of land with a use restriction binds subsequent owners required that some other land benefited (a dominant estate) o The rule against creation of a servitude with a benefit in gross does not apply to easements but it may apply to real covenants, equitable servitudes, or both o Distinction between appurtenant and in gross easements benefits is important on the question of transferability of the benefit not the creation o Prohibited the transfer of the benefit of an easement in gross even if assignability was intended Default rule for transferability only applied to commercial benefits Now there is a presumption that a benefit in gross is freely transferable and absence of assigns does not prevent transferability Rebutted if something indicates otherwise Termination - In the agreement - Abandoning - Statutes Walton v. Capital Land (1996) (702) Willow conveyed a tract of land to D but retained an easement for right of way to the highway. P acquired an adjacent plot of land and the easement so D barricaded the road. - An easement always allows the owner of the servient property to retain the right to use the land subject to the easement in any manner which does not interfere with the use granted by the easement. o Gives use rights but not the right to exclude other - as long as the exclusive use is limited to a particular purpose, the conveyance is still an easement, and the owner of the servient estate retains the right to use the underlying property. Holding: P cannot exclude D but D cannot use the servient property in a manner that interferes with P’s right to use the easement To determine if the language the grants a fee simple absolute or merely an easement Amount of consideration Particularity of property Extent of limitation on use Peculiarities of the wording To whom the property was assessed and who paid taxes How the parties or their heirs to the conveyance run the land Issues in Servitude Cases 1. Creation of a servitude a. In cases with an express agreement between A and B there are many questions i. Whether parties intended to create a servitude or only a simple contractual relationship b. In cases with an informal unwritten servitude the creation depends on compliance with the law's requirements for informal servitudes 2. Running of the burden of servitude a. Burden the servitude imposes on the burden party's and has the capacity to run with the land and bind subsequent owners of that land if certain requirements are met 3. Running of the benefit a. Running of the burden and running of the benefit are different i. Whether a successor to the beneficiary of the servitude obligation is entitled to enforce the servitude against the burden party or successor b. A servitude is not created at all unless the benefit or burden is appurtenant to land i. An in gross burden and benefit is a simple contract 4. Validity a. If the contract meets the formal requirements, it may still fail because of unconscionability to violation of public policy b. Usually asked by asking whether the burden or benefit touches and concerns the land of the respective parties c. In easement questions it is usually phrased whether a novel burden may be imposed on or accorded to landowners 5. Scope and interpretation a. Parties often fail to express themselves with clarity or completeness on important aspects of their relationship i. Law establishes rules of construction to determine what burden and benefits the parties must bear 6. Termination a. Can end at the agreement or other factor Fitzstephens v. Watson (1959) (709) Davies owned a ranch and used the property’s spring water. The Mairses bought part of the ranch. The parties orally agreed that the remaining part of the ranch would operate as servient tract and supplu the tract with water. Davies gave an easement deed to the Mairses. Davies conveyed the servient tract to the D and the Mairses sold their tract to P. the D shut of the P’s water. - A conveyance that uses language such as “agree” and “covenant” typically creates a contract, not an easement. o However, parties frequently use contractual language to describe an easement that the parties already agreed upon as part of a previous conveyance. o A contract or agreement to supply water may be an easement because, even if it uses contractual terms, the instrument describes a right traditionally recognized by the courts as an easement. Holding: If the instrument uses contractual terms to convey a right traditionally recognized as an easement the instrument may still be considered an easement especially considering the intent and language used. o First, the right to use water from someone else’s land is usually recognized as an easement. o Second, the parties designated the conveyance as an easement. o Third, the instrument purports to bind the future owners of the servient estate, which shows an intent to create more than just a personal contract. Reservation Garze v. Grayson (1970) (715) Gadeholt bought 2 adjacent lots before the city connected the properties to the sewer system and sold each lot to different people, including a reservation on the P’s deed for an easement for public utility purposes on what would eventually be the D’s property. P sued to install a sewer line. - Previously, most jurisdictions, including this one, have held that a grantor creating an estate in cannot reserve an easement burdening that estate for the benefit of third party. o This rule is based on the idea that, technically, creating an easement is done by reserving the easement, or keeping it back. - The more modern view is to allow the grantor to use a single instrument to create an estate in a grantee and create an easement for a third party. Holding: A grantor may create an easement for the benefit of a person other than themselves if these adequately express their intention and there is sufficient evidence to establish there is an easement that allows the P to install a sewer line. - Restatement view and 14 states still use the common law view Running of Burden and Benefit: - Subsequent purchase for Value without notice takes the property free of the servitude Witter v. Tagart (719) (Facts above) A landowner is only bound by restrictions on his land if said restrictions are included in his deed or the deed of a landowner in the same chain of title, unless actual notice of a restriction exists. Holding: Since D did not have notice of any restrictive covenant, he is not bound by the covenant present on the P’s land. O’Dononvan v. Mcintosh (1999) (725) Piece of land had an easement opposing development and P wanted to sell the easement - The vast majority of modern authority, however, has rejected this restrictive rule to further the policy of making property freely alienable. - However, the transferee must limit his use to that which the original parties intended. Holding: Here, the parties’ intent to make the subject easement transferrable is clear from the language of the deed so the easement can convey it. Informal Easements: - Unwritten/implied o May be created by estoppel, prior use, necessity, and adverse use for the statute of limitations o - - - - Includes Easement of necessities Easements by prior use Prescriptive easements o Created by A separation of title Use which gives rise to the easement shows that it was intended to be permanent Intent is not implied easement is necessary to the enjoyment of the land o same scope as an expressly created easement Easement at will Licenses o The nonpossessory equivalent of a tenancy at will estate but is easily revocable o The catch all function o Can be an oral agreement o Ticket is a license to the seat Estoppel o Protects detrimental reliance o Implemented when there is enough evidence o Prior use o Takes into consideration: Sophistication of the parties Complexity of the servitude Potential economic impact Residential or commercial character Consideration Strict necessity o Common law required strict necessity and is still required in some states o While other states accept reasonable necessity but require strict prior use Statutes o More than half the states have codified easement by necessity with landlocked parcels but also provides compensation to the servient owner because it is a taking Mandia v. Applegate (1998) (733) P purchased an amusement pier and boardwalk and D owned a 99 year lease for a space to operate a business—they could not obstruct the boardwalk but wanted to install an awning. Parties were unable to come to terms with a written agreement but agreed on rent and D still put the awning up - license is a personal privilege to use someone else’s land in a specific way or for a specific purpose. - A revocable license can be revoked by the licensor at any time with or without cause. o A license can be given orally. o However, easements are real property interests and must be in writing. Holding: An oral agreement to allow someone to use a property creates a revocable license rather than an easement because there is no evidence that the P intended their permission to be permanent. Public Policy Henry v. Dalton (1959) (739) P purchased a home next to the D and put a driveway on their respective properties, but the D refused to execute a written easement, when they were going to sell the home. - Authorities on this matter are divided. o Some authorities find that if a licensee spends money in reliance on the permission, the permission becomes irrevocable. o However, the cases finding that a license became irrevocable in this manner deal with oral licenses with a time limit of some sort because a license without a duration and is irrevocable it is basically an easement - SF requires all easements to be in writing Holding: An oral agreement that has no time limit must be a revocable license so since the license did not have a time limit it is not an easement and revocable. - NY view adopted o Protects landowners who act neighborly and certainty in the public records, burdening the person who granted the easement o Other view: Does not let A watch their neighbor spend money and they revoke to avoid unjust enrichment and allows easements to be granted informally Prior Use Otero v. Pancheco (1980) (744) D owned a home that was built partically on a second lot and connected to the sewer line underneath the second lot. Later owner of the second lot, the P, sued the D for damages. - The resulting easement not only affects the parcel conveyed to the other individual, known as an “implied grant,” but also affects the parcel of land remaining in the ownership of the landowner, known as an “implied reservation.” - However, there is a split in authority regarding the degree of necessity required to be shown to imply that an easement has been reserved on a parcel of land. o Some courts hold that an easement is implied by reservation only under circumstances warranting strict necessity. o Alternatively, some jurisdictions take a more relaxed approach and recognize that the degree of necessity is answered if the easement by implied reservation is reasonable for a landowner to enjoy the continued use of his property. Holding: The D has an implied easement by reservation due to a reasonable necessity that continues to exist because the exception to a bona fide protection, not protecting purchasers that could have reasonably inquired regarding an unknown concern. Adverse Use prescriptive easement Fiese v. Sitorius (1995) (754) P operated an airstrip on his property and D tried to place obstructions to keep P from using it. - A prescriptive easement is an easement acquired by the adverse use of another’s property. - To obtain a prescriptive easement, for the full prescriptive period, the use must be: o (1) adverse, (2) under a claim of right, (3) continuous and uninterrupted, (4) open and notorious, exclusive, and (5) with the full knowledge and acquiescence of the owner of the servient estate. - An avigation easement grants the holder the right to navigate aircraft in the designated airspace overlying another’s property but the court has never granted a private person one The Federal Aviation Act prohibits landowners from inhibiting transit through the navigable airspace; Therefore, federal law makes all use of someone else’s airspace legally a permissive license. o A permissive use of another’s property is not adverse and thus does not qualify as a prescriptive easement. Holding: Using someone else’s property is a permissible way (the statute) is not adverse enough to create an easement but Congress did not provide remedy so the court cannot grant an injunction and the P must seek relief for the Sec of Transportation Prescriptive Easement - American o The use by another of someone's land for a long enough time means that the user has acquired the right to the easement o Mailboxes - English o By allowing someone to use your property for sufficient time it must mean that you granted them this right and the grant is mislaid - Common law requirements o (1) adverse, (2) under a claim of right, (3) continuous and uninterrupted, (4) open and notorious, exclusive, and (5) with the full knowledge and acquiescence of the owner of the servient estate. rd - 3 restatement does not require exclusivity because servitudes are not generally exclusive o Also holds a servitude is extinguished to the extent that a property violates a servitude burdening the property and the use is maintained adversely to a person entitled to enforce the servitude for the prescriptive period - Some courts do not require hostility especially for the woods and beaches o Public can get an easement by prescription - Disfavored doctrine Scope: Scherger v. Northern Natural Gas Co (1998) (762) D transports natural gas via pipeline and got a blanket easement in 1931 over a portion of the a farm to contrast, inspect, repair, maintain, and replace. In 1995 D decided to replace it taking up different land but P said that they had to provide a definite and specific description of the pipeline. - If the language granting the easement is clear and unambiguous, a court must apply those terms to determine the scope of the easement. Holding: If an easement agreement exists, it rules the agreement and in this case the language is clear and unambiguous allowing D to replace it and the statute applied to easements is inapplicable. Frenning v. Dow (1998) (769) P had an easement to cross D’s property but P bought more property and used the easement to access all of the acres. - Courts disfavor terminating an easement unless injunctive relief would be ineffective to relieve the servient estate from the burden of increased use. - Increased use of an easement does not extinguish the easement if it is possible to sever the increased burden while preserving the original easement’s benefit Holding: The burden of increased use can be severed but P has to propose a plan. Raven Red Ash Coal Co v. Ball (1949) 773 P owned the land that D had an easement to pass over his property to reach the land they had their mines over and was intended for 1 mine but acquired more rights and transferred 5 mines coal across the lines - An easement holder may be held liable under a theory of implied contract or assumpsit for the increased use of an easement if the easement holder has benefited from the increased use. o Every increased use of an easement is a trespass, and the easement holder is liable to for all damages from these trespasses but without damages only nominal damages are available - Sue in implied contract to prevent the trespasser from being unjustly enriched by the illegal use of another’s property. Holding: The increased use was a trespass and only paying nominal damages would result in a better deal than paying for legal access so the court implies a promise from the D to pay a fair value for the increased benefits it receives. - Restitution Termination of Easements - May end o When its purpose has been fulfilled o Conduct o Relinquish the benefit Voluntary or not o Both parties may agree to end it o Statute o Abandoned Not non-use, must show clear and convincing evidence and intent to abandon Defeasibility Howell v. Clyde (1997) (777) A easement across the D’s property limited to only residential use and no trailers or camping but P put a camp site on it - - If an easement instrument specifies that the easement may be terminated, a termination does not need to be recorded to be effective. o A determinable or defeasible easement is an easement that will terminate automatically upon the happening of a certain event or upon the discontinuance of certain existing facts without any action by the servient or underlying estate. Separately, a state statute provides that no easement is valid against a bona-fide purchaser for valuable consideration unless the easement is recorded. Holding: An easement termination is different from and easement and does not need to be recorded so P no longer has an easement Extinguishment abandonment Strahin v. Lantz (1995) (781) D owned a large piece of property with a road on it that a mine used to get there. After the mine closed the D put a gate on it but P purchased property that he needed to use the road to get to. - A prescriptive easement is abandoned if there is both nonuse of the easement and an intent to abandon the easement. o This majority rule is consistent with the public policy of protecting vested property rights. The party asserting abandonment of an easement has the burden of proving the abandonment by clear and convincing evidence. courts have failed to find an intent to abandon even if a fence has been erected and large trees have grown where the easement existed before. o Alternatively, a party may also extinguish or terminate an easement by adverse possession. Holding: The D has not shown intent to abandon, only nonuse, so the easement still exists - Minority of courts hold that reliance by the servient owner on the easement beneficiary's abandonment is a necessary element of abandonment doctrine Estojak v. Marsa (1989) (786) P own a business located and bought 2 lots designated for public use but the town did not accept the streets for public use and bulldozed the road (had not previously restricted access). D own homes on the street and used the area as an extension of their yards. - To use adverse possession to extinguish an existing easement, the servient estate must show both: (1) the normal elements of adverse possession: a visible, notorious, and continuous hostile use; and (2) that the servient estate’s use has been inconsistent with the use and rights of the easement holder. Both elements must have existed for at least 21 years. - To set up a sufficiently hostile claim to end an easement, the servient estate must actually use the property in some way that is adverse to the easement holder’s interests. Holding: Until recently the D did not take actions inconsistent with an easement and a natural embankment is not enough to show the D were using the property inconsistent with the easement holder’s use so the P still have an easement. Mortgage Exception: - Owner owns 2 lots and sells one that gives them access to the road, they can use the property to access the road/lot because their right preexisted the mortgage Negative Easements - Beneficiary does not acquire the right to make a physical or constructive intrusion onto the servient estate but instead gets the rights to prevent the servient owner from using their land in some way that if it weren’t for the easement they could - Expandable o An obligation that cannot be enforced as an easement will be enforced as a covenant or equitable servitude o Advantageous for a P to present their interest as an easement - Common law o 4 types Light Air Flow from a stream Support for a building - o Prohibition against new negative easements Cannot be created by prior use, necessity, prescription but can be created by estoppel if the court is willing American courts are more lenient on negative easements especially in conservation Equitable Servitudes - Classifications on pg 807 o Nearly indistinguishable from easements - Rules depend on classification o First focus on the interest of the beneficiary of the servitude If the bargain between A and B allows B to go onto A's land courts will likely find it to be an easement If the bargain allows B to go onto A's land and the veto power falls within the 4 negative easements recognized at common law it should also be easily classified as an easement If veto power is not within the 4/novel the court will likely find it's not an easement but it could always find a new easement o Second focus on the servient owner If the duty is from A's standpoint is to not to do anything - American law o Some veto powers held by B over A's land might not qualify as easements and all affirmative duties-imposed on A will probably not qualify as easements US v. Blackman (2005) (798) Historical society was created to preserve and granted an easement in gross for perpetuity for land conservation over the Atkin’s farm. The conveyed it to the government and National Park service now administers the easement. D bought the farm and submitted renovation plans that kept getting rejected and eventually just did them. - The conveyance of a negative easement in gross for the purpose of land conservation and historic preservation is valid. o Easements in gross were disfavored at common law because they were viewed as nontransferable and as interfering with free use of the land. - Virginia has recognized that an easement in gross could be transferred by deed or will, and, in 1962, Virginia amended its code to state this expressly. In 1988, the legislature also enacted the VCEA. The VCEA defined a conservation easement and provided that conservation easements, affirmative and negative, may be transferred. But it did not create a new right to transfer easements in gross because since 1962 Virginia has recognized easements in gross, both affirmative and negative, are transferable Holding: The easement to the historical society was created after 1962 so it is transferable and the US has the right to bar the D from renovating . o A negative easement gives the dominant tract or easement holder the legal right to object to the servient tract using the property in any way that is inconsistent with the easement terms. Easements are classified as either appurtenant, which means running with the land, or in gross, which means held by an individual and not attached to the land.