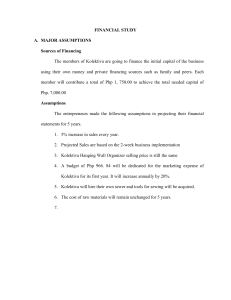

Reviewer Materials for Perpetual and Periodical Accounting Cycle Additional Guides and Tips for TESDA NC III Bookkeeping. -Accounting Tutorial Therefore, I tell you, whatever you ask in prayer, believe that you have received it, and it will be yours. -Mark 11:24 ESV Heavenly Father, please be with this student as he/she go where they do not know. As they seek to grow in knowledge, show and give him/her to find your light and graciousness. As they start to conquer the world, I pray that he/she start to conquer your kingdom too. Give them struggles for this will be their strengths and will use to fight all the hindrances along the way to you and to your kingdom. Take he/she deeper that his/her feet could ever wander and let his/her will be made stronger in the presence of our Lord Jesus, Our Savior. Always bring him/her to where he/she belong. To your hands, heart and kingdom. Amen SOLE PROPRIETORSHIP ACCOUNTING TRANSACTIONS (MOCK EXAM) Completing the Accounting Cycle from Journal Entries to Post closing Trial balance with a provided worksheet and answer keys. On December 1, Mark Rivera began an AUTO REPAIR SHOP, Rivera’s Quality Automotive. The following transactions occurred during December: December 1 Rivera contributed PHP 200,000.00 cash to the business in exchange of shares of common stocks. December 1 Purchased PHP 12,000.00 of computer equipment paid thru cash. December 1 Paid a 3 months insurance policy starting December 1,2020, PHP 9,000.00 December 5 Purchased Office Supplies on account, PHP 5,800.00 December 8 Borrowed PHP 80,000.00 from the bank for business use. Rivera prepared and signed promissory notes payable to bank under the name of his business. December 9 Paid advertising expenses for only PHP 1,580.00 December 10 Paid half of the supplies on account December 13 Rivera’s Quality Automotive paid registration and licensing fees for the business, PHP 10,800.00 December 16 The company acquired tables, chairs, shelves, and other fixtures for a total of PHP 30,000.00 The entire amount was paid in cash. December 17 The company acquired service equipment for PHP 16,000.00 The company paid a 50% down payment and the balance will be paid after 60 days. December 17 The company received PHP 10,900.00 for services rendered. December 17 Rendered services on account, PHP 78,000.00. As per agreement with the Rapid Automotive, the amount is to be collected after 10 days December 19 Mr. Rivera invested an additional PHP 53,200.00 into the business December 20 Rendered services to a big corporation on December 20. As per agreement, the PHP 33,400.00 amount due will be collected after 30 days December 21 Paid in full the supplies on account December 21 The owner withdrew cash due to an emergency need. Mr. Rivera withdrew PHP 60,000.00 from the company. December 22 Paid rent for December, PHP 1,500.00 December 23 Paid salaries to its employees, PHP 3,500.00 December 27 Collected from the Rapid Automotive full amount. December 28 Paid the bank 30% of loan payable Rivera's Quality Automotive Chart of Accounts 101 102 103 104 105 106 107 108 109 201 202 203 204 205 301 302 303 401 601 602 603 604 605 606 607 608 609 Cash Accounts Receivable Office Supplies Prepaid Insurance Computer Equipment Accumulated Depreciation - Equipment Furniture and Fixtures Service Equipment Accumulated Depreciation - Service Equipment Accounts Payable Notes Payable Interest Payable Loan Payable Unearned Revenue Capital Withdrawal Income Summary Account Service Revenue Salaries Expense Rent Expense Utilities Expense Supplies Expense Insurance Expense Taxes and Licenses Advertising Expenses Depreciation Expense – Computer Equipment Depreciation Expense – Service Equipment ADJUSTMENT DATA: A. B. C. D. Office Supplies used during the month, PHP 3,800.00 Depreciation of the computer for the month, PHP 2,400.00 Depreciation of the service equipment for the month, PHP 3,200.00 One-month insurance was expired. REQUIREMENTS: 1. 2. 3. 4. 5. Prepare the journal entries and post to the T-Accounts Prepare unadjusted trial balance Prepare the adjusting journal entries and post to the T-Accounts Prepare adjusted trial balance Prepare the Financial Statements: (Income Statements, Statement of Owner’s Equity, Balance Sheet) 6. Prepare the closing entries and post to the T- Accounts 7. Prepare post-closing trial balance PREPARE JOURNAL ENTRIES: JOURNAL ENTRIES Sr No. Particulars DR Amount (in PHP) CR Amount (in PHP) JOURNAL ENTRIES: JOURNAL ENTRIES Sr No. Particulars DR Amount (in PHP) CR Amount (in PHP) JOURNAL ENTRIES: JOURNAL ENTRIES Sr No. Particulars DR Amount (in PHP) CR Amount (in PHP) Cash TOTAL Accounts Receivable TOTAL Balance: TOTAL Balance: Office Supplies TOTAL Balance: TOTAL TOTAL Prepaid Insurance TOTAL Balance: TOTAL Service Equipment TOTAL TOTAL Balance: Accumulated Depreciation - Service Equipment TOTAL Balance: Accounts Payable TOTAL Balance: TOTAL TOTAL Notes Payable TOTAL Balance: TOTAL Loan Payable TOTAL TOTAL Balance: Unearned Revenue TOTAL Balance: Capital TOTAL Balance: TOTAL Withdrawal TOTAL TOTAL Balance: TOTAL Income Summary Account TOTAL TOTAL Balance: Service Revenue TOTAL Balance: Salaries Expense TOTAL Balance: TOTAL TOTAL Rent Expense TOTAL Balance: TOTAL Utilities Expense TOTAL TOTAL Balance: Supplies Expense TOTAL Balance: Insurance Expense TOTAL Balance: TOTAL TOTAL Taxes and Licences TOTAL Balance: TOTAL Depreciation Expense - Computer Equipment TOTAL Balance: TOTAL Depreciation Expense - Service Equipment TOTAL Balance: TOTAL RIVERA’S QUALITY AUTOMOTIVE UNADJUSTED TRIAL BALANCE DECEMBER 31,2020 RIVERA’S QUALITY AUTOMOTIVE ADJUSTED TRIAL BALANCE DECEMBER 31,2020 RIVERA’S QUALITY AUTOMOTIVE INCOME STATEMENT DECEMBER 31,2020 RIVERA’S QUALITY AUTOMOTIVE STATEMENT OF ACCOUNT DECEMBER 31,2020 RIVERA’S QUALITY AUTOMOTIVE CASH FLOW DECEMBER 31,2020 RIVERA’S QUALITY AUTOMOTIVE BALANCE SHEET DECEMBER 31,2020 RIVERA’S QUALITY AUTOMOTIVE POST CLOSING TRIAL BALANCE DECEMBER 31,2020 SOLE PROPRIETORSHIP ACCOUNTING TRANSACTIONS (ANSWER KEYS) ADJUSTMENT DATA: E. Office Supplies used during the month, PHP 3,800.00 F. Depreciation of the computer for the month, PHP 2,400.00 G. Depreciation of the service equipment for the month, PHP 3,200.00 H. One-month insurance was expired. REQUIREMENTS: 8. 9. 10. 11. 12. Prepare the journal entries and post to the T-Accounts Prepare unadjusted trial balance Prepare the adjusting journal entries and post to the T-Accounts Prepare adjusted trial balance Prepare the Financial Statements: (Income Statements, Statement of Owner’s Equity, Balance Sheet) 13. Prepare the closing entries and post to the T- Accounts 14. Prepare post-closing trial balance PREPARE JOURNAL ENTRIES: JOURNAL ENTRIES Sr No. 101 301 105 101 101 103 201 101 204 607 101 201 101 606 101 107 101 108 101 201 Particulars CASH RIVERA, CAPITAL To record the investment of the owner COMPUTER EQUIPMENT CASH To record purchased computer equipment PREPAID INSURANCE CASH To record availed insurance OFFICE SUPPLIES ACCOUNTS PAYABLE To record bought office supplies on account CASH LOANS PAYABLE To record loans payable ADVERTISING EXPENSE CASH To record the payment for advertising ACCOUNTS PAYABLE CASH To record the payment for office supplies in half TAX AND LICENSES CASH To record the payment for the registration of licenses FURNITURE AND FIXTURES CASH To record bought furniture and fixtures SERVICE EQUIPMENT CASH ACCOUNTS PAYABLE To record bought service equipment on cash and on account DR Amount (in PHP) CR Amount (in PHP) 200,000.00 200,000.00 12,000.00 12,000.00 9,000.00 9,000.00 5,800.00 5,800.00 80,000.00 80,000.00 1,580.00 1,580.00 2,900.00 2,900.00 10,800.00 10,800.00 30,000.00 30,000.00 16,000.00 8,000.00 8,000.00 JOURNAL ENTRIES: JOURNAL ENTRIES Sr No. 101 401 102 401 101 301 102 401 201 101 302 101 101 101 101 101 Particulars CASH SERVICE REVENUE To record rendered services received on cash ACCOUNTS RECEIVABLE SERVICE REVENUE To record rendered services received on AR CASH RIVERA’S CAPITAL To record additional investment of owner ACCOUNTS RECEIVABLE SERVICE REVENUE To record rendered services received on AR ACCOUNTS PAYABLE CASH To record full payment on supplies RIVERA’S WITHDRAWAL CASH To record withdrawal of owner RENT EXPENSES CASH To record payment of rent SALARIES EXPENSES CASH To record payment of salaries of employees CASH ACCOUNTS RECEIVABLE To record the cash received from Rapid Customer LOAN PAYABLE CASH To record payment of loan 30% JOURNAL ENTRIES: DR Amount (in PHP) CR Amount (in PHP) 10,900.00 10,900.00 78,000.00 78,000.00 53,200.00 53,200.00 33,400.00 33,400.00 2,900.00 2,900.00 60,000.00 60,000.00 1,500.00 1,500.00 3,500.00 3,500.00 78,000.00 78,000.00 24,000.00 24,000.00 JOURNAL ENTRIES Sr No. Particulars DR Amount (in PHP) CR Amount (in PHP) ADJUSTING ENTRIES SUPPLIES EXPENSE 3,800.00 OFFICE SUPPLIES 3,800.00 To adjust office supplies DEPRECIATION EXPENSE – COMPUTER 2,400.00 ACCUMULATED DEPRECIATION - COMPUTER 2,400.00 To record depreciation of computer equipment DEPRECIATION EXPENSE – SERVICE EQUIPMENT ACCUMULATED DEPRECIATION – SERVICE EQUIPMENT To record depreciation of service equipment 3,200.00 INSURANCE EXPENSE 3,000.00 3,200.00 PREPAID INSURANCE 3,000.00 To recognize 1-month insurance CLOSING ENTRIES SERVICE REVENUE 122,300.00 INCOME SUMMARY ACCOUNT 122,300.00 To closed revenue INCOME SUMMARY AMOUNT 29,780.00 SALARIES EXPENSE 3,500.00 RENT EXPENSE 1,500.00 TAX EXPENSE 10,800.00 ADVERTISING EXPENSE 1,580.00 INSURANCE EXPENSE 3,000.00 DEPRECIATION EXPENSE - COMP. EQUIPMENT 2,400.00 DEPRECIATION EXPENSE - SERVICE EQUIPMENT 3,200.00 To closed expenses INCOME SUMMARY ACCOUNT 92,520.00 RIVERA, CAPITAL 92,520.00 To closed income summary account RIVERA, CAPITAL WITHDRAWAL To closed withdrawal 60,000.00 60,000.00 Cash Capital 200,000 Computer 12,000 Loans 80,000 Insurance 9,000 Revenue 10,900 Supplies 2,900 Capital 53,200 Revenue 78,000 Tax 10,800 Furnitures 30,000 Equipment 8,000 Withdrawal 60,000 Salaries 3,500 Loan 24,000 Advertising 1,580 Supplies 2,900 Rent 1,500 TOTAL 422,100 Balance: 255,920 TOTAL 166,180 Accounts Receivable Revenue 78,000 Revenue 33,400 Revenue 78,000 TOTAL 111,400 TOTAL 78,000 Balance: 33,400 Office Supplies Adjustment Supplies 5,800 3,800 Prepaid Insurance Adjustment Insurance 9,000 3,000 TOTAL 5,800.00 Balance: 2,000.00 TOTAL 9,000 TOTAL 3,800 Balance: 6,000 TOTAL 3,000 Service Equipment Service 16,000 TOTAL 16,000 Balance: 16,000.00 TOTAL Accumulated Depreciation - Service Equipment Adjustment 3,200 TOTAL TOTAL 3,200 Balance: 3,200.00 Computer Equipment Accumulated Depreciation - Equipment Adjustment 2,400.00 Computer 12,000 TOTAL 12,000 Balance: 12,000 TOTAL TOTAL TOTAL 2,400 Balance 2,400.00 Accounts Payable AP 5,800 Notes Payable AP 2,900 AP 2,900 AP 8,000 TOTAL 5,800 TOTAL 13,800 TOTAL Balance: 8,000.00 Balance: LP 24,000 Loan Payable LP 80,000 TOTAL Unearned Revenue TOTAL 24,000 TOTAL 80,000 TOTAL Balance: 56,000.00 Balance: TOTAL Capital Withdrawal Withdrawal 60,000 ISA 60,000.00 TOTAL 60,000.00 TOTAL 345,720. TOTAL 60,000 TOTAL 60,000 Balance: 285,720.00 Balance: 0.00 Capital 200,000 Capital 53,200 ISA 92,520.00 Withdrawal 60,000 Expenses 29,780 Income Summary Account Revenue 122,300.00 Capital 92,520 TOTAL 122,300 Balance: 0.00 TOTAL 122,300 Service Revenue Revenue ISA 122,300.00 10,900 Revenue 78,000 Revenue 33,400 TOTAL 122,300 TOTAL 122,300 Balance: 0.00 Salaries Expense Salaries 3,500 ISA 3,500.00 TOTAL 3,500 TOTAL 3,500 Balance: 0.00 Balance: TOTAL 1,500.00 TOTAL 1,500.00 Balance: 0.00 Utilities Expense TOTAL Rent 1,500 Rent Expense ISA 1,500.00 TOTAL Supplies Expense Adjustment 3,800.00 ISA 3,800.00 TOTAL 3,800 Balance: 0.00 TOTAL 3,800.00 Insurance Expense Adjustment 3,000.00 ISA 3,000.00 TOTAL 3,000.00 TOTAL 3,000.00 Balance: 0.00 Taxes and Licenses TAX 10,800 ISA 10,800 TOTAL 10,800 TOTAL 10,800 Balance: 0.00 Depreciation Expense - Computer Equipment Adjustment 2,400 ISA 2,400 Depreciation Expense - Service Equipment Adjustment 3,200 ISA 3,200 TOTAL 2,400.00 TOTAL 3,200 Balance: 0.00 TOTAL 2,400 Balance: 0.00 TOTAL 3,200 Furniture and Fixtures Furnitures 30,000 Advertising Expenses Advertising 1,580 1,580 TOTAL 30,000.00 TOTAL 1,580 TOTAL 1,580 Balance: 0.00 0.00 Balance: 30,000.00 TOTAL RIVERA’S QUALITY AUTOMOTIVE UNADJUSTED TRIAL BALANCE DECEMBER 31, 2020 101 Cash PHP 255,920.00 102 Accounts Receivable PHP 33,400.00 103 Office Supplies PHP 5,800.00 104 Prepaid Insurance PHP 9,000.00 105 Computer Equipment PHP 12,000.00 107 Furniture and Fixtures PHP 30,000.00 108 Service Equipment PHP 16,000.00 201 Accounts Payable PHP 8,000.00 204 Loan Payable PHP 56,000.00 301 Capital PHP 253,200.00 302 Withdrawal 401 Service Revenue 601 Salaries Expense PHP 3,500.00 602 Rent Expense PHP 1,500.00 606 Taxes and Licenses PHP 10,800.00 607 Advertising Expenses PHP 1,580.00 TOTAL TRIAL BALANCE PHP 439,500.00 PHP 60,000.00 PHP 122,300.00 PHP 439,500.00 RIVERA’S QUALITY AUTOMOTIVE ADJUSTED TRIAL BALANCE DECEMBER 31,2020 101 Cash PHP 255,920.00 102 Accounts Receivable PHP 33,400.00 103 Office Supplies PHP 2,000.00 104 Prepaid Insurance PHP 6,000.00 105 Computer Equipment PHP 12,000.00 106 Accumulated Depre - Computer Equipment 107 Furniture and Fixtures PHP 30,000.00 108 Service Equipment PHP 16,000.00 109 Accumulated Depre - Service Equipment PHP 3,200 201 Accounts Payable PHP 8,000.00 204 Loan Payable PHP 56,000.00 301 Capital PHP 253,200.00 302 Withdrawal 401 Service Revenue 601 Salaries Expense PHP 3,500.00 602 Rent Expense PHP 1,500.00 606 Taxes and Licenses PHP 10,800.00 607 Advertising Expenses PHP 1,580.00 604 Supplies Expenses PHP 3,800.00 605 Insurance Expenses PHP 3,000.00 607 Depreciation Exp – Computer PHP 2,400.00 608 Depreciation Exp – Service TOTAL TRIAL BALANCE PHP 3,200.00 PHP 445,100.00 PHP 2,400.00 PHP 60,000.00 PHP 122,300.00 PHP 445,100.00 RIVERA’S QUALITY AUTOMOTIVE INCOME STATEMENT DECEMBER 31,2020 REVENUES Service Revenue PHP 122,300.00 TOTAL REVENUES PHP 122,300.00 EXPENSES Salaries Expense (PHP 3,500.00) Rent Expense (PHP 1,500.00) Taxes and Licenses (PHP 10,800.00) Advertising Expenses (PHP 1,580.00) Supplies Expenses (PHP 3,800.00) Insurance Expenses (PHP 3,000.00) Depreciation Exp – Computer (PHP 2,400.00) Depreciation Exp – Service (PHP 3,200.00) TOTAL EXPENSES NET INCOME (PHP 29,780.00) PHP 92,520.00 RIVERA’S QUALITY AUTOMOTIVE STATEMENT OF ACCOUNT DECEMBER 31,2020 Mark Rivera, Capital December 1, Investment during the year PHP 253,200.00 Net Income for the year PHP 92,520.00 TOTAL PHP 345,720.00 Less: Withdrawal (PHP 60,000.00) Net Increase in owner’s equity PHP 285,720.00 Mark Rivera, Capital December 31, PHP 285,720.00 RIVERA’S QUALITY AUTOMOTIVE CASH FLOW DECEMBER 31,2020 CASH FLOW FROM OPERATING ACTIVITIES Cash received from customers PHP 88,900.00 Less paid cash for: Insurance PHP 9,000.00 Supplies PHP 5,800.00 Taxes and Licenses PHP 10,800.00 Salaries PHP 3,500.00 Advertisement PHP 1,580.00 Rent PHP 1,500.00 (PHP 32,180.00) NET CASH PROVIDED BY OPERATING ACTIVITIES PHP 56,720.00 CASH FLOW FROM INVESTING ACTIVITIES Purchase of Equipment: Computer PHP 12,000.00 Service Equipment PHP 8,000.00 Furnitures and Fixtures PHP 30,000.00 NET CASH PROVIDED BY INVESTING ACTIVITIES (PHP 50,000.00) CASH FLOW FROM FINANCING ACTIVITIES Capital PHP 253,200.00 Loans PHP 80,000.00 Repayment of Loans (PHP 24,000.00) Withdrawal (PHP 60,000.00) NET CASH PROVIDED BY FINANCING ACTIVITIES PHP 249,200.00 CASH BALANCE AT DECEMBER 31,2020 PHP 255,920.00 RIVERA’S QUALITY AUTOMOTIVE BALANCE SHEET DECEMBER 31,2020 ASSETS CURRENT ASSETS Cash Accounts Receivable Office Supplies Prepaid Insurance Total Current Assets: LIABILITIES AND OE CURRENT LIABILITIES PHP 255,920.00 PHP 33,400.00 PHP 2,000.00 PHP 6,000.00 PHP 297,320.00 Accounts Payable PHP 8,000.00 Total Current Liability PHP 8,000.00 Long-term liabilities PHP 56,000.00 TOTAL LIABILITY PHP 64,000.00 PLANT AND EQUIPMENT Computer Equipment PHP 12,000.00 Less: Accumulated Depre - Computer (PHP 2,400.00) Furniture and Fixtures PHP 30,000.00 Service Equipment PHP 16,000.00 Less: Accumulated Depre - Service (PHP 3,200.00) Total Plant Equipment: PHP 52,400.00 Owners Equity TOTAL ASSETS: TOTAL LIABILITIES & OWNERS EQUITY PHP 349,720.00 PHP 349,720.00 PHP 285,720.00 RIVERA’S QUALITY AUTOMOTIVE POST CLOSING TRIAL BALANCE DECEMBER 31,2020 101 Cash PHP 255,920.00 102 Accounts Receivable PHP 33,400.00 103 Office Supplies PHP 2,000.00 104 Prepaid Insurance PHP 6,000.00 105 Computer Equipment PHP 12,000.00 106 Accumulated Depre - Computer Equipment 107 Furniture and Fixtures PHP 30,000.00 108 Service Equipment PHP 16,000.00 109 Accumulated Depre - Service Equipment PHP 3,200.00 201 Accounts Payable PHP 8,000.00 204 Loan Payable PHP 56,000.00 301 Capital PHP 285,720.00 TOTAL POST CLOSING TRIAL BALANCE PHP 355,320.00 PHP 2,400.00 PHP 355,320.00