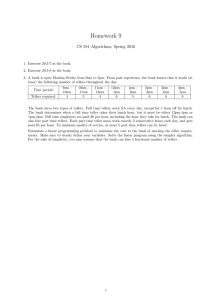

BNK401SEM: New Account Procedures & Account Maintenance TOPIC 2-Part 1 :Opening New Accounts Outline • Operate Opening New Accounts • Access to Accounts for the Unbanked and Under-banked • Utilize Computer Training / System Knowledge Opening New Accounts • Customer Service Representative(CSR) or Tellers major role is to open new accounts. • Senior tellers also called to open accounts for customers. • Address, identification cards, tax identification numbers, FNPF details: standard account information to open new accounts. Opening New Accounts • Type of products explained to customers. • Example: Checking, savings, certificate of deposit, money market deposit • Type of account explained to customers. • Example: individual, joint or business Opening New Accounts • Customers Need: Tellers to anticipate customers need because not all customers walk in the lobby and tell you what kind of account they want. Access to Accounts for the Unbanked and Under-banked. • Under-banked:er Customers who do not have access to financial services and products offered by banks. • Unbanked Customers who do not have bank accounts and they prefer to make payments with cash. Access to Accounts for the Unbanked and Under-banked. • Importance of Financial Institutions to search for unbanked and under-banked: Potential excellent customers eventhough they not have a banking relationship. Positive approach towards customers will enable them to do business more often with the bank. Access to Accounts for the Unbanked and Under-banked • Business opportunities. • Customer base. • Building a relationship with the unbanked and under-banked. Targeting Money Management for Young Adults • Targeting young adults at an early stage in educating them on the importance of saving and investment. High School University Starting a Career Starting a life investment Starting a Family Computer training / Systems Knowledge • Tellers Role: maintaining accurate records and customer information. • These include: Customer Information Standards Codes Directly Systems Procedures Computer training / Systems Knowledge Customer Information Systems: Name Address TIN-Tax Identification Number Computer training / Systems Knowledge • Tellers/CSR have to know how to: Identify the owner of a record. Enter information of customer record through specific instructions. Computer training / Systems Knowledge How to tie relationships Address Standards Short Name Standards (entering an abbreviated version of customer’s name) Other customer information Computer training / Systems Knowledge Customer - Codes Directly The codes directly acquaints Teller with the data code that relate to Information such as: *Account Level (e.g. demand deposit) * Classification Type (e.g. individual account) *Mail Status (e.g. do not mail) Computer training / Systems Knowledge * Insider (e.g. Director) * Certification (e.g. not certified) * Tax Identification Number (e.g. Business) * Relationship: (e.g. power of attorney) * Deposit Product (e.g. checking account) Computer training / Systems Knowledge System Procedures Teller learn these procedures when opening new accounts. i.e: *Main menu screen: Teller select from a listing of available products offered by the bank. Computer training / Systems Knowledge *Series of data entry screen appears: Teller complete the required customer and document print information on this screen. Function keys: streamline the operation keyboard operations Key to efficiently open new accounts Computer training / Systems Knowledge • Processing a new account: i. Product selection from the menu ii. Account select up screen iii. Customer Information Screen iv. Additional input information screen v. Forms selection screen to print account documents References: Chapter 3: New Account Procedures. pp. 1-14. Damu, J, T. (2001). Payment Movement. Serial Course name, Tabular Application Development for Information Systems. Publisher, Springer New York. pp. 122-138. Kritzer, A. (2012). Opening an Account. Publisher, Apress. pp. 195-212. http://www.immihelp.com/newcomer/bankaccount.html End of Lecture Thank you for your attention Questions? Head to the Moodle Topic 2 discussion forum and post them