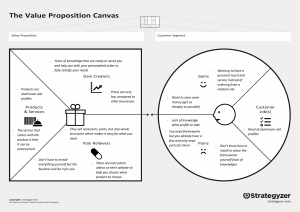

Batch 2021-23 Business Environment Interim Report Company name - Hindalco Industries Ltd. Group- 11_Section D Submitted By : Mohit Bhatia Submitted To: ( 202132037) Vikas Ashok Doddamani ( 202132059) Saradindu Datta ( 202132051) Dr. Gajavelli V S Executive Summary of Hindalco Ltd The report aims to access Hindalco’s Market and Non-Market environment through various tools of analysis keeping an eye on the values of the company and its vision for success which in turn will drive home the ultimate goal of enhancing the shareholder’s wealth. The tools ues are as followsThe 4 A’s Approaches study on Hindalco: The effectiveness with which a firm and its managers address non-market issues depends upon their approach (A) to the non-market environment. The (IA)3 Framework study w.r.t Hindalco: This framework is built around the analysis of issues, actors, interests, arenas, information and assets. For effective management of the non-market the management of Hindalco has to ask itself the important questions around each of these aspects and answer it. The CIE framework: This framework covers the Market Environment and Non-Market Environment of the organization and on the company’s internal processes. Non-market environment is the environment which includes Political, economic, social, technological, legal, environment factors that affect the company’s operations. Market environment include buyers, new entrants, new substitutes, suppliers and conventional competitors affecting the organizations business. Integrated strategy adopted by Hindalco: An effective business strategy integrates both the strategies and tailors them to the firm’s market and non-market environment to fulfill the ultimate objective of increasing the Shareholder’s Wealth. Budget: The budget part covers the last three years budget and how it impacted the company’s business over the course of the period. The period covered in this is from 2020-21 to the latest budget of 2022-23. Vision: To be a premium metals major, global in size and reach, excelling in everything we do, and creating value for its stakeholders. Mission: To relentlessly pursue the creation of superior shareholder value, by exceeding customer expectation profitably, unleashing employee potential, while being a responsible corporate citizen, adhering to our values. Values: Integrity: Honesty in every action Commitment: Deliver on the promise Passion: Energized action Seamlessness: Boundary less in letter and spirit Speed: One step ahead always Hindalco operations in India: In India, Hindalco commissioned the Renukoot plant in Uttar Pradesh in 1962. The facility operates across the aluminium value chain from bauxite mining, alumina refining, aluminium smelting to downstream rolling and extrusions. The integrated facility houses a 700,000 tpa alumina refinery and a 345,000 tpa aluminium smelter along with facilities for production of semi-fabricated products namely conductor redraw rods, sheet and extrusions. Hindalco's other units in India are located at Muri in Jharkhand, Belur in West Bengal, Hirakud in Orissa, Alupuram in Kerala, Taloja in Maharashtra, Belagavi in Karnataka and Dahej in Gujarat. Hindalco operates captive bauxite mines in Jharkhand, Chhattisgarh, Maharashtra and Orissa, which provide the raw material to alumina refineries at Belagavi, Muri and Renukoot. Hindalco also has two research and development centres in Belagavi and Taloja. Hindalco operations around the world: Novelis is headquartered in Atlanta, Georgia and operates 33 manufacturing facilities in nine countries on four continents, with nearly 15,000 employees. Novelis is the world’s largest rolled aluminium producer in terms of volume shipped, and the largest purchaser of aluminium as well. Hindalco-Almex operates a first-of-its-kind facility in India, which is exclusively devoted to high-performance aluminium alloys. HAAL is located at Shendra, Aurangabad in western India, around 350 km from Mumbai. CIE framework: Market Environment: 1. 2. 3. 4. 5. Buyers: New Entrants New Substitutes Suppliers Conventional Competitors Non-market Environment: 1. 2. 3. 4. 5. 6. Political Economic Social Technological Legal Environmental NON-MARKET ENVIRONMENT: Hindalco Industries Limited, the metals flagship of Aditya Birla Group, has achieved the No.1 rank in the Aluminium Industry for its sustainability performance in the 2021 edition of the S&P Dow Jones Sustainability Indices (DJSI) Corporate Sustainability Assessment (CSA)rankings. This is the 2nd consecutive year that Hindalco is at the top of the DJSI Indices having achieved a score of 73 percentage points against an industry average score of 30. Aluminum consumption will expand at a CAGR of 10% or more due to rapid development in electric cars, renewables, contemporary infrastructure, energy efficient consumer products, and a higher reliance on critical industries such as aerospace and defence. For example, the amount of aluminium used in an EV battery is 40-50 percent higher than in a conventional ICE. Because it is three times lighter than steel, it improves fuel economy, making it an excellent alternative for electric vehicles. Hindalco achieved 100th percentile in most aspects of the 3 dimensions of Environmental, Social and Governance (ESG) including Climate Strategy, Environment and Social reporting, Water-related risks, as well as in operational eco-efficiency parameters such as Waste Management and Resource Consumption, Cybersecurity, Community Engagement and Employee Development. The company is leading the way in terms of red mud utilization across the Aluminium industry, with a utilization of 100 per cent in three of its alumina refineries in FY21, primarily through the establishment of high-volume supply contracts with cement industries across India. Hindalco has developed a Sustainable Mining Charter alongside with sustainability advisory partner Xynteo, focusing on best environmental practices in water and biodiversity, community livelihood and health, among others. Aluminium is infinitely recyclable and Hindalco has been consistently working to increase use of recycled aluminium in its global operations through its subsidiary, Novelis Inc. In fact, increasing its presence in downstream aluminium products and use of recycled aluminium is an important lever in Hindalco's decarbonization strategy. Recycling aluminium requires just five per cent of the energy used to produce primary aluminium with only five percent of the associated greenhouse gases. In FY21, the recycled content in Novelis' products rose to 61 per cent. Hindalco's aims to become carbon neutral by 2050 through a combination of transition to cleaner energy and product stewardship. PESTEL ANALYSIS Political Factors Court Independence – The country's judiciary is mostly autonomous when it comes to economic and business matters. Regulatory Practices - Regulatory practises have been simplified to align with global norms, assisting the country in improving its "ease of doing business" ranking. Non-Governmental Organizations, Civil Society, and Protest Groups — The country has a thriving civil society group, and Novelis Hindalco should create links with them and look for areas of collaboration. Civil society organisations have a significant impact on policy development as well as the development of a societal narrative. Economic factors Demand Shifts from Products to Service Economy – In comparison to manufacturing, goods, and agriculture, the percentage of services in the economy is steadily expanding. GDP Trend and Rate of Economic Growth – A greater GDP growth rate indicates more economic demand. Hindalco may take advantage of this trend by increasing its product line and focusing on new markets. One place to begin is to track changes in customer purchasing behaviour and developing value propositions. Consumer Disposable Income – In comparison to the US market, where household income is still below 2007 levels and has not improved in real terms since the early 1980s, the country's household income has steadily climbed over the previous decade and a half. Hindalco can leverage this trend to expand the market beyond its traditional customers by employing a differentiated marketing campaign. Social Factors - Social Hierarchy and Norms – The types and levels of consumption in a culture are influenced by the hierarchy and standards that are acceptable in that community. In highly hierarchical societies, decision-making authority is generally concentrated at the top. - Society's Power Structure – Novelis Hindalco should carefully examine both: What is the society's power structure? What effect does it have on the economy's demand? For example, in the US economy, the power structure is steadily shifting towards the older generation, which has more discretionary money than the younger age. Technological Factors - Level of Technology Adoption in Society – Before introducing new goods, Hindalco must determine the level of technology acceptance in society. Frequently, businesses enter the market without the necessary infrastructure to sustain the technology-driven strategy. - Development of E-Commerce and Related Infrastructure – E-Commerce is fundamental to Novelis Hindalco's business strategy. Before entering a new market, it should assess the ecommerce infrastructure, technical infrastructure, and other factors. Environmental Factors - How Environmental Regulation Affects Industry Absolute Cost Advantage Dynamics - Increased focus and investment in renewable technologies – How much of the budget is allocated to renewable energy sources, and how can Hindalco use this investment to strengthen its competitive position? - Consumer Activism Regarding Environmental Concerns – Hindalco wants to know how active consumers are when it comes to environmental issues. It will aid Hindalco in producing ecologically friendly goods as well as avoiding public relations stumbling blocks. Legal Factors - Common Law Adherence – Does the country follow common law, which is uniform for all parties – local and international? Hindalco cannot be certain of the judgements if there is arbitrariness in the legal procedure. - Transparency in the Judiciary System and Processes – For fair and consistent decisionmaking, transparency is crucial. Hindalco can plan more confidently in the future if the approach is consistent and open. - Business Rules – Before entering a new market, Hindalco must determine what the business laws are and how they differ from those in its home market. MARKET ENVIRONMENT: Hindalco Industries Limited (Unit: Birla Copper) has already set up permanent and efficient laboratory with adequate manpower and facilities for the effective implementation of environmental control measures. PM2.5, PM10, SO2, NOX, Cl2, HCl etc samples are taken from ambient air and analysed in their laboratory on daily basis. Analysis of PM, SO2, SO3, Acid mist, Ammonia and fluoride for stack sample is carried out as per their pre scheduled basis for various stacks emission points. COD, Acidity and heavy metal analysis is also carried out on daily basis for smooth operation of ETP. BOD, TSS and residual chlorine is also measured on daily basis for STP. The current practice will be continued after proposed expansion. Birla Copper also submit the monthly statics (based on daily results) of ambient air quality and stack and effluent analysis report to state pollution control Board. In Aluminium, it has business presence in Alumina Chemicals, Primary Aluminium, Aluminium Extrusions, Aluminium Rolled Products, Foil and Packaging. In Copper, the primary products are Copper Cathodes and Continuous Cast Copper Rods. The Copper business is also associated with recovery of precious metals as well as using process waste to produce useful products such as acids and fertilizers. Hindalco’s operations span across 51 units in 13 countries and includes a workforce of 33,000 representing more than 15 different nationalities. The Renukoot plant in Uttar Pradesh in India, commissioned in 1962, operates across the aluminium value chain from bauxite mining, alumina refining, aluminium smelting to downstream rolling and extrusions. In addition to Plant level Quality Assurance/R&D Labs, Hindalco has two Innovation Centres at Belgaum and Taloja. These Innovation Centres have R&D programmes in the areas of Alumina, Aluminium, Rolling, Tribology, Foil Conversion and Modelling to support plants located in India. Also, we work in close coordination with the Novelis Global Research & Technology Centre. Aluminium manufacturing being an energy intensive process, the regulatory changes in the field of energy, has a strong impact on Hindalco’s operations. Five of Hindalco’s units (Renukoot complex, Hirakud complex, Belgaum, Muri and Taloja) are included in the PAT scheme (Perform-Achieve-Trade – a market-based mechanism for promotion of energy efficiency, spearheaded by the BEE) and five units (Renukoot, Renusagar, Hirakud complex, Muri, and Dahej) will be affected by Renewable Purchase Obligation as and when the respective states implement them. All the five units affected by PAT have identified and implemented energy conservation projects to meet or exceed the Specific Energy Consumption (SEC) targets and aim to monetize the gains, by generation and sale of Energy Saving Certificates (ESCerts). The Company is also gearing up to take on new renewable energy projects. One such project is the hydel power plant in Maharashtra, which is in the initial stages of construction; the feasibility of putting up a solar PV power plant in Kerala, and a waste heat recovery plant in pyro-metallurgical processing of copper, have also been studied. The (IA)3 framework Issues There are several issues that surround Hindalco in the present time. The first issue is the Russia Ukraine war. As Russia accounts for 10% of Global Aluminium exports, the sanctions and logistics issue arising out of the war poses a great opportunity for Hindalco for filling this potential market gap. The second issue is the Coal shortages taking place across the country. Since August 21, the industry is getting just 50% coal supplies, which has been drastically reduced to 10% currently. The industry is struggling to sustain operations with alarmingly depleted coal stocks of only 1.5 to 3 days and is on the verge of stock out. The third issue is the Concerns of sustainability and biodiversity conservation caused by mining of metals. As the need for environmental protection arises, the mining companies are posed with constant challenges created by the institutions and public forums. The forth issue is the shortages of Bauxite supplies from China to the global markets. Since Hindalco sources its Bauxite form its plants in Jharkhnd, Chhattisgarh, Maharashtra and Odisha; it is in a great position to supply its aluminium products without any distruptions. INTEREST The stakeholders comprise employees, customers, suppliers and vendors, communities, investors and shareholders, Government & Regulatory Bodies, Industry Associations and Media. The level of engagement depends on the stakeholder group and the communication is carried out through various engagement channels such as website, newsletters, social media and by conducting surveys. Frequency of Engagement range from Continuous, Quarterly and Periodically or Annually. Modes of Engagement varies from: • Emails and meetings • Intranet portals • Employee satisfaction surveys • Training programmes • Performance appraisal reviews • Employee engagement programmes • Grievance redressal mechanism • COVID-19 Care • Board meetings • Annual Reports • Newsletters • Regular business interaction • Annual Reports • Communication with regulatory bodies • Formal dialogues Their Key Concerns and Expectations include – • Equal opportunities and wages • Training and skill development with career growth • Employee well-being • Occupational health and safety • Transparent communication • Medical facilities and operational continuity • Sustainable growth and returns • Market share • Operational performance • Risk management • Corporate governance • Tax and royalties • Pollution prevention The Approach of hindalco towards its interest groups corresponds: • 67% of workforce are covered under provision of collective bargaining at Hindalco • 100% compliant in terms of payment in minimum wages • Providing technical and behavioral training • E-learning events and development programmes by Hindalco Technical University • Awareness programmes on health and wellness • Fatality prevention programme • Disaster management plan • Sufficient notice period regarding any significant operational change • COVID-19 management • Continuous operational performance • Focusing on cost optimisation and value-added products • Enterprise risk management framework • Corporate governance framework • Supplier code of conduct • Risk assessment for suppliers • Contractor safety management system • Management framework involving ethics and transparency INFORMATION Dematerialization of Shares and Liquidity: Around 98% of outstanding shares have been dematerialized. Trading in Hindalco Shares is permitted only in the dematerialized form 5th April, 1999 as per notification issued by Securities and Exchange Board of India Commodity product with a smaller share of VAP currently Upstream business linked to LME volatility LME, forex and raw material price volatility Competition from China The threat of rising imports of scrap and other VAP to India from the Free Trade Agreement (FTA) countries Domestic availability/ shortage of resources like coal and bauxite Lack of access to Shanghai Futures Exchange (SHFE) metal in China China price competitiveness in the Speciality market Increasing tariffs and protectionist measures Cost Competitiveness in China Price erosion on account of growing competition The pace of recovery from COVID-19 pandemic in the automotive and aerospace sectors Import dependence for Copper concentrate supplies Mine disruptions Duties & FTAs – trade policies Latest News: Hindalco Industries Limited, the metals flagship of Aditya Birla Group, has achieved the No.1 rank in the Aluminium Industry for its sustainability performance in the 2021 edition of the S&P Dow Jones Sustainability Indices (DJSI) Corporate Sustainability Assessment (CSA) rankings. Hindalco is the only aluminium company to enter the exclusive DJSI World Index in 2021 and retains its membership of DJSI Emerging Markets Index. The DJSI World Index comprises top 10 per cent of the largest 2,500 companies by market capitalisation in the S&P Global Broad Market Index based on long-term economic and ESG factors. This is the 2nd consecutive year that Hindalco is at the top of the DJSI Indices having achieved a score of 73 percentage points against an industry average score of 30. Actors: The aluminium industry is struggling to sustain operations with alarmingly depleted coal stocks of only 1.5 to 3 days and is on the verge of stock out.The Aluminium Association of India has urged the Central government to immediately restart supply of coal and rakes to the aluminium industry to normalise the "precarious situation" due to fuel shortage. Apart from government institutions, non-governmental institutions such as the news media, social media and public sentiment will have a major impact on any organisations. Hindalco is consistently recognised for its excellence in Safety, Environment, Community welfare as also for Quality Exports, which has helped the organization to receive many national and international awards over the years by elite institutions and boards. Arena: The main arena for these actors to work in the case of Hindalco Ltd were various regulatory proceedings which is taken care by Ministry of Mines which is a branch of Government of India and is the apex body for the formulation and administration of the rules and regulations and laws relating to mines in India. Apart from this, various industry forums and media industry within the country have also played a key role in it. The recent developments in the markets has also pushed the share prices of Hindalco skyrocketing and thus the Indian Share market also becomes an arena. Assets: Hindalco being established in 1958, is a well reputed industry leader in aluminium and copper sector. Right from very small household requirements to its vastly popular CSR activities, Hindalco has not only built trustworthiness amongst the people, built has also led by example in the Country. The large market share that the company acquires, the reputation that it holds, the network that it has in more than ten countries with a workforce of more than 40,000 people make it a powerful company to influence an issue in the context of a parliamentary committee. Impact of Last Three years Budget on Hindalco Ltd Budget 2020-21 For the financial year 2020-21, a total of Rs 27300 crore was allocated for development and promotion of Industry and Commerce. The dividend distribution tax has been removed which means that the companies no more need to pay taxes for the dividends distributed by its shareholders. Earlier companies had to pay a tax of 15% on dividends distributed. Now, the dividend income will be taxable to the recipient. One of the major schemes in commerce and industry is focused on encouraging manufacturing of mobile phones which will eventually increase the use of aluminium alloys which is one of the main products of the company, various electronic equipment and semi-conductors. Budget 2021-22 Government of India increases the budget estimates by 13% as comparted to 2020-21. Nominal GDP was expected to grow around 14.4%. The tax incentives were extended for a year up to the end of fiscal 2021-22 which included tax deduction of up to RS 1.5 lakh on interest on housing loan, affordable housing projects which implies that more usage of building sheets, flooring sheets and various other aluminium products, ultimately increasing the overall usage of the aluminium. Not only the housing sector, even the plan to establish seven new textile parks can be a booster for the company. The major infrastructure projects lined up in the year with estimated investments of more than five lakh crore will indirectly help the company to Custom duties wereincreased on some of the automobile and mobile parts which can negatively impact this sector. Disinvestment in Air India could have a minute impact on the company. A portal to collect information on gig workers and construction workers, among others will be launched to help frame schemes on health, housing, insurance and others for migrant unorganized workers. The apprenticeship act will be amended to enhance apprenticeship opportunities. Budget 2022-23 The Union Budget seeks to complement macro-economic level growth with a focus on micro-economic level. India’s economic growth estimated at 9.2% to be the highest among all large economies. The National highways network to be expanded by 25000km in the current year which means more new road signs will be in demand whose main component is aluminium which could be beneficial for the company. The addition of new trains in the country can have a positive impact on the organisation. The new scheme PM-DevINE launched to fund infrastructure and social development projects in the North-East will have a huge impact on the organisation. Telecommunication cavity processing adopts aluminium alloys as raw material. Various schemes for design-led manufacturing to build a strong ecosystem for 5G are introduced. The company may be in demand to meet these requirements. Integrated strategy of Hindalco Hindalco has set its Strategic Priorities for a long term goal of achieving success in both their market and non-market environment. There are 4 set priorities namely1. 2. 3. 4. Focus on Value-added Products Strong ESG Commitment Strengthening the Balance Sheet Capital Allocation to Maximise Shareholder Returns Focus on Value-added Product: Hindalco’s investments in the downstream industry will drive its growth in the medium future. This will continue to insulate the profits stream from LME price fluctuations and offer stability. It will also bring the company closer to its end users and consumers. Aluminium FRP is in great demand in the transportation sector, particularly in the luxury and electric car segments. The need for lightweighting and safety, such as crash management systems constructed of aluminium for safety and low weight, is predicted to grow. Hindalco is taking advantage of this chance to broaden its product offering. Low-carbon products such as aluminium buses and e-rickshaws are also being considered as viable product offers in the next years. Strong ESG Commitment: Hindalco thinks that for long-term success, a balanced approach to environmental, social, and governance elements of business is essential. They are targeting on increasing the percentage of recycled materials used in manufacturing. In addition, by 2050, the company wants to achieve net carbon neutrality, zero waste to landfill, water positively in all of our mines, and no net loss of biodiversity. With an expenditure of'2,800 Cr, Hindalco have also made headway in decreasing air pollutants by deploying Flue Gas De-sulphurisation (FGD) systems at our different plant locations. These systems will be active from April 2022 to April 2025, according to the plans. Strengthening the Balance Sheet: Hindalco want to enhance its financial sheet for future development and minimize its Net Debt to EBITDA ratio to 2.5x during the next two years. This will be accomplished by Novelis' $2.6 billion debt reduction plan and Hindalco's $0.3 billion debt reduction plan. Capital Allocation to Maximise Shareholder Returns: After satisfying maintenance capex and working capital requirements, Hindalco released its Capital Allocation Framework for the next five years in terms of broad allocation of its consolidated operational cashflows. The framework's main focus is on pursuing profitable development possibilities through organic expansions in both India downstream and Novelis, as well as strengthening the Balance Sheet through deleveraging and improving overall Shareholder value/return distributions. Bibliography: http://www.hindalco.com/ https://economictimes.indiatimes.com/ https://www.india.gov.in/ https://www.pib.gov.in/ https://embapro.com/