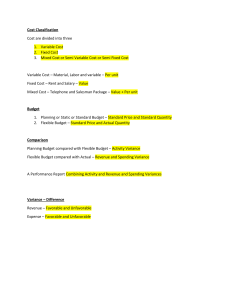

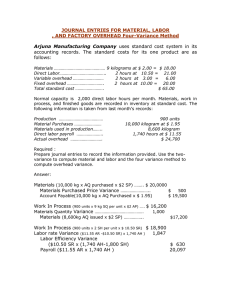

Standard Costs and Variance Analysis STANDARD COSTS AND VARIANCE ANALYSIS A. B. C. D. THEORIES: Standard cost system 1. A primary purpose of using a standard cost system is A. To make things easier for managers in the production facility. B. To provide a distinct measure of cost control. C. To minimize the cost per unit of production. D. b and c are correct No incentive bonus will be paid. Most variances will be unfavorable. Employees will be strongly motivated to attain the standard. Costs will be controlled better than if lower standards were used. 7. To measure controllable production inefficiencies, which of the following is the best basis for a company to use in establishing the standard hours allowed for the output of one unit of product? A. Average historical performance for the last several years B. Engineering estimates based on ideal performance C. Engineering estimates based on attainable performance D. The hours per unit that would be required for the present workforce to satisfy expected demand over the long run 2. Which one of the following statements is true concerning standard costs? A. Standard costs are estimates of costs attainable only under the most ideal conditions, but rarely practicable. B. Standard costs are difficult to use with a process-costing system. C. If properly used, standards can help motivate employees. D. Unfavorable variances, material in amount, should be investigated, but large favorable variances need not be investigated. 8. Which of the following statements about the selection of standards is true? A. Ideal standards tend to extract higher performance levels since they give employees something to live up to. B. Currently attainable standards may encourage operating inefficiencies. C. Currently attainable standards discourage employees from achieving their full performance potential. D. Ideal standards demand maximum efficiency which may leave workers frustrated, thus causing a decline in performance. 3. Which of the following is a purpose of standard costing? A. Determine “breakeven” production level B. Control costs C. Eliminate the need for subjective decisions by management D. Allocate cost with more accuracy Standard costs vs. budgeted costs 9. A difference between standard costs used for cost control and the budgeted costs representing the same manufacturing effort can exist because A. standard costs must be determined after the budget is completed B. standard costs represent what costs should be while budgeted costs represent expected actual costs C. budgeted costs are historical costs while standard costs are based on engineering studies D. budgeted costs include some “slack” or “padding” while standard costs do not 4. When evaluating the operating performance management sometimes uses the difference between expected and actual performance. This refers to: A. Management by Deviation C. Management by Objective B. Management by Control D. Management by Exception Standard setting 5. The best basis upon which cost standards should be set to measure controllable production inefficiencies is A. Engineering standards based on ideal performance B. Normal capacity C. Engineering standards based on attainable performance D. Practical capacity Process costing 10. When standard costs are used in a process-costing system, how, if at all, are equivalent units involved or used in the cost report at standard? A. Equivalent units are not used. B. Equivalent units are computed using a “special” approach. C. The actual equivalent units are multiplied by the standard cost per unit. 6. A company employing very tight (high) standards in a standard cost system should expect that 203 Standard Costs and Variance Analysis D. The standard equivalent units are multiplied by the actual cost per unit. A. B. C. D. Normal costing 11. The fixed overhead application rate is a function of a predetermined “normal” activity level. If standard hours allowed for good output equal this predetermined activity level for a given period, the volume variance will be A. Zero B. Favorable C. Unfavorable D. Either favorable or unfavorable, depending on the budgeted overhead. Total overhead application rate Volume of total expenses at various activity levels Variable overhead application rate Fixed overhead application rate 17. Assuming that the standard fixed overhead rate is based on full capacity, the cost of available but unused productive capacity is indicated by the: A. Factory overhead cost volume variance B. Direct labor cost efficiency variance C. Direct labor cost rate variance D. Factory overhead cost controllable variance Types of standards 12. The absolute minimum cost possible under the best conceivable operating conditions is a description of which type of standard? A. Currently attainable (expected) C. Theoretical B. Normal D. Practical 18. In analyzing manufacturing overhead variances, the volume variance is the difference between the: A. Amount shown in the flexible budget and the amount shown in the debit side of the overhead control account B. Predetermined overhead application rate and the flexible budget application rate times actual hours worked C. Budget allowance based on standard hours allowed for actual production for the period and the amount budgeted to be applied during the period D. Actual amount spent for overhead items during the period and the overhead amount applied to production during the period 13. Standards, which are difficult to achieve due to reasons beyond the individual performing the task, are the result of firm using which of the following methods to establish standards? A. Ideal Standards C. Practical Standards B. Lax Standards D. Employee Standards 14. Standards that represent levels of operation that can be attained with reasonable effort are called: A. Theoretical standards C. Variable standards B. Ideal standards D. Normal standards 19. The variance least significant for purposes of controlling costs is the: A. Material usage variance B. Variable overhead efficiency variance C. Fixed overhead spending variance D. Fixed overhead volume variance Variances Generic variances 15. When performing input/output variance analysis in standard costing, “standard hours allowed” is a means of measuring A. Standard output at standard hours C. Actual output at standard hours B. Standard output at actual hours D. Actual output at actual hours 20. The variance most useful in evaluating plant utilization is the: A. Variable overhead spending variance B. Fixed overhead spending variance. C. Variable overhead efficiency variance D. Fixed overhead volume variance Two way variances Volume variance 16. A company uses a two-way analysis for overhead variances: budget (controllable) and volume. The volume variance is based on the Four way variances 21. The choice of production volume as a denominator for calculating its factory overhead rate A. Has no effect on the fixed factory overhead rate for applying costs to production 204 Standard Costs and Variance Analysis B. Has an effect on the variable factory overhead rate for applying costs to production C. Has no effect on the fixed factory overhead budget variance D. Has no effect on the fixed factory overhead production volume variance position of a production process on a learning curve? A. Materials mix C. Labor rate B. Materials price D. Labor efficiency 22. The budgeted overhead costs for standard hours allowed and the overhead costs applied to product are the same amount A. for both variable and fixed overhead costs. B. only when standard hours allowed is less than normal capacity. C. for variable overhead costs. D. for fixed overhead costs. 27. Which of the following is the most probable reason with a company would experience an unfavorable labor rate variance and a favorable labor efficiency variance? A. The mix of workers assigned to the particular job was heavily weighted toward the use of higherly paid, experienced individuals. B. The mix of workers assigned to the particular job was heavily weighted toward the use of new, relatively low paid, unskilled workers. C. Because of the productive schedule, workers from other production areas were assigned to assist in this particular process. D. Defective materials caused more labor to be used in order to produce a standard unit. Responsibility for variances 23. Which department is customarily held responsible for an unfavorable materials usage variance? A. Quality control C. Purchasing B. Engineering D. Production Two-way overhead variance 28. The budget for a given cost during a given period was P1,600,000. The actual cost for the period was P1,440,000. Considering these facts, it can be said that the plant manager has done a better than expected job in controlling the cost if: A. The cost is variable and actual production was 90% of budgeted production B. The cost is variable and actual production equaled budgeted production C. The cost is variable and actual production was 80% of budgeted production D. The cost is discretionary fixed cost and actual production equaled budgeted production Variance analysis 24. Which of the following should be least considered when deciding whether to investigate a variance? A. Whether the variance is favorable or unfavorable B. Significance of the variance C. Cost of investigating the variance D. Trend of the variances over time Budget variance 29. The budget variance for fixed factory overhead for the normal-volume, practical-capacity, and expected-activity levels would be the: A. Same except for normal volume C. Same except for expected activity B. Same except for practical capacity D. Same for all three activity levels Total materials variance 25. If the total materials variance (actual cost of materials used compared with the standard cost of the standard amount of materials required) for a given operation is favorable, why must this variance be further evaluated as to price and usage? A. There is no need to further evaluate the total materials variance if it is favorable B. Generally accepted accounting principles require that all variances be analyzed in three stages C. All variances must appear in the annual report to equity owners for proper disclosure D. To allow management to evaluate the efficiency of the purchasing and production functions Volume variance 30. You have leased a 5,000-gallon storage tank for P5,000 per month. You stored 4,000 gallons of liquid in the tank during the month. The cost of storage was P1.25 per gallon, rather than P1.00 per gallon based on 5,000 gallon capacity. Therefore, the cost of storing 4,000 gallons was P1,000 more (P.25 x 4,000) in total than if you had stored 5,000 gallons of liquid in the tank. Which variance is being described? A. Variable-overhead efficiency variance B. Fixed-overhead spending variance C. Variable-overhead spending variance Labor variances 26. Which of the following unfavorable cost variances would be directly affected by the relative 205 Standard Costs and Variance Analysis D. Fixed-overhead volume variance 31. Favorable fixed overhead volume variance occurs if: A. There is a favorable labor efficiency variance B. There is a favorable labor rate variance C. Production is less than planned D. Production is greater than planned PROBLEMS: Standard setting Raw Materials i. Shampoo Company is a chemical manufacturer that supplies industrial users. The company plans to introduce a new chemical solution and needs to develop a standard product cost for this new solution. 32. The unfavorable volume variance may be due to all but which of the following factors? A. Failure to maintain an even flow of work B. Machine breakdowns C. Unexpected increases in the cost of utilities D. Failure to obtain enough sales orders The new chemical solution is made by combining a chemical compound (Nyclyn) and a solution (Salex), boiling the mixture; adding a second compound (Protet), and bottling the resulting solution in 20-liter containers. The initial mix, which is 20 liters in volume, consists of 24 kilograms of Nyclyn and 19.2 liters of Salex. A 20% reduction in volume occurs during the boiling process. The solution is then cooled slightly before 10 kilograms of Protet are added; the addition of Protet does not affect the total liquid volume. 33. How will a favorable volume variance affect net income under each of the following methods? Absorption Variable A. Decrease No effect B. Decrease Increase C. Increase No effect D. Increase Decrease The purchase prices of the raw materials used in the manufacture of this new chemical solution are as follows: Nyclyn P15.00 per kilogram Salex P21.00 per liter Protet P28.00 per kilogram The total standard materials cost of 20 liters of the product is: A. P1,043.20 C. P 834.56 B. P1,304.00 D. P1,234.00 34. Favorable volume variances may be harmful when: A. Machine repairs cause work stoppages B. Supervisors fail to maintain an even flow of work C. Production in excess of normal capacity cannot be sold D. There are insufficient sales orders to keep the factory operating at normal capacity ii. Three-way Overhead variance 35. During 2006, a department’s three-variance overhead standard costing system reported unfavorable spending and volume variances. The activity level selected for allocating overhead to the product was based on 80% of practical capacity. It 100% of practical capacity had been selected instead, how would the reported unfavorable spending and volume variances be affected? Spending Variance Volume Variance A. Increased Unchanged B. Increased Increased C. Unchanged Increased D. Unchanged Unchanged iii. Each finished unit of Product EM contains 60 pounds of raw material. The manufacturing process must provide for a 20% waste allowance. The raw material can be purchased for P2.50 a pound under terms of 2/10, n/30. The company takes all cash discounts. The standard direct material cost for each unit of EM is: A. P180.00 C. P187.50 206 El Andre Co. uses a standard costing system in connection with the manufacture of a line of Tshirts. Each unit of finished product contains 2.25 yards of direct material. However, a 25 percent direct material spoilage calculated on input quantities occurs during the manufacturing process. The cost of the direct materials is P150 per yard. The standard direct material cost per unit of finished product is A. P 253 C. P 450 B. P 422 D. P 405 Standard Costs and Variance Analysis B. P183.75 D. P176.40 Laborers’ fringe benefits treated as direct labor costs What is the standard direct labor cost per unit of Part J35? A. P62.500 C. P41.670 B. P78.125 D. P84.125 iv. The Vandana Company has a signature scarf for ladies that is very popular. Certain production and marketing data are indicated below: Cost per yard of cloth P40.00 Allowance for rejected scarf 5% of production Yards of cloth needed per scarf 0.475 yard Airfreight from supplier P1.00/yard Motor freight to customers P0.90 /scarf Purchase discounts from supplier 3% Sales discount to customers 2% The allowance for rejected scarf is not part of the 0.475 yard of cloth per scarf. Rejects have no market value. Materials are used at the start of production. Calculate the standard cost of cloth per scarf that Vandana Company should use in its cost sheets. A. P19.85 C. P19.40 B. P20.00 D. P19.90 Materials & Labor Questions Nos. 7 and 8 are based on the following: Supercold Company is a small producer of fruit-flavored frozen desserts. For many years, Supercold’s products have had strong regional sales on the basis of brand recognition. However, other companies have begun marketing similar products in the area, and price competition has become increasingly important. Haydee Mejia, the company’s controller, is planning to implement a standard costing system for Supercold and has gathered considerable information on production and material requirements for Supercold’s products. Haydee believes that the use of standard costing will allow Supercold to improve cost control and make better pricing decisions. Supercold’s most popular products is strawberry sherbet. The sherbet is produced in 10-gallon batches, and each batch requires six quarts of good strawberries. The fresh strawberries are sorted by hand before entering the production process. Because of imperfections in the strawberries and normal spoilage, one quart of berries is discarded for every four quarts of acceptable berries. Three minutes is the standard direct labor time for sorting that is required to obtain one quart of acceptable berries. The acceptable berries are then blended with the other ingredients; blending requires 12 minutes of direct labor time per batch. After blending, the sherbet is package in quart containers. Haydee has gathered the following information from Rizza Alano, Supercold’s cost accountant. Direct labor v. Double M company is a chemical manufacturer that supplies various products to industrial users. The company plans to introduce a new chemical solution called Bysap, for which it needs to develop a standard product cost. The following labor information is available on the production of Bysap. • The product, which is bottled in 10-liter containers, is primarily a mixture of Byclyn, Salex, and Protet. • The finished product is highly unstable, and one 10-liter batch out of six is rejected at final inspection. Rejected batches have no commercial value and are thrown out. • It takes a worker 35 minutes to process one 10-liter batch of Bysap. Employees work on eight-hour a day, including one hour per day for rest breaks and cleanup. What is the standard labor time to produce one 10-liter batch of Bysap? A. 35 minutes C. 48 minutes B. 40 minutes D. 45 minutes vi. The following direct labor information pertains to the manufacture of Part J35: Number of hours required to make a part Number of Direct workers Number of total productive hours per week Weekly wages per worker 25% of wages Supercold purchases strawberries at a cost of P8.00 per quart. All other ingredients cost a total of P4.50 per gallon. Direct labor is paid at the rate of P50 per hour. The total cost of material and labor required to package the sherbet is P3.80 per quart. Rizza Alano has a friend who owns a berry farm that has been losing money in recent years. Because of good crops, there has been an oversupply of strawberries, and prices have dropped to P5.00 per quart. Rizza has arranged for Supercold to purchase strawberries form her friend and hopes that P8.00 per quart will help her friend’s farm become profitable again. 2.5 DLH 75 3000 P1,000 vii. The standard materials cost per 10-gallon batch of strawberry sherbet is: A. P 85.00 C. P101.00 B. P 60.00 D. P105.00 207 Standard Costs and Variance Analysis A. P6,000 unfavorable B. P5,200 unfavorable viii. The standard direct labor cost per 10-gallon batch of sherbet is: A. P50.00 C. P25.00 B. P28.75 D. P15.00 C. P3,200 unfavorable D. P2,000 unfavorable xiv. The Bohol Company uses standard costing. The following data are available for October: Actual quantity of direct materials used 23,500 pounds Standard price of direct materials P2 per pound Material quantity variance P1,000 U The standard quantity of materials allowed for October production is: A. 23,000 lbs C. 24,000 lbs B. 24,500 lbs D. 25,000 lbs Materials variance ix. Under a standard cost system, the materials quantity variance was recorded at P1,970 unfavorable, the materials price variance was recorded at P3,740 favorable, and the Goods in Process was debited for P51,690. Ninety-six thousand units were completed. What was the per unit price of the actual materials used? A. P0.52 each C. P0.54 eac B. P0.53 each D. P0.51 each xv. Information on Dulce’s direct material costs for May is as follows: Actual quantity of direct materials purchased and used Actual cost of direct materials Unfavorable direct materials usage variance Standard quantity of direct materials allowed for May production For the month of May, Dulce’s direct materials price variance was: A. P2,800 favorable C. P2,800 unfavorable B. P6,000 unfavorable D. P6,000 favorable x. Blake Company has a standard price of P5.50 per pound for materials. July’s results showed an unfavorable material price variance of P44 and a favorable quantity variance of P209. If 1,066 pounds were used in production, what was the standard quantity allowed for materials? A. 1,104 C. 1,066 B. 1,074 D. 1,100 xi. Elite Company uses a standard costing system in the manufacture of its single product. The 35,000 units of raw material in inventory were purchased for P105,000, and two units of raw material are required to produce one unit of final product. In November, the company produced 12,000 units of product. The standard allowed for material was P60,000, and there was an unfavorable quantity variance of P2,500. The materials price variance for the units used in November was A. P 2,500 U C. P12,500 U B. P11,000 U D. P 3,500 F xvi. Information on Katrina Company’s direct material costs is as follows: Standard unit price Actual quantity purchased Standard quantity allowed for actual production Materials purchase price variance – favorable What was the actual purchase price per unit, rounded to the nearest centavos? A. P3.06 C. P3.11 B. P3.45 D. P3.75 xii. Sheridan Company has a standard of 15 parts of component BB costing P1.50 each. Sheridan purchased 14,910 units of component BB for P22,145. Sheridan generated a P220 favorable price variance and a P3,735 favorable quantity variance. If there were no changes in the component inventory, how many units of finished product were produced? A. 994 units. C. 1,000 units B. 1,090 units. D. 1,160 units 30,000 lbs. P84,000 P 3,000 29,000 lbs P 3.60 1,600 1,450 P 240 xvii. Palmas Company, which has a standard cost system, had 500 units of raw material X in its inventory at June 1, purchased in May for P1.20 per unit and carried at a standard cost of P1.00. The following information pertains to raw material X for the month of June: Actual number of units purchased 1,400 Actual number of units used 1,500 Standard number of units allowed for actual production 1,300 Standard cost per unit P1.00 Actual cost per unit P1.10 The unfavorable materials purchase price variance for raw material X for June was: xiii. The standard usage for raw materials is 5 pounds at P40.00 per pound. Cave Company spent P131,200 in purchasing 3,200 pounds. Cave used 3,150 pounds to produce 600 units of finished product. The material quantity variance is: 208 Standard Costs and Variance Analysis A. P 0 B. P130 C. P140 D. P150 Total Actual output The material yield variance is: A. P 280 unfavorable B. P3,989 unfavorable xviii.During March, Lumban Company’s direct material costs for the manufacture of product T were as follows: Actual unit purchase price P6.50 Standard quantity allowed for actual production 2,100 Quantity purchased and used for actual production 2,300 Standard unit price P6.25 Lumban’s material usage variance for March was: A. P1,250 unfavorable C. P1,250 favorable B. P1,300 unfavorable D. P1,300 favorable 20,160 18,500 C. P 280 favorable D. P3,989 favorable Labor variance xxi. The flexible budget for the month of May 2007 was for 9,000 units with direct material at P15 per unit. Direct labor was budgeted at 45 minutes per unit for a total of P81,000. Actual output for the month was 8,500 units with P127,500 in direct material and P77,775 in direct labor expense. Direct labor hours of 6,375 were actually worked during the month. Variance analysis of the performance for the month of May would show a(n): A. Favorable material quantity variance of P7,500. B. Unfavorable direct labor efficiency variance of P1,275. C. Unfavorable material quantity variance of P7,500. D. Unfavorable direct labor rate variance of P1,275. xix. Razonable Company installs shingle roofs on houses. The standard material cost for a Type R house is P1,250, based on 1,000 units at a cost of P1.25 each. During April, Razonable installed roofs on 20 Type R houses, using 22,000 units of material cost of P26,400. Razonable’s material price variance for April is: A. P1,000 favorable C. P1,100 favorable B. P1,400 unfavorable D. P2,500 unfavorable xxii. The standard hourly rate was P4.10. Standard hours for the level of production are 4,000. The actual rate was P4.27. The labor rate variance was P654.50, unfavorable. What were the actual labor hours? A. 3,700 C. 3,850 B. 4,150 D. 4,000 xx. Samson Candle Co. manufactures candles in various shapes, sizes, colors, and scents. Depending on the orders received, not all candles require the same amount of color, dye, or scent materials. Yields also vary, depending upon the usage of beeswax or synthetic wax. Standard ingredients for 1,000 pounds of candles are: Input: Standard Mix Standard Cost per Pound Beeswax 200 lbs. 1.00 Synthetic wax 840 lbs. 0.20 Colors 7 lbs. 2.00 Scents 3 lbs. 6.00 Totals 1,050 lbs. 9.20 Standard output 1,000 lbs. Price variances are charged off at the time of purchase. During January, the company was busy manufacturing red candles for Valentine’s Day. Actual production then was: Input: In Pounds Beeswax 4,100 Synthetic wax 13,800 Colors 2,200 Scents 60 xxiii.Clean Harry Corp. uses two different types of labor to manufacture its product. The types of labor, Mixing and Finishing, have the following standards: Labor Type Standard Mix Std Hourly Rate Standard Cost Mixing 500 hours P10 P5,000 Finishing 250 hours P5 P1,250 Yield: 4,000 units During January, the following actual production information was provided: Labor Type Actual Mix Mixing 4,500 hours Finishing 3,000 hours Yield: 36,000 units What is the labor mix variance? A. P2,500 F C. P2,500 U B. P5,000 F D. P5,000 F 209 Standard Costs and Variance Analysis xxiv. How much labor yield variances should be reported? A. P6,250 U C. P5,250 F B. P6,250 F D. P5,250 U xxix. Simbad Company’s operations for the month just ended originally set up a 60,000 direct labor hour level, with budgeted direct labor of P960,000 and budgeted variable overhead of P240,000. The actual results revealed that direct labor incurred amounted to P1,148,000 and that the unfavorable variable overhead variance was P40,000. Labor trouble caused an unfavorable labor efficiency variance of P120,000, and new employees hired at higher rates resulted in an actual average wage rate of P16.40 per hour. The total number of standard direct labor hours allowed for the actual units produced is A. P52,500 C. P62,500 B. P77,500 D. P70,000 xxv. Hingis had a P750 unfavorable direct labor rate variance and an P800 favorable efficiency variance. Hingis paid P7,150 for 800 hours of labor. What was the standard direct labor wage rate? A. P8.94 C. P8.00 B. P7.94 D. P7.80 xxvi. Powerless Company’s operations for April disclosed the following data relating to direct labor: Actual cost P10,000 Rate variance 1,000 favorable Efficiency variance 1,500 unfavorable Standard cost P 9,500 Actual direct labor hours for April amounted to 2,000. Powerless’ standard direct labor rate per hour in April was: A. P5.50 C. P5.00 B. P4.75 D. P4.50 Questions 30 and 31 are based on the following information. Information on Goodeve Company’s direct labor costs are presented below: Standard direct labor hours Actual direct labor hours Direct labor efficiency variance Favorable Direct labor rate variance Favorable Total payroll xxx. What was Goodeve’s standard direct labor rate? A. P3.54 C. P3.80 B. P4.00 D. P5.80 xxvii. Lion Company’s direct labor costs for the month of January were as follows: Actual direct labor hours 20,000 Standard direct labor hours 21,000 Direct labor rate variance – Unfav. P 3,000 Total payroll P126,000 What was Lion’s direct labor efficiency variance? A. P6,000 favorable C. P6,150 favorable B. P6,300 favorable D. P6,450 favorable Using the information given below, determine the labor efficiency variance: Labor price per hour Standard labor price per gallon of output at 20 gal./hr Standard labor cost of 8,440 gallons of actual output Actual total inputs(410 hours at P21/hr) A. P 410 unfavorable C. P 240 favorable B. P 170 unfavorable D. P 410 favorable 30,000 29,000 P 4,000 P 5,800 P110,200 xxxi. What was Goodeve’s actual direct labor rate? A. P3.60 C. P3.80 B. P4.00 D. P5.80 xxxii. The Islander Corporation makes a variety of leather goods. It uses standards costs and a flexible budget to aid planning and control. Budgeted variable overhead at a 45,000-direct labor hour level is P27,000. During April material purchases were P241,900. Actual direct-labor costs incurred were P140,700. The direct-labor usage variance was P5,100 unfavorable. The actual average wage rate was P0.20 lower than the average standard wage rate. The company uses a variable overhead rate of 20% of standard direct-labor cost for flexible budgeting purposes. Actual variable overhead for the month was P30,750. What were the standard hours allowed during the month of April? A. 50,250 C. 58,625 B. 48,550 D. 37,520 xxviii. P 20 P 1 P8,440 P8,610 210 Standard Costs and Variance Analysis xxxiii. Information on Barber Company’s direct labor costs for the month of January is as follows: Actual direct labor hours 34,500 Standard direct labor hours 35,000 Total direct labor payroll P241,500 Direct labor efficiency variance – favorable P 3,200 What is Barber’s direct labor rate variance? A. P17,250 U C. P21,000 U B. P20,700 U D. P21,000 F xxxvii. Kent Company sets the following standards for 2007: Direct labor cost (2 DLH @ P4.50) P 9.00 Manufacturing overhead (2 DLH @ P7.50) 15.00 Kent Company plans to produce its only product equally each month. The annual budget for overhead costs are: Fixed overhead P150,000 Variable overhead 300,000 Normal activity in direct labor hours 60,000 In March, Kent Company produced 2,450 units with actual direct labor hours used of 5,050. Actual overhead costs for the month amounted to P37,245 (Fixed overhead is as budgeted.) The amount of overhead volume variance for Kent Company is A. P250 unfavorable C. P500 unfavorable B. P750 Unfavorable D. P375 Unfavorable xxxiv. STA Company uses a standard cost system. The following information pertains to direct labor costs for the month of June: Standard direct labor rate per hour P 10.00 Actual direct labor rate per hour P 9.00 Labor rate variance (favorable) P12,000 Actual output (units) 2,000 Standard hours allowed for actual production 10,000 hours How many actual labor hours were worked during March for STA Company? A. 10,000 C. 8,000 B. 12,000 D. 10,500 Information of Hanes’ direct labor costs for the month of May is as follows: Actual direct labor rate Standard direct labor hours allowed Actual direct labor hours Direct labor rate variance – favorable What was the standard direct labor rate in effect for the month of May? A. P6.95 C. P8.00 B. P7.00 D. P8.05 xxxviii. Calma Company uses a standard cost system. The following budget, at normal capacity, and the actual results are summarized for the month of December: Direct labor hours 24,000 Variable factory OH P 48,000 Fixed factory OH P108,000 Total factory OH per DLH P 6.50 Actual data for December were as follows: Direct labor hours worked 22,000 Total factory OH P147,000 Standard DLHs allowed for capacity attained 21,000 Using the two-way analysis of overhead variance, what is the controllable variance for December? A. P 3,000 Favorable C. P 5,000 Favorable B. P 9,000 Favorable D. P10,500 Unfavorable xxxv. P7.50 11,000 10,000 P5,500 Two-way overhead variance xxxvi. The overhead variances for Big Company were: Variable overhead spending variance: P3600 favorable. Variable overhead efficiency variance: P6,000 unfavorable. Fixed overhead spending variance: P10,000 favorable. Fixed overhead volume variance: P24,000 favorable. What was the overhead controllable variance? A. P31,600 favorable C. P24,000 favorable B. P13,600 favorable D. P 7,600 favorable xxxix. Heart Company uses a flexible budget system and prepared the following information for the year: Percent of Capacity 80 Percent 90 Percent Direct labor hours 24,000 27,000 Variable factory overhead P 54,000 P 60,750 Fixed factory overhead P 81,000 P 81,000 Total factory overhead rate per DLH P5.625 P5.25 Heart operated at 80 percent of capacity during the year, but applied factory overhead based 211 Standard Costs and Variance Analysis on the 90 percent capacity level. Assuming that actual factory overhead was equal to the budgeted amount of overhead, how much was the overhead volume variance for the year? A. P 9,000 unfavorable C. P 9,000 favorable B. P15,750 unfavorable D. P15,750 favorable A. P1,000 favorable B. P6,000 favorable C. P1,000 unfavorable D. P6,000 unfavorable xliv. The standard factory overhead rate is P10 per direct labor hour (P8 for variable factory overhead and P2 for fixed factory overhead) based on 100% capacity of 30,000 direct labor hours. The standard cost and the actual cost of factory overhead for the production of 5,000 units during May were as follows: Standard: 25,000 hours at P10 P250,000 Actual: Variable factory overhead 202,500 Fixed factory overhead 60,000 What is the amount of the factory overhead volume variance? A. 12,500 favorable C. 12,500 unfavorable B. 10,000 unfavorable D. 10,000 favorable xl. The Fire Company has a standard absorption and flexible budgeting system and uses a twoway analysis of overhead variances. Selected data for the June production activity are: Budgeted fixed factory overhead costs P 64,000 Actual factory overhead 230,000 Variable factory overhead rater per DLH P 5 Standard DLH 32,000 Actual DLH 32,000 The budget (controllable) variance for June is A. P1,000 favorable C. P1,000 unfavorable B. P6,000 favorable D. P6,000 unfavorable Three-way overhead variance xlv. The following data are the actual results for Wow Company for the month of May: Actual output 4,500 units Actual variable overhead P360,000 Actual fixed overhead P108,000 Actual machine time 14,000 MH Standard cost and budget information for Wow Company follows: Standard variable overhead rate P6.00 per MH Standard quantity of machine hours 3 hours per unit Budgeted fixed overhead P777,600 per year Budgeted output 4,800 units per month The overhead efficiency variance is A. P3,000 Favorable C. P3,000 Unfavorable B. P5,400 Favorable D. P5,400 Unfavorable xli. Sorsogon Company had actual overhead of P14,000 for the year. The company applied overhead of P13,400. If the overhead budgeted for the standard hours allowed is P15,600, the overhead controllable variance is A. P 600 Favorable C. P1,600 Favorable B. P2,200 Unfavorable D. P1,600 Unfavorable xlii. Compo Co. uses a predetermined factory O/H application rate based on direct labor cost. For the year ended December 31, Compo’s budgeted factory O/H was P600,000, based on a budgeted volume of 50,000 direct labor hours, at a standard direct labor rate of P6 per hour. Actual factory O/H amounted to P620,000, with actual direct labor cost of P325,000. For the year, over-applied factory O/H was A. P20,000 C. P30,000 B. P25,000 D. P50,000 xlvi. The Libiran Company produces its only product, Menthol Chewing Gum. The standard overhead cost for one pack of the product follows: Fixed overhead (1.50 hours at P18.00) P27.00 Variable overhead (1.50 hours at P10.00) 15.00 Total application rate P42.00 Libiran uses expected volume of 20,000 units. During the year, Libiran used 31,500 direct labor hours for the production of 20,000 units. Actual overhead costs were P545,000 fixed and P308,700 variable. The overhead efficiency variance is xliii. The Terrain Company has a standard absorption and flexible budgeting system and uses a two-way analysis of overhead variances. Selected data for the June production activity are: Budgeted fixed factory overhead costs P 64,000 Actual factory overhead 230,000 Variable factory overhead rater per DLH P 5 Standard DLH 32,000 Actual DLH 32,000 The budget (controllable) variance for the month of June is: 212 Standard Costs and Variance Analysis A. P22,500 Favorable B. P22,500 Unfavorable C. P15,000 Favorable D. P15,000 Unfavorable Budgeted output The overhead efficiency variance is: A. P3,000 Favorable B. P5,400 Favorable xlvii.Abbey Company produces a single product. Abbey employs a standard cost system and uses a flexible budget to predict overhead costs at various levels of activity. For the most recent year, Abbey used a standard overhead rate equal to P8.50 per direct labor hour. The rate was computed using normal activity. Budgeted overhead costs are P100,000 for 10,000 direct labor hours and P160,000 for 20,000 direct labor hours. During the past year, Abbey generate the following data: Actual production: 1,400 units Fixed overhead volume variance: P5,000 U Variable overhead efficiency variance: P3,000 F Actual fixed overhead costs: P42,670 Actual variable overhead costs: P82,000 The number of direct labor hours used as normal activity are: A. 16,000 C. 14,000 B. 15,000 D. 13,500 xlviii. Using the information presented below, calculate the total overhead spending variance. Budgeted fixed overhead P10,000 Standard variable overhead (2 DLH at P2 per DLH) P4 per unit Actual fixed overhead P10,300 Actual variable overhead P19,500 Budgeted volume (5,000 units x 2 DLH) 10,000 DLH Actual direct labor hours (DLH) 9,500 Units produced 4,500 A. P 500 U C. P1,000 U B. P 800 U D. P1,300 U 4,800 unit per month C. P3,000 Unfavorable D. P5,400 Unfavorable l. The following information is available from the Tyro Company: Actual factory overhead Fixed overhead expenses, actual Fixed overhead expenses, budgeted Actual hours Standard hours Variable overhead rate per DLH Assuming that Tyro uses a three-way analysis of overhead variances, what is variance? A. P 750 F C. P 950 F B. P 750 U D. P1,500 U li. The Sacto Co.’s standard fixed overhead cost is P3 per direct labor hour based on budgeted fixed costs of P300,000. The standard allows 2 direct labor hours per unit. During 2006, Sacto produced 55,000 units of product, incurred P315,000 of fixed overhead costs, and recorded P106,000 actual hours of direct labor. What are the fixed overhead variances? Spending variance Volume variance A. P15,000 U P30,000 F B. P33,000 U P30,000 F C. P15,000 U P18,000 F D. P33,000 U P18,000 F P15,000 P 7,200 P 7,000 3,500 3,800 P 2.50 the spending lii. Using the information in the preceding number, the amounts of controllable variances for variable overhead are: Spending Efficiency A. P20,000 Fav P20,000 Unf B. P20,000 Unf P20,000 Fav C. P 5,000 Unf P20,000 Unf D. P20,000 Fav P 5,000 Unf xlix. The following data are the actual results for Bustos Company for the month of May: Actual output 4,500 units Actual variable overhead P360,000 Actual fixed overhead P108,000 Actual machine time 14,000 MH Standard cost and budget information for Bustos Company follows: Standard variable overhead rate P6.00 per MH Standard quantity of machine hours 3 hours per unit Budgeted fixed overhead P777,600 per year Four-way overhead variance liii. Safin Corporation’s master budget calls for the production of 5,000 units of product monthly. The annual master budget includes indirect labor of P144,000 annually. Safin considers 213 Standard Costs and Variance Analysis indirect labor to be a variable cost. During the month of April, 4,500 units of product were produced, and indirect labor costs of P10,100 were incurred. A performance report utilizing flexible budgeting would report a budget variance for indirect labor of: A. P1,900 Unfavorable. C. P1,900 Favorable. B. P 700 Unfavorable. D. P 700 Favorable. lviii. Calvin Klein Company has a standard fixed cost of P6 per unit. At an actual production of 8,000 units a favorable volume variance of P12,000 resulted. What were total budgeted fixed costs? A. P36,000. C. P48,000. B. P60,000. D. P75,000. liv. Wala Company applies overhead on a direct labor hour basis. Each unit of product requires 5 direct labor hours. Overhead is applied on a 30 percent variable and 70 percent fixed basis; the overhead application rate is P16 per hour. Standards are based on a normal monthly capacity of 5,000 direct labor hours. During September 2006, Wala produced 1,010 units of product and incurred 4,900 direct labor hours. Actual overhead cost for the month was P80,000. What is total annual budgeted fixed overhead cost? A. P 56,000 C. P672,000 B. P 56,560 D. P678,720 lix. Puma Company had an 25,000 unfavorable volume variance, a P18,000 unfavorable variable overhead spending variance, and P2,000 total under applied overhead. The fixed overhead budget variance is A. P41,000 favorable C. P45,000 favorable B. P41,000 Unfavorable D. P45,000 Unfavorable lx. Arlene had an P18,000 unfavorable volume variance, a P25,000 unfavorable variable overhead spending variance, and P2,000 total under applied overhead. The fixed overhead budget variance is: A. P41,000 favorable C. P45,000 favorable B. P41,000 Unfavorable D. P45,000 Unfavorable lv. Budgeted variable overhead for the level of production achieved is 40,000 machine-hours at a budgeted cost of P62,000. Actual variable overhead at the level of production achieved was 38,000 hours at an actual cost of P62,400. What is the total variable overhead variance? A. P400 favorable C. P3,100 unfavorable B. P400 unfavorable D. P3,100 favorable lxi. Fixed manufacturing overhead was budgeted at P500,000 and 25,000 direct labor hours were budgeted. If the fixed overhead volume variance was P12,000 favorable and the fixed overhead spending variance was P16,000 unfavorable, fixed manufacturing overhead applied must be: A. P516,000 C. P512,000 B. P504,000 D. P496,000 lvi. The Pinatubo Company makes and sells a single product and uses standard costing. During January, the company actually used 8,700 direct labor-hours (DLHs) and produced 3,000 units of product. The standard cost card for one unit of product includes the following: Variable factory overhead: 3.0 DLHs @ P4.00 per DLH Fixed factory overhead: 3.0 DLHs @ P3.50 per DLH For January, the company incurred P22,000 of actual fixed overhead costs and recorded a P875 favorable volume variance. The budgeted fixed overhead cost for January is: A. P31,500 C. P30,625 B. P32,375 D. P33,250 lxii. CTV Company has a standard fixed cost of P6 per unit. At an actual production of 8,000 units a favorable volume variance of P12,000 resulted. What were total budgeted fixed costs? A. P36,000 C. P48,000 B. P60,000 D. P75,000 lxiii. Richard Company employs a standard absorption system for product costing. The standard cost of its product is as follows: Raw materials P14.50 Direct labor (2 DLH x P8) 16.00 Manufacturing overhead (2 DLH x P11) 22.00 Total standard cost P52.50 The manufacturing overhead rate is based upon a normal activity level of 600,000 direct labor lvii. The variable-overhead spending variance is P1,080, unfavorable. Variable overhead budgeted at 40,000 machine hours is P50,000. Actual machine hours were 36,000. What was the actual variable-overhead rate per machine hour? A. P1.28 C. P1.39 B. P1.25 D. P1.52 214 Standard Costs and Variance Analysis hours. Richard planned to produce 25,000 units each month during the year. The budgeted annual manufacturing overhead is: Variable P 3,600,000 Fixed 3,000,000 P 6,600,000 During November, Richard produced 26,000 units. Richard used 53,500 direct labor hours in November at a cost of P433,350. Actual manufacturing overhead for the month was P260,000 fixed and P315,000 variable. The total manufacturing overhead applied during November was P572,000. The fixed manufacturing overhead volume variance for November is: A. P10,000 favorable C. P10,000 unfavorable B. P3,000 unfavorable D. P22,000 favorable Applied (Standard input allowed for actual output achieved x the budgeted rate) Fixed overhead Variable overhead spending variance Production volume variance P125,000 1,200 F 5,000 U lxvi. The fixed overhead efficiency variance is: A. P 3,000 favorable B. P10,000 unfavorable C. P 3,000 unfavorable D. Never a meaningful variance The following information pertains to the month of March: Units actually produced Actual direct labor hours worked Actual overhead incurred: Variable Fixed Question Nos. 65 and 66 are based on the following: Tiny Bubbles Company had the following activity relating to its fixed and variable overhead for the month of July. Actual costs Fixed overhead P120,000 Variable overhead 80,000 P 90,000 C. 100 direct labor hours efficient D. 440 direct labor hours efficient Questions 67 and 68 are based on a monthly normal volume of 50,000 units (100,000 direct labor hours). Raff Co.’s standard cost system contains the following overhead costs: Variable P6 per unit Fixed P8 per unit lxiv. Using the information for Richard Company in the preceding number, the total variance related to efficiency of the manufacturing operation for November is: A. P 9,000 unfavorable C. P12,000 unfavorable B. P21,000 unfavorable D. P11,000 unfavorable Flexible budget (Standard input allowed for actual output achieved x the budgeted rate) Variable overhead A. 100 direct labor hours inefficient B. 440 direct labor hours inefficient 38,000 80,000 P250,000 384,000 lxvii.For March, the unfavorable variable overhead spending variance was: A. P6,000 C. P12,000 B. P10,000 D. P22,000 lxviii. For March, the fixed overhead volume variance was: A. P96,000U C. P80,000U B. P96,000F D. P80,000F lxix. Edney Company employs standard absorption system for product costing. The standard cost of its product is as follows: Raw materials P14.50 Direct labor (2 DLH x P8) 16.00 Manufacturing overhead (2 DLH x P11) 22.00 The manufacturing overhead rate is based upon a normal activity level of 600,000 direct labor hours. Edney planned to produce 25,000 units each month during the year. The budgeted annual manufacturing overhead is Variable P3,600,000 Fixed 3,000,000 During November, Edney produced 26,000 units. Edney used 53,500 direct labor hours in lxv. If the budgeted rate for applying variable manufacturing overhead was P20 per direct labor hour, how efficient or inefficient was Tiny Bubbles in terms of using direct labor hours as an activity base? 215 Standard Costs and Variance Analysis November at a cost of P433,350. Actual manufacturing overhead for the month was P260,000 fixed and P315,000 variable. The total manufacturing overhead applied during November was P572,000. The variable manufacturing overhead variances for November are: Spending Efficiency A. P9,000 unfavorable P3,000 unfavorable B. P6,000 favorable P9,000 unfavorable C. P4,000 unfavorable P1,000 favorable D. P9,000 favorable P12,000 unfavorable A. P1,600 Favorable B. P 800 Favorable Questions 75 through 78 are based on Darf Company, which applies overhead on the basis of direct labor hours. Two direct labor hours are required for each product unit. Planned production for the period was set at 9,000 units. Manufacturing overhead is budgeted at P135,000 for the period, of which 20% of this cost is fixed. The 17,200 hours worked during the period resulted in production of 8,500 units. Variable manufacturing overhead cost incurred was P108,500 and fixed manufacturing overhead cost was P28,000. Darf Company uses a four variance method for analyzing manufacturing overhead. lxx. The fixed manufacturing overhead variances for November are: Spending Volume A. P10,000 favorable P10,000 favorable B. P10,000 unfavorable P10,000 favorable C. P 6,000 favorable P 3,000 unfavorable D. P 4,000 unfavorable P22,000 favorable lxxv. The variable overhead spending variance for the period is A. P5,300 unfavorable C. P6,300 unfavorable B. P1,200 unfavorable D. P6,500 unfavorable lxxvi. The variable overhead efficiency variance (quantity) variance for the period is A. P5,300 unfavorable C. P1,200 unfavorable B. P1,500 unfavorable D. P6,500 unfavorable The following information will be used to answer Question Nos. 71 through 74: Garch, Inc. analyzes manufacturing overhead in the production of its only one product, CD. The following set of information applies to the month of May, 2006: Budgeted Actual Units produced 40,000 38,000 Variable manufacturing OH P 4/DLH P16,400 Fixed manufacturing overhead P20/DLH P88,000 Direct labor hours 6 min/unit 4,200 hr lxxi. What is the fixed overhead spending variance? A. P4,000 Favorable C. P8,000 Unfavorable B. P8,000 Favorable D. P4,000 Unfavorable lxxii.What is the volume variance? A. P4,000 Favorable B. P4,000 Unfavorable lxxvii. The fixed overhead budget (spending) variance for the period is A. P6,300 unfavorable C. P2,500 unfavorable B. P1,500 unfavorable D. P1,000 unfavorable lxxviii. The fixed overhead volume (denominator) variance for the period is A. P 750 unfavorable C. P2,500 unfavorable B. P1,500 unfavorable D. P1,000 unfavorable Comprehensive lxxix. Big Marat, Inc. began operations on January 3. Standard costs were established in early January assuming a normal production volume of 160,000 units. However, Big Marat produced only 140,000 units of product and sold 100,000 units at a selling price of P180 per unit during the year. Variable costs totaled P7,000,000, of which 60% were manufacturing and 40% were selling. Fixed costs totaled P11,200,000, of which 50% were manufacturing and 50% were selling. Big Marat had no raw materials or work-in-process inventories at December 31. Actual input prices and quantities per unit of product were equal to standard. Using absorption costing, Big Marat’s income statement would show: A. B. C. D. Cost of Goods Sold at Standard Cost P8,200,000 P7,200,000 P6,500,000 P7,000,000 C. P8,000 Favorable D. P8,000 Unfavorable lxxiii. How much was the variable overhead spending variance? A. P 400 Favorable C. P400 Unfavorable B. P1,200 Favorable. D. P1,200 Unfavorable lxxiv. C. P1,600 Unfavorable D. P800 Unfavorable How much overhead efficiency variance resulted for the month of May? 216 Standard Costs and Variance Analysis Overhead Volume Variance It is now 8:30 A.M. The executive committee meeting starts in just one hour; you realize that to avoid looking like a bungling fool you must somehow generate the necessary “backup” data for the variances before the meeting begins. Without backup data it will be impossible to lead the discussion or answer any questions. P800,000 U P800,000 F P700,000 U P700,000 F Questions No. 80 through 85 are based on the following information: You have recently graduated from a university and have accepted a position with Villar Company, the manufacturer of a popular consumer product. During your first week on the job, the vice president has been favorably impressed with your work. She has been so impressed, in fact, that yesterday she called you into her office and asked you to attend the executive committee meeting this morning for the purpose of leading a discussion on the variances reported for last period. Anxious to favorably impress the executive committee, you took the variances and supporting data home last night to study. lxxx. How many pounds of direct materials were purchased and used in the production of 22,500 units? A. 138,000 lbs. C. 135,000 lbs. B. 132,000 lbs. D. 137,300 lbs. lxxxi. What was the actual cost per pound of material? A. P3.00 C. P2.95 B. P3.05 D. P3.10 On your way to work this morning, the papers were laying on the seat of your new, red convertible. As you were crossing a bridge on the highway, a sudden gust of wind caught the papers and blew them over the edge of the bridge and into the stream below. You managed to retrieve only one page, which contains the following information: Standard Cost Summary Direct materials, 6 pounds at P3 Direct labor, 0.8 hours at P5 Variable overhead, 0.8 hours at P3 Fixed overhead, 0.8 hours at P7 lxxxii. How many actual direct labor hours were worked during the period? A. 18,000 C. 19,400 B. 16,600 D. 18,970 P18.00 4.00 2.40 5.60 P30.00 lxxxiii. How much actual variable manufacturing overhead cost was incurred during the period? A. P55,300 C. P56,900 B. P58,200 D. P59,500 lxxxiv. What is the total fixed manufacturing overhead cost in the company’s flexible budget? A. P112,500 C. P139,500 B. P140,000 D. P125,500 Total VARIANCES REPORTED Standard Price or Spending or Quantity or Volume Cost Rate Budget Efficiency Direct materials P405,000 P6,900 F P9,000 U Direct labor 90,000 4,850 U 7,000 U Variable overhead 54,000 P1,300 F ?@ Fixed overhead 126,000 500 F P14,000U Applied to Work in process during the period @ Figure obliterated. lxxxv. What were the denominator hours for last period? A. 18,000 hours C. 20,000 hours B. 22,000 hours D. 25,000 hours Productivity measures Manufacturing cycle efficiency lxxxvi. Fireout Company manufactures fire hydrants in Bulacan. The following information pertains to operations during the month of May: Processing hours (average per batch) 8.0 Inspection hours (average per batch) 1.5 Waiting hours (average per batch) 1.5 Move time (average per batch) 1.5 You recall that manufacturing overhead cost is applied to production on the basis of direct labor-hours and that all of the materials purchased during the period were used in production. Since the company uses JIT to control work flows, work in process inventories are insignificant and can be ignored. 217 Standard Costs and Variance Analysis Units per batch The manufacturing cycle efficiency (MCE) is: A. 72.7% C. 64.0% B. 36.0% D. 76.0% Throughput time lxxxvii. Choco Company manufactures fire hydrants in Bulacan. pertains to operations during the month of May: Processing time (average per batch) Inspection time (average per batch) Waiting time (average per batch) Move time (average per batch) Units per batch The throughput time is: A. 12.5 hours C. 4.5 hours B. 8.0 hours D. 9.5 hours 20 units must be A. P516,000 B. P488,000 i. The following information 8.0 hours 1.5 hours 1.5 hours 1.5 hours 20 units Answer: D Nyclyn Salex Protet Total C. P512,000 D. P496,000 (24 ÷ 0.80 x P15) (19.20 ÷ 0.80 x P21) (10 x P28) P 450.00 504.00 280.00 P1,234.00 ii. Answer: C Required inputs to be placed in process per unit of product: 2.25 ÷0.75 Standard Material cost per unit of product: 3.0 x P150 iii. Answer: B Required inputs of raw materials (in pounds) Standard price per pound Standard materials cost per unit Delivery cycle time lxxxviii. Alabang Corporation is a highly automated manufacturing firm. The vice president of finance has decided that traditional standards are inappropriate for performance measures in an automated environment. Labor is insignificant in terms of the total cost of production and tends to be fixed, material quality is considered more important than minimizing material cost, and customer satisfaction is the number one priority. As a result, production and delivery performance measures have been chosen to evaluate performance. The following information is considered typical of the time involved to complete and ship orders. Waiting Time: From order being placed to start of production 8.0 days From start of production to completion 7.0 days Inspection time 1.5 days Processing time 3.0 days Move time 2.5 days The Delivery Cycle Time is: A. 22 days C. 14 days B. 11 days D. 7 days iv. Answer: D Net price per yard: Purchase price Freight Purchase discount Standard cost per yard Standard quantity per scarf Standard cost per scarf: 0.03 x 40 0.475/0.95 0.50 x 39.80 (60 ÷ 0.80) (2.5 x 0.98) 218 75.00 x 2.45 183.75 40.00 1.00 ( 1.20) 39.80 0.50 19.90 v. Answer: C Total Minutes per worker (8 hours x 60) Rest Time Productive minutes Output per day per worker (420 ÷ 35) in 10-liter batch Production hour – good units Rest minutes (60 ÷ 12) Minutes used for rejects (35 + 5) ÷ 5 good units Total standard minutes per 10-good liter batch lxxxix. Fixed manufacturing overhead was budgeted at P500,000 and 25,000 direct labor hours were budgeted. If the fixed overhead volume variance was P12,000 favorable and the fixed overhead spending variance was P16,000 unfavorable, fixed manufacturing overhead applied 3.0 yards P450 480 60 420 12 35 min 5 min 8 min 48 Min Standard Costs and Variance Analysis vi. Answer: B Weekly wages per worker Fringe benefits (1,000 x 0.25) Total weekly direct labor cost per worker Labor cost per hour (1,250 ÷ 40 hrs) Labor cost per unit (31.25 x 2.50 hrs) Standard price Actual Quantity used: Price variance based on usage: 1,000 250 1,250 31.25 P78.125 vii. Answer: D Required number of quarts of berries (6 ÷ 0.80) Cost of berries (7.50 @ P8.00) Cost of other ingredients (10 x 4.50) Standard materials cost per batch viii. Answer: C Minutes required by sorting good berries 6 quarts @ 3 min. Minutes required by mixing Total number of minutes Standard labor cost per batch (0.50 @ P50) P25 xii. Answer: D Actual Quantity used Favorable Quantity 3,735/1.5 Standard Quantity allowed Production in units 17,400/15 7.50 60 45 105 xiii. Answer: A AQ @ SP (3,150 x 40) SQ @ SP (600 x 5 x 40) Unfavorable Quantity Variance xi. Answer: C Actual materials price Standard Quantity 14,910 2,490 17,400 1,160 P126,000 120,000 P 6,000 xv. Answer: D Actual Purchase Costs – (AQ x SP) = 84,000 – (30,000 x 3) 6,000 Favorable Standard Price = Usage Variance ÷ (AQ – SQ) 3,000 ÷ (30,000 – 29,000) = P3 1,066 38 1,104 105,000/35,000 12,000 x 2 2.50 25,000 12,500 xiv. Answer: A Actual quantity used (pounds) 23,500 Less: Excess pounds used (1,000 ÷ 2) 500 Standard Quantity Allowed 23,000 Alternative Solution using the formula for Usage Variance: MUV = (AQ –SQ)SP 1,000 = (23,500 – SQ)2 1,000 ÷ 2 = 23,500 – SQ 500 = 23,500 – SQ SQ = 23,000 18 12 30 ix. Answer: A Unit cost of materials: (Debit to Goods in Process + Debit to Materials Quantity Variance Credit to Materials Price Variance)/Number of Units Completed Total debits to work in process account P51,690 Debit to materials quantity variance 1,970 Credit to materials price variance ( 3,740) Actual materials cost P49,920 Per unit cost: P49,920/96,000 P0.52 x. Answer: A Actual quantity used Add favorable quantity (209/5.5) Standard quantity allowed 60,000/24,000 24,000 + (2,500/2.5) 25,000 x (3 – 2.50) xvi. Answer: B The actual purchase price per unit can be conveniently solved by using the purchase price variance - MPV = AQ(AP-SP) -240 = 1,600 (AP – 3.60) -240 ÷ 1,600 = AP – 3.60 3.00 24,000 219 Standard Costs and Variance Analysis 0.15 = AP – 3.60 AP = 3.45 xvii. xviii. Answer: C (AR - SR) x AH = rate variance Therefore, the total variance (P654.50) when divided by the hourly difference (P4.27 - P4.10) will equal the actual hours. Actual hours (P654.50/P.17) = 3,850. Proof: (P4.27 - P4.10) x 3,850 = P654.50 xxii. Answer: C MPV = 1,400(1.10 – 1.00) = 140 Answer: A MUV = (AQ – SQ)SP = (2,300 – 2,100) 6.25 = 1,250 Unfavorable xix. Answer: C Actual materials cost AQ @ SP (22,000 x 1.25) Favorable Price Variance xxiii. 26,400 27,500 ( 1,100) xxiv. xx. Answer: A Standard materials cost per batch (200 x 1) + (840 x 0.20) + (7 x 2) + (3 x 6) P400 Expected yield in batch (20,160 ÷ 1,050) 19.20 Actual yield 18.50 Unfavorable yield in batch 0.70 Unfavorable yield variance (0.70 x 400) P 280 xxi. Answer: D Materials Actual cost Budgeted cost (8,500 @ 15) Materials cost variance Labor AH @ SR (6,375 @ 12) SH @ SR (8,500 @ 0.75 @ 12) Labor Efficiency Variance Actual Payroll AH @ SR (6,375 @ 12) Labor Rate Variance xxv. 127,500 127,500 0 xxvi. 76,500 76,500 0 77,775 76,500 1,275 Answer: A Labor AH M 4,500 F 3,000 7,500 Std. Mix at AH 5,000 2,500 7,500 SR P10 5 Labor Mix Variance P (5,000) 2,500 P (2,500)Fav Answer: A Labor Yield Variance: Expected Yield Actual Yield Difference Multiply by Standard labor cost per unit P1.5625* Yield Variance *Standard cost ÷ Standard Yield = P6,250 ÷ 4,000 = P1.5625 Answer: C Direct labor cost at standard rate Standard rate 7,150 – 750 6,400/800 Answer: A Actual cost Favorable Rate Variance Actual hours @ standard rate Standard Rate: 11,000 ÷ 2,000 Expected yield (400,000 units / 750 hrs) 7,500 = 40,000 xxvii. Answer: C LEV: (20,000 – 21,000)6.15 = (6,150)F Standard Rate: 3,000 = 126,000 – 20,000SR 220 Diff (500) 500 - 40,000 36,000 4,000 P6,250U 6,400 8.00 10,000 1,000 11,000 5.50 Standard Costs and Variance Analysis 123,000 = 20,000SR SR = 6.15 SR = 6.40 xxviii. Answer: C LEV: (410 x 20) – 8,440 = (240)F xxix. Answer: C Actual hours Less Unfavorable hours Standard hours allowed Standard rate: 960,000/60,000 xxx. Answer: B SR = LEV ÷ (AH – SH) = -4,000 ÷ (29,000 – 30,000) = P4.00 xxxi. Answer: C AR = SR – (LRV ÷ AH) AR = P4.00 – (5,800 ÷ 29,000) = P3.80 1,148,000/16.40 120,000/16 Answer: B Actual hours = Labor rate variance ÷(AR-SR) P12,000 ÷ (P10 – P9) 12,000 hours xxxv. Answer: D LRV = AH(AR – SR) -5,500 = 10,000(7.50 – SR) -5,500 ÷ 10,000 = 7.5 – SR -0.55 = 7.50 – SR SR = 8.05 70,000 7,500 62,500 16.00 xxxvi. Answer: D The controllable variance is the sum of the spending variances plus the efficiency variance. Variable overhead spending variance P( 3,600) Fixed overhead spending variance P(10,000) Variable overhead efficiency variance P 6,000 Total controllable variance P 7,600 The volume variance is not considered a controllable variance. xxxvii. xxxii. Answer: B Variable OH rate/hr - P27,000 ÷ 45,000 Direct labor rate/hr = P0.60 ÷ 0.20 Variable OH is applied at 20% of direct labor cost Actual hours P140,700 ÷ (P3 – P0.20) Unfavorable hours P5,100 ÷ P3 SH allowed xxxiii. Answer: B Actual direct labor costs Actual hrs at std labor rate Unfavorable labor rate variance Standard labor rate: -3,200 = (34,500 – 35,000) SR 3,200 = 500SR xxxiv. P 0.60 P 3.00 (150,000/12) (2,450 x 2 x 2.5) xxxviii. Answer: A Variable OH per DLH 48,000/24,000 Actual overhead Budgeted OH at standard hours: Variable 21,000 x 2 Fixed Favorable controllable/budget variance 50,250 1,700 48,550 (34,500 x P6.4) Answer: A Monthly budgeted fixed overhead Applied fixed overhead Unfavorable volume variance P241,500 220,800 P 20,700 xxxix. 221 12,500 12,250 250 2.00 147,000 42,000 108,000 Answer: A Budgeted fixed overhead Applied fixed overhead based on 80% achieved (24,000 x 3) 150,000 ( 3,000) 81,000 72,000 Standard Costs and Variance Analysis Unfavorable volume variance Fixed overhead rate based on 27,000 hours: (81,000 ÷ 27,000) xl. Answer: D Actual overhead Less Budgeted OH at standard hours Variable 32,000 x 5 160,000 Fixed 64,000 Unfavorable budget variance xli. Answer: C Actual overhead Budget at SH Favorable controllable variance xlvi. Answer: D Efficiency Variance = (31,500 – 30,000) 10 Standard hours: 20,000 units x 1.5 hours 230,000 xlvii.Answer: A Fixed overhead rate per hour Denominator hours (previous number) (224,000) 6,000 xlviii. 14,000 15,600 ( 1,600) xlii. Answer: C OH application rate based on DL cost Applied overhead Actual overhead Overapplied Overhead 600,000/(50,000 x 6) 325,000 x 2 xliii. Answer: D Actual overhead Budget at standard hours: Fixed OH Variable OH (32,000 x 5) Unfavorable controllable variance xliv. Answer: B Budgeted fixed overhead Applied FOH Unfavorable volume variance 9,000 3.00 (30,000 x 2) (25,000 x 2) 8.50 – 6.00 40,000/2.5 Answer: B Actual OH (10,300 + 19,500) Less: Budgeted OH at actual hours (P2 x 9,500 hrs) + P10,000 Unfavorable spending variance xlix. Answer: C EV = (AH – SH) SVOHR (14,000 – 13,500) 6 SH (4,500 x 3) 200% 650,000 620,000 30,000 230,000 64,000 160,000 15,000 Unfavorable 224,000 6,000 60,000 50,000 10,000 xlv. Answer: C Efficiency variance = (AH – SH) x SVOHR (14,000 – 13,500) 6 = 3,000 UNF Standard hours: 4,500 x 3 13,500 222 P29,800 29,000 P 800 3,000U 13,500 l. Answer: A Actual OH Budgeted OH at actual hours (3,500 x P2.50) + P7,000 Favorable spending variance li. Answer: A Fixed OH spending variance: Actual Fixed OH - Budgeted Fixed OH (P315,000 – P300,000) Fixed OH volume variance: (Budgeted Units – Actual Units) x SFOH rate (50,000 – 55,000) x P6 Budgeted production: P300,000 ÷ P3 ÷ 2 hours lii. Answer: A Actual variable overhead AH @ SVOHR (270,000 x 2) Variable Oh spending variance, Favorable AH @ SVOHR SH @ SVOH (260,000 x 2) Unfavorable VOH efficiency variance 2.50 16,000 P15,000 15,750 P( 750) P15,000 U P(30,000)F 520,000 540,000 ( 20,000) 540,000 520,000 20,000 Standard Costs and Variance Analysis liii. Answer: D Actual Budget (4,500 x 2.40) Favorable Budget variance liv. Answer: C Fixed overhead per hour: 16 x 0.7 Annual fixed OH budget 5,000 x 12 x 11.20 lv. Answer: B Actual variable overhead Variable OH applied Unfavorable variable OH variance lvi. Answer: C Applied fixed overhead Less: Favorable volume variance Budgeted fixed overhead lvii. Answer: A Standard rate: Excess rate Actual rate Net OH variance, Unfavorable Less: Unfavorable volume variance Unfavorable spending variance Favorable FOH budget variance P10,100 10,800 P( 700) 11.20 672,000 62,400 62,000 400 (3,000 x 3 x 3.50) 50,000/40,000 1,080/3,600 lviii. Answer: A Applied fixed overhead Less favorable volume variance Budgeted fixed overhead lix. Answer: A Unfavorable volume variance Unfavorable VOH spending variance Total Net Unfavorable variance Favorable fixed OH budget variance 31,500 875 30,625 2,000 ( 18,000) ( 25,000) 41,000 lxi. Answer: C Budgeted fixed OH Add: Favorable volume variance Applied fixed overhead 500,000 12,000 512,000 lxii. Answer: A Applied FOH (8,000 x 6) Less: Favorable volume variance Budgeted FOH 48,000 12,000 36,000 lxiii. Answer: A Budgeted fixed OH (3,000,000 ÷ 12 months) Applied fixed OH (26,000 @ 2 x 5) Favorable volume variance Fixed OH rate per hour (3,000,000 ÷ 600,000) 1.25 0.03 1.28 lxiv. Answer: B Labor Efficiency: (53,500 – 52,000) 8 Variable OH Efficiency (53,500 – 52,000) 6 Total efficiency variance 48,000 12,000 36,000 12,000 9,000 21,000 lxv. Answer: D Total variable overhead variance (80,000 – 90,000) Variable overhead spending variance Variable overhead efficiency variance 8,800 ÷ 20 25,000 18,000 43,000 2,000 41,000 250,000 260,000 ( 10,000)F 5.00 10,000 favorable 1,200 favorable 8,800 favorable 440 Favorable lxvi. Answer: D Fixed overhead volume variance is a more meaningful variance in evaluating the use of the capacity. lx. Answer: A lxvii.Answer: B 223 Standard Costs and Variance Analysis Actual variable OH Budgeted VOH at actual hours (80,000 x P3) Unfavorable VOH spending variance lxviii. P250,000 240,000 P 10,000 Answer: A (38,000 units – 50,000 units) x P8 P96,000 lxix. Answer: B Spending [P315,000 – (53,500 x P6)] Efficiency [(53,500 – 52,000) x P6] lxx. Answer: B Spending [P260,000 – (P3M ÷ 12)] Volume [(26,000 – 25,000) x P10] P(6,000) P 9,000 lxxiv. lxxv. Answer: A Actual variable overhead Budget at actual hours (4,200 x P4) Favorable variable OH spending variance lxxvii. Answer: D The amount of fixed overhead budget (spending) variance is calculated by subtracting from the actual fixed overhead the amount of budgeted fixed overhead. Actual fixed overhead 28,000 Budgeted fixed overhead (135,000 x 0.2) 27,000 Unfavorable fixed overhead budget variance 1,000 P10,000U P10,000F lxxii.Answer: B Budget fixed overhead Applied fixed overhead (38,000 x 0.10 x P20) Unfavorable volume variance 108,500 103,200 5,300 P6.00 lxxvi. Answer: C The computation of variable overhead efficiency variance involves the comparison of the actual hours and standard hours allowed by actual production. (17,200 – 17,000) x P6 1,200 UNF Standard hours allowed: 8,500 x 2 17,000 lxxi. Answer: C Actual fixed overhead Budget fixed overhead (4,000 hrs @ P20) Unfavorable fixed OH Spending variance Budgeted (denominator) hours (40,000 units x 6 ÷ 60) lxxiii. Actual variable overhead Budgeted VOH at actual hours (17,200 x 6) Variable overhead spending variance, UNF VOH rate per hour (135,000 x 0.80) ÷ 18,000 hours P88,000 80,000 P 8,000 4,000 lxxviii. Answer: B The amount of volume variance (denominator or over/underapplied fixed overhead variance) is calculated by comparing the budgeted fixed overhead and fixed overhead applied to production. Budgeted fixed overhead (135,000 x 0.2) 27,000 Applied fixed overhead (8,500 x 3) 25,500 Underapplied (unfavorable) volume variance 1,500 Alternative calculation: (9,000 – 8,500) x 3 1,500 Fixed overhead per unit (27,000 ÷ 9,000) 3 P80,000 76,000 P 4,000 P 16,400 16,800 P ( 400) lxxix. Answer: C Unfavorable Efficiency Variance: (AH – SH) SVOHR (4,200 – 3,800) x P4 = 1,600 UNF SH allowed (38,000 units x 1 ÷ 10) = 3,800 hours Answer: A lxxx. 224 Answer: C Std unit cost: Variable Fixed OH Std unit cost CGS – Std OH Volume Variance: Answer: A (7,000,000 x 0.60) ÷ 140,000 (11,200,000 x 0.50) ÷ 160,000 (100,000 x 65) (160,000 – 140,000) x 35 P30 35 P65 6,500,000 P 700,000 UNF Standard Costs and Variance Analysis SQ allowed (22,500 x 6) Unfavorable usage variance Actual quantity of materials 135,000 3,000 138,000 lxxxi. Answer: C Actual quantity purchased and used at standard price (138,000 x 3) Favorable price variance Actual Quantity @ Actual Price Actual Price (407,100 ÷ 138,000) 414,000 6,900 407,100 P2.95 lxxxii. Answer: C SH @ SR Efficiency Variance AH @ SR Actual hours (97,000 ÷ 5) 90,000 7,000 97,000 19,400 lxxxiii. Answer: D AH @ SR (19,400 x 3) Spending variance Actual Variable Overhead 58,200 1,300 59,500 lxxxiv. Answer: B Applied Fixed OH Underapplied fixed overhead Budgeted fixed overhead lxxxv. Answer: C Denominator or Budgeted Hours: (140,000 ÷ 7) = 20,000 lxxxvi. lxxxvii. Answer: A lxxxviii. Answer: A Delivery cycle time: Total waiting time Inspection time Processing time Move time Delivery Cycle Time 15.00 1.50 3.00 2.50 22.00 lxxxix. Answer: C A favorable volume variance arises when the applied fixed overhead is higher than the budgeted fixed overhead. Budgeted fixed overhead 500,000 Favorable volume variance (overapplied) 12,000 Applied fixed overhead 512,000 126,000 14,000 140,000 Answer: C MCE = Value Added Hours ÷ Throughput Time Processing hours 8.00 Inspection hours 1.50 Waiting time 1.50 Move time 1.50 Throughput time 12.50 MCE (8.00 ÷ 12.50) 64% 225