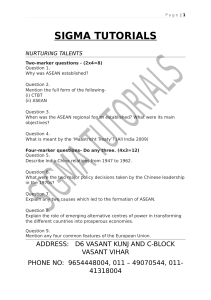

![Master-Plan-on-ASEAN-Connectivity-2025[1]](http://s2.studylib.net/store/data/025788385_1-c32c4715bc03a99e4a0e6d2c5ea3bed7-768x994.png)