Opportunity Cost Explained: Definition, Examples, and Limitations

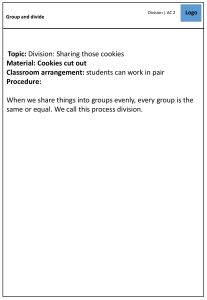

advertisement

Index What is opportunity cost? Examples to understand the concept of opportunity cost Formula to calculate the opportunity cost Limitations of opportunity cost Definition Opportunity cost is the value of what you lose when you choose from two or more alternatives.1 Or, The opportunity cost is the value of the next best alternative foregone. When you invest, opportunity cost can be defined as the amount of money you might not earn by purchasing one asset instead of another. Here’s another way to think about opportunity cost, from legendary value investor, Warren Buffett. “The real cost of any purchase isn’t the actual dollar cost. Rather, it’s the opportunity cost—the value of the investment you didn’t make, because you used your funds to buy something else.” Examples Choosing to commute using public transit for 80 minutes instead of driving for 40 minutes. Opportunity cost: you might save on the cost of gas but double the trip length and miss out on other things you could have done during that time. Imagine a situation in which you paid $1 for a chance to choose between two mystery packages that each contained an unknown number of cookies. Let's say that you chose a package that contained one cookie, while the other package contained three cookies. Opportunity cost: of two cookies for going with your chosen package -- the number of additional cookies that you missed out on by not going with the other package. Holding money Opportunity cost: Returns you can get from investing in stocks or bonds. Calculating Opportunity Cost “In economics, opportunity cost equals the expected return on the Forgone Investment Option (FO) minus the expected return on the Chosen Investment Option (CO),” says Todd Soltow, co-founder of Frontier Wealth Management, in Houston, Texas. The opportunity cost formula is: Opportunity Cost = Forgone Option – Chosen Option EG: for instance, you’re deciding between an exchange-traded fund (ETF) with an expected return of 10% and a rental property that will provide a return of 8%, your opportunity cost of choosing the rental property over the ETF is 2%. However, opportunity cost is not only about flat returns but also risk involved in an investment. It can be difficult, then, to compare the opportunity costs of very risky investments, like individual stocks, with virtually risk-free investments, like U.S. Treasury bonds. On paper, there might be a huge opportunity cost of opting for Treasuries over stocks, but the former security might make them preferable depending on the situation, like if you needed access to that money in the short term. Limitations of Opportunity Cost • The primary limitation of opportunity cost is that it is difficult to accurately estimate future returns • you can never predict an investment's performance with 100% accuracy. • While the concept of opportunity cost applies to any decision, it becomes harder to quantify as you consider factors that can't be assigned a dollar amount. • Example: 2 investment; One offers a conservative return but only requires you to tie up your cash for two years, while the other won't allow you to touch your money for 10 years, but it will pay higher interest with slightly more risk. • In this case, part of the opportunity cost will include the differences in liquidity. • The biggest opportunity cost regarding liquidity has to do with the chance that you could miss out on a prime investment opportunity in the future because you can't get your hands on your money that's tied up in another investment. • Very time consuming to calculate opportunity cost for every single options/