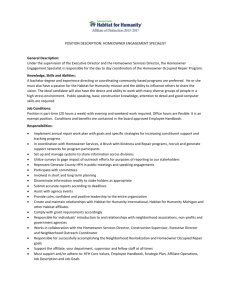

1. One type of insurance a consumer is likely to pay for in their lifetime. Homeowner's Insurance: Homeowner's insurance covers losses and damage to your property in the event of an unforeseen event, such as a fire or burglary. When you have a mortgage, your lender will want to ensure that your property is insured. 2. What does the insurance protect the consumer against? For many people, an insurance policy is the only thing that stands between them and financial ruin in the case of an accident, sickness, or other unforeseeable disasters. As a result, consumers must be wary of insurers' misleading and fraudulent tactics, and consumer protection laws are frequently available to assist them. 3. What factors could increase or decrease the cost of the insurance for the consumer? Their credit score, conduct, and payment history can all be used to ascertain this. A low-risk individual will pay less to their insurance provider on a monthly basis, whereas a high-risk person would pay more. This is because the insurance company assumes that a high-risk individual is more likely to require insurance at some point in their life. 4. Provide 1 example of a situation where you might need to USE the insurance. You are at a party and after some hours you realize that someone has stolen your telephone; you would use the insurance in order to get another one. 5. In your opinion, is this type of insurance necessary? When things go wrong, insurance is one method to safeguard your life, your health, your capacity to make an income, and your ability to maintain a roof over your head. There are several forms of insurance available, and it's doubtful that you'd need (or even want) them all.