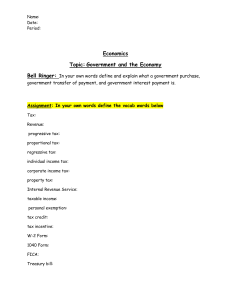

BEST PRACTICES CRITICAL EXPERTISE COMPETENCY VALIDATION CERTIFIED TREASURY PROFESSIONAL ® The Global Standard of Excellence in Treasury IS THE CTP RIGHT FOR YOU? ARE YOU LOOKING TO ADVANCE YOUR CAREER IN TREASURY? Join more than 36,000+ treasury professionals in 58 COUNTRIES who have taken the next step and BECOME A CTP. BENEFITS OF EARNING THE CTP CREDENTIAL CAREER FLEXIBILITY The CTP credential is the standard for treasury. If you are looking to stand out and make a move in your career, the CTP can help you do just that. COMPETENCY VALIDATION CTPs demonstrate a mastery of knowledge and skills required to effectively execute critical functions related to corporate liquidity, capital and risk management. And because CTPs need to earn continuing education credits to maintain the credential, they are constantly learning new practices and standards. STANDARDS OF ETHICAL CONDUCT CTPs have an obligation to their employers, co-workers, customers, shareholders, the profession and themselves to maintain the highest standards of conduct and to encourage their peers to do likewise. CTP holders must agree to abide by these ethical standards. EMPLOYERS WANT CTPs More than 80% of Fortune 500 companies employ CTPs. BUILD A PROFESSIONAL NETWORK CTPs can connect through AFP. Maintain your AFP membership and be part of a global network via the virtual AFP Collaborate group, or attend the largest conference for treasury and finance professionals each year. www.CTPCert.org ABOUT THE CTP EXAMINATION This is one exam with 170 multiple choice questions. The Exam is offered during two testing windows each year—June/July and December/January. In order to sit for the Examination you must meet certain work and/or education requirements. The CTP examination is based on globally recognized standards of practice, concepts and theories in treasury management. It is competency-based and designed to test mastery of knowledge, skills and abilities required by treasury professionals to execute critical functions such as: 1. 2. 3. 4. 5. 6. aintain corporate liquidity to meet M current and future obligations anage optimal cash positioning M through forecasting and short-term investing and borrowing activities Optimize treasury operations, (including considerations for roles/ responsibilities and outsourcing options). Calculate, analyze, and evaluate financial ratios to optimize financial decision making. anage capital structure, manage M costs of long-term capital, and quantitatively evaluate long-term capital resource investments. Evaluate current market conditions (including credit availability, spreads, interests rates, terms, risk) as they relate to long-term borrowing strategies. www.CTPCert.org 7. 8. 9. Manage internal and external relationships Monitor and control corporate exposure to financial, regulatory, and operational risk (including emerging and reputational risk). enchmark performance against B external sources to ensure best practices (including banking fees, comparative analysis). 10. Ensure regulatory compliance, and report internally and externally on compliance. 11. Assess impact of technologies on the treasury function. WHO ARE CTPs? Here is a list of some of the most common titles of professionals who have earned the CTP. Treasurer Treasury Analyst Cash Manager Investor Relations Manager Treasury Manager Treasury Product Manager Assistant Treasurer Cash Operating Supervisor Senior Treasury Analyst Financial Analyst Treasury Management Officer Cash and Debt Manager Investment Manager CFO Controller Risk Manager Senior Financial Analyst Consultant Managing Director Client Manager Capital Markets Supervisor Director of Treasury Bank Relationship Manager Treasury Operations Manager Global Treasury Manager Cash Forecasting Analyst Accounting Manager Director of Finance Manager of Tax and Treasury Liquidity Manager www.CTPCert.org “I was just recruited for my recent job. They were specifically looking for somebody with YEARS OF EXPERIENCE as well as a DEEP KNOWLEDGE with a CTP. The certification definitely opened that door.” —Derick Apt, CTP Treasurer Providence Group and Affiliates CHECK YOUR ELIGIBILITY You must have a minimum of two years of full-time work experience in a careerbased corporate cash/treasury management or corporate finance-related position to take the CTP exam. A Master’s degree or higher or global equivalent degree in a finance, accounting, economics or business related field may be substituted for one year of the required two years of relevant experience. WORK EXPERIENCE Full-time in a career-based cash/treasury management or finance-related position EDUCATION Graduate or Masters degree in business or finance Minimum 2-Years None Minimum 1-Year Completed If you have College or University-level teaching experience in a finance-related topic, check your eligibility at www.CTPCert.org/Exam/Eligibility. 96% OF CTPS WOULD RECOMMEND THE CREDENTIAL TO THEIR PEERS www.CTPCert.org SCHEDULE YOUR EXAMINATION TESTING WINDOW CTP Examination Testing Window: June 1, 2021- July 31, 2021 Early Application Deadline March 24, 2021 Final Application Deadline April 28, 2021 Re-Registration Deadline April 28, 2021 Cancellations/Refund Request Deadline May 17, 2021 Deferral Request Deadline July 31, 2021 CTP Examination Testing Window: December 1, 2021 - January 31, 2022 Early Application Deadline September 22, 2021 Final Application Deadline October 27, 2021 Re-Registration Deadline October 27, 2021 Cancellations/Refund Request Deadline November 17, 2021 Deferral Request Deadline January 31, 2022 New Applicant Fees Fees are subject to change; all fees in USD. AFP Member Non-Member Early Deadline $875 Early Deadline $1,270 Final Deadline $975 Final Deadline $1,370 For more information visit www.CTPCert.org/Exam/Deadlines-and-Fees. Group pricing is available for two or more candidates from the same organization. www.CTPCert.org PRACTICE QUESTIONS Try out practice questions to test your treasury management knowledge. Due to a loss of proprietary information held for clients, ABC Company has been named in a billion dollar lawsuit. It was determined that the loss of information was due to a breach in its computer system firewalls by outside parties. When the lawsuit became public, the company experienced a steep drop in its stock price. This scenario is an example of what kind of risk? When using the Internet to access auction markets, companies may use certificate authorities to reduce their exposure to which of the following types of risk? A. B. C. D. A company is looking for a way to finance their inventory. What is the BEST funding match? Internal technology Compliance External theft/fraud Market A U.S. company decides to enter a new geographic market facing some dominant competitors, but projects sales growth of 40% in its first year due to its superior product line. The company decides to only offer electronic payment methods for settlement of its receivables. A year later, the company’s sales volume only increases by 10%, but their average days’ sales outstanding of 32 days is the best in the industry. What should the company have considered in its collection policy objectives? A. B. C. D. Cost efficiency Customer satisfaction Performance measurement Approved collection practices www.CTPCert.org A. B. C. D. A. B. C. D. Credit Valuation Counterparty Foreign exchange Long-term private placement Short-term debt Stock split Equity issuance The company has 30 for Days’ Payables, 37 for Days’ Inventory, and 14 for Days’ Receivables. What is their Cash Conversion Cycle? A. B. C. D. 81 Days 21 Days 7 Days 30 Days Download the Exam Prep Guide for answers at www.CTPCert.org/Preparation/Guide. CTP EXAM PREP PLATFORM The CTP Exam Prep Platform is the preferred study resource for the CTP Exam and is based on the test specifications for the 2020 - 2022 windows. This fully digital and interactive platform contains study materials, evaluations, sample questions and customized progress tracking. CTP EXAM PREP PLATFORM + 20 HOURS of instructor-led video + 20 CHAPTERS of digital reading material + CASE STUDIES + KNOWLEDGE CHECKS in quiz format PRACTICE QUESTIONS BODY OF KNOWLEDGE The reference guide every treasury professional should own. Essentials of Treasury Management® Developed by a committee of subject matter experts to reflect the knowledge, skills and abilities performed by treasury professionals as identified in the CTP test specifications. This textbook is the complete Body of Knowledge tested on the CTP exam. Learn more at www.CTPCert.org/ETM. www.CTPCert.org “The CTP has provided me more AUTHORITATIVE ROLES and RESPONSIBILITIES, and more opportunities for advancement.” —Danielle L. Massey, CTP Finance Manager Eversheds Sutherland www.CTPCert.org GET STARTED TODAY INCREASE EARNING POTENTIAL. MAXIMIZE JOB SECURITY. IMPROVE MARKETABILITY. GAIN CAREER FLEXIBILITY. BOOST RELEVANCY. Y ou must meet the work experience requirement to be eligible to take the CTP exam eview the Certification Candidate Handbook, which R contains the rules, regulations and details you’ll need to reference as you undertake and progress through the certification process—it is a must read for all CTP applicants. Request yours online at www.CTPCert.org/CCH Apply for the Exam and select a testing window repare for the Exam. Create a study plan and use the P resources available through AFP Schedule your exam appointment Visit www.CTPCert.org for more information. www.CTPCert.org ABOUT CTP ® The Certified Treasury Professional (CTP®) designation serves as a benchmark of competency in the finance profession and is recognized as the LEADING CREDENTIAL IN CORPORATE TREASURY WORLDWIDE. Sponsored by the Association for Financial Professionals® (AFP), the CTP credential signifies that you have demonstrated the knowledge and skills required to effectively execute critical functions related to corporate liquidity, capital and risk management. Learn more at www.CTPCert.org ABOUT AFP ® Headquartered outside of Washington, D.C. and located regionally in Singapore, the Association for Financial Professionals (AFP) is the professional society committed to advancing the success of treasury and finance members and their organisations. AFP established and administers the Certified Treasury Professional and Certified Corporate FP&A Professional credentials, which set standards of excellence in treasury and finance. Each year, AFP hosts the largest networking conference worldwide for more than 7,000 corporate financial professionals. USA 4520 East-West Highway | Suite 800 | Bethesda, MD 20814 USA T: +1 301.907.2862 | F: +1 301.907.2864 | www.AFPonline.org SINGAPORE WeWork Beach Centre | 15 Beach Road #02-01 | Singapore 189677 Phone: +65 8879 2988 AFP, Association for Financial Professionals, the AFP logo, CTP, Certified Treasury Professional, the CTP logo, Essentials of Treasury Management and AFP Learning System Treasury are registered trademarks of the Association for Financial Professionals. © 11/20 CTP-21_Intro_Brochure 11/19/20