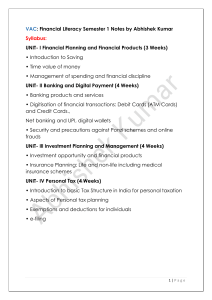

The gist of Unit 1 is to introduce and provide an overview of tax planning, what it is, why it matters, and how it works. Fundamentally, tax planning is a tool that shall aid in sorting out one’s financial affairs by utilizing opportunities such as exemptions, deductions, concessions, rebates, anything that can efficiently lower tax liability. However, this is not the sole goal of tax planning. In exercising tax planning, several factors are taken into account, as succinctly discussed in the learning material. Furthermore, the types of tax planning were identified and included in this unit: short-range tax planning, long-term tax planning, permissive tax planning, and purposive planning. It is also important to note that tax planning differs from tax evasion and tax avoidance. Learning and understanding proper tax planning is such an advantage, given that tax can be a burden to both personal and business finances. Taxes depletes the chance to establish savings and investment of most employees. Tax planning can be a lifesaver in such situations by taking advantage of the various exemptions and deductions available. As a future earner, I feel relieved knowing that I can save money from minimizing tax liability without the need to break the law. Tax planning can help improve my financial plan which outlines my spending and savings.