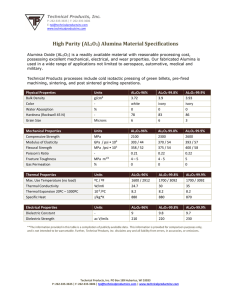

Non-metallurgical alumina -- trends and issues Although the non-metallurgical alumina industry is as small part of the overall consumption of alumina it is a diverse sector with many applications and total consumption of about 7 million tonnes in terms of alumina content. Feedstock for the alumina chemicals and specialty calcined or fused alumina is alumina hydrate or calcined alumina from Bayer plants with the exception of some of the very highest grades with 4N or 5N purity. Feedstock grades The basic grades of non-metallurgical alumina from Bayer plants are wet hydrate, dried hydrate and normal calcined alumina. In addition, white or near white hydrates are supplied from some plants and low soda grades of calcined alumina are supplied for more specialised applications. In some cases, calcined grades are to all intents and purposes the same as metallurgical alumina, although often specifications for non-metallurgical grades are more demanding. Because of that and because the volumes are much smaller, prices are higher than those for standard metallurgical grades by $30-40 per tonne. Low soda grades will be higher with grades under 0.2% Na20 of the order of $100120 per tonne higher and even lower soda grades below 0.1% considerably higher. Sales tend to be on a contract basis, frequently for a year, although multi-year contracts are also fairly common. Total production or rather sales of non-metallurgical grades of alumina reported as “chemical grade” by the International Aluminium Institute amounted to 7.22 million tonnes in 2017, an increase of almost 1 million tonnes over the previous year. It should be stressed that this is recorded sales, of calcined alumina and alumina hydrate (reported as Al2O3 content), rather than production as total production of alumina hydrate will be of the order of 200 million tonnes, much of which was calcined to make 126 million tonnes of smelter grade alumina in 2017. Most of the increase in chemical grade sales was recorded in China with increases also in Europe and Latin America but declines in North America and declines in Asia other than China and Oceania. The increases in Latin America reflect sales into the North American market, most notably for hydrate from Brazil, filling the gap in supply left after the closure of Point Comfort and Corpus Christi plants in the USA. While there may be some anomalies such as much lower sales than is realistic for Eastern and central Europe, given Russian demand, the figures that are available from IAI still give a reasonable approximation of the overall situation and the trends. After a significant fall in sales in the recession year of 2009 sales of chemical grade alumina recovered quickly to levels above pre-recession levels although they dipped again in 2012 and 2016. There was a significant increase in 2017 largely fuelled by increases in China, but there has certainly been strong demand from applications in sectors such as refractories, ceramics and flame retardants on a worldwide basis. World Annual Production (Sales) "Chemical Alumina" 8 000 7 000 6 000 5 000 4 000 3 000 2 000 1 000 0 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Trends in non-metallurgical applications for alumina Non-metallurgical applications for alumina can be separated into those that use hydrates as the raw material and those that use calcined alumina, although there are some instances where alumina hydrate is purchased for calcination to specialty grades of alumina. Alumina hydrate applications Total usage of alumina hydrate is estimated to have been about 3.8 million tonnes in 2017 in terms of alumina content, equivalent to about 5.85 million tonnes of gross weight. The largest use is for the production of water treatment chemicals. Total use of alumina hydrate in water treatment chemicals is estimated to be of the order of 1.75 million tonnes of alumina content equivalent to about 2.7 million tonnes gross weight. The primary raw material for this is wet filter cake from Bayer alumina plants. Markets for grades used in water treatment chemicals tend to be regional because consumers are looking for the alumina content and more than a third of the gross weight of wet hydrate is water of crystallisation plus the free moisture content is normally about 5%. However, with the closure of two Bayer plants in the USA, consumers turned to Brazil as a major source of raw material. Up until 2013, Brazilian exports of alumina hydrate had primarily been to Japan but exports to the USA started in that year rising to more than 74,000 tonnes in 2014. However, after the closure of Point Comfort and Corpus Christi plants exports to the USA escalated rapidly and in 2017, overtook those to Japan at a level of almost 380,000 tonnes in a year when exports to Japan fell from their 2016 peak of 443,000 tonnes. Tonnes Brazil Exports ATH 500 000 450 000 400 000 350 000 300 000 250 000 200 000 150 000 100 000 50 000 2011 2012 2013 USA 2014 2015 2016 2017 Japan ALUMINA HYDRATE DEMAND TOTAL 3.8 MILLION TONNES Activated alumina Zeolites 3% 7% Others 10% Water treatment chemicals 46% Flame Retardants 15% Aluminium fluoride 19% The water treatment chemicals business is a mature one is developed nations with very modest growth rates in line with population trends, possibly no more than 1-2% in the most developed nations. There is greater potential for growth in developing nations but it is expected to be slow from a relatively low base requiring major growth of water delivery infrastructure. Bauxite is also used directly to manufacture these chemicals. All of the European producers now produce exclusively from wet hydrate feedstock. There is still some bauxite used in the USA, primarily low iron bauxites from Guyana, by a couple of producers and considerable amounts in India and China using local raw materials. Aluminium fluoride production is the second largest user of wet hydrate. In this case the situation at Alunorte has not posed so much of a problem with supply as North America production is by aluminium producers using hydrate from their own Bayer plant to produce with purchased fluorspar. Essentially these producers are vertically integrated as they are also the customers for the aluminium fluoride in their production of aluminium metal. Growth in this sector has been strong in the last decade at over 5% CAGR on a worldwide basis driven by growth of over 10% in China and more than doubling demand in that period. Demand will depend on the growth in aluminium production with an almost direct relationship between the volume of aluminium produced and aluminium fluoride demand, with minor reductions as more efficient methods of production reduce aluminium fluoride requirements per tonne of aluminium. Flame retardants is a fast growing sector with growth rates of 3-6% per annum depending on the region. Current production is estimated to be 800-850,000 tonnes, which will have an alumina content of 520-550,000 tonnes. It includes both white or near white Bayer hydrate and fine reprecipitated hydrates, with significant added value from the Bayer hydrate commonly used as the raw material. The finished product is sold and used as the hydrate and at prices 2-3 times the cost of wet hydrate for ground white Bayer more for fine precipitated grades with some special grades well over $1,000 per tonne. It is estimated that the total consumption of alumina hydrate in zeolites is probably less than 400,000 tonnes now representing 260,000 tonnes in terms of Al2O3 content. The market for zeolites has declined from its peak because of the shift from powder detergents to liquid or gel detergents in Europe and North America, although there are still large volumes of detergents used in Eastern Europe and Asia. There are still important markets for zeolites in things like fluid cracking catalysts and adsorbents or dessicants. Growth rates are expected to be relatively modest at perhaps 1-2% per annum reversing declines over a number of years as the loss of detergent markets seems to have matured. Calcined alumina There are a variety of used for calcined alumina feedstocks from Bayer plants, although in aggregate the largest consuming sector is refractories. Total consumption of feedstock calcined alumina for the production of specialty grades or derivatives is estimated to be about 3.2 million tonnes. Of that about 2.2 million tonnes or close to 69% is used in refractory applications. CALCINED ALUMINA DEMAND TOTAL 3.2 MILLION TONNES WFA Abrasives 8% Catalysts 4% Polishing 2% Tabular 22% WFA refractories 9% Ceramics 17% CAC 4% ceramic fibres 4% Spinel 3% Calcined direct use refractories 25% Misc 2% Direct use of calcined alumina in refractories is estimated for be of the order of 800,000 tonnes. Tabular alumina is estimated to be around 700,000 tonnes, white fused alumina for refractory applications 270,000 tonnes, with those two products often in direct competition. In the case of calcium aluminate cements, calcined alumina is used in the production of 70-80% alumina grades, almost exclusively used in refractories and the 120,000 tonnes of alumina used represents a total CAC production of the order of 150-160,000 tonnes, with much of the production of those grades concentrated in Europe. High alumina ceramic fibres, do have other uses outside of refractories but the total consumption of alumina in included under the category of refractories, which is the majority of the use. The refractories markets were strong in 2017 after a stuttering recovery from the 2009 recession when volumes dropped significantly. That strength has continued into 2018 and major companies such as Vesuvius, RHI Magnesita, Imerys refractories division and Minteq all reporting strong sales levels. Part of the increases in their sales has been due to escalating prices for some raw materials filtering through to sales prices, but there have also been increases in volumes. Despite issues concerning the imposition of 25% tariffs on imports to the USA the steel industry, by far the largest consumer of refractories accounting for 60-70% of total consumption, has been a strong and resilient market recently. Crude steel production, which is the best measure of demand for refractories increased by 4.6% in 2017 on a worldwide basis there is a forecast for growth of 4.7% in 2018 from the July 2018 monthly report prepared by James King, independent steel industry consultant. The growth has been widespread with few countries either stagnating or going down. Total global growth for 2019 is predicted to fall to 1.6% but much of that due to a forecast of no growth in China after 6.4% growth for 2018, because of the impact of trade restrictions on steel consumers in China and adjustment from overproduction in 2018, although local demand for steel in China is expected to remain fairly strong despite the impact of environmental restrictions. In contrast 2019 is expected to be a strong growth year for European production, possibly over 5%. Sanctions on steel imports into the USA appear to be having little effect on the overall market apart from raising prices to a level where the 25% import duty is having no effect on the net price that importers can achieve. Some idled steel capacity may come back on stream but in the short term duties are expected to have little effect on US or world production, with few possible exceptions such as Canada. The ceramics sector, which covers everything from grinding balls to high tech ceramics is also a fast growing part of the industry with growth in 2017 and 2018 as high as 4-5%, and other sectors such as catalysts, polishing and white fused alumina for abrasives are expected to show growth, but perhaps a little below that of current growth rates for refractories and ceramics. Supply and Pricing Issues Alunorte The supply situation for alumina hydrate for both the USA and Japan changed dramatically in 2018. Following heavy rains in Brazil, there were fears that the tailings dam at the Alunorte Bayer alumina plant could overflow, which in the end it did not. However, the company was instructed by Brazilian Environmental authorities to reduce production at its plant by 50% effective at the beginning of March, resulting in the loss of about 3 million tonnes of alumina supply. Alunorte had been the main exporter of hydrates from Brazil and it had a significant effect in supplies for both Japan and the USA. As a result of the problems in Brazil the largest importer in the USA, Southern Ionics declared force majeur for its alumina hydrate based products. It had been informed by Hydro Aluminium, the owner of the Alunorte plant that they were declaring force majeur effective 2nd March and would only commit to supplying 50% of its contracted requirements to Southern Ionics and other customers. However, Hydro did assist Southern Ionics to obtain further supplies on a monthly basis by purchasing smelter grade alumina and swapping it for hydrate from other suppliers. Much of the ATH requirements were achieved through those actions, but at higher prices. Initially it was hoped that the Alunorte plant could return to normal operation after a brief period, but that has not been the case. With no foreseeable prospect for the plant to return to full capacity, and because Hydro asked Southern Ionics to reduce volumes in future planned shipments, Southern Ionic felt that it had no alternative but to declare force majeur effective, 19th June. It will allocate deliveries of its alumina hydrate based products, although it stated that it was confident that it would be able to source sufficient alumina hydrate from other suppliers to supply product to its customers, although at a higher price. The alternative sources were not revealed. No resolution to the problem of reduced capacity is apparent. While there has been no official announcements, the feeling amongst industry sources is that there will be no resolution until after the Brazilian elections in October. In the meantime, supplies of hydrate in the USA and Japan are tight. Alternative sources are being pursued with Japanese consumers most likely looking to Australia, its second major source of hydrates and possibly even China as alternatives. Noranda’s Gramercy plant was already in the process of expanding its capacity for hydrates with the installation of additional filtration equipment and has completed the first phase of its expansion with the second phase due very soon, which will help to alleviate the situation, but not completely replace lost supply from Alunorte. Sources in Jamaica and elsewhere have been investigated, but without equipment in place for filtration of the material it is difficult to react quickly to alleviate the reduced supply situation. Producers in Europe have reported enquiries from both the USA and Japan for hydrates, but in general they are working at high levels of capacity and all their product is allocated to existing contracts so they are unable to supply, certainly for 2018 and probably for 2019. Rusal The threat of sanctions against Rusal by the USA caused further anxiety in the overall alumina market, although its involvement with supply to non-metallurgical applications outside of Russia is limited. Indications are that with Oleg Deripaska, who was the target of sanctions, stepping back from his involvement and reducing his ownership of Rusal, that sanctions, which had already been delayed to October may not take effect. There is still a degree of uncertainty and just the perception that there may be sanctions has resulted in some companies, particularly US based companies or those with extensive US interests, trying to avoid doing business with Rusal until there is a degree of clarity. Pricing issues There are several issues influencing prices in the current market conditions. Apart from the Alunorte Rusal issues, costs of production have been rising rapidly. Caustic soda, a significant part of the cost of processing bauxite to alumina hydrate, has essentially doubled in price in the last year. Energy, another significant cost factor especially for calcining the hydrate to smelter grade or nonmetallurgical grades of alumina, has also seen significant increases. Freight costs both for delivery of raw materials such as bauxite to the Bayer plants or product to customers have also been increasing, as have labour costs in many regions. All of these factors are leading to upward pricing pressures. Most non-metallurgical alumina consumers tend to contract for a year or more, although pricing negotiations may be negotiated on an annual basis for multi-year contracts. The general indications in the industry are that prices for 2019 are expected to rise by double digit percentages, possibly 20% and some feel that it may be more. It is known that some consumers in the USA have already had mid-year price increases of 10% imposed and indications that there could be one or even two more increases before the end of 2018. Few if any contracts have been agreed based on a link to an alumina index price which has become the norm for third party sales of smelter grade by alumina producers, many of whom are vertically integrated. Consumers of non-metallurgical grades from Bayer plants are not normally in a position to tolerate the sorts of fluctuations that can occur with these index prices, as they cannot easily pass on increases to their customers for say water treatment chemicals or specialty aluminas. In 2018 the alumina index prices have been particularly volatile. On 20th March the Metal Bulletin index was sitting at $374.50 per tonne FOB Australia, but increased soon after to over $450 per tonne, largely attributed to the developments at Alunorte in what was already a tight market for smelter grade alumina. When sanctions were announced against Rusal by US authorities some suppliers and customers invoked force majeur clauses in contracts to comply with US sanctions, resulting in an even higher price spike, for a brief period going over $700 per tonne. With sanctions against Rusal delayed till October and possibly not being imposed the index quickly moved down, falling to a low of almost $440 per tonne before rising again to $527 per tonne at the beginning of August, which would be an increase of about 40% over the price at the beginning of March. While consumers of non-metallurgical feedstock grades of alumina will no doubt resist a move to contracts linked directly to index prices, which they view as essentially spot pricing, the price of smelter grade alumina certainly plays a role in the contract price for these consumers. It appears that consumers seem to be expecting an index price of about $450 per tonne at the time of negotiation of contracts for 2019, which is about a 20% increase over the fourth quarter of 2017 when many contracts for 2018 delivery were concluded. There is an acceptance with increasing costs of Bayer alumina production that prices will rise. However, consumers wish to insulate themselves from short term volatility. In addition to the increase in costs for Bayer alumina, producers are also attempting to improve their margins, which many of them feel have been too low for some time now. Another factor that will need to be addressed in the next round of contract negotiations is that the smelter grade alumina market is strong so there will be greater competition for product. As usual non-metallugical alumina consumers have to contend with Bayer alumina suppliers favouring sales of smelter grades when demand is high. The negotiation period for non-metallurgical alumina feedstock contracts for 2019 deliveries seems likely to be a worrying time for consumers. If the situation at Alunorte in not resolved by that time, North American consumers of hydrate may opt for alternative sources if they can secure them, even if prices are higher than they would like. However, some may risk waiting to see if Alunorte resumes full production in the hope that contract prices will rise less than might otherwise be the case. Prices for specialty aluminas and products derived from hydrates, will certainly have to rise to reflect the additional raw material costs possibly at or close to the levels of increase of the feedstock grades.