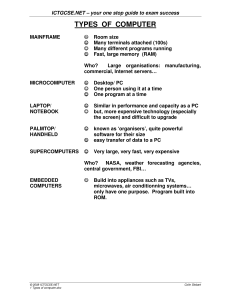

CF END TERM PROJECT Group 4 BUSINESS MODEL CANVAS By: Jeetkumar Rana MBA21260 Shivam Choudhary MBA21174 Shubham Guntewar MBAA21053 GROUP 4: Abhay Pal MBA21139 Avinash Gautam MBA21147 Adrika Agrawal MBA21144 Rupanshi Priya MBAA21042 Mansi Goriyan MBA21160 Aditya Meena MBA21142 Indira Dhar PHD2103 Kuljeet Jolly PHD2106 Pavan Saxena PHD2109 VALUE PROPOSITION Organization. Help bring order to the financial life of the customers by assisting them in getting their financial house in order (at both the “macro” level of investments, insurance, estate, taxes, etc., and also the “micro” level of household cash flow). Accountability. Help the customers follow through their financial commitments by working with them to prioritize their goals, show them the steps they need to take, and regularly review their progress towards achieving those. Objectivity. Bring insight from the outside sources to help the customers avoid emotionally driven decisions in important monetary matters by being available to consult them at key moments of decision-making, undertaking the necessary research to ensure that they have all the information, and managing and disclosing any of their own potential conflicts of interest. Proactivity. Work with the customers to anticipate their life transitions and to be financially prepared for them by regularly assessing any potential life transitions that might be coming and creating the action plan necessary to address and manage them ahead of time. Education. Explore what specific knowledge will be needed for the customer by first thoroughly understanding their situation, then providing the necessary resources to facilitate their decisions and explaining the options and risks associated with each choice. Partnership. An attempt to help the customers achieve the best life possible by investing time to clearly understand their background, philosophy, needs and objectives, work collaboratively with them and on their behalf, and offer transparency around their own costs and compensation. Customer Segmentation Two-Wheeler Loans – Commercial Vehicle finance- TVS disbursed `2,901 Cr of loan as compared against `3,223 Cr in the previous year. Tractor LoanTVS disbursed `1,958 Cr in this segment as against `1,169 Cr in the previous year Which is registering a de-growth of 10%. TVS registering a growth of 67%. TVS disbursed `623 Cr during the current year as against `574 Cr in the previous year TVS continues to be the leading financier for TVS Motor Company Ltd. Car LoansTVS disbursed `366 Cr of Used Car Loans as against `740 Cr in the previous year TVS focused only on profitable regions. Consumer Durable Loans- Business Loans segment- TVS disbursed `1,338 Cr to 6.7 Lakh customers as against `1,025 Cr to 5.2 Lakh customers in the previous year TVS disbursed `898 Cr during the current year as against `326 Cr in the previous year. TVS Credit are in various categories of banks which focused on different segments like Regional Rural Banks. TVS Credit established to provide the facility of banking and other financial services to the rural areas of the country. TVS Credit carrying out operations like disbursement of Wages of MGNREGA workers and distribution of pensions, providing Para-banking facilities like locker facilities, debit and credit cards etc. TVS Credit explore the market and analyses the need and requirement of the customer by carrying the research on the behavior, Prior to the customer segment. TVS Credit asking the requirement of the customer, what kind of service or product they required TVS Credit distribute the sample product or free service to the customer and get response from the retailers or by feedback form. In all the process TVS Credit does huge amount conducting research which reflects the outflow of cash flow of the company prior to earn the revenue company required some expenditure to create value proposition. Aftermath, TVS Credit appropriately divide the segment and are able to generate revenue which reflects the inflow of cash. Customer Relationship Management Regular Communication with Customers New Product Announcements maintains a regular engagement with its customers via several digital and offline means awareness about the InstaCard programme, that allows customers to make online and offline payments In 2021, proactively communicated to its customers on the easy and hassle-free loan payments digital facilities. launched a Retailer Loan product specifically targeted at small retailers to build a connect with this customer segment Digital App Feedback Saathi app for user experience; available in 5 Indian languages WhatsApp Bot and a ChatBot on the Company’s website, thus improving the selfservice capabilities Customer Relationship Management (contd.) An estimate of their total cash outflow due to CRM services can be made as follows: (all amounts are expressed in Rs. Crores) The values have been taken from the operating expenses segment of the financial report statements of TVS Credit. ESTIMATED CASH OUTFLOW due to CRM (Rs. Crores) Nature of Expenses / Year 2021 2020 2019 2018 Awareness programme 3.78 3.07 2.82 3.97 Advertisement & Promotional activities 62.51 57.69 42.91 34.17 Feedback Mechanism 13.7 15.89 12.65 10.96 TOTAL 79.99 76.65 58.38 49.1 Delivery Channel The channels building block outlines how a firm connects with and reaches its consumer segments to create a value proposition. A company's interaction with customers is made up of communication, distribution, and sales channels. Customer touchpoints are known as channels. factors that have a significant impact on the consumer experience Delivery Channel Overview • Marketing • Marketing • Trade shows • Create awareness • Blogs & other social media • Create Leads • Email Marketing • Sales • Advertising • Engage with • Magazine articles customers • Technical • Take orders conferences • Support • Direct emails • Sales • • • • • • • • • • • Support E-commerce Direct sales force Distributor Manufacturer’s rep Tele-sales Original Equipment Manufacturer Retail stores Value added resellers In-app purchases Affiliate sales • • • • • Website Online chat Phone On-site User groups/forums Delivery Channel (contd.) Given the unprecedented situation caused by the pandemic in the last few years, TVS Credit has taken numerous initiatives to ensure smooth business continuity. The emphasis was on regular digital engagement with customers, channel partners, and employees. Regular communication with Employees, Channel Partners and Customers. When the pandemic hit and uncertainty was at its height, the Company established a communication calendar with its customers, channel partners, and employees in order to raise awareness, engage, and ensure business continuity. The Company proactively communicated to customers about the EMI moratorium facility and how they could make loan repayments safely and conveniently through digital modes of payment. New Products Offerings and Branding Initiatives Delivery Channel (contd.) • The company launched the Insta Card programme, which provides customers with a continuous credit line for all of their immediate needs. Customers can use this programme to make online and offline payments in a variety of categories such as Lifestyle, Groceries, Shopping, Health, and so on. • An omni-channel communication campaign was launched to encourage adoption and usage. • In addition, the company launched a Retailer Loan product aimed specifically at small retailers. Local retailer activations were carried out in order to connect with this customer segment. • Ambient branding was implemented across several Two-Wheeler and Consumer Durable dealerships to increase brand saliency. • Throughout the year, the Company also integrated systems with select ecosystem partners to enable instant lead flow from the partners' systems to the Company's Lead Management System. • In addition, the company began mobility solutions for Business Loans products such as Term Loans, Overdraft, and Invoice Financing with quick sanctions. -Focus on Digitalisation • Saathi app was developed and made available in 5 regional languages to provide the best-in-class user experience for its customers and channel partners via digital assets. • The Saathi app is available for both Android and iOS devices. Furthermore, the Company implemented a WhatsApp Bot and a ChatBot on the Company's website, enhancing self-service capabilities. Delivery Channel (contd.) Community Support Initiative As part of the Saksham community support initiative, the Company collaborated with Yuva Parivartan to upskill 100 students from low-income communities in Karnataka and Maharashtra in order to revive, rebuild, and reset the lives of youth affected by the pandemic. Funding The Company had an adequate Capital Adequacy Ratio (CAR) of 18.51 percent as of March 31, 2021, thanks to equity infusion and participation from NBFCs, banks, and financial institutions in the form of Tier 1 (Perpetual Debt Instrument) and Tier 2 capital (Subordinated Debt). Prudent Asset Liability Mix (ALM) within a one-year bucket was 14.4 percent (positive), compared to the accepted mismatch of 15 percent under RBI guidelines as of March 31, 2021. Liability Asset REVENUE MODEL Total 2018 2019 2020 2021 2022 2023 2024 2025 -6130.35 -8224.91 -8864.36 -10593.45 -14155.3754 -21492.94172 -36608.32835 -67746.0248 8363.94 9504.28 10029.13 11943.19 13857.25 15771.31 17685.37 19599.43 0 0 0 0 1294.1 1395.5 1504.9 1622.8 2233.59 1279.37 1164.77 1349.74 995.9746 -4326.131724 -17418.05835 -46523.7948 104.9 209.79 314.69 419.58 39.862 79.7202 119.5822 159.4404 274,894.03 1,119,766.89 1,964,639.75 2,809,512.61 27489.4032 111976.6891 196463.9749 280951.2608 Gold PNBL Profit (Cr) Profit Further calculation in excel* The Company disbursed `2,901 Cr of Two-Wheeler Loans as against `3,223 Cr in the previous year, registering a de-growth of 10%. The Company continues to be the leading financier for TVS Motor Company Ltd. The Company disbursed `1,958 Cr in the Tractor Loan segment as against `1,169 Cr in the previous year, registering a growth of 67%. The Company disbursed `366 Cr of Used Car Loans as against `740 Cr in the previous year, since it focussed only on profitable regions. In Consumer Durable Loans, the Company disbursed `1,338 Cr to 6.7 Lakh customers as against `1,025 Cr to 5.2 Lakh customers in the previous year. The Company scaled up its Used Commercial Vehicle finance and disbursed `623 Cr during the current year as against `574 Cr in the previous year. The Company also scaled up its Business Loans segment and disbursed `898 Cr during the current year as against `326 Cr in the previous year. The Company also did Cross Selling to its existing customers to the tune of `536 Cr as against `525 Cr during the previous year. Cost Structure Year-by-Year Performance ANALYSIS Particulars 2021 2020 2019 2018 2017 Financial cost 729.44 699.81 557.46 418.40 346.75 Fees & Commission, Employee Benefit, Admin.& Other Operating Expenses 919.38 802.74 661.08 511.91 535.86 Impairment of Financial Instruments 466.79 258.80 184.45 132.48 87.91 Depreciation and Amortization Expenses 19.92 20.10 15.22 9.98 8.71 Total Cost 2135.53 1781.45 1418.20 1072.79 979.23 Revenue from operations 2237.82 1989.64 1601.32 1252.41 1110.77 Other income 3.11 10.12 32.85 26.88 4.02 Total Revenue 2240.93 1999.76 1634.17 1279.29 1114.79 EBITDA 105.4 218.31 215.97 206.5 135.56 Total Cost Total reveue 2500 2000 1500 1000 1114.79 979.23 1279.29 1072.79 1634.17 1418.2 1999.6 1781.45 2240.93 2135.53 500 0 135.56 206.5 215.97 218.31 2017 2018 2019 2020 Key-Performance Indicator • • • • EBITDA AUM crossed the 10,000 Cr milestone in financial year 2020-21 Disbursements increased by 13% in Fiscal 2020-21 Total Cost during the financial year 2020-21 increased by 19.87 In Fiscal year 2021, total revenue increased by 12 % from last year 105.4 2021 Key Partners Dealers and Sub dealersTo increase distribution reach and increase its twowheeler loans company has partnered with dealers and sub dealers to increase their Customer base. Channel partners- Ecosystem Partners- The Company has taken numerous initiatives to ensure that the business continued in a smooth manner. To increase brand engagement company has partnered with many channel partners. The company integrated sy stems partnered with ecosystem partners to communicate instant flow of leads from dealers and sub dealers to company's lead management system. Community support partnersTo increase its CSR initiatives company partnered with Yuva Parivartan as its community support partners. Key activities LOGO DEPICTS Blue- Inherited from parent group's identity, represents freedom, inspiration, confidence, and stability. Green- Associated with development, harmony, and rejuvenation. MAJOR ACTVITIES PERFORMED • • • • • Designing up of the financial products Primary customers- self-employed hardworking individuals of small-town in India Provision for credit facilities Initiation of a activity- “Saksham” Offering the loan services To be among the top 10 NBFCs in India by creating value for our customers, employees, and partners. VISION To empower Indians to dream bigger, secure in the knowledge that we are partners in the fulfillment of their aspirations. MISSION “Empower India, One Indian at a time” Key Resources Various key resources are required depending on the business model's requirements: Physical Assets Financial Assets Office Building Cash and cash equivalents Multi-purpose commercial premises Loan, Investments, Bank balances Motor vehicles, Money Derivative financial Instruments, Receivables Web-based platform Human Assets Intellectual Assets Company’s most significant asset is still its People Saathi App Partnership with NGO TVS credit offers Trade and other payables, Employees benefits, Trade receivables which represent the company’s cash flow TVS offers variety of services, including employee benefits, trade and other payable, trade receivables & loans To keep clients, the corporation invested in technology to ensure that TVS ran well, Develop facilities to increase TVS’s sturdiness THANK YOU!