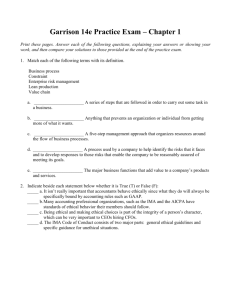

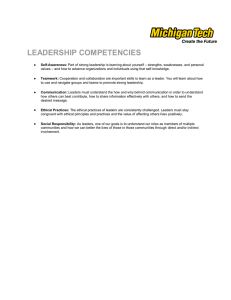

1 COST ACCOUNTING AND CONTROL SYSTEM OVERVIEW OF COST ACCOUNTING AND MANAGEMENT ACCOUNTING Module 001 Overview of Cost Accounting and Management Accounting LEARNING OBJECTIVES (LO) After completing this module, the student should be able to: 1. Define the meaning of accounting 2. Familiarize the users of accounting information and uses of cost accounting information 3. Understand the decision-making processes and the organization structure in the accounting function 4. Describe the difference between financial accounting, managerial accounting and cost accounting 5. Illustrate the value chain analysis 6. Knows the ethical guidelines that management accountants should observe Course Module LO No. 1 Accounting is a systematic process of providing financial information of an organization or unit that is intended to be useful in decision making. LO No. 2 In an organization, users of financial information are the ones making decisions. In other words, accounting supplies financial information to users which are referred to as internal and external users, so they can make informed judgment and sound decisions. Internal users These are the users of financial information who working within the company and use financial information primarily on planning, controlling and making decision for the betterment of the company’s operations. They are the company’s management itself – Senior/top-level management, middle level management and low-level management. External users These are the users of financial information who are outside of an organization and do not directly run its operations but uses financial information of the company to make decisions particularly if decisions involve investing or granting credit to the company. Accounting has different branches that cater specific financial information needed by decision makers. Of these branches, the three common financials information being conveyed are the information provided by financial accounting, management or managerial accounting and cost accounting. These three branches of accounting give information that is usually being used for planning, controlling, strategy formulation, leading, and organizing, all of which leads to decision making. 3 COST ACCOUNTING AND CONTROL SYSTEM OVERVIEW OF COST ACCOUNTING AND MANAGEMENT ACCOUNTING LO No. 3 Decision making involves the process of selecting the best course of actions among the given different competing alternatives which roots from the primary pillars of accounting which are the planning and controlling. On the planning phase, goals are first set, and its detailed courses of actions are individually enumerated. This phase helps decision makers to answer the following questions: What are the current problems or issues of an organization? What are the short-term and long-term objectives of an organization that they wish to achieve? What would be the alternative courses of actions that an organization should undertake? On the other side, controlling involves the process of gathering responses and feedbacks on the plan being executed through evaluation and monitoring, so as to ensure that goals are met. Course Module Shown below is the cycle of planning and controlling: (excerpted from Managerial Accounting by Brewer et.al, 12th Edition, p.8) Formulating long and short-term plans (PLANNING) Comparing actual to planned performance (CONTROLLING) Decision Making Implementing plans (DIRECTING and MOTIVATING) Measuring Performance (CONTROLLING) On this context, decision making process, thus, involves the following steps: 1. Identify the problems or issues. 2. Obtain the necessary information in order to solve the current problems or issues. 3. Anticipate possible outcomes in the future. 4. Lay down different alternative courses of actions and choose the best among them. 5. Implement the decision 6. Evaluate performance by comparing what was planned to actual outcomes. 5 COST ACCOUNTING AND CONTROL SYSTEM OVERVIEW OF COST ACCOUNTING AND MANAGEMENT ACCOUNTING The following are the guidelines which can be of help to decision makers: DECISION MAKING PROCESS PLANNING PHASE • Identify the problems or issues. • Obtain the necessary information in order to solve the current problems or issues. • Anticipate possible outcomes in the future • Lay down different alternative courses of actions and choose the best among them •5. Implement the decision •6. Evaluate performance by comparing what was planned to actual outcomes. CONTROLLING PHASE LO No. 4 ACCOUNTING INFORMATION NEEDED Budgets Reports on: Costs Actual vs. Budgeted Comparison of Three Common Branches of Accounting (Financial, Managerial and Cost Accounting) Financial Accounting It is an area of accounting which is primarily concerned in recording business transactions and finally prepares financial statements. Thus, this is usually intended for external use. Financial accounting adhere strict compliance to Generally Accepted Accounting Principles (GAAP), the framework of accounting standards, rules and procedures. Course Module Managerial Accounting Managerial or management accounting is used to gather both the financial and nonfinancial information needed by internal users. It commonly addresses individual or divisional concerns rather than the organization as a whole. This area of accounting measures, analyzes, and reports financial and nonfinancial information that help managers make decisions to fulfil the goals of an organization. Managers use management accounting information to choose and implement strategies. Primary users Purpose FINANCIAL ACCOUNTING MANAGERIAL ACCOUNTING External Internal of Conveys information financial Helps managers to make decisions information to banks, investors, to fulfill an organization’s objectives government regulatory agencies and other outside parties Scope of Entire (whole) organization Divisions/Departments/Segments of Past-oriented Future-oriented of Must be: May be: information Emphasis information Characteristics information Overriding criteria Historical data Current data Quantitative Forecasted data Monetary Quantitative or qualitative Verifiable Monetary or nonmonetary Timely Generally Accepted Does not conform with GAAP as 7 COST ACCOUNTING AND CONTROL SYSTEM OVERVIEW OF COST ACCOUNTING AND MANAGEMENT ACCOUNTING Accounting Principles long as it is relevant to management (GAAP) decision making and complies with standards set by the management Recordkeeping Formal Independent Financial reports must be Does not need to be audited by an examination Combination of formal and informal and audited by an independent independent CPA verification process Certified Public Accountant (CPA) Cost Accounting It is an intersection between financial and managerial accounting. It captures company's costs of production by assessing the costs incurred to each step of production. Cost accounting information is needed and used by both financial and managerial accounting. External parties and management uses product cost information for investment decision and, planning and controlling. Course Module LO No. 5 Uses of Cost Accounting Data 1. It is being used to determining product costs to help management in making the following decisions: What would be the selling price of a product What would be the bestselling price to meet competition in the market Given the costs data, what would be the profitability of the company 2. It also helps management in planning and controlling operations particularly those decisions involving costs of materials, labour and other factors needed in the production LO No. 6 Value Chain It is a cycle of processes in an organization. Taking the side of a business organization, it functions as an order of business functions namely; research and development, design of products, services and processes, production, marketing, distribution and customer service. Each of those mentioned business functions is vital in an organization’s success in the business industry since it caters the essentials of satisfying customers. Accordingly, through this value chain, planning and controlling activities in the organization is to be managed on a sequential order of the business functions, as depicted below:(excerpted from Cost Accounting by Horngren et.al, 13th Edition, p.7) Research and Development Design of products, services and processes Production Marketing Distribution Customer service 9 COST ACCOUNTING AND CONTROL SYSTEM OVERVIEW OF COST ACCOUNTING AND MANAGEMENT ACCOUNTING On the financial side, accountants’ top most concern on this value chain are the costs being incurred on each business function, since the goal is always to reduce costs but improve efficiency. LO No. 7 Organization Structure in the Accounting Function Sample illustration of an organizational chart Board of Directors President / CEO Chief Operating Officer (COO) Production Marketing Chief Financial Officer (CFO) Distribution Controller/ Accounting Treasury Line and Staff Relationships Line Position It is the position in the organization structure wherein the personnel assigned are directly involved in the responsibility of achieving the goals of an organization. This position is usually assigned to the production, marketing and distribution management. Course Module Purchasing Staff Position Personnel involvement in achieving the goals of an organization is only indirect. This position provides assistance to the line position but has no controlling authority to personnel under the line positions. Chief Financial Officer This is an executive position wherein the personnel assigned is responsible in overseeing the overall financial operations of the company. This top management position is responsible in providing financial information necessary in planning and controlling activities of the organization. LO No. 8 Ethical Guidelines that Management Accountants Should Observe The Institute of Management Accountants (IMA) of the United States has adopted an ethical code called Statement of Ethical Professional Practice that describes the ethical responsibilities of management accountants (NOTE: excerpted from Introduction to Managerial Accounting by Brewer et.al, 7th Edition, p.9) Institute of Management Accountants (IMA), the association of accountants and financial professionals in business, is one of the largest and most respected associations focused exclusively on advancing the management accounting profession. Globally, IMA supports the profession through research, the CMA® (Certified Management Accountant) program, continuing education, networking, and advocacy of the highest ethical business practices. IMA has a global network of more than 85,000 members in 140 countries and 300 professional and student chapters. Headquartered in Montvale, N.J., USA, IMA provides localized services through its four global regions: The Americas, Asia/Pacific, Europe, and Middle East/ India. 11 COST ACCOUNTING AND CONTROL SYSTEM OVERVIEW OF COST ACCOUNTING AND MANAGEMENT ACCOUNTING IMA has been committed to advocating the highest standards of ethical business practices—both for its members and the profession at large—since the organization was founded in 1919. In the early 1980s, IMA took a bold leadership role in the area of ethics by developing its first written code of ethics: Standards of Ethical Conduct of Management Accountants. In 2005, in the wake of global financial scandals and an increasing need for more direct ethical guidelines, IMA issued new guidance to better reflect the ethical climate of the time. The result was the IMA Statement of Ethical Professional Practice, which required each IMA member to be committed to the highest ethical behaviour. After considering the many changes in the business and regulatory environment, including the globalization of commerce and the management accounting profession, IMA determined to issue a revised Statement in 2017, which is published here as a Statement on Management Accounting. More concise and simpler to understand and apply, this updated version more fully reflects the global scope of management accounting. It also requires IMA members to contribute to a positive ethical culture in their organization and to place integrity of the profession above personal interests. These requirements recognize the need for members to take an active role in ensuring their organization has a strong, open, and positive ethical culture. Course Module IMA Statement of Ethical Professional Practice Effective July 1, 2017 Members of IMA shall behave ethically. A commitment to ethical professional practice includes overarching principles that express our values and standards that guide member conduct. Principles IMA’s overarching ethical principles include: Honesty, Fairness, Objectivity, and Responsibility. Members shall act in accordance with these principles and shall encourage others within their organizations to adhere to them. Standards IMA members have a responsibility to comply with and uphold the standards of Competence, Confidentiality, Integrity, and Credibility. Failure to comply may result in disciplinary action. I. COMPETENCE 1. Maintain an appropriate level of professional leadership and expertise by enhancing knowledge and skills. 2. Perform professional duties in accordance with relevant laws, regulations, and technical standards. 3. Provide decision support information and recommendations that are accurate, clear, concise, and timely. Recognize and help manage risk. 13 COST ACCOUNTING AND CONTROL SYSTEM OVERVIEW OF COST ACCOUNTING AND MANAGEMENT ACCOUNTING II. CONFIDENTIALITY 1. Keep information confidential except when disclosure is authorized or legally required. 2. Inform all relevant parties regarding appropriate use of confidential information. Monitor to ensure compliance. 3. Refrain from using confidential information for unethical or illegal advantage. III. INTEGRITY 1. Mitigate actual conflicts of interest. Regularly communicate with business associates to avoid apparent conflicts of interest. Advise all parties of any potential conflicts of interest. 2. Refrain from engaging in any conduct that would prejudice carrying out duties ethically. 3. Abstain from engaging in or supporting any activity that might discredit the profession. 4. Contribute to a positive ethical culture and place integrity of the profession above personal interests. Course Module IV. CREDIBILITY 1. Communicate information fairly and objectively. 2. Provide all relevant information that could reasonably be expected to influence an intended user’s understanding of the reports, analyses, or recommendations. 3. Report any delays or deficiencies in information, timeliness, processing, or internal controls in conformance with organization policy and/or applicable law. 4. Communicate professional limitations or other constraints that would preclude responsible judgment or successful performance of an activity Resolving Ethical Issues In applying the Standards of Ethical Professional Practice, the member may encounter unethical issues or behaviour. In these situations, the member should not ignore them, but rather should actively seek resolution of the issue. In determining which steps to follow, the member should consider all risks involved and whether protections exist against retaliation. When faced with unethical issues, the member should follow the established policies of his or her organization, including use of an anonymous reporting system if available. If the organization does not have established policies, the member should consider the following courses of action: The resolution process could include a discussion with the member’s immediate supervisor. If the supervisor appears to be involved, the issue could be presented to the next level of management. 15 COST ACCOUNTING AND CONTROL SYSTEM OVERVIEW OF COST ACCOUNTING AND MANAGEMENT ACCOUNTING IMA offers an anonymous helpline that the member may call to request how key elements of the IMA Statement of Ethical Professional Practice could be applied to the ethical issue. The member should consider consulting his or her own attorney to learn of any legal obligations, rights, and risks concerning the issue. If resolution efforts are not successful, the member may wish to consider disassociating from the organization. End of Module 1 Course Module References and Supplementary Materials Books and Journals 1. Brewer P., Garrison, R., and Eric Noreen (2016). Introduction to Managerial accounting (7th ed). New York City: Mc Graw Hill Eudcation. 2. Horngren, C. T., Datar, S. M., and Madhav V. Rajan (2018). Cost Accounting: A Managerial Emphasis (16th ed). New Jersey: Prentice Hall. Online Supplementary Reading Materials 1. IMA Statement of Ethical Professional Practice; https://www.imanet.org//media/b6fbeeb74d964e6c9fe654c48456e6 1f.ashx; June 15, 2018