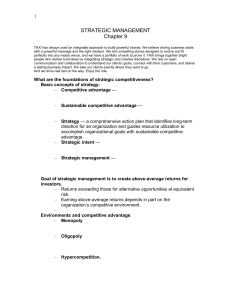

Strategic Management MBA Coursebook - Pondicherry University

advertisement