Lehman Brothers Scandal: A Case Study of the 2008 Bankruptcy

advertisement

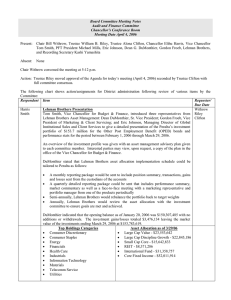

Carino, Patricia Andrea A334 The Lehman Brothers Scandal Bankruptcy of the fourth biggest investment bank in America September 2008 Facts: Lehman Brothers Holdings, Inc. was the fourth largest investment bank in the United States until it declared bankruptcy less than a year after reporting its maximum profit ever. It was revealed during the filing of these papers that they had $639 million in assets and $613 million in debt. They progressed from humble beginnings as a goods store in Montgomery, Alabama, to something like an employee base of 25,000 in 1844. They were seen as extremely successful, to the point where they were labeled "too big to fail." Despite this, the federal government did not provide any assistance to Lehman Brothers to help them recover from their economic meltdown. Issues: Lehman Brothers' problems influenced the occurrences of the financial crisis, which included the start of subprime mortgages in 2007 and a large economic loss. The United States of America Real estate markets and subprime mortgages were just two of the primary factors that contributed to Lehman Brothers' downfall. Many investment banks, like Lehman Brothers, relied on the short-term market to raise the funds they needed to run their day-to-day operations. The failure of Lehman Brothers to secure cash within their company was basically what held them back. Lehman Brothers was known for its high-risk, high-leverage business practices, which were supported by a small amount of equity. They relied on short-term financing or short-term liabilities, despite the fact that the proposed transaction holdings were still in long-term state. The employment of Ernst & Young Global Limited as Lehman Brothers' auditors from 2001 to 2008 which was another major issue. There were many sign-offs and financial statement evaluations, all of which were unqualified. During the bankruptcy proceedings, examiner Anton Valukas highlighted a number of concerns regarding Lehman Brothers' accounting methods, claiming that Ernst & Young was accountable to Lehman Brothers because of misleading report statements.