G002: Advanced Macroeconomics Exam 2014

There are THREE questions on this exam. Answer any TWO Questions. You have

TWO HOURS.

In cases where a student answers more questions than requested by the examination rubric, the policy of the Economics Department is that the student’s first

set of answers up to the required number will be the ones that count (not the best

answers). All remaining answers will be ignored.

TURN OVER

1

Question 1

Consider the following stochastic process for income for an individual i in birth cohort k:

yit = yitp + uit

for i œ k,

If°hth0

==

.

where☐

yitp represents the permanent component of income and uit the transitory shock in period

t. The permanent component is assumed to follow a random walk:

p

yitp = yi,t≠1

+ vit,

where vit is a permanent shock assumed orthogonal to uit . Both shocks are independent across

individuals within a period. The shocks are also independent over time.

Pil

.

-

1.A. Drive the expression for current period income as a function of last period’s income and

the shocks.

yie-yie-i v-e u.ie/ snmofGHVN- - p?i - -

Under the assumptions that utility is quadratic, and the discount rate is equal to the interest

rate, consumption evolves according to

cit = ci,t≠1 + vit +

r 1

uit ,

1 + r flt

where r is the interest rate, flt = 1 ≠ (1 + r)≠(T ≠t+1) , and T is remaining years of life.

1.B. Assume that the variances of the shocks are the same in any period for all individuals

in any birth cohort k, but that these variances are not constant over time. Also assume

that the cross-sectional covariances of the shocks with previous periods’ incomes are zero.

Define varkt (u) as the cross-section variance of the transitory shocks for cohort k in period

t and varkt (v) the corresponding variance of permanent shocks. Derive expressions for

i. The growth in the cross-sectional variance of income for cohort k:

✓

varkt (y)

ii. The growth in the cross-sectional variance of consumption for cohort k:

varkt (c)

iii. The growth in the cross-sectional covariance of consumption and income for cohort

k: covkt (c, y)

CONTINUED

2

1.C. Describe how to use the expressions derived in part 1.B to estimate the parameters of

interest ( varkt (u) and varkt (v)) using minimum distance estimation (MDE). Be precise

about the number of moments, the parameters to be estimated, and any over identifying

restrictions. Why might over identifying restrictions be useful?

a

r 1

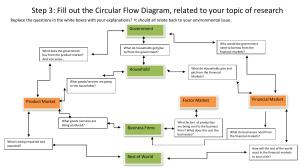

1.D. Assume now that r is small and T ≠ t is large so that 1+r

is approximately zero. Write

flt

down these approximations. Using these approximations, along with the data presented

in Figure 1 (next page), what can you say about the contributions of permanent and

transitory shocks to the rise in income inequality observed over the period 1968 to 1992?

⇒

-

⇒c)

=

Vat

#É④y ,

=

Var ( r)

1.E. Comment on the following statement as either true, false, or uncertain: “Looking at the

bottom panel of Figure 2, it is clear that the younger cohorts experienced lower initial

levels of permanent inequality, and the variance of the permanent shocks increased faster

over time for the older cohorts.”

.

1.F. Write a brief note (3 or 4 paragraphs) summarizing what we learn from these results. Your

intended audience should be a government minister (unlikely to have studied economics

at a graduate level).

You shoudldn’t e too much concerned about the var income because in the upper graph it seems that hh can

smooth consumption.

^

You might think of increasing social security etc.

TURN OVER

3

Var income grows way more

]

-

rant

YP

Figure 1: Variances of Expenditures and Income and Their Covariance by Cohort, 1968–1992

Source: Blundell, R. and Preston, I. “Consumption Inequality and Income Uncertainty.” Quarterly Journal of

Economics, 1998, 113, 603–640.

CONTINUED

4

Slope is the variance of perma shock

Var of perma shock is higher for younger HH

⇐

I

y the transitory one bcs you don’t see the upward for c.

In the case of perma, c var also should go up

Figure 2: Variances of Expenditures and Income for Each Cohort by Age, 1968–1992

Source: Blundell, R. and Preston, I. “Consumption Inequality and Income Uncertainty.” Quarterly Journal of

Economics, 1998, 113, 603–640.

TURN OVER

5

Question 2

Consider a simple exchange economy with endogenous constraints due to limited enforceability

of inter-temporal contracts. Time is discrete, t = 0, ..., Œ. There are two ex ante identical

households i = 1, 2. Households’ endowments come from two sources. The first is stochastic

labour income. The stochastic process is such that if one household receives 1 + Á then the

other household receives 1 ≠ Á. Denote by st œ S = {1, 2} the household who has the high

endowment in period t. Let st be i.i.d. with fi(st = 1) = fi(st = 2) = 12 . In addition to labour

income, each household has capital income r per period. Neither labour nor capital income

endowments are storable.

Households are free to engage in risk pooling. Households are also free to break any risk

sharing contracts they have made, subject to the penalty of being excluded from all future risk

sharing plus loss of current and future capital income r.

Households rank consumption streams from period t onward according to

U = (1 ≠ —)E0

Œ

ÿ

· =t

— · ≠t log(c· ),

where 0 < — < 1. Note that the per-period utility flow is given by (1 ≠ —) log(ct ).

2.A. What is the feasibility constraint in any period t in which both agents have kept their

risk sharing agreements up to, and including, this date?

2.B. What is the first best (perfect insurance) allocation, cF B (st )? In other words, if an unconstrained social planner could allocate consumption to the two households each period

as a function of their current endowment, what would this allocation look like?

2.C. Derive the first best lifetime utility U F B (r) associated with this allocation.

2.D. Now, define the autarkic allocation as the allocation in which each household simply

consumes their labour endowment (but no capital income) each period. What is the

autarkic allocation, cA (st )?

2.E. Derive the lifetime utility associated with autarky for the currently high endowment,

U A (1 + Á), and the currently low endowment, U A (1 ≠ Á), households.

CONTINUED

6

2.F. Verify that U A (1 + Á) is strictly increasing in Á at Á = 0; U A (1 + Á) is strictly decreasing

in Á as Á æ 1; and U A (1 + Á) is strictly concave in Á. Verify that U A (1 ≠ Á) is strictly

decreasing in Á.

2.G. What is a constrained efficient allocation? What constraint(s) must be satisfied for this

allocation to be sustainable?

2.H. Discuss, possibly using a diagram, how and why the ability to share risk (either fully

or partially) in this economy depends on r, —, and Á. In other words, how does the

relationship between income inequality and consumption inequality depend on r, —, and

Á in an economy with limited commitment?

2.I. Write a brief note (3 or 4 paragraphs) summarizing what we learn from these results.

Assume your intended audience is an intelligent undergraduate student studying political

science (but with no formal economics background).

TURN OVER

7

Question 3

Consider the incomplete markets economy studied by Aiyagari (1994). The economy is populated by a large number of households with identical preferences. Households order streams of

consumption according to

E0

Œ

ÿ

— t u (ct ) ,

t=0

where — œ (0, 1) is the discount factor; u (c) is a strictly increasing, strictly concave, twice differentiable one-period utility function satisfying the Inada condition limc¿0 uÕ (c) = Œ. Households

may save/borrow using a single asset: homogeneous physical capital, denoted k. The capital

holdings of a household evolve according to

kt+1 = (1 ≠ ”) kt + it

where ” œ (0, 1] is the depreciation rate and it is gross investment. The household’s consumption

is constrained by

ct + it = rkt + wst

where r is the rental rate on capital and w is the competitive wage, both to be determined

in equilibrium. The household’s “efficiency units of labour” endowment is denoted by st and

evolves according to the Markov transition matrix

(s, sÕ ) = Pr (st+1 = sÕ |st = s) .

There are a large number of these households and their average behavior determines the average

labour and capital supplied in the market. The current state of a household is described by

their capital holdings and efficiency units of labour endowment, (k, s) . Define the unconditional

stationary distribution of (k, s) pairs over households as ⁄ (k, s).

There is an aggregate, constant returns to scale, production function whose arguments are

the average levels of capital and efficiency units of labour:

F (K, N ) = AK – N 1≠– ,

– œ (0, 1).

3.A. Write down the Bellman equation that describes the households’ problem.

3.B. Derive the “natural debt limit” for a household in this economy.

3.C. Write an expression for the average level of capital and the average level of efficiency units

of labour supplied by households.

CONTINUED

8

3.D. Write an expression implicitly defining the average level of capital and the average level

of efficiency units of labour demanded for production.

Average is the same as integral as labour sums as 1

3.E. Define a stationary competitive equilibrium for this economy.

3.F. Outline pseudo code for computing this equilibrium. (Recall that pseudo code is an

algorithm describing precisely how to implement the solution on a computer. It should

be unambiguous to a human reader, but is not necessarily written in a specific computer

programming language).

3.G. Now we relax the assumption that households have identical preferences. Let —t œ (0, 1)

denote a household’s discount factor in period t. —t is time varying, and evolves according

to a discrete Markov chain with transition probabilities

(—, — Õ ) = Pr (—t+1 = — Õ |—t = —) .

Formulate the Bellman equation for the household’s problem.

3.H. Write a brief note (3 or 4 paragraphs) summarizing what we learn from these results. Your

intended audience should be a smart undergraduate student who is currently studying

economics and is considering applying for a graduate school.

We’ve written down a model such that HH are facing these constraints this income shock, and firms one the

other side, .. agg supply of HH are consistent with the firms’ demand?...

If the interest rate is too high, then firm will have too low level of k...

END OF EXAM

9