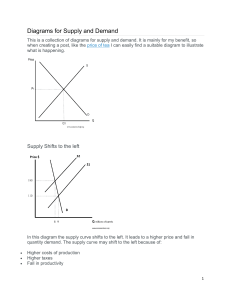

Manager is a person who directs resources to achieve a stated goal. Managerial economics is the study of how to direct scarce resources in the way that most efficiently achieves a managerial goal. Well defined goals are a must. Constraints make it difficult to achieve goals. Economic profits is the difference between total revenue and total opportunity cost. Accounting profit is the total amount of money taken in from sales minus the cost of producing the good or service. Opportunity cost is the cost of the explicit and implicit resources that’re forgone when a decision is made. PROFTS ARE A SIGNAL TO RESOURCE HOLDERS WHERE RESOURCES ARE MOST VALUED BY SOCIETY. Incentives determine how resources are utilized and how hard individuals work; constructing proper incentives will enhance productivity and profitability. Market Interactions: CONSUMER­PRODUCER RIVALRY consumers attempt to locate low prices while producers attempt to charge high prices. CONSUMER­CONSUMER RIVALRY scarcity of goods reduces consumers’ negotiating power as they compete for the right to those goods. PRODUCER­PRODUCER RIVALRY scarcity of consumers causes producers to compete with one another for the right to service customers. THE ROLE OF GOVERNMENT disciplines the market process. PV of Perpetuity: an asset that perpetually generates a stream of cash flows (CFi) at the end of each period. [CF/(1+i) ] + [CF/(1+i)2 ]+ [CF/(1+i)3 ]; or CF/i Firm valuation and maximization of profit: the firm ­ the PV of current cash and the future profits (cash flows). Π is the current level of profit. PV = Π0 + [ Π1/(1+i) ] + [ Π2/(1+i)2 ]... If profits grow at a steady rate (g <i) and current period profits are Π0 after dividends are: Π0 * (1+i)/(i­g) before current profits have been paid out as dividends. Π0 * (1+g)/(i­g) immediately after current profits have been paid out as dividends. Marginal (Incremental) Analysis: control variables: output, price, product quality, advertising, R&D. NET BENEFITS: total benefits ­ total costs PROFITS: revenue ­ costs. MARGINAL BENEFIT: change in total benefits arising from a change in the control variable, Q: MB=∆B/∆Q . (the slope of the total benefit curve). MARGINAL Cost: change in total costs arising from a change in the control variable, Q: MC=∆C/∆Q . (the slope of the total cost curve). To maximize net benefits, the marginal control variable should be increased to the equilibrium point MB=MC. If MB>MC then the last unit of the control variable increased benefits ore than cost & vice versa.B(Q) = 150 + 28Q ­ 5Q2 & C(Q)= 100 + 8Q * MB(Q) = 28­10Q & MC(Q) = 8 The equation for net benefits is benefit ­ cost ­­> B(q) ­ C(Q) so 150 + 28Q ­ 5Q2 ­ 100 + 8Q so N(Q) = 50+20Q­5Q2. Marginal net benefits is MB(Q) ­ MC(Q). To maximize net benefits, equate MB to MC. If MC > MB at the current level of production, the firm should decrease its production level. If total benefits and total costs are given by B(Y)=150Y­10Y2 & C(Y)=5Y2, what level of Y will yield the max benefits? 150­20Y=10Y; 150=30Y; 5=Y The opportunity cost of an action is the value of the most highly valued alt action given up. The drop in the price of good A would NOT shift the demand of good A. But the drop in the price of good B, consumer inc, and the change in the level of advertising would. The drop in the price of good A would NOT shift the demand of good A. The maximum legal price that can be This study source was downloaded by 100000840868283 from CourseHero.com on 03-12-2022 14:18:32 GMT -06:00 charged for a good is price ceiling. Changes in the price of other goods lead to a change in demand. If market demanded and supplied are QD= 100­2P and QS=5+3P. If a price ceiling of $15 is imposed there will be a shortage of 20 https://www.coursehero.com/file/39242309/econ-test-1doc/ units; 100­2(15)=70 demanded while 5 + 3(15)=50 is supplied. If steak is a normal good, what do you suppose would happen to price and quantity during an economic recession? Price and quantity would both decrease. Suppose the demand for X is given by QD=100­2Px +4Py+10M+2A where Px is the price of good X, Py is the price of good Y, M is income, and A is the amount of advertising for good X. Based on this information we know that good X is a substitute good. When quantity demanded exceeds quantity supplied the price is below the equilibrium price. The market demand curve shows the amount of a good that’ll be purchased at alternative prices, holding all other factors constant. The demand curve is DOWNWARD sloping. Demand shifters are variables other than price of a good that influence demand. Change in quantity demanded are changes in the price of a god that lead to a change in the quantity demanded of that good; corresponds movement nit he demand curve. Change in demand are changes in variables other than price of a good; income or price of another good and it shifts the entire demand curve. SUBSTITUTES are goods where an increase in the price of one good leads to an increase in the demand for another. COMPLEMENTS are good where an increase in the price of one good leads to the decrease in the price of another. DEMAND FUNCTION describes how much of a good will be purchased at alt prices of that good and related good, alt income leels, and alt values of other variables affecting demand. LINEAR DEMAND FUNCTION represents the demand function where the demand for a given good is a linear function of prices, income levels, and other variables influencing demand. IF SIGN OF GOOD Y IS POSITIVE, IT’S A SUBSTITUTE IF IT’S NEGATIVE IT’S A COMPLEMENT. IF M IS POSITIVE GOOD X IS A NORMAL GOOD, IF IT’S NEGATIVE IT’S INFERIOR. Consumer Surplus is the value consumers get from a good but don’t have to pay for (area of triangle...1/2bh). MARKET SUPPLY CURVE indicates the total quantity of a good that all producers in a competitive market would product at each price, holding input prices, technology, and other variables affecting supply constant. Change in quantity supplies changes in the price of a good lead to a change in the quanity supplied of that good. An excise tax is a tax on each unit of output sold where tax is collected from the supplier. Ad valoren tax is collected from the buyer. FULL ECONOMIC PRICE is the dollar amount paid to a firm under a price ceiling, plus the nonpecuniary price ==> In a competitive market, the demand is QD=60­6P and the market supply is QS= 4P. The full economic price is $3. QD= 60­ 18=42; QS­12; supplied = demand ==> 12 = 60­6PF; 6PF = 48; $8 = PF. The X­Corp produces good X that is a normal good. It’s competitor Y­Corp makes a substitute good that it markets under Y. Good Y is inferior. How will the demand for good X change if consumer incomes increase? Demand would increase and so the demand curve of X would shift to the right. How will the demand for good Y change if consume incomes decrease? Demand would increase and shift the demand curve of Y to the right. How will the demand for good X change if the price of good Y decreases? A decrease is price of Y will lead to a decrease in the demand for good X so the demand curve for X will shift to the left. Is good Y lower quality than X? No, it’s just consumed more when people are on a budget. Demand Curve is 460­4PX, find inverse demand curve. PX=115­ 1/4QD how much consumer surplus do consumers receive when PX=$35? 460­4(35)=320 units; consumer surplus is 1/2BH so 115­35=80 height .5(320)(80)=$12800 when PX=$25? (.5)(115­25)(360)=16200 What happens to the level of consumer surplus as price of a good falls? As long as the law of demand holds, a decrease in price leads to an increase in consumer surplus and vice versa. Inverse relationship b/w price of a product and consumer surplus. Elasticity is a measure of the responsiveness of one variable to changes in another variable; the percentage change in one variable that arises due to a given percentage of another. Elasticity = %change in Q/ %change in price; %change in Q= change in quantity/avg. Quantity; %change in P= change in P/avg. P; OR elasticity = (dQ/dP) * P/Q 2 aspects of elasticity are important: whether it’s positive or negative and whether it’s greater than 1 or less than 1 in absolute value. If elasticity is > 0 then Q and P are directly related; an increase in P is an increase in Q, if E <0 then Q and P are inversely related so an increase in price leads to a decrease in demand. If E=0 then they are unrelated. | E | >1, the numerator is larger than the denominator in the elasticity formula and we know that a small %change is P will lead to a relatively large percentage change in Q and vice versa. Own price elasticity is a measure of the responsiveness of the quantity demanded of a good tao change in the price of that good; the percentage change in quantity demanded divided by the percentage change in price of the good. This study source was downloaded by 100000840868283 from CourseHero.com 03-12-2022 GMT -06:00 The relationship among the changesonin price, 14:18:32 elasticity, and total revenue is the total revenue test. https://www.coursehero.com/file/39242309/econ-test-1doc/ Perfectly elastic demand if the vale; horizontal. Perfectly inelastic demand if vertical. If Marginal own price elasticity is infinite in absolute the ow price elastic is 0; Revenus >0, deland is elastic, MR=0 demand is unit elastic; MR < 0 demand is inelastic. MR is the change in total revenue due to a change in output, and that to max profits a firm should produce where MR=MC. FACTORS AFFECTING OWN­PRICE ELASTICITY: Available Substitutes the more substitutes available for the good, the more elastic the demand. Time demand tends to be more inelastic in the short term than the long term. Time allows consumers to seek out available substitutes. Expenditures good that comprise a small share of consumer’s budgets tend to be more inelastic than good for which consumers spend a large portion of their incomes. CROSS PRICE ELASTICITY: is a measure of the responsiveness of the demand for a good to changes in the price of a related good. The percentage change in Q demanded in 1 good/percentage change of price of a related good. If elasticity >0, X & Y are substitutes and it ifs’ less than they’re complements. INCOME ELASTICITY: If EM>0, X is a normal good and if EM<0, then X is an inferior good. How much would the firm’s revenue change if it lowered it’s price from $12 to $10? Inelastic or elastic in this range?When P = $12, R = ($12)(1) = $12. When P = $10, R = ($10)(2) = $20. Thus, the price decrease results in an $8 increase in total revenue, so demand is elastic over this range of prices. How much would the firm’s revenue change if it lowered price from $4 to $2? Is demand elastic or inelastic? When P = $4, R = ($4)(5) = $20. When P = $2, R = ($2)(6) = $12. Thus, the price decrease results in an $8 decrease total revenue, so demand is inelastic over this range of prices. What price maximizes the firm’s total revenues? What is the elasticity of demand at this point on the demand line? Recall that total revenue is maximized at the point where demand is unitary elastic. We also know that marginal revenue is zero at this point. For a linear demand curve, marginal revenue lies halfway between the demand curve and the vertical axis. In this case, marginal revenue is a line starting at a price of $14 and intersecting the quantity axis at a value of Q3.5 units, which corresponds to a price of $7. The demand curve for a product is given by QD = 1000 - 2Px + .02Pz, where Pz=$400. (A) What is the own price elasticity when Px = $154? Is demand elastic or inelastic? What happens to the firm’s revenue if it decided to change a price below $154? QD=1000 -2(154) +.02(400) =700; -2(Px/Qx) = -2(154/700) =.44, which is less than 1 so it’s inelastic. If the firm charged a lower price, total revenue would decrease. (A) What is the cross price elasticity of demand between good X and good Z when Px=$154? Are these good complements or substitutes? QD=1000 -2(154) +.02(400) =700; .02(400/700)=.011 number is positive, goods X and Z are substitutes. lnQD= 3 - 0.5 ln Px - 2.5 ln Py + ln M + 2 ln A, where Px = $10, Py=$4 M = $20,000 and A = $250 The own price elasticity of demand is simply the coefficient of ln Px, which is –0.5. Since this number is less than one in absolute value, demand is inelastic. This study source was downloaded by 100000840868283 from CourseHero.com on 03-12-2022 14:18:32 GMT -06:00 Suppose the own price elasticity of demand for good X is -2, it’s income elasticity is 3, it’s advertising elasticity is 4, and the cross-rice elasticity of demand between it and good is -6. Determine how much the consumption of the good will https://www.coursehero.com/file/39242309/econ-test-1doc/ change if (a) the price of good X increases by 5% -2 = Q/5 => -10 = Q. The quantity demanded of good X with decrease by 10%. (b) the price of good Y increases by 10% -6 = Q/10 => -60 = Q The quantity demanded for X will decrease by 60% (C)advertising decreases by 2% 4=Q/-2 => -8=Q demand for X will decrease b 8% (d) income falls by 3% 3=Q/-3 => Q=-9 so demand for X will decrease by 9% You are the manager of a firm that rec revenue of $30K/yr. From X and $70K/yr. From Y. The OPE of demand for X is -2.5 and the CPE of demand b/w Y and X is 1.1 How much will your firm’s total revenues change if you increase the price of X by 1% TOTAL PRODUCT (TP) is the maximum output produced with given amounts of inputs. Average Product of an Input measure of output produced per unit of input. APL = Q/L This study source was downloaded by 100000840868283 from CourseHero.com on 03-12-2022 14:18:32 GMT -06:00 https://www.coursehero.com/file/39242309/econ-test-1doc/ A firm can manufacture a product according to the production function Q=F(K,L) = K.75L.25. Calculate APL when level of capital is fixed at 16 units and the firm uses 16 units of labor. How does APL change when the firm uses 81 units of labor? Find an expression of marginal product of labor, MPL, when the amount of capital is fixed at 16 units. Then illustrate that MPL depends on the amount of labor hired by calculating the marginal product of labor for 16 and 81 units of labor. Suppose capital is fixed at 16units. If the firm can sell its output at a price of $100/unit and hire labor at $25/unit how many units of labor should they hire to max profits? Fixed costs are associated with fixed inputs, and do not change when output changes. Variable costs are costs associated with variable inputs, and do change when output changes. Sunk costs are costs that are forever lost once they have been paid. Q= 2K.5L.5 where a total of $10K has alread been spend on the 4 units of capital equipment it owns. Co doesn’t have flex needed to get more equipment. Workers get paid a competitive wage of A $100 and chairs can be sold for $200 each. What is profit max level of output and labor usage. What is max profit? firm’s product sells for $2/unit in a highly competitive market. The firm produces output using capital (rent $75/hr) and labor ($15/hr under a contract for 20hrs) The law of diminishing marginal returns is the decline in marginal productivity experienced when input usage increases, holding all other inputs constant. In contrast, the law of diminishing marginal rate of technical is a property of a This substitution study source was downloaded by 100000840868283 from CourseHero.com on 03-12-2022 14:18:32 GMT -06:00 production function stating that as less of one input is used, increasing amounts of another input must be employed to produce the same level of output. https://www.coursehero.com/file/39242309/econ-test-1doc/ Cost function of a single product firm C(Q) = 50 + 25Q+30Q2+5Q3 This study source was downloaded by 100000840868283 from CourseHero.com on 03-12-2022 14:18:32 GMT -06:00 https://www.coursehero.com/file/39242309/econ-test-1doc/ Powered by TCPDF (www.tcpdf.org)