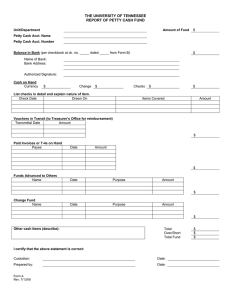

MODULE 1 CASH & CASH EQUIVALENTS •Once you have completed this module you should be able to : • Define cash and cash equivalents. • Know the measurement of the cash & cash equivalents. LEARNING OBJECTIVES • Explain the meaning of “unrestricted cash” • Give examples that are considered cash for accounting purposes. • Explain the line item “cash & cash equivalents” • Explain what is petty cash fund and can explain two accounting methods of handling petty cash fund. • To determine the adequate disclosures to be made OVERVIEW Major topics covered in this module include: Overview cash and cash equivalents Petty cash fund and its two accounting methods. Journal entry describing the adjustment pertaining to cash. Example of cash & cash equivalents and its measurements. INTRODUCTION From point view of layman, “cash” simply means money. Money is the standard medium of exchange in business transactions. It refers to the currency and coins which are in circulation and legal tender. Cash � Cash- includes unrestricted money and any other negotiable instrument that is payable in money and acceptable by the bank for deposit and immediate credit. What does it includes? It includes cash on hand, cash in bank and cash fund • PAS 1, paragraph 66, which provides that Unrestricted cash “an entity shall classify an asset a current when the asset is cash or cash equivalent unless it is restricted from being exchanged or used to settle a liability for at least twelve months after the end of the reporting period.” Cash items: Cash on handincludes undeposited cash collections and other cash items awaiting deposits. Cash in bankincludes demand deposit or checking account and saving deposit which are unrestricted as to withdrawal. Cash fundfund set aside for current purposes such as petty cash fund, payroll fund and dividend fund. 15-7 • PAS 7, paragraph 6, “cash & cash Cash Equivalents equivalents” as a short-term and highly liquid investments that are readily convertible into cash and so near their maturity that they present insignificant risk of changes in value because of changes in interest rates.” Examples of cash equivalent: Three-month BSP treasury bill. Three-month time deposit. Three-year BSP treasury bill purchased three months before the date of maturity Three-month money market instrument or commercial paper. 15-9 Measurement Initially measured at face value. Cash in foreign currency is measured at current exchange rate If the fund of the entity in the bank is in bankruptcy or financial difficulty, cash should be written down to estimated realizable value if the amount of recoverable is estimated to be lower than the face value Financial Statement Presentaion • Cash and Cash Equivalents shown as the first item among the current assets, as one line item but the detail of which should be disclose in the notes to the financial statements. If yes part of cash If no, either current asset or not current asset Cash items: Cash on hand Ascertain to as part of cash? Cash fund Use in current operation? Cash in bank Local deposit deposit 3 month time deposit? Saving deposit? Demand deposit? Compensating balance Not legally restricted? Cash in foreign currency Not subject to restriction? Cash equivalent 3 month or less before maturity on upon acquisition? Y E S Presented as cash and cash equivalent: Measured at face value for cash in hand, realizable value which ever is lower between face value and recoverable for cash in bank and current exchange rate for cash in foreign bank. Other consideration: Cash fund – is set aside for use in current operations or for the payment of current obligation, it is a current asset. It is included as part of cash and cash equivalents. Bank overdraft – is a cash in bank with a credit balance (overdraft)0 Compensating balance – a minimum checking or demand balance that must be maintained in connection with a borrowing arrangement with a bank. Undelivered or unreleased check – is one that merely drawn and recorded but not given to the payee before the end of the reporting period. Postdated check – is a check drawn, recorded and already given to the payee but it bears a date subsequent to the end of reporting period. Stale check – is a check not encased by the payee within a relatively long period of time. Petty cash fund – is a money set aside to pay small expenses which cannot be paid conveniently by the means of check. Accounting for Petty Cash fund Two methods of handling the petty cash • Imprest System • Fluctuating fund system Impress fund system A. A check drawn to established the fund. Petty Cash fund XX Cash in Bank XX B. Payment of expenses. C. Replenishment of petty cash. Expenses XX Cash in Bank XX D.At the end of the reporting period, if no replenishment of petty cash fund was made. Expenses XX Petty Cash fund XX E. Increase and decrease in petty cash fund. Petty Cash fund Cash in Bank XX XX Fluctuating fund system A. A check drawn to established the fund. Petty Cash fund Cash in Bank XX XX B. Payment of expenses. Expenses XX Petty Cash fund XX C. Replenishment or increase of the petty cash fund. Expenses XX Cash in Bank XX D.At the end of the reporting period, no adjustment is necessary. E. Decrease in petty cash fund. Cash in Bank Petty Cash fund XX XX Accounting for cash short or over Cash accounted Pxxx Less: Cash accountability xxx Cash (short) over Pxxx Cash accounted- actual cash ascertain during the conduct of audit Cash accountability- the amount of cash that supposedly reflect in ledger and to be disclose in the financial position Adjustment for cash short or over Where cash count shows cash which is less than the balance per book, there is cash shortage to be recorded as follows: Cash short or over PXXX Cash PXXX The cash shortage account is a temporary account. Hence if the cashier or cash custodian is held liable, the adjustment should be Due from cashier PXXX cash short or over PXXX However, if reasonable effort fail to ascertain the cause of shortage, the adjustment is Loss from cash shortage PXXX cash short or over PXXX Adjustment for cash overage Where the cash count shows cash which is more than the balance per book, there is a cash overage to be recorded as follow: Cash PXXX Cash short or over PXXX If there is no claim, the overage is treated as miscellaneous income Cash short or over PXXX Miscellaneous income PXXX But if the money is properly found to be money of cashier Cash short or over PXXX Payable to cashier PXXX Others: • Window dressing – is a practice of opening the books of accounts beyond the close of the reporting period for the purpose of showing a better financial position and performance. It is accomplished usually as follows: By recording as of the last of the last day of the reporting period collections made subsequent to the close of the period. By recording as of the last year of the reporting period payments of accounts made subsequent to the close of the period. • Lapping – consist of misappropriating a collection from one customer and concealing this defalcation by applying a subsequent collection made from another customer. • Kiting – it occurs when a check drawn against first bank and depositing the same check in a second bank to cover the shortage in the latter bank. No entry is made both the drawing and deposit of the check.