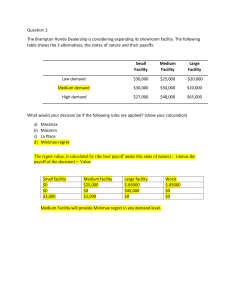

ST THEORY Q1. Calculate mean, median mode for the following data Class limit 30-60 60-90 90-120 120-150 150-180 180-210 Frequency 10 25 35 20 10 7 Answer:- Q2.Calculate mean and standard deviation from the following data. 136,129,120,117,134,140,156,165,170,173 Answer:- Q3.Draw the histogram and frequency polygon from the following data Classes 20-40 40-60 60-80 80-100 100-120 120-140 140-160 Frequency 26 50 78 100 65 38 25 Answer:- Q4.The mean of 20 observations is 15. On checking it was found that two observations were wrongly copied as 3 and 6. If wrong observations are replaced by correct values 8 and 4, then find the correct mean. Answer:- Q5.From the following table showing the age of the car of certain make and annual maintenance costs .Obtain the regression equation for the maintenance cost related to age. Estimate the approximate cost of maintaining a 3 year old car. Age of car(Yrs) 2 4 6 8 10 12 Maintenance Cost (in Rs) 27 29 33 40 31 37 Answer:- Q6.Calculate the coefficient of variation and comment of variation in following series. X 25 38 37 40 32 Y 126 130 100 120 125 Answer:- Q7. From the data given below calculate regression line Y on X and Estimate the value of Y when X is 30. X 46 35 37 49 60 31 44 Y 27 29 33 40 31 37 38 Answer:- Q8. From the data given below calculate regression line Y on X and Estimate the value of demand (Y) when price (X) is Rs.10 Price (in Rs) Demand (‘000 units) Mean 12 40 Standard deviation 3 6 Answer:- Q9.Two friends A & B apply for an interview. The probabilities of their selection are 1/4 and 1/5 respectively. What is the probability that (i) One of them will be selected? (ii) Both will be selected? Answer:- Q10.Tickets numbered from 1 to 100 are shuffled and a ticket is drawn, what is the Probability that the ticket drawn has (i) an odd number (ii) a number 5 or its Multiple. Answer:- Q11.In a sample of 1000 students, the mean score of student is 14 and standard deviation is 2.5. How many students have scored between 12 and 15? , How many scored above 18? (Given that area under normal curve) Z +0.4 or -0.4 +0.8 or -0.8 +1.6 or -1.6 P(Z) 0.1554 0.2881 0.4452 Answer:- Q12.A businessman has three alternative actions that he can take. Each of the action can be followed by any of the four possible events. The conditional payoffs for each action-event combination are as under. State of Nature N1 N2 N3 N4 Courses of action S1 4 0 -5 3 S2 -2 6 9 1 S3 7 3 2 5 Find the optimal strategy using (i) Laplace criteria (ii) Hurwicz criteria (alpha @0.70) Answer:- Q13.The conditional payoffs for each course of action-state of nature combination are as under. State of Nature N1 N2 N3 N4 Courses of action S1 10 5 8 6 S2 3 9 15 2 S3 -3 4 6 10 Find the optimal strategy using (i) Minimax regret criteria (ii) Hurwicz criteria (alpha @ 0.65) Answer:- Q14.The length of a large shipment of chromium strips has a mean of 0.44m and standard deviation of 0.001m. What percentages of chromium strips have a length that lies between 0.438m and 0.442m? (Given that area under normal curve) Z +1.0 or -1.0 +1.5 or -1.5 +2.0 or -2.0 +2.5 or -2.5 P(Z) 0.3413 0.4332 0.4772 0.4938 Answer:- Q15.A florist has four alternative actions that he can take. Each of the action can be followed by any of the four possible events. The conditional payoffs for each action-event combination are as under. State of Nature N1 N2 N3 N4 Courses of action S1 70 70 70 70 S2 40 140 140 140 S3 10 110 210 210 S4 -20 80 180 280 Find the optimal strategy using (i) Maximax criteria (ii Minimax Regret Criterion Answer:- Q16. Write a short note on A) Application of statistics in relevant fields. B) Measures of Central Tendency and Dispersion C) Correlation and Regression Analysis D) Concept of Probability and its rules E) Methods of decision making under uncertainty F) Association of attributes Answer:A) Application of statistics in relevant fields. Statistics plays a vital role in every field of human activity. Statistics helps in determining the existing position of per capita income, unemployment, population growth rates, housing, schooling medical facilities, etc., in a country. Now statistics holds a central position in almost every field, including industry, commerce, trade, physics, chemistry, economics, mathematics, biology, botany, psychology, astronomy, etc., so the application of statistics is very wide. Now we shall discuss some important fields in which statistics is commonly applied. ) Business Statistics plays an important role in business. A successful businessman must be very quick and accurate in decision making. He knows what his customers want; he should therefore know what to produce and sell and in what quantities. Statistics helps businessmen to plan production according to the taste of the customers, and the quality of the products can also be checked more efficiently by using statistical methods. Thus, it can be seen that all business activities are based on statistical information. Businessmen can make correct decisions about the location of business, marketing of the products, financial resources, etc. (2) Economics Economics largely depends upon statistics. National income accounts are multipurpose indicators for economists and administrators, and statistical methods are used to prepare these accounts. In economics research, statistical methods are used to collect and analyze the data and test hypotheses. The relationship between supply and demand is studied by statistical methods; imports and exports, inflation rates, and per capita income are problems which require a good knowledge of statistics. (3) Mathematics Statistics plays a central role in almost all natural and social sciences. The methods used in natural sciences are the most reliable but conclusions drawn from them are only probable because they are based on incomplete evidence. Statistics helps in describing these measurements more precisely. Statistics is a branch of applied mathematics. A large number of statistical methods like probability averages, dispersions, estimation, etc., is used in mathematics, and different techniques of pure mathematics like integration, differentiation and algebra are used in statistics. (4) Banking Statistics plays an important role in banking. Banks make use of statistics for a number of purposes. They work on the principle that everyone who deposits their money with the banks does not withdraw it at the same time. The bank earns profits out of these deposits by lending it to others on interest. Bankers use statistical approaches based on probability to estimate the number of deposits and their claims for a certain day. (5) State Management (Administration) Statistics is essential to a country. Different governmental policies are based on statistics. Statistical data are now widely used in making all administrative decisions. Suppose if the government wants to revise the pay scales of employees in view of an increase in the cost of living, and statistical methods will be used to determine the rise in the cost of living. The preparation of federal and provincial government budgets mainly depends upon statistics because it helps in estimating the expected expenditures and revenue from different sources. So statistics are the eyes of the administration of the state. (6) Accounting and Auditing Accounting is impossible without exactness. But for decision making purposes, so much precision is not essential; the decision may be made on the basis of approximation, know as statistics. The correction of the values of current assets is made on the basis of the purchasing power of money or its current value. In auditing, sampling techniques are commonly used. An auditor determines the sample size to be audited on the basis of error. (7) Natural and Social Sciences Statistics plays a vital role in almost all the natural and social sciences. Statistical methods are commonly used for analyzing experiments results, and testing their significance in biology, physics, chemistry, mathematics, meteorology, research, chambers of commerce, sociology, business, public administration, communications and information technology, etc. (8) Astronomy Astronomy is one of the oldest branches of statistical study; it deals with the measurement of distance, and sizes, masses and densities of heavenly bodies by means of observations. During these measurements errors are unavoidable, so the most probable measurements are found by using statistical methods. Example: This distance of the moon from the earth is measured. Since history, astronomers have been using statistical methods like method of least squares to find the movements of stars. Abstract. Correlation analysis is a statistical method used to evaluate the strength of relationship between two quantitative variables. A high correlation means that two or more variables have a strong relationship with each other, while a weak correlation means that the variables are hardly related. For example, a correlation of r = 0.9 suggests a strong, positive association between two variables, whereas a correlation of r = -0.2 suggest a weak, negative association. A correlation close to zero suggests no linear association between two continuous variables. here are three possible results of a correlational study: a positive correlation, a negative correlation, and no correlation. ∙ A positive correlation is a relationship between two variables in which both variables move in the same direction. Therefore, when one variable increases as the other variable increases, or one variable decreases while the other decreases. An example of positive correlation would be height and weight. Taller people tend to be heavier. ∙ A negative correlation is a relationship between two variables in which an increase in one variable is associated with a decrease in the other. An example of negative correlation would be height above sea level and temperature. As you climb the mountain (increase in height) it gets colder (decrease in temperature). ∙ A zero correlation exists when there is no relationship between two variables. For example there is no relationship between the amount of tea drunk and level of intelligence. https://miro.medium.com/max/535/0*w1arRie5XbU0Qx6U egression analysis is a set of statistical methods used for the estimation of relationships between a dependent variable and one or more independent variables. It can be utilized to assess the strength of the relationship between variables and for modeling the future relationship between them. Regression Analysis – Linear model assumptions Linear regression analysis is based on six fundamental assumptions: 1. The dependent and independent variables show a linear relationship between the slope and the intercept. 2. The independent variable is not random. 3. The value of the residual (error) is zero. 4. The value of the residual (error) is constant across all observations. 5. The value of the residual (error) is not correlated across all observations. 6. The residual (error) values follow the normal distribution. Regression Analysis – Simple linear regression Simple linear regression is a model that assesses the relationship between a dependent variable and an independent variable. The simple linear model is expressed using the following equation: Y = a + bX + ϵ Where: ∙ Y – Dependent variable ∙ X – Independent (explanatory) variable ∙ a – Intercept ∙ b – Slope ∙ ϵ – Residual (error) Regression Analysis – Multiple linear regression Multiple linear regression analysis is essentially similar to the simple linear model, with the exception that multiple independent variables are used in the model. The mathematical representation of multiple linear regression is: Y = a + bX 1 + cX2 + dX3 + ϵ Where: ∙ Y – Dependent variable ∙ X1, X2, X3 – Independent (explanatory) variables ∙ a – Intercept ∙ b, c, d – Slopes ∙ ϵ – Residual (error) Multiple linear regression follows the same conditions as the simple linear model. However, since there are several independent variables in multiple linear analysis, there is another mandatory condition for the model: ∙ Non-collinearity: Independent variables should show a minimum of correlation with each other. If the independent variables are highly correlated with each other, it will be difficult to assess the true relationships between the dependent and independent variables. Ans:D Concept of Probability and its rules Probability is defined as a number between 0 and 1 representing the likelihood of an event happening. A probability of 0 indicates no chance of that event occurring, while a probability of 1 means the event will occur. If you're working on a probability problem and come up with a negative answer, or an answer greater than 1, you've made a mistake! Go back and check your work. In this formula: ∙ P(A) is read as 'the probability of A', where A is an event we are interested in. ∙ P(A|B) is read as 'the probability of A given B occurs'. ∙ P(not A) is read as 'the probability of not A ', or 'the probability that A does not occur'. Probability Rules Probability Rules 1.(For simultaneous trials) Addition Rule Multiplication Rule A. Mutually Exclusive Events B. Patrtially Overlapping Events 2.(For consecutive trials) Addition Rule Multiplication Rule A. Dependent event B. Independedent event. 3. Baye’s Theorem There are three main rules associated with basic probability: the addition rule, the multiplication rule, and the complement rule. You can think of the complement rule as the 'subtraction rule' if it helps you to remember it. 1.) The Addition Rule: P(A or B) = P(A) + P(B) - P(A and B) If A and B are mutually exclusive events, or those that cannot occur together, then the third term is 0, and the rule reduces to P(A or B) = P(A) + P(B). For example, you can't flip a coin and have it come up both heads and tails on one toss. 2.) The Multiplication Rule: P(A and B) = P(A) * P(B|A) or P(B) * P(A|B) If A and B are independent events, we can reduce the formula to P(A and B) = P(A) * P(B). The term independent refers to any event whose outcome is not affected by the outcome of another event. For instance, consider the second of two coin flips, which still has a .50 (50%) probability of landing heads, regardless of what came up on the first flip. What is the probability that, during the two coin flips, you come up with tails on the first flip and heads on the second flip? Let's perform the calculations: P = P(tails) * P(heads) = (0.5) * (0.5) = 0.25 3.) The Complement Rule: P(not A) = 1 - P(A) Do you see why the complement rule can also be thought of as the subtraction rule? This rule builds upon the mutually exclusive nature of P(A) and P(not A). These two events can never occur together, but one of them always has to occur. Therefore P(A) + P(not A) = 1. For example, if the weatherman says there is a 0.3 chance of rain tomorrow, what are the chances of no rain? Let's do the math: P(no rain) = 1 - P(rain) = 1 - 0.3 = 0.7 The Bayes' theorem is expressed in the following formula: Where: P(A|B) – the probability of event A occurring, given event B has occurred. P(B|A) – the probability of event B occurring, given event A has occurred. P(A) – the probability of event A. Decision making under Uncertainty example problems A decision problem, where a decision-maker is aware of various possible states of nature but has insufficient information to assign any probabilities of occurrence to them, is termed as decision-making under uncertainty. A decision under uncertainty is when there are many unknowns and no possibility of knowing what could occur in the future to alter the outcome of a decision. We feel uncertainty about a situation when we can't predict with complete confidence what the outcomes of our actions will be. We experience uncertainty about a specific question when we can't give a single answer with complete confidence. Launching a new product, a major change in marketing strategy or opening your first branch could be influenced by such factors as the reaction of competitors, new competitors, technological changes, changes in customer demand, economic shifts, government legislation and a host of conditions beyond your control. These are the type of decisions facing the senior executives of large corporations who must commit huge resources. The small business manager faces, relatively, the same type of conditions which could cause decisions that result in a disaster from which he or she may not be able to recover. A situation of uncertainty arises when there can be more than one possible consequences of selecting any course of action. In terms of the payoff matrix, if the decision-maker selects A1, his payoff can be X11, X12, X13, etc., depending upon which state of nature S1, S2, S3, etc., is going to occur. Methods of Decision Making under Uncertainty The methods of decission making under certainity are.There are a variety of criteria that have been proposed for the selection of an optimal course of action under the environment of uncertainty. Each of these criteria make an assumption about the attitude of the decision-maker. 1. Maximin Criterion: This criterion, also known as the criterion of pessimism, is used when the decision-maker is pessimistic about future. Maximin implies the maximisation of minimum payoff. The pessimistic decision-maker locates the minimum payoff for each possible course of action. The maximum of these minimum payoffs is identified and the corresponding course of action is selected. This is explained in the following example : Example : Let there be a situation in which a decision-maker has three possible alternatives A1, A2 and A3, where the outcome of each of them can be affected by the occurrence of any one of the four possible events S1, S2, S3 and S4. The monetary payoffs of each combination of Ai and Sj are given in the following table: Solution: Since 17 is maximum out of the minimum payoffs, the optimal action is A2. 2. Maximax Criterion: This criterion, also known as the criterion of optimism, is used when the decision-maker is optimistic about future. Maximax implies the maximisation of maximum payoff. The optimistic decision-maker locates the maximum payoff for each possible course of action. The maximum of these payoffs is identified and the corresponding course of action is selected. The optimal course of action in the above example, based on this criterion, is A3. 3. Regret Criterion: This criterion focuses upon the regret that the decision-maker might have from selecting a particular course of action. Regret is defined as the difference between the best payoff we could have realised, had we known which state of nature was going to occur and the realised payoff. This difference, which measures the magnitude of the loss incurred by not selecting the best alternative, is also known as opportunity loss or the opportunity cost. From the payoff matrix (given in § 12.6), the payoffs corresponding to the actions A1, A2, ...... An under the state of nature Sj are X1i, X2j, ...... Xnj respectively. Of these assume that X2j is maximum. Then the regret in selecting Ai, to be denoted by Rij is given by X2j - Xij, i = 1 to m. We note that the regret in selecting A2 is zero. The regrets for various actions under different states of nature can also be computed in a similar way. The regret criterion is based upon the minimax principle, i.e., the decision-maker tries to minimise the maximum regret. Thus, the decision-maker selects the maximum regret for each of the actions and out of these the action which corresponds to the minimum regret is regarded as optimal. The regret matrix of example can be written as given below: From the maximum regret column, we find that the regret corresponding to the course of action is A3 is minimum. Hence, A3 is optimal. 4. Hurwicz Criterion: The maximax and the maximin criteria, discussed above, assumes that the decision-maker is either optimistic or pessimistic. A more realistic approach would, however, be to take into account the degree or index of optimism or pessimism of the decision-maker in the process of decision-making. If a, a constant lying between 0 and 1, denotes the degree of optimism, then the degree of pessimism will be 1 - a. Then a weighted average of the maximum and minimum payoffs of an action, with a and 1 - a as respective weights, is computed. The action with highest average is regarded as optimal. We note that a nearer to unity indicates that the decision-maker is optimistic while a value nearer to zero indicates that he is pessimistic. If a = 0.5, the decision maker is said to be neutralist. We apply this criterion to the payoff matrix of example 17. Assume that the index of optimism a = 0.7. Since the average for A3 is maximum, it is optimal. 5. Laplace Criterion: In the absence of any knowledge about the probabilities of occurrence of various states of nature, one possible way out is to assume that all of them are equally likely to occur. Thus, if there are n states of nature, each can be assigned a probability of occurrence = 1/n. Using these probabilities, we compute the expected payoff for each course of action and the action with maximum expected value is regarded as optimal.