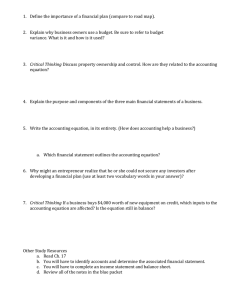

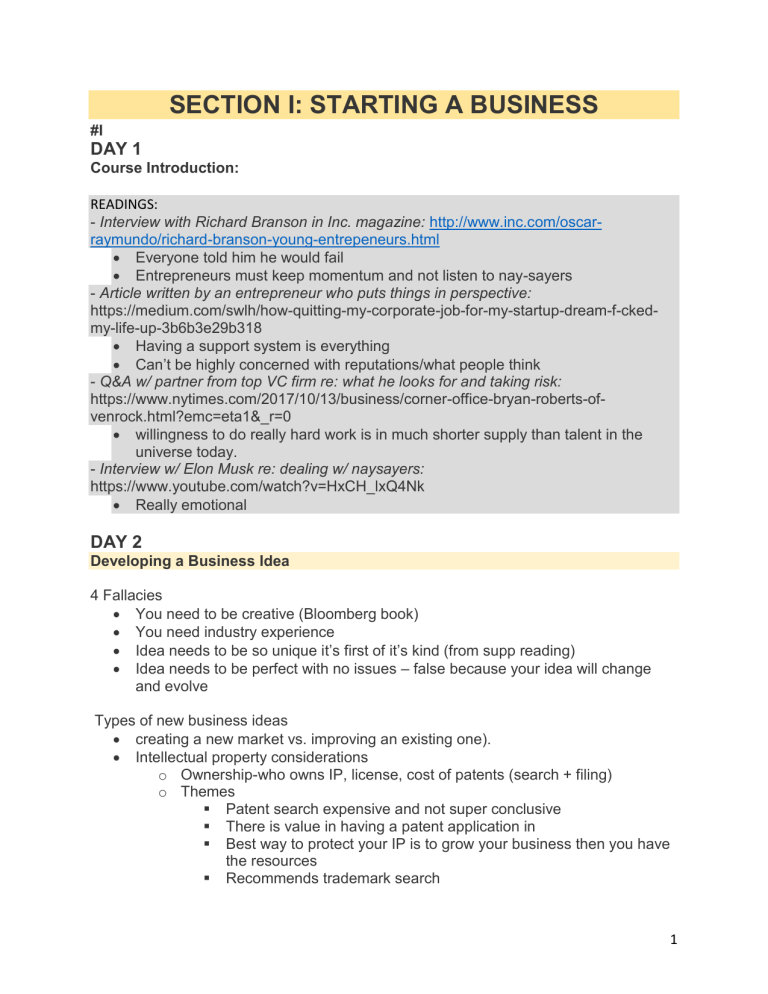

SECTION I: STARTING A BUSINESS #I DAY 1 Course Introduction: READINGS: - Interview with Richard Branson in Inc. magazine: http://www.inc.com/oscarraymundo/richard-branson-young-entrepeneurs.html Everyone told him he would fail Entrepreneurs must keep momentum and not listen to nay-sayers - Article written by an entrepreneur who puts things in perspective: https://medium.com/swlh/how-quitting-my-corporate-job-for-my-startup-dream-f-ckedmy-life-up-3b6b3e29b318 Having a support system is everything Can’t be highly concerned with reputations/what people think - Q&A w/ partner from top VC firm re: what he looks for and taking risk: https://www.nytimes.com/2017/10/13/business/corner-office-bryan-roberts-ofvenrock.html?emc=eta1&_r=0 willingness to do really hard work is in much shorter supply than talent in the universe today. - Interview w/ Elon Musk re: dealing w/ naysayers: https://www.youtube.com/watch?v=HxCH_lxQ4Nk Really emotional DAY 2 Developing a Business Idea 4 Fallacies You need to be creative (Bloomberg book) You need industry experience Idea needs to be so unique it’s first of it’s kind (from supp reading) Idea needs to be perfect with no issues – false because your idea will change and evolve Types of new business ideas creating a new market vs. improving an existing one). Intellectual property considerations o Ownership-who owns IP, license, cost of patents (search + filing) o Themes Patent search expensive and not super conclusive There is value in having a patent application in Best way to protect your IP is to grow your business then you have the resources Recommends trademark search 1 Regulatory considerations. o Certain industries have heavy regulations so it’s harder/more costly to get into them BUT it means even giant competitors wanting to get in on them have to go through the same process Framework for Vetting o Customer pain o Winning- you need to beat competition at something o Consider market opportunity Forming an Initial Team: Importance and characteristics of value-added business partner(s) and key employees. o HQ people are EVERYTHING to startups o Want a partnership where 1+1=3 o Look for complimentary skillset + shared values/character o Sometimes it’s good to have an industry vet + visionary operator Key considerations for structuring the participation of business partner(s) and key employees – equity/options, vesting, and tax implications. o Important roles and responsibilities Front person, operator, sales/ BD, hiring/firing Equity/ownership Founders Shares Vesting (keeps employees engaged o Gives time to evaluate everyone’s performance Thoughts on initial Board size and composition. o Don’t give up a board sear unless you absolutely have to o You ALWAYS want to control board (Alley Watch Article) Advisory board: what makes a valuable advisor and how is their participation structured? o No legal liability for AB members o Gives startup credibility o Huge Advantage that’s relatively easy Establishing a Legal Entity (didn’t get to this section today): Different entity types and the advantages / disadvantages of each. Business and Legal considerations. Future capital raising implications. Readings for class: - Bagley, Constance E. and Dauchy, Craig E. The Entrepreneur’s guide to Business Law (Chapter 4 re: form of legal entity and Chapter 5 re: structuring ownership, pp. 7778 and 88-96). - “7 Mistakes to Avoid in Forming a New Venture Board,” 2 AlleyWatch.com, http://www.alleywatch.com/2018/07/7-mistakes-to-avoid-in-forming-anew-venture-board/ - Read Supplemental Reading 2 (on Canvas) DAY 3 Guest Speakers DAY 4 Business Plans HOW ENTREPRENEURS CAN CREATE EFFECTIVE BUSINESS PLANS Business plan- A business plan to me is a 25-page, maximum 30-page, document, which is a description, analysis and evaluation of a venture that you want to get funded by somebody. It provides critical information to the reader — usually an investor — about you, the entrepreneur, about the market that you are going to enter, about the product that you want to enter with, your strategy for entry, what the prospects are financially, and what the risks are to anybody who invests in the project. • Components o executive summary that grabs the attention of the potential investor. This should be done in no more than two pages. The executive summary is meant to convince the potential investor to read further and say, “Wow! This is why I should read more about this business plan.” Most Important- do it last Most important part- Value proposition o revenue model- reoccurring (getting paid periodically over time generally until it’s canceled) o market analysis. What is the market? How fast is it growing? How big is it (size) ? Who are the major players? Dynamics? Is power concentrated or diffused? Margins in the market – stable or shrinking? Barriers to entry? VC wants to know they at least have a potential chance of making 10x’s the money Even if no competition yet- what will people do if you’re sucessful o strategy section. It should address questions such as, “How are you going to get into this market? And how are you going to win in that marketplace against current competition?” o marketing plan. Define the market. How are we going to segment the market? Which parts of the market are we going to attack? How are we going to get the attention of that market and attract it to our product or service? o management team- better have a robust slide, includes advisory board o implementation plan. How to get to a to b to z? Timeline/milestones. Develop project, introduce beta, customer feedback, regulatory approval, sales milestones, key hires 3 o operations plan that answers the question, “How are we going to make it happen?” And you need an organization plan, which shows who the people are who will take part in the venture. o set milestones key events that will take place as the plan unfolds. What are the major things that are going to happen? If your plan happens to be about a physical product, are you going to have a prototype or a model? If it happens to be a software product, are you going to have a piece of software developed — a prototypical piece of software? What are the key milestones by which investors can judge what progress you are making in the investment? Remember that you will not get all your money up front. You will get your funds allocated contingent on your ability to achieve key milestones. So you may as well indicate what those milestones are. Risky because if you don’t get your valuation things will be set back o key risks- hard-nosed assessment of the key risks. For example, what are the market risks? What are the product risks? What are the financial risks? What are the competitive risks? To the extent that you are upfront and honest about it, you will convince your potential investors that you have done your homework. You need to also be able to indicate how you will mitigate these risks — because if you can’t mitigate them, investors are not going to put money into your venture. o financial plan where you basically do a five-year forecast of what you think the finances are going to be — maybe with quarterly data or projections for the first two years and annual for the next three years. Fogel Rule- prepare good faith estimates, figure out runway, then go back, cut profits by half and double costs. Be conservative- on receipt of revenue (i.e. build in delay) Putting money in- makes a big difference to investors o pro forma financial statements pro forma profit and loss statement. You need a pro forma balance sheet if you have assets in the balance sheet. You need to have a pro forma cash flow. Your cash flow is important, because it is the cash flow that kills. You may have great profits on your books but you may run out of money — so you need a pro forma cash flow statement. And you need a financing plan that explains, as the project unfolds, what tranches of financing you will need and how will you go about raising that money. o financial evaluation that tells investors, if you make this investment, what is its value going to be to you as an investor. That is basically the structure of the plan. o Summary terms of the offer- investors need to know what kind of security they are buying, valuation, termso exit plan/opportunity- helps investor see if there’s an alignment of interest, what types of buyers o legal considerations- disclosure, is IP protected, is it owned by a company? Funky corporate org structure? Self-interested transactions? • • convince stakeholders (articulate and satisfy the different perspectives of various stakeholders) 4 show that we understand the needs — the unmet needs — of potential customers. o we need to understand the strengths and weaknesses of the current most competitive offering out there. o we need to understand the skills and capabilities that you and your team have as entrepreneurs. o understand what the investors need to get out of their investment, because they have to put their money in and they need to have some kind of sense of what they are going to get in terms of returns. o In addition, the investment needs to be competitive with alternative investments that the investors might make. What it needs to do o First and foremost-for YOU-to prepare you to launch you into business o convince the reader that there are customers out there who will in fact buy the product — not because it’s a great product, but because they want it and they are willing to pay for it. o convince the reader that you have some kind of proprietary position that you can defend. o convince your readers that you have an experienced and motivated management team and that you have the experience and the management capabilities to pull it off. o convince potential investors that they are going to get a better return than they could get elsewhere, so you need to estimate the net present value of this venture. o show that the risk they are taking will be accompanied by appropriate returns for that risk. o you need to be able to articulate all these issues in some 25 to 30 pages. o • 1- concept statement- A concept statement is about three to five pages that you put together and share with potential customers or investors just to see if they think it’s worth the energy and effort of doing more detailed work. • a description of the market need that has to be fulfilled; • a description of the products or services that you think are going to fulfill that need; • a description of the key resources that you think are going to be needed to provide that product or service; a specification of what resources are currently available; • an articulation of what you think the risks are; • and then a sort of rough and ready estimate of what you think the profits and profitability will be. 2- Customer conversations 3- Feasibility analysis- 15- to 20-page. This means we are now going to take this idea to the next level. We’ve learned from potential customers and distributors. We’ve learned who the major competitors are. We’ve shaped the idea more clearly, and now we’re digging deeper. • what evidence do you have that the market actually wants it? 5 • • • • • • • Tips • Who do you think would write a check for your product? You need to articulate what makes your product or your service feasible. What has to be done in order to make this thing real? You need a description of how you intend to enter the market, a description of who the major competitors are, a preliminary plan — a very rough plan — which specifies what you think your revenues and profits are going to be, estimate of what you think the required investment will be. Go out and speak to potential customers o What dissatisfies you about your current offering o Who is providing alterntive Discovery-driven Planning READ SUPPLEMENTAL READING 3 (ON CANVAS)- PREPARE FOR THE WORST Stress Tests 1- What happens if everything goes right 2- If I remove one piece that’s central to the functionality of my business what happens? 3- Is my business valued? 4- What’s the worse thing that could happen THE SPECTACULAR DOWNFALL OF ELIZABETH HOLMES AND THERANOS IS THE BEST STARTUP CAUTIONARY TALE IN YEARS. HERE'S WHAT YOU SHOULD LEARN 1. Don't over promise and under deliver. 2. Trust but verify. a. The best entrepreneurs I know do as much digging on their financial partners as their investors do on them 3. Don't raise too much money. 4. Say yes to no men and woman Bagley, Constance E. and Dauchy, Craig E. The Entrepreneur’s guide to Business Law (Chapter 7 (pp. 157 - 162 only) and Chapter 13 (pp. 464-465 only) re: business plans). Chap. 7 Pitching to Investors Describe the Company Describe the Product and the Market 6 Strengths and Weaknesses of the Management Team Identify Risks (including relationships) Describe the Competition Avoid Unsupported Statements Prepare Backup File ROGERS, STEVEN. -ENTREPRENEURIAL FINANCE (CHAPTER 2 RE: FINANCIAL STATEMENTS AND CREATING PRO - FORMA PROJECTIONS). Income Statement (profit and loss statement)- company’s profitability • Flow of resources over time, shows revenues and expenses (dif is net income) • Margins o GROSS --Revenue-COGS o OPERATING – (COGS+ operating expenses) o NET – (Difference between revenues and ALL of the company’s costs) Balance Sheet- financial condition of company at a particular time • Snapshot of company’s assets, liabilities, stockholder’s equity at a particular time • Shows assets, liabilities, and equity Statement of Cash Flows• Cash sources – cash uses = net cash flow Pro Formas • Figures for 3 yrs • 3 scenarios (best, worst, most likely) SECTION II: RAISING CAPITAL #II DAY 5 FUNDING *See table Cryptocurrency Mania Fuels Hype and Fear at Venture Firms • ? CarGurus' IPO proves you don't need early venture funding to succeed on Wall Street • A Boston-based tech company that hadn’t raised any money from venture capital until ten years after its founding staged a successful initial public offering Thursday — a reminder startups don’t need to raise huge amounts of cash from Sand Hill Road to succeed. • 7 How Crowd-Funding Is Changing Everything and What That Means for Your Startup • Two main models for crowd-based financing o rewards-based crowd-funding PRO- work well as a step towards de-risking customer demand and building a community of early adopters without giving up equity in the business. CON- There can be a disconnect in your ability to deliver to those expectations o equity-based crowd-funding PRO- broad range of investors, savvy investors to provide feedback and connections that you can use to shape your trajectory all of that money is combined into one pool and treated as though it came from a single traditional VC firm on the cap table • "That is actually the best time to fundraise, with early winds at your back, and we have learned that startups at this point are best able to leverage crowd-funding.” • Rewards Based Best Practices o Setup a strong feedback loop o Keep running your company o Expect customers to be customers o Set a price point o Do your recon • Equity Based Best Practices o Know who you are working with o Be ready o Clarity is king o Cover the key points Is Outside Capital an Option? Venture Deals Chap. 8 (pg. 69) – CONVERTIBLE DEBT E’s Guide to Business Law- Raising Money and Securities Regulation Chap. 7 (pg. 36) NOTES: Types of Capital: Common Stock- most basic equity shareholders can get Founders stock Preferred Stock- dividends (distributing profits to shareholders) , gets paid first • Used to entice investors • Dividends (cumulative or non cumulative) • Conversion rights: the PS will convert to CS at the option of the holder 8 • • Before IPO- everything turns to CS Liquidation Preference o Upon a liquidation, after all the debts paid, preferred holder gets back their investment amount + their accrued and unpaid dividends • Participating vs non-participating stock o Participating Preferred: dream for investors, nightmare for entrepreneurs Best of all worlds- get liq preference & participate in profits of what’s left Convertible Notes • Postpones valuation DAY 6 WRAP UP FROM LAST CLASS In Section 2 of class: Raising Capital Types of Investors Ways of Investing SAFE- Simple Agreement for Future Equity Really hot right now Similar to convertible debt- but equity A Warrant (to buy stock) for third-parties Gives investor right to convert into actual equity of the company Investors aren’t getting interest payment b/c not debt Avoids concept of “maturity day” b/c not debt (inventors loose leverage of maturity date) Legal Considerations: Securities- if you have a security and you’re offering them to the public, then the default is you have to register those securities to the public but there are exceptions. (Example- rule 701 is an exception for employees but doesn’t take into account the “gig” economy) Disclosure Q’s: How many people? How sophisticated are the people? How are you marketing it? Documentation- Terms Sheets, PPM, Stock Purchase Agreement AKA- you have some primary document that lays out what you are getting, and says how much you are investing, how many shares/units you’re getting, accredited investorbased on income level/assets are you of a sufficient wealth to quality as an AI and 9 therefore you’re able to participate in an exempt offering (don’t need to know all the requirements) TERMS Valuation – pre and post money valuation; balancing the need for capital vs. dilution; interplay of liquidation preference, preferred stock terms and option pool. Board seats, protective provisions, and “control.” Vesting and Milestones. Rights associated with selling and buying shares: tag-along, drag-along, ROFR, preemptive rights, registration rights, anti-dilution terms, etc. Term Sheet Process / Exclusivity. Rando: Remember: as an entrepreneur you do not want participating preferred You always want numerous options for investors o Don’t count on your one term sheet Investors goal is to mitigate risk and maximize return Pre-Money valuation vs. Post-money valuation o 10mil valuation, investor gives 5mil Pre= 5/10th Post= 5/15th Canvas Reading 5 – “Nothing is Standard” “I never ever say that a specific provision is “standard”. Nothing is standard. You either need it or you don’t. Explain why you need it and most of the time you’ll get it or something like it as long as both sides really want to make a deal.” “I don’t give a f>>>k that you always get this provision. Doesn’t mean shit to me. This deal will be the first time you don’t get it if you don’t explain why you need it.” Bagley, Constance E. and Dauchy, Craig E. The Entrepreneur’s guide to Business Law (Chapter 13 re: venture process and terms). Pg. 88 Deciding whether to seek venture capital $1-$3 million Look for liquidity in 3-5 years PROS- grow more quickly, secure more patents, higher market share, do better if they go public , 90% of new biz w/ no VC fail in a year, only 33% w/VC fail 10 CONS-drive harder bargains on pricing & terms, may assert more power in molding the enterprise, may try to take over if entrepreneur stumbles Common Business Plan for VC pitfalls Plan is too long Executive summary is too long Opportunity is too small Poor organization Plan lacks focus Feld, Brad and Mendelson, Jason. venture deals (Chapters 3-7) 3. Overview of Term Sheet (pdf pg.2) VCs care about: Economics + Control Economics = ROI Preferred stock terms: o Dividends Higher rate (good for investor/ bad for founder) Cumulative (good for investor/ bad for founder) Compounding (even better for investors/ worse for founder) o Liquidation Preference 1x’s money, 2x, 3x o Participating Preferred Always good for investors- very bad for founders o Option Pool o Control = mechanisms to affirmatively exercise control OR veto 4. Economic Terms of the Term Sheet (pdf pg.4) Price / number of shares Option Pool Cap Table Founders Investors Option Pool – amount of stock available for ee’s to incentivize people to Warrants Fully diluted shares outstanding Have to think numerator…not denominator Raises questions about what happens if employees stocks (in the option pool) haven’t vested What Investors Fully Diluted SharesNormally Are Given Option Pool Founders 900 900 11 Investors Option Pool Warrants 100 1000 100 50 150 1200 5. Control Terms of the term sheet (pdf pg.32) Generally share-holders vote on an as converted basis So if you’re valuation is 1/3 you generally get 1/3 of the vote Protective Provisions Rights investors negotiate for that would allow them to block things they’d otherwise not have enough votes to do Examples: Issuing new stock Going Public Selling the company Management Changes Hiring/Firing Key EE’s Borrowing $$ above a certain level Declaring or paying dividends Board Seats (board sets strategy of company and hires officers) o Professor Tip- BOARD SEATS ARE SO IMPORTANT HOLD ONTO THEM Maybe instead give up advisory board seats or observer seats o Sometimes split 2 founders, 2 investors, 1 mutually agreed upon neutral As a founder-NO you want to control that board b/c you want to control the direction of the company “mutually agreeable” = VETO right for investors 6. Other Terms of the Term Sheet (pdf pg.45) 7. The Capitalization Table (pdf pg.60) TERMS HIGHLIGTED BY FOGEL Milestones Scary for founder because if you don’t hit them, investor may have rights Avoid if you can Founder/ maybe Employee vesting Fred Wilson’s piece on pros/cons of making founders vest over time 12 Redemption Rights Professor says this one is a nightmare Often overlooked but VERY important Right to make founder buy back investor’s shares at some predetermined formula Anti-Dilution Automatic o Like a stock split Pre-empted rights o “If you do a future offering, I want to maintain my percentage so I get to buy up to my %” o Investors have to put more money in, but maintain percentage of ownership o A way to adjust ownership back to percentage down to the next round’s lower valuation Registration Rights If IPO shares need to be registered and available for purchase Right of First Refusal Way of saying if you wanna sell your stock, you can, but the same price and terms you reach with new buyer have to be offered to me first Tag Along Rights / Drag along rights Tag Along (good for investors) o When common stock holders are selling, preferred shareholders get to sell their stocks at the same terms Drag Along Rights (bad for investors) o If the majority of the investors Information Rights What information rights do investors have? o Financial Statements o Periodic Reports Exclusivity You ask for term sheets, investor gives you a term sheet, gives you 30 days where you have to negotiate exclusively with us o Investor wants good faith exclusive negotiations Is a term sheet binding? No, they aren’t binding Will usually say “this is all subject to final investor approval” DAY 7 Guest Speakers 13 SECTION III: EXECUTING / SCALING THE BUSINESS #III DAY 8 Scaling & Surviving • Culture – the importance of culture to the success of a business. • People – attracting and managing quality people and related employment issues. • Product – developing products and markets; determining product readiness and market fit. • Sales – leadership and organization. • Marketing – building and executing a go-to-market strategy. • Growth – using data to deeply understand your business and grow it. • Revenue & Profits – what's most important? • Cash Flow Management – keeping enough gas in the tank. • Adaptability & Perseverance – necessary tools for surviving the startup phase and moving to a going concern and beyond. Governance & Additional Capital: • Building accountability. • Relationships with Board and investors. • Need for additional financing – options and considerations. Organic vs. Inorganic Growth: • Benefits/Negatives/Difficulties of add-on acquisitions. READINGS “The Defining Elements of a Winning Culture,” Harvard Business Review: https://hbr.org/2013/12/the-definitive-elements-of-a-winning-culture Culture is more than just a unique identity, however. The best performing companies typically display a set of performance attributes that align with the company’s strategy and reinforce the right employee behaviors. Our research revealed seven of these: 1. Honest. There is high integrity in all interactions, with employees, customers, suppliers, and other stakeholders; 2. Performance-focused. Rewards, development, and other talentmanagement practices are in sync with the underlying drivers of performance; 3. Accountable and owner-like. Roles, responsibilities, and authority all reinforce ownership over work and results; 4. Collaborative. There’s a recognition that the best ideas come from the exchange and sharing of ideas between individuals and teams; 5. Agile and adaptive. The organization is able to turn on a dime when necessary and adapt to changes in the external environment; 14 6. Innovative. Employees push the envelope in terms of new ways of thinking; and 7. Oriented toward winning. There is strong ambition focused on objective measures of success, either versus the competition or against some absolute standard of excellence. Few organizations exhibit all seven of these attributes. But high-performing organizations typically spike on the three or four that are most critical to their success. “The Fall of Travis Kalanick Was a Lot Weirder and Darker Than You Thought,” Bloomberg BusinessWeek, https://www.bloomberg.com/news/features/2018-01-18/thefall-of-travis-kalanick-was-a-lot-weirder-and-darker-than-you-thought Blumberg, Matt. Startup CEO (Read Part Two: Building the Company's Human Capital) Key elements of running the people side of a company o Team Building o Culture Let people be people / work life balance Trust o Full Cycle of Employment Recruiting Selling your vision Start with generalists willing and able to take on dozens of tasks Pay attention to cultural fit Find outstanding specialists Complement your weaknesses Don’t hire up TOO much Check references carefully Let your team have input on your team Need a paranoia and an optimism Roles o Consider hiring HR (by 100 ee’s too late) TOOLS o Values o Use people from old jobs o Your team o Company’s reputation o Sales skills “what do you think of our business/company?” Let the candidate lead the interview process Hiring Defining Job properly Takes a lot of time 15 Hiring doesn’t end on employee’s first day Most can be forecasted o Onboarding Start before Day 1 Set up their new desk in advance Prepare an orientation deck for Day 1 Clearly set 90-day objectives and goals Run a review process at the end of 90 days Feedback / performance management Compensation 3 elements of SU comp o Base Pay o Incentive Pay o Equity Promoting Not everyone who is good at their job would be good at managing Peter Principle “people are promoted to their level of incompetence” Think about “title inflation” Consider thinking of every senior member of an org as the “head” of something Rewarding It NEVER goes without saying Humans live for “moments” Culture of appreciation Firing No one should ever be surprised to be fired Alert EE, Institute a performance improvement plan, radically increase supervision of at-risk employees Layoffs suck (cut earlier, deeper, get rid of ALL poor performers, plan talking points, follow layoffs with an allhands meeting) 16 Collins, Jim. Good to Great (Chapters 3, 5 & 8) 3- First Who…Then What o Purpose of comp not to incentivize behavior- but to get the right people on the bus o Don’t be a Leader with a thousand helpers o Be Rigorous with people When in doubt don’t hire—keep looking When you know you need to make a people change- act Put your best people on your biggest opportunity not your biggest problem Good people will preform regardless of incentive Incentives won’t change the wrong people 5- Hedgehog Concept (simplicity within the Three Circles) o Hedgehog Concept is an understanding of what you can be the best at (not a goal or a plan) o Be a hedgehog – know “one big thing” not a fox “crafty, cunning, know many things but lack consistency” o Must set goals and strategies based on understanding – not bravado o Counsel can help o To get insight into drivers of your economic engine find the denominator (profit per x, social sector, cash flow) that has the single greatest impact 8- Flywheel and the Doom Loop o No single defining action that turned company great o Sustainable pattern of buildup and breakthrough o Deals are often done because they’re exciting not because they make sense o Should be done ONLY as an accelerator of the flywheel Horowitz, Ben. The Hard Thing About Hard Things (pp. 57-67, 91-104, and 119-129) SURVIVAL Keep death in mind at all times When things are going wrong “Nobody cares” you just have to fix it “The Struggle” Chapter pg. 60 o Don’t put it all on yourself as the founder/CEO o “This is chess, not checkers” issues are complicated o Thinking that you’re the only one that can handle bad news is wrong- most people handle news better than Founder Absolute necessity to watch cash until you break even Every day you’re not breaking even, is a day closer to running out of cash and failure When raising money, raise more money than you think you need (cushion) o Worst case-bit of dilution 17 o Avoid failing Hard to bring in BIG people to small companies o Less scrappy, rely on staff and resources to help them do their job, not a player coach When things go badly managers often blame outside facts Supplemental Readings 7: Jeff Bezos Don’t worry about the money Forget output focus on input Be a leader not just a decider Even as you grow find ways to stay small Supplemental Readings 8: Create a Thriving Team Supplemental Readings 9: Equity Comp “I don’t have any specific recommendations to make on this topic except that Boards should be thinking way more deeply and creatively about this issue than we are. We should be confronting the true cost of this practice and asking ourselves if it is best for our employees, and if so, which ones, and if it is best for our companies and our shareholders.” Supplemental Readings 10: Keep The Degree Of Difficulty Down In many sports, like diving, gymnastics, skating, etc, the way to win is to perfectly execute a high degree of difficulty move. In startups, I advise founders to avoid that way of thinking and try to execute a simple dive and hit the water perfectly. ___________________________________________________________________ SURVIVAL Horowitz Piece Keep death in mind at all times When things are going wrong “Nobody cares” you just have to fix it “The Struggle” Chapter o Don’t put it all on yourself as the founder/CEO o “This is chess, not checkers” issues are complicated o Thinking that you’re the only one that can handle bad news is wrong- most people handle news better than Founder Absolute necessity to watch cash until you break even Every day you’re not breaking even, is a day closer to running out of cash and failure When raising money, raise more money than you think you need (cushion) o Worst case-bit of dilution o Avoid failing 18 FINDING PEOPLE: Bus Analogy - “WHO is on the bus” o First (before finding out where bus is going) decide WHO is on the bus o Getting right people on the bus and in the right seas o The right people WILL preform o Right people Easier to manage More adaptable More motivated o Horowitz: People products profits o Incentives- used to get people on the bus, but can’t make the wrong people preform OUT of Central Casting o Important to ignore the traditional pedigree of someone (and the propensity of management to follow the pedigree) o IGNORE School, industry experience o INSTEAD look at character, integrity, personal attributes When in doubt don’t hire—keep looking When you know you need to make a personnel change- do it fast o In the context of a startup, time is ticking, and you need to get them out fast MANAGEMENT Level 5 Management o Debate vigorously but once decision is made everyone agrees and moves forward Flywheel and the Doom Loop o No single defining action that turned company great o Sustainable pattern of buildup and breakthrough o Doom Loop is trying to skip ahead and artificial momentum- then everything falls apart o Deals are often done because they’re exciting not because they make sense (inorganic growth = accqusition) o Should be done ONLY as an accelerator of the flywheel Integration is always hard (culture right, incentives right) EMPLOYMENT AGREEMENTS: At-Will vs. Protected o At-Will can leave anytime and can be fired at any time o Protected – can only be fired for cause If terminated otherwise, employee receives a more significant amount Definition of cause one of the most debated provisions Termination 19 o Departing with good reason or without good reason o Good reason- still gets paid severance Ex. Demoted, someone was brought in with me, you moved me SALES STRATEGIES Engaging Wear multiple hats Don’t want to hire someone that’s just there for the paycheck Want people who are going to get “something more” out of the experience o Salespeople with that same team mentality “Kiss of death for a startup are people just there picking up paychecks” “No limit on the amount of credit you can give people in a business” PRODUCT Good product managers, know the market, know their product, know entire line, and know the competition extremely well Good product managers take responsibility when the product doesn’t preform Focus on revenue and customers Sales and Marketing = organic growth Acquisitions = inorganic growth FINANCIALS Often a tradeoff between revenue and profits 83% of US listed IPOS were unprofitable for the 12 months leading up to their preview Cashflow is absolutely critical CULTURE Culture can change overtime Critical to have good corporate culture When things are going bad it’s critical to be a good company Fox v. Hedgehog from reading Diversity from the very begining ETHICS Think back to Theranos reading o “Illegality is bad, lack of any ethics is disgusting” There will always be opportunities for a shortcut – don’t cross that line EVER DAY 9 Simulation: Up Against The Wall Day 10 20 Canceled SECTION IV: EXITING THE BUSINESS #IV Day 11 EXITING THE BUSINESS Guest Professor: Mike Labriola (Wilson Sonsini) *slides from presentation will be sent after class US Venture Investing and Exit Activity Understanding how exit works is essential to your ability to make money What Do Exits Look Like 80/20 rule o 80% M&A o 20% IPO Sale usually in 5-7 years IPOs trending towards 8 years Frequently sales are less than total capital raised (LIFO) IPO PROCESS Reason people go public o People need money o Liquidity- get money after pouring in blood, sweat, and tears o Market recognition Candy Crush example, didn’t need money, needed branding o Stock becomes acquisition currency (no one wants privately held shares) o Employee Comp Alternative o Future access to cap markets o Perceived stability (stable investment- odds of going down to zero low) Risks and Costs o VERY expensive (lawyers, accounting, bankers) o Quiet Period (Restricts ability to talk to investors and customers) o Compliance- SEC + Sarbanes-Oxley o Quarterly reports – vicious cycle of reporting results o Loss of control (giving up percentage of company to general public) o Stockholder activism (groups work to influence companies in good and bad ways. Ex.- diversity) o If you don’t get enough attention from analysts it’s hard to be a public co. What it takes to Go Public o “It’s a process” 21 o Realistically takes 2.5 years to do it right Starts with culture and ends with compliance o At the mercy of the market “windows” open and close quickly “hot” companies and markers of success change/move o Have to be be one of the top companies in your market Unique, huge market, growing fast, factors to operate as a public co Timeline o See table in slides that will be sent after class (slide 18) M&A Alternative Reason people merge/sell to acquirer o People need money o Can’t feed your family with your stock o Liquidity- get money after pouring in blood, sweat, and tears o Way to further founder’s vision- take it a step further o Market power or presence o Avoiding SEC compliance for IPO Risks and Costs o “Everyone you deal with has a day job – no one you deal with has the job title of Sell The Company” o Disruption of business o Confidentiality Not telling employees because worried about moral o Substantial costs and negotiation time o Loss of Control Many founders don’t like giving up companies o Potential to be left at alter No one wants to buy the car the last guy didn’t want May lead to missing their “window” o Acquirer’s stock performance risk - your investment may dry up Taking your value and tying it to something much bigger and out of your control o Liquidation preferences and carve-outs Legal issues- tension between ability to pay investors but possibility of eventually being about to increase value for common stock holders Carve-out: we’re going to give the preference x-million but we’re also going to give something to common stock holders “Just the beginning of the next negotiation” o Escrows (middle ground taking part of the proceeds in a neutral 3rd party bank account if buyer find problem they can go to escrow agent and tell the problem)typical size is 10%-20% with 1-2 yr duration often CAP on liability , o Indemnities (if it’s not what you paid for, I will make you whole), 22 o Earn-outs (for business that still hasn’t proven itself – buyer gets more certainty and seller taking a bit of a gamble that business will actually be successful) Fundamental principal of M&A Anytime you do a transaction two competing tensions o Buyer - certainty of asset- want to know what they’re getting, as many guarantees that they are getting what they paid for o Seller- certainty of proceeds & closure o Failure to integrate and execute successfully Timing Factors o Competitive threats o Market consolidation/hard time finding a buyer you could be left without a dance partner o Want to sell when solid performing o Potential to step up a level in combined company o Non-receptive IPO market o Antitrust, CFIUS and others Regulations like you have to tell gov’t THEN wait 30 Days before you can do the deal CFIUS-committee for foreign investment in the US Originally designed for national security Great place for “boogieman stories” Sale Process o Lots of things can go wrong during sale process o Deal doesn’t end until $$ is wired o Role of professional Advisors (bankers & lawyers) Good cop, bad cop dynamic So someone can throw a fit Important for the technical advice Keep ears open – link the business to the deal ASK- why are they doing this deal, what are they looking for What they do Bankers – determine valuation, some of the sales guys, some of the best negotiators (comes from eco system of being bankers) Lawyers—advocates of the company, sometimes “scribes” writing the deal, preparation of Sales Materials Accountants – a lot of what you need to produce in a sale is from accounting dept o PROCESS (slides 26-27) Prep Sales Materials Evaluation Period Bid Process 23 In the end: (Exclusivity but usually a clause that says “if someone comes unsolicited and goes higher you can break exclusivity) Document Stage Where lawyers really come in Figuring out what to do with key execs motivating KEY employees critical (can’t force someone to stay, and can’t force someone not to work if they don’t stay) Approvals (Board consent, SH approval, etc.) Closing After all regulatory/gov’t approval o Structure (see slide 28-) Asset Purchase Bad new is seller is stuck with the liability Stock Purchase Buyer taking whole business- getting assets and liabilities Reverse Triangular Merger Buyer Subsidiary of buyer Merge target into subsidiary All stockholders now own subsidiary o Typical Merger Agreement Elements (official names on slide 31) ARTICLES I. What we’re going to do II. How we’re going to sell, conditions (financing III. Representations of the target co. (certainty of assets- if the things we promise are true are not true we will pay you) heavily negotiated IV. Representations of buyer (sometimes buyer needs to rep that they have the $ and authority to do the deal, nature of stock if stock is being used to purchase V. Between sign and close what you can and can’t do VI. Extension of exclusivity agreement- (whether you can entertain a new better deal) VII. Supporting agreements (commercial arrangement on the side) VIII. Under these circumstances THEN either party can decide to unilaterally terminate the deal (there is a penalty) IX. Big big debate (back to certainty of asset negotiation) rule of road saying how you get paid if something is broken in the company (current move toward insurance for M&A deals) X. When you merge out everyone is gone (paid-out) so who’s the advocate for the stock holder XI. Self-explanatory XII. Self-explanatory 24 OTHER ISSUES (more detail slide 33) o Securities Law considerations Issuances exemption Resale exemption o Purchase Price o Employee Matters A lot of employees have stock options, so treatment of share options May cost employees $$$ to get stock option they can’t afford Most stock options are vesting (will you accelerate? Even though it’s taking money from your stock holders) o Selected Closing Conditions “SEC sufficient financial statements EE retention Key EE’s Aggregate ee base Legal opinion – is the deal valid? o Transaction Expenses Big debate who pays Sometimes as the seller you can force the buyer to pay If you have everyone pay the same way it incentivizes everyone to be efficient SELECT M&A ISSUES o The Board Process and Role o Duty of care o Duty of loyalty Interesting dynamic Can’t be indemnified for duty of loyalty o Make sure you establish a record that everything was done with due care, business judgement rule (make sure things are fair) o Shopping the Company o Goes hand in hand with board process o Change of Control Acceleration o “upon a change of control my vesting accelerates” o Often for EE’s usually don’t go with company (finance, legal) o Earn-outs o If there is a difference in valuation, earn-outs a tool to bridge that gap o Can do it off milestones, revenue metrics, usually treated as comp as far as tax considerations (capital gains ½ tax of comp) Fogel’s EXITING THE BUSINESS Day 12 Business Exit Overview 25 •Why pursue an exit? 1) Founders get paid 2) Investors get paid 3) Scale the Business- Reached peak growth on your own and you don’t have the resources to do it 4) Some may not want to exit- law firm, generational family business 5) TAX- in tax world you’re paying normal income tax rates (40%) instead of capital gains taxes from selling (20%) •Why is “monetization” a better word? In most situations you are likely to stay-on to help with transitions o Strategic Buyers Most likely to stay on for 2-3 more years o Financial Buyer Ex. Private Equity firms Some “roll” Equity into new company Business Exit — Different Types Bankruptcy Sale o Pro Less regulation Immediate liquidity (if you sell for cash) Long term focus vs. short term focus Macro Market issues are less if you’re a private company IPO — how it works and challenges. o You’ve got to stay for awhile You can’t leave right away because bankers are selling you and your company to the public You get “restricted stock” that you cannot sell Public perception if you walk away / try to sell your stock will be “if insider is selling, I need to sell” Diversifies your investor base o Pros Might want capital for acquisitions Might not want to take out loans (interest rates Market recognition Candy Crush example, didn’t need money, needed branding Public Market Premium *debatable All things equal- the public company makes more money (is valued higher because they are public) Preferred Stock Rights o If you go public all preferred stock rights go away o From a founder’s perspective it’s a pro o Risks and Costs 26 Compliance- SEC + Sarbanes-Oxley Regulatory mess (cost and time spent complying with regulations) Short term emphasis of a public company (obsession with quarterly estimates – game on Wall Street and a lot of time spent preoccupied with estimates and forget about long term growth. VERY expensive (lawyers, accounting, bankers) Other people making money (sell your shares to bank for $14Bank sells to public at $18) Limited Liquidity You can’t sell your shares for at least 6 months Subject to Macro-Market conditions IPO windows can narrow or completely close for years at a time Quiet Period (Restricts ability to talk to investors and customers) Quarterly reports – vicious cycle of reporting results Loss of control (giving up percentage of company to general public) Stockholder activism (groups work to influence companies in good and bad ways. Ex.- diversity) If you don’t get enough attention from analysts it’s hard to be a public co. Strategic vs. financial buyers. o Strategic o Financial Going to have founders roll their equity- and we’ll all make a ton of money in a few years when we sell DF buys P’s company for $50M sells for $100M makes $50M Financial buyer uses financial leverage not out-of-pocket o DF pays $20M out of pocket, borrows $30M gives $50M o Knew borrowing $30M and paying interest on the cash flow of the business he now owns. o 5 years later $30M is only $15M selling for $100M NET $85M If no debt paid off- Net $70M Majority vs. minority sales. o In readings Typical Merger Agreement Elements (official names on slide 31) o Reps and Warranties – way to disclose (more from seller to buyer) things about your company that the other party needs to know Duly organized in all the operational areas Financial Statements accurate Clear and free title Environmental Issues Paid all your taxes 27 o Indemnification Provisions—if you didn’t accurately disclose reps and warranties you need to pay me later o Disclosure schedule “I’m on the hook for anything that I don’t disclose right now except for Appendix XXX (disclosure Schedule)” o Escrow—special kind of account where part of money from purchase is set aside for a period of time incase legitimate claim raised that a rep was wrong (middle ground taking part of the proceeds in a neutral 3rd party bank account if buyer find problem they can go to escrow agent and tell the problem)typical size is 10%-20% with 1-2 yr duration often CAP on liability , o Business Exit Process: #1 Preparation of sale materials ( DECK + TEASER) o PowerPoint deck that summarizes the business o Marketing document- puts companies in best light, gives all the growth opportunities o Teaser- highlights opportunities that you send to potential buyers #2 Evaluation Period o Bankers send teaser out people express interest & want to see the book bankers say great you have to sign a NDA they sign and get the book out o Virtual data room is set up- financial documents o Maybe prospective buyers are allowed to ask questions #3 Bid Process o A lot going on, bankers selling like crazy o Eventually select few submit a Letter of Intent Valuation Range (willing to pay $40-60M) Deal Structure Asset Purchase -or- Equity Purchase (Stock/Merger) Payment type? Financing Structure Employment terms for key employees Expected Timing Plans for Business o Letters come in- you pick and choose #4 Document Stage (Exclusivity agreement here) o Negotiate the Principal Document Agreement Asset Purchase Agreement Equity Purchase Stock Purchase Merger o Don’t need to know the types of mergers Due diligence. •Management meetings with prospective buyers. •Final bids and document negotiations. 28 •Role of investment bankers and legal counsel. BUSINESS EXIT- KEY TERMS: •Form - Merger vs. stock sale vs. asset purchase. •Stock vs. cash consideration. •IP assignment/transfer •Representations, warranties, and conditions. •Indemnities and escrow. •Seller financing for small businesses. •Employment issues and non-competes. •Purchase price adjustments and earn-outs. •Tax Considerations. ASSET PURCHASE Liabilities Buyer picks and chooses what assets he’s buying and what liabilities he’s assuming (BUYERS LOVE ASSET PURCHASES) SH Approvals Easiest- Don’t need to run around and get shareholders to approve rd 3 Party Approvals Company X now sells (Most vendors have its assets to Company Assignment Approval Y…Company Y now Agreements) needs approval for assigning all contracts Have to get the consent of everyone EQUITY PURCHASE STOCK MERGER Getting all the assets Getting all the assets and all the liabilities and all the liabilities (GOOD FOR SELLER) (GOOD FOR SELLER) Hardest- All selling shareholders need to approve Medium- Generally requires the majority of shareholders to approve Because you’re selling all the stockthe company stays in place. Company X is still the party. BUT some have change in control triggers- if control changes you need to get my consent to continue the relationship/contract 29 Taxes Double Taxed- entity Seller doesn’t have to Seller doesn’t have to tax & income tax ( worry about double worry about double Seller doesn’t like tax tax this) When company is selling just asset-if there is profit- the company pays tax on the profit THEN when money goes to shareholders taxed again. HOWEVER gain can be offset by losses from prior years so the taxable event is taxed 0 for entity. For each asset there is a price the selling company paid to make them or acquire them now selling for a big premium. This makes a step up in basis. BUT Seller isn’t stupid and knows the buyer likes it so they req. Buyer to effectively give them some of the tax benefits through an increased purchase process Few More Small Points: Purchase Price Adjustment o Let’s see how many clients/customers came over o Purchase price is set at $X subject to amount of clients who move over Earn Out o B pays $15M out of pocket but gives S the ability to sell the company $30M at another time (so B pays $15M more) 30 o Vs. paying $20M now total READINGS FROM THIS SECTION: -Bagley, Constance E. and Dauchy, Craig E. The Entrepreneur’s guide to Business Law(pp. 628-679). Skim also pp. 689-694. -Blumberg, Matt. Startup CEO(Read Foreword and pp. 355-358) -“Silicon Valley Startups Favor IPOs Over Deals as M&A Languishes,” Bloomberg: https://www.bloomberg.com/news/articles/2017-03-28/silicon-valley-startups-favor-ipos-over-deals-as-ma-languishes -Supplemental Readings 11: Musing of a VC Timing -Supplemental Readings 12: Being Public Pros and Cons -“How Spotify's direct listing is different from an IPO,” CNBC.com, https://www.cnbc.com/2018/04/03/howdoes-spotify-direct-listing-work.html In a traditional initial public offering, banks underwrite the offering, meaning they set an offering price, and buy or sell shares during the initial selling to keep prices from being too volatile. But Spotify's direct listing — unusual enough on its own — is further different because the company is both direct listing and offering shares for the first time without the banks' underwriting assistance. (Didn’t need or want to raise capital- wanted their employees, investors, etc. to have the ability to sell their shares over time) -Bagley, Constance E. and Dauchy, Craig E. The Entrepreneur’s guide to Business Law(pp. 679-689) .-“How To Negotiate A Business Acquisition Letter Of Intent,” Forbes: https://www.forbes.com/sites/allbusiness/2015/07/30/how-to-negotiate-a-business-acquisition-letterof-intent/#447bcd7a1b2a -Bagley, Constance E. and Dauchy, Craig E. The Entrepreneur’s guide to Business Law(pp. 679-689) .-“How To Negotiate A Business Acquisition Letter Of Intent,” Forbes: https://www.forbes.com/sites/allbusiness/2015/07/30/how-to-negotiate-a-business-acquisition-letterof-intent/#447bcd7a1b2a Forming a legal entity Make sure you have a good lawyer who understands this stuff! Sole Proprietorship o Simple o Entity in-that its yourself o Recording financials through your tax-return o No limited liability Corporation o BEST ADVANTAGE- Limited Liability o Long history of established law o Legally very rigid- have to follow the corporate form 31 If you don’t corporate veil may be pierced o Double taxation- what goes on inside corp is taxed and then if you want to get money out of Corp you distribute it up to shareholders via dividend that gets taxed too Partnership o General partner is liable for all the debts o Limited partner only liable to the extent they invested HAS to be passive (no control over business) o Permeable membrane- inside operations doesn’t get taxed- passed up to interest holders and taxed LLC o Generally the preferable set up o Limited Liability (benefit like a C-Corp) o Like a partnership o Has to file its own tax return if multiple members o Permeable membrane- inside operations doesn’t get taxed- passed up to interest holders and taxed o VC funds don’t like investing in pass-through entities (they like to invest in a closed vehicle so that nothing that happens inside goes up to affect institutional investors) o SO if you think you’ll need to raise professional money- be a corporation 32