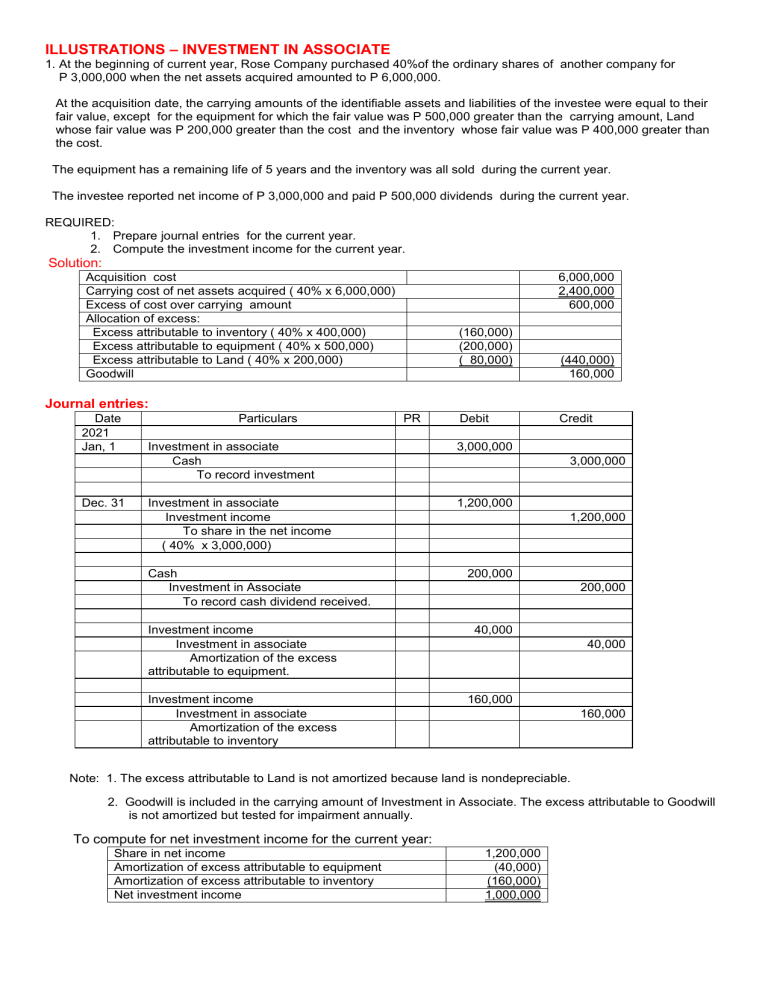

ILLUSTRATIONS – INVESTMENT IN ASSOCIATE 1. At the beginning of current year, Rose Company purchased 40%of the ordinary shares of another company for P 3,000,000 when the net assets acquired amounted to P 6,000,000. At the acquisition date, the carrying amounts of the identifiable assets and liabilities of the investee were equal to their fair value, except for the equipment for which the fair value was P 500,000 greater than the carrying amount, Land whose fair value was P 200,000 greater than the cost and the inventory whose fair value was P 400,000 greater than the cost. The equipment has a remaining life of 5 years and the inventory was all sold during the current year. The investee reported net income of P 3,000,000 and paid P 500,000 dividends during the current year. REQUIRED: 1. Prepare journal entries for the current year. 2. Compute the investment income for the current year. Solution: Acquisition cost Carrying cost of net assets acquired ( 40% x 6,000,000) Excess of cost over carrying amount Allocation of excess: Excess attributable to inventory ( 40% x 400,000) Excess attributable to equipment ( 40% x 500,000) Excess attributable to Land ( 40% x 200,000) Goodwill 6,000,000 2,400,000 600,000 (160,000) (200,000) ( 80,000) (440,000) 160,000 Journal entries: Date 2021 Jan, 1 Dec. 31 Particulars PR Debit Investment in associate Cash To record investment 3,000,000 Investment in associate Investment income To share in the net income ( 40% x 3,000,000) 1,200,000 Cash Investment in Associate To record cash dividend received. Credit 3,000,000 1,200,000 200,000 200,000 Investment income Investment in associate Amortization of the excess attributable to equipment. 40,000 Investment income Investment in associate Amortization of the excess attributable to inventory 160,000 40,000 160,000 Note: 1. The excess attributable to Land is not amortized because land is nondepreciable. 2. Goodwill is included in the carrying amount of Investment in Associate. The excess attributable to Goodwill is not amortized but tested for impairment annually. To compute for net investment income for the current year: Share in net income Amortization of excess attributable to equipment Amortization of excess attributable to inventory Net investment income 1,200,000 (40,000) (160,000) 1,000,000 Investment in Associate 1/1 12/31 3,000,000 1,200,000 ________ 4,200,000 3,800,000 Bal. 12/31 200,000 40,000 160,000 400,000 Investment Income 12/31 40,000 160,000 200,000 12/31 1,200,000 ________ 1,200,000 Balance: 1,000,000 Problem 2: Same as Problem 1, except that the equipment whose fair value was P 500,000 lower than the carrying amount. Solution: Acquisition cost Carrying cost of net assets acquired ( 40% x 6,000,000) Excess of cost over carrying amount Allocation of excess: Excess attributable to inventory ( 40% x 400,000) Excess attributable to equipment ( 40% x 500,000) Excess attributable to Land ( 40% x 200,000) Goodwill 6,000,000 2,400,000 600,000 (160,000) 200,000 ( 80,000) (40,000) 560,000 Journal entries: Date 2021 Jan, 1 Dec. 31 Particulars PR Debit Investment in associate Cash To record investment 3,000,000 Investment in associate Investment income To share in the net income ( 40% x 3,000,000) 1,200,000 Credit 3,000,000 1,200,000 Cash Investment in Associate To record cash dividend received. 200,000 200,000 Investment in Associate Investment income Amortization of the excess attributable to equipment. 40,000 Investment income Investment in associate Amortization of the excess attributable to inventory 160,000 40,000 160,000 To compute for net investment income for the current year: Share in net income Amortization of excess attributable to equipment Amortization of excess attributable to inventory Net investment income 1,200,000 40,000 (160,000) 1,080,000 Investment in Associate 1/1 12/31 Bal. 3,000,000 1,200,000 40,000 4,240,000 3,880,000 12/31 200,000 160,000 Investment Income 12/31 160,000 160,000 360,000 12/31 1,200,000 __ 40,000 1,240,000 Balance: 1,080,000 Problem 3: Same as Problem 1, except that the equipment whose fair value was P 1,500,000 greater than the carrying amount. Solution: Acquisition cost Carrying cost of net assets acquired ( 40% x 6,000,000) Excess of cost over carrying amount Allocation of excess: Excess attributable to inventory ( 40% x 400,000) Excess attributable to equipment ( 40% x 1,000,000) Excess attributable to Land ( 40% x 200,000) Excess of net fair value over cost 6,000,000 2,400,000 600,000 (160,000) (400,000) ( 80,000) (640,000) (40,000) Journal entries: Date 2021 Jan, 1 Dec. 31 Particulars PR Debit Investment in associate Cash To record investment 3,000,000 Investment in associate Investment income To share in the net income ( 40% x 3,000,000) 1,200,000 Credit 3,000,000 1,200,000 Cash Investment in Associate To record cash dividend received. 200,000 Investment Income Investment in Associate Amortization of the excess attributable to equipment. 400,000 Investment income Investment in associate Amortization of the excess attributable to inventory 160,000 200,000 400,000 160,000 Investment in Associate Investment income Excess of net fair value 40,000 40,000 To compute for net investment income for the current year: Share in net income Amortization of excess attributable to equipment Amortization of excess attributable to inventory Excess net fair value Net investment income 1,200,000 (400,000) (160,000) 40,000 680,000 Investment in Associate 1/1 12/31 Bal. 3,000,000 1,200,000 40,000 4,240,000 3,480,000 12/31 200,000 400,000 160,000 760,000 Investment Income 12/31 400,000 160,000 560,000 12/31 1,200,000 __ 40,000 1,240,000 Balance: 680,000