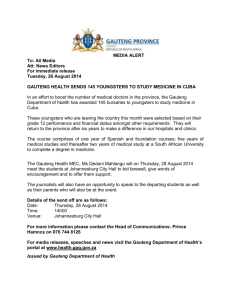

SECONDARY SCHOOL IMPROVEMENT PROGRAMME (SSIP) 2021 GRADE 12 SUBJECT: ECONOMICS SATURDAY CLASSES TERM 1 LEARNER WORKBOOK (Page 1 of 99) 1 © Gauteng Department of Education TABLE OF CONTENTS SESSION TOPIC PAGE 1 Macroeconomics: The Circular Flow 3 - 32 2 Macroeconomics: The Business Cycle-Part 1 32 - 48 3 Macroeconomics: The Business Cycle-Part 2 49 - 72 4 Macroeconomics: The Public Sector 73 - 99 2 © Gauteng Department of Education SESSION 1: MACROECONOMICS: THE CIRCULAR FLOW SECTION A: TYPICAL EXAM QUESTIONS THE CIRCULAR FLOW QUESTION 1: 20 minutes Section A – Short Questions (Taken from various sources) HINT: When answering Section A – short question, it is important not to rush but to read the questions carefully and to make sure you understand what the question is asking. Always remember one alternative is completely wrong, one is nearly correct and one is totally correct. It is easy to eliminate the completely wrong answer, but if you do not read the question carefully the nearly correct answer will also appear correct. The answer will NEVER be two options. Only ONE option is correct. Your answer will immediately be marked incorrect if you write TWO options. 1.1 Various options are provided as possible answers to the following questions. Choose the answer and write only the letter (A–D) next to the question number. 1.1.1 In the simple circular flow of economic activity, goods and services flow via… A. B. C. D. factor markets from households to firm. goods markets from household to firms. factor markets from firms to households. goods markets from firms to households. 1.1.2 In the circular flow of income and spending, that is, the basic flow of income and spending between households and firms supplemented by the foreign, financial and government sectors … A. B. C. D. exports are leakages from the circular flow. savings are injections into the circular flow. imports are injections into the circular flow. taxes are leakages from the circular flow. 1.1.3 According to the Keynesian model, the factors that influence a household’s induced consumption are the marginal propensity to consume and ….. A. its disposable income . B. its total wealth. C. The number of persons in the household. D. its net wealth. 3 © Gauteng Department of Education 1.1.4 The point labelled A2 represents A. B. C. D. Autonomous consumption. Autonomous investment. Induced consumption. Autonomous spending. 1.1.5 The goods market describes a market in which…… A. B. C. D. consumer goods and services are sold by households consumer goods and services are exchanged for money firms buy goods and services from households 0buyers and sellers of resources meet to trade 1.1.6 The two major markets in the circular flow of income and expenditure are the… . A. foreign exchange market and factor market. B. goods market and factor market. C. goods market and services market. D. factor market and production market. 1.1.7 In the circular flow of income and spending, financial institutions… A. B. C. D. act as an intermediary between those who have surplus funds and those who have deficit funds. are not always useful, as households generally spend all their available funds. create an injection into the flow by collecting savings from participants with surplus units only; therefore, there is no need to provide funds to deficit units. generally, exist to collect investment spending and transform it into savings. 1.1.8 in the circular flow of income and spending, government A. B. injects government spending into the factor market and collects taxes from the goods market. withdrawals taxes from firms and households. 4 © Gauteng Department of Education C. D. provides public goods and services to the factor market and receives labour from the goods market. withdrawals government spending by providing it to firms and withdraws taxes from households. 1.1.9 The three ways of calculating GDP are … A. B. C. D. production, prices and income methods. income, product and service methods. expenditure, spending and production methods. income, expenditure and production methods. 1.1.10 What is the value of nominal GDP in 2006 Year 2005 2006 2007 A. B. C. D. Price of mangos R3 R3 R4 Number of mangos 100 120 120 Price of oranges R10 R12 R14 Number of oranges 50 70 70 R800. R1 460. R1 060. R1 200. 1.1.11 The multiplier is useful in determining … A. B. C. D. the level of business inventories. a change in inflation resulting from a change in interest rates. a change in equilibrium production or income resulting from a change in spending. a change in unemployment resulting from a change in spending. 1.1.12 Mpho’s monthly disposable income increases from R1 800 to R2 300. As a result, his monthly savings increase from R290 to R440. This implies that his marginal propensity to consume is the following A. B. C. D. 0.60. 0.40. 0.20. 0.70. 1.1.13. In the simple Keynesian model without a government or foreign trade, assuming the MPC is 0.70. The multiplier is A. B. C. D. 1-0.7/1. 1/0.7. 1/1-0.7. 1-0.3/1. 5 © Gauteng Department of Education 1.1.14. A decrease in the marginal propensity to import results in. A. B. C. D. a decrease in the multiplier. less domestic consumption. a decrease in aggregate spending. less foreign exchange flowing out of the country. 1.1.15 The method used to derive total remuneration on factors of production is called the …. method A. B. C. D. production. income. circular. expenditure. 1.1.16 Earnings received from the export of goods and services are called … A. B. C. D. leakages. injections. taxes. savings. 1.1.17 The market for short-term savings and loans is know as…market A. B. C. D. capital . money. foreign exchange. resource. 1.1.18 A market where a currency can be exchanged for another country’s currency A. B. C. D. currency market. foreign market. foreign exchange market. capital market. 1.1.19 The continuous flow of production, income and expenditure between participants in the economy A. B. C. D. business cycle. economic equilibrium. money market. circular flow. 6 © Gauteng Department of Education 1.1.20 if the marginal propensity to consume (mpc) is 0.6 in a 2-sector model,the marginal propensity to save(mps) will be… A. B. C. D. 4. 6. 9.4. 0.4. 1.1.21 The consumption function is based on the premise that as income increases, consumption expenditure. A. B. C. D. increases by a larger amount. increases by the same amount. remains constant unless saving also changes. increases by a smaller amount. 1.1.22 The equation c=70+0.65Y, where C is consumption and Y is disposable income, tells us that… A. B. C. D. households will save R70 if their disposable income is zero and will consume 0.65 of any increase in disposable income they receive. households will consume R70 if their disposable income is zero and will consume 0.65 of any increase in disposable income they receive. households earn R70 and spend three quarters of their income. households will consume 0.35 of whatever level of disposable income they receive. 1.1.23 Spending in the economy comes from A. B. C. D. land, firms, consumers and government . households, firms, government and foreign sector. foreign sector, capital and entrepreneur. government, labour, firms and households. 1.1.24 The South Africa labour market is an example of a… A. B. C. D. 1.25 factor market. goods market. foreign exchange market. financial market. if we say that GDP=C+I+G+X-Z, then GDP has been measured using the… A. B. C. D. expenditure method. production method. income method. value-added method. (25 x 2) 7 © Gauteng Department of Education 1.2 Choose a description from COLUMN B that matches the item in COLUMN A. Write only the letter (A-I) next to the question number (1.2.1 – 1.2.8) in the ANSWER BOOK. 1.2 (A) COLUMN A COLUMN B 1.2.1 Real flow 1.2.2 Multiplier 1.2.3 Marginal propensity to save 1.2.4 Money flow 1.2.5 Leakage 1.2.6 GDP 1.2.7 Factors of production 1.2.8 Factor market A. The flow of spending B. The flow of money C. The portion of an increase in income that is not consumed. D. The ration between the eventual change in income and the initial investment. E. The flow of goods and services. F. Savings G. Inputs into the production of goods and services H. Economic growth I. Where labour, entrepreneurship, land and capital are traded (8 x 1) 1.2 (B) COLUMN A COLUMN B 1.2.1 Injection 1.2.2 Marginal propensity to consume 1.2.3 Model 1.2.4 Double counting 1.2.5 GDP 1.2.6 Open economy 1.2.7 Foreign sector 1.2.8 Imports and exports A. Forms part of closed economic circular flow B. Flows from and to the foreign sector C. Forms part of open economic circular flow D. An economy that is open to foreign trade E. The value of goods and services produced within the borders of a country in a given year F. Pensions added to the national income figures G. A simplified representation of reality H. The portion of an increase in income that is consumed. I. Government spending (8 x 1) 1.3 Provide the economic term/concept for each of the following descriptions. Write only the term/concept next to the question number. NO ABBREVIATIONS WILL BE ACCEPTED.. 1.3.1 An economy that imports and exports goods and services to other countries 8 © Gauteng Department of Education 1.3.2 A representation of the economy showing how the economic participants interact with one another 1.3.3 An economy that does not take part in international trade. 1.3.4 The flow of money from the financial sector to businesses 1.3.5 Remuneration for the factors of production in the form of rent, wages, interest and profits 1.3.6 Goods and service produced in other countries and purchased by local firms 1.3.7 The flow of goods and services from firms to households. 1.3.8 Goods and services produced locally and then sold to the foreign sector 1.3.9 The flow of money between the different economic participants 1.3.10 A compulsory payment made by a private household to the local government 1.3.11 The money which households and firms provide to financial institutions 1.3.12 The total value of all spending by households on goods and services 1.3.13 Any spending which is not derived from income 1.3.14 The total value of expenditure by the government on goods and services 1.3.15 Any flow of money which does not give rise to a further round of income from within the economy 1.3.16 A market where goods and services are exchanged 1.3.17 The value of al final goods and services produced within the borders of a country within a given period of time, usually one year 1.3.18 1.3.19 The price of one country in terms of another Communication between actual and potential buyers and actual and potential sellers of a good or services 1.3.20 The market on which factors of production are traded. 1.3.21 The market for short-term savings and loans 9 © Gauteng Department of Education 1.3.22 The financial institutions where foreign currency is bought and sold 1.3.23 The market where long-term deposits and borrowings are negotiated 1.3.24 Paid by consumers for goods and services including taxes less subsidies 1.3.25 Products that have reached the end of the production process and are used by consumers 1.3.26 The initial prices in production of final goods before taxes and subsidies are considered 1.3.27 The proportion of disposable income which households spend on consumption 1.3.28 Amount to be paid for the various factors of production used to produce goods and services 1.3.29 The proportion of additional income which households save 1.3.30 GDP at current prices 1.3.31 The portion of household spending which is independent of income 1.3.32 Production that takes place within the borders of a country 1.3.33 GDP at constant prices 1.3.34 A measure of the value of production once adjustments have been made for consumption of fixed capital 1.3.35 The output of a country produced by the factors of production owned by the permanent residents of that country, regardless of geographically location 1.3.36 The number by which the change in initial spending or withdrawal must be multiplied to determine the resulting change in income of an economy 1.3.37 The situation where a change in spending causes a disproportionate change in aggregate demand and hence in the level of aggregate income (36 x 1) 10 © Gauteng Department of Education SECTION B QUESTION 2: 20 minutes Section B (Adapted from DBE) HINT: When the question requires you to “list” or “name”, you need not write a sentence but merely one or two words. This MUST be done in bullet form. This types of questions are applicable for 2.1.1, 3.1.1 and 4.1.1 2.1 2.2 2.3. 2.4 2.5 2.6 2.7 2.8 2.9 2.10 2.11 2.12 2.13. 2.14. 2.15. Name TWO major processes in the circular flow model (2 x 1) Name TWO types of income earned labour as a production factor (2 x 1) Name TWO basic sets of markets in the economy (2 x 1) List Any TWO injections from the basic circular flow of income and spending (2 x 1) List any TWO leakages from the basic circular flow of income and spending (2 x 1) List any TWO components of the total spending on goods and services produced in a domestic economy (2 x 1) Name TWO leakages found in the multiplier four sector model (2 x 1) Name TWO institutions found in the financial market (2 x 1) List ANY two sub-markets within the factor market (2 x 1) Name any TWO items that are considered when calculating GDP at market prices Name any TWO items that are considered when calculating expenditure on GDP at market price (2 x 1) List any TWO basic assumption of the multiplier effect (2 x 1) Name any TWO items that convert Gross Value Added at factor costs to Gross Value added at basic prices. (2 x 1) List any TWO symbols used in deriving the multiplier (2 x 1) List any TWO examples of primary sector in the production method (2 x 1) QUESTION 3: (Taken from various sources) HINT: These types of questions are applicable for 2.1.2, 3.1.2 and 4.1.2 3.1 3.2. 3.3 3.4 3.5 3.6 3.7 3.8. How does proportional income tax affect aggregate spending (1 x 2) Why exports are classified as part of autonomous spending (1 x 2) Why is the Johannesburg Securities exchange important for south African investors (1 x 2) How do bonds impact mortgage rates? (1 x 2) What is the role of savings in the financial market? (1 x 2) Why is Gross national income useful to the economy (1 x 2) What is the main purpose of subsidies on production? (1 x 2) Why is the GDP at market prices normally higher than the GDP at factor cost? (1 x 2) Data Response 11 © Gauteng Department of Education HINT: All section B questions have TWO data interpretation questions – each total 10 marks. Section B consist of Questions 2-4 not as numbered in this document QUESTION 4: Study the table below and answer the questions that follow Aggregate expenditure (AE) Aggregate Income(Y) Point 250 450 900 1200 0 300 900 1300 A B C D [Adapted from www.google.com] 4.1 Give the economic concept illustrated in the table above. (1) 4.2 Identify the autonomous consumption point from the table above. (1) 4.3 Briefly describe the term injections. (2) 4.4 Explain how a decrease in savings patterns by the nation will affect the marginal propensity to consume (mpc). (2) 4.5 Suppose the other equilibrium income was R300, calculate the multiplier using the formula ∆Y / ∆ J. Show ALL your calculations. (2x2) (4) QUESTION 5: Study the graph below and answer the questions that follow. 12 © Gauteng Department of Education 5.1 Identify the original consumption function on the graph. (1) 5.2 Identify the marginal propensity to consume (mpc) from the above graph. (1) 5.3 Briefly describe the term induced consumption. (2) 5.4 How do investors impact on the multiplier? (2) 5.5 Calculate the multiplier for the above scenario. (Show all calculations) (4) QUESTION 6: Study the table below and answer the questions that follow. GROSS VALUE ADDED ACCORDING TO TYPE OF ECONOMIC ACTIVITY At current prices (R millions) 2017 2018 2019 Primary sector 369 683 368 300 398 770 Secondary sector 723 562 772 875 815 816 Tertiary sector 2 324 815 2 484 291 2 654 870 Gross value added at basic prices 3 418 060 3 625 466 A At constant 2014 prices (R millions) 2017 2018 2019 Primary sector 303 563 307 875 291 143 Secondary sector 556 028 555 915 556 935 Tertiary sector 1 888 785 1 919 390 1 945 596 Gross value added at basic prices 2 748 376 2 783 180 2 793 674 [Adapted: SARB Quarterly Bulletin, December 2019] 6.1 Which method was used in the calculation of the gross domestic product GDP above (1) 6.2 Which year is currently used as the base year by the South African Reserve Bank(SARB) (1) 6.3 Calculate Gross Value Added at ‘A’ (2) 6.4 Which sector has increased its contribution to the GDP steadily since 2017? (2) 6.5 What happened to the value added by the primary sector between 2018 and 2019?Motivate your answer. (4) 13 © Gauteng Department of Education QUESTION 7 Study the extract below and answer the questions that follow HUNTING: AN ECONOMIC INJECTION FOR SA South Africa, with its wide variety of wildlife, is seen as one of the world’s leading hunting destinations. A study which was conducted by the research unit of Tourism Research in Economic Environment and Community (Trees) in association with the Professional Hunter’s Association of South Africa (Phasa) shows that trophy hunting is an economic injection of R1, 98 billion in South Africa. [Adapted from: www.media24.com, 18 April 2018] 7.1 Which economic participant is referred to in the extract (1) 7.2 Name ONE other in the economy (1) 7.3 Briefly describe the concept injection (2) 7.4 Explain the impact of leakages in the economy (2) 7.5 How do injections influence employment in the economy? (4) QUESTION 8 Study the cartoon below and answer the questions that follow. 14 © Gauteng Department of Education 8.1 Name the type of economy in the circular flow illustrate above (1) 8.2 Identify ONE participate in the circular flow which interact with foreign sector (1) 8.3 Briefly describe the term leakages (2) 8.4 How does unemployment affect the circular flow model? (2) 8.5 Explain briefly the significance of circular flow of income. (2x2) (4) QUESTION 9 Study the table below and answer the questions that follow National account figures 2017 and 2018 at constant prices 2017 2018 R million R million Final consumption expenditure by households 1902 851 1 937 396 Final consumption expenditure by general government 629 712 A Gross fixed capital formation 618 712 609 614 B 3 189 -5 440 C -2 442 316 Gross domestic expenditure 3 151 826 3 183 398 Exports of goods and services 905 898 929 792 Imports of goods and services D 968 651 Gross domestic product 3 119 984 3 144 539 Source :SARB Item 9.1 Which method of calculating the national account is used above (1) 9.2 Name one item used to convert GDP to GNP (1) 9.3 Briefly describe the term gross fixed capital formation (2) 9.4 How do imports of goods and services affect the multiplier? (2) 9.5 Use the table above and calculate the economic growth rate for 2018.show all calculations (4) 15 © Gauteng Department of Education QUESTION 10 MULTIPLIER Assume an economy is initially in equilibrium where income (Y) equals R100 000m, savings (S) R40 000m and consumption (C) R60 000m. Source: Enjoy Economics, 2012 10.1 10.2 10.3 10.4 Briefly describe the term macroeconomic multiplier. What does the term equilibrium in the extract refer to? Calculate the marginal propensity to consume (mpc). Calculate the value of the multiplier. Show ALL calculations. (2) (2) (2) (4) HINT: To do question 10.4 you need to use your answer in question 10.3. HINT: All section B questions have TWO 8 marks questions, numbered according to questions not like in this document. QUESTION 11 Paragraph type questions – Middle Cognitive 11.1. 11.2. 11.3. 11.4. Explain the difference between production and income Draw and interpret an open four-sector circular-flow diagram. Explain how double counting can be avoided when GDP is estimated Distinguish between measurement at current prices and measurement at constant prices 11.5. Explain the difference between nominal GDP and real GDP 11.6. Distinguish the difference between GDP and GNI 11.7. Discuss gross capital formation 11.8. Explain the difference between money market and capital market 11.9. Discuss components of expenditure method 11.10. Explain the interactions between economic participants in a closed economy. 11.11. Discuss the multiplier and its effect on the national income if the marginal propensity to consume (mpc) is 0,6 and investment increases by R10 bn. 11.12. With aid of a circular flow diagram, explain the multiplier process. 11.13. Discuss basic assumption of the multiplier effect 11.14. Explain the multiplier concept with the aid of a well-labelled graph. . QUESTION 12 12.1. 12.2. 12.3. 12.4. 12.5. 12.6. 12.7. Paragraph type questions – Higher cognitive Why Are the Factors of Production Important to Economic Growth? How are leakages affecting the circular flow? How does consumption affect economic growth? How do financial institutions serve as a link between savings and investment? how does unemployment affect the circular flow of income? Why government expenditure is an injection into the economy? How does the international sector (foreign sector) affect the economy? 16 © Gauteng Department of Education 12.8. How does the circular flow of income primarily affect households? 12.9. Analyse the impact of closed economy on South Africa economy 12.10. Why does lack of education affect factor market 12.11. How does inflation affect financial markets? 12.12. Analyse the impact of drought on production? 12.13. How do investors impact on the multiplier? 12.14. How does the multiplier effect government policy? 12.15. How do taxes affect the multiplier? SECTION C HINT: All section C questions have TWO questions 5 & 6 NOT 13 like in this document. In the examination you will need to answer only one. ESSAY STRUCTURE HINT: Section C – the long question, must be answered in FOUR sections: Introduction (definition), Body (headings and full sentences in bullets) additional part and conclusion (summarising). The mark allocations for Section C is as follows: STRUCTURE OF ESSAY: Introduction The introduction is a lower-order response. • A good starting point would be to the main concept related to the question topic • Do not include any part of the question in your introduction. • Do not repeat any part of the introduction in the body • Avoid saying in the introduction what you are going to discuss in the body Body: Main part: Discuss in detail/ In-depth discussion/ Examine/ Critically discuss/ Analyse / Compare/ Distinguish/ Differentiate/ Explain/ Evaluate Additional part: Give own opinion/ Critically discuss/ Evaluate/ Critically evaluate/ Draw a graph and explain/ Use the graph given and explain/ Complete the given graph/ Calculate/ Deduce/ Compare/ Explain Distinguish / Interpret/ Briefly debate/ How/ Suggest Conclusion Any Higher or conclusion include: • A brief summary of what has been discussed without repeating facts already mentioned in the body • Any opinion or value judgement on the facts discussed • Additional support information to strengthen the discussion/analysis • A contradictory viewpoint with motivation, if required Recommendations TOTAL MARK ALLOCATION: Max 2 Max 26 Max 10 Max 2 40 [40] 17 © Gauteng Department of Education QUESTION 13 • Discuss the role of markets in the circular flow. (26 marks) • Evaluate the contribution/role of firms in growing the economy (10 marks) SECTION D: Homework 1.1.1 The expression “GDP” minus net primary income payments to the rest of the world” defines A B C D 1.1.2 At point above the 45 line in the aggregate spending function diagram A B C D 1.1.3 Aggregate expenditure is in equilibrium Aggregate spending is less than GDP Aggregate spending is greater than GDP Aggregate spending is equal to GDP Government economic activities include three major flows, namely... A B C D 1.1.4 The consumer price index The gross national product Gross domestic expenditure Net national income government spending on factors of production; tax levied on households and firms; transfer payment. government spending on factors of production; tax levied on households and firms; selling public goods and services. government spending on factors of production; government spending on goods and services; collection of income from the private sector, Transfer payment; spending on factors of production; collection of tax from the markets. Suppose South Africa does not export nor import. Therefore, South Africa’s total spending formula can be written as… A B C D 𝐴=𝐶+𝐼+𝐺. 𝐴=𝐶+𝐼+𝐺+𝑋−𝑍. 𝐴=𝐶+𝐼+𝐺+𝑋+𝑍. 𝐴=𝐶+𝐼. 18 © Gauteng Department of Education 1.1.5 Given that GDP at market prices is 350 million, subsidies on products are 16 million and taxes on products are 50 million. The value of GDP at basic prices will be … million. A B C D 1.1.6 The multiplier effect means that … A B C D 1.1.7 600 million 400 million 6000 million 4000 million In an open economy, the size of the multiplier depends on … A B C D 1.1.11 The level of economic activity Income The standard of living The terms of trade Suppose the GDP at market prices is R500 million, net primary income payments to the rest of the world is –R100 million and the exchange rate is 1$USD = R10,00. The gross national income at market prices equals A B C D 1.1.10 The income of other countries exporters. The income of our importers The income of other countries importers The income of our exporters Gross Domestic Product(GDP) is the best measure of.. A B C D 1.1.9 consumption is typically several times as large as investment. a large change in consumption can cause a much larger increase in investment. a large increase in investment can cause GDP to change by a larger amount. there is a proportional relationship between the change in income and the change in investment South Africa’s exports represent A B C D 1.1.8 300 384 316 56 Autonomous spending and equilibrium income Marginal propensity to consume, tax rate and marginal propensity to import. All the components of aggregate spending Exports minus imports If the base year prices are used during the measurement of GDP, 19 © Gauteng Department of Education then the _____________ is obtained. A B C D 1.1.12 National income will fall when: A B C D 1.1.13 Current GDP Gross national product Real GDP Nominal GDP I+G+X>S+T+M T+S+M>G+I+X Y=C+I+G+(X-M) I+G+X>C+M+S According to the information in the table, what are the values of MPC and MPS? Initial change in investment expenditure (R million) 400 A B C D 1.1.14 Change in equilibrium national income (R million) 2000 MPC is 5.0 and MPS is 5.0 MPC is 0,5 and MPS is 0.5 MPC is 8.0 and MPS is 2.0 MPC is 0.8 and MPS is 0.2 Product market Factor market Goods and services market Foreign exchange market The value of multiplier increase if the marginal propensity to…increase A B C D 1.1.16 ? Marginal propensity to save (MPS) ? Labour Relations Act 66 of 1995 A B C D 1.1.15 Marginal propensity to consume (MPC) Consume Save To invest Spending In the below diagram the multiplier is 20 © Gauteng Department of Education A B C D 1.1.17 The market for short-term savings and loans A B C D 1.1.18 Gross Domestic production Domestic production National production Net domestic production In the circular flow model, GDP would most likely increase if there was: A B C D 1.1.20 Government bonds Mortgage bonds Pension funds Foreign currencies Production that takes place within the borders of a country A B C D 1.1.19 1.5 2.0 2.5 3.0 A decrease in exports A decrease in government spending An increase in imports A decrease in savings The value of GNI at market price is 21 © Gauteng Department of Education NATIONAL AGGREGATES GDP at market prices Primary income from the rest of the world Primary income to the rest of the world GNI at market prices A B C D 1.2 3 796 460 82 235 183 779 ? 3 694 916 3 898 004 4062 474 3530 446 Choose a description from COLUMN B that matches the item in COLUMN A. Write only the letter (A – H) next to the question number (1.2.1 – 1.2.8) in the ANSWER BOOK, for example 1.2.9 J. 1.2.1 COLUMN A Systems of national accounts A COLUMN B Long term loans are obtained 1.2.2 Capital market B Owners of the factors of production 1.2.3 Households C prescribed by the United Nations to compile the gross domestic product figures 1.2.4 Gross National Product D The portion of disposable income which households spend on goods and services. 1.2.5 Marginal propensity to consume E Spending by firms on capital goods F The original prices in production, before taxes and subsidies are taken in account. G The total value of all final goods and services produced in the country during a specific period H Systematic and comprehensive record of economic activity. 1.2.6 Investment 1.2.7. National accounts 1.2.8. Basic price (8 × 1) (8) 1.3 Give ONE term for each of the following descriptions. Write only the term next to the question number (1.3.1 – 1.3.6) in the ANSWER BOOK. Abbreviations, acronyms and examples will NOT be accepted. 22 © Gauteng Department of Education 1.3.1 The market for short-term savings and loans 1.3.2 Royalties paid for the use of intellectual property and extractable natural resources. 1.3.3 Measures total expenditure of final goods and services produced within the borders of a country 1.3.4 Value of production is calculated by multiplying the volume of the final goods and services by their prices 1.3.5 The multiplier shows how an increase in spending produces a more than proportional increase in national income. 1.3.6 The movement of money in the form of income and expenditure 1.3.7 GDP at constant price is also known as 1.3.8 An economy that includes the foreign sector 1.3.9 The market where long-term deposits and borrowings are negotiated 1.3.10 The total value of expenditure by the government on goods and services QUESTION 2 2.1 Name TWO types of the economy in the circular flow (2 x 1) (2) 2.2 List any TWO financial markets in the economy (2 x 1) (2) 2.3 Name two examples of government expenditure (2 x 1) (2) 2.4 List any TWO injections in closed economy (2 x 1) (2) 2.5 Name TWO flows found in a open economy (2 x 1) (2) 2.6 List any TWO use of per capita income figures (2 x 1) (2) 2.7 Name TWO types of spending in money flow of an open economy (2 x 1) (2) 2.8 List the TWO types of markets of a factor market (2 x 1) (2) 2.9 Name TWO products sold in the money market (2 x 1) (2) 2.10 List any TWO products sold in the capital market (2 x 1) (2) 23 © Gauteng Department of Education QUESTION 3 3.1 How does the mpc relate to the multiplier? (1 x 2) (2) 3.2 Why is gross National Product of south African generally lower than the Gross Domestic Product? (1 x 2) (2) How will the multiplier be influenced when a country experiences net leakages ? (1 x 2) (2) What is the purpose of the residual item when the expenditure method is used to calculate national income? (1 x 2) (2) Why are households regarded as the important participant in the circular flow? (1 x 2) (2) Why does South Africa prescribe to the System of National Accounts as stipulated by the International Monetary Fund (IMF)? (1 x 2) (2) What effect does taxes and subsidies have on the calculation of basic prices? (1 x 2) (2) How will the scenario, I+G+X>S+T+M, effect the national income? (1 x 2) (2) How will the multiplier be influenced when foreign direct investments increase in the local economy (2) (1 x 2) What is the effect of an increased marginal propensity to consume on the multiplier? (1 x 2) (2) 3.3 3.4 3.5 3.6 3.7 3.8 3.9 3.10 DATA RESPONSE QUESTIONS (taken from various DBE past papers) 24 © Gauteng Department of Education QUESTION 4 Study the following illustration and answer the questions that follow SAVERS Firms households Financial intermediaries Government Firms Households BORROWERS 4.1 List any institution found in the financial market (1) 4.2 Name ONE leakage that exist between financial intermediaries and households. (1) 4.3 Briefly describe the term closed economy (2) 4.4 Explain the basic function of a financial intermediary 4.5 How do unemployment affect household savings ? (2) (2x2) (4) QUESTION 5 25 © Gauteng Department of Education Study the following information and answer the questions that follow Autonomous consumption Investment spending Government spending Marginal propensity to consume 50 billion Rands 200 billion Rands 250 billion Rands 0.6 5.1 Name one leakage in the four -sector model of the multiplier (1) 5.2 What is the marginal propensity to save? (1) 5.3 Briefly describe the term marginal propensity to consume (2) 5.4 Why is government spending classified as part of autonomous spending in the Keynesian model? (2) Calculate the multiplier effect above (4) 5.5 (2x2) QUESTION 6 Study the article below and answer the questions that follow. The South Africa agriculture sector is estimated to register a CAGR of 4.5% during the forecast period (2020-2025). In 2019, the price received by the farmers in the country increased by 4.3% and the prices that farmers pay for agricultural inputs increased by 5%. The increase in the population level of the country has fuelled the demand for cereals. Maize is the staple food in the country, consumed in its direct form, and is used for products, such as sweeteners, bread, and cornmeal. Wheat is also another major staple food in the country, which is mostly imported, as it is economical to import rather than produce it domestically. Most of the country’s oilseed demand is met by domestic production. However, palm oil, a well-in-demand oilseed in the country, is currently imported from Indonesia and Malaysia. In the forecast period, the country is expected to reduce imports to a great extent and become self-sufficient in the production of oilseeds. https://www.mordorintelligence.com/industry-reports/agriculture-in-south-africa-industry 6.1 What generates income in agriculture of South Africa ? (1) 26 © Gauteng Department of Education 6.2 In which market of the circular flow does agricultural fall? (1) 6.3 Briefly explain the concept net domestic production. (2) 6.4 Why is agriculture important at Johannesburg security exchange? (2) 6.5 How are households’ relations with government affected by natural disasters? (2 x 2) (4) QUESTION 7 Study the table below and answer the questions that follow. INCOME(Rands) CONSUMPTION (Rands) 0 10 50 50 100 90 150 130 200 170 Savings (Rands) -10 0 10 20 30 Investment (Rands 20 20 20 20 20 7.1 What is the marginal propensity to save? (1) 7.2 What is the marginal propensity to consume (mpc) on the above table? (1) 7.3 7.4 7.5 Describe the term national income multiplier (2) Discuss how a decrease in investment spending will affect the equilibrium level of income in a simple Keynesian model. (2) Explain the economic significance of the intercept and the slope of the consumption function. (4) Question 8 Study the picture below and answer the questions that follow 27 © Gauteng Department of Education DIGITIZATION LEADS STANDARD BANK TO CLOSE BRANCHES, CUT JOBS The future of traditional banking in South Africa is under the spotlight after standard bank announced its closing 91 branches and cutting around 1,200 jobs. 8.1 Name the market above (1) 8.2 Which key institution is involved in the market illustrated? (1) 8.3 Briefly describe the term corporation for public deposits (CPD) (2) 8.4 How is the foreign exchange market affected with current news of standard bank? (2) 8.5 Explain why the investment function has a negative slope (4) QUESTION 9 Study the diagram below and answer the questions that follow. 28 © Gauteng Department of Education 9.1 What is depicted in the diagram above (1) 9.2 Which participants is the major consumer in the economy (1) 9.3 Briefly describe the term circular flow (2) 9.4 What is the role of the factor market in the circular flow (2) 9.5 How does the multiplier effect influence the government in marking decisions? (2x2) (4) QUESTION 10 Study the table below and answer the questions that follow. 29 © Gauteng Department of Education 10.1 Which method was used in the calculation of the gross domestic product (GDP) above? (1) 10.2 Which year is currently used as the base year by the South African Reserve Bank (SARB)? (1) 10.3 Briefly describe the term gross national product. (2) 10.4 Which sector has increased its contribution to the GDP steadily since 2014? (2) 10.5 What happened to the value added by the primary sector between 2015 and 2016? Motivate your answer. (2x2) (4) QUESTION 11 Study the diagram below and answer the questions that follow. Gross national Income 2016 to 2019 30 © Gauteng Department of Education 11.1 When did south African reach its highest GNI? (1) 11.2 Name ONE method that can be used to calculate the GDP (1) 11.3 Briefly describe the concept gross national income. (2) 11.4 How would the GNI @ market prices be calculated? (2) 11.5 Explain the importance of measuring national account aggregates. (4) QUESTION 12 Study the diagram below and answer the questions that follow. 12.1 Identify the original consumption function on the graph above. (1) 12.2 What is the marginal propensity to consume (mpc) on the graph? (1) 12.3 Briefly describe the term induced consumption. (2) 12.4 How will an increase in government spending affect the multiplier? (2) 12.5 Use the formula K = ΔY/ΔI to calculate the multiplier from the scenario. Show ALL calculations. (4) QUESTION 13 (2x2) Paragraph type questions-Middle cognitive 31 © Gauteng Department of Education 13.1 Illustrate and explain how an increase in the income level will affect the money market. (8) 13.2 With aid of diagram of multiplier explain how the economy move due to an increase in investment as a result of decrease in the interest rate level (8) 13.3 Use the following diagram to show how an increase in autonomous consumption expenditure will influence the economy (8) 13.4 Differentiate between subsidies on production and subsidies on products (8) 13.5 Differentiate between taxes on production and taxes on products. (8) QUESTION 14 Paragraph type questions-Higher cognitive 14.1 How can the multiplier be used to analyze the economic impact of professional sports? (8) 14.2 How can households as an important participant in the circular flow model contribute in building the economy (8) 14.3 How is Gross domestic Product derived by using the expenditure method 14.4 Analyse the impact of unemployment on financial sector (8) 14.5 How are national account conversions made? (8) (8) 32 © Gauteng Department of Education SESSION 2: MACROECONOMICS: BUSINESS CYCLES PART 1 SECTION A: TYPICAL EXAM QUESTIONS 10 minutes Section A – Short Questions QUESTION 1: HINT: When answering Section A – short question, it is important not to rush but to read the questions carefully and to make sure you understand what the question is asking. Always remember one alternative is completely wrong, one is nearly correct and one is totally correct. It is easy to eliminate the completely wrong answer, but if you do not read the question carefully the nearly correct answer will also appear correct. The answer will NEVER be two options. Only ONE option is correct. Your answer will immediately be marked incorrect if you write TWO options. 1.1 Various options are provided as possible answers to the following questions. Choose the answer and write only the letter (A–D) next to the question number. 1.1.1 Negative economic growth for at least two consecutive quarters of the year is referred to as … A B C D 1.1.2 An economic slump associated with a reduction in purchasing power is called a … A B C D 1.1.3 A boom A depression A recession Recovery Boom Prosperity Depression Peak The point where economic expansion is at its highest. A B C D Boom Peak Recovery phase Trough 33 © Gauteng Department of Education 1.1.4 A monetary policy that attempts to curb economic activity is known as … policy. A B C D 1.1.5 Fluctuating factors that originate outside the economic system are referred to as ... factors. A B C D 1.1.6 Recession Recovery Depression Trough In the business cycle, the opposite of a peak is a/an… A B C D 1.1.9 Expansionary Restrictive Money supply Interest rates Employment figures in the business cycle will increase during a … A B C D 1.1.8 Indigenous Exogenous Endogenous International A fiscal policy that attempts to stimulate economic activity. A B C D 1.1.7 Lagging Monetary Expansionary Restrictive Upswing Trough Downswing Recession During a downswing phase, cyclical unemployment will … and inflation will … A B C D Increase; decrease Decrease; decrease Decrease; increase Increase; increase 34 © Gauteng Department of Education 1.1.10 In the business cycle, an economic expansion occurs… A B C D 1.1.11 f the government intends making use of a contractionary fiscal policy, it should … A B C D 1.1.12 Recovery phase Peak phase Expansion phase Trough phase Expansionary fiscal policy refers to_______, while contractionary fiscal policy refers to_______. A B C D 1.1.14 Decrease taxes and decrease government spending. Decrease taxes and increase government spending. Increase the interest rate. Increase taxes and decrease government spending The phase of the business cycle, in which almost all available resources in the economy are in use, is referred to as… A B C D 1.1.13 at the peak. between the peak and trough. at the trough. between the trough and the peak. an increase in government borrowing; decrease in government spending decrease in taxes; increase in government spending an increase in government spending ;an increase in taxes demand management policy, monetary policy The business cycle shows … A B C D phases of economic cycles as the production output of goods and services fluctuates due to changes in policy, demand factors and supply factors. phases of economic activities as the production of goods only increases or decreases due to changes in aggregate demand. Patterns of economic fluctuations along the short-term trend Patterns of upswings and expansion around the long-term trend 35 © Gauteng Department of Education 1.1.15 Name the economic period between A and B A B C D 1.2 Contraction Recovery Expansion Peak Choose a description from COLUMN B that matches the item in COLUMN A. Write only the letter (A – I) next to the question number (1.2.1 – 1.2.8) in the ANSWER BOOK, for example 1.2.9 J. A COLUMN B The highest point between the end of an economic expansion 1.2.2 Peak B Changes in business conditions 1.2.3 Economic fluctuations 1.2.4 Endogenous factors C Originate within the market system D A phase of full employment 1.2.5 Jugler cycles E The rate of inflation decreases F Changes in net investments by business and government 1.2.1 COLUMN A Economic expansion 1.2.6 Economic boom 1.2.7 Economic recession 1.2.8 Monetary policy G General period of rising economic activity, resulting in an increase in real GDP Measures taken by SARB to influence the supply of money and interest rate. (8 × 1) 8) 36 © Gauteng Department of Education 1.3 Give ONE term for each of the following descriptions. Write only the term next to the question number (1.3.1 – 1.3.15) in the ANSWER BOOK. Abbreviations, acronyms and examples will NOT be accepted. 1.3.1 Government policy which is aimed at stimulating economic activity 1.3.2 Believes that the market economy is always stable 1.3.3 A period in the economy when economic activity decrease 1.3.4 Government policy aimed at slowing down a fast-growing economy that is accompanied by high rates of inflation 1.3.5 Causes of business cycles which come from inside the economy itself 1.3.6 Causes of business cycles that come from outside the economy 1.3.7 A combination of taxation policy and government spending used to regulate the economy 1.3.8 A fiscal policy that attempts to dampen economic activity 1.3.9 An approach that advocates monetary policy should be used to smooth out economic cycles 1.3.10 Business cycles that last between three and five years 1.3.11 The recurrent but not periodic pattern of expansion and contraction 1.3.12 The lowest point between the end of an economic recession and economic expansion 1.3.13 A phase of the business cycle following a recovery in which economy is at full employment 1.3.14 The highest point between economic expansion and recession 1.3.15 Business cycles that last 50 years and longer 37 © Gauteng Department of Education QUESTION 2: HINT: When the question requires you to “list” or “name”, you need not write a sentence but merely one or two words. This MUST be done in bullet form. 2.1 List any TWO types of business cycles 2.2 Name TWO turning points in business cycles 2.3 Name TWO periods recognized in business cycles 2.4 List any TWO phases found in expansion period 2.5 Name any TWO monetary policy instruments 2.6 List any TWO examples of endogenous factors 2.7 Name any TWO examples of exogenous factors 2.8 List TWO instruments of fiscal policy that government can use 2.9 Name any TWO phases found in the contraction period 2.10 Name TWO methods used employed in economic forecasting QUESTION 3: (Taken from various sources) 3.1 How does a recession affect the average person? (1x2) 2 3.2 How does depression affect the economy? (1X2) 2 3.3 How (1x2) 3.4 does fiscal policy affect economy ? 2 Why is fiscal policy important (1x2) ? 2 3.5 Why is monetary stability important (1x2) 2 3.6 How does a phase of expansion lead to recession? (1X2) 2 3.7 What happens to prices when the economy is in a trough? (1X2) 2 3.8 Why do lower interest rates lead to increased investment? (1x2) 2 3.9 Why does the level of economic activity fluctuate? (1X2) 2 38 © Gauteng Department of Education 3.10 How does the state use fiscal policy to influence business cycles? (1x2) 2 QUESTION 4: Study the information and answer the questions that follow l 4.1 Identify the point marked 'C' in the graph above. (1) 4.2 Which feature underpinning forecasting is represented by AC? (1) 4.3 Briefly describe the term business cycle. (2) 4.4 Explain the significance of a long-term trend in the economy. (2) 4.5 How effective are leading indicators in business forecasting? (2x2) (4) 39 © Gauteng Department of Education QUESTION 5: Study the information and answer the questions that follow 5.1 Give the alternative term for recovery (growth) as depicted from trough to peak in the diagram. (1) 5.2 How is the length of a business cycle measured? (1) 5.3 Briefly describe the term business cycle. (2) 5.4 Explain the government policy that is effective in smoothing-out the business cycle when the economy is at the peak. (2) How effective are government policies in stimulating the economy at the trough? (2x2) (4) 5.5 40 © Gauteng Department of Education QUESTION 6: Study the information and answer the questions that follow SA DOWNGRADE SETS SCENE FOR GREATER TURMOIL The Minister of finance warns that Moody’s action to downgrade South Africa will add to prevailing financial market stress caused by the technical recession emanating from power outages and currently the COVID 19. South Africa’s financial markets, hit by dislocation that prompted Reserve Bank intervention could have a shaky start after Moody’s stripped the country of its last remaining investment-grade rating. Source: Adapted from: https://mg.co.za/business/2020-03-28-moodys-junk-status-south-africa-economy/ 6.1 Name the phase of the business cycle that is discussed on the above information. (1) According to the above information, what has been the cause for the contractions in the economy? (1) 6.3 Briefly describe the trough. (2) 6.4 Briefly explain how loss of income can negatively affect the performance of economic activities. (2) How can the Monetary Policy Committee use interest rate as a tool to reduce slow economic performance? (2x2) (4) 6.2 6.5 41 © Gauteng Department of Education QUESTION 7: Study the information and answer the questions that follow 7.1 What message is depicted in the above cartoon? (1) 7.2 What main economic indicator is used to determine the state of the South African Economy? (1) 7.3 Give a reason for the current state of the economy. (2) 7.4 How can government stabilise the business cycle? (2) 7.5 How can the South African government avoid public – sector failure? (2x2) (4) 42 © Gauteng Department of Education QUESTION 8: Study the information and answer the questions that follow SOUTH AFRICA FACING ITS LONGEST DOWNWARD BUSINESS CYCLE SINCE 1945: According to a report by the Centre for Risk Analysis, South Africa’s latest business cycle has been in a downward phase since 2013. It seems unlikely that the cycle will experience an upward trajectory in the near future. Adapted source: https://www.thesouthafrican.com/south-africa-worst-business-cycle 8.1 Identify the longest period (months) in which South Africa experienced an upswing in the economy. (1) 8.2 How long (years) is the current downswing of the South African economy? (1) 8.3 Briefly describe the term economic trend (2) 8.4 Why are long upward amplitudes preferred than long downward amplitudes in the economy? (2) 8.5 How can the South African government use open market transaction to overcome the above ongoing economic decline? (2x2) (4) 43 © Gauteng Department of Education QUESTION 9: Study the information and answer the questions that follow 9.1 Identify a trough in the business cycle above. (1) 9.2 During which year was the first business cycle fully completed in the graph above? (1) 9.3 Briefly describe the term(actual) business cycle (2) 9.4 How can the South African government use government spending as fiscal measure to stimulate the economy? (2) 9.5 How could the South African Reserve Bank have prevented the business cycle from plunging to T3? (2x2) (4) 44 © Gauteng Department of Education QUESTION 10: Study the information and answer the questions that follow 10.1 Name ONE endogenous cause of business cycles (1) 10.2 Describe the state of an economy during a recession (1) 10.3 When is an economy officially in recession (2) 10.4 What can the SARB do to stimulate the economy? (2) 10.5 How can aggregate supply be increase to combat inflation caused by excess demand? (2x2) (4) QUESTION 11: Study the information and answer the questions that follow FNB MAINTAINS 7% PRIME LENDING RATE AFTER SARB INTEREST RATES DECISION Following the South African Reserve Bank’s (SARB) decision to keep interest rates unchanged, FNB will maintain its prime lending rate at 7 percent. FNB will review its position after the next SARB Monetary Policy Committee meeting in March 2021. Source: https://www.iol.co.za/business-report/companies/fnb-maintains-7-prime-lending-rate-after-sarb-interestrates-decision-fab41ba3-778f-4873-a3b5-4c02d582fb4a 45 © Gauteng Department of Education 11.1 Name the government policy above (1) 11.2 Who is the governor for South Africa Reserve Bank (1) 11.3 Briefly describe the interest rate (2) 11.4 How do exchange rate policy affect business? (2) 11.5 Discuss a combination of monetary and fiscal policies (2x2) (4) QUESTION 12: Study the cartoon below and answer the questions that follow 12.1 Name the causes of exogenous factor above (1) 12.2 Identify the period of business cycles caused by bad weather (1) 12.3 Briefly describe the term exogenous factor (2) 12.4 How does weather affect demand? (2) 12.5 Discuss the endogenous factors as a cause of business cycle. (4) QUESTION 13: 46 © Gauteng Department of Education Study the information and answer the questions that follow RECESSION D E C L I N E INTEREST RATE RATE OF INFLATION ECONOMIC ACTIVITY EMPLOYMENET D E C L I N E 13.1 Which phase is after recession in the business cycle (1) 13.2 Name ONE period of business cycles (1) 13.3 Briefly describe the term recession (2) 13.4 Explain the statement “was that your stomach growling” (2) 13.5 How effective will an expansionary monetary policy be in times of recession? (2x2) (4) QUESTION 14 Paragraph type of questions Middle order 14.1 Demonstrate a typical business cycle (8) 14.2 Explain the nature of business cycle (8) 14.3 Discuss types of business cycles (8) 14.4 Distinguish between taxes and government expenditure (8) 14.5 Discuss interest rate and open market transactions as instruments of monetary (8) 47 © Gauteng Department of Education 14.6 Discuss cash reserve requirement and moral suasion as instruments of monetary QUESTION 15 Paragraph type of questions (8) Higher cognitive 15.1 How could the monetarists’ viewpoint on government policies cause a contraction in a business cycle? (8) 15.2 Evaluate the use of fiscal policies to influence the economy. (8) 15.3 How has the Keynesian (endogenous) school of thought influence the business cycle? (8) 15.4 How will businesses react to the different phases in the business cycle? (8) 15.5 How does like of investors contribute to trough in a typical business cycle? (8) 48 © Gauteng Department of Education SESSION 3: MACROECONOMICS: BUSINESS CYCLES PART 2 SECTION A: TYPICAL EXAM QUESTIONS Section A – Short Questions QUESTION 1: HINT: When answering Section A – short question, it is important not to rush but to read the questions carefully and to make sure you understand what the question is asking. Always remember one alternative is completely wrong, one is nearly correct and one is totally correct. It is easy to eliminate the completely wrong answer, but if you do not read the question carefully the nearly correct answer will also appear correct. The answer will NEVER be two options. Only ONE option is correct. Your answer will immediately be marked incorrect if you write TWO options. 1.1.1 The difference in the value of the output at the peak and the value of the output at the trough of a business cycle is known as the… A B C D 1.1.2 An indication of long-term growth in the economy is referred to as the … A B C D 1.1.3 Length Trend line Amplitude Real output Trend line Amplitude Length trough A focus on the improvement of input efficiency is a characteristic of the … policy. A B C D Demand side Monetary Demand -and supply side Supply side 49 © Gauteng Department of Education 1.1.4 The activity that minimizes the effects of short-term economic fluctuations is called … A B C D 1.1.5 In a business cycle, estimating something known from Information that is unknown is called … A B C D 1.1.6 Leading Co-incident Lagging Composite Demand -side Supply side Demand and supply side Monetary Changes in technology will lead to a … business cycle. A B C D 1.1.9 before The new economic paradigm is embedded in … policy/policies. A B C D 1.1.8 Amplitude Extrapolation Trend Interpolation Economic indicator which shows changes changes in general level of economic activities. A B C D 1.1.7 Amplitude A trend Moving average Extrapolation Demand-driven Supply driven Political Kuznets A focus on the improvement of input efficiency is a characteristic of the … side policy. A B C D Demand Supply Fiscal Monetary The number of new vehicles sold is a … business cycle 50 © Gauteng Department of Education 1.1.10 indicator. A B C D 1.1.11 The Phillips curve shows that an increase in aggregate demand will result in … and … A B C D 1.1.12 a decrease in unemployment rate; a decrease in inflation rate. an increase in unemployment rate; a decrease in inflation rate. an increase in unemployment rate; a decrease in inflation rate. a decrease in unemployment rate; an increase inflation rate. The Phillips curve shows the relationship between the… A B C D 1.2 Lagging Coincident Leading Social Nominal interest rate and the real interest rate. Unemployment rate and the inflation rate. Inflation rate and the interest rate. Unemployment rate and the interest rate. Choose a description from COLUMN B that matches the item in COLUMN A. Write only the letter (A – F) next to the question number (1.2.1 – 1.2.6) in the ANSWER BOOK, for example 1.2.9 J. COLUMN A 1.2.1 Trend A COLUMN B Difference in the value of total output between peak and a trough 1.2.2 Amplitude B To identify a trend and then make predictions accordingly C Manufacturing labour productivity 1.2.3 Extrapolation 1.2.4 Philips curve total value of goods and services produced in an economy 1.2.5 Leading economic indicator D inflation and unemployment have a stable and inverse relationship E General direction of the economy F Number of hours worked in construction 1.2.6 Aggregate supply (6 × 1) 1.3 (6) Give ONE term for each of the following descriptions. Write only the term next 51 © Gauteng Department of Education to the question number (1.3.1 – 1.3.6) in the ANSWER BOOK. Abbreviations, acronyms and examples will NOT be accepted. 1.3.1 Economic indicators that do not change direction until after business cycles changed its direction 1.3.2 the straight line in the business cycle model, which is usually upward sloping and shows the long-run pattern of change in real GDP over time 1.3.3 the total supply of goods and services produced by a nation’s businesses 1.3.4 the total demand for a nation’s output, including household consumption, government spending, business investment, and net exports 1.3.5 A statistic used to measure some aspect of the economy 1.3.6 Economic indicator which changes before the economy changes 1.3.7 Economic indicators that simply move at the same time together with the aggregate economic activity 1.3.8 Amount of time it takes to move through one complete cycle 1.3.9 The difference in the value of total output between a peak and trough QUESTION 2: HINT: When the question requires you to “list” or “name”, you need not write a sentence but merely one or two words. This MUST be done in bullet form. 2.1 Name TWO economic paradigm policies. 2.2 List (2X1) 2.3 any TWO (2X1) economic 2 indicators. 2 Name (2X1) any TWO non-economic indicators. 2 2.4 List any TWO examples of leading economic indicators. (2X1) 2 2.5 Name any TWO examples of coincident economic indicators. (2X1) 2 2.6 List 2 any TWO lagging economic indicators. 52 © Gauteng Department of Education (2X1) 2.7 Name TWO segments of Philips curve. (2X1) 2 2.8 List any TWO economic sources of efficiency. (2X1) 2 2.9 Name TWO measures of supply-side policies. (2X1) 2 QUESTION 3: (Taken from various sources) 3.1 Why does unemployment decrease when GDP increases? (1x2) 2 3.2 What is a criticism of the Phillips curve? (1x2) 2 3.3 How can extrapolation be used in predicting the trend of the economy? (1x2) 2 Why does a business cycle diagram serve as a forecasting model? (1x2) 2 Why does unemployment rise during the recession phase of the business cycle? (1x2) 2 3.4 3.5 Data Response QUESTION 4: Study the graph below and answer the questions that follow 53 © Gauteng Department of Education 4.1 Provide a name for the graph given above. (1) 4.2 What is the original natural rate of unemployment in the graph above? (1) 4.3 Briefly describe the term new economic paradigm. (2) 4.4 Explain how the government can use its fiscal policy to speed up the recovery of an economy. (2) 4.5 With the aid of a graph, illustrate the effect of demand-side and supply-side policies in smoothing out business cycles. (2x2) (4) QUESTION 5: Study the information and answer the questions that follow October 2018 35 044 South Africa: New Passenger Car Sales October 2019 35 904 5.1 What type of economic indicator is reflected in the table above? (1) 5.2 In addition to your answer in above, name any other type of economic indicator. (1) 5.3 Briefly describe the term economic indicator. (2) 5.4 Explain the trendline of a business cycle’ (2) 5.5 Analyse the state of the economy by using the data provided in the table above. (2x2) (4) 54 © Gauteng Department of Education QUESTION 6: Study the cartoon and answer the questions that follow 6.1 Identify the phenomenon illustrated above. (1) 6.2 Name the infrastructure services in the illustration. (1) 6.3 Briefly describe the term monetary policy (2) 6.4 Explain under which circumstances monetary policy will be most effective to stimulate demand and increase the income level in the aggregate demand and aggregate supply. (2) 6.5 How will price increase affect the economy and standard of living? (4) 55 © Gauteng Department of Education QUESTION 7: Study the graph and answer the questions that follow Foreign Direct Investment in South Africa decreased by 16545 ZAR Billion in the third quarter of 2020 Adapted source: https://tradingeconomics.com/south-africa/foreign-direct-investment 7.1 Name the approach of business cycle shown above (1) 7.2 Which year is having the least on investment? (1) 7.3 Briefly describe the term lagging economic indicators (2) 7.4 How an increase in investment may affect unemployment? (2) 7.5 Calculate the moving averages from January 2018 to January 2020 (2x2) (4) 56 © Gauteng Department of Education QUESTION 8: Study the graph below and answer the questions that follow 8.1 Name the new economic paradigm policy illustrated above. (1) 8.2 What do you think will happen to the AD curve when there is a decrease in consumer confidence or business confidence? (1) 8.3 Briefly describe the term aggregate supply. (2) 8.4 Explain how Changes by Consumers and Firms Can Affect AD. (2) 8.5 How Government Macroeconomic Policy Choices Can Shift AD (2x2) (4) 57 © Gauteng Department of Education QUESTION 9: Study the information and answer the questions that follow 9.1 Name the new economic paradigm policy illustrated above. (1) 9.2 Identify the original equilibrium intersection. (1) 9.3 Briefly describe the term aggregate demand. (2) 9.4 When does a supply shock shift potential GDP? (2) 9.5 How does changes in input prices shift the AS curve? (2x2) (4) 58 © Gauteng Department of Education QUESTION 10: Study the extract below and answer the questions that follow ECONOMIC INDICATORS USED IN FORECASTING Decreases in newspaper job advertisements, a deterioration in the composite leading business cycle indicators of South Africa’s major trading partners, fewer hours worked in the manufacturing sector and softer commodity prices in the month all contributed to a fall. . 10.1 Identify an example of a leading economic indicator from the above extract. (1) Name the factor that contributed to a fall in the manufacturing Sector. (1) 10.3 Briefly explain the term composite indicator. (2) 10.4 Explain how leading economic indicators are used in forecasting? (2) 10.5 How can the government use fiscal policy to stimulate the economy? (4) 10.2 (2x2) QUESTION 11: Study the information and answer the questions that follow Imports into South Africa reached an all-time high of over R125 billion in October of 2018. This year, however, the import industry has suffered under restrictions and delays caused by the global pandemic. According to Trading Economics imports into South Africa are expected to be around R103 billion by the end of this quarter. They estimate imports into South Africa to reach around R105 billion in the next 12 months. In the long-term, South African imports are projected to trend around R106 billion during 2021, increasing to R108 billion by 2022. So, while there is a definite decline, there are clear signs that the import sector is ready to pick up again. SA’s main imports are: machinery (23.5% of total imports), mineral products (15.1%), vehicles and aircraft vessels (10%), chemicals (10.9%), equipment components (8.1%) and iron and steel products (5.3%r 11.1 Identify an example of a leading economic indicator from the above (1) 59 © Gauteng Department of Education extract. 11.2 Name ONE example of lagging indicator on the above extract. (1) 11.3 Briefly explain the term lagging indicator. (2) 11.4 Why is the unemployment rate an important economic indicator? (2) 11.5 How does real output affect unemployment? (4) (2x2) QUESTION 12: Study the information and answer the questions that follow 12.1 Name the feature underpinning forecast labelled A. (1) 12.2 Identify the economic phase which occurs at A. (1) 12.3 Briefly describe the term length of a business cycle. (2) 12.4 What is the purpose of a trend line? (2) 12.5 How is the length of a particular business cycle measured? QUESTION 13 Paragraph type of questions (2x2) (4) Middle order 60 © Gauteng Department of Education 13.1 Discuss moving averages for 6 with numerical values as features underpinning forecasts (8) 13.2 Distinguish the difference between amplitude and extrapolation as features of underpinning forecasts (8) 13.3 With aid of diagram discuss Philips curve as demand-side policies (8) 13.4 Explain reduction in costs as a supply -side policies (8) 13.5 Discuss expansionary and contractionary policies in smoothing out business cycles (8) 13.6 Explain the effect of demand-side and supply-side policies using a graph (8) 13.7 Discuss lagging and composite as features of underpinning forecasting (8) 13.8 Use a diagram and discuss the cycle length and amplitude as features underpinning forecasting (8) 13.9 With aid of diagram discuss the cycle length and the trend line as features underpinning forecasting (8) 13.10 Discuss leading and coincidence as features underpinning forecasting (8) QUESTION 14 Paragraph type of questions Higher cognitive 14.1 How does unemployment and inflation affect GDP? (8) 14.2 How important are low direct tax rates to achieving supply side improvements? (8) 14.3 How has the widespread use of the internet affected the supply side of an economy (8) 14.4 Why is it impossible to achieve zero unemployment and low inflation rates in an economy? (8) 14.5 Why are leading indicators important in forecasting business cycles? (8) SECTION C 61 © Gauteng Department of Education HINT: All section C questions have TWO questions 5 & 6 NOT 9 & 10 like in this document. In the examination you will need to answer only one. ESSAY STRUCTURE HINT: Section C – the long question, must be answered in FOUR sections: Introduction (definition), Body (headings and full sentences in bullets) additional part and conclusion (summarising). The mark allocations for Section C is as follows: MARK STRUCTURE OF ESSAY: ALLOCATION: Introduction Max 2 The introduction is a lower-order response. • A good starting point would be to the main concept related to the question topic • Do not include any part of the question in your introduction. • Do not repeat any part of the introduction in the body • Avoid saying in the introduction what you are going to discuss in the body Body: Main part: Discuss in detail/ In-depth discussion/ Examine/ Critically Max 26 discuss/ Analyse / Compare/ Distinguish/ Differentiate/ Explain/ Evaluate Additional part: Give own opinion/ Critically discuss/ Evaluate/ Critically evaluate/ Draw a graph and explain/ Use the graph given and Max 10 explain/ Complete the given graph/ Calculate/ Deduce/ Compare/ Explain Distinguish / Interpret/ Briefly debate/ How/ Suggest Conclusion Any Higher or conclusion include: Max 2 • A brief summary of what has been discussed without repeating facts already mentioned in the body • Any opinion or value judgement on the facts discussed • Additional support information to strengthen the discussion/analysis • A contradictory viewpoint with motivation, if required Recommendations TOTAL 40 QUESTION 15 • Discuss in detail the demand-side policies used in ‘smoothing of cycles’ (26 marks) • Explain the effect of supply-side policies on South Africa economy (10 marks) QUESTION 16 • Discuss in detail the supply- side policies used in ‘smoothing of cycles’ (26 marks) • Explain peak and trough by using the Philips curve (10 marks) SECTION D: Homework 62 © Gauteng Department of Education 1.1.1 The new economic paradigm is embedded in … policy/policies. A B C D 1.1.2 The distance of the fluctuation of a variable from the trend-line is measured by the … A B C D 1.1.3 Prosperity Downswing Trough Depression Indicators which change before the business cycle changes are called …indicators. A B C D 1.1.6 demand-driven political supply-driven kitchin Which period of the business cycle is associated with increased profits and consumption? A B C D 1.1.5 moving average amplitude frequency trough Changes in technology will lead to a … business cycle A B C D 1.1.4 supply-side demand and supply-side demand-side inflation lagging leading coincident composite A technique used in forecasting to predict the unknown by using facts or information that is known is called … A B C D extrapolation estimation innovation moving average 63 © Gauteng Department of Education 1.1.7 During an economic recession … A B C D 1.1.8 An approach that advocates that monetary policy should be used to smooth out economic cycles A B C D 1.1.9 increase. upswing. downswing. expansion. A cycle that shows strength has a… A B C D 1.2 weather patterns immobility of markets demand patterns of consumers technological change Retrenchment is the effect of an economic … A B C D 1.1.12 restrictive fiscal policy monetary policy expansionary fiscal policy SARB policy Exogenous factors, such as … will cause fluctuations in the level of economic activity. a b c d 1.1.11 Keynesiian Monetarists Marxism New economic paradigm A fiscal policy that attempts to stimulate economic activity is called … A B C D 1.1.10 unemployment will increase. production increases. spending increase. real GDP will increase. long wave length. short wave length. high fluctuation. high amplitude. Choose a description from COLUMN B that matches the item in COLUMN A. Write only the letter (A – L) next to the question number (1.2.1 – 1.2.12) in the ANSWER BOOK, for example 1.2.13 - P. 64 © Gauteng Department of Education Column A Column B 1.2.1 New economic A. Exogenous factor influencing business cycles paradigm 1.2.2 Political shocks B. Successive periods of fluctuations in economic activities 1.2.3 Monetarist approach C. The downwards phase of the business cycle. 1.2.4 Depression D. Used to measure trends in the economy e.g. GDP 1.2.5 Contraction phase E. Stabilising markets using monetary and fiscal policy 1.2.6 Phillips curve F. A fiscal policy that attempts to dampen economic activity 1.2.7 Leading indicators G. A fiscal policy that attempts to stimulate economic activity 1.2.8 Economic indicator H. Economic activity is at its lowest. Deepening of the recession 1.2.9 Extrapolation I. Believes that markets are inherently stable. 1.2.10 Business cycle J. Illustrates the relationship between Unemployment and inflation 1.2.11 Expansionary fiscal K. The technique of using known facts/ Policy. information to predict unknown information. 1.2.12 Restrictive fiscal L. Building plans passed, opinion surveys and policy job advertisements 1.3 Give ONE term for each of the following descriptions. Write only the term next to the question number (1.3.1 – 1.3.8) in the ANSWER BOOK. Abbreviations, acronyms and examples will NOT be accepted. 1.3.1 A phase of a business cycle following a recession, in which there are very low levels of economic output, mass unemployment and low levels of aggregate income 1.3.2 A policy instrument that uses tax and public expenditure to even out the swings of the business cycle 1.3.3 A business cycle caused by changes in activity in the building, and construction industry 1.3.4 The method of predicting the future of a business cycle, based on historical data 1.3.5 The recurrent but not periodic pattern of increasing and decreasing economic activity 65 © Gauteng Department of Education 1.3.6 A period of sever economic prosperity 1.3.7 The distance from the trend line to the peak and the trough 1.3.8 Factors that cause fluctuations which originate outside the market system SECTIOB B: QUESTION 2 2.1 Name any TWO types of interest rate indicators (2 x 1) (2) 2.2 Name TWO service indicators (2 x 1) (2) 2.3 List any TWO monetary policy instruments (2 x 1) (2) 2.4 Name TWO turning points in a typical business cycle (2 x 1) (2) 2.5 Name any TWO measures that improve market efficiency (2 x 1) (2) 2.6 List TWO measures to improve the efficiency of inputs (2 x 1) (2) QUESTION 3 3.1 How does the South African government try to smooth out fluctuations in the business cycle? (1x 2) 3.2 How will the contraction phase of a business cycle influence the economy through interest rates? (1 x 2) 3.3 (2) (2) How can extrapolation be used in predicting business cycles? (2) 3.4 How is length and amplitude of a typical business cycle measured? (2) 3.5 Why do investors loss confidence during trough? (1 x 2) (2) DATA RESPONSE QUESTION 4 66 © Gauteng Department of Education Study the following extract and answer the questions that follow 4.1 Identify the trend line in the business cycle above. (1) 4.2 Which letter represents a trough in the diagram above? (1) 4.3 Briefly describe the term business cycle. (2) 4.4 Explain economic activity during phase EF in the business cycle. (2) 4.5 How can the length (BF) be used in forecasting of business cycles? (2x2) (4) QUESTION 5 67 © Gauteng Department of Education Study the following information and answer the questions that follow 5.1 What do dotted lines a and b represent? (1) 5.2 Name turning point D? (1) 5.3 Briefly describe the term real (actual) business cycles. (2) 5.4 What is the importance of the length (T2–T3) of a business cycle? (2) 68 © Gauteng Department of Education 5.5 What can the government do to ensure that high inflation does not occur during peaks of business cycles? (2x2) (4) QUESTION 6 Study the article below and answer the questions that follow. 6.1 How long does a Juglar cycle last? (1) 6.2 What is the slope of the trendline in the above graph? (1) 6.3 Describe the term composite indicator. (2) 6.4 Explain briefly the government’s aim with business cycle policies. (2) 6.5 How can the length of a business cycle be used in forecasting? (4) 69 © Gauteng Department of Education QUESTION 7 Study the table below and answer the questions that follow. YEAR GDP(bn) 2017 5 2018 8 2019 9 2020 11 2021 4 7.1 Name any other economic indicators used in forecasting (1) 7.2 List ONE reason for growth of Gross domestic product (1) 7.3 Briefly describe the term economic indicator. 7.4 Why Is the Moving Average (MA) important for traders and analysts? 7.5 Calculate moving averages for 5 years above (2) (2) (4) Question 8 70 © Gauteng Department of Education Study the table below and answer the questions that follow. 8.1 Name the monetary policy instrument above. (1) 8.2 Which exchange rate policy is being used by South African Reserve Bank? (1) 8.3 Briefly describe the term monetary policy. (2) 8.4 Explain open market transactions as an instrument of monetary policy. (2) 8.5 Discuss the difference between cash reserve requirements and moral suasion. (4) QUESTION 9 Paragraph type questions-Middle cognitive 9.1 Explain endogenous approaches to business cycles. (8) 9.2 Discuss the new economic paradigm. (8) 9.3 Distinguish between expansion phase and depression phase of a typical business cycle. (8) 9.4 Discuss the monetary policy instruments used in stabilising the economy. (8) 9.5 Discuss the Monetarist approach as a cause of business cycles. (8) QUESTION 10 Paragraph type questions-Higher cognitive 10.1 How can taxation be used to stimulate employment in South Africa? (8) 10.2 How has the Keynesian (endogenous) school of thought influenced business cycles? (8) 10.3 How could the Monetarist’s viewpoint on government policies cause a contraction in the business cycle? 10.4 How does the government use the fiscal policy to restrict the economy? (8) (8) 71 © Gauteng Department of Education SECTION C HINT: All section C questions have TWO questions 5 & 6 NOT 9 & 10 like in this document. In the examination you will need to answer only one. ESSAY STRUCTURE HINT: Section C – the long question, must be answered in FOUR sections: Introduction (definition), Body (headings and full sentences in bullets) additional part and conclusion (summarising). The mark allocations for Section C is as follows: MARK STRUCTURE OF ESSAY: ALLOCATION: Introduction Max 2 The introduction is a lower-order response. • A good starting point would be to the main concept related to the question topic • Do not include any part of the question in your introduction. • Do not repeat any part of the introduction in the body • Avoid saying in the introduction what you are going to discuss in the body Body: Main part: Discuss in detail/ In-depth discussion/ Examine/ Critically Max 26 discuss/ Analyse / Compare/ Distinguish/ Differentiate/ Explain/ Evaluate Additional part: Give own opinion/ Critically discuss/ Evaluate/ Critically evaluate/ Draw a graph and explain/ Use the graph given and explain/ Complete the given graph/ Calculate/ Deduce/ Compare/ Explain Max 10 Distinguish / Interpret/ Briefly debate/ How/ Suggest Conclusion Any Higher or conclusion include: Max 2 • A brief summary of what has been discussed without repeating facts already mentioned in the body • Any opinion or value judgement on the facts discussed • Additional support information to strengthen the discussion/analysis • A contradictory viewpoint with motivation, if required Recommendations TOTAL 40 QUESTION 11 • Discuss in detail the features underpinning forecasting (26 marks) • Explain the effect of demand side policies on South African economy (10) 72 © Gauteng Department of Education SESSION 4: MACROECONOMICS: PUBLIC SECTOR SECTION A: TYPICAL EXAM QUESTIONS 10 minutes Section A – Short Questions QUESTION 1: HINT: When answering Section A – short question, it is important not to rush but to read the questions carefully and to make sure you understand what the question is asking. Always remember one alternative is completely wrong, one is nearly correct and one is totally correct. It is easy to eliminate the completely wrong answer, but if you do not read the question carefully the nearly correct answer will also appear correct. The answer will NEVER be two options. Only ONE option is correct. Your answer will immediately be marked incorrect if you write TWO options. 1.1.1 Which ONE of the following is presented in October to inform parliament of changes in budget since February? A B C D 1.1.2 South African Defence Force services are provided by ... government. A B C D 1.1.3 district local provincial central Goods such as cigarettes which are deemed to be socially harmful are called … goods. A B C D 1.1.4 Main budget Medium-term Budget Policy Statement Medium-term Expenditure Framework National Budget demerit communal merit collective The government’s financial year ends on this date A B C D 28 February 31 March 01 April 30 April 73 © Gauteng Department of Education 1.1.5 The … government encompasses metropolitan, districts and municipalities. A B C D 1.1.6 The budget deficit for developing countries should not exceed … % of GDP. A B C D 1.1.7 Regulation Privatisation Nationalisation Deregulation Social grants to the citizens of South Africa form part of the ... policy. A B C D 1.1.11 Philips Lorenz Laffer Demand This refers to the transfer of functions, activities and ownership of the private sector to the public sector. A B C D 1.1.10 deregulation. government withdrawal. regulation. market economy. The … curve illustrates the relationship between taxation and government income. A B C D 1.1.9 4 3 6 5 The removal of unnecessary restrictions by law is … A B C D 1.1.8 local provincial national central monetary growth trade fiscal Value-Added Tax (VAT) is an example of a/an … tax A B C ad valorem direct excise duty 74 © Gauteng Department of Education 1.1.12 D specific A tax system is progressive if… A B C D 1.1.13 The government increases government spending to try to reduce unemployment. This is an example of … A B C D 1.1.14 buying goods and services. employing labour. making transfer payments. raising taxes. An indirect tax such as value-added tax is regressive since … A B C D 1.1.17 the acquisition of commercial companies by the public sector. the acquisition of private companies by the public sector. the acquisition of public companies by the private sector. the acquisition of mining by the private sector. When government is paying old-age pensions, it is intervening in the economy by… A B C D 1.1.16 expansionary monetary policy. contractionary monetary policy. expansionary fiscal policy. contractionary fiscal policy. Nationalisation refers to… A B C D 1.1.15 an increase in tax causes prices to increase but wages to fall. the average tax rate increases as taxable income decreased. an increase in taxable income causes an increase in tax paid. the marginal tax increases while the average tax rate decreases. rich people pay a higher amount of taxes while poor people pay a lower amount of taxes. poor people pay a higher amount of taxes while rich people pay a lower amount of taxes. the percentage of income, which rich people pay towards taxes, is less than the percentage of income that poor people pay towards taxes. the percentage of income, which rich people pay towards taxes, is more than the percentage of income that poor people pay towards taxes. The electronic filing (eFiling) system of the South African Revenue Service is an example of dealing with…in a tax system. A B C Personal income tax Equity Administrative simplicity 75 © Gauteng Department of Education D 1.1.18 Price stability implies that… A B C D 1.1.19 Public Free market Government South African Reserve Bank The current value added tax in South Africa is A B C D 1.1.23 flat rate. user charge. municipal tax. Boycott. Public goods are provided by the… A B C D 1.1.22 1 April to 31 March 31 march to 1 April 1 May to 30 April 1 January to 31 December A fixed amount paid by consumers on water and electricity irrespective of the units consumed is known as a… A B C D 1.1.21 inflation must be low. prices must not change at all. wages must be the same. prices in all countries must be the same. The financial year of the government runs from…the following year A B C D 1.1.20 Indirect taxes 14% 16% 15% 18% The relationship between tax rates and tax revenue is illustrated in the … A B C D Lorenz curve. Philips curve. Laffer curve. Tax curve. 76 © Gauteng Department of Education 1.2 Choose a description from COLUMN B that matches the item in COLUMN A. Write only the letter (A – I) next to the question number (1.2.1 – 1.2.8) in the ANSWER BOOK, for example 1.2.9 J. COLUMN A 1.2.1 Central national government 1.2.2 Demerit goods 1.2.3 Budget 1.2.4 Local government 1.2.5 Medium Term Budget Policy Statement (MTBPS) 1.2.6 State Owned Enterprises (SOE) 1.2.7 Bureaucrat 1.2.8 Taxes 1.2.9 Monetary Policy Committee of the Reserve Bank (MPC) 1.2.10 Value Added Tax (VAT) A B C D E F G H I J K 1.3 COLUMN B An official in a government department Deals with local issues within a town or municipal area Government's statement setting out its three-year budget A business owned wholly or partly by the state and run by a public authority, e.g. Eskom and SAA Direct or indirect compulsory payments to the government. Concerned with national issues, e.g. safety and security Decides on the country's monetary policy Taxes levied on the sale of goods and services A document that details the expected revenue and projected expenditure Harmful goods, e.g. cigarettes Deals with economic and other issues specific to a region/province Give ONE term for each of the following descriptions. Write only the term next to the question number (1.3.1 – 1.3.22) in the ANSWER BOOK. Abbreviations, acronyms and examples will NOT be accepted. 1.3.1 Those goods and services provided by the state for use by all the members of a society 1.3.2 Refers to an increase in the production of goods and services in the economy 1.3.3 State -owned enterprises that provide public goods and services on behalf of government 1.3.4 A situation where individuals realise that they will still benefit from a good or service even if they don’t pay for it 1.3.5 Goods which it is not possible to exclude people from using once they have been provided 1.3.6 Goods which are non-rivalrous in consumption 77 © Gauteng Department of Education 1.3.7 A situation that arises when free market forces of supply and demand fail to lead to an efficient allocation of resources 1.3.8 A good or service whose provision has more public benefit than private benefit 1.3.9 Goods such as cigarettes which are deemed to be socially harmful 1.3.10 A situation in which a person is required to explain their decisions and expenditure 1.3.11 All resources are allocated in such a way that it is not possible to make anybody better off without making someone else worse off. 1.3.12 The process whereby stated owned enterprises and state-owned assets are sold to private individuals 1.3.13 The process whereby the state takes control and ownership of privately-owned assets and private enterprises 1.3.14 The statement of anticipated income 1.3.15 A system of budgeting which requires the state to use a rolling budget for three-year period 1.3.16 Tax imposed on consumers when they purchase goods and services 1.3.17 A tax imposed on certain luxury items in order to discourage consumption of these goods 1.3.18 A tax levied on the sale of goods and services 1.3.19 A tax that is levied on the income of business 1.3.20 Refers to price reduction causes more consumers to buy more of the cheaper goods 1.3.21 Attempts by interest groups to influence government behaviour to their advantage 1.3.22 The branch of economics that studies decision making by the economy as a whole government’s planned expenditure and 78 © Gauteng Department of Education QUESTION 2: HINT: When the question requires you to “list” or “name”, you need not write a sentence but merely one or two words. This MUST be done in bullet form. 2.1 Name any TWO taxes on goods and services (2X1) 2 2.2 Name TWO objectives of the state (2X1) 2 2.3 Name TWO types of public goods (2X1) 2 2.4 Name any provisioning TWO problems experienced in public sector (2X1) 2 Name the TWO main fiscal policy instruments that can be used by government to regulate the economy (2X1) 2 2.6 List any TWO necessity of the public sector (2X1) 2 2.7 List any TWO items of main budget (2X1) 2 2.8 List any TWO effects of fiscal policy (2X1) 2 2.9 Name TWO variables of national budget (2X1) 2 2.10 Name TWO features of fiscal policy (2X1) 2 2.11 List any TWO effects of public sector failure (2X1) 2 2.12 List any TWO reasons for public sector failure (2X1) 2 2.13 List any TWO composition of the public sector (2X1) 2 2.14 Name TWO features of public sector failure (2X1) 2 2.15 List any TWO equitable share grants to municipalities (2X1) 2 2.5 QUESTION 3: 3.1 3.2 3.3 (Taken from various sources) How does wasteful spending by the government affect economic growth? (1x2) 2 What is the effect of the fiscal policy on the general price level? (1x2) 2 How does the South African government use progressive tax to achieve economic equity? (1x2) 2 79 © Gauteng Department of Education 3.4 What is the relationship between the main budget and MTEF? (1x2) 2 3.5 Why would public sector failure lead to economic instability? 2 3.6 Why are public goods important? (1x2) 2 3.7 How are socio-economic rights are embedded in the budgets of the South African government? (1x2) 2 3.8 How does public debt affect GDP? (1x2) 2 3.9 Why is the debt to GDP ratio important? (1x2) 2 3.10 How does government spending affect the unemployment rate? Data Response QUESTION 4: 2 (Taken from various sources) Study the information and answer the questions that follow 4.1 Name a monetary instrument used to achieve price stability. (1) 4.2 What is the inflation target range set by the South African Reserve Bank? (1) 4.3 Briefly describe the term repurchase rate (Repo rate). (2) 4.4 Explain the reason why government pursues price stability as a macroeconomic objective. (2) 80 © Gauteng Department of Education 4.5 How does the South African Reserve Bank maintain price stability? (4) QUESTION 5: Study the information and answer the questions that follow 5.1 Identify the fiscal instrument shown on the above table. (1) 5.2 According to the table above, how much is contributed by companies to government revenue? (1) 5.3 Briefly describe the term national budget (2) 5.4 Calculate the value of A from the above table. (2) 5.5 How does public sector failure affect the tax system of the country? (2x2) (4) QUESTION 6: Study the information and answer the questions that follow We won't privatise state enterprises needed for development As government works on reforming state-owned enterprises (SOEs), the president has assured that state assets will be kept if they are strategic for the development of the economy of South Africa. During the State of the Nation Address, the president shared on the progress made in turning around state-owned enterprises which have been plagued with corruption and mismanagement. It was highlighted that over the past year, new boards had been appointed at Eskom, Denel, Transnet, Safcol, Prasa and SA Express. The new boards had been mandated with addressing corruption of the past. [Adapted from: Fin 24 Newsletter, 7 February 2019] 81 © Gauteng Department of Education 6.1 Which policy is used by the government to influence economic activities? (1) 6.2 What is the role of the Minister of Finance? (1) 6.3 Briefly describe the term privatisation. (2) 6.4 Briefly explain why the government aims to achieve economic growth. (2) How will the eradication of corruption and mismanagement of SOEs benefit the economy? (2x2) (4) 6.5 QUESTION 7: Study the information and answer the questions that follow 7.1 Name the biggest contributor of revenue to the State. (1) 7.2 What is the current VAT rate in South Africa? (1) 7.3 Briefly describe the term indirect tax. (2) 7.4 Why is it necessary for government to provide schools and hospitals for its citizens? . (2) 7.5 How does the Minister of Finance use his discretion on fiscal decisions? (2x2) (4) 82 © Gauteng Department of Education QUESTION 8: Study the information and answer the questions that follow 8.1 Which curve is depicted in the graph above? (1) 8.2 What tax rate will generate maximum revenue for the government? (1) 8.3 What is the correlation between a tax rate of zero and a tax rate of 100% for government? (2) 8.4 Why will an increase in tax rate not necessarily increase government revenue? (2) 8.5 Suggest ways that the state can use to increase its revenue without increasing taxation. (2x2) (4) QUESTION 9: Study the information and answer the questions that follow PUBLIC AND PRIVATE SECTOR INTEGRATION Financial investments through public private partnerships are critical in meeting the socio-economic needs of the people. Addressing backlogs in essential public services and simultaneously maintaining fiscal prudence require the country's budgetary resources to work harder. (Source: https://mg.co.za/tag/gauteng-treasury) 9.1 Name ONE example of socio-economic needs of people. (1) 9.2 Give ONE example how the private sector can assist the government to address socio-economic issues. (1) 9.3 Briefly describe the term public-private-partnerships. (2) 9.4 What is fiscal prudence? (2) 9.5 How can public private partnerships contribute to income (4) 83 © Gauteng Department of Education redistribution? (2x2) QUESTION 10: Study the information and answer the questions that follow Illicit cigarettes cost SA billions in lost revenue The drop in sales volumes of excise-paid tobacco products has resulted in a significant loss of revenue for the government, as consumers move to cheaper illicit products, said economic research house Econometrix on Tuesday. Citing National Treasury data, Econometrix said income from tobacco excise declined by R1.94 billion between 2015/16 and 2017/18, despite the government raising excise taxes annually for several years in a bid to discourage smoking while collecting revenue. “Considering the high price elasticity for tobacco products, holding excise at current levels is the only way to prevent further erosion of the tax base, while enforcement measures are implemented to curb the illicit tobacco trade,” Jammine said. Source: The citizen 10.1 Identify other excise tax which is not mentioned in the article. (1) 10.2 What is the other name for excise taxes? (1) 10.3 Briefly describe the term tax (2) 10.4 Explain the criteria for a good tax. (2) 10.5 Analyses who bears the burden of a specific excise tax. (2x2) (4) 84 © Gauteng Department of Education QUESTION 11: Study the information and answer the questions that follow 'Where will government find R4bn?': Taxis demand Covid-19 billions Taxi bosses have rejected a R1.1bn Covid-19 relief payment from the government and are threatening to bring SA to a halt unless they get billions more. The R1.1bn offer of a one-off payment was turned down in talks between the South African National Taxi Council (Santaco) and transport minister Fikile Mbalula this week. Taxi owners are demanding R20,000 per taxi for each month of the lockdown. With an estimated 200,000 taxis across SA, a bailout on these terms could cost up to R4bn a month. Santaco did not give a total figure for how much it wanted but insists further talks with Mbalula on the taxpayer-funded bailout would be on the basis of its numbers, not his. The taxi industry has announced fare hikes of between 10% and 25% nationwide It is understood taxi owners also want the regulation restricting them to 70% loads scrapped. Mbalula is apparently open to granting that request but is standing firm on the R1.1bn figure. Source: Sunday times 11.1 Name the reason for public sector failure from the extract above. (1) 11.2 Identify one positive externalities for using public transport. (1) 11.3 Briefly describe the term rent-seeking. (2) 11.4 What can government do to avoid public sector failure? (2) 11.5 Discuss the instruments available to government to achieve its objectives (2x2) (4) QUESTION 12: Study the information and answer the questions that follow PUBLIC SECTOR CHALLENGES The public sector comprises three levels of government, namely national, provincial and local government. The government programmes include the Medium-term strategic Framework implemented from 2014-2019 as part of the National Development Plan. It consists of various focus areas such as education, health and economic growth and development 12.1 Which level of government develops policy and coordinates services across all nine provinces? (1) 85 © Gauteng Department of Education 12.2 Name ONE macroeconomic objectives of the state. (1) 12.3 Briefly describe the term accountability. (2) 12.4 How will the government benefit from privatising state-owned enterprises? (2) 12.5 Why is the pricing policy a problem for the government in respect of the provisioning of goods and services? (2x2) (4) QUESTION 13: Study the information and answer the questions that follow Inflation edges up as food and drink prices bite 13.1 Name the effect of fiscal policy illustrated above. (1) 13.2 List other effect of fiscal policy. (1) 13.3 Briefly describe the term consumption. (2) 13.4 Explain why the Laffer curve has a characteristic shape. (2) 13.5 Discuss the relationship government spending and the level of national income. (2x2) (4) 86 © Gauteng Department of Education QUESTION 14: Study the information and answer the questions that follow 2021 tax year (1 March 2020 - 28 February 2021) 14.1 Name one source of government revenue. (1) 14.2 Which department is responsible for personal income tax? (1) 14.3 Briefly describe the term personal income tax. (2) 14.4 How do taxes affect the economy in the long run? (2) 14.5 Calculate personal income tax for Ms Mhlanga who earns R120 429 (2x2) (4) QUESTION 15 (taken from various DBE past papers) Paragraph type of questions Middle order 15.1 Briefly discuss efficiency and parastatals as reasons that contribute to public sector failure. (8) 15.2 Differentiate between community goods and collective goods. (8) 15.3 Explain accountability as a problem of public sector provisioning. (8) 15.4 Explain privatisation as a problem of public sector provisioning. (8) 15.5 Explain management failure and lack of motivation as reasons for public sector failure. (8) 15.6 Illustrate with an aid of diagram the Laffer curve. (8) 15.7 Explain how socio-economic rights are embedded in the budgets of the South (8) 87 © Gauteng Department of Education African government 15.8 Differentiate between Medium Term Expenditure Framework (MTEF) and Medium Term Budget Policy Statement (MTBPS) (8) 15.9 Explain discretion as effect of fiscal policy (8) 15.10 Explain sources of government income (8) 15.11 Discuss reasons for inefficiency of the public sector (8) 15.12 Distinguish special interest groups and lack of motivation as reason for public sector failure. (8) QUESTION 16 (taken from various DBE past papers) Paragraph type of questions Higher cognitive 16.1 Evaluate the impact of value added tax in the economy. (8) 16.2 How can the government reduce the cost of the business sector to stimulate aggregate supply? (8) 16.3 How successful is the government in achieving its macroeconomic objectives? (8) 16.4 How can the government improve the efficiency of service delivery? (8) 16.5 Evaluate the provisioning of public goods and services in South Africa (8) 16.6 Why are State-Owned Enterprises (SOE’s) seen as a problem in public sector provisioning? (8) 16.7 Evaluate the impact of social rights that promoted through the national budget (8) 16.8 How is it possible to exclude individuals from using public goods (8) 16.9 How does poor service delivery affect the community? (8) 16.10 How does expansionary fiscal policy affect interest rates? (8) 88 © Gauteng Department of Education SECTION C HINT: All section C questions have TWO questions 5 & 6 NOT 9 & 10 like in this document. In the examination you will need to answer only one. ESSAY STRUCTURE HINT: Section C – the long question, must be answered in FOUR sections: Introduction (definition), Body (headings and full sentences in bullets) additional part and conclusion (summarising). The mark allocations for Section C is as follows: MARK STRUCTURE OF ESSAY: ALLOCATION: Introduction Max 2 The introduction is a lower-order response. • A good starting point would be to the main concept related to the question topic • Do not include any part of the question in your introduction. • Do not repeat any part of the introduction in the body • Avoid saying in the introduction what you are going to discuss in the body Body: Main part: Discuss in detail/ In-depth discussion/ Examine/ Critically Max 26 discuss/ Analyse / Compare/ Distinguish/ Differentiate/ Explain/ Evaluate Additional part: Give own opinion/ Critically discuss/ Evaluate/ Critically evaluate/ Draw a graph and explain/ Use the graph given and Max 10 explain/ Complete the given graph/ Calculate/ Deduce/ Compare/ Explain Distinguish / Interpret/ Briefly debate/ How/ Suggest Conclusion Any Higher or conclusion include: Max 2 • A brief summary of what has been discussed without repeating facts already mentioned in the body • Any opinion or value judgement on the facts discussed • Additional support information to strengthen the discussion/analysis • A contradictory viewpoint with motivation, if required Recommendations TOTAL 40 QUESTION 17 • Discuss in detail the reasons for public sector failure • What are the consequences of public sector failure? (26 marks) (10 marks) 89 © Gauteng Department of Education SECTION D: Homework - (taken from various DBE past papers) 1.1.1 Large public corporations or business entities in the public sector are known as: A B C D 1.1.2 The transfer of ownership from the public to the private sector is known as … A B C D 1.1.3 Strike Strategy Initiative Policy In the case of merit goods, the market tends to…these goods A B C D 1.1.6 provincial budget. main budget. mini budget. medium-term expenditure framework(MTEF) A definite course of action which is adopted by a group or organisation in an effort to promote best practice is known as… A B C D 1.1.5 decentralisation. nationalisation. privatisation. title deeds. Government income and expenditure estimates for a three-year period are reflected in the … A B C D 1.1.4 Corporates. Departments. Parastatals Enterprises undersupply oversupply tax sell The role of government is threefold. What are the three functions of 90 © Gauteng Department of Education government A B C D 1.1.7 Which ONE of the following is presented in October to inform parliament of changes in the budget since February ? A B C D 1.1.8 6 9 7 10 Education is an example of a … A B C D 1.2 Central government Provincial government Local government Public corporation Provincial government consist of …provinces A B C D 1.1.10 Main budget Medium-term Budget Policy Statement Medium-term Expenditure Framework National Budget In which sphere of government is City of Johannesburg? A B C D 1.1.9 Allocative, dispersal and stabilization functions Allocative, dispersal and equitable distribution functions Allocative, equitable distribution and stabilization functions Equitable distribution, dispersal and stabilization functions demerit good. merit good. production good. public good. Choose a description from COLUMN B that matches the item in COLUMN A. Write only the letter (A – I) next to the question number (1.2.1 – 1.2.8) in the ANSWER BOOK, for example 1.2.9 J. 91 © Gauteng Department of Education 1.2.1 COLUMN A Parastatals A 1.2.2 Accountability B Tax imposed on consumers when they purchase goods and services 1.2.3 Value added tax C It is not possible to exclude people from using goods once they have been provided 1.2.4 Laffer curve D Shows the relationship between tax rates and tax revenue E State -owned enterprises that provide public goods F The statements of governments planned expenditure and anticipated income 1.2.5 1.2.6 COLUMN B Person is required to give an explanation of their decisions and expenditure National budget Excise duty 1.2.7. Medium-term expenditure framework G A system of budgeting which requires the state to use a rolling budget for three years 1.2.8. Collective goods H Tax imposed on certain luxury items (8 × 1) 1.3 (8) Give ONE term for each of the following descriptions. Write only the term next to the question number (1.3.1 – 1.3.5) in the ANSWER BOOK. Abbreviations, acronyms and examples will NOT be accepted. 1.3.1 An economic system that allows for the simultaneous operation of state-owned and privately owned enterprises 1.3.2 Costs which result from the production of a good or services but which are not reflected in the price of the product 1.3.3 Goods which are non-rivalrous in consumption 1.3.4 A situation where individuals realise that they will still benefit from a good or service even if they do not pay for it 1.3.5 Relating to government finances such as government revenue or expenses SECTIOB B: QUESTION 2 92 © Gauteng Department of Education 2.1 Name any TWO pricing policy options 2.2 . (2 x 1) (2) List TWO instruments of fiscal policy? (2 x 1) (2) 2.3 Name TWO examples of government expenditure (2 x 1) (2) 2.4 Name TWO examples of social services . (2 x 1) (2) 2.5 List any TWO forms of the public sector (2 x 1) (2) 3.1 How is the public benefiting from the government subsidised products? (1 x 2) (2) 3.2 What is the main aim of privatisation? (1 x 2) (2) 3.3 Why is it important for the government to use the tax system effectively? (1 x 2) (2) 3.4 How does government impact society? (1 x 2) (2) 3.5 Why is value-based pricing better? (1 x 2) (2) QUESTION 3 QUESTION 4 Study the information and answer the questions that follow 4.1 What is the deficit rule percentage of GDP? (1) 4.2 Name one use for government borrowing money. (1) 93 © Gauteng Department of Education 4.3 Briefly describe the term national debt. (2) 4.4 Explain the discretion of the debit rule. (2) 4.5 How does deficit spending relate to the national debt? (2x2) (4) QUESTION 5: Study the information and answer the questions that follow 5.1 Which period does a person over the age of 65 and over receive R128 650 (1) 5.2 Which age is exempt from income tax in South Africa (1) 5.3 Briefly describe the term fiscal policy (2) 5.4 How does education benefit from taxes (2) 5.5 Calculate the personal income tax for Mr Samsung who earns R260 500 (2x2) (4) QUESTION 6 94 © Gauteng Department of Education Study the article below and answer the questions that follow. 6.1 Name any ONE budget plan that the government oversees. (1) 6.2 What challenge is the government facing as depicted in the cartoon above? (1) 6.3 Briefly describe the term budget.. (2) 6.4 Why will an increase in tax rate not necessarily increase government revenue ? (2) 6.5 How can the government effectively reduce management failure? (2 x 2) (4) QUESTION 7 95 © Gauteng Department of Education Study the table below and answer the questions that follow. TAX REVENUE PERSONAL INCOME TAX CORPORATE INCOME TAX VAT CUSTOMS AND EXCISE DUTIES FUEL LEVIES OTHERS TOTAL 2018/ 19 505.8bn 231.2bn 348.1bn 97.4bn 77.5bn 84.8bn 1344.8bn 7.1 Identify ONE indirect tax from the table above. (1) 7.2 Name the government department responsible for monitoring the effective use of public funds. (1) 7.3 7.4 7.5 Briefly describe the tax excise duties. Why is it necessary for government to provide schools and hospitals for its citizens? Calculate the total percentage contribution of personal income tax to the government’s total tax revenue. Show all calculations. (Round-off to two decimal places.) (2) (2) (4) 96 © Gauteng Department of Education Question 8 Study the table below and answer the questions that follow. 8.1 Name non-profit organisation that are financed by the central government (1) 8.2 List any provincial government in South Africa (1) 8.3 Briefly describe the term public sector) (1) 8.4 How does the central government control the economy? (1) 8.5 Discuss the main duties of government according to Adam Smith (1) 97 © Gauteng Department of Education QUESTION 9 Paragraph type questions-Middle cognitive 9.1 Briefly discuss distribution of income (economic equity) and price stability as macroeconomic objectives. (8) 9.2 Explain accountability as problems of public sector provisioning (8) 9.3 Discuss the reasons for the existence of a public sector (8) 9.4 Differentiate between productive and allocative Inefficiency (8) 9.5 Explain the reasons for public sector failure. (8) QUESTION 10 Paragraph type questions-Higher cognitive (taken from various DBE past papers) 10.1 How can the South African municipalities improve efficiency in service delivery? (8) 10.2 Evaluate the provisioning of public goods and services in South Africa (8) 10.3 Evaluate the success of the South African Reserve Bank in maintaining price stability in the economy. 10.4 How does corruption influence good governance in South Africa? (8) 10.5 How can the South African government going about to achieve a more equitable income distribution? (8) (8) 98 © Gauteng Department of Education SECTION C HINT: All section C questions have TWO questions 5 & 6 NOT 9 & 10 like in this document. In the examination you will need to answer only one. ESSAY STRUCTURE HINT: Section C – the long question, must be answered in FOUR sections: Introduction (definition), Body (headings and full sentences in bullets) additional part and conclusion (summarising). The mark allocations for Section C is as follows: MARK STRUCTURE OF ESSAY: ALLOCATION: Introduction Max 2 The introduction is a lower-order response. • A good starting point would be to the main concept related to the question topic • Do not include any part of the question in your introduction. • Do not repeat any part of the introduction in the body • Avoid saying in the introduction what you are going to discuss in the body Body: Main part: Discuss in detail/ In-depth discussion/ Examine/ Critically Max 26 discuss/ Analyse / Compare/ Distinguish/ Differentiate/ Explain/ Evaluate Additional part: Give own opinion/ Critically discuss/ Evaluate/ Critically evaluate/ Draw a graph and explain/ Use the graph given and explain/ Complete the given graph/ Calculate/ Deduce/ Compare/ Explain Max 10 Distinguish / Interpret/ Briefly debate/ How/ Suggest Conclusion Any Higher or conclusion include: Max 2 • A brief summary of what has been discussed without repeating facts already mentioned in the body • Any opinion or value judgement on the facts discussed • Additional support information to strengthen the discussion/analysis • A contradictory viewpoint with motivation, if required Recommendations TOTAL 40 QUESTION 11 • Evaluate the problems of public sector provisioning in South Africa • (26 marks) Outline examples of problems with regards to public sector provisioning you have observed in your own community or elsewhere in South Africa (10 marks) 99 © Gauteng Department of Education