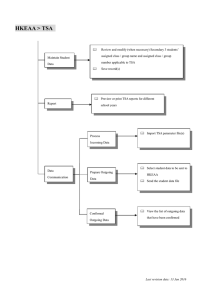

Week 1: Auditing and Assurance Services Chapter 01 “Our system of capital formation relies upon the confidence of millions of savers to invest in companies. The auditor’s opinion is critical to that trust." -- James R. Doty, Chairman Public Company Accounting Oversight Board (PCAOB) Prepared by Louwers et al. 2012 Edited by Assistant Prof. Kanyarat Sanoran, Ph.D. 1 Accounting vs Auditing • Accountants – Record, classify and summarize economic events for the purpose of providing financial information used in decision making • Auditors – Determine whether recorded information properly reflects the economic events that occurred during the accounting period Prepared by Louwers et al. 2012 Edited by Assistant Prof. Kanyarat Sanoran, Ph.D. 2 Information Risk vs Business Risk • Information risk – The risk that the information disseminated by a company will be materially false or misleading. – Users demand an independent third party assessment of the information • Business risk – The risk that an entity will fail to meet its stated business objectives Prepared by Louwers et al. 2012 Edited by Assistant Prof. Kanyarat Sanoran, Ph.D. 3 Information Risk Causes: • Remoteness of information • Biases and motives of the provider • More complex information • Voluminous data Challenges: • Demanded in a more timely manner • Has far reaching consequences Prepared by Louwers et al. 2012 Edited by Assistant Prof. Kanyarat Sanoran, Ph.D. 4 Definition of Auditing Financial Statements (including footnotes) Persons who rely on the financial reports Auditing is a systematic process of objectively obtaining and evaluating evidence regarding assertions about economic actions and events to ascertain the degree of correspondence between the assertions and established criteria GAAP and communicating the results to Auditor's Report/ interested users. Other Reports •Creditors •Investors Source: American Accounting Association Committee on Basic Auditing Concepts. 1973. A Statement of Basic Auditing Concepts, American Accounting Association (Sarasota, FL). 5 Exhibit 1.1: Overview of Financial Statement Auditing Prepared by Louwers et al. 2012 Edited by Assistant Prof. Kanyarat Sanoran, Ph.D. 6 Exhibit 1.3: The Relationships Among Auditing, Attestation, and Assurance Engagements Assurance Services Any Information Attestation Services Primarily Financial Information Auditing Historical financial Statements Prepared by Louwers et al. 2012 Edited by Assistant Prof. Kanyarat Sanoran, Ph.D. 7 Types of Audits and Auditors • Financial (External Auditors/CPAs) • Ensure that financial statements are reliable • Operational (Internal and Governmental Auditors/CIAs) • Improve operational effectiveness • Improve operational efficiency • Compliance (Internal and Governmental Auditors) • Ensure compliance with company and/or governmental rules and regulations • Forensic (Fraud Auditors/CFEs) • Designed to investigate a crime and will often involve gathering evidence designed to convict a fraudster Prepared by Louwers et al. 2012 Edited by Assistant Prof. Kanyarat Sanoran, Ph.D. 8 Attestation Engagements • An attestation engagement - a practitioner is assesses and reports on “subject matter or an assertion about the subject matter that is the responsibility of another party.” • Some financial attestation engagements (other than audits) • Financial forecasts and projections • Examination of Management’s Discussion & Analysis • Pro forma financial information • Some non-financial attestation engagements • Effectiveness of internal control systems • Compliance with environmental regulations • Verifying inventory quantities and locations 9 Prepared by Louwers et al. 2012 Edited by Assistant Prof. Kanyarat Sanoran, Ph.D. Financial Forecasts and Projections ISAE 4400 • Prospective Financial Information (PFI) – Financial information representing the financial position, results of operations, and cash flows for some period of time in the future. • Types of PFI – Financial projection: PFI based on the occurrence of one or more hypothetical events that change existing business structure – Financial forecast: PFI based on expected conditions and courses of action (e.g., no new distribution center). • • The company may be negotiating directly with a single user who has requested prospective financial information for use in economic decisions. – This is referred to as limited use. – Any PFI can be used for limited purposes. The company may be preparing prospective financial statements that it intends to present to a large number of users, none of whom it is negotiating with at the current time. – This type of situation is referred to as general use. Prepared by Louwers et al. 2012 Edited by Assistant Prof. Kanyarat Sanoran, Ph.D. 10 Attestation Engagements • Report on subject matter or assertion about subject matter. • Responsibility of another party • Responsible party—acknowledge responsibility Prepared by Louwers et al. 2012 Edited by Assistant Prof. Kanyarat Sanoran, Ph.D. 11 Types of Attestation Engagements—Levels of Assurance • Examination – Similar to an audit – High level of assurance • Review – Moderate level of assurance – Not allowed on certain engagements • Agreed upon procedures – Assurance depends on procedures Prepared by Louwers et al. 2012 Edited by Assistant Prof. Kanyarat Sanoran, Ph.D. 12 Prepared by Louwers et al. 2012 Edited by Assistant Prof. Kanyarat Sanoran, Ph.D. 13 Differences Between Reasonable Assurance Engagements and Limited Assurance Engagements Type of engagement Reasonable assurance engagement Objective Evidence-gathering procedures The assurance report A reduction in assurance engagement risk to an acceptably low level in the circumstances of the engagement, as the basis for a positive form of expression of the practitioner’s conclusion Sufficient appropriate evidence is obtained as part of a systematic engagement process that includes: •Obtaining an understanding of the engagement circumstances; •Assessing risks; •Responding to assessed risks; •Performing further procedures using a combination of inspection, observation, confirmation, recalculation, reperformance, analytical procedures and inquiry. Such further procedures involve substantive procedures, including , where applicable, obtaining corroborating information, and depending on the nature of the subject matter, tests of the operating effectiveness of controls; and • Evaluating the evidence obtained Description of the engagement circumstances, and a positive form of expression of the conclusion Source: www.ifac.org 14 Differences Between Reasonable Assurance Engagements and Limited Assurance Engagements Type of engagement Limited assurance engagement Objective Evidence-gathering procedures A reduction in assurance engagement risk to a level that is acceptable in the circumstances of the engagement but where that risk is greater than for a reasonable assurance engagement, as the basis for a negative form of expression of the practitioner’s conclusion Sufficient appropriate evidence is obtained as part of a systematic engagement process that includes obtaining an understanding of the subject matter and other engagement circumstances, but in which procedures are deliberately limited relative to a reasonable assurance engagement The assurance report Description of the engagement circumstances, and a negative form of expression of the conclusion 15 Source: www.ifac.org Review of Interim Financial Information • Financial information that covers a period ending on a date other than the entity’s fiscal year end. • SEC companies are required to have a review of the interim financial information filed with the SEC. • Need to gain sufficient knowledge of the entity’s business and internal control. • May have a report on interim financial information – Separate from the audited financial statements. – Presented as a supplement to audited financial statements. Prepared by Louwers et al. 2012 Edited by Assistant Prof. Kanyarat Sanoran, Ph.D. 16 Assurance Services • Assurance services are independent professional services that improve the quality of information, or its context, for decision makers. • Examples • Sustainability and other types of “Green” Reporting • Information risk assessment • Internal audit outsourcing Prepared by Louwers et al. 2012 Edited by Assistant Prof. Kanyarat Sanoran, Ph.D. 17 Agreed-Upon Procedures Engagements ISAE 4400 • Consists of performing procedures normally associated with an audit or special engagement – Inventory observation – Confirmation of receivables – Summarize customer comment cards • Scope less than in an audit (responsibility of user) • Accountant reports procedures and findings – No opinion or negative assurance provided • Must restrict distribution of report to users who established scope of engagement Prepared by Louwers et al. 2012 Edited by Assistant Prof. Kanyarat Sanoran, Ph.D. 18 The Public Accounting Profession • Assurance services • Financial statement audit engagements • Attestation engagements • Assurance engagements • Tax services • Consulting and Advisory services Prepared by Louwers et al. 2012 Edited by Assistant Prof. Kanyarat Sanoran, Ph.D. 19 Exhibit 1.6: Public Accounting Firm Organization Prepared by Louwers et al. 2012 Edited by Assistant Prof. Kanyarat Sanoran, Ph.D. 20 Organization of the Profession • “Big Four” Accounting Firms – Deloitte, EY, KPMG, PwC • National – Grant Thornton, BDO • Local/Regional • Sole Proprietor Prepared by Louwers et al. 2012 Edited by Assistant Prof. Kanyarat Sanoran, Ph.D. 21 Become Certified! • Education • Examination • Experience Prepared by Louwers et al. 2012 Edited by Assistant Prof. Kanyarat Sanoran, Ph.D. 22 Standards • Statements on Standards for Attestation Engagements (SSAEs) • Similar to fundamental auditing principles – Practitioner’s knowledge about subject matter – Suitable criteria – Evaluation of internal control not required – Restricted distribution Prepared by Louwers et al. 2012 Edited by Assistant Prof. Kanyarat Sanoran, Ph.D. 23 24 Source: www.ifac.org AUDITS OF HISTORICAL FINANCIAL INFORMATION 200–299 GENERAL PRINCIPLES AND RESPONSIBILITIES TSA 200 TSA 210 Overall Objectives of the Independent Auditor and the Conduct of an Audit in Accordance with Thai Standards on Auditing Agreeing the Terms of Audit Engagements TSA 220 Quality Control for an Audit of Financial Statements TSA 230 Audit Documentation TSA 240 The Auditor’s Responsibilities Relating to Fraud in an Audit of Financial Statements Consideration of Laws and Regulations in an Audit of Financial Statements Communication with Those Charged with Governance TSA 250 TSA 260 TSA 265 Communicating Deficiencies in Internal Control to Those Charged with Governance and Management 25 Source: www.fap.or.th 300–499 RISK ASSESSMENT AND RESPONSE TO ASSESSED RISKS TSA 300 Planning an Audit of Financial Statements TSA 315 (Revised) Identifying and Assessing the Risks of Material Misstatement through Understanding the Entity and Its Environment TSA 320 Materiality in Planning and Performing an Audit TSA 330, The Auditor’s Responses to Assessed Risks TSA 402 Audit Considerations Relating to an Entity Using a Service Organization TSA 450 Evaluation of Misstatements Identified during the Audit Source: www.fap.or.th 26 500–599 AUDIT EVIDENCE TSA 500 TSA 501 Audit Evidence Audit Evidence—Specific Considerations for Selected Items TSA 505 TSA 510 External Confirmations Initial Audit Engagements—Opening Balances TSA 520 Analytical Procedures TSA 530 Audit Sampling TSA 540 Auditing Accounting Estimates, Including Fair Value Accounting Estimates, and Related Disclosures TSA 550 TSA 560 TSA 570 TSA 580 Related Parties Subsequent Events Going Concern Written Representations Source: www.fap.or.th 27 600–699 USING THE WORK OF OTHERS TSA 610 (Revised 2013) Special Considerations—Audits of Group Financial Statements (Including the Work of Component Auditors) TSA 610 (Revised), Using the Work of Internal Auditors Using the Work of Internal Auditors Conforming Amendments to Other TSAs TSA 620 Using the Work of an Auditor’s Expert TSA 600 700–799 USING THE WORK OF OTHERS TSA 700 TSA 705 TSA 706 TSA 710 TSA 720 Forming an Opinion and Reporting on Financial Statements Modifications to the Opinion in the Independent Auditor’s Report Emphasis of Matter Paragraphs and Other Matter Paragraphs in the Independent Auditor’s Report Comparative Information—Corresponding Figures and Comparative Financial Statements The Auditor’s Responsibilities Relating to Other Information in Documents Containing Audited Financial Statements 800–899 SPECIALIZED AREAS TSA 800 TSA 805 TSA 810 Special Considerations—Audits of Financial Statements Prepared in Accordance with Special Purpose Frameworks Special Considerations—Audits of Single Financial Statements and Specific Elements, Accounts or Items of a Financial Statement Engagements to Report on Summary Financial Statements Source: www.fap.or.th 28 2000–2699 THAI STANDARDS ON REVIEW ENGAGEMENTS (ISRES) 2400 Engagements to Review Financial Statements (Previously TSA 910) Review of Interim Financial Information Performed by the Independent Auditor of the Entity 2410 3000–3699 THAI STANDARDS ON ASSURANCE ENGAGEMENTS (TSAES) 3000–3399 3000 Applicable To All Assurance Engagements 3400–3699 3400 Subject Specific Standards 3402 3410 3420 Assurance Engagements Other than Audits or Reviews of Historical Financial Information The Examination Of Prospective Financial Information (Previously TSA 810) Assurance Reports on Controls at a Service Organization Assurance Engagements on Greenhouse Gas Statements Assurance Engagements to Report on the Compilation of Pro Forma Financial Information Included in a Prospectus Source: www.fap.or.th 29 RELATED SERVICE 4000–4699 THAI STANDARDS ON RELATED SERVICES (ISRSS) 4400 Engagements to Perform Agreed-Upon Procedures Regarding Financial Information (Previously TSA 920) 4410 Engagements to Compile Financial Information FRAMEWORK Framework Thai Framework for Assurance Engagements AUDITING PRACTICE NOTES IAPN 1000 Special Considerations in Auditing Financial Instruments REVISED STANDARDS Source: www.fap.or.th 30