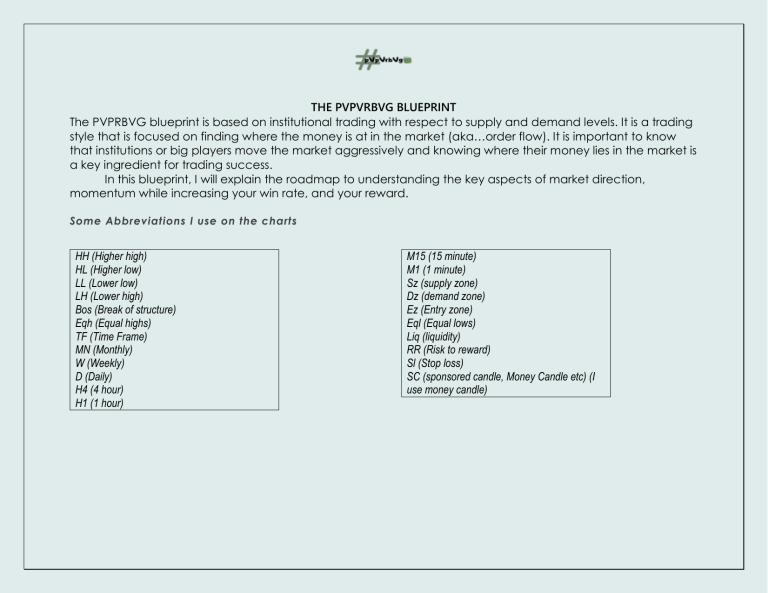

THE PVPVRBVG BLUEPRINT The PVPRBVG blueprint is based on institutional trading with respect to supply and demand levels. It is a trading style that is focused on finding where the money is at in the market (aka…order flow). It is important to know that institutions or big players move the market aggressively and knowing where their money lies in the market is a key ingredient for trading success. In this blueprint, I will explain the roadmap to understanding the key aspects of market direction, momentum while increasing your win rate, and your reward. Some Abbreviations I use on the charts HH (Higher high) HL (Higher low) LL (Lower low) LH (Lower high) Bos (Break of structure) Eqh (Equal highs) TF (Time Frame) MN (Monthly) W (Weekly) D (Daily) H4 (4 hour) H1 (1 hour) M15 (15 minute) M1 (1 minute) Sz (supply zone) Dz (demand zone) Ez (Entry zone) Eql (Equal lows) Liq (liquidity) RR (Risk to reward) Sl (Stop loss) SC (sponsored candle, Money Candle etc) (I use money candle) Supply and Demand First I will briefly explain Supply and Demand. Supply: This is a zone on the chart where institutions distribute their orders. In other words. It is also a zone where buyers and sellers come to make transactions and if there are more sellers the market reacts by selling off. Some people also call these zones institutional zones (sponsored candle, institutional candle , order blocks, etc. I just think these are all supply zones and it is easier to see and understand the movement and language of the market. An example of a supply zone will be an area on the chart where there is indecision and then a drop in the market as it is seen below Demand : Demand is the opposite of supply. In this aspect there will be more buyers than sellers after indecision. It is also known as a zone where institutions or banks come to accumulate orders before a mark up. As simple as this might seem there are other things to consider before taking a buy or sell in these zones. Before looking for a supply or demand zone we first need to know the trend ( Is it an uptrend or downtrend or are we making higher highs or higher lows) this can easily be found or decided by making use of higher time frames (monthly, weekly, daily and 4 hour time frames. I personally pick out my direction from the weekly then I pick out zones between the daily time frames and the 15 minutes time frame, depending on how long I would like to trade. (understand that more pips or bigger or larger distance traveled in the market does not mean more profits. What determines more profits depends on the risk to reward).