Cash and Cash Equivalents: Accounting Textbook Chapter

advertisement

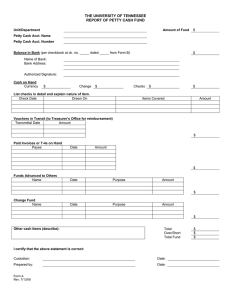

CHAPTER ONE: Cash and Cash Equivalents Definition of Cash (Current Asset) In Layman’s term “money” Money: a standard medium of exchange in business transactions. It refers to the currency and coins which are in circulation and legal tender (recognized by law). In accounting, “cash” includes money and other negotiable instrument that is payable in money and acceptable by the bank for deposit and immediate credit. There is no specific standard dealing with cash (unrestricted) It must be unrestricted in use. It includes : CHECKS, BANK DRAFTS and MONEY NOTE: Postdated checks received cannot be considered as cash yet because these checks are unacceptable by the bank for deposit and immediate credit or outright encashment. Unrestricted Cash There is no specific standard with “cash”. The only guidance is found in PAS 1, paragraph 66, which provides that an entity shall classify an asset as current when the asset is cash or a cash equivalent unless it is restricted to settle a liability for more than 12 months after the end of the reporting period. Accordingly, to be reported as “cash”, an item must be unrestricted in use. Unrestricted Cash: means that the cash must be readily available in payment of current obligations and not be subjected to any restrictions, contractual or otherwise. NOTE: Cash, as a current asset, sometimes will not be considered as one when cash is restricted for at least 12 months after the end of the reporting period. Measurement of Cash Cash is measured at face value (if the bills shows that it is P100, then it is P100). Cash in foreign currency is measured at the current exchange rate. If a bank or financial institution holding the funds of an entity is in bankruptcy or financial difficulty, cash should be written down to estimated realizable value if the amount recoverable is estimated to be lower than the face value. Foreign Currency Cash in foreign currency should be translated to Philippine pesos using the current exchange rate. Deposits in foreign countries which are not a subject to any foreign exchange restriction are included in “cash”. Deposits in foreign bank which are subject to foreign exchange restriction should be classified separately among noncurrent assets and the restrictions clearly indicated. Financial Statement Presentation The caption cash and cash equivalent should be shown as the first line item under current assets. This caption includes all cash items, such as cash on hand, cash in bank, petty cash fund, and cash equivalents which are unrestricted in use for current operations. However, the details comprising the cash and cash equivalents should be disclosed in the notes to financial statements. Cash items included in cash: a. Cash on Hand includes undeposited cash collections and other cash items awaiting to deposit such as customers’ check, cashier’s or manager’s check, traveler’s check, bank drafts, and money orders. NOTE: Even if the money is in the bank, as long as you received a check, it is considered as cash on hand. Cash on hand because even though the money (bills and coins) is not in your hands (business) you already have the collection of the check which is considered as undeposited cash collection. The value of the check is only equivalent to what is deposited in the bank. You cannot withdraw 1.2M if the deposited in the bank is only 1M. Customer’s check is the check paid by the customer which is equivalent to the things they have acquired. Cashier or manager’s check a check drawn by the bank's manager upon the bank itself and accepted in advance by the bank by the act of its issuance. It is really the bank's own check and may be treated as a promissory note with the bank as its maker. Traveler’s check is for a prepaid fixed amount and operates like cash, so a purchaser can use it to buy goods or services when traveling. Bank drafts are negotiable instrument where payment is guaranteed by the issuing bank. Money order is also a negotiable instrument that is a safe alternative to cash b. Cash in Bank includes demand deposit or checking account and saving deposit which are unrestricted as to withdrawal. NOTE: Saving deposit means saving your money in the bank. Demand deposit’s purpose is to be used on a daily basis. It is more accessible than saving deposit. Undelivered or unreleased check is the one that is merely drawn and recorded but not given to the payee before the end of the reporting period. There is no payment when the check is pending delivery to the payee at the end of the reporting period. The undelivered check is still a property of the entity therefore if you already recorded the check, you have to restore the cash balance and record an adjusting entry. Postdated check delivered is a check already drawn, recorded, and given to the payee but bears a date subsequent to the end of the reporting period. There should be a reversed entry or an adjusting entry to restore the cash balance recorded since there is still no payment made until the date drawn in the check and the check is presented in the bank for encashment or deposit. Stale check is a check not encashed by the payee for a relatively long period of time. The Negotiable Instruments Law does not specify a definite period within which checks must be presented for encashment. In banking practice, a check becomes stale if not encashed within six months from the time of issuance. It is a matter of entity policy. If the amount of stale check is immaterial, it is simply recognized as miscellaneous income. However, if the amount is material, liability is set up again (debit cash, credit A/P or appropriate account) Bank Overdraft is from the issuance of check in excess of the deposits resulting to a bank account having credit balance. Bank overdraft is classified as current liability and should not be offset against other bank accounts with debit balances. For example, an entity maintains two bank accounts: o Cash in Bank – first bank, which is overdrawn by 10,000 o Cash in Bank – second bank, with a debit balance of 100,000 The net balance is 90,000 The proper classification of the two is: Current Asset: Cash in Bank – second bank 100,000 Current Liability: Cash in Bank – first bank 10,000 It is not necessary to adjust and open a bank overdraft account in the ledger. The Cash in Bank – First Bank account is maintained in the ledger with a credit balance. Bank Overdraft is not allowed in the Philippines. Offsetting is not allowed unless both bank accounts (debit and credit balance account) belong in the same bank. c. Cash Fund includes change fund, tax fund, payroll fund, dividend fund and many others. It is a form of cash that has restrictions or set aside for current operations or for the payment of current obligations and is a current asset. If the cash fund is set aside for non-current operations, it is considered as long-term investment. Example of this is sinking fund, preference share redemption fund, contingent fund, insurance fund and fund for acquisition or construction of property, plant, and equipment. NOTE: The classification of a cash fund as current or noncurrent should parallel the classification of the related liability. For example, a sinking fund that is set aside to pay a bond payable shall be classified as current asset when the bond payable is already due within one year after the end of reporting period. However, a cash fund set aside for the acquisition of a noncurrent asset should be classified as noncurrent asset regardless of the year of disbursement. Compensating Balance Generally takes the form of minimum checking, maintaining balance or demand deposit account balance that must be maintained in connection with a borrowing arrangement with the bank. For example, an entity borrowed 5M from the bank and agrees to maintain a 10% or 500,000 minimum compensating balance in the demand deposit account. In effect, this arrangement results in the reduction of the amount borrowed because the compensating balance provides a source of fund to the bank as partial compensation for the loan extended. Classification of Compensating Balance If the deposit is not legally restricted as to withdrawal by the borrower because of an informal compensating balance agreement, the compensating balance is part of cash. If the deposit is legally restricted because of a formal compensating balance agreement, the compensating balance is classified separately as “cash held as compensating balance” under current assets if the related loan is short-term. If the related loan is long-term, the compensating balance is classified as noncurrent investment. Investment of Excess Cash The control and proper use of cash is an important aspect of cash management. Basically, the entity must maintain sufficient cash for use in current operations. Any cash accumulated in excess of what is needed for current operations should be invested even temporarily in some type of revenue earning investment. Excess cash may be invested in time deposits, money market instruments, and treasury bills for the purpose of earning interest income. Classification of Investment in Excess Cash a. If the term is three months or less, such instruments are classified as cash equivalents b. If the term is more than three month but within one year, such investments are classified as short-term financial asset or temporary investments and presented separately as current assets. c. If the term is more than one year, such investments are classified as non-current or long-term investments. NOTE: Investments that become due within one year from the end of the reporting period are reclassified as current or temporary investment. Definition of Cash Equivalents PAS 7, paragraph 6, defines cash equivalents as short-term and highly liquid investments that are readily convertible into cash and so near their maturity that they present insignificant risk of changes in value because of changes in interest rate. The standard further states that only highly liquid investments acquired three months before maturity can qualify as cash equivalents. NOTES: Cash equivalents is not a medium of exchange unlike cash. They are investments. To be considered as cash equivalent, an investment should be both (1) short-term and (2) highly liquid (dali na mahimong kwarta usob) Examples of cash equivalents are: a. Three-month BSP treasury bill (it is an obligation with maturity within one-year where in the investor buys a treasury bill in a discount and receive the original value upon its maturity) (example: you buy a treasury bill for 95 pesos with its original price as 100 pesos. Upon maturity, you get the original value of the bill which is 100 therefore you gained 5) b. Three-year BSP treasury bill purchased three months before date of maturity c. Three-month time deposit (it is a deposit in a financial institution with a specific maturity date wherein you deposit your money and you will be penalized if you withdraw it, unlike saving deposit or checking accounts that you can withdraw anytime) d. Three-month money market instrument or commercial paper (its concept is the same as Tbills but instead of the bank that issues the bill/paper, private businesses are the ones who issue money market instrument or commercial paper) (Commercial paper is often issued at a discount without paying coupons and matures to its face value, reflective of current interest rates.) NOTES: Any money market instrument or treasury bills that have a maturity for 1 year or more cannot be reclassified as cash equivalents even if the remaining maturity is three months or less and therefore cannot be considered as cash equivalents. What is important is the date of purchase which should be three months or less before maturity. Equity investments/securities cannot also be considered as cash equivalents because they do not have maturity date. ONLY redeemable preference share that is acquired three months before maturity can qualify as cash equivalent. Accounting for Cash Shortage Where the cash count shows cash which is less than the balance per book, a cash shortage is to be recorded. Cash Short or over Cash The cash short or over account is only temporary or suspense account. When financial statements are prepared the same should be adjusted. Hence, if the cashier or cash custodian is held responsible for the cash shortage, the adjustment should be: Due from the cashier Cash short or over However, if reasonable efforts fail to disclose the cause of the shortage, the adjustment is Loss from cash shortage Cash short or over Accounting for Overage Where the cash count shows cash which is more than the balance per book, a cash overage is to be recorded Cash Cash short or over Note that whether it is a cash shortage or cash overage, the offsetting account is cash short or over account. Such account should be adjusted when statements are made. The cash overage is treated as miscellaneous income if there is no claim on the same Cash short or over Miscellaneous income But where the cash overage is properly found to be the money of the cashier, the entry is Cash short or over Payable to cashier Cash In – Receipts Cash Out - Disbursements Imprest System The imprest system is a system of control of cash which requires that all cash receipts should be deposited intact and all cash disbursements should be made by means of check. While internal control ideally requires that all payments should be made in checks, this is sometimes impossible. Petty Cash Fund Is money set aside to pay small expenses which cannot be paid conveniently by means of check. There are two methods of handling the petty cash, namely: a. Imprest Fund System b. Fluctuating Fund System Imprest Fund System The one usually followed in handling petty cash transactions Accounting Procedures a. A check is drawn to establish fund Petty Cash Fund Cash in Bank b. Payment of Expenses NO ENTRY c. Replenishment Whenever the petty cash fund runs low, a check is drawn to replenish the fund The replenish check is usually equal to the petty cash disbursement Expenses Cash in Bank d. At the end of the accounting period, it is necessary to adjust the unreplenished expenses in order to state the correct petty cash balance Expenses Petty cash balance The adjustment is to be reversed at the beginning of the next accounting period e. An increase in the fund Petty Cash Fund Cash in Bank f. A decrease in the fund Cash in Bank Petty Cash Fund Fluctuating Fund System The system is called the “fluctuating fund system” because the checks drawn to replenish the fund do not necessarily equal the petty cash disbursement. The replenish checks are simply drawn upon the request of the petty cashier Moreover, petty cash disbursements are immediately recorded thus resulting in a fluctuating petty cash balance per book from time to time Accounting Procedures a. Establishment of the fund Petty Cash Fund Cash in Bank b. Payment of Expenses out of the petty cash fund Expenses Petty Cash Fund c. Replenishment or increase of the fund Petty Cash Fund Cash in Bank The replenishment check may or may not be the same as the petty cash disbursement d. At the end of the reporting period, no adjustment is necessary because the petty cash expenses are recorded outright e. The decrease of the fund is reverted to the general cash Cash in Bank Petty Cash Fun