Advanced Financial Accounting: Consolidation Methods & Analysis

advertisement

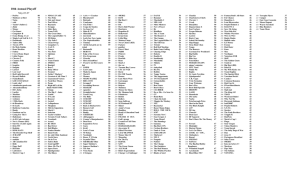

Name Shobhit Prabhakar Course CSAC4520 Advanced Financial Accounting - Full-Time Fall 2021 Student No. 218355172 Topic Hand-in Participation #4 Instructor Saurab Mehta Case 4-1 Barring the fair value enterprise (FVE) method, only the portion of Leaf’s goodwill purchased by Maple is disclosed on the consolidated balance sheet under all the consolidation methods. For an acquisition cost of $1200000, $528000 got paid as the share of Leaf's goodwill (presented in the first column of Exhibit 1). Placing a value on 100% of Leaf’s goodwill is subjective, as there are different ways of determining this value. Firstly, assuming a linear relationship between the amount paid for 60% and the value of 100% of the subsidiary. As per this scenario, if 60% of the shares equals $1200000, 100% of them must be $2000000. So, consequently, 100% of the goodwill would be measured at $880000 (presented in the second column of Exhibit 1). Secondly, in response to the argument put forth by the Maple management, a non-linear relationship between the amount paid for 60% and the value of 100% of the subsidiary can be considered. The management fully states its willingness to pay $240000 over and above the market price of Leaf shares to gain control. Also, the premium would stand at $240000, irrespective of the percentage of shares acquired. Accordingly, in this scenario, the total value of Leaf’s would be $1840000. Goodwill amounting to $720000 would be allocated out of this amount (indicated in the third column of Exhibit 1). Under IFRS 3.19, the value assigned to the goodwill does affect the reported value for non-controlling interest, as per the fair value enterprise (FRV) method. For the goodwill measured at $880000, the reported value of non-controlling interest would be $800000 (indicated in the third column of Exhibit 2). As for the goodwill valued at $720000, the value of non-controlling interest would be $640000 (marked in the fifth column of Exhibit 2). The subsidiaries assets and liabilities are transferred onto the consolidated balance sheet at fair values, only at the date of acquisition. These fair values become the historical values for reporting purposes, consequent to the date of acquisition. It implies that the subsidiary’s assets and liabilities are not remeasured to fair value on each reporting date, after the date of acquisition. The FVE method highlights the fair value of the net assets of the subsidiary, including goodwill at the date of acquisition. Since the fair value is often a good indicator of the economic reality of the business combination, this method is increasingly prominent. But, the FRV method also presents the highest value for assets. It can cause the lowest percentage return on assets in subsequent periods, as these assets need to be depreciated, expensed, or written off at some point. For this reason, the management of Maple may prefer not to use the fair value enterprise method when preparing the consolidated financial statements. Exhibit 1 Allocation of Acquisition Cost (in 000 $) 60 % Cost of 60% of Leafs 100 % 100 % 1200 2000 Implied Value of 100% of Leafs (Note 1) 1840 Implied Value of 100% of Leafs (Note 2) (400) (400) 960 1600 1440 Fair Value excess for identifiable assets (480) (800) (800) Fair Value excess for liabilities 48 80 80 Goodwill 528 880 720 Carrying amount of Leafs net assets [ 60%* (2000-1600) ] (240) Acquisition Differential Allocated Notes 1) Assuming a linear relationship, the implied value is computed as follows: If 60 % = $1200000 Then 100 % = 1200000/60*100 = $2000000 2) Assuming a non-linear relationship, the implied value is computed as follows: Control Premium = $240000 ; Value per share = $40 ➢ Shares Outstanding = 240000/.06 = 40000 shares Total Value of Leafs = 40000*40 + 240000 = $1840000 Exhibit 2 Maple Company Consolidated Balance Sheet At December 31, Year 7 ( In 000 $ ) ( see notes ) Proprietary (a) Identifiable Assets 5680 Parent Ex (b) 6800 Goodwill 528 528 880 720 6208 7328 7680 7520 4008 4680 4680 4680 2200 2200 2200 2200 Liabilities Entity (c1) Entity (c2) 6800 6800 Shareholders Equity Controlling Interest Non-controlling Interest 6208 448 800 340 7328 7680 7520 Notes 1. The assets and liabilities are calculated as follows: (a) Carrying amounts for Maple and 60% of fair values for Leafs (b) Carrying amounts for Maple and carrying amounts for Leafs plus 100% of fair value excess for Leafs’ identifiable assets and liabilities plus 60% of the value of Leafs goodwill (c1) Carrying amounts for Maple and carrying amounts for Leafs plus 100% of fair value excess for Leafs’ identifiable assets and liabilities plus 100 % of the value of Leafs’ goodwill assuming a linear relationship between the value of 60% and the value of 100% (c2) Carrying amounts for Maple and carrying amounts for Leafs plus 100% of fair value excess for Leafs’ identifiable assets and liabilities plus 100 % of the value of Leafs’ goodwill assuming a non-linear relationship and a control premium of $120,000 2. The non-controlling interest is calculated as follows: (b) 40% x fair value of Leafs’ identifiable assets and liabilities (c1) 40% x fair value of Leafs’ identifiable assets, liabilities, and goodwill (c2) 40% x fair value of Leafs’ identifiable assets and liabilities and Leafs’ goodwill in total less goodwill purchased by Maple. i.e., 40% x ((2,800,000 –1,680,000) + (720,000 –528000)) P 4-8 In $ Cost of 90% of Whyte 292500 Implied Value of 100% of Whyte 325000 - Goodwill (50000) Fair Value of Whyte’s Identifiable Net Assets 275000 Fair Value Differences (FV-CA) Land $50000 Buildings $20000 Equipment ($10000) $ 60000 Note Payable ($5000) (55000) Carrying amount of Whytes Net Assets = Carrying amount of Whytes Shareholders Equity Retained Earnings (as given in question) Common Shares 220000 (140000) 80000 Balance Sheet of Whyte Inc. as on January 1, Year 5 In $ Cash [ 52000-36000 ] 16000 Accounts Receivable [ 168000-116000 ] 52000 Inventory [ 234000-144000 ] 90000 Land [ 280000-210000-50000 ] 20000 Buildings (net) [ 720000-640000-20000 ] 60000 Equipment [ 338000-308000+10000 ] 40000 278000 Accounts Payable [ 96000-88000] 8000 Notes Payable [ 562500-507500-5000 ] 50000 Common Shares 80000 Retained Earnings 140000 278000

![[Date] [Name of College] ATTN: [Department]](http://s2.studylib.net/store/data/015675584_1-19c1f2d4f2acfcfa6a51fd36241fad38-300x300.png)